Discover Fresh Economic Thinking

Fresh Economic Thinking

Fresh Economic Thinking

Author: Cameron Murray

Subscribed: 49Played: 1,509Subscribe

Share

© Cameron Murray

Description

Cameron Murray is famous for questioning sacred cows and conventional wisdoms of both left and right. We chat about Cameron's latest Twitter battle and then delve into a controversy. Wide-ranging analysis - no topic out of bounds - inequality, regulation, housing, superannuation, lockdowns, tax, war, the meaning of life.

www.fresheconomicthinking.com

www.fresheconomicthinking.com

119 Episodes

Reverse

You may have heard that our town planning system of rules and institutions that govern land uses in cities and often across the country is stifling new housing production, causing high prices. But much of the commentary misunderstands how town planning rules operate. I chat with Sydney town planner Tim Sneesby about how the system works, from a strategic level of creating zones and desired outcomes at a broad level, including earmarking infrastructure locations, to the day-to-day operations of assessing applications against those broader plans.I also push a little on some of the potential perverse incentives—wouldn’t town planners prefer to create cumbersome rules to keep themselves in a job and make their roles valuable even if there is no (or negative!) social benefit from those rules?For example, this article notes a rise in town planners per new home developed and the economic cost of regulating so many aspects of building designs. Let me know what you think?All comments are personal views and not those of Tim’s employer or associated entities. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

