Discover The Flying Frisby - money, markets and more

The Flying Frisby - money, markets and more

The Flying Frisby - money, markets and more

Author: Dominic Frisby

Subscribed: 148Played: 7,437Subscribe

Share

© Dominic Frisby

Description

Readings of brilliant articles from the Flying Frisby. Occasional super-fascinating interviews. Market commentary, investment ideas, alternative health, some social commentary and more, all with a massive libertarian bias.

www.theflyingfrisby.com

www.theflyingfrisby.com

593 Episodes

Reverse

This is a free preview of a paid episode. To hear more, visit www.theflyingfrisby.comGood Sunday to you,In case you missed them, I put out two articles this week. Here they are.By now I am sure you will have stumbled across Matt Shumer’s essay Something Big Is Happening, which has gone bananas viral. Eighty-one million views on X alone. That’s even more than We’re All Far Right Now.Shumer describes how AI capability is improving exponentially, meaning that most screen-based jobs face imminent and major disruption. By that he means all but disappearing. His advice is blunt: get good at using AI now; assume much of what you do will be automated, and thus your doing it will soon be redundant; and start saving up, there’s economic upheaval coming.It’s perhaps the best articulated essay there is describing this bleak view of what is coming.From my own little vantage point, I’m not nearly so pessimistic. I use AI a lot, and I use it more and more. Its rapid improvement over the last six months has been obvious, though it still cannot recognise humour, let alone write it - humour that’s actually funny, anyway. So it’s rather like the BBC comedy department in that regard.EDIT: Having written that last paragraph, I just watched this. It is a perfect Frat Pack joke. I’ve now watched a load of other clips made with AI movie generator Seed Dance 2.0 from Byte Dance (parent company of TikTok), and I’ve a mind to short Disney first thing on Monday morning. The content is breathtaking, even the comedy.I use AI as a sounding board, for legal and regulatory questions, bureaucratic procedures, personal advice, career and business advice, videos, images. I use it to proof read copy, in the case of PR which I hate writing, I use it to actually generate copy; it helps me with titles, SEO summaries and research. I am not at the point where it writes my articles for me, and I like to think I would not let that happen, but I know others are: I am increasingly reading pieces in respectable broadsheets that are clearly written by bots.That represents a lot of work I might once have given to other people.On the other hand, if I had needed to pay someone proper money to do it, I probably would not have done it at all. In that sense it is not so different from the democratisation of media that followed the turn of the 21st century, when filmmaking, podcasting and publishing suddenly became accessible to anyone with a laptop.From a personal point of view I know I have lost a shedload of voiceover work to AI, and what used to be my main source of income no longer is. More annoying, my voice, with the countless documentaries, promos, trailers and ads I’ve voiced over the years, has been harvested, modelled and copied like mad. Not a lot I can do. But the net result to the world is more content, better content, produced faster and at lower cost.I’m not sure quite how end-of-days it all is. But Shumer’s finger is on the pulse in a way mine is not.Let’s assume he is more right than I am. What then?Two things follow.First, AI is deflationary. Services get cheaper. Productivity rises. Labour loses bargaining power.Second, governments will not sit back and watch demand collapse. If employment and incomes come under pressure, the political response will be fiscal support, especially if it win s elections. This means more borrowing, therefore lower interest rates, and more money-printing. Different routes, same destination: easy money.That is essentially the conclusion reached by analyst Lyn Alden in her latest newsletter, though her reasoning is more technical. The Federal Reserve has already moved from balance sheet reduction back to ongoing expansion. Not a dramatic “QE moment”, but a structural, steady increase to keep the financial plumbing functioning. She calls it the “gradual print”.Jefferies’ Chris Woods, whose Greed & Fear letter I have come to rather like, arrives at a similar place via politics. The US government is now so sensitive to interest costs that sustained tight policy is unrealistic. If markets wobble or growth weakens, intervention returns. Monetary restraint will not survive contact with fiscal reality.Hedge fund billionaire, Ray Dalio’s argument, laid out in his latest offering, is similar, though simpler and colder. The United States is late in a long-term debt cycle, with borrowing rising faster than income. There are three ways out: austerity, default or money printing. The US will choose the third. If foreign buyers will not fund the deficits at acceptable rates, the central bank ultimately does. Different language, same conclusion.Which brings me to an interview I listened to this week, between Grant Williams and Rabobank’s Michael Every. Every thinks stable coins will act as the funding vehicle. Every’s argument is more macro than AI or the Fed. He believes we are seeing a structural shift in the global economic system, comparable to the late Soviet period. With Communism in its final throes, Gorbachev tried to transform the USSR from a military-industrial economy into a consumer one. It failed and the system collapsed.The United States, Every argues, is now attempting the reverse. After decades of financialisation and consumption, it is trying to rebuild industrial and military capacity. That means: industrial policy, trade protection, supply-chain control and capital directed toward production, rather than asset inflation. Instead of buying US treasuries, foreign dollars get recycled into US manufacturing, industry and, yes, its military.This is not the liberal globalisation model of the last thirty years. It is economic statecraft. This means growth may be slower and inflation structurally higher, while financial markets less dominant relative to the real economy.Success is by no means guaranteed, but the direction of travel is toward a more managed, more political, less free market economic system.So … large forces are converging. Different stories, maybe, but the destination is be rather similar.* AI will improve productivity, but lower labour power* Governments will be forced towards fiscal support* No longer independent, central banks will drift towards balance sheet expansion* Geopolitics will drive reindustrialisation and energy demandWhich brings us to the question that matters.What are the implications for your money?Where do you put it?

