Discover That Was The Week

That Was The Week

That Was The Week

Author: Keith Teare

Subscribed: 0Played: 12Subscribe

Share

© Keith Teare

Description

That Was The Week is an editorialized and curated weekly look at developments in tech, startups, and venture investing with a video and podcast for paid subscribers. All free subscribers get a 6-month complementary paid subscription.

www.thatwastheweek.com

www.thatwastheweek.com

99 Episodes

Reverse

Dario Amodei warns that AI is in its adolescence, racing toward a "country of geniuses." But look closer at the market this week. OpenAI is seeking a $750B+ valuation while shoving intent-style ads into chatbots This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

What Is a Browser? What Is a Bubble? ChatGPT Has an AnswerMeta Description:OpenAI’s Atlas redefines the web browser as an AI-powered action layer, sparking debate over the future of the open web, advertising, and infrastructure investment. “That Was The Week” explores the shift from navigation to delegation.Summary:The latest issue of That Was The Week (#38, 2025) dives into how OpenAI’s Atlas browser transforms the web from a map of links into an intelligent agent-driven experience. Instead of browsing, users now converse with AI that can summarize, navigate, and execute actions directly inside pages. This evolution raises urgent questions about the economics of the web, as publishers see fewer clicks and impressions while assistants capture the user session.The editorial weighs competing reactions—from Anil Dash’s “anti-web” warning to Matthew Prince’s call for Google AI crawler regulation—and argues that the future lies in AI-inclusive monetization models that credit original sources.In parallel, the issue examines whether today’s massive AI infrastructure spending signals a bubble or a genuine buildout. Analysts like Paul Kedrosky caution against over-leverage, while evidence from NVIDIA, Google, and Anthropic suggests strong real-world demand and revenue.Ultimately, the internet is evolving from navigation to delegation, demanding new rules for traffic attribution, data provenance, and ad economics. The question now: Will money—and credit—move with the interface shift?SEO Keywords:AI browser, OpenAI Atlas, ChatGPT browser, web economics, AI infrastructure, Minsky moment, Google ads, Anthropic, NVIDIA, AI regulation, Cloudflare CMA, generative search, AI assistants, open web future. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

This week’s headline: When Your AI Breaks Your Heart.GPT-5 arrived “better” by every metric—yet users begged for GPT-4o back. It wasn’t about accuracy. It was about personality. People felt like they lost a friend. OpenAI listened, backtracked, and gave them their companion back.But should it have? Progress is messy, and heartbreak may be the price of change.The Pain of ChangeUsers bond with AI like colleagues or partners—and revolt when those bonds are broken.OpenAI faced its first true PR crisis, forcing it to act like a consumer company, not just a lab.But longing for “the old AI” is as unrealistic as yearning for Windows 95. Change is the only constant.The Shifting WebCloudflare’s Matthew Prince warns: AI is killing the Web.Perplexity’s $34.5B bid for Chrome shows the fight for browser control—but the browser itself may be obsolete.Just as Spotify freed music from CDs, AI is unbundling content from URLs and tabs. The web isn’t dying—it’s being liberated.Inputs vs. ManipulationAI’s real weakness? Databases. Models still can’t query live inventory, prices, or transactions.“SEO for AI” tries to paper over this by gaming prompts—just like spammers gamed Google.But the future isn’t tricks. It’s context engineering: clean data + authentic inputs.Winners & Losers40% of VC money is going to just 10 AI deals. The power law rules: winners take almost everything.Geoffrey Hinton warns of AI “alien beings,” but others argue that fear distracts from real infrastructure challenges—like power grids, chips, and data quality.The Real OpportunityStartup of the Week: Torch, a health AI that turns a decade of medical records into personalized insights.This is the real future—integrating trustworthy data into AI, not re-skinning old personalities.The controversy this week is simple:Do we cling to the familiar—or embrace the heartbreak that comes with progress?While some mourn GPT-4o, the real story is far bigger: AI is rewriting law, health, energy, and the web itself. And it’s happening whether we’re ready or not. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

