Discover Transportation Insights

Transportation Insights

45 Episodes

Reverse

In this episode of Transportation Insights, Peter Sand, Chief analyst at Xeneta, discussed what digitalization means from a shipper or BCO perspective with Mr. Kris Kosmala, Partner at Click and Connect. The conversation reflected on ways in which digital solutions can be an enabler of sustainability in the supply chain industry.

Kris also talked about the future of digital advancements introduced during Covid. Will these new solutions stay around or face a similar destiny as Tradelens?

Key Highlights

Causality - Is this the holy grail for digitalization in container shipping?

The crash and burn of Tradelens

Sustainability in container shipping can be achieved by reducing waste, primarily by reducing the waste of 'time.'

How can digitalization help in reducing carbon emissions?

What is the future of reshoring/nearshoring? Does it support a sustainable mindset in the supply chain?

The Xeneta ocean & air podcast series is back to spice up your freight insights!! In this episode, Xeneta's Chief analyst, Peter Sand, is joined by Patrik Berglund, CEO and Co-founder at Xeneta, Niall van de Wouw, Chief Air freight officer at Xeneta and Emily Stausbøll, Market analyst at Xeneta, to debate top 7 factors that he suspects will impact the ocean & air freight markets in 2023.

Key highlights:

Will COVID continue causing chaos at a global level?

Where does the looming recession fall on the list of factors affecting 2023?

Will the contracts be in breach, or will they be renegotiated again?

Will we see more index-linked contracts coming up?

Will we see the spot and contract market rates at par anytime soon?

How will the energy crisis affect ocean and air freight next year?

PS: Don't forget to follow us NOW to get an alert when the new episode goes LIVE next month.