An extra piece for you this week. I had planned to follow up on Dr John’s timely piece on oil and gas today, but it will have to wait.We need to talk about bitcoin.Since peaking at $126,000 in early October, the bitcoin price has been in freefall, and the declines have accelerated this year. Earlier in the week, it touched $60,000 - declines of over 50% from peak to trough. Today it sits at $67,000.Call it what it is. It’s a bear market.Here’s a 2-year chart so you can see the price action. All the gains of 2025 have been given back and we are back at 2024 levels.Bitcoin has become a software proxyMy first observation is that bitcoin’s decline since October has coincided exactly with a brutal selloff in software stocks, even as hard assets - gold, silver, and other metals - have caught one heck of a bid.Just a few years ago, hard assets had no value, it seemed. Forget land, mining, the real economy. It was all about digital, software, IP, trademarks. How things have changed.This chart appeared in a WhatsApp group and I don’t know who made it to give credit, but the story is clear: Bitcoin has become a software proxy and vice versa.The correlation is striking. As concerns around AI have hammered software more generally, bitcoin has followed. Hardware plays within tech have held up Maybe they're next to be hit. That remains to be seen.When the mainstream media calls the bottom - the next wave of bitcoin obituariesThe Financial Times, wrong about bitcoin since 2009, came out with its latest stupidity this week claiming that bitcoin is $69,000 overvalued. Yesterday the Daily Mail joined the Retard Gang in telling us bitcoin will go to zero.Remember: just as media frenzy often indicates the peak of a market, so does a media scrum at the bottom. All we need is a high-profile article from the Economist and the lows will be in.I get that some people don’t like bitcoin, and bitcoiners can be obnoxiously vocal when the price is rising, but nocoiners can be just as bad. The amount of people trolling me about bitcoin - cc-ing me into tweets telling me how badly it’s doing, slagging off Michael Saylor, sharing “going to zero” articles - has risen sharply.The more evolved and widespread these narratives, the more people repeating them, the closer we are to an end.On which note, here is a longer-term weekly chart of bitcoin. That weekly RSI is close to all-time lows. Doesn’t mean this is the end. But you get these kinds of sentiment extremes at the end of cycles, not at the beginning. Join this elite readership.Where we go from hereThis is a bear market. Crypto winter is upon us once again. The trend is down.But the trend will end. It always does.Looking at the above charts, there’s a lot of price memory in the $50-70,000 range. Bitcoin spent much of 2021 and 2024 here. I expect $50,000 - or just below - to hold. I give that a more than 50% probability.But it’s bitcoin. So anything is possible. A typical bitcoin monster correction would see us go all the way back to the 2022 lows at ~$15,000. I don’t see that as likely - especially as the preceding bull market wasn’t that mammoth - maybe 10% probability.It’s also possible the lows are already in, but my gut tells me this bear market has a bit longer to play out. It’s not a short sharp correction like we saw in the spring of last year around the Tariff Tantrum ™, but more of a grinder. Corrections happen in price and time, and I feel this one has a few more twists to it, especially as markets generally are not quite as easy as they were a couple of months ago.My outlook at the beginning of this year was that the S&P 500 would follow the typical trajectory of the second year of a US presidency - and that points to a rocky second and third quarter with a strong final quarter. That has implications for liquidity and sentiment more generally. Bitcoin is the same technological genius creation it always was. It hasn’t changed. Only perception has changed, as it always does.It has been repeatedly demonstrated that bitcoin is a volatile asset that goes to the extremities of both pessimism and optimism, that it is cyclical and that it crucifies hubris. Those cheering the bear market clearly haven’t learned.Instead of celebrating, I urge the skeptical to take advantage of this bear market and use it to learn.On which note, if you’re new to bitcoin, my 2014 book Bitcoin: the Future of Money? is a good place to start.Bitcoin isn’t dead. It’s just going through a bear market. They happen.What’s the story that takes bitcoin higher, then?Remember: narrative follows price.When the price starts rising, all sorts of reasons will get attached and the story will form. Just as now with the price falling, all sorts of bearish narratives have emerged. Quantum Computing is going to end it. Jeffrey Epstein hijacked it. The core devs have fallen out. Strategy (NASDAQ.MSTR) is going bust. Whatever.It doesn’t matter what the story is. That will come. Price leads.Quantum BSWhen you go to a bitcoin conference, one thing that’s notable is just how intelligent, educated, informed and ambitious the participants are. There is not the proliferation of midwits that you might find on, for example, the FT payroll. The bitcoin community is super bright.Do you think those involved haven’t thought about and prepared for Quantum computing and the threats it may or may not present? Of course they have.Is bitcoin more likely to be ready to deal with the quantum computing threat than say SWIFT, the BBC, the NHS, or some bank? And which is likely to cope with it better - a sector crammed full of genius computer scientists with their own capital at stake, or some institution run by a government?If you actually had a computer capable of taking down bitcoin, there are much easier, more satisfying things to take out, such as the House of Commons email server.Way more important than the actual threat of quantum computing is the perception of what that threat is, even if that perception is bogus. But, as I say, perceptions change, just as bull and bear market cycles do, and so will this narrative die except among the most ardent nocoiners.Of course I would rather bitcoin was at $150,000. But I am not worried. I won’t like it if bitcoin goes to $50,000. I’ll like it even less if it goes to $15,000. But we have been here before, and we’ll likely be here again.We know how this story ends.A prediction for the recordHere it is: It may have to go lower first, but bitcoin will outperform precious metals over the next 18 months, and probably over the next 12.Let’s mark the price: gold is $5,000. Silver is $78. Bitcoin is $67,000.By the way, I advocate owning both: gold and bitcoin. So at this point I should really plug Charlie Morris’s BOLD, an ETF you can buy through your broker which owns both gold and bitcoin. Until next time,DominicBitcoin: the Future of Money? by Dominic Frisby is available at all good bookstores. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.theflyingfrisby.com/subscribe

I can’t tell you how many messages I am getting from people about silver.Have I seen this video, read this article, looked at this data, listened to this podcast. JP Morgan is about to go bust, the paper markets are overwhelmed, the price is manipulated, China is setting the real price, this is a reset. And so on.The problem with speculative manias, especially when silver is involved, is that enormous amounts of misinformation get spread, much of it about things you and I, as ordinary investors, can do nothing about.Take it all with a pinch of salt is my advice.What I find interesting is that similar amounts of misinformation are being spread about bitcoin. The price is being manipulated on the futures markets, Strategy is about to go bust, Michael Saylor is this, that and the other, and so on. It’s game over.The only real difference is that one is in a bull market, which may or may not be over, and the other is in a bear market, which may or may not be over. Sentiment for both is at extremes, albeit at different ends of the investment spectrum.During every crypto winter I’ve known, people start to give up on it. The future is no longer what it once was. The tech is flawed. It’s going to zero. It’s not real. It’s a scam invented by the CIA, Jeffrey Epstein, Elon Musk, take your pick.Again, take it all with a pinch of salt.Remember, neither situation is permanent.There is a case for owning both, and I do in my portfolio.I’d rather bitcoin was $150,000 and more, of course I would. But I’ll take a sportsman’s bet that, from current levels over the next 12 months, bitcoin will outperform gold, and probably silver.I know some readers prefer tangible precious metals. Others prefer bitcoin. Both points of view are fine. Each to their own. But I’m an own-both guy. Over the past six months the disappointment in bitcoin has been more than offset by the gains in precious metals. In previous years the reverse has been true, and the reverse will be true again.With the extraordinary accumulation of gold by central banks, the rising price, Triffin’s Dilemma, and de-dollarisation, I do think it is possible some kind of reset is coming as far as gold is concerned. The price does need to go much higher for it to overtake the dollar as central banks’ primary reserve asset. It has already overtaken US Treasuries.But that does not mean silver is going to be remonetised. Silver’s monetary role was always as a medium of exchange, and we now live in a world where exchange is almost entirely digital. Yes, I would prefer to be paid in physical silver. There is something quite spiritual about being paid for a job in physical silver. But so what. Convenience wins.Silver’s role as a store of wealth was minimal. That is where gold still has use.Yes, silver has umpteen industrial uses. It is a critical metal and in short supply. A rising gold price will carry silver higher too, just as it has platinum in recent months. But I don’t buy the monetary reset arguments as far as silver is concerned.I do get them about gold though.Anyway, good Sunday to you.This week I appeared on Geoff Norcott’s podcast. If you fancy a watch or a listen, here are links to Spotify and Apple podcasts.If you live in a third world country such as the UK, I urge you to own gold or silver. The pound will be further devalued, as will the euro and dollar. The bullion dealer I recommend, whereever you are int he world, is The Pure Gold Company. More here.ICYMI here is this week’s commentaryThis coming week I’ll be looking at the tax loss trades and I am aiming to have more on oil as well.Until next timeDominic This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.theflyingfrisby.com/subscribe

This is a free preview of a paid episode. To hear more, visit www.theflyingfrisby.comPhew. I need to write about something else apart from silver and gold. But I have to look at the price action we have seen this week, and I will say this. It was violent. Extraordinary, even. But it wasn’t necessarily bearish.Sharp sell-offs like those we saw on Friday and Monday are characteristic of bull markets. In bear markets, corrections are grinding and protracted. Selling pressure is persistent. Value erodes slowly amid deteriorating fundamentals.Bull markets behave differently. They flush. Explosively.Late entrants and overleveraged speculators get shaken out. Stops are tight. Everyone is climbing the wall of worry. When a correction comes, a cascade of stop losses gets triggered all at once. Hence the violence.BTW the latest Atlas Pulse came out on Friday, as level-headed as always. It’s the best gold and silver newsletter out there, in my view. Get your copy here - it’s free.This is not just a precious-metals phenomenon. It’s a broader market truism. I’ve seen it in equities, other commodities, you get it all the time in tech - especially bitcoin. Indeed the action we are seeing in bitcoin at the moment is typical of a bear market. The selling is grinding and relentless, rather than sharp and explosive.What’s more the gold and silver miners behaved well, and in a way that is consistent with a bull market flush. Yes, they saw significant selling. But gold corrected 21% and silver 41%. GDX (the large mining companies) only corrected 19% and SIL (the large silvers) 24%. Most importantly, they recovered faster. You would not have got a bounce like that in a bear market.The relative strength is telling. If this were a reversal, the miners would have sold off by more. They didn’t.If you live in a third world country such as the UK, I urge you to own gold or silver. The pound will be further devalued, as will the euro and dollar. The bullion dealer I recommend is The Pure Gold Company. More here.What’s more, theh miners only need $4,000 gold and $50 silver to be highly profitable. But if higher prices are the new normal, then a lot of previously uneconomic mines - particularly the low-grade, bulk-tonnage in Canada - are going to become economic. Heck, even STLLR Gold (TSX.STLR) might work. I should probably delete that last sentence.How the landscape has changed from a couple of years ago.Such huge potential, but …In other news, I sat through the Comstock Inc (AMEX:LODE) conference call yesterday. An hour of my life I won’t get back.The asymmetric potential of this company remains enormous. But that call was a red flag bonanza.With the silver story what it is, and a clear path for this company to become North America’s largest silver producer, this stock should be trading above $15.