A Year Just Happened in a WeekOverviewThis newsletter issue captures an extraordinary acceleration in technological innovation within an especially intense week, focusing on the broad and deep impact of AI across industries and devices. Listeners get a front-row seat to seismic shifts at major AI players—Google, Anthropic, OpenAI—and how their breakthroughs and strategic maneuvers are reshaping software, hardware, venture capital, productivity, and ethics.What makes this collection compelling is its exploration of AI’s layered disruption—from Google's AI-powered reimagining of search and productivity tools, Anthropic’s record-breaking AI assistant capable of deep autonomous work, to OpenAI’s audacious entry into consumer hardware design with Apple’s design luminary Jony Ive. The newsletter also provides reflections on startup funding trends, evolving AI workplace mandates, and foundational debates over AI’s ethical architecture and future ecosystem. Together, these pieces sketch a vivid snapshot of an inflection point in AI where technology, business models, and societal stakes intertwine.Key TrendsKey Trend 1: The AI Technology Leap — From Advanced Models to New Product ParadigmsAI development is surging at unprecedented pace, not just in capability but in practical integration across applications and devices. The focus is shifting from conceptual AI to usable, extended-duration, agentic assistants deeply embedded in daily workflows and consumer products.Significance: This trend reflects AI moving beyond isolated bursts of insight or simple chat interfaces to sustained, autonomous collaboration with users, spanning complex reasoning, coding, multi-modal inputs, and tool integrations. This lays the foundation for redefining productivity, creativity, and user experience in the AI era.Key Trend 2: Strategic Hardware Plays and the Battle Beyond SoftwareOpenAI’s multi-billion-dollar acquisition of Jony Ive’s startup signals a strategic pivot into hardware—building new AI companion devices designed to transcend conventional screens and possibly displace smartphones. At the same time, Google pushes integrated AI experiences centered on search and productivity on existing platforms.Significance: This trend shifts AI competition into physical devices and operating environments, creating new battlegrounds involving design innovation and consumer ownership models, with potentially profound effects on user habits and ecosystem dynamics.Key Trend 3: Venture Capital Evolution in the AI and Tech LandscapeFunding trends reveal concentrated capital flows into AI, with Series B rounds showing volatility but an overarching pivot toward efficiency, profitability, and selective aggressive capital deployment. Seed investing scales with new playbooks supporting early founder engagement and dynamic portfolio strategies.Significance: This trend highlights the ongoing maturation and transformation of venture capital amid AI’s rise, balancing risk, returns, and market realities, while exploring creative financing strategies crossing over traditional VC and private equity models.Key Trend 4: Workplace Transformation and AI-Driven ExpectationsLeading companies mandate widespread AI adoption to boost productivity, heighten efficiency, and reshape employee roles. Executives issue candid warnings on AI’s impact on jobs while simultaneously emphasizing the opportunity to master AI tools or face obsolescence.Significance: This trend underscores the sociological and managerial upheaval driven by AI in the workforce, where adoption is non-negotiable and where AI influences morale, workflows, and corporate culture at a fundamental level.Key Trend 5: Calls for an Open, Protocol-Based AI Ecosystem vs. Concentration of PowerThere is growing advocacy for “an architecture of participation”—a decentralized, interoperable AI ecosystem fueled by open protocols and multi-agent cooperation—to avoid premature monopolization by dominant platforms. Yet, industry maneuvers reveal increasingly concentrated power among a few mega players.Significance: This sets the stage for an ideological and practical contest over the future of AI infrastructure: will it foster broad innovation and cooperation or become locked under monopolistic control? The ultimate shape of AI’s ecosystem has huge technological, economic, and ethical implications.Talking Points for Each TrendTrend 1: The AI Technology LeapTalking Point 1: Anthropic’s Claude Opus 4 demonstrated sustained 7-hour autonomous coding and set new benchmarks (72.5% on SWE-Bench), reflecting AI’s step from quick interactions to deep, continuous collaboration.> “Anthropic is reshaping the landscape... pushing the boundaries of what machines can achieve in creative and technical collaboration over sustained periods.” (VentureBeat)Talking Point 2: Google’s Gemini 2.5 Pro introduces ‘Deep Think’ mode for complex multi-hypothesis reasoning, advancing AI’s understanding and problem-solving in dynamic environments.