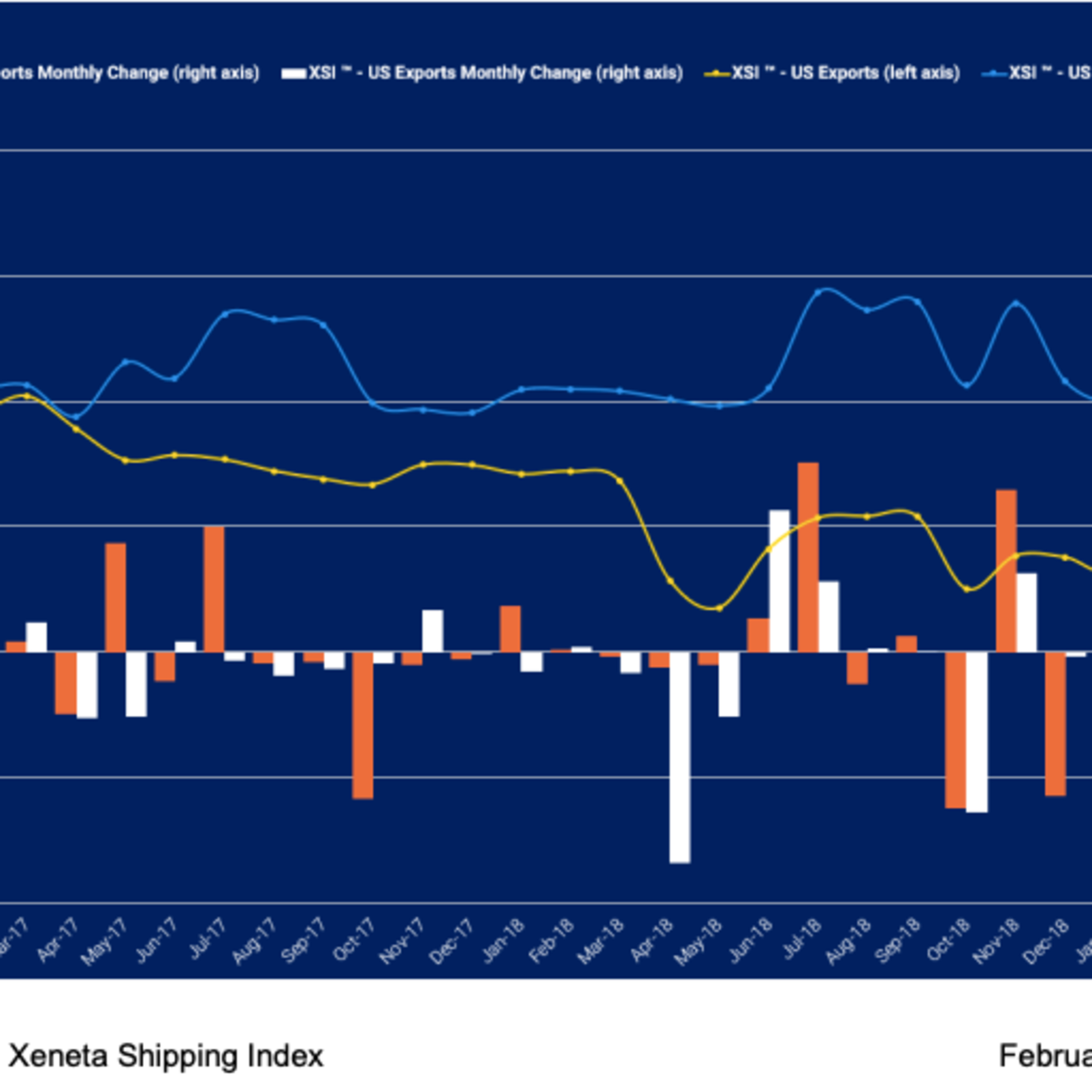

The monthly XSI® Public Indices report gives an indication of the global market movements in the container shipping industry focusing on the long-term market for the biggest regions in the world:

Global index:

1. Far East indices (import/export)

2. Europe indices (import/export)

3. US Indices (import/export)

Access the XSI Public Indices Reports (PDF) here:

www.xeneta.com/xsi-public-indices

Latest episode of The Air & Ocean Freight Podcast

For clients who ship cargo overseas, the choice of whether to use sea freight or air freight will depend on a few factors, including:

- Distance

- Type of cargo

- Time sensitivity

- Cost consideration

- Cargo safety

- Accessibility

A customer may have various requirements influencing their decision regarding the mode of transport to be used, but essentially, it comes down to the nature of the freight, the time frame and how much the shipper is willing and able to spend.

Why Use Air Freight

Perishable goods, like flowers and fresh-produces, are often pigeon-holed into being carried by air freight because of their short lifetime. Naturally, there are many exceptions like bananas, which tend to travel on ship due their long ripening process.

North America and Europe are both huge consumers of flowers, for instance-- especially around holidays like Mother’s Day and Valentine’s Day. These flowers are sourced largely from South America and East Africa, so air freight is an obvious choice in such an instance.

Demand for cargo capacity on freight carriers tends to vary seasonally. A recent example is the unprecedented spike in demand for flowers that occurred before Valentine’s Day, which caused a scramble for freight capacity on planes flying from Kenya to Europe, where most of the flowers were sourced. Some carriers reported that the traffic moved in anticipation of the holiday soared to nearly double average rates.

Some pharmaceutical products also tend to be carried by air freight because of their temperature-sensitivity, which, if not monitored properly, can result in the product being spoiled and pallets of potential profit wasted. That means they need to be shipped within a limited time frame, with maximum visibility. However, depending on the exact nature of the pharmaceutical companies cargo, reefer containers on ships are also frequently used.

Pros and Cons of Ocean Freight

E-commerce goods like electronics, cosmetics, apparel and home goods are all good candidates for ocean freight.

This mode of long-distance transportation is a great option because it is much less expensive than moving product by air. If time is not an important deciding factor in choosing a preferred mode of freight, ocean freight is the obvious choice.

One downside of ocean freight is that it can be difficult to predict and control the timeline due to circumstances like congestion at ports, which can end up causing delays.

A prudent customer would always seek a good balance between the service quality offered, cost component, the reliability of the service provider and time frame.

It's important to always keep an eye on both the air and ocean markets as both are extremely volatile. Readily available rate data for benchmarking and market intelligence for both markets will make tendering and negotiations for BCO procurement professionals more efficient.

In many cases, depending on how market rates are moving and other market dynamics, one mode of transport can be chosen over the other. Real time and on- demand rate data is what allows professionals to react instantaneously and make the right decision that positively impacts the bottom line.

BAF is the abbreviation for Bunker Adjustment Factor. The term "Bunker" refers to the Fuel that is used to operate ships. The ship operator is responsible for the payment of these bunkers to the bunker supplier.

As fuel prices are quite volatile, the shipping lines charge a fee called "Bunker Adjustment Factor (BAF)" to cover the fluctuations in global bunker costs.

