Discover Finance Tech Brief By HackerNoon

Finance Tech Brief By HackerNoon

183 Episodes

Reverse

This story was originally published on HackerNoon at: https://hackernoon.com/wealth-management-in-the-digital-age-trends-and-strategies.

Explore 7 AI-driven trends transforming wealth and asset management with smarter data, analytics, and digital tools.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #ai-wealth-management, #intelligent-data-solutions, #digital-asset-transformation, #predictive-portfolio-analysis, #cloud-adoption-in-finance, #ai-compliance-tools, #advanced-investment-analytics, #good-company, and more.

This story was written by: @sanya_kapoor. Learn more about this writer by checking @sanya_kapoor's about page,

and for more stories, please visit hackernoon.com.

Wealth and asset management is rapidly evolving through AI and intelligent data solutions. Firms that adopt predictive analytics, cloud systems, automation, and AI-driven portfolio tools gain faster insights, stronger compliance, and better client experiences. Digital transformation is no longer optional—it’s the foundation for competitive advantage and long-term growth in modern financial services.

This story was originally published on HackerNoon at: https://hackernoon.com/why-bitmexs-70000-usdt-rewards-mark-a-shift-in-cross-asset-trading-access.

BitMEX launches equity perps campaign with 70,000 USDT prize pool for Apple and Tesla trading from Feb 12 to March 12, 2026.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #bitmex-news, #bitmex, #crypto-trading, #defi, #blockchain, #cryptocurrency, #good-company, #web3, and more.

This story was written by: @ishanpandey. Learn more about this writer by checking @ishanpandey's about page,

and for more stories, please visit hackernoon.com.

BitMEX launched a campaign from February 12 to March 12, 2026, offering 70,000 USDT in prizes for users trading equity perpetual contracts on stocks like Apple and Tesla. The campaign includes three reward categories: trade rewards up to 500 USDT for 10,000 USD volume, 5 USDT for social media sharing, and 5 USDT for completing an educational quiz. Equity perps allow cryptocurrency traders to speculate on stock prices without traditional brokerage accounts, operating 24/7 with leverage and crypto settlement. BitMEX emphasizes its security record and twice-weekly proof of reserves publications. The campaign targets user acquisition during Q1 earnings season when stock volatility typically increases trading interest.

This story was originally published on HackerNoon at: https://hackernoon.com/estimating-future-discretionary-benefits-without-monte-carlo-simulation.

A deterministic framework for estimating future discretionary benefits in life insurance, offering tight bounds without Monte Carlo simulation.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #insurance-regulation, #market-consistent-valuation, #solvency-ii, #actuarial-modeling, #mean-field-libor-market-model, #asset-liability-management, #monte-carlo-valuation, #financial-risk-modeling, and more.

This story was written by: @solvency. Learn more about this writer by checking @solvency's about page,

and for more stories, please visit hackernoon.com.

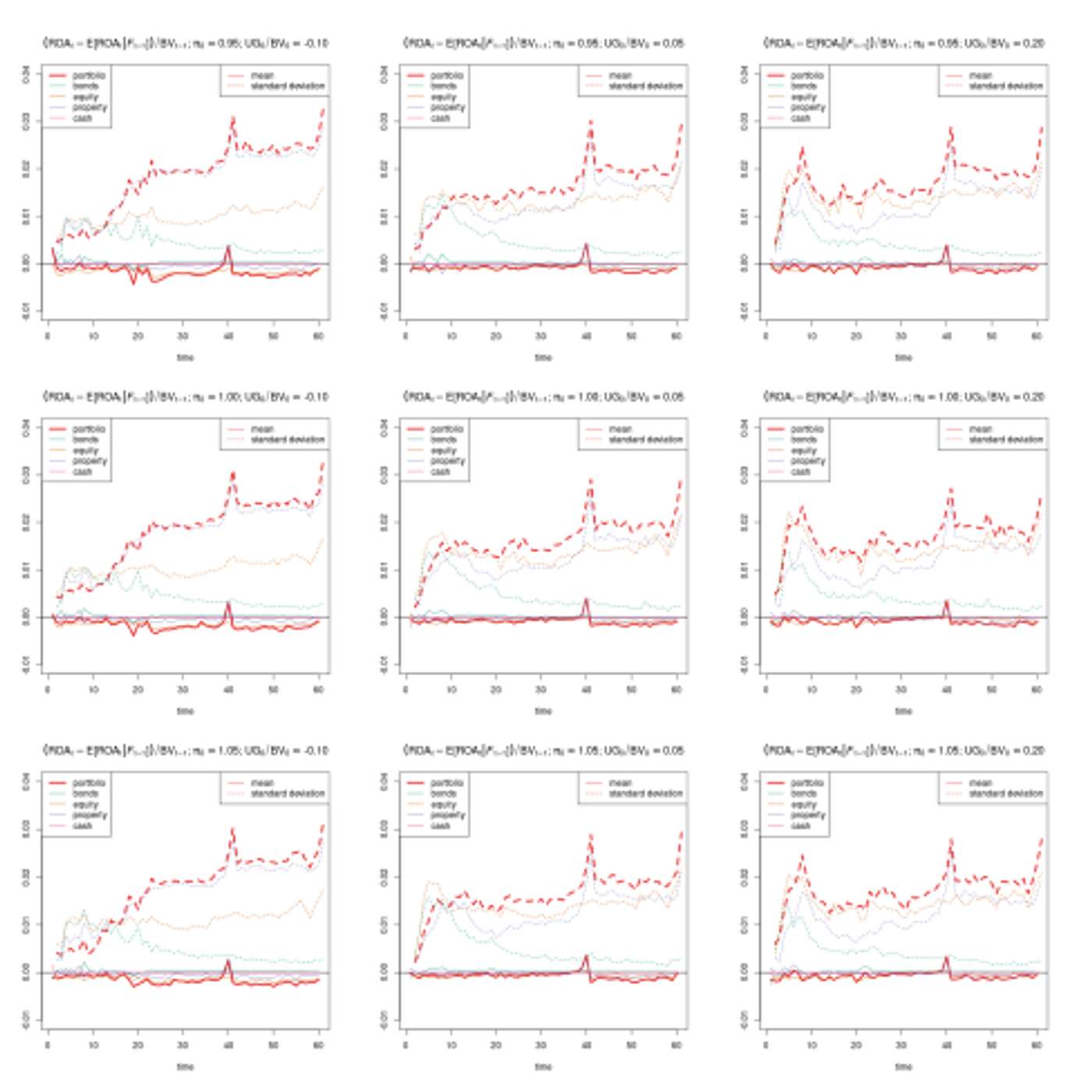

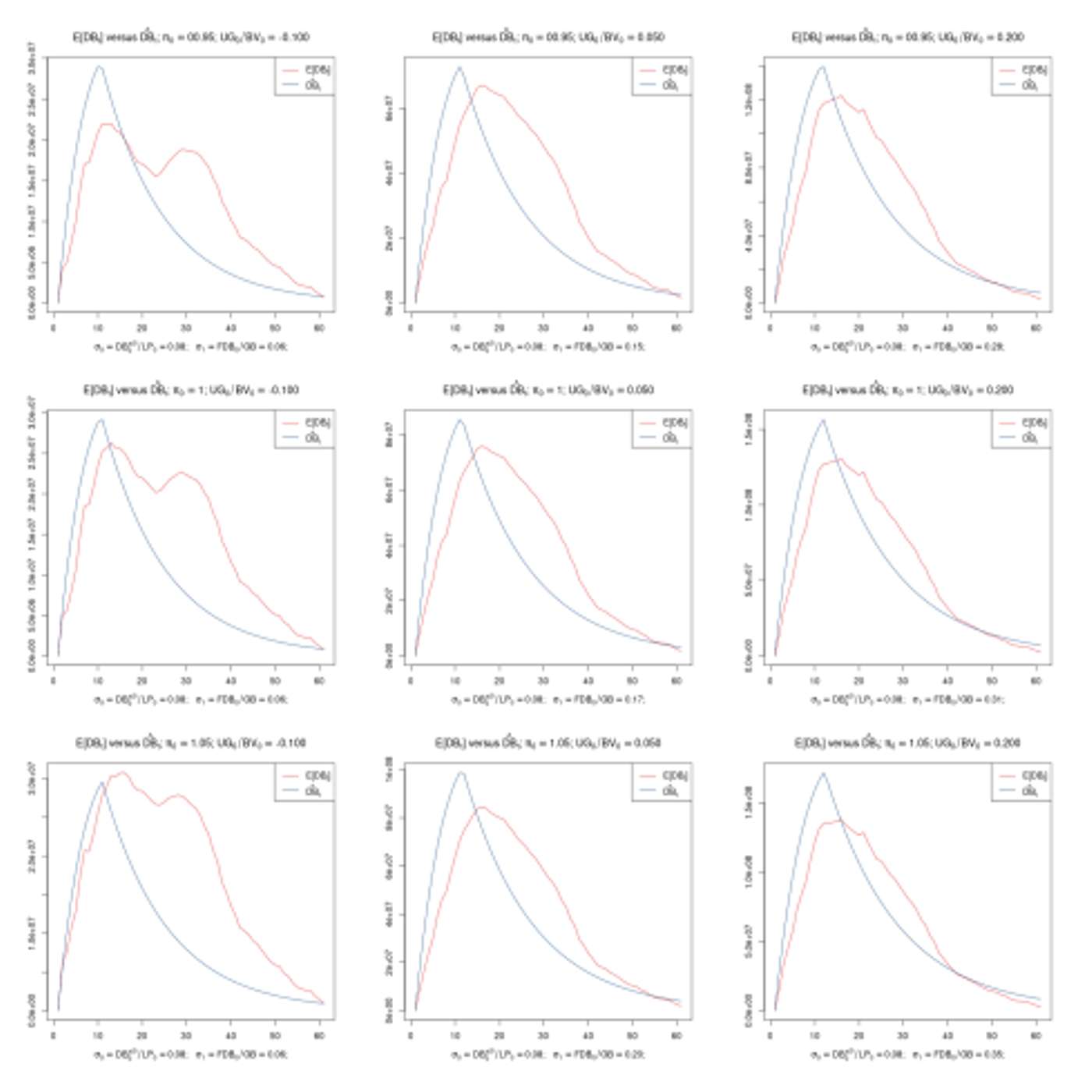

This article presents a deterministic method for estimating future discretionary benefits in life insurance portfolios by deriving stable upper and lower bounds, avoiding reliance on Monte Carlo simulations while maintaining market consistency.

This story was originally published on HackerNoon at: https://hackernoon.com/testing-actuarial-assumptions-with-realistic-life-insurance-data.

Numerical evidence testing key actuarial assumptions in life insurance models, with implications for surplus dynamics and the cost of guarantees.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #insurance-regulation, #market-consistent-valuation, #solvency-ii, #actuarial-modeling, #mean-field-libor-market-model, #asset-liability-management, #monte-carlo-valuation, #insurance-risk-management, and more.

This story was written by: @solvency. Learn more about this writer by checking @solvency's about page,

and for more stories, please visit hackernoon.com.

This article evaluates common actuarial assumptions used in life insurance valuation by testing them against numerical simulations, showing where simplified surplus and liability models remain reliable—and where they break down.

This story was originally published on HackerNoon at: https://hackernoon.com/how-profit-participation-shapes-risk-and-returns-in-traditional-life-insurance.

A technical deep dive into profit-participating life insurance, explaining asset-liability dynamics, surplus allocation, and optimal control strategies.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #insurance-regulation, #market-consistent-valuation, #solvency-ii, #actuarial-modeling, #mean-field-libor-market-model, #asset-liability-management, #monte-carlo-valuation, #surplus-fund-management, and more.

This story was written by: @solvency. Learn more about this writer by checking @solvency's about page,

and for more stories, please visit hackernoon.com.

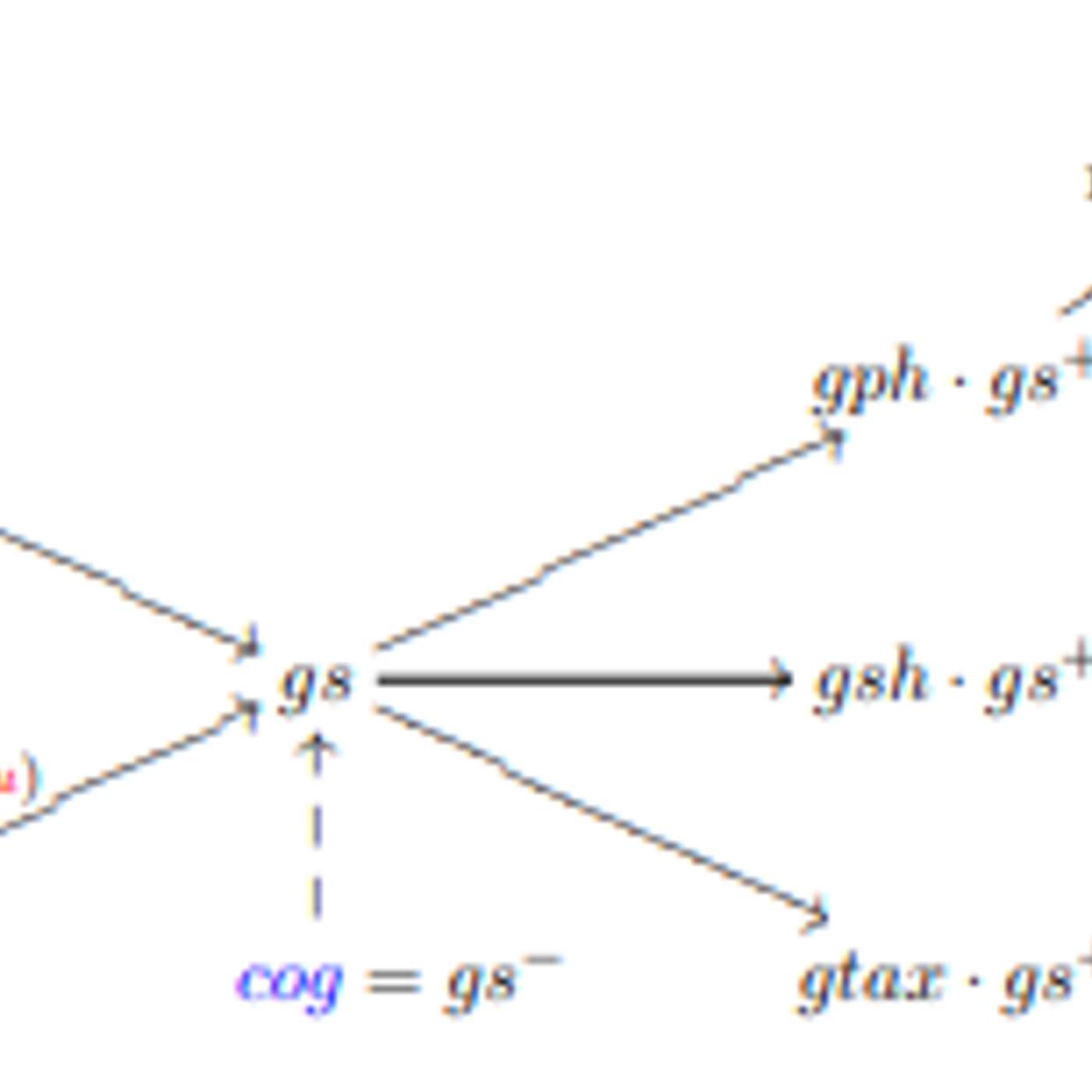

This article presents a mathematical framework for profit-participating life insurance, showing how asset returns, guarantees, and management controls jointly shape policyholder bonuses and shareholder value over long horizons.

This story was originally published on HackerNoon at: https://hackernoon.com/valuing-profit-participating-life-insurance-liabilities-in-a-solvency-ii-framework.

A market-consistent framework for valuing profit-participating life insurance under Solvency II, combining interest rate modeling and FDB bounds.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #insurance-regulation, #market-consistent-valuation, #solvency-ii, #actuarial-modeling, #mean-field-libor-market-model, #asset-liability-management, #monte-carlo-valuation, #stochastic-interest-rate-model, and more.

This story was written by: @solvency. Learn more about this writer by checking @solvency's about page,

and for more stories, please visit hackernoon.com.

This paper presents a market-consistent framework for valuing profit-participating life insurance under Solvency II, combining mean-field interest rate modeling, asset-liability management, and computable bounds for future discretionary benefits.

This story was originally published on HackerNoon at: https://hackernoon.com/inside-the-millisecond-machine-a-candid-conversation-with-trading-tech-veteran-kanaiyalal-gangani.

A two-decade trading-tech veteran explains why modern high-frequency systems are less about being the fastest and more about building resilient.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #trading, #millisecond-machine, #trading-tech, #kanaiyalal-gangani, #algorithmic-trading, #ultralow-latency-trading, #trading-technology, #good-company, and more.

This story was written by: @manasvi. Learn more about this writer by checking @manasvi's about page,

and for more stories, please visit hackernoon.com.

A two-decade trading-tech veteran explains why modern high-frequency systems are less about being the fastest and more about building resilient, meticulously monitored infrastructure that keeps global markets stable in milliseconds.

This story was originally published on HackerNoon at: https://hackernoon.com/the-sepa-instant-deadlines-have-passed-but-did-europe-really-go-instant.

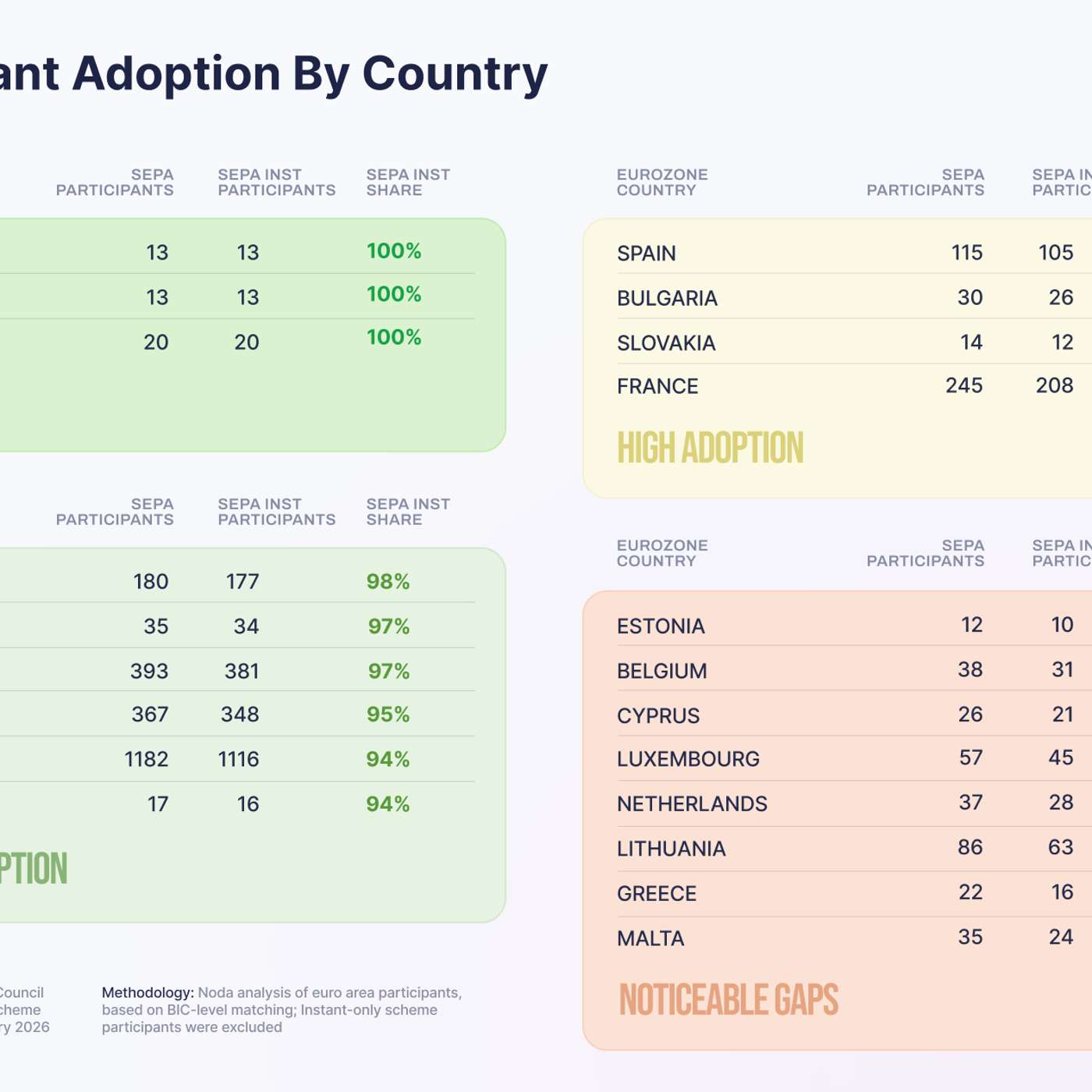

The major SEPA instant payments deadlines have passed, but adoption varies by country. Noda analysis reviews whether Europe has really gone instant.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #digital-payments, #sepa-instant, #eu-instant-payments-regulation, #european-payments, #real-time-payments-in-europe, #sepa-credit-transfer, #fintech-infrastructure, #good-company, and more.

This story was written by: @noda. Learn more about this writer by checking @noda's about page,

and for more stories, please visit hackernoon.com.

The major SEPA instant payments deadlines have passed, but adoption varies by country. Noda analysis reviews whether Europe has really gone instant.

This story was originally published on HackerNoon at: https://hackernoon.com/why-expected-value-is-not-enough-in-production-trading-systems.

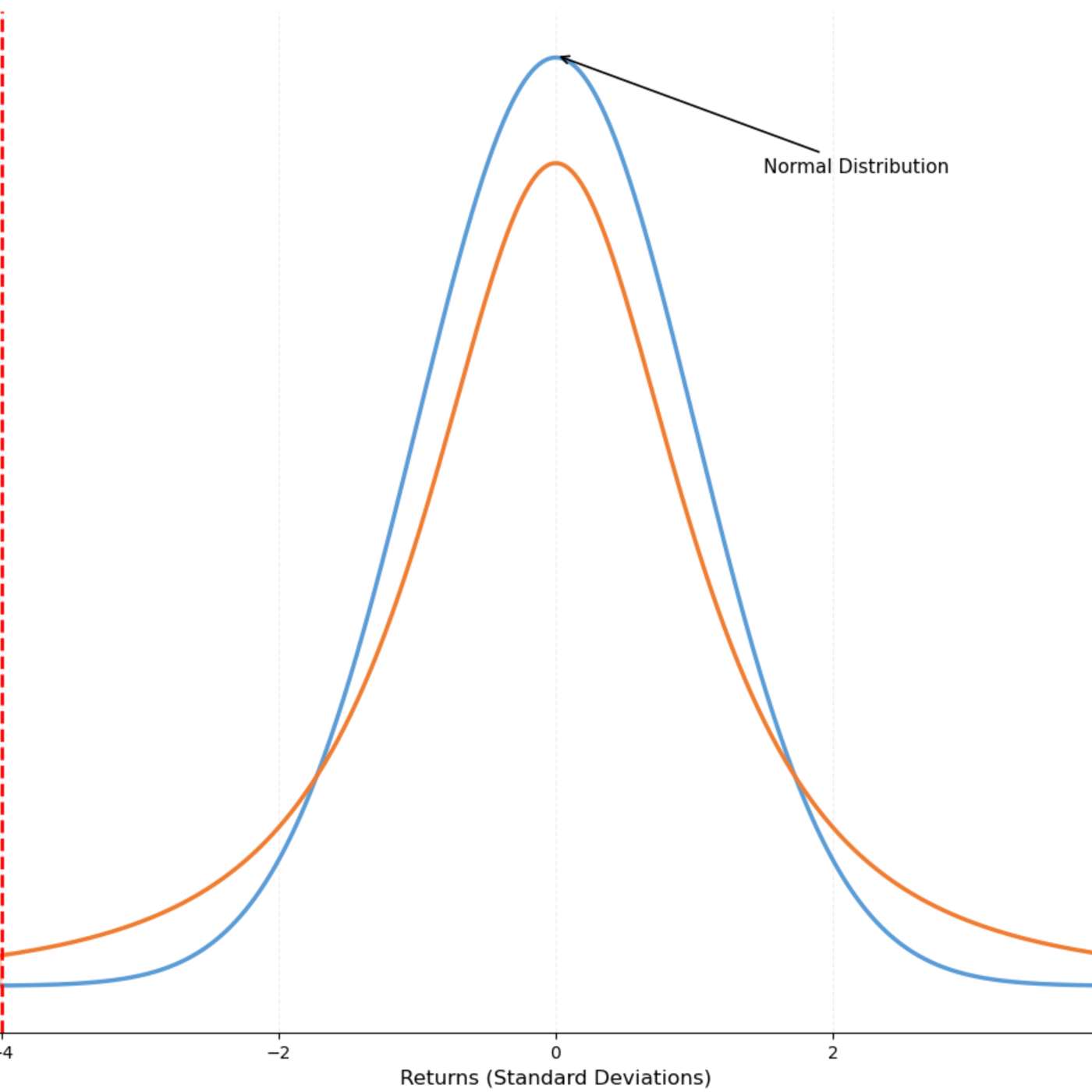

Positive expected value isn’t enough. Why real trading systems fail without risk control, time-horizon awareness, and survival-first optimization.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #quantitative-finance, #numerical-methods-in-finance, #quadratic-optimization, #expected-value-trading, #quantitative-trading-risk, #cvar-optimization, #kelly-criterion, #financial-risk-management, and more.

This story was written by: @nnilia. Learn more about this writer by checking @nnilia's about page,

and for more stories, please visit hackernoon.com.

Expected value optimization fails in production because it ignores the path to profitability—our system had positive EV but bled capital through occasional wins followed by persistent small losses. We fixed it by implementing CVaR constraints, fractional Kelly position sizing (25% of theoretical), and robust optimization that assumes our model is wrong, trading lower theoretical returns for survival and consistent compounding.

This story was originally published on HackerNoon at: https://hackernoon.com/architecting-the-future-of-financial-planning-karan-shahs-pioneering-cutting-edge-sap-epm-systems.

Karan Shah revolutionizes financial planning with SAP-powered EPM solutions, boosting speed, accuracy, and strategic decision-making globally.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #financial-planning, #global-finance-technology, #epm-solutions, #business-process-automation, #predictive-financial-analytics, #sap-bpc, #transform-financial-planning, #good-company, and more.

This story was written by: @sanya_kapoor. Learn more about this writer by checking @sanya_kapoor's about page,

and for more stories, please visit hackernoon.com.

Karan Shah transforms global financial planning with innovative Enterprise Performance Management solutions. By modernizing legacy systems, automating complex calculations, and leveraging SAP technologies, he dramatically improves speed, accuracy, and scalability, enabling better decision-making, global operational efficiency, and long-term strategic value for enterprises.

This story was originally published on HackerNoon at: https://hackernoon.com/25-things-to-leave-behind-in-2025-for-investor-decks.

Here are 25 critical mistakes startups must avoid in investor presentations—from unrealistic projections to missing competitive analysis to buzzword overload.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #venture-capital, #investment-portfolio, #fundraising-tips, #startup-fundraising, #vc-funding, #vc-investment, #founder-stories, #founder-advice, and more.

This story was written by: @brandonlvlupvc. Learn more about this writer by checking @brandonlvlupvc's about page,

and for more stories, please visit hackernoon.com.

Venture capital rebounded in 2025, but the seed market is more selective than ever. After reviewing thousands of pitch decks, here are the top mistakes to avoid.

This story was originally published on HackerNoon at: https://hackernoon.com/the-invisible-line-item-why-pollution-is-missing-from-every-balance-sheet.

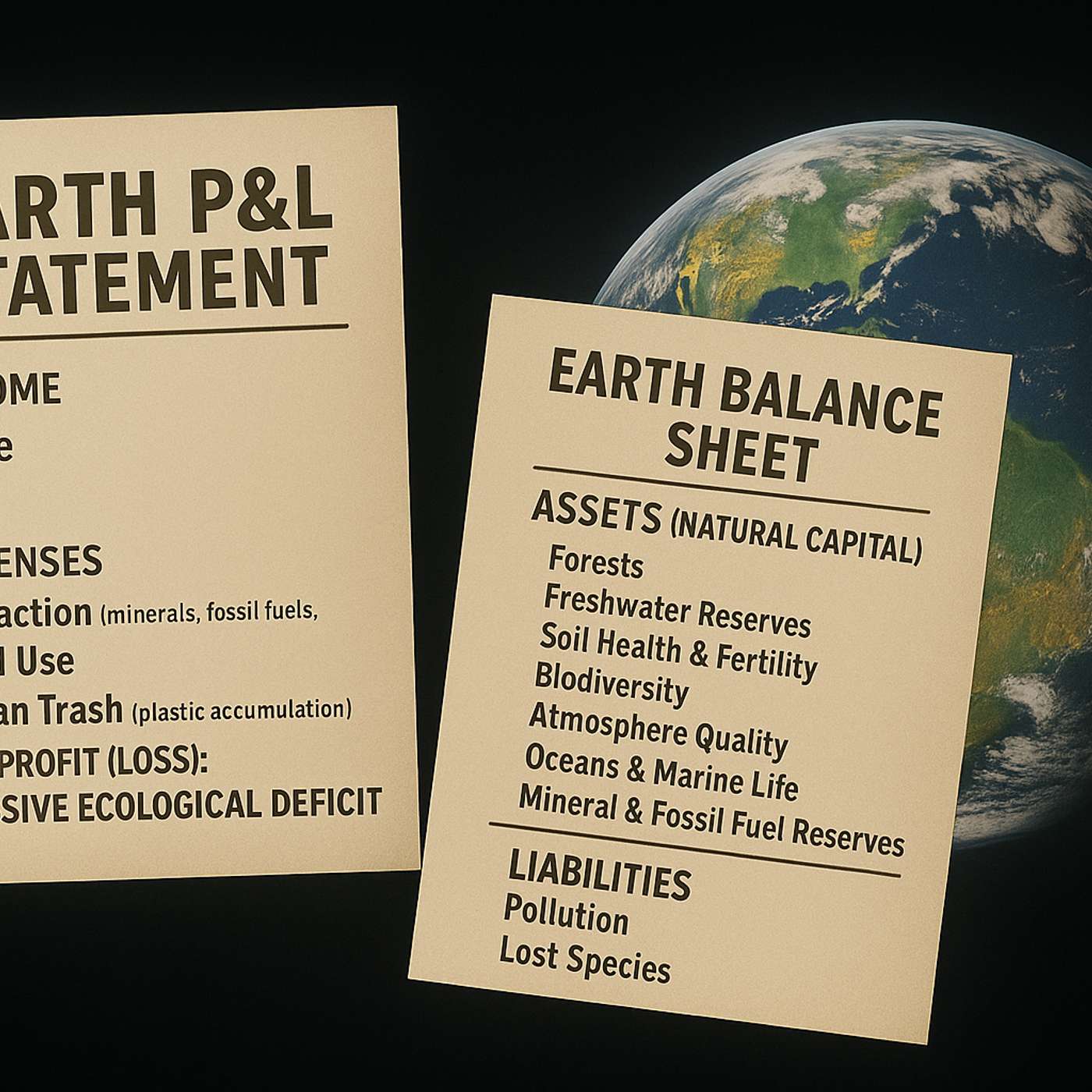

For centuries, pollution has been the missing line item of our accounting. First from ignorance. Then from choice. Now, from necessity. We must account for it!

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #climate-finance, #earth-cleaning, #water-based-digital-currency, #o-blockchain, #sustainable-finance, #environmental-cleanup-funding, #pollution-accounting, #good-company, and more.

This story was written by: @chris127. Learn more about this writer by checking @chris127's about page,

and for more stories, please visit hackernoon.com.

For centuries, pollution has been the missing line item. First from ignorance. Then from choice. Now from necessity—we must account for it. This isn't about blame. It's about balance. If pollution has created $Z trillion in costs, we need $Z trillion to fix it. And programmable money can provide this!

This story was originally published on HackerNoon at: https://hackernoon.com/wall-streets-underrated-advantage-what-top-firms-get-right.

Why some investment firms retain more clients: clear communication, compliant materials, and transparent reporting that builds investor trust.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #investment-rfp-strategy, #asset-management-comms, #due-diligence-questionnaire, #regulatory-communication, #private-placement-memorandum, #investor-reporting-honesty, #investment-client-retention, #good-company, and more.

This story was written by: @jonstojanjournalist. Learn more about this writer by checking @jonstojanjournalist's about page,

and for more stories, please visit hackernoon.com.

Client retention in asset management isn’t just about performance—it’s about clarity. As regulatory pressure rises and investors demand transparency, firms that deliver clear, compliant, and customizable communications keep more clients. Anuj Maheshwari’s overhaul of investor materials shows how better reporting, clearer risk explanations, and tailored documents directly lift retention, shorten sales cycles, and strengthen trust.

This story was originally published on HackerNoon at: https://hackernoon.com/your-gen-z-loved-ones-are-stressed-about-money-an-ai-coach-might-actually-help.

Gen Z is overwhelmed by money stress. Here’s how new AI-first, emotionally aware fintech tools are reshaping financial support for a generation in crisis.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #personal-finance, #fintech, #tech-gifts, #genz, #ai-coaching, #finance, #ai-financial-assistants, #budgeting, and more.

This story was written by: @sarahevans. Learn more about this writer by checking @sarahevans's about page,

and for more stories, please visit hackernoon.com.

Vera is an AI-driven financial coach that aims to go after that psychological layer. The shift it represents is worth paying attention to. Gen Z adults carry more education-related debt relative to income.

This story was originally published on HackerNoon at: https://hackernoon.com/building-a-rural-finance-ecosystem-for-the-philippines-part-1-the-asset-stack.

A new model for rural Philippine finance proposes indexing and tokenizing stored rice to create climate-resilient collateral for farmers and local banks.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #fintech, #fintech-for-agriculture, #philippine-rural-finance, #asset-backed-tokens, #rural-banking-philippines, #crop-indexing-model, #agricultural-fintech-solutions, #indo-pacific-tech-ecosystems, and more.

This story was written by: @nxtgencode. Learn more about this writer by checking @nxtgencode's about page,

and for more stories, please visit hackernoon.com.

The Philippines faces the challenges of a fast growing youth population in a largely agrarian society, being constrained by continuous extreme weather events The need is to make rural fintech more efficient, responsive to the unique needs of its users, to provide baseline growth. This will lay the basis for true financial inclusion.

This story was originally published on HackerNoon at: https://hackernoon.com/the-day-the-house-entered-epistemic-hold-a-story-of-ternary-logic-congress-and-credible-evidence.

A satirical trip through Congress to explain Ternary Logic, Epistemic Hold, and a new evidentiary framework for economic systems and accountability.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #economic-systems, #ternary-logic, #epistemic-hold, #evidentiary-framework, #immutable-ledger, #cbdc-settlement, #hybrid-shield-architecture, #accountability-in-finance, and more.

This story was written by: @lev-goukassian. Learn more about this writer by checking @lev-goukassian's about page,

and for more stories, please visit hackernoon.com.

This story dramatizes what happens when the U.S. House of Representatives stumbles onto “Ternary Logic,” an evidentiary framework for economic systems built around a third state: Epistemic Hold. Through a satirical tour of Decision Logs, Immutable Ledgers, Hybrid Shield, Anchors, and “No Log = No Action,” it imagines a world where markets, CBDCs, ESG finance—and even lawmakers—are forced to act only on transparent, auditable evidence.

This story was originally published on HackerNoon at: https://hackernoon.com/pretty-charts-are-lying-to-you.

Many projects still treat market making as a way to create a clean picture rather than a functional market.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #market-making, #what-is-a-market-maker, #market-maker-crypto, #real-liquidity, #crypto-market-making, #market-makers, #how-does-market-making-work, #crypto-market, and more.

This story was written by: @RomanKorotchin. Learn more about this writer by checking @RomanKorotchin's about page,

and for more stories, please visit hackernoon.com.

Many projects still treat market making as a way to create a clean picture rather than a functional market. A pretty chart is incredibly easy to manufacture. Once trading picks up, superficial support disappears almost immediately. The spread widens, price movement becomes erratic, traders start to doubt the asset.

This story was originally published on HackerNoon at: https://hackernoon.com/avici-raises-$35-million-gives-back-90percent-of-capital-via-futarchy-governance.

Avici raises $3.5M and returns 90% of capital to its community using a futarchy governance model, signaling a new approach to crypto-fintech decision-making.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #avici-funding, #futarchy-governance, #crypto-fintech, #decentralized-banking, #onchain-credit, #prediction-markets, #fintech-funding, #good-company, and more.

This story was written by: @kashvipandey. Learn more about this writer by checking @kashvipandey's about page,

and for more stories, please visit hackernoon.com.

Avici secured $3.5M in funding while returning roughly 90% of committed capital to its community through a futarchy governance model. The fintech-crypto startup aims to build unified internet banking tools—wallet, savings, spend card, credit scoring, and lending—while using market-driven governance to align incentives and build trust.

This story was originally published on HackerNoon at: https://hackernoon.com/jumper-exchange-announces-cross-rollup-routing-update-and-releases-2025-layer-2-outlook.

The release tightens liquidity sourcing and route selection across Arbitrum, OP Mainnet, Base, Starknet, zkSync Era, Linea, and additional networks.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #finance, #jumper-sequel, #financewire, #press-release, #crypto-exchange, #layer-2-rollups, #good-company, and more.

This story was written by: @finance_wire. Learn more about this writer by checking @finance_wire's about page,

and for more stories, please visit hackernoon.com.

Jumper Exchange has announced an update to its cross-rollup routing engine. The release tightens liquidity sourcing and route selection across Arbitrum, OP Mainnet, Base, Starknet, zkSync Era, Linea, and additional networks.

This story was originally published on HackerNoon at: https://hackernoon.com/daniel-zakharov-ceo-of-buburuza-on-why-youll-monitor-money-instead-of-managing-it-soon.

Buburuza CEO Daniel Zakharov explains why emotional spending makes budgeting fail—and how AI will soon help you monitor money instead of managing it.

Check more stories related to finance at: https://hackernoon.com/c/finance.

You can also check exclusive content about #daniel-zakharov, #buburuza, #ai-financial-assistants, #emotional-spending, #personal-finance-automation, #ai-money-management, #fintech-innovation, #good-company, and more.

This story was written by: @kashvipandey. Learn more about this writer by checking @kashvipandey's about page,

and for more stories, please visit hackernoon.com.

Buburuza CEO Daniel Zakharov predicts that AI financial assistants will soon replace manual money management. Instead of stressing over budgets and bills, users will co-create financial strategies that AI executes and monitors—eliminating emotional spending, shame, and decision fatigue. The future of finance is collaborative, not controlling.