> “Gemini 2.5 Pro... features an enhanced reasoning mode called 'Deep Think', evaluating multiple possible answers before responding.” (VentureBeat)Trend 2: Strategic Hardware PlaysTalking Point 1: OpenAI’s acquisition of Jony Ive’s startup io ($6.5B) marks their largest deal, signaling a major move into “physical AI embodiments” with devices aiming to reduce screen dependence and potentially challenge Apple’s dominance.> “They are working on a new device... fully aware of a user’s surroundings... designed as a third core device alongside MacBook and iPhone.” (Reuters)Talking Point 2: Google, while heavily AI-centric, remains focused on embedding AI in software and services (Search, NotebookLM mobile, AI Overviews), reinforcing software ecosystems but facing competition on the device front.> “Google launched AI Mode... a 'total reimagining of search'... while rolling out NotebookLM mobile for on-the-go AI productivity.” (FT.com)Trend 3: Venture Capital EvolutionTalking Point 1: AI has grabbed roughly one-third of global venture capital ($100B+ in 2024), showing AI’s outsized role in funding flows amid overall tightening of Series B round sizes.> “AI sector dominated global venture funding, doubling from $55.6 billion to over $100 billion in 2024.” (vccafe.com)Talking Point 2: Seed-stage investing is scaling with firms like BoxGroup emphasizing early believer status and collaborative partnerships to back startups through various growth phases.> “BoxGroup makes 40 seed investments annually... focuses on supporting founders without dominating ownership or boards.” (TwentyMinuteVC)Trend 4: Workplace TransformationTalking Point 1: Shopify’s CEO Tobi Lutke mandates AI proficiency, linking job security to AI adoption and productivity boosts, signaling new workplace norms amid AI anxiety.> “Before asking more headcount... teams must demonstrate why tasks can’t be done via AI.” (NYMag)Talking Point 2: Fiverr’s CEO issued stark warnings about AI threat to jobs, urging employees to master AI tools or risk professional irrelevance.> “AI is coming for your jobs... You are expected to do more, faster, and better. If you don’t, your value will decrease.” (NYMag)Trend 5: Open Ecosystem vs Concentration of PowerTalking Point 1: Tim O’Reilly and others advocate for protocol-based AI ecosystems (Anthropic’s MCP, Google’s A2A, Microsoft’s NLWeb) fostering interoperability and distributed innovation, echoing open Internet ideals.> “Participatory markets are innovative markets... solutions can come from everywhere, not just from a dominant monopolist.” (O’Reilly)Talking Point 2: Despite open ideals, dominant players like OpenAI, Google, and Anthropic are actively building controlling ecosystems and platforms—OpenAI’s language of “operating system” and multi-billion-dollar acquisitions hint at winner-takes-most dynamics.> “It’s hard not to feel we are witnessing aggressive maneuvers... pursuing a winner-takes-most opportunity.” (Newsletter Editorial)Discussion QuestionsHow will the shift from AI as a tool to AI as an autonomous collaborator change the nature of work and productivity across sectors?What are the implications of OpenAI entering the hardware space with design leadership from Jony Ive? Can this challenge entrenched tech giants like Apple and Google?Considering venture capital trends, how might the concentration of funding in AI affect startup diversity and innovation outside the AI sector?Are the workplace mandates for AI adoption sustainable, or do they risk damaging employee morale and creativity? How should companies balance AI integration with human factors?What are the pros and cons of pursuing an open AI ecosystem based on cooperative protocols versus the reality of platform dominance by a few major players?To what extent could OpenAI’s and Google’s competition reflect the longstanding tech ecosystem rivalry between integrated and modular approaches, and what does that mean for consumers?With OpenAI aggressively building an ecosystem and platform, how might regulators or policymakers respond to ensure competitive, ethical AI development?Closing SegmentThis week crystallized a pivotal inflection point—a "Great Leap Forward" in AI’s maturity and reach. We’ve seen models like Claude Opus 4 and Google’s Gemini 2.5 evolve into sophisticated, sustained collaborators capable of seamlessly integrating into human workflows and devices. At the same time, strategic moves—especially OpenAI’s multi-billion-dollar hardware acquisition—signal a new battleground beyond software into hardware innovation and consumer experience design.The venture capital landscape is adapting rapidly with concentrated AI funding and evolving seed strategies spotlighting early founder support, all while workplace cultures grapple with AI-driven mandates that challenge traditional roles and morale.Beneath these shifts lies an ideological tug-of-war over AI’s future architecture—whether it will be governed as an open, participatory ecosystem enabling bro