This is a free preview of a paid episode. To hear more, visit www.theflyingfrisby.comI am rotating some of my gold and silver profits into oil and gas, as I think energy is next. I will have more on this very soon. I promise. But we need to talk gold and silver today, plus we have an update on top pick Metals Exploration (MTL.L)I thought Monday was the top. Silver went from $100/oz to $115/oz over the weekend and then on Monday in US hours reversed and gave back all those gains. It looked like we were shaping up for an island reversal.Here we are on Wednesday and, as I write, we are at $115 again.This is one strong market.If you live in a third world country such as the UK, I urge you to own gold or silver. The pound will be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.Let’s all do the Randolph?I have a friend. We’ll call him Randolph (which I read means “”wolf shield” - cool, huh?). He’s about 30 and he works in the City, as a quant analyst or something. After some extensive research, a few months back he put 95% of his entire portfolio into a silver mining company by the name of Hycroft Mining (NASDAQ.HYMC). It was $5.Bear in mind, he has no real estate, so to put 95% of his entire portfolio into something can’t be that far off 95% of his entire net worth.The research he’d done into both silver and, specifically, into the situation that was Hycroft, and the trust he had in his own judgment, gave him the conviction he needed to go for it.Today the stock is trading at $50. He’s 10xd his money.Randolph was talking to me about the company in December when it was $13. I resisted. I got so many ideas thrown at me, I can’t buy them all and I already had my silver exposure via Sierra Madre (SM.V) which was going and continues to go great guns. (It has almost tripled since December so it’s not like I can complain).But you always hear about the ones you should have bought. The ones you were tipped that then collapsed - they get forgotten very quickly.So good for Randolph. Events have proved him right. You’ve got to be in it, to win it, and all that.But what if events had gone against him? What if silver had turned down 30%? He’d have been up the proverbial, and some.But it didn’t and he’s been proved right.My buddy Simon Catt, by the way, who was in Hycroft even before Randolph, thinks Hycroft can go up another 10x from here. He could be right. I am just too cautious about buying things that have moved this much. Maybe I shouldn’t be. I didn’t buy bitcoin at $10 because it had just 10xd.But, as I say, you only remember the ones that went up.The price is always there to remind you and eat away at you.The ones you didn’t buy that collapsed - the gazillion of shitcoins and shitcos I’ve avoided over the years - I’ve no idea what they even are. I should put them all on a spreadsheet, calculate how much I’ve saved by avoiding them and use the money I haven’t lost to buy myself a new frock.I don’t advocate doing what Randolph did because there is so much that can go wrong.When it does go wrong, the person who advocated it will get the blame as much as the person who actually did it. More importantly, it’s a poor way to manage riskBut I’ve done something similar myself. And ballsy bets can and do work - when you get them right. But they are better done when young I’d say. If they do go wrong, you still have plenty of time to recover.My mate Swen Lorentz, who writes the exemplary Undervalued Shares says he sees it among his readers. “Many went from 10k to 100k and then from 100k to 1m with ballsy bets. Thereafter things can become more normal.”The problem is when you ‘re wrong.Position sizing - especially when using leverage - is everything.Charlie Morris’s monthly gold report, Atlas Pulse is, in my view, the best gold newsletter out there. Get your copy here. No pay nada.Where you need to be with silver right nowWith all the above in mind, here is where I think you need to be with silver. The easy money has been made. In the miners and leveraged silver plays, the asymmetry is no longer what it was.Yes, I can see a bananas scenario in which the calls of the most ardent silver bulls prove true and silver goes to $300/oz or even $700/oz. Unlikely, though possible. In such a scenario, Hycroft and Sierra Madre and many other silver miners besides will be 10 baggers and more, even from today’s prices.But silver could just as easily top at $125, and go back to $25.The more elevated a price gets the more vulnerable that market becomes. It’s only a month ago that silver was $50 and that felt high.Many will feel differently and want to be all in. Animal spirits and all that. But Auntie Dominic says you should be in a position with speculative silver plays, where you now have your original investment off the table, and have banked some profit.The rest you can let run, in case those higher prices do actually come into play.Every time we feel at a point of extremity take a little bit more off the table.But you do not want to be in a state where this winning position could still turn into a loss.There is a bullet-proof vest available to you. You may as well put it on.We need to look at Metals Exploration (MTL.L)

With all sorts of rumours about physical shortages of silver, for your Sunday thought piece today, I spoke to precious metals dealer Joshua Saul to try and find out what is really happening in the metals markets.Joshua Saul has been dealing gold and silver bullion for 20 years. He’s never seen anything like what’s happening now.His key points: silver is catching up from decades of undervaluation. The gold-silver ratio historically sat at 15:1. In recent years it hit 100:1. That’s not a price quirk - it’s a structural anomaly that’s now correcting.Supply can't keep up. Most silver comes as a byproduct of other mining, so production can't respond quickly to price spikes. Industrial demand is surging (solar, EVs, data centres). Mints are sold out. China's quietly accumulating. Physical premiums are spiking globallyThe Pure Gold Company has metal, but only because they have large contractual commitments with the Royal Mint, but he’s clear - this is unprecedented. Even 2008 didn’t look like this.Find out more about the Pure Gold Company, here.NB: I was trying out a new camera and I know it looks crap. Won’t happen again.Meanwhile, ICYMI, here is this week’s commentary.Until next time,DominicPS Let me give my buddy Charlie a plug. His monthly gold report, Atlas Pulse is, in my view, the best gold newsletter out there. Get your copy here. No pay nada. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.theflyingfrisby.com/subscribe