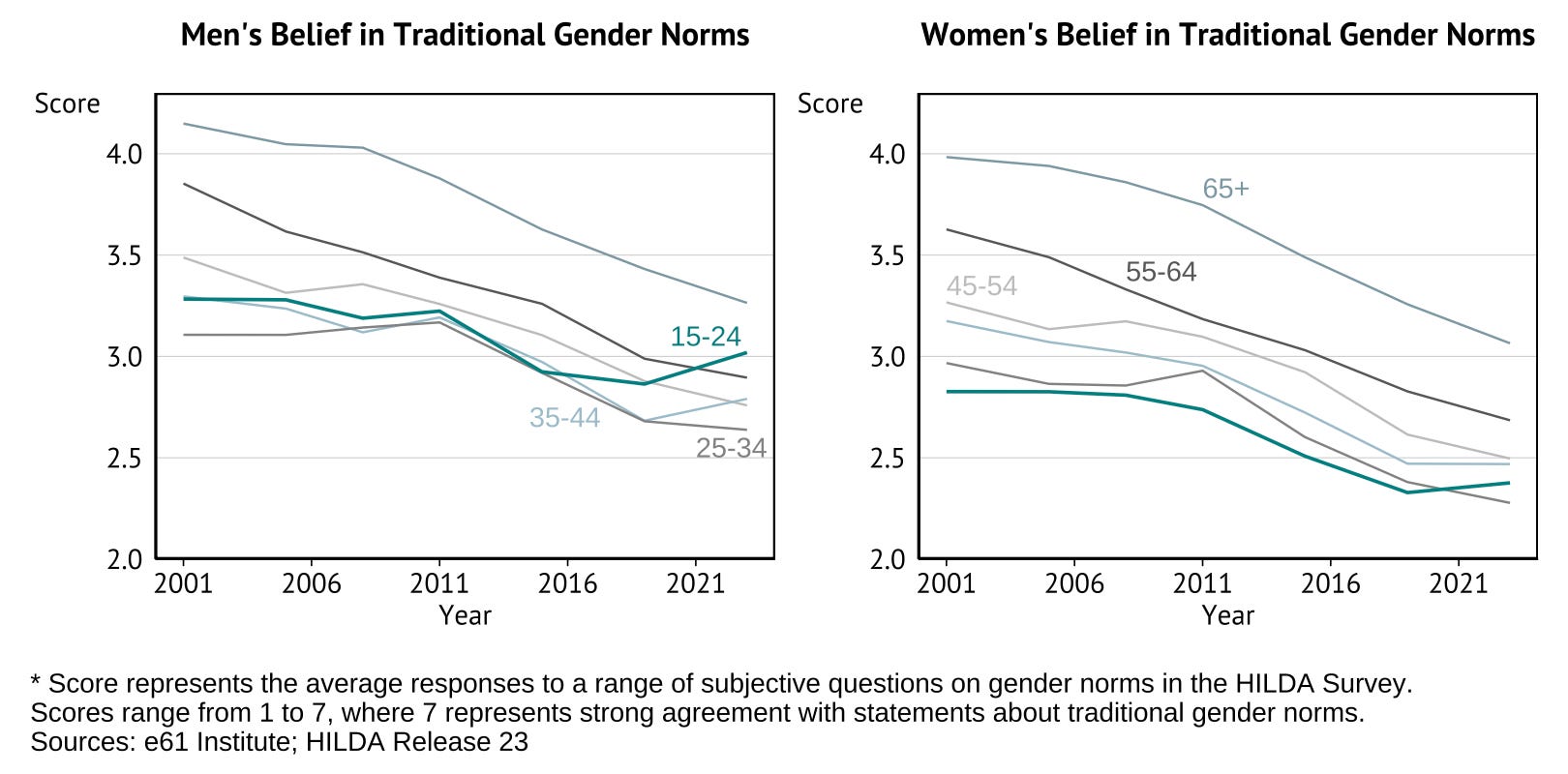

Has the cultural and political pendulum swung too far in favour of women?That’s the argument made by David Maywald in his new book, The Relentless War on Masculinity. He doesn’t argue that women have done this. But even men in power are still fighting the battles of many decades ago. David looks at education and health outcomes, noting that women became the majority of university students four decades ago. There are four ways in which the cultural and political bias is expressed, called the Four Horsewomen. Once you understand them, they are hard to miss. * Misandry — the hatred of men, as well as the systemic contempt for men.* Gamma bias — the psychological tendency to interpret male and female behaviour through different lenses. A man who asserts himself is labelled aggressive, while a woman doing the same is praised as confident. A mother who works long hours is celebrated for her ambition, while a father who does so is criticised for neglecting his family.* Gynocentrism — societies that focus on women, are primarily concerned with female perspectives and interests, and take a feminine point of view.* Gaslighting — convincing men that their concerns are imaginary. Speak up about family law bias, and you’re told you must hate women. Question the “gender pay gap” narrative, and you’re accused of being sexist.David explains how to perceive these biases by whether the same judgment would be made regardless of the gender of the person being observed. As a father with two sons reaching adulthood, the most interesting data point was that young men (aged 15-24) only sit behind men over 65 in the strength of their views about traditional gender roles. Perhaps the pendulum is swinging back. Here’s a chart showing these trends, courtesy of analysis by e61 Institute. Finally, an excerpt from the book is in the article below at David’s Substack. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

During the COVID panic one of the sane voices was congitive scientist Mark Changizi. He saw the resulting panic as an emergent social and cultural phenomenon, and went as far as to sue the Department of Health and Human Services (DHHS) for directing social media companies to censor what they deemed as misinformation. In this conversation, Mark talks of his intellectual