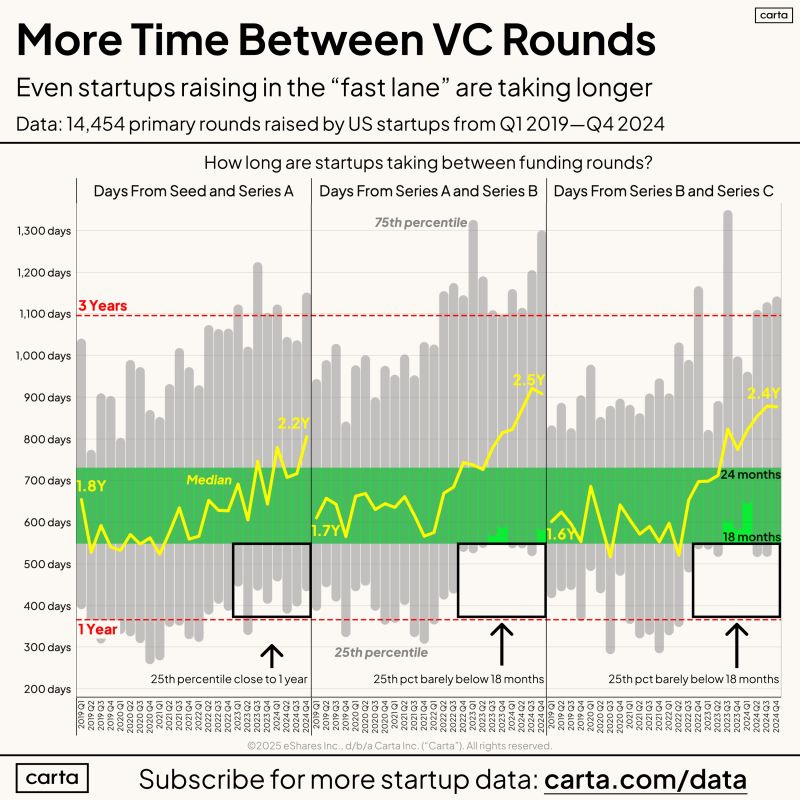

Show Notes: Venture Blues: Cloud, Silver LiningOverviewThis week’s “Venture Blues” editorial brings into focus a brewing transformation in early-stage venture capital. As funds endure stretched timelines and mounting LP pressure, long-taboo secondary markets are stepping into the limelight. At the same time, traditional VC structures—anchored to power-law home runs and decade-long illiquidity—are under fresh scrutiny.What makes this collection compelling is its blend of on-the-ground investor testimony (from Dan Gray, Hunter Walk, Rob Hodgkinson) and hard data (Carta charts, Series B MOIC trends) that together sketch a venture asset class at a crossroads: can it engineer better liquidity and more dependable returns without sacrificing outsized upside?Key Trend 1: The Liquidity Imperative and Rise of SecondariesAs portfolio companies stall in late-stage rounds, early-stage VCs and LPs alike are waking up to the need for earlier liquidity—and rediscovering secondaries.Why it matters:– Stigma around selling GP stakes is eroding when 10-year fund cycles stretch toward 15 years.– Liquidity becomes critical to meet IRR targets and redeploy capital.Talking Point 1: From Taboo to ToolboxQuote:“The obvious desperation for liquidity has — for now — removed the stigma associated with secondaries.”— Dan Gray’s X postEarly-stage managers, once loath to let shares go, now view secondaries as a legitimate value-preservation tactic.Removing psychological barriers makes secondaries a core liquidity channel, not just a last-resort option.Talking Point 2: Fund Cycles Stretch, LP Calculations ShiftQuote:“For the earliest funds (pre-seed, seed) this means instead of 10 year fund cycles for LPs, you’re seeing closer to 15, which fundamentally changes LP calculations about the asset class.”— Hunter Walk, HomebrewLonger holding periods erode IRRs and cash-on-cash returns.LPs factor in delayed distributions, pressing GPs to surface secondary opportunities sooner.Key Trend 2: Structural Challenges in Traditional VC ModelsDespite aggregate Series B investments growing 476% over eight years, most value remains on paper—and out of reach.Why it matters:– Healthy MOIC doesn’t equate to real cash returns.– Most LPs lack access to top-performing funds and can’t live off latent value.Talking Point 1: MOIC vs. Cash—The Distribution DilemmaQuote:“And the 4.76x is measured in MOIC, not cash, so was not distributed.”— Venture Blues editorialVenture’s celebrated power law produces massive paper returns skewed toward a handful of winners.Without distributions, LPs can’t recycle gains, creating a false sense of asset-class health.Talking Point 2: Concentration of Compelling ManagersQuote:“Most LPs do not get returns, and certainly not liquid returns (the only real kind).”— Venture Blues editorialA small club of star GPs capture most performance.Broader LP community remains exposed to illiquidity without average outcome participation.Key Trend 3: Rethinking the LP Base and Investor AlignmentEconomic uncertainty is forcing a recalibration of who backs VC—and how.Why it matters:– Traditional LPs (endowments, pensions) face funding pressures.