BAF is charged either as a separate charge or included in the freight charge depending on the trade route and agreement between the carrier and the shipper/BCO.

BAF depends entirely on how oil prices shape up, and there is no fixed recipe for success. But if you consider BAF to be a “concept” rather than a “charge”, there is certainly scope for the customer to customize the concept to suit their business.

To explain further, BAF comes in a few different “flavors” – Fixed, Locked In and Floating.

Fixed BAF means the quantum of BAF that the carriers charge is fixed and does not vary based on market forces or price of fuel. This option is suitable for customers who want to know the exact costs that they will be paying for a shipment.

The opposite of Fixed BAF is Floating BAF which means that the quantum of BAF fluctuates depending on the price of fuel. This option may be advantageous to the shipping line in that, they may not lose money if the fuel price increases or decreases as this surcharge is linked to the price of fuel. However, for a customer, floating BAF may be disadvantageous as significant variations may mean that their product price could increase making them uncompetitive in the market.

As kind of a “compromise”, big volume shippers may choose a third option and “lock in” the BAF quantum with the carrier for a fixed period of time in order to gauge the market and may agree to adjust the terms. This could work in favour of either side as they could gain if the bunker prices go up or down respectively during the “locked in” period.

Whether the liner updates their BAF fee on a daily, weekly, monthly, quarterly or annual basis will depend on the fluctuations of oil prices, the vessels deployed on the various corridors and whether their customers are looking to secure short or long-term rates.

What Does This Mean for BCOs or NVOCCs?

If you are a BCO or Freight-Forwarder / NVOCC, depending on the volumes that you can commit to a shipping line, there may be an opportunity for you to negotiate a fixed BAF quantum for at least a year. Especially, if your freight rate negotiation is based on a yearly tender/bid.

In the past, many shippers have resisted the practice of allowing Floating BAF as they had a suspicion that carriers may be using the BAF amount to compensate for the lack of increase in freight rates.

Shipping lines like Maersk did try to dispel these suspicions of the customers by ending all-inclusive contract rates and charging BAF using a new formula based on which, the BAF would be determined in a simple and transparent way using calculations provided by independent, third-party shipping industry sources.

This formula was based on The Transpacific Stabilization Agreement which was a discussion group covering the majority of the Eastbound Trans-Pacific carriers. As per this agreement, bunker surcharges were based on average bunker costs in various markets.

Through extensive interaction with their customers, Maersk Line understood that this model could not work because carriers deployed larger ships across the years and the technological advances of ship design actually reduced the impact of bunker costs per container. Also, there was an imbalance between head-haul and back-haul because on the back-haul there were more empty containers.

So, Maersk

There are a few pros and cons to going short term, but it’s more a matter of whether you ‘can’ leverage a short-term market or not. And, you have to consider all, both from organizational and operational point of views.

Moreover, the definition of short-term is also subjective. To shippers who are used to long-term tenders of 2 years or over, short-term might be 6-12 months. But to others who are used to negotiating rates every quarter or twice a year, short term might be a 30-day rate validity. For shipping lines, short-term could mean a month or less. In some extreme markets it can be bi-weekly, weekly or even daily.

How Carriers React to Market Rates

Carriers are always watching the market. If they see the short term market rates moving upwards, they may capitalize on the same by pushing for more long-term contracts on a higher price. In a day-to-day operation, some carriers choose even to roll cargo that’s on very low long-term contracts.

If short-term market trends downwards carriers will try and secure long-term at a healthy level before the market drops too low..

If at the other end of the spectrum, the short-term market is at a really low level, the carriers will try and cover their losses as best as they can and focus more on long-term deals which they will offer to bigger volume shippers as the smaller volume shippers may be covered under NVOCCs.

Consider This Before Deciding on Short- or Long-Term Rates

Before you decide whether you want to go short-term or not, it is essential to understand both the shipping and your own market you are trading in. Our data reveals that some retail shippers can never move to short term as they are required to hold their cataloged prices for a long period. Other larger volume shippers may not be organizationally rigged to even consider operating in the short term, no matter how beneficial it could be.

If your market and commodity prices are volatile with more of a downward swing in prices and your sales contracts are also of short validity, it is better for you to go short term so that you don’t get stuck with freight rates that could jeopardize your business.

In some cases, there could also be potential to use the short term market for a portion of the total volume or as a temporary measure to secure a tender in a more favorable market both of which indicates to timing it suitably.