journey, from mathematician and physicist to congitive scientist. He describes the overarching view of human perception and coordination as evolved tools and how leads to social patterns that would be replicated in any civilised large scale cooperative creatures. Would aliens also be debating free markets and communism? Here’s one example of evolved traits. Why do humans perceive visual illusions rather than have an accurate visual receptor? Because our visual perception evolved to anticipate outcomes, not accurately represent the light hitting the eyeballs. This was a fascinating discussion, and stay tuned for Mark’s comments on academia and his life since leaving academia 16 years ago. His latest book is called Motorcycle Mind, and I would recommend his previous book Expressly Human. Please find Mark at the following. Youtube: https://www.youtube.com/@markchangizi X: https://x.com/MarkChangiziWebsite: https://www.changizi.comAs always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Wouldn’t it be great if we had a coherent way of understanding the economics of housing supply?You might be surprised, given the confidence of the prognostications of public commentators, that most don’t have a broadly accepted economic theory of why homes are built. It’s all ad hoc and often contradictory.Here, Tim Helm walks through the main empirical patterns that need to be explained by our economic theory of housing supply, and steps through why most current approaches are a poor fit. A good written explanation is here. Thanks for listening. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights.Fresh Economic Thinking is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Previously, I have described an educational experiment happening in a castle in Belgium, called Academia Libera Mentis (ALM). It is run by my friend and co-author, Paul Frijters, with his wife Erika Turkstra, and alongside Gigi Foster and many others. In this episode, we discuss the story of this endeavour, as told in the upcoming book Minds that Dare. You can read about the trials and tribulations of this educational endeavour at the ALM substack. Check out the ALM website and the courses available in 2026. With a bit of luck, you might see me at ALM at some point in 2026. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