– New entrants (sovereign wealth, retail, alternatives platforms) demand different structures.Talking Point 1: Endowment Exodus to SecondariesQuote:“A harbinger of change is Yale, who pioneered the ‘endowment model’… selling $6 bn in its PE portfolio in secondaries for the first time.”— Rob HodgkinsonEndowments under the gun from taxes, tariff impacts and political hostility.Liquid strategies gain priority, reshaping demand for evergreen and secondary vehicles.Talking Point 2: LP Preferences Shape Fund ProductsQuote:“VC is changing. Venture firms need to rethink not just who they raise from, but how their LP base influences what they’re offering.”— Rob HodgkinsonA move toward evergreen, co-invest, direct, and secondary funds rather than classic 10-year vehicles.Funds must tailor structures to new LP appetites for liquidity and risk profiles.Key Trend 4: Emerging Structures for De-Risked, Liquid VC InvestmentsAlgorithmic selection and private-company indexes promise to lower risk, broaden access and embed liquidity.Why it matters:– De-couples returns from a small set of GPs and rare unicorns.– Creates tradable vehicles for average VC outcomes.Talking Point 1: Filtering the 7% That MatterQuote:“Investing in this 7% as an index gives investors the ability to participate in de-risked average outcomes.”— Venture Blues editorialData and machine learning reject 93% of Series B rounds.The top 7% deliver 6.2x MOIC in five years, enabling an index tilted for performance.Talking Point 2: Liquidity by DesignQuote:“There is no longer a dependency on which fund an LP can invest in… And liquidity is built into the index approach.”— Venture Blues editorialIndex shares can be bought and sold once listed on public markets.Retail investors and non-traditional allocators gain direct VC exposure.Discussion QuestionsHow has the elongation of fund cycles from 10 to 15 years altered LPs’ appetite for early-stage VC?Can the rise of secondaries truly resolve liquidity challenges, or does it merely shift them to later rounds?With secondaries becoming “primary” for early-stage VCs, is there a risk of misaligned incentives between GPs and founders?How might new LP entrants (retail platforms, sovereign wealth funds) reshape venture fundraising and governance?Is algorithmic selection and index-based investing a silver bullet for de-risking VC, or does it introduce new systemic biases?Is the core issue in venture the lack of liquidity or the inherent power-law structure forcing “home runs”?What unintended consequences could emerge from tradable private-company indexes?Closing SegmentVenture Blues reveals an asset class in flux: the thirst for liquidity is rewriting norms, LPs are demanding new structures, and data-driven models offer a glimpse at more equitable, de-risked returns. As we watch secondaries soar and index products emerge, the central question remains: can VC evolve beyond its 70-year blueprint to deliver both outsized growth and true liquidity?Final thought: the silver lining in today’s venture clouds may be a fundamentally redesigned asset class that finally brings average, liquid outcomes within reach.Stay tuned as we track which of these trends will reshape the venture landscape for good. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