But a major con of going short term would be if you have misread the market and there is not much variation in product pricing or ocean freight rates. If you have gone on a short-term basis, it would then mean additional admin work for you to keep negotiating the rates and also the added risk that the lines might increase your rate.

Hi everybody, and welcome to another edition of The Brief, the audiocast series providing answers to the most frequently asked questions revolving around the complex world of ocean freight rate benchmarking and procurement.

This week, as you already know, is all about freight contract negotiation. As we’re entering the negotiation season, we want to focus on what the best practices in freight contract negotiation are.

If you haven’t subscribed to our channel, go to your favorite podcast provider and search for Xeneta. Now without further a due, let’s jump right into it.

The general best practices involved in a freight contract negotiations are the following:

Take a soft approach! Being tough will not work in a business environment like shipping and freight. You must always take steps, however big or small, towards a mutually advantageous business relationship.

While pricing is negotiable, how you approach carrier rate negotiations may make a great difference to your bottom line.

Some fundamentals of freight negotiation such as benchmarking your rates against others should not be ignored.

A review of all sales and carrier contracts may assist with any savings on freight charges.

Always remember that ocean freight prices are volatile and freight rate negotiations are seasonal with peak season yielding a higher price.

Know your market and service patterns. Once you have that understanding, you can determine what kind of carrier rate negotiations to enter into. Long-term rate, short-term rate, quarterly rate, capped rate system, etc.

Understanding how a carrier works is also essential, such as how their costing works, what local, national and international requirements a carrier needs to fulfill. By understanding this, you can avoid some unpleasantness like asking the lines to drop some of their legitimate charges such as ISPS charges which are essential in maintaining the security of the ship, cargo, and port.

By studying the rate matrix developed from a shipper/BCO point of view across various trades, one can get proper visibility of the various surcharges involved in a freight contract.

The surcharges involved in a freight contract is also an interesting subject to explore in preparation for negotiations. We’ve compiled a list of these for you on the Xeneta blog. Head on over to xeneta.com/blog and use the search function named “Search Articles” and search for “surcharges”

Allright, that is it for this week’s episode of The Brief. Make sure to check back next week for more answers to the most common questions revolving around the complex world of ocean freight rate benchmarking and procurement. Bye for now!

Should I benchmark my shipping freight rates against the competition?

Yes, of course. How else do you know if you have received a competitive rate from your supplier? You need to know how your rates compare to your peers, the market, in order to make sane freight procurement decisions.

In the current market, carriers are placing more focus on reducing their costs and increasing their bottom line through mergers and acquisitions, shipping alliances and other factors. When coupled with socio-economic factors it is in many cases difficult to keep up with how container market rates are moving.

The Importance of Freight Benchmarking

Such developments create unpredictability in the market, and it is important that you have the factual data and information in order to benchmark the rates that you should be paying.

Depending on the Incoterms® used, ocean freight rates form a very integral and critical component of your total end-product price.

As a BCO, irrespective of the size of your business, freight benchmarking can and should be done against other BCOs. It is important that you benchmark the ocean freight rates against your competition as benchmarking is the only way by which you ascertain that you have secured the best possible freight rate, are working with the supplier that best meets your target rate and needs and ultimately make sure you are making fact-based freight procurement decisions.

Freight benchmarking is not restricted only to BCOs but also commonly used by NVOCCs or Freight Forwarders as part of establishing their identity and standing in the market.

Even carriers and VOCCs have their own methodologies of freight benchmarking although this is mostly based on supply and demand. When there is excess capacity in terms of ships and space availability, for example just after Chinese New Year or Christmas when the sale season has finished, carriers and VOCCs may be able to offer better spot rates to optimize their utilization.

Whether you are a Carrier, VOCC, BCO, NVOCC or Freight Forwarder, it is definitely beneficial to benchmark in order to ascertain one’s position in the market over time.

By leveraging that position in the market and through regular benchmarking against the competition, one can ascertain the direction in which the market is moving and tackle the market volatility suitably and remain relevant in this competitive industry.

An alliance is a grouping of ocean carriers joining forces to operate ships on some trade routes. Only the vessels and its operations are shared, and there is no commercial terms being shared.

As of April 2017, three major shipping alliances (one new, one re-aligned after a big merger and one re-aligned after a major takeover) have been dominating container liner operations.