A long chat with power engineer Ben Beattie about Australia’s energy conversation, some of the muddled economics and arguments in favour of privatisation, public provision, and more. Check out Ben’s Baseload Podcast here.As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Is Australia’s housing market REALLY functioning normally? Regular co-host Jonathan Gadir pushes back on my recent statements about the housing market doing exactly what we should expect it to do in a conversation with Josh Szeps at his Uncomfortable Conversations podcast. I also respond to Steve Keen’s idea that the secret to lower home prices is regulating access to credit, such as with tighter rules limiting loan sizes to a function of current rent or value, which he expresses in this video. My basic view is that this can certainly change the speed of price adjustment in the housing market by preventing some trades, possibly dampening a bubble, but it won’t change the overall long-term average price level. It might also inadvertently make first home buying harder, not easier, which was a frustration of the strict credit controls pre-1980s. I explain more about the economic forces that constrain what housing markets can do in my book The Great Housing Hijack. This is why I argue that rather than trying to fight these forces, simply side-step them with subsidised non-market housing for the groups we think should be able to access it. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

James Nuzzo’s sports science and health research shows the gap between perception and reality when it comes to gender issues. This research, and especially his public comments about his various studies, got him cancelled and squeezed out by Edith Cowan University. You can read about it here in detail.As someone with an interest in the pursuit of truth and who is frustrated when the public conversation is at odds with the data, this topic is of interest. For example, few would realise that women became the majority of university students four decades ago, and are now the majority of staff too. So why is there still such a big push to give women more opportunities in higher education when it is men who have been behind for decades? Find James at X/Twitter here, and sign up to his newsletter below (and enjoy his Graph of the Week too).As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights.Fresh Economic Thinking is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Would you believe that the same stories told in Australian housing debates about a lack of supply were dominant in Toronto, Canada, right up until the bust?I speak with Canadian real estate analyst and broker John Pasalis about how the market has changed in the past few years in Canada—from a speculative mania, to a sudden stop, to a new slow grind. Amongst it all, new apartment construction has plummeted, banks are facing numerous financing risks, and the outlook is soft. We also pick up the importance of the post-COVID immigration boom on the housing story. Find John’s Move Smartly podcast here, and follow him on Twitter here. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights.Fresh Economic Thinking is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Regular co-host Jonathan Gadir pushes back on my claim that Australia’s economic complexity is fine. Can a more complex economy generate better job choices and higher wages? Is it really okay to outsource the production of fundamental ingredients to a modern economy to other nations? Is Cameron just spouting nonsense neoclassical economics?Tune in to hear these questions answered, and find the original article here for paid FET subscribers:As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Too often, the public debate about housing focuses on costs and ignores investment returns to property owners. Mike Fellman was an economist at Freddie Mac and is now a property investor. He explains in this conversation how important the investment dynamics in housing are for understanding what gets built where. Find Mike on Twitter/X here and read his “thread of threads” that explains many of the misperceptions about the financial drivers of housing markets here. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

How do organisations that emerge to help people end up degrading over time and becoming a plain old shakedown?That’s the topic I discuss with regular co-host Jonathan Gadir. Although we don’t mention it, my book Rigged, co-authored with Paul Frijters, explains many of the economic mechanisms behind the degradation of institutions into what could be described as a rent-seeking mafia. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Will rent control destroy your city? Or is this a slogan economists use to signal their tribal allegiance?Cahal Moran, aka Unlearning Economics, discusses his intellectual journey into economics and the discovery of many shortcomings of how economics is taught and practised. Cahal’s latest Current Affairs article is called Rent Control is Fine, Actually. Watch all his YouTube videos here, and find his terrific video on rent control we discussed here. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