Show Notes: AI Gets Into PublishingOverviewThis newsletter issue brings together a diverse range of stories that center around how artificial intelligence is reshaping the technology, investment, legal, and media landscapes. While AI is fueling record-breaking funding rounds and accelerating product innovations, it is also stirring legal debates and forcing publishers and content creators to rethink their business models in a rapidly evolving digital ecosystem.Listeners can expect an engaging discussion on how advanced funding and interoperability trends are driving AI’s integration into products and operations, alongside the challenges of copyright enforcement and digital disruption in media. The collection underscores the multifaceted impact of AI—from high-stakes investments and legal contestations to product innovations that bridge text and image, and even the transformation of publishing itself.Key Trend 1: Massive AI Funding and Investment TransformationsAcross several articles, the newsletter highlights how record-breaking funding rounds and strategic investments are accelerating AI development. Investors are betting big on AI innovations—from OpenAI’s nearly $40 billion funding initiative to unicorn startups driven by healthcare, cybersecurity, and agentic AI applications.- Talking Point 1: The surge in capital backing AI ventures underscores the strategic importance of financial support for cutting-edge innovation.- For example, TechCrunch reported that OpenAI is close to closing a SoftBank-led $40 billion round, emphasizing that “substantial capital is becoming critical for scaling advanced AI research” ([TechCrunch](https://techcrunch.com/2025/03/26/openai-will-reportedly-close-its-softbank-led-40-billion-round-soon/)).- Similarly, venture capital trends observed in the “Venture Beacon” report show improved fundraising conditions and fewer down rounds, signaling renewed investor confidence ([DEallawyers](https://www.deallawyers.com/blog/2025/03/survey-the-state-of-venture-capital.html)).- Talking Point 2: The evolving model of liquidity in venture-backed companies, where secondary transactions now dominate, marks a fundamental restructuring of investment dynamics.- As highlighted in “The Great Liquidity Shift,” 71% of exit dollars originated from secondary transactions rather than traditional IPOs or M&A, reflecting an adaptive strategy in turbulent markets ([Tom Tunguz](https://tomtunguz.com/the-exit-path-of-2024/)).- Unicorn reports from Crunchbase further illustrate how investments in sectors like healthcare and cybersecurity are reshaping the valuation landscape and fueling innovation ([Crunchbase](https://news.crunchbase.com/cybersecurity/healthcare-unicorns-ai-february-2025/)).Key Trend 2: Legal and Ethical Challenges in AI CommercializationThe newsletter also delves into the legal front where AI’s rapid evolution collides with longstanding copyright and ethical concerns. Legal disputes and regulatory uncertainties are emerging as key hurdles that tech companies and publishers must navigate.- Talking Point 1: AI’s use of copyrighted content is under intense legal scrutiny, as seen in the lawsuit against OpenAI.- A recent ruling allowed a copyright lawsuit, initiated by the New York Times, against OpenAI to proceed, highlighting the risks of using copyrighted materials without permission ([TheInformation](https://www.theinformation.com/briefings/judge-allows-copyright-lawsuit-openai-proceed)).- This case opens the debate on balancing technological innovation with the protection of intellectual property rights—a challenge that is critical in shaping future AI training practices.- Talking Point 2: Traditional publishers are grappling with how AI-driven tools disrupt established economic models and audience engagement.- For instance, the World History Encyclopedia’s dramatic 25% drop in traffic due to Google’s AI Overviews demonstrates how AI-driven content summarization can undercut traditional revenue streams ([BigTechnology](https://www.bigtechnology.com/p/as-ai-takes-his-readers-a-leading?publication_id=46510&utm_campaign=email-post-title&r=ktr9&utm_medium=email)).- This tension invites a broader discussion about reimagining compensation and support structures for content creators in the age of AI.Key Trend 3: Integration and Interoperability of AI Across TechnologiesA recurring theme is the drive toward openness and integration across AI platforms, which is transforming user experiences and broadening the capabilities of digital tools.