2M – MSC; Maersk; HMM (on slot purchase)

Ocean Alliance - CMA-CGM; Cosco Group; OOCL; Evergreen

THE Alliance - Hapag Lloyd; NYK; Yang Ming; MOL; K-Line

As mentioned, in an alliance commercial information is never officially shared. Therefore, service contracts between customers and carriers are unique and individual between customers and carriers in that alliance.

The same customer can have separate different rates and service contracts with different lines in the same alliance.

Having rates and service contracts with carriers in an alliance has its owns advantages and disadvantages.

Advantage of Having Rates and Service Contracts with Carriers in an Alliance

The advantage is that customers could have a choice of lines within the alliance to choose the best rates, equipment availability and after-sales service.

For example, on a particular route say USA - Asia – Cosco might have the best rates compared to other lines in the alliance but on the USA - Europe sector – Cosco might not have the best rates, and therefore you may need to look at other lines in the alliance for better rates.

But if you have substantial volumes, you could negotiate same rates with the other carriers in the alliance on the basis that there is no difference in terms of calling ports, terminals and transit times.

The way the alliance could affect your rates would be that if there are any issues with the ship, calling port, transit time, etc. then the customer cannot switch to any other line within the alliance as these issues affect all carriers the same way and even if you are willing to pay a higher rate to the carrier at that point, it may not help.

For example, if there is a problem with the schedule of a certain vessel and the customer has booked it with one of the carriers, he cannot change to any other carrier within that same alliance as all will be equally affected.

Basically by using Alliances while you could get more connections, you are also restricted to a fewer operators with whom you can negotiate freight rates. These are some of the factors affecting rates, service contracts within an alliance.

However, with the advent of the 3 big alliances controlling around 87% of the global container volumes, do we really have a choice?

In the case of agreeing to prices “subject to GRI” or “subject to peak season surcharge”?, the first question to ask is – “Do you have a choice?”, especially if you ship on the spot market. The reason is that GRI (General Rate Increase) or PSS (Peak Season Surcharge) is something that the shipping lines implement, whether you like it or not, whether you agree or not. However, as with any rule, there are exceptions.

Depending on your committed volume with the carrier, the relationship that you have with the carrier and the support that you give the carrier, you may be able to negotiate a waiver for the GRI or PSS.

This could be done at the time of you signing a long-term contract or a fixed term contract with the lines as that is the best period of bringing up this eventuality. Large volume shippers who usually go for long term contracts do not accept GRI or PSS because if there is scope of increase in rate during a contract period, there also should be option for reduction which usually does not happen.

Other than that, there is not much choice for you as a BCO (Beneficial Cargo Owner) or NVOCC in this matter as generally once one carrier starts implementing surcharges, the others follow suit. In this age of carrier alliances and partnerships, it is doubtful that one partner in the alliance doesn’t implement the GRI or PSS at the prescribed time.

Both GRI and PSS are often introduced unsuccessfully as more often than not, the market does not accept it. These charges get waived quite quickly especially bearing in mind that these two are applied more on short term rates or spot rates as the time frame where it can be applied is also short.

In some cases the time frame can be so short that some BCOs or NVOCCs may even stall their negotiations or shipments in order to avoid these charges.

Having said that, if the choice has to be made between a GRI and a PSS, the better option would be a PSS because the PSS is applied at the “Peak Season” which is normally around the period of August to October in certain trade lanes and around Chinese New year which is when most carriers try to implement PSS.

Our data trends shows that there is a higher potential of clients accepting PSS because at least the period of increase is known, one can secure supply based on the acceptance of the right PSS. Based on the knowledge of the timing of application of PSS, there may be some businesses who can avoid shipping between these months and avoid the PSS entirely.

Whether you are a BCO (Beneficial Cargo Owner) with big volumes of specific cargo on multiple trade lanes or an OTI (Freight Forwarder or NVOCC) with big volumes of FAK (Freight All Kinds) cargo on multiple trade lanes, choosing the right carrier is of paramount importance to the success of your business.

In this regard, the question could be whether you should choose a carrier based on trade lane or choose carrier based on global volume?

The answer to this question lies in the trade lane. Although there are several global carriers such as Maersk, MSC, CMA-CGM, etc. These global carriers may not be the best fit for your supply chain, based on your specific business or trade lane.

For example, if you are trading in the Intra-Asia trades, there are many smaller lines, that can provide much better service and rates compared to the global carriers. These lines that specialize in specific trade lanes, often have better connectivity, transit times, and schedule reliability.