With all the cost-of-living crisis talk these days, you might wonder if it is possible for young Aussies to get ahead financially. But there is a group of people out there winning the financial game of life with their approach to financial independence. The perfect guest to discuss personal financial habits is Matt, who runs the Aussie Firebug website, where he documents his journey of to financial independence, retire early (FIRE). It is well worth checking out if financial independence is on your agenda. A couple of years back, Matt hosted a debate between me and Scott Phillips on superannuation, which you can listen to in two parts below. As a financially independent person, Matt was able to start multiple businesses, one of which is a co-working business called The Collective Co-space. You can find it here. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Taxpayers Alliance Chief Economist John Humphreys joins the FET podcast to talk all things tax. Is it possible to tax unrealised gains, as is proposed on superannuation accounts over $3 million in value? Maybe. But why bother doing it when it mostly changes the timing of taxation rather than the revenue? We speculate as to whether it is a daring political manoeuvre—propose something you know your opposition will find outrageous to trick them into arguing for exactly the tax setting you actually want.Enjoy this conversation on taxes, strange politics (where was this super-tax conversation pre-election?), my favourite topic of Effective Marginal Tax Rates, and more. Side note: One thing John and I have in common is that we both want to scrap the superannuation system. I explain my reasons in this article. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

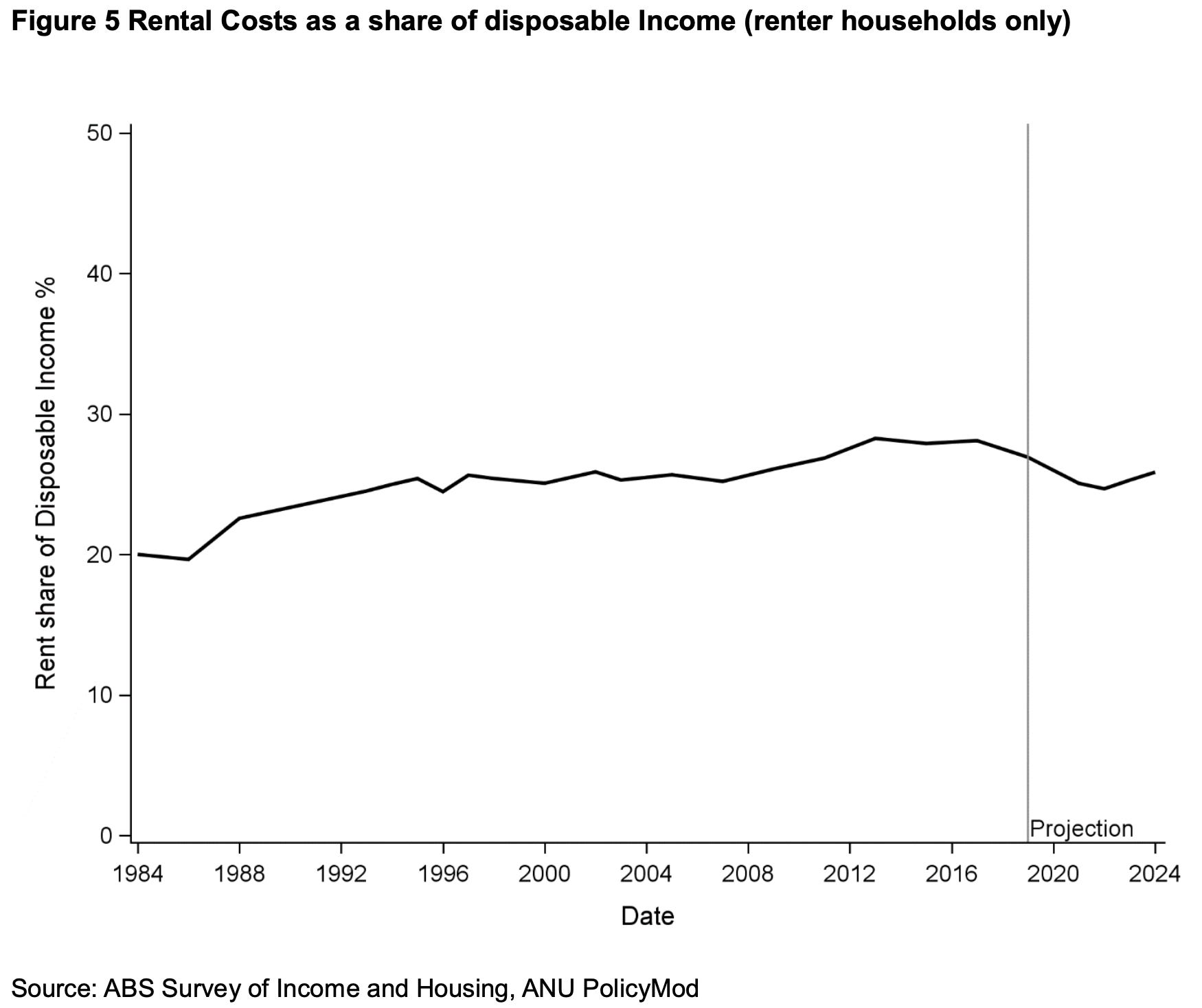

Given the Australian media’s obsession with the housing crisis, it would come as a shock to many that the share of after-tax disposable income spent on rent by renter households is lower in 2025 than it has been for most of the last decade.But that’s what ANU Professor Ben Phillips found in his latest research on rental affordability (you can find it here or download it below).In today’s FET video podcast, I chat with Ben about this surprising data and how we can make sense of it in light of current housing “crisis” debates. A key part of the story is this chart. It shows the share of disposable income (after-tax) income spent on housing for renter households. Notice that the most unaffordable period by this metric was 2012-2018.The situation is not great for renters on the lower incomes. There are people struggling at the bottom of the income distribution to keep up and rent where they previously could. But they are struggling to compete with those household who can pay higher rents. One interesting part of our discussion was the big difference between the price growth in rent advertisments and price growth of rents paid by all renter households. The chart below, from Ben’s report, shows that advertised rents (in this case using Corelogic’s data) diverge from rents paid by all renters in a cyclical way, and by a surprising amount, with advertised rents being between 10% and 40% higher than rents paid by all renters. Currently, the gap is near record highs. The existence of a gap comes from the fact that turnover in the rental market is about 2.5% per month, or 30% per year, and the distribution is such that some properties turnover more than others and hence appear more regularly in the advertised rental figures. But why is the gap so cyclical?We also chat about the fierce media debate playing out around the proposal to increase tax on the gains in superannuation accounts for the marginal amount over $3 million, which is just the top 0.5% of accounts. This has been a hot topic online. We chat about the feverish and unhinged reaction to what is a minor tightening up of an overly generous tax break that affects very few people. And if you missed my recent deep dive into why scrapping superannuation could make us all better off, try this article. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

