Discover The Algorithmic Advantage

The Algorithmic Advantage

The Algorithmic Advantage

Author: The Algorithmic Advantage

Subscribed: 79Played: 1,848Subscribe

Share

© The Algorithmic Advantage

Description

The Algorithmic Advantage is a podcast about quantitative trading and investing. We're here to expand the toolkit of the quant-trading community and introduce investors to the many advantages of systematic trading. Our goal is to educate and inspire as we embark on a captivating journey into the vast knowledge and experience of leading portfolio managers and other experts in the field! www.algoadvantage.io

48 Episodes

Reverse

Today we spoke with Corey Hoffstein, a well-known market practitioner with a deep and broad knowledge across quantitative trading & trend following, but also across developing investment products for wider advisor distribution. I’m super interested in almost every aspect of the financial markets, because I feel like a broad and generalist knowledge helps me make better trading and business decisions. Corey hits the nail on the head when he says that a given industry participant may be making optimal business decisions which are sub-optimal trading decisions.

If we are aware of this kind of behaviour, it can help shape the way we trade. More than that, understanding market participants, infrastructure, technology, business motivations, and so on, is critical to effective trading. At a basic level, this would include knowing the exact differences between the execution of a market versus a limit order for example. It builds from there, but the point is, it doesn’t hurt you to gain more and more knowledge of how the markets ‘actually work’.

So much more over on the website:

www.thealgorithmicadvantage.com

Courses, community & more: https://www.algoadvantage.ioThis is part II, part I is Episode 46.I know we all want “quick, actionable take-aways”, but the reality is that foundational principles of strategy development process is at the core of successful trading, and you more than likely do not have half of this in place like you should. So, while this is ‘foundational’, and can only be covered briefly, don’t skimp on reviewing this stuff. It’s only in the Algo Collective that we’ll be able to take the time to deep-dive how to set this all up in a highly practical way. Believe me, once you have a pipeline for strategy development, you’re done! You churn out strategies that are more robust, quickly drop bad ideas and refine your portfolio quickly. You can focus on risk management, other research and constant review, while your trading takes place automatically in the background. At least, that’s my approach.

Detailed write up on how institutions trade differently: https://www.algoadvantage.io/podcast/046-tom-starke/Part 2: coming soon!Dr Tom Starke trades significant institutional capital as a quant trader for a private fund. In Part 1, we cover the common pitfalls of 'retail' or newer traders. Tom makes the case that institutions 'think differently', applying an extra dimension to their thinking, as compared to retail traders. A significant result of this is the critical role a systematic R&D process plays in strategy development. The development pipeline is a 'research first', 'hypothesis testing' laboratory, designed to invalidate bad ideas quickly, and push viable ideas through a strict robustness testing framework to ensure out-of-sample results. Applying a scientific approach (which is just good data science), means letting the data speak, rather than squeezing it for the answers we want! The result is a process designed to minimize overfitting and produce the highest risk-adjusted returns for the pre-defined objectives.Courses, Community & More: https://algoadvantage.ioContents:0:00 Introduction to Systematic Trading and Research6:47 Tom Stark’s Journey: From Physics to Trading13:16 The Scientific Approach: Pros and Cons in Trading19:30 Avoiding Analysis Paralysis in Quant Trading26:02 The Transition: Retail vs Institutional Trading32:28 The Motivation Behind Teaching and Mentoring Traders38:04 Mindset Shifts: From Retail to Institutional Thinking44:34 Risk Management: How Institutions Approach Risk51:08 Defining Trading Objectives: A Key Starting Point57:06 Portfolio Construction: Balancing Risk and Return1:03:10 Diversification: The Key to Long-Term Success1:09:30 Position Sizing: Crucial for Strategy Success1:15:00 Machine Learning’s Role in Systematic Trading1:21:10 Python: The Essential Tool for Quantitative Research1:27:00 Back-testing and Strategy Evaluation: Avoiding Overfitting

Detailed write-up on all of the concepts discussed here: https://www.algoadvantage.io/podcast/045-rob-hannaRob Hanna has been trading since the mid 90's and has slowly progressed from discretionary swing trading to a systematic, research driven approach, while still carrying some of those qualitative features into his quant trading. He trades a diversified set of strategies in equities and ETFs, with a focus on the shorter term (and particularly mean-reversion) models. Of particular interest to me was his VIX trading strategies due to their usefulness as a hedge in times of crises, and because they employ more than just price data (they look to the VIX futures curve - whether in backwardation or contango as a critical filter to his models). Trading volatility (through the futures, options or ETFs) can be extremely risky, but given the strong edges that are present in trading a consistent down-trending market, it's always of interest to me how traders find a way to profit while minimizing the risks inherent in these models. Rob has been trading the VIX long enough to share some invaluable insights. Enjoy!The only reliable source for trading COURSES, COMMUNITY & more: https://algoadvantage.io