This is a free preview of a paid episode. To hear more, visit www.theflyingfrisby.comThis has been for ages one of those things that has been going to happen that never actually happens.But on Monday there were signs it is actually going to happen.I’m talking about some kind of financial crisis in Japan, whether in its currency, its debt markets or a bit of both. Because it’s so far away, we tend to overlook in Western Europe what a big deal Japan is: but it’s the world’s 4th largest economy - only the US, China and Germany have greater GDP.But its debt-to-GDP is 230% - 4 times Germany’s (~63%), more than double the UK’s (100%) and almost double the US’s (~124%). But it has sustained these “unsustainable” levels for so long it’s now normal. Shorting the yen has been the great widow maker.In addition to roughly $10 trillion of government debt, Japan also carries around $8 trillion of non-financial sector debt, including corporate and household borrowing. This is not new. What may be new is the market’s willingness to continue absorbing it at the margin.On Monday Japan Prime Minister Sanae Takaichi called a snap election for February 8th, seeking a stronger mandate for her coalition government. She has high approval ratings, I read, and is looking to capitalise on them, restoring the Liberal Democratic Party's majority in the powerful lower house. Even so, though she is favourite, this is also a gamble.If you live in a third world country such as the UK, I urge you to own gold or silver. The pound will be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.Takaichi will run on a platform of more stimulus. The worry is how she “pays” for her proposed cuts to food taxes. It’s not totally unlike the Liz Truss situation, when she proposed tax cuts without material cuts to spending.How much is enough?I just don’t get it with governments. Something doesn’t have the desired effect. Instead of stopping and reassessing, they do more. Ooh, this petrol isn’t putting out the fire. Let’s add more petrol.But the result of her announcement was that Japanese borrowing costs rose sharply to all-time highs (again). 30-year yields posted their biggest daily jump since 2003, and 10-year yields surged 19 basis points. Not quite such a record breaking rise but the sharpest since 2022.Japan’s bond market, long regarded as the safest and dullest corner of global finance, is suddenly being treated as risky. Compounding the problem is the fact that Japanese insurers, historically reliable buyers of long-dated bonds when yields rose, have become net sellers. That removes a key stabilising force.Charlie Morris monthly gold report, Atlas Pulse is, in my view, the best gold newsletter out there. Get your copy here. No pay nada.At some point the Bank of Japan may step in and buy bonds to calm things down. That’s what usually happens. The risk, however, is that Japan is deemed even more fiscally permissive, the yen weakens further, and inflationary pressures stoke.If the yen carry trade unravels - that is the financial world borrowing Japanese yen at low rates and using the money to invest elsewhere - then everything unravels, and we get the 2020s version of 2008. It’s been threatening to happen a long time, but it never quite does. But hot money - aka liquidity - will get sucked out of everything from gold and silver to the stock market to the bond markets to bitcoin, and the world gets a massive margin call. The bottom line is that this raises the risk of more global market volatility. If Japan, long the calmest corner of global finance, becomes unstable, everything priced on the assumption of low and stable interest rates needs to repice. Risk-on flips to risk-off. Speculative assets get hit.Add all the Greenland stuff to the mix and everything looks very shaky all of a sudden.Periods like this are not necessarily about bold calls. They’re about deciding where you refuse to be sloppy. So I am taking some action.

If the stories are to be believed, and the first casualty of war is truth and all that, Venezuelan President Nicolas Maduro sent some 3.6 million ounces of gold - $16 billion in today’s money - to Switzerland before 2017, when the EU brought sanctions against Venezuela.Switzerland last week froze his accounts and the accounts of some 36 others with close ties. We don’t know how much money he had in them, or how many accounts there were, but the figure doing the rounds is $10 billion.It has also emerged that Tether has been freezing “wallets identified as being involved in the Venezuelan oil trade.” As much as 80% of Petroleos de Venezuela’s oil revenue is believed to be transacted in tether. This could be a total figure in the billions too.We also know that Venezuela was mining bitcoin for many years - when the price was a lot lower - but we don’t know what they did with the coins. Did they fall into Maduro’s hands? Were they sold? Were they held?The number doing the rounds here that it owns 600,000 BTC (~$60 billion). That would put Venezuela up there with Michael Saylor and Strategy. It’s three times the 198,000 coins the US government itself is said to own.There’s a seed phrase I’d like to know. Where are the keys, I wonder?And where did the proceeds of Venezuela’s enormous oil, gold and other natural resource exports end up, exactly? Only some of them we know. At this point we remind you that the Venezuelan currency itself - the bolivar - collapsed in hyperinflation and has little to no value. Beware national currencies, particularly under socialist regimes. They don’t last.There are several things I take away from all of this.First, the US dollar - whether via SWIFT or stablecoin - remains the number one international currency of choice, even for America’s enemies.Second, tether and other US dollar stablecoins might be convenient - you don’t have to use banks - but Tether will do what the US government tells it to do, and if the government wants your assets frozen, Tether will freeze them.Stablecoins, then, have a central point of failure. If someone can freeze them, they are not sovereign. And just as the US froze Russian US dollar assets after its invasion of Ukraine, so can and will it freeze the stablecoin assets of its enemies too.What did that 2022 freezing of Russian assets trigger? The mother of all bull markets in gold, and then silver and miners.What will this freezing trigger? A bull market in bitcoin. Possibly. Likely.It’s already creeping back up.While the US does its geo-political, strategic, critical minerals thing, quaint old Western Europe is sinking deeper into higher taxes and - I’m sure they’re coming eventually - capital controls. In fact, capital controls already exist in effect, banks are so heavily regulated and limiting of what you can send and to whom.The value of permissionless, international money just went up.You need to own money that they can’t touch, whether by seizure or debasement.Meanwhile …Gold and silver continue to go bananas - the latter especially.So many roads lead to gold at the moment, it’s hard to see when this stops.The inevitable debasement of national currencies off the back of uncontrollable government spending. Gold. Dedollarisation. Gold. Increasing geo-political uncertainty - Iran, Venezuela. Gold. Reshoring of US industry - highly inflationary. Gold. Revaluation of US gold holdings. Gold. Looming crisis from Japan as yields spike. Gold. China’s ambitions for its currency and trade. Gold. Triffin’s dilemma. Gold. AI putting everyone out of work leading to more money printing. Gold. Declining competence of and as a result faith in institutions worldwide. Gold.The dollar has now fallen to a 40% share of global central bank reserves, while gold is now at 30% on the back of its higher price and central bank accumulation. (Note currency and reserves are not the same).We are in a major capital rotational event the like of which occurs only every few decades.Typical portfolios are still underweight gold.If you live in a Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, US, Canada and Europe or you can store your gold with them. More here.Own bothAs regular readers will know, I advocate owning both bitcoin and gold. The two assets have many similarities in that they are non-government, independent money. But the fundamental difference is that one is physical and one is digital.Both have their uses, and I have little patience with this notion that one must choose one or the other.In that regard, as with many others, my worldview is aligned with that of Charlie Morris (whose newsletters I urge you to subscribe to. There are lots of free options, including Atlas Pulse, which I love). Remember many years ago Charlie was calling for $7,000 gold by the end of this decade and many thought he was dotty. His call is looking perfectly sensible now, which it was - and which he is. Charlie previously managed a multi-billion-dollar fund for HSBC, before going solo. Aside from his newsletter, one his main endeavours has been BOLD, and he has been trying to get it listed for years. But the UK’s Financial Conduct Authority is retarded.BOLD is a fund you can buy through a broker which is 75% gold and 25% bitcoin - all properly audited and backed, of course, with institutional-grade custody.Over the past five years, BOLD has returned 186%, while bitcoin has returned 202%, gold 128%, and equities 77%. The average return of bitcoin and gold together was 165%, yet BOLD was 21% ahead. This is because every month Charlie rebalances the portfolio, effectively buying more of whichever is the weaker asset to retain that 75:25 ratio. This act of rebalancing both strips out the volatility and increases the gains.Since Charlie first conceived of it in 2017, over pretty much any timeframe, BOLD (in blue) has beaten everything.Since its listing in Europe in 2022 BOLD has returned 123% since launch (in GBP to end 2025 including fees) compared to 111% for bitcoin and 113% for gold.It would have been nice to have been able to enjoy these gains in the UK. Thank goodness the FCA has protected us from them.Not for much longer.I was delighted to be at the London Stock Exchange yesterday to see the listing of this product which delivers “bitcoin-like returns with the lesser volatility of gold.”Congratulations, Charlie, for finally getting this listed. I wish you every success.Now we can actually invest.Obviously, if gold AND bitcoin both turn down, BOLD will suffer. But this is a classic buy-and-forget product, perfect for the Dolce Far Niente portfolio. You can own it in your pension, your ISA and it should become a mainstay of any portfolio.The 21Shares Bitcoin Gold ETP, BOLD, has the ticker LSE:BOLD.I am a buyer.PS some brokers such as AJ Bellend have only made this product available to pro investors. The broker I use is Interactive Investor, who are pretty good about getting these kinds of things live. If you open an account via this link you get a year’s free. I am just on the phone to them now to get this listed.Disclaimer:The Flying Frisby is not regulated by the Financial Conduct Authority (FCA) or any other regulatory body as a financial advisor. Therefore, any information provided in this newsletter does not constitute regulated financial advice. It is solely an expression of opinion. Please conduct your own due diligence and consult with a financial advisor, if you have any doubts. Remember, markets can both rise and fall, especially in the case of small and mid-cap stocks. I am not aware of your individual financial circumstances, so only invest money that you can afford to lose. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.theflyingfrisby.com/subscribe