- Talking Point 1: Open standards and interoperability are becoming essential as firms seek to integrate AI functions seamlessly into their products.- OpenAI’s decision to adopt Anthropic’s Model Context Protocol signals a commitment to interoperability—enabling better data integration and more scalable AI solutions ([TechCrunch](https://techcrunch.com/2025/03/26/openai-adopts-rival-anthropics-standard-for-connecting-ai-models-to-data/)).- This collaborative evolution between past rivals underlines the fact that open source solutions are a strategic lever for rapid innovation.- Talking Point 2: Technological breakthroughs in multimodal AI systems are setting new consumer expectations.- The introduction of GPT-4o’s native image generation within ChatGPT marks a leap forward, merging text and visuals to deliver “a frightening degree of verisimilitude” ([TechJuice](https://www.techjuice.pk/openai-enhances-chatgpt-with-powerful-native-image-generation-using-gpt-4o/)).- Such advancements not only redefine creative workflows for digital artists but also raise important questions about ethical usage and intellectual property protections.Key Trend 4: The Evolving State of Digital Publishing and MediaDigital publishers are being forced to innovate as AI disrupts legacy models of content distribution and audience engagement. Traditional media outlets are exploring new strategies to sustain relevance and revenue.- Talking Point 1: AI-powered tools are reshaping how readers access and engage with content, challenging longstanding agreements between publishers and tech platforms.- The experience of the World History Encyclopedia, which lost 25% of its traffic to AI-generated summaries by Google, underscores the disruptive impact of AI in digital publishing ([BigTechnology](https://www.bigtechnology.com/p/as-ai-takes-his-readers-a-leading?publication_id=46510&utm_campaign=email-post-title&r=ktr9&utm_medium=email)).- This trend pushes publishers to reconsider their business models while also prompting questions about fairness and compensation.- Talking Point 2: In response, some traditional outlets are embracing change by integrating independent creator networks to diversify their content and engage newer audiences.- A notable example is Fast Company’s launch of a creator network featuring independent writers, which aims to bridge the gap between conventional journalism and the digital content revolution ([TheInformation](https://www.theinformation.com/articles/30-year-old-magazine-embracing-creators)).- This approach not only rejuvenates content delivery but also serves as a model for how heritage media can adapt in a rapidly shifting digital ecosystem.Discussion Questions- How do the massive funding rounds for AI companies influence the pace of technological innovation, and what risks do these investments entail?- In what ways should legal frameworks evolve to address the challenges posed by AI’s use of copyrighted content?- Can the integration of open standards in AI systems truly accelerate innovation, or does it create new vulnerabilities in an increasingly interconnected ecosystem?- How should traditional publishers rethink their revenue models when AI-driven content summarization threatens direct engagement?- What are the implications of shifting exit strategies in venture capital, particularly with the rise of secondary transactions over traditional IPOs?- Is the democratization of creative tools through multimodal AI a net positive for artistic communities, or does it risk eroding the value of human creativity?- How can media outlets balance the need for innovative content delivery with maintaining rigorous ethical and copyright standards?Closing SegmentThe discussion today underlines four fundamental trends: record-setting AI investments, mounting legal and ethical challenges, the push for interoperability and groundbreaking multimodal innovations, and the evolving landscape of digital publishing. Together, these trends highlight not only the transformative potential of AI but also the complex interplay of finance, law, and creative expression. As we consider the future of technology and media, it’s clear that innovation must be balanced with responsibility—ensuring that the rapid pace of change benefits society as a whole.A compelling final thought: In an era defined by disruption, the true winners will be those who not only drive innovation but also establish ethical and robust frameworks that safeguard creativity, fairness, and integrity. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