I think Nick Radge’s edge is actually an architecture: robust, simple, momentum-driven systems stitched together into a portfolio that survives, adapts, and compounds. Across nearly four decades, he’s traded through crashes, chop, and melt-ups; shifted from futures to equities for business reasons; and kept his build-process stubbornly logic-first and comfortingly boring—by design. The pro vs amateur divide, per Nick: pros ride the drawdowns and are present for the next outlier. They profit from human bias—fear, greed, crowding—by refusing to trust their own emotions and by outsourcing discretion to rules they can defend under pressure. Write the plan. Build the engines. Diversify the return streams. Rebuke complexity. Then let compounding do its weird, beautiful work.COURSES, COMMUNITY & MORE OVER ON THE WEBSITE:https://www.algoadvantage.io

Can caveman-simple trading rules still work in today’s markets? Brent Penfold says yes. In this interview, he reveals why old strategy rules remain powerful, why portfolio-level thinking is the real edge, and how diversification and discipline create timeless success.Brent talks about trading patterns in a range of 30 futures markets, deploying 20 strategies diversified across mean reversion and trend following principles. I write an article inspired by each podcast which are full of my insights and practical tips. Check them out on the website: https://www.thealgorithmicadvantage.comLinks for Quant Strats conference in London on the 14th-15th October 2025:https://www.alphaevents.com/events-quantstratsuk --- 10% off using ALGOADVANTAGE10

Round II of a systematic trading masterclass with Laurens Bensdorp: architect non-correlated, purpose-built portfolios—mix trend following, mean reversion, and long-volatility hedges to drive smoother, higher risk-adjusted returns.We unpack the “paradox of diversification” (Parrondo’s paradox) to turn “ugly” equity curves into compounding machines, and when (not) to switch systems off to avoid recency bias and overfitting.Plus: robust portfolio construction, capital allocation, and highlights from Laurens’ latest book, Trading Retirement Accounts.Combining losing investments into a winner:https://blog.ephorie.de/parrondos-paradox-in-finance-combine-two-losing-investments-into-a-winner"The Paradox of Diversification" paper:https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1567126 More on our site: https://www.thealgorithmicadvantage.com#Quant #SystematicTrading #AlgorithmicTrading #PortfolioConstruction #Diversification #RiskManagement #TrendFollowing #MeanReversion #Volatility #Hedging #Backtesting #Robustness

Dive into the deep experience of quantitative trading with Cesar Alvarez (trader first, martial artist second), a veteran trader known for his mastery in mean reversion, breakouts, momentum, ETF and volatility strategies. Discover his innovative methods building a dynamic portfolio, retiring strategies, parameter sensitivity tests, strategy robustness checks, and the art of balancing risk and return to ensure long-term trading success. Cesar’s insights highlight essential strategies for thriving in volatile markets, fine-tuning strategy components, and avoiding the trap of overfitting. Perfect for systematic traders looking for practical edges!#QuantTrading #MeanReversion #AlgorithmicTrading #ETFStrategies #QuantTradingContents:0:00 Cesar's Journey: Discretionary to Quant Trading3:59 Inside Connors Research: Mean Reversion Insights5:48 Cesar's Current Quant Trading Portfolio8:35 Tactical ETF Strategies & Retirement Focus14:34 Designing Quant Strategies: Goals & Principles17:07 Robustness Testing & Avoiding Overfitting22:49 Knowing When to Retire a Trading Strategy29:53 Amibroker vs RealTest: Tools for Systematic Traders34:03 Cesar’s Featured Quant Trading Strategies37:03 Short Selling & Mean Reversion in Bear Markets41:12 Breakout & Momentum Strategies for Stocks43:53 Navigating Volatility: Trading VIX & SVIX ETFs50:50 Secrets to Effective Mean Reversion TradingWhat could it be?