It’s that time of year again.What’s going to happen? What does the future hold?We all want to know. Knowing what’s going to happen makes you feel better.NostreDominic is here to tell you.Here are 19 predictions for 20261. Gold Breaks $5,000Gold doesn’t quite have the year it had in 2025, but it has a good year nonetheless and rises above $5,000/ozOn which note: Charlie Morris’s monthly gold report, Atlas Pulse is, in my view, the best gold newsletter out there. Get your copy here. No pay nada.2. S&P 500 FrustrationThe S&P500 will spend much of 2026 in a frustrating range trade with a couple of nasty pullbacks. We see an interim peak in April-May, followed by a weak summer, but a strong final quarter means we end the year with a 10-15% gain.The problem of disproportionately few stocks (41 is it?) being responsible for most of the gains remains.3. Inflation Finds New FormsInflation doesn’t die, it mutates. Headline inflation looks reasonably controlled (by recent standards), enabling leaders to declare that it is controlled or some other BS. Despite this “victory”, inflation finds other ways to rob you.4. Bitcoin Hits $150,000Bitcoin has a good year. With escalating geo-political conflict, as well as capital controls and tax grabs, more and more people wake up to the value of permissionless, apolitical currency. Falling trust in fiat - never mind government institutions - becomes more culturally entrenched. Bitcoin goes to $150,000.5. Starmer Survives (Just)Prime Minister Keir Starmer manages another year. His position gets even more precarious after a bad showing in the May local elections, but it is still only 2026 and the next General Election is not till 2029. Too early to oust him just yet.6. Government Spending: The Unstoppable ForceGovernment spending keeps on increasing. Even if they wanted to, they just can’t stop it. Western Europe continues, therefore, its great march on the road to serfdom7. But No Sovereign Debt CrisisDespite the mathematics verging on the impossible, government debt continues to outpace GDP (it has grown at three times the pace this century) but the inevitable sovereign debt crisis that is coming to the UK, Western Europe and perhaps even the US, is somehow averted.By saying it won’t happen, it will happen. I know it.8. British Stocks Shine Despite Economic StagnationBritain’s economy continues to stagnate, but British stocks do well. Rather like Japan circa 2015, the valuations are so cheap that mergers and acquisitions are inevitable. Foreign money takes advantage.9. Oil RecoversOil, currently lagging metals, begins to turn around. Brent crude stays above $55 and flirts with $80 a barrel.10. UK Energy Costs Stay ElevatedEnergy costs in the UK remain high because Millibrain. Limited growth is the result.If you live in a Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.11. Critical Minerals BoomI would venture that the decision to overthrow Venezuelan President Maduro was as much about critical minerals - so-called strategic metals et al - and China’s chokehold on them, as it was oil and gas, narco-terrorism, Russian drones and liberating the poor suffering people.To the US’s credit it is trying to put the China chokehold problem right. The UK and Europe are hopeless. But this process, especially re-shoring industry, is highly inflationary, hence my comment about inflation finding new forms.It is a good year to be invested in both industrial and critical minerals, and the related stocks end the year considerably higher than when they began.This is something I’ll be looking at a lot next year12. Emerging Markets RallyEmerging markets have a good year. Commodities, innit.13. The Pound Weakens A BitThe pound gradually weakens against the US dollar. High is $1.37, low is $1.25. Or thereabouts.14. Silver. Triple Digits.Silver goes above $100. There I’ve said it. Now watch it crash.15. AI-Powered Government OverreachA highly worrying development. Government Blob bodies, such as Ofcom and HMRC in the UK (though this problem is global), make increasing use of AI to make their processes more efficient. This enables them in a really bad way.This is already happening. In 2026 people start to wake up to the fact.I like AI. But it enables Big Bureaucracy. Beware.16. UK Property: More Stagnation The stagnation, particularly at the upper end of the market, continues. And why wouldn’t it? Moving is too expensive.While nominal prices might be flat or slightly up, real prices are down, liquidity is poor, transactions fall.17. Rents Stay ElevatedBecause so many now prefer to rent so they don’t have to pay moving taxes, and because the game is now over for amateur landlords, who continue to exit the market due to the increased cost of regulations, rents stay elevated.18. Official Reassurance = The Biggest MistakeThe biggest mistake of 2026, as with every year, will be trusting official reassurance. Governments and central banks remain behind the curve. Markets lead, policymakers follow. The crisis won’t come from what they warn us about, but from something they’ve missed.19. Your Bruce-y Bonus Sports PredictionArsenal win the League. West Ham, Burnley and Wolves all get relegated.Have a wonderful 2026. Let’s hope as with last year I’m wrong about everything and we make a potload of dosh. Until next time Dominic This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.theflyingfrisby.com/subscribe

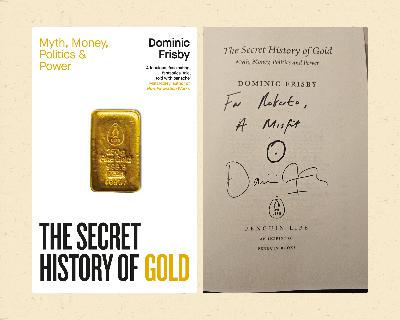

Happy New Year to you.This time last year I did something I’d never done before, which was to publish my New Year’s resolutions.I was nervous about doing it because, despite constantly putting stuff out on the internet, I’m actually quite private about some things, and it made me feel quite vulnerable publishing them.However, publicly stating goals pushes you to achieve them. You’re making yourself accountable, so you’re more likely to deliver. It also clarifies what you’re actually looking for, and solidifies goals beyond abstract ideas. It can also prompt those reading them to help in some way, whether through advice, introductions or collaboration.I’m glad I did it, and I’m sure it helped me achieve a lot of those goals.Here they are, in case of interest:The health, body and mind stuff I pretty much succeeded at - I stayed fit, I drank even less (to the point of barely drinking at all), my fasting fell by the wayside and so my weight has crept up a little. I hit my reading target - just - though really I should read a lot more.Money was also a goal hit with gold, silver and most Flying Frisby tips all performing well (though let’s be honest last year was a bonanza year for pretty much everyone except bitcoin maximalists).On the love and family side of things, I think I did ok - you’ll have to ask my kids and mother if I have been a good father/son. My other big target of settling down with a certain Miss Downing was an abject failure, which is probably for the best all things considered, and I am grateful to my Guardian Angel for stepping in there.On the work and career front I should consider the year a success. The live shows were brilliant, sold out, we have a lot of dates in for the spring. The book has also done well. It’s coming out in the US next year.Above all I have got Kisses on a Postcard moving forward, which was the most important target of the year.The two big failures were that I didn’t finish two writing projects I had in mind - my Gilbert and Sullivan and Peasants Revolt musicals - nor did I do many gigs in the US or practice my uke every day, but I probably asked a bit too much of myself.All in all I should consider 2025 an annus perhaps not quite mirabilis, but certainly bonus, prosperus, felix et secundus - and be very grateful for itSo what are my goals this year?They’re not unlike last year.Love and Family* Be a good dad to Samuel, Eliza, Lola and Ferdie, and to daughter-in-law, Millie.* Be a good grandad to Cecilia.* Be a good son to my mum.* Get a girlfriend.Kisses on a Postcard* Get the script as good as it can possibly be (happening as we speak).* Get a s**t hot director and cast* Raise 10 million quid* Shoot the next great musical.Easy!MoneySame as last year. Invest well and grow my net worth - and the net worth of Flying Frisby readers - by at least 20%. I beat that by some margin in 2025 in what, looking back, was a gift of a year thanks to gold, silver and the miners.If you live in the Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.Hard to see things being as easy in 2026, but I’ve got my eye on a few things. I will keep you very much in the loop.You know you should.Work & Career - Laughter, Acclaim, Opportunity* Grow the Flying Frisby by 20% in subscribers and revenue. Break into the Top 50. (Currently 60th)* Comedy - keep storming the gigs, land more tour dates in bigger venues selling more tickets* Promote The Secret History of Gold really well in the US when it launches in May* Build my online presence as both comic and commentator - I’ve got a specific plan for this* Keep writing songs and material, get better at the uke and make a start on guitarHealth, Body & MindI’m 76kg (12 stone/167lb). My weight has crept up these last few months, mainly since my habit of fasting has fallen by the wayside. I hit 67kg (10 ½ stone, 147lb) at one point in 2024 leading to several interventions from friends telling me I looked like a lesbian Gary Lineker. Maybe. But I felt great. I reckon my ideal weight is 72kg (11st 7, 160lb). So get there and stay there. Which means:* Fasting more regularly* Weights two or three times a week* Something aerobic two or three times a week* Daily stretching - dead hangs, pelvic floors, neck exercises* Stay off the booze* Eat more protein and starve that sweet tooth* Play more racket sports (good for the brain apparently). More tennis and table tennis, get into padel and pickleball.PLUS* Morning breathing practice and regular meditation/prayer* Read another 15 booksWish me luck!What about you - what are your goals for the year? Stick them in the comments if you fancy making yourself accountable tooIn the meantime, let me wish you a happy, healthy and prosperous 2026.I’ll be back mid-week with my annual predictions piece.Until next time,DominicPS I was planning to take Christmas and New Year off. Never mind.PPS The tax loss trade is now positioned and ready to go. Take a look. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.theflyingfrisby.com/subscribe