The Advantage of Combining Global Volumes

The advantage however of combining your global volumes and choosing a global carrier is that if there are any adjustments to be made in the total global volume vs. local trades, it is possible. This may not be possible with a local/regional carrier.

The trade-off however maybe that by combining all your volumes and giving it to a global carrier, you may be putting all your eggs in one basket, and if there is a dispute with that carrier, then you may have a problem getting out of that contract.

The suggested option would therefore be to spread the volumes across a few global carriers, and in certain, specific trade lanes, where you need a more tailored solution, use local/regional carriers.

"Leaving money on the table" is an idiom which signifies someone not getting or saving money that they could be. This idiom is thought to have originated from poker wherein if you don’t play intelligently, you may be leaving your money on the poker table.

This expression is quite widely used in negotiations. But does it apply to ocean freight rate negotiations?

Definitely.

Ocean freight rate negotiation is an art and if not done correctly, you could be leaving money on the table.

If you consider a 12-month fixed ocean freight rate, is it possible that you may be leaving money on the table? Probably yes, probably no.

Let’s play around with a couple of scenarios. Assume a competitive environment for a shipper/BCO, which is the case for most.

Scenario #1

BCO #1 ties in their rates for 12 months at the beginning of the year. BCO #2 negotiates a 12-month contract with quarterly reviews/adjustments based on market movements. In this scenario the market, during the 12 month period, moves significantly upwards. The first BCO ‘wins’ in this case.

Scenario #2

Assume the same BCOs with the contract types as above. Now, however, the market moves both up and down – but mostly down – BCO #2 “wins” as rates are adjusted downwards and they have the flexibility in their contact to do reviews and adjust.

If you are thinking “Ah, I have big volumes, I will score if I negotiate rates on a longer-term basis”, think again.

Based on the volatility of freight rates, it has been shown that volume no longer necessarily translates to savings and in many cases, big volume shippers are paying far above the average Asia-Europe or Asia-US TEU rates.

You can gauge this using freight benchmarking services which will tell you what the performance on the trade lane has been and what is anticipated.

Freight benchmarking provides you with actionable data to study the various markets, trade lanes, your peers and after analyzing same, you can decide on whether to fix your rates for a 12-month period, 6m, quarterly, short term or a combination.

This year the US trades have been dominated by the tit-for-tat trade war with China that have contributed to a significant increase in rates, however, 2018 didn’t get off to the best start. In this part-2 blog post, Xeneta looks back over the last 12 months to highlight key developments in the Far East - US West Coast trade.

Those operating in the Far East - US West Coast (USWC) trade saw rates in Jan-18 30.5% lower than the same period of 2017. They then developed in an unspectacular fashion, declining as they usually do in the run-up to Chinese New Year and thereby remaining below the same period a year earlier.

In fact, for the first quarter of 2018, rates were 25.4% lower than those recorded in 2017.

However, the FE - USWC trade showed some positive signals. In Apr-18 rates increased at a faster pace than the previous year, a trend that has continued, and therefore rates began to claw back some of the yearly losses. But it wasn’t until Jun-18 that rates surpassed the equivalent month of 2017. As a result, for the first six months of the year, they were 18.2% lower than in 2017.

While month-on-month rate developments were mostly better than those recorded during 2017, they only started to significantly improve once President Trump announced plans to impose trade tariffs on $50 billion worth of Chinese imports, starting in Jul-18.

In Jul-18, rates subsequently jumped 19.3% compared to the previous month, taking them to $1,705 FEU and 16.0% higher than Jul-17.

The increases didn’t stop there, with rates jumping 27.8% in Aug-18 to $2,179 FEU. A further round of tariffs starting in Sep-18, added yet more uncertainty to the trade and the result was an average spot rate of $2,409 FEU, which represents a level not recorded since early 2015 and a 40.7% premium to rates recorded in Jun-18.

While rates have developed positively for carriers, the trade war masks like-for-like rate developments, making it harder to determine underlying market fundamentals. For example, will demand wither and rates tumble once shipments rushed forward to beat the tariffs begin to die down? Or will continued uncertainty lead to even more increases?

Regardless of the fundamentals, carriers will push home the opportunity to improve revenue streams.