A Smart Portfolio of Trend Following, Mean Reversion & Hedging StrategiesUnlock insane returns with quant crypto trading! Discover how Pavel from Robuxio builds robust portfolios combining mean reversion, momentum, and hedging strategies—even with limited historical data. Learn essential techniques for managing crypto volatility, optimizing execution, and leveraging diversified strategies. Curious? Dive into the show! #QuantTrading #CryptoTrading #Momentum #MeanReversion #Hedging #AlgorithmicTrading #CryptoStrategies

Psychology for Quant Traders? Really?Quantitative futures traders like to think in code, not clichés—but Dr Brett Steenbarger makes a compelling case that mindset is part of the edge. In this interview, Brett argues that the same statistical rigor quants apply to markets should be applied to the grey matter behind the keyboard. Here's a guide for the advanced systematic trader who suspects “psy-stuff” might be more than motivational posters.The punch-line from Brett’s research is simple: systematic trading is less “set-and-forget” and more Formula 1 pit-crew—engineering precision plus real-time human performance. Code finds edges; psychology keeps you creative enough to refresh them. Or, as one of Brett’s blog posts puts it, “We can’t run robust systems from brittle minds.” Not a bad mantra to stick on your trading monitor!#traderpsychology #tradermindset #tradinginthezone

Finishing our little mini-series on shorter-term futures trading we talk to Andrea Unger and happily inject some click-bait in the form of gloating about his 672% return in a single year when he won the World Trading Competition. Naturally, we know that this kind of return is generated by specifically trying to win the comp, and taking on the associated risks! If you've been asleep the first two guests in this series were Bob Pardo and Kevin Davey. Between the three we've got a complete masterclass in shorter-term, diversified and responsive futures trading!Andrea Unger is actually a four-time World Trading Champion, and here he offers a comprehensive and structured approach to quantitative trading in futures markets, emphasizing practical methods for strategy design, robustness testing, portfolio construction, and system deployment.www.thealgorithmicadvantage.com

Kevin’s systematic approach melds rigorous quantitative testing with pragmatic risk management and monthly maintenance protocols. By enforcing single-pass optimizations, extensive real-time validation, and lean portfolio sizes, he constructs a robust trading framework designed for consistency and longevity. Advanced traders can draw from his workshop principles to refine strategy design, navigate common back-testing pitfalls, and build diversified, adaptive portfolios capable of weathering market uncertainties.Topics: Strategy Design PrinciplesWalk Forward Analysis: Best Practices and Common MistakesRobustness Testing Beyond Walk ForwardTech Stack and Automation ToolsPortfolio Construction ProcessMonthly Maintenance and RebalancingRisk Management and Psychological PreparednessPerformance Benchmarks and Goals

In the cutthroat world of algorithmic futures trading, a structured process is non-negotiable. Kevin Davey’s approach—defining objectives, rigorous validation via walk-forward and Monte Carlo methods, live incubation, and proactive portfolio management—offers advanced quantitative traders a framework to thrive in. By blending engineering precision with market adaptability, his methodology underscores that success lies not just in the strategies themselves, but in the disciplined process behind them.www.thealgorithmicadvantage.com

Many trading strategies are developed using extensive historical data to calibrate model parameters. However, this process often leads to over-optimization, where the strategy is too finely tuned to past market conditions. Two things stand out:Noise vs. Signal: Financial markets inherently contain a high degree of randomness. A model that fits historical data exceptionally well may simply be capturing random fluctuations rather than a persistent trading edge. Regime Shifts: Markets change over time. A strategy that works during a bull market might not perform in a bear market or during periods of high volatility.Enter Walk-Forward Analysis. It's also not easy, but if done right can create an incredible method to solve for over-fitting in a systematic manner, leading to:Realistic Performance Metrics: By testing on entirely out-of-sample data (not just one out of sample period), traders can obtain performance metrics that are closer to what would be experienced in real-world trading. Adaptive Strategies: Walk forward analysis inherently forces a re-optimization process. This means the model is continually updated to reflect more recent market conditions, thereby reducing the risk that it’s built solely on outdated historical data. Robust Parameter Selection: Instead of selecting a single “optimal” parameter set that may be an outlier, traders can identify a plateau of robust parameters that perform consistently across multiple windows. This approach minimizes the risk of curve fitting, ensuring the strategy’s parameters are not overly sensitive to one specific dataset.

Of the two biggest problems quantitative traders probably face, the first is over-optimization and the second is likely finding inspiration for new ideas. In-depth interviews with market wizards surely has to be one of the best ways to learn quickly, avoid common pitfalls and find untold amounts of inspiration hidden between the lines. Listening to experts that have been at it for decades, for me anyway, is an incredible education. In this show I invite you to again spend over an hour with Bob Pardo on the ins and outs of his trading, his philosophy and his edge. And the best bit is, this is just part 1 of 2. In the second part I'm going to deep-dive walk forward analysis with him and I'm sure I'll be walking away with some highly practical tips and tricks. Bob’s career spans several decades of evolving market dynamics, groundbreaking system development, and a philosophy rooted in adaptability and robustness. His journey—from early days on the trading floor to pioneering walk forward analysis and working with the likes of Solomon Brothers, Dunn Capital, Daiwa Securities & Goldman Sachs—offers a compelling narrative for quantitative traders seeking both inspiration and technical insights.Intra-day Futures Traders and others - grab a chamomile tea and enjoy!www.thealgorithmicadvantage.com for contacts and more.