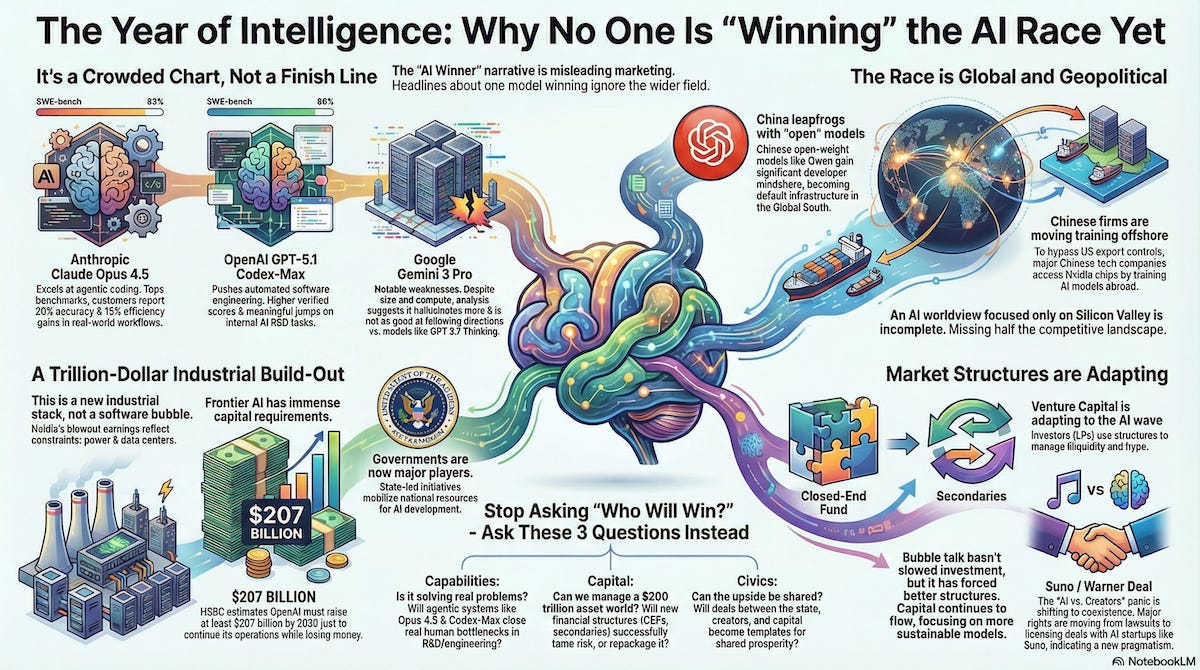

The week ending November 30, 2025, was characterized as a "wacky races kind of week," with constant shifts in the perceived leadership of the AI sector. Google was highlighted as the biggest weekly winner, seeing a rise in stock, positive reviews for Gemini, and developing its own chip that critics suggest has pierced NVIDIA's "aura of invulnerability". Other models, including Anthropic's Opus 4.5 and ChatGPT 5.1 Codex-Max, were also noted as big deals in the accelerating innovation cycle. Internationally, China reportedly "leapfrogged the U.S. in global markets for open AI models".Despite individual corporate victories, the discussion emphasized that the AI development is an "endless and accelerating innovation cycle" with no "finish line," making the media framing of a "race" misleading. Key tensions include the fact that corporations are not embracing AI as much as expected due to the innovator's dilemma and general climate uncertainty. Furthermore, AI appears to be "winning the copyright fight", while venture capital is experiencing massive concentration into fewer funds and companies, creating a significant liquidity trap. The overarching theme suggests that the AI boom represents a new industrial stack, not a software bubble, making the ultimate outcome dependent on managing the three Cs: Capabilities, Capital, and Civics This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