Good Sunday to you, Before we begin, let me flag this week’s commentary. This a trade with a remarkably successful hit rate, a clear timescale and a relatively easy risk to manage - you know pretty quickly if it isn’t working. 8 of last year’s 9 ideas worked. By my reckoning you will find the biggest bargains of the year tomorrow, Monday December 22, and Tuesday December 23. So take a look: Right, so today I am marking my own homework.Every year, as old timer’s will know, I like to offer some predictions for the year ahead - usually 10, but with inflation being what it is, it ends up higher. Today we look back and see how I did. The usual disclaimers apply - the more outlandish the prediction, the more entertaining - so the more likely I am to make it. But the less likely it is to actually happen. I try to strike a balance …As events change, so do opinions. Process is gradual. But when you jump a year, with no scope to revise as events turn in a different direction, quoted out of context and with the benefit of hindsight, predictions can look really, really stupid. Don’t judge me, bro.I often find that the worse my predictions, the better my portfolio performs, which is odd, but there you go.If you want to read last year’s piece in full, it’s here. But I’ll quote quite copiously below.A reminder of the scoring system: 2 points for a direct hit, 1 for a quite good, 0 for a miss, and -1 for an epic fail, giving me a maximum of 30 and a minimum of -10. How did I do? Let’s find out. 1. The long overdue correction in the UK housing market finally begins.You can read my reasoning here, but it boiled down to: richer people being net sellers as they leave the UK, few foreign buyers, fewer buyers more generally because of high moving costs (Stamp Duty etc), little bullish sentiment in the economy meaning a reluctance to borrow and invest and the 18-year-property cycle turning down.What actually happened is by no means clearcut, but I’ll try and summarise.Price growth and transaction volume were relatively high in the first 3 months, until Stamp Duty changes came into effect in April, after which the market became “subdued”. Overall, the north saw some increase, while London fell 2.4% in the year to October. Average growth was 1.7%, which is some 2% below official inflation rates - real inflation is of course much higher - meaning there have been price falls in real terms. This is even with the Bank of England bringing rates down, thereby enabling more money to enter the market via increased borrowing.Overall, transactions volumes increased by 9% on 2024, to get back in line with the 10-year average, though there is a very different story at the upper end of the market.The housing market has big problems, especially in the south, but it hasn’t cratered - though nor has it soared. I’m giving myself 1 point. 2. Keir Starmer survivesEveryone thought he was toast this time last year - and he is - but my argument that “it’s too early for Labour MPs, worrying about their seats, to give him the shove” prevailed. 2 points. 3. Gold hits $3,000.And the rest. It’s $4,300 as I write and going higher. I was too conservative. 1 point. BTW. If you live in a Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.4. Microstrategy (NASDAQ:MSTR) becomes a top 100 company by market cap.Oops. When Strategy hit $450 in July, its market cap would have been around $130 billion, making it perhaps a top 300 company but not a top 100. It would have needed to get above about $250 billion to make the cut. And since then it has the skids so badly it’s now a tax loss opportunity.-1.5. Bitcoin goes to $200,000 then crashesI got the crash bit right. Sort of. $126k was the high, having begun the year at $91k. Today it’s $88k. 0 points.6. Sterling has big problemsNope. It’s had a good year. -1.7. X thrives, Blue Sky dies, Blogging Blue SkiesWell sort of. X saw strong numbers growth in the first part of the year, but these have tailed off. It is now a key place to go for breaking news and a leading news app, but by no means the Governor. The exodus to Blue Sky has slowed, but BS (LOL) is still growing albeit at a much slower rate. Blogging, as evidenced by Substack, is thriving. I’ll give myself 1 point.8. The S&P500 Rises 10%15% actually. We predicted a decent year, despite year 1 of the electoral cycle tending to be the weakest. 1 point. Do I get 2? Nah.9. Oil ranges.Oil would neither crater nor moonshot, we argued. We saw a range of $60-90. Its actually been $55-80. 1 point.10. Small Caps ThriveThe Russell 2000 has had a good year - rising 12% - but the large caps are still winning. 1 point.11. The US Dollar Index breaks out to 20-year highs. Oops. I was looking for a high around 117 in the US$ index. It didn’t get above 110. It fell! -112. The BRICS don’t come out with a proper US dollar alternative … yetEveryone says it’s coming, but it never actually does. 2 points.13. Silver disappoints … as always$33 is the high, $22 the low, I said. Ha! $28 was the low, and the high - $68. To be fair to myself, I said multiple times it was going to $50 and if it gets above there it goes to $90+, but the call was still an epic fail. Irony: silver has been a huge winner for readers this year and our pick, Sierra Madre Gold and Silver (SM.V), has been a joy to own. From 45c north of $1.50 :(I still get -1 though.14. Despite all the crap, the world becomes a better place to live.We live longer, we eat better, tech keeps improving things. We advance. AI makes us more productive and betters living standards.It’s so obvious I can’t believe I even said it. I’ll give myself a point, but not 2.15. Your Bruce-y bonus sports prediction.Liverpool win the league. Ipswich, Southampton, and Leicester all go down.Bullseye. I should take up sports betting. 2 points.I don’t actually follow football any more, but one of my son’s told me that’s what would happen.So, overall, a very poor showing for the DF Predictions, possibly my poorest year ever: totalling a measly 7 points.And, as always seems to be case, a much better year for my portfolio of companies. Here’s hoping I get all next year’s predictions similarly wrong.I’ll be making those early next year - so look out for that.Thank you so much for being a subscriber to the Flying Frisby. I wish you and your family a very happy Christmas. Don’t eat too much, go easy on the booze, pray, sing, get plenty of exercise, avoid toxic people and the lurgy, and be thankful for the many good things there are in your life.Once again - I urge you to take a look at the tax loss opportunities. Tomorrow and Tuesday are the buy days.Here’s to a healthy, wealthy 2025. Until next time,DominicPS This Wednesday being Christmas Eve I almost certainly won’t be putting out any commentary. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.theflyingfrisby.com/subscribe

