Discover Unusual Whales

Unusual Whales

Unusual Whales

Author: Unusual Whales

Subscribed: 97Played: 1,810Subscribe

Share

© Unusual Whales, Inc 2022

Description

Unusual Whales covers financial topics and market news. We help navigate various topics in finance, from options, to equities, and get some of the experts in the field to help you follow the flow. 🐳

60 Episodes

Reverse

Unusual Whales Pod Ep. 67: Fed HOLDS Rates at First FOMC Meeting of 2026This episode of the Unusual Whales Pod was recorded Live on January 28th, 2026. From housing, to the absolute faceripper in Gold and Silver, the panel breaks down how the macro landscape looks as we breach into 2026.Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngJonny Matthews https://x.com/super_macroMartin Pelletier https://twitter.com/MPelletierCIOCem Karsan https://x.com/jam_croissantHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**Disclaimer:Any content referenced in the video or on Unusual Whales are not intended to provide legal, tax, investment or insurance advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. Nothing on Unusual Whales should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by Unusual Whales or any third party. Certain investment planning tools available on Unusual Whales may provide general investment education based on your input.

This episode of the Unusual Whales Pod was recorded Live on January 26, 2026, sponsored by PlusAI. Nicholas hosts two co-founders of PlusAI, to walk through where they see autonomous trucking headed next.David Liu is the CEO and co-founder of PlusAI, with a background that blends deep technical training and startup experience, including a PhD in Electrical Engineering from Stanford. He leads the company’s strategy and commercialization efforts as autonomous trucking moves toward scale.Tim Daly is the chief architect and co-founder of PlusAI, bringing more than two decades of experience in AI and large-scale systems. He leads the technical development of PlusAI’s autonomy platform, focused on making real-world, highway-ready self-driving technology work reliably.PlusAI Website: https://plus.ai/Joined by:PlusAI (David Liu): https://x.com/PlusAI_IncTim Daly: https://x.com/thetimjrHosted by:Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.

This episode of the Unusual Whales Pod was recorded Live on October 29th, 2025. Nicholas hosts a panel of macroeconomic experts and investors to discuss the economy’s continued contradictions: growth hasn’t collapsed, yet inflation refuses to bow out, and the labor market is showing patches of fatigue. All this while the government shutdown is delaying key data releases, leaving the Fed to fly partially blind. Global friction persists from trade tensions to energy supply jitters, and the panel breaks down each of these topics in turn!Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngJonny Matthews https://x.com/super_macroMartin Pelletier https://twitter.com/MPelletierCIOHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**Disclaimer:Any content referenced in the video or on Unusual Whales are not intended to provide legal, tax, investment or insurance advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. Nothing on Unusual Whales should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by Unusual Whales or any third party. Certain investment planning tools available on Unusual Whales may provide general investment education based on your input.

This episode of the Unusual Whales Pod was recorded Live on September 17th, 2025. Nicholas and macroeconomic experts and investors to discuss the economy giving us a mixed bag: GDP rebounded in Q2, but inflation remains stickier than anyone hoped, the labor market is cooling, and markets are trying to read the Fed’s mind while balancing sheets and bond yields do their own thing. Housing is still pricey, consumer spending shows resilience but is uneven, and global factors from trade friction to energy volatility are keeping many on edge Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngJonny Matthews https://x.com/super_macroMartin Pelletier https://twitter.com/MPelletierCIOHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**Disclaimer:Any content referenced in the video or on Unusual Whales are not intended to provide legal, tax, investment or insurance advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority.

This episode of the Unusual Whales Pod was recorded Live on July 30th, 2025. Nicholas hosts a panel of macroeconomic experts and investors to discuss the labor market, oil prices flirting with a breakout toward $90 again, bond yields seemingly undergoing an existential crisis. The Fed has been “playing it cool” while half the committee whispers of September, and rate cut predictions get revised more often than the narrative around the Epstein list.Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngBob Elliott https://x.com/BobEUnlimitedCem Karsan https://twitter.com/jam_croissantAdam Ozimek https://x.com/ModeledBehaviorMarko Bjegovic https://x.com/MBjegovicHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**Disclaimer:Any content referenced in the video or on Unusual Whales are not intended to provide legal, tax, investment or insurance advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority.