There is an interesting debate taking place in urbanist circles. Is more density good for families because it helps reduce housing costs, or bad for families because it creates a lifestyle and environment that is not conducive to large families?Indeed, we might consider changing our policies and regulations based on what we think is the answer to this question. But do we have a reasonable answer?Daniel Hess runs the More Births Substack and is on Twitter @MoreBirths. Daniel has taken up the case against density because of its potential fertility effects and is my guest for this FET podcast video episode.Here is one of his articles on the topic.But Daniel is not alone in his concerns. The negative correlations between urban density and fertility are clear to many. In this episode, we discuss global and national fertility trends, and I push Daniel to justify why we should be concerned about these trends—after all, low-fertility places are the better places to live, have more opportunities for women, and many nations historically encouraged lower fertility to generate economic growth. In Hong Kong, the saying was “Two is enough”. In South Korea, it was “Stop at two, regardless of sex”. In Bangladesh, it was “One child is ideal, two children are enough”. Were they all wrong? I press Daniel to make the case for why low fertility is so bad, given that low fertility countries are generally the most desirable ones to live in. Here are three previous FET articles on the general topic, which show that I am not so concerned about declining fertility. A main issue Daniel identifies when it comes to the effect of housing density on fertility is the step-change in appropriateness of housing for families when increasing density from detached homes to apartments, even if the internal space in each dwelling is similar. Because of this, suburbia could be the secret sauce for high fertility. This makes intuitive sense to me.My own home is about 100 sqm internally, which is not too different from many nearby apartments. But it is on a 300 sqm lot and is therefore much more family-friendly than the 100 sqm apartments available in buildings just down the road. Maybe intermediate densities, like the small homes and townhouses that are more popular in new subdivisions these days, can still be as conducive to family formation as homes on large lots while economising on space and infrastructure. Unfortunately, this density is the most difficult to promote in existing areas where incremental change to much higher density and towers is usually the most economical for the property owner. We didn’t have a chance to dig into the popular idea in urbanist circles that the market will accommodate all needs at all locations, but regulations prevent large apartments that can accommodate families from being built. If we could deregulate to unleash the large-format family apartment, then this fertility and density issue might be resolved. For example, here’s one such statementThe fastest growing category of Toronto homes have zero bedrooms: Bachelor units grew by 28 per cent, jumping from 22,355 to 28,765."Basically, the only housing getting created in Toronto tends to be high-rise: 30, 40, 50 storeys," Mr. Moffat said. It's hard to put in units with three-plus bedrooms in those types of buildings.A mix of high land costs, restrictive zoning, using investors as preconstruction funders and high development charges pushes builders away from creating family-style units, according to Mr. Moffatt.I think such claims are 180 degrees wrong on the effect of regulations. Generally, if town planning rules limit housing types, they do so by preventing apartments so that detached homes are built instead, or requiring apartments that are built to be above a minimum size (or, in the language of The Great Housing Hijack, they restrain uses below the density equilibrium). But even having more three-bedroom and larger apartments would miss the step-change benefit of detached housing for families.Daniel comes down on the side of zoning regulations that promote detached homes where they would otherwise not be the market outcome. A key economic pattern that comes up in our conversation is that although young people have many detached housing options in smaller towns, they still commonly move to large cities and pay a premium to live in smaller apartments. For example, in Japan, small towns are giving away houses for free to try and attract families. In Australia, as in most places, housing is large and cheap in regional towns, yet the young people who grow up in those towns usually leave for higher-density places. Should we take this as evidence that low fertility and higher density lifestyles are a choice being actively made? If so, why is it bad?Finally, what of fertility policy?Should we pay a $5,000 per-child baby bonus, like Australia has done, and now Donald Trump is proposing? Or are social and cultural factors more important? After all, a lot of the decline in fertility was promoted through intentional moral suasion and cultural shifts, so perhaps this is the way it will reverse. I hope you enjoy the episode. I am keen to read comments from you all. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Was voting easy and efficient for you? This is something we should all appreciate. Australia’s electoral commission makes voting easy. Our preferential system improves on first-past-the-post single-member electoral systems. And all of this happens quietly and quickly for $30 per vote, thanks to the Australian Electoral Commission.Together with Jonathan Gadir, we riff on the good, the bad, and the ugly of elections. As always, please like, share, comment, and subscribe. Thanks for your support. You can find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts.Here’s some recent paid subscriber FET content you might have missed:Theme: Happy Swing by Serge Quadrado Music—Creative Commons Licence CC BY-NC 4.0Interested in learning more? Fresh Economic Thinking runs in-person and online workshops to help your organisation dig into the economic issues you face and learn powerful insights. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe

Anna Samson has had a decade-long career in aid, was a US State Department-funded Fulbright Scholar, and has a PhD in international relations and American foreign policy.In this episode we discuss the inadvertent economic and political outcomes of foreign aid on receiving nations. What surprised me was Anna’s view on the scale of the rent-seeking across the aid industry and the transformation of the aid project into one of strategic military and economic interests rather than one of humanitarianism.Apologies for the audio quality.Please read Anna’s full article below about foreign aid, its failures, and its creeping national security objectives.As always, please like, share, comment, and subscribe. Thanks for your support. Find Fresh Economic Thinking on YouTube, Spotify, and Apple Podcasts. Theme music: Happy Swing by Serge Quadrado Music under Creative Commons Licence CC BY-NC 4.0The United States has had its fair share of Presidential foreign policy doctrines over the years.The Truman Doctrine underpinned America’s Cold War containment policy to stop the spread of communism and Soviet influence.After the 2001 terrorist attacks on the World Trade Centre, the Bush Doctrine brought us preventative military strikes and the ‘if you’re not with us, you’re against us’ principle.Just over 50 days into his second term, the Trump Doctrine is shaping up to be ‘you can’t make an omelette without blowing up the entire chicken coop’.Nowhere has this approach been more sharply felt than in the dismantling of USAID, a cornerstone of contemporary US foreign policy.Jettisoning USAID has achieved symbolic and practical purposes; it is both exactly what MAGA fans hoped for and what its critics feared: Trump embracing radical honesty in international relations by saying the quiet bits out loud and rupturing the mythology of the self-limiting guardrails on Executive power.Moments after his inauguration, President Trump, bolstered by Elon Musk’s analysis of USAID as “not an apple with a worm in it [but] a ball of worms”, froze $60 billion in overseas development aid and then stood down 97% of its staff.Industry veterans highlighted the catastrophe the Executive Orders caused: polio vaccination programs halted, tonnes of food aid left rotting in warehouses in the midst of famines, and a stop on urgent humanitarian assistance delivered to hard-to-reach conflict zones.That’s the problem with applying a Silicon Valley move-fast-and-break-things mindset to government policy: you can’t just CTRL-Z your way out of any unintended consequences.The recent Supreme Court decision ordering the Trump Administration to immediately unfreeze US$2 billion in existing aid contracts only provides temporary reprieve for those relying on American development assistance. The ruling doesn’t apply to billions in planned program funding or USAID jobs that have already been axed, both of which are the subject of separate legal challenges.To the President’s detractors, gutting USAID is ideological and myopic. But it’s also another example of Trump seeing which way the crowd is moving and running out in front.Indeed, rather than leaping to fill the void left by the US vacating the field, UK Prime Minister Keir Starmer announced a 40 per cent cut to his country’s aid budget. France and the Netherlands are also cutting their aid expenditure by about a third.While Western aid workers are wringing their hands and UN buildings are lowering their thermostats as a cost-saving measure, the sector bears a great deal of responsibility for its own demise.With little evidence to show aid programs are delivering on their grand promises of economic prosperity and development, spending billions on aid is increasingly justified as a tool to advance donor countries’ national security interests.This connection is not new: the modern aid system was built by imperial powers to help maintain influence even as their former colonial territories were achieving political independence.It should come as no surprise that many aid recipients are not exactly mourning USAID’s downfall. They point to numerous instances where USAID used humanitarianism as a front for meddling in other nations’ domestic politics.For all the talk of ‘empowerment’ and ‘local partnerships’, government-funded foreign aid is rooted in and continues to reproduce historical structures of resource extraction, dependence, market distortion and racism.Explicitly blurring the lines between humanitarianism and self-interest lays bare the iron fist of neocolonialism within the velvet glove of benevolence.From the perspective of donor countries, all this real-talk about interests over altruism requires the aid industry to demonstrate bang for taxpayer buck.It’s no accident that among the first casualties in DOGE’s USAID cuts were expat bureaucrats enjoying all the cushy accoutrements that a career in the aid industry guaranteed.Government donor agencies - including Australia's Department of Foreign Affairs and Trade (DFAT) — frequently administer aid money inefficiently and ineffectively; 40 per cent of Australian aid investments were rated as 'unsatisfactory' upon completion.If the aim of aid is to bolster our own security, not only should this causal link be established more directly, DFAT should explain why Australia funds aid over other defence spending with a clearer line of sight to maintaining the nation’s middle power status.Current approaches to aid program evaluations, including in DFAT’s most recent Performance of Australian Development Cooperation Report 2023-24, do not provide that level of accountability. Taxpayers are expected to accept measures like “capacity building” and numbers of individuals “supported” or “reached” in pursuit of development goals.USAID’s abolition, while confronting in its audacity, should not be met simply with self-righteous indignation about the supposed nobility of aid work or showing how aid can be weaponised to undercut the West’s rivals.Instead, it should be seen as an opportunity to rethink the whole foreign aid system. It's a chance to create a world where countries drive their own development and self-interested ‘generosity’ and donor dependence are no longer required.Decoupling foreign aid from national security will allow this money to do what it does best: humanitarian action based on foundational principles of humanity, impartiality, independence and neutrality. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.fresheconomicthinking.com/subscribe