I was having breakfast with my son, daughter-in-law and grand child earlier in the week. He is 25, she is 24, and baby is 5 weeks old.They’re both pretty successful in their jobs - both in sales, on commission, so very much performance-based - and they both work very hard. They are ambitious. They want a big house with a big family, and plenty of money to live off. Pretty normal ambitions, really, and once upon a time not so impossible to achieve.I’m extremely proud of them both for having gone against the grain and had their first child so young. I’m also proud of how they have both adapted to parenthood. They live with me, so I see every day how utterly devoted they are, how much effort they put in, how they are learning and flourishing. The way Millie has thrown herself into motherhood and totally dedicated herself to her child is a thing to behold. Breast feeding on demand, everything. It really is a joy to see.Because they’ve started a family young, there is a very real chance they will go on to have a very big family. They both say that is what they want. My son, Samuel, has now gone back to work, while Millie is on maternity leave. But having both made several successful deals, and with a backlog of outstanding commission coming payable too, they found themselves between them paying £26,000 of taxes last month - 50% of the £53,000 they earned was taken, when you factor in the student loans they have to repay. (They might get some of that back at the end of the year).To earn that kind of money in a month at such a young age is just brilliant - I see how hard both of them work, the hours they put in, early morning after early morning, late night after late night, the persistence - and I’m proud of them. It is not easy. None of their university colleagues are doing anything like as well, at least in financial terms.With the bonanza month they both had, they could have paid off significant chunks of their student loans. But no such luck. The tax man cometh first.Meanwhile, they are so far from being able to buy a house for their young family - not just in the area they grew up, but anywhere in Greater London - it’s a joke. I like having them live with me, don’t get me wrong, but the fact that even a couple as successful as this are miles away from owning a property of reasonable enough size to start a family makes my blood boil.We live in a Victorian terraced house in South London that was built 150 years ago for a working-class man and his family. Yet a working-class man could never afford to buy this house now, even though it’s 150 years old - never mind the highest-earning couple in their peer group.The most commonly given reason why people do not have bigger families earlier in life is expense. And what is the greatest expense in your life? Altogether now, “your government”. By far and away. Lower that expense and people will have bigger families again, earlier in life. (Even the cost of housing itself - the second biggest expense in a typical life - would come down with less government - less planning permission, less building regulation, less market intervention for political ends, less fiat and so on).Quite a few of the houses in our street are owned by the council. An old lady who lived in one of them recently died, and her house was given to a Somali family. So the taxes that Samuel and Millie are paying, and would like to have been able to use towards their own family, are being used to house another family not just from another country, but another continent never mind another culture. I’ve no doubt their needs are great. They get the house they need. We pay. How many more families not from the UK are we expected to sponsor - and delay/minimize our own procreation for?We are literally taxing our own to enable to the procreation of others. As I say in the title, we are taxing ourselves into oblivion.“Have you ever known taxes to actually go down?” My son asked me.“Well,” I said. “They came down a bit in 1980s under Thatcher”.It might feel relatively recent to me, but that was a good 15 years - half a generation - before my son was born in 2000. And even under Thatcher and Reagan, it’s worth remembering, the state actually grew.The state continued to grow in the 90s and 00s, and, by the time you factor in all the various stealth taxes that got introduced, not least fiscal drag - perhaps the most odious of the lot - as well as currency debasement, so did taxes.Now, because of fiscal drag, you see teachers paying higher rates of Income Tax. It’s not in any way exceptional in London to earn more than 50 grand. You haven’t got a hope of having any kind of lifestyle, if you don’t. I dread to think how many Londoners - those that work hard at least - are paying higher rates of tax. And for what?What chance do these people have of buying a home and starting a family?And all this money is being taken to spent on what, exactly? Not potholes, that’s for sure.I think the question my son was really asking was, “Is there any chance taxes come down?”Well, if you look at Britain since World War II - actually since World War I - the growth in the state has been relentless and inexorable. So the rise in taxes we must pay has been inexorable. I’m not just talking about Income Tax. As I say, I’m talking about all the stealth taxes and debasement of currency as well. Is there any realistic chance they’ll come down? Liz Truss only tried to slash government spending by two and a half percent. And look what that did.It’s incredible to think that at the turn of the 20th century taxation - or the state - amounted to less than 10% of GDP.Even if Reform were to win the next election, how would they realistically cut state spending by more than a couple or three percent? The institutional resistance - the blob, the civil service, the quangos, the media - would fight them at every turn. In short, taxes are unlikely to come down by anything meaningful.We cannot get this country purged until the currency collapses. That’s the only way I see it happening. It’s very sad. If you live in a Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.My son, who is not particularly political, observes the absurdity of it: many people who build wealth, the most productive and talented, are leaving because of high taxes, and we replace net contributors with net takers. The country is systematically driving away the people who create value while importing those who consume it. It’s economic suicide by design.As readers of Daylight Robbery will know, I regard taxation as the best measure of freedom there is. The more heavily taxed societies - where obviously there is limited economic freedom - tend to be the societies where there is limited freedom of speech, freedom of movement, freedom of thought, freedom to experiment and all the rest of it.Freedom of movement in the UK is limited by the cost of movement - whether it’s transport costs, petrol costs, Stamp Duty, fines, charges, new mileage taxes - all reduce movement. They’re all a tax. There might not be laws preventing movement in the way there once were if you were, say, a serf, but taxes give you a similar outcome. They restrict movement - and thus possibility - because people cannot afford to move.You don’t need me to demonstrate how freedom of both thought and speech are being attacked. The two-tier justice system sees people committing violent crimes getting released early - indeed often not even getting convicted - while people who just said words get locked up.I’m sorry to say it, but I don’t think even Farage and Reform can turn this one around, particularly when Farage is watering a lot of his policies down in order to give the media less to smear him with, and make himself more electorally palatable. Starmer did something not so totally dissimilar.And if something should happen to Farage, what then? What would Reform be without him? I like Richard Tice a lot, but there is not exactly a huge queue of people waiting to fill Farage’s boots.Tell someone about this great article.So I come back to my point that I’ve made on these pages many times. If you are young and wanting to build a good life for yourself, and you want to be rewarded for the hard work you put in, your chance of doing that in the UK is limited. You’re best off going somewhere else. Sorry to sound negative. There are many things to be positive about in this world, but the future of taxation and freedom in the UK is not one of them.Remember the golden rule of Daylight Robbery: fix taxation, everything else follows.But there is no sign of us doing that.Until next time,DominicICYMI, here is this week’s commentary - also prepping for the North American tax loss trade.And, finally, I appeared on the mighty Tom Woods Show this week. I love Tom, and he is fast becoming one of my best buddies. Here are links to the interview on Apple podcasts, Spotify and YouTube. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.theflyingfrisby.com/subscribe