This episode of the Unusual Whales Pod was recorded Live on June 18th, 2025. Nicholas hosts a panel of macroeconomic experts and investors to discuss the macroeconomic outlook in both the United States and abroad amidst softening GDP, sticky inflation, nervous bond market, housing fatigue, and the ever-reassuring backdrop of geopolitical tension. So thank you all for listening to our FOMC panel, where the vibes are uncertain at best, and the yield curve doesn’t wanna talk about it!Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngBob Elliott https://x.com/BobEUnlimitedCem Karsan https://twitter.com/jam_croissantHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**

Unusual Whales Pod Ep. 61: FOMC, Jerome Powell, Inflation, and the Economy in 2025This episode of the Unusual Whales Pod was recorded Live on May 8th, 2025. Nicholas hosts a panel of macroeconomic experts and investors to discuss the continued Fed Rate Pause, holding rates at 4.25% to 4.5%, Trump’s enduring tariff battle and international trade war, the economy, and how things are looking from a macroeconomic point of view heading into the latter half of 2025.Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngBob Elliott https://x.com/BobEUnlimitedCem Karsan https://twitter.com/jam_croissantMichael Kao https://twitter.com/UrbanKaoboyHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**

Unusual Whales Pod Ep. 60: Tariff Developments and Potential Trade Deals sponsored by ETFsThis episode of the Unusual Whales Pod was recorded Live on March 26th, 2025. Nicholas is joined by the CIO of Tema ETFs Yuri Khodjamirian, sponsored by Tema ETFs who manages the American Reshoring ETF Trading Symbol: $RSHO. Along with Yuri and a panel of experts, Nicholas explores the topics of tariffs, reshoring, nearshoring, and the global macroeconomic implications amidst ongoing tariff uncertaintyPanel:Yuri Khodjamirian https://x.com/YuriKhodjamAdam Ozimek https://x.com/ModeledBehaviorMarko Bjegovic https://x.com/MBjegovicBen Golub https://x.com/ben_golubBrad Freeman https://x.com/StockMarketNerdHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/

Unusual Whales Pod Ep. 58: Rate Pause, Fed Policy, Recession, Trump's Tariffs, and Macro Outlook for 2025This episode of the Unusual Whales Pod was recorded Live on March 19, 2025. Nicholas is joined by a panel of macro experts to discuss the Fed Rate Pause, Trump’s Tariffs, the economy, and how things are looking from a macroeconomic, bird’s eye view here in 2025.Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngBob Elliott https://x.com/BobEUnlimitedMarko Bjegovic https://x.com/MBjegovicHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**

Unusual Whales Pod Ep. 55: Quantum Computing Innovation, Investments, and Policy sponsored by Defiance ETFsThis episode of the Unusual Whales Pod was recorded Live on February 27th, 2025. Our host is joined by the CEO and CIO of Defiance ETFs, who manages the $QTUM Quantum ETF, as well as several experts in the fields of quantum computing and AI to discuss the potential of quantum computing, and how companies and investors are positioning themselves for the future. This podcast episode was sponsored by Defiance ETFs.Panel:Sylvia Jablonski https://x.com/SylvushkaPierre-Luc Dallaire-Demers https://x.com/dallairedemers Patrick Coles https://x.com/ColesThermoAI Richa Sharma https://x.com/richa_lq Hosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/