Time will tell whether recent developments represent a short-term market reaction to the measures imposed by Trump. However, these increases have begun flowing through to contracted rates. Although increases for long-term contracts have been less severe, those entering long-term deals most recently still paid a substantial uplift compared to those negotiated just 3-4 months earlier.

The true long-term impact of the tariffs is hard to determine, but Fig 2 indicates the market is prepared to pay an increase for contracted rates to remove the continued uncertainty and risk surrounding the spot market.

In other key developments, a malware attack on Cosco in Jul-18, which affected its US services, reduced it to communicate with customers via social media highlights the growing importance of cybersecurity within the sector.

While the effects on Cosco were far less damaging than those Maersk reported due to the infamous NotPetya attack in 2017, it serves as a stark reminder to industry players that might be struggling financially, that failing to invest in cybersecurity could lead to dire consequences.

Make sure to read our Part 1 Container Rate Developments: Far East - NW Europe 2018 YTD here.

With 2019 fast approaching, Xeneta looks back over the last 12 months to highlight key developments across the industry.

Far East - North West Europe

2017 was a positive year for carriers, with rates during the first six months on the FE - NWE route in particular, at healthy levels. However, as the market entered Q4, weakness began to materialize.

Although carriers were able to lift rates in the run up to Chinese New Year in Feb-18, which is not unusual, a prolonged slump in rates sent them tumbling from $1,734 FEU to around $1,208 FEU, reflecting a decline of 30.3%.

Demand seemingly then recovered at a slower pace than it has done historically, resulting in an average freight rate of $1,538 FEU for the first six months compared to $1,781 FEU in 2017, down 13.6%.

This decline in rates couldn’t have come at a worse time, with bunker costs during the same period rising significantly. The toxic mix of declining freight rates and increasing costs resulted in Maersk issuing a profit warning, thereby cutting its full-year forecast. The Danish carrier said its fuel costs rose 28% year-on-year during the first half of the year.

The result was a standoff between carriers seeking to recoup some of the additional costs and those with fixed-rate contracts, either with or without a floating bunker element.

By May-18 lines were able to increase rates, with CMA CGM and others announcing FAK rates of circa $1,600 FEU. Despite the recovery, it still points to an over-reliance on public rate announcements.

For example, some market participants may not be able to recall the last time carriers were able to meaningfully lift rates organically, i.e without the use of GRIs or planned FAK rates, highlighting the continuous battle they face in maintaining or improving revenue streams.

However, as the market entered Q3 rates still developed positively for carriers. In recent times there’s been question marks over the impact that peak season truly has on the market, but Figure 1 highlights Q3 rates continue to carry a premium compared to the previous quarter, suggesting it does still have an impact.

Elsewhere, contract developments have been mixed for carriers, with average rates year-to-date more or less in line with the same period a year earlier.

With short market rates still fluctuating considerably and contracted rates not necessarily falling to the same degree when the market declines, the discount shippers have been able to achieve for long-term rates has been eroded slightly year-on-year.

The spread or difference between the two, has narrowed from an average discount of 13% in 2017 to 10% in 2018. Whilst, shippers on contracted rates can still expect to pay less on average than those in the spot market, it’s not guaranteed.

Therefore, market participants may be tempted to move to a floating mechanism that tracks the market, thereby reducing the pressure on carrier-shipper relations when there’s a large swing in rates, as witnessed after Chinese New Year.

As the year comes to a close, shippers should expect rates on average to be lower in Q4. However, attention may be focused on the proposed surcharge mechanisms being put forward by lines a year ahead of new IMO Sulphur regulations, although as history has shown, carriers have been largely unsuccessful at recovering fuel costs.

www.xeneta.com/blog/what-if-my-v…y-contract-period

Shipping is a dynamic industry, and shipping volumes are always fluctuating based on the movement of global trade and business performance.

When there are stability and continuity of business, Beneficial Cargo Owners (BCO) may opt for a service contract. But then, of course, perceptions of stability and business continuity are relative as these could disappear in a flash as we have seen over the years.

Service Contracts Factoring In

A service contract is a contract between a BCO and an ocean carrier. In a service contract, the BCO gives the carrier an MQC (Minimum Quantity Commitment) to ship a minimum volume over a fixed period of time. In return, the ocean carrier commits to set rates and a defined level of service.

In principle, a service contract may contain specific terms regarding the fulfillment of the MQC and penalties thereof in case of non-fulfillment. However, whether the penalties mentioned in the contracts can be enforced is one of the conundrums facing container shipping, and the jury is still out on this.

If there is a decrease in volumes from the MQC, the shipping line is well within their rights to apply a higher rate or charge the BCO the differential in the freight levels. But this largely depends on how good the relationship is between the two sides.

For example, if there is an MQC (Minimum Quantity Commitment) of 2000 TEUs per year to secure a specific rate and the volume achieved is 1950 TEUs, the line may take a favorable view and not charge any penalties. Carriers may offer a tolerance level on the MQC of around 20% depending on the reliability and credibility of the BCO.

Other than with companies that have high and quick growth possibilities (like Amazon for example) increase in MQC volumes are quite rare.

But if it happens, shipping lines may choose to create a new service contract with different terms for the remainder of the period. But this again depends on the terms negotiated at the time of the service contract and the relationship with the line

In short, if volumes increase or decrease during the contract period, the BCO or NVOCC could be at the mercy of the carrier, and eventually, it could all boil down to the relationship with the carrier and how much the carrier needs you at that stage in their business - or whether the customer has provided substantial volumes and delivered on commitments in previous contracts.

Knowing when is the best time to negotiate freight rates depends on who you are as an entity and what is most suitable for you, for your business and for your supply chain. No general time frame suits everyone for the negotiation of ocean freight rates.

For example, if you are a seller trading with a buyer in a new country, then the best time for you to benchmark and negotiate ocean freight rates is BEFORE you finalize the trade deal or the sales contract. This would be important as the ocean freight rates, and the associated charges that you negotiate can influence the shipping terms (Incoterms®) you agree with your trading partner. CIF, CFR, CPT, CIP. This may apply even if you are selling to a new customer with higher volumes in a country that you are already trading in.

If you are an OTI (Freight Forwarder or NVOCC) for example, you may need a fixed, long-term ocean freight negotiation schedule to utilize your volumes and secure a good FAK rate (Freight All Kinds).

If you are a BCO (Beneficial Cargo Owner) who has fixed volumes that require longer validity of say 12-18 months, you may choose to negotiate ocean freight rates based on a tender. You may float this tender in line with your financial year which may be the middle of the year or end of the year. Besides, it is worth considering launching a bid outside the peak shipping season. Lower shipping demand might prompt carriers to offer and commit to better deals.

If you are a BCO, that deals with seasonal cargo such as tobacco, cotton, fruits, wool, etc. you will need to negotiate your rates well in advance of the next season. While negotiating ocean freight rates in this space, you may need to consider how the season has been and how the commodity is expected to sell for the next season.

Irrespective of who you are as an entity and the business you are in, if you are involved in ocean freight rate negotiations, you always can use freight benchmarking tools to choose the right time to negotiate the ocean freight rate based on historical, present and future contract-rate data, global trends on trade, capacity development and shipping agreements of your peers.

For some trade corridors, September 2018 has proven to be a month of uncertainty due to tariffs causing slight frenzy from shippers and carriers taking the opportunity to jack up rates. Golden Week is also inching up giving carriers even more open waters to see what they can do before year end. Here is a rundown of the latest September ocean freight rate developments as seen in Xeneta for the trans-Pacific, Asia-Europe, Asia-Australia and Asia – South America corridors

This month, we discuss the top 6 factors predicted to impact the air freight market in 2024. We discuss each of the six factors in detail, sharing our insights on the potential impact each will have on the market and what shippers and freight forwarders can do to prepare.

Additional Resources:

Access all 2024 Outlook material : https://hubs.ly/Q02b9d8w0

Xeneta Blog: https://hubs.ly/Q023KwJ80

Learn more about Xeneta https://hubs.ly/Q023Kxkv0

This month, we debate the top 6 factors predicted to impact the ocean freight market in 2024. We discuss each of the six factors in detail, sharing our insights on the potential impact each will have on the market and what shippers and freight forwarders can do to prepare. We don’t hold back and promise you won’t want to miss this episode

Additional Resources: Download the 2024 Ocean Freight Outlook: https://www.xeneta.com/outlook/2024/ocean-freight

Xeneta Blog: https://hubs.ly/Q023KwJ80

Learn more about Xeneta https://hubs.ly/Q023Kxkv0

Host: Peter Sand, Chief Analyst, Xeneta

Guest: Patrik Berglund, CEO, Xeneta and Emily Stausbøll, Market Analyst, Xeneta