This is a free preview of a paid episode. To hear more, visit www.theflyingfrisby.comBefore we come to the main thrust of today’s piece, there is something I need to flag. We are just coming into North American tax loss selling season, and a number of you have asked if I will be putting together a portfolio of tax loss trades this year.The answer is, “maybe”.I’m not sure how well it will work this year for reasons you are about to find out, but it’s something I am still considering, and I will I try to have a list of options for next week’s missive. By my reckoning the dates when you’ll find the biggest bargains this year will be Friday December 19, Monday December 22 and Tuesday December 23, though the window stretches from next week all the way to New Year’s Eve.What am I talking about?At the end of the year in the US and Canada, investors (both retail and institutions) sell their worst performing stocks in order to realise losses to offset against gains elsewhere in order to reduce their tax bill.This selling tends to climax in the last two or three days of trading before Christmas and it means badly performing stocks, particularly illiquid ones, get way oversold only to experience something of a rally in the first few weeks of the following year as the selling dissipates.So the trade is simple: buy as the selling climaxes and then flip sometime in February (my Canadian broker says March and last year this proved very true).Nothing is guaranteed in this cruel world (except the further debasement of your national currency), but it is a trade with a remarkably successful hit rate, and a clear timescale. It also becomes apparent pretty quickly if it isn’t working, enabling you to exit any losers early.If you live in a Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.By all means go back and audit me, but last year I believe 8 of the 9 ideas worked.Some picks work better than others. Some years work better than others, but gains of 20-50%, even doubles sometimes, are not uncommon. The trade works particularly well in smallcap Canadian resource stocks, as, when they are bad, they are really bad, and can get hugely oversold. However, this year Canadian resource stocks, particularly gold and silver miners, have had a bonanza year, so there won’t be much tax selling there. In fact, markets more generally have been strong, so there is not the normal flood of dogs to be sold. However, I have some ideas. Crypto Treasury Companies, for example, could be big winners because of the huge losses they have generated. So keep an eye out and I will try and have something for you this time next week. Be ready to move quickly, as well, so have some cash to play with.Right. Changing the subject. Why both legal and illegal immigration is set to increase I can’t go online now without seeing something about uncontrolled immigration. Yesterday saw the sentencing of two Afghan 17 year olds for raping a 15-year-old girl in Leamington Spa. (Spoiler: they weren’t 17. They’ve lied about their age, on that I’ll bet the house. Not that anyone in authority will have noticed). And it’s not just online, it’s in the world around me. I live in south London, so I see it all the time. I travel a lot around the country doing gigs and the changing demographics of the UK are everywhere, even in the remotest parts of the country. I think a little bit of immigration is a good thing, but this is happening too fast and on too big a scale.When a business messes up badly, it goes bust and another, better run business comes along and does the job better. When a state body messes up badly, a load more money gets spent on an inquiry - in the case of the rape gangs £65 million - usually headed by a Blob insider (in this case Starmer appointed peer Baroness Anne Longfield). The mess gets whitewashed as much by time as anything, and the state body continues as before, dysfunctional as ever, if not more so.Unlike those operating in a free market, the state as it currently functions, is incapable of reacting to the new realities of the world around us. There are more people than ever before in the world, and more of them than ever are on the move. Thanks to better planes, trains, boats and cars, they are able to move further and faster than ever before. Thanks to smart phones, which over 90% of the world’s adult population now has, better information about how and where to go gets spread. Smart phones also create FOMO - you gaze at the life you could have - so there is more desire to move than ever before. And the fact that 3 billion people earn less than $40/day means there is a greater urge to move than ever. This is the reality of the world in which we live. It is patently obvious mass migration of people is going to increase. And yet the British government, nor most Western governments, have no plan in place to deal with it all. They can’t even deal with current levels of migration, let alone illegal migration or future migration. There has been no debate or agreement on what the right levels of migration should actually be. With no clarity, policy is, inevitably, both incoherent and inadequate. Promises by every government since Cameron’s coalition have been broken. The courts and legal system were designed for a different people in a different age and are no longer fit for purpose. This all assumes, of course, government could actually lower migration levels if it wanted, which I don’t believe it actually can because of sheer weight of numbers. Thanks to the ECHR and a general unwillingness within the Blob to address this, there is not even the ability to properly tackle this issue anyway. State institutions and infrastructure - from roads to health to education to welfare - cannot cope with the increased numbers and are crumbling. Wealth creators are leaving to be replaced by net takers, resulting in an increased tax burden and eventual likely bankruptcy of the country. Trust has gone and we are accelerating along the road to ruin.Such repeated failure by a business over many years would result in the extinction of that business. But the state operates by a different set of rules, and the only thing that can end it is the destruction of the currency itself. Hence why I say own gold.So that’s where we are. Exploiting the end of Britain: blood money and crony capitalism You can rant and rail and make a noise. But I don’t see what you or anyone can actually do about it. A Reform majority at the next election is what many are pinning their hopes on, but a hung parliament looks more likely. Would even a runaway win for Reform at the next election change much? I doubt it, myself. There’s too much opposition within the system. Liz Truss only tried to slash government spending by 2.5% and look what happened there. As investors our job is not to pass moral judgement on the rights and wrongs of all this. Many think it’s a good thing the West gets destroyed! Our job is to navigate the waters as best we can. As you know I urge readers to own non- government currencies, money they can’t debase - gold and bitcoin. But having just said our job is not to pass moral judgement, I do pass moral judgement when I invest. I shouldn’t, but I do. I don’t buy government bonds, especially gilts, for example, because in doing so you enable government, when government is the problem. Starve the monster is my take. I’m also not participating in the trade I am about to outline here, because it would make me feel dirty. But the more ruthless of you will be fine with it, and you’ll get no flack from me. I hate getting ripped off at airports and train stations, so I have a bit of WH Smith in my portfolio as an offset. This is a little bit like that.There are companies making an absolute fortune from illegal migration. And while this situation continues, they are going to continue making money. Why shouldn’t you as well?Their customer, the government, is a bureaucrat spending somebody else’s money so will pay pretty much whatever. Demand for their services is only going to increase as migration increases. There is no competitive marketplace - you’re not having to compete with other hotels, for example. These companies are all paid by the government - you in other words - to provide facilities for asylum seekers. The contracts are juicy, and those bureaucrat fingers are fat with taxpayer cash. Here’s how to profit from illegal migration in the UK.

This is a free preview of a paid episode. To hear more, visit www.theflyingfrisby.comI found myself at a very VIP event last night at the home of a well-known politician. There was a heck of lot of money, age and experience in the room. I felt like I’d gone back in time to the City of the 1980s.I got talking to an old boy who, it turned out, had made his money in mining. He had worked at one point for the Hunt Brothers (who famously tried to corner the silver market in 1980). He had speculated in Australian’s Poseidon bubble (1969-70), one of the mothers of all speculative mining frenzies. He recalled a stock he had bought at 10c, offloading his final shares at A$120, only to watch it go to A$280. (50 years on, he was still cross with himself for selling too soon, even though it soon went all the way back to 10c).“Are we in a secular bull market for mining stocks now?” I asked him. He didn’t seem to think we are.“What about gold and silver?” “Silver’s at $53,” he smiled.“$58,” I corrected him.“$58!” he said. “Gosh. I must go home and sell the cutlery.”There was a photograph in a large silver frame on the sideboard. We discussed the merits of selling that.I tell this story for a reason. Bull markets like this one in silver do not come along very often. The old boy know that - and he knew what to do. Because silver bull markets don’t last forever.And when they end, they really end. You can make informed and educated guesses where the top will be. Getting out at the absolute top can be done but it requires so much good fortune that it is near impossible.In the Poseidon bubble, the old boy was selling on the way up, only to see his stock double and more again after he’d unloaded his final tranche. He made money. A lot of money. He didn’t make as much as he could have made - and is still, more than fifty years on, cross with himself.Yet he also didn’t lose anything when the bubble popped.Is that not more important?Yet, bizarre thing the human mind is, we seem to get more cross with ourselves for selling too early than we do for overstaying our welcome and riding the collapse all the way down.If you live in the Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.That amazing cup and handleSilver has now broken out of that incredible cup-and-handle formation that has been building since the 1970s. We have spoken about it before. The standard view is that, in a cup-and-handle pattern, the distance from the rim to the bottom of the cup will be your target to the upside. In this case, $3.50 was the low in the early 1990s. The distance from $50 to $3.50 is $46.50, giving us a target of $96 or thereabouts.$96.50 then. It could get there. I don’t say it will, but it could.You can argue that based on logarithmic charts and percentage falls, the targets should be even higher. I’ve read some as high as $700/oz. It’s possible. $50 in 1980 was a similarly elevated figure.