Unusual Whales Pod Ep. 54: Trump, RFK Jr., and the U.S. Healthcare Outlook in 2025This episode of the Unusual Whales Pod was recorded Live on February 24th, 2025. Our host is joined by the CIO of Tema ETFs Yuri Khodjamirian, sponsored by Tema ETFs and their GLP-1, Obesity & Cardiometabolic ETF, ticker $HRTS. Along with experts in medicine, research, and markets, we take a look at potential policy shifts in the United States Healthcare system following Robert F. Kennedy Jr.’s appointment as Secretary of Health and Human Services.Panel:Yuri Khodjamirian https://x.com/YuriKhodjamDr. Jason Fung https://x.com/drjasonfung Dr. Jesse Morse https://x.com/DrJesseMorse Dr. Ken Berry https://x.com/KenDBerryMDNicolas Hulscher https://x.com/NicHulscher Hosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/

This episode of the Unusual Whales Pod was recorded Live on January 29, 2025. Nicholas is joined by a panel of macro experts to dive deep into the topics of the Fed Rate Pause, Trump Administration fiscal policies, and the general macroeconomic outlook and markets as we break into 2025. Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngCem Karsan https://twitter.com/jam_croissantMarko Bjegovic https://x.com/MBjegovicRandy Woodward https://x.com/TheBondFreak Hosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**

Episode 51: JPM Health Conference, Biotech, and Biopharma sponsored by BioPharmCatalystThis episode of the Unusual Whales Pod, sponsored and joined by BioPharmCatalyst, was recorded Live on January 21, 2025. Our host is joined by doctors and BioTech investors to discuss the 43rd JPM Health Conference. Covering a wide array of topics from expiring patents, to industry hopes and concerns with the incoming administration, BioPharmCatalyst walks us through what they’re watching here at the top of 2025.Panel:BioPharmCatalyst https://twitter.com/BPharmCatalystChristian Marulanda https://x.com/crismarulandacDr. Jason Fung https://x.com/drjasonfungChristian Angermayer https://twitter.com/C_AngermayerHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/

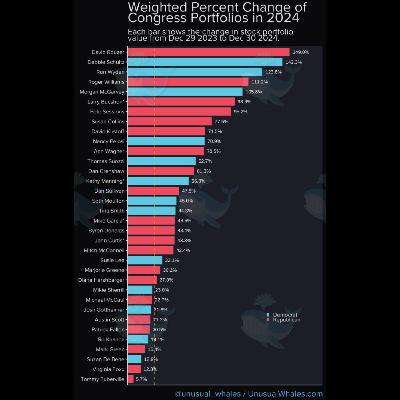

Unusual Whales Pod Ep. 50: The 2024 Congress Trading Report - Who In Congress Beat the market?This episode was generated by Google's Notebook LM and fine tuned with prompts. We published our 2024 Congressional Trading report. Like every year since 2020, some US politicians beat the market. From the start of 2024 to year end, many had unusual trades & huge portfolio gains. Here are the top political traders of 2024.This year, Democrats beat their Republican counterparts. Dems were up 31% & Republicans +26%. Meanwhile the S&P500 itself was up 24.9%. Many traded, despite having conflicts between their committees and stock holdings. Read the full report here: http://unusualwhales.com/congress-trading-report-2024By:Unusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/

Unusual Whales Pod Ep. 49: 25 Basis Point Fed Rate CUT, Bonds, Housing, and InflationThis episode of the Unusual Whales Pod was recorded Live on December 18, 2024. Nicholas is joined by a panel of macro experts to discuss the Fed rate cut, Housing costs, recessionary signals, the Bond yields and the connotations inherent within. Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngBob Elliott https://x.com/BobEUnlimitedJonny Matthews: https://x.com/super_macroCem Karsan https://twitter.com/jam_croissantHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/

Unusual Whales Pod Ep. 46: Fed CUTS RATES by 25BPS, Trump Tariffs, Equities, and Jerome PowellThis episode of the Unusual Whales Pod was recorded Live on November 7th, 2024. Our host is joined by a panel of macro experts to discuss the Fed rate cut, the implications of Trump’s presidency on the economy, the Fed, and Tariffs, and the state of the economy, of commodities and equities, as well as the Fed’s mandate moving forward toward a new year in 2025.Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngBob Elliott https://x.com/BobEUnlimitedMartin Pelletier https://twitter.com/MPelletierCIOCem Karsan https://twitter.com/jam_croissantHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/