The A-Z of building a systematic futures portfolioIn this episode, seasoned trader Rob Carver shared his nuanced approach to building and managing a diversified futures portfolio—a methodology that appeals to advanced, technical traders, while we also covered off some of the 'basics' of futures trading, such as rolling, back-adjusting, and so on. I did my best to break down the key elements of his strategy, from market selection to dynamic optimization and continuous trading. A couple of interesting things came up, there's a lot of detail in here, and luckily you can go to his blog and books for all the technical detail.For the long-term futures trader with a smaller account, this is essential listening. How much diversification across markets and models is enough? How can we capture the benefits of this diversification with a limited account size? Rob has innovative approaches to both market diversification and model diversification to generate a highly capital efficient approach.For futures data, check out Norgate on our site: https://thealgorithmicadvantage.com/tools/www.thealgorithmicadvantage.com for more!

Building Better Strategies with Good Science

It was strangely comforting talking to Ernie Chan. Whilst I was completely out of my depth talking about AI and Machine Learning, I came away broadly reinforced in my own belief that great trading still requires a human touch, and that the best niche's in the market are best discovered by applying a certain kind of wisdom, experience and competitive approach. The machine learning techniques and computer power needed to make them work are, however, quickly catching up, so how long we have is anyone's guess.

For now, however, even Ernie is on the same page: that causal strategies (ones you can say 'why' they work) are still superior, more robust, easier to tweak if they should begin to decay. Furthermore, diversification across strategy types is key, merging long and short vol strategies, diversifying between trend and mean reversion. Avoiding over-fitting these strategies is best done by applying the scientific method: create a hypothesis of what should work in the market, then try to invalidate it with a logical analysis of the data. Well, that's nicely validating for my approach, so I'm happy.

More detail / notes over at www.thealgorithmicadvantage.com

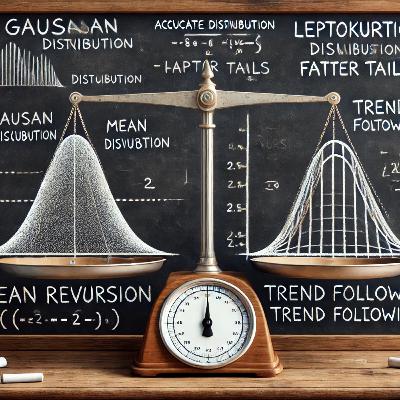

In the domain of quantitative finance, the juxtaposition of mean reversion and trend-following strategies constitutes a pivotal dialogue in the formulation of robust trading paradigms. Each methodology is underpinned by unique theoretical and empirical foundations, presenting distinct opportunities and inherent vulnerabilities. However, when synthesized within a cohesive portfolio framework, these strategies reveal a profound synergy that not only enhances diversification but also attenuates systemic risks. This discourse delves into the nuances of each strategy and elucidates their integrative potential.

www.thealgorithmicadvantage.com

Wayne Himelsein, President and CIO of Logica Capital Advisors, has developed a robust approach to options trading centred on long volatility strategies that balance systematic rigor with human oversight. His methodology involves "gross long volatility," rejecting short volatility trades to ensure full protection during market downturns, and dynamically adjusting positions through a technique he calls "scalping to fund long vol." This process leverages mean-reverting market behaviours to offset the inherent costs of options while maintaining asymmetric risk-reward structures like straddles and strangles.

Supported by extensive quantitative analysis and adaptability to varying volatility regimes, Wayne’s strategies exemplify a nuanced blend of art and science in trading.

More over at www.thealgorithmicadvantage.com

The concept of the “Cockroach Portfolio” is a novel take on building a robust investment strategy that thrives across diverse market conditions. Drawing inspiration from one of nature's most resilient creatures, this approach emphasizes adaptability, diversification, and risk mitigation.

Jason Buck runs Mutiny Funds with a core belief that: “Offense wins games. Defense wins championships.” Mutiny’s version of a diversified, all-weather portfolio therefore combines defensive-minded strategies, such as long volatility and trend, with offensive-minded strategies, such as stocks and bonds. Ensuring survival, and reducing draw-downs through time, provides the best opportunity for long-term capital growth.

This show is all about risk management. If you don’t know what ergodicity is, or how you can drown in a river that is 2 feet deep on average, listen in.

Loads more, including contact links and a detailed write-up over at www.thealgorithmicadvantage.com

Great discussion, and good questions.