Unusual Whales Pod Ep. 45: American Reshoring, Tariffs, and Trump’s plansThis episode of the Unusual Whales Pod was recorded Live on October 31, 2024. Our host is joined by the CIO of Tema ETFs Yuri Khodjamirian, sponsored by Tema ETFs and their American Reshoring ETF Trading Symbol: $RSHO. Along with experts in global shipping, investing, and history, the panel discusses everything from the positive and negative effects of Tariffs, and the shifting climate toward domestic manufacturing and supply chains in the United States.Panel:Yuri Khodjamirian https://x.com/YuriKhodjamJohn Konrad https://x.com/johnkonradDr. Sal Mercogliano https://x.com/mercoglianos Sven Heinrich https://x.com/NorthmanTrader Marko Bjegovic https://x.com/MBjegovic Hosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/

This episode of the Unusual Whales Pod was recorded Live on October 17, 2024. Our host is joined by the CIO of Tema ETFs Yuri Khodjamirian, sponsored by Tema ETFs, and investment experts Martin Pelletier of Trivest Wealth at Wellington-Altus Private Counsel, and Jerome from Quality Stocks, to discuss myriad topics relating to Quality Investment, companies with strong moats, and long term growth. Learn from experts on how they pick their investments! Panel:Yuri Khodjamirian https://x.com/YuriKhodjamJerome https://x.com/QualityStocksMartin Pelletier https://x.com/MPelletierCIOHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/**

This episode of the Unusual Whales Pod was recorded Live on September 18th, 2024. Our host is joined by a panel of macro experts to discuss the first Fed rate cut since 2020. The panel also discusses the state of the economy, of commodities and equities, as well as the Fed’s mandate moving forward toward a new year in 2025.Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngMichael Kao https://twitter.com/UrbanKaoboyDan Ives https://x.com/DivesTechCem Karsan https://twitter.com/jam_croissantHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesUnusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/**Disclaimer:Any content referenced in the video or on Unusual Whales are not intended to provide legal, tax, investment or insurance advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. Nothing on Unusual Whales should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by Unusual Whales or any third party. Certain investment planning tools available on Unusual Whales may provide general investment education based on your input. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your legal or tax professional regarding your specific situation. You can lose some or all of your investment. See terms for more information.

Unusual Whales Pod Ep. 41: Fed HOLDS Rates with Dovish Release; Treasuries, Commodities, and 2024 OutlookThis episode of the Unusual Whales Pod was recorded Live on July 31, 2024 prior to and after the FOMC interest rate decision. Our panel of experts cover all topics from gold and commodities, to international inflation sentiment, as well as the overall outlook in the markets for the latter half of 2024!Panel:Joseph Wang https://twitter.com/FedGuy12Thelastbearstanding https://twitter.com/LastBearStandngMichael Kao https://twitter.com/UrbanKaoboyMartin Pelletier https://twitter.com/MPelletierCIOCem Karsan https://twitter.com/jam_croissantHosted by: Nicholas FNS: https://twitter.com/NicholasFNSUnusual Whales: https://twitter.com/unusual_whalesThis Pod is not financial advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for financial decisions or for investing. You should consult your legal or tax professional regarding your specific situation.Unusual Social Media:Discord: https://discord.com/invite/unusualwhalesFacebook: https://www.facebook.com/unusualwhalesInstagram: https://www.instagram.com/unusualwhales/Reddit: https://old.reddit.com/r/unusual_whales/TikTok: https://www.tiktok.com/@unusual_whalesTwitter: https://twitter.com/unusual_whalesTwitch: https://www.twitch.tv/unusualwhalesYouTube: https://www.youtube.com/unusualwhales/Merch: https://unusual-whales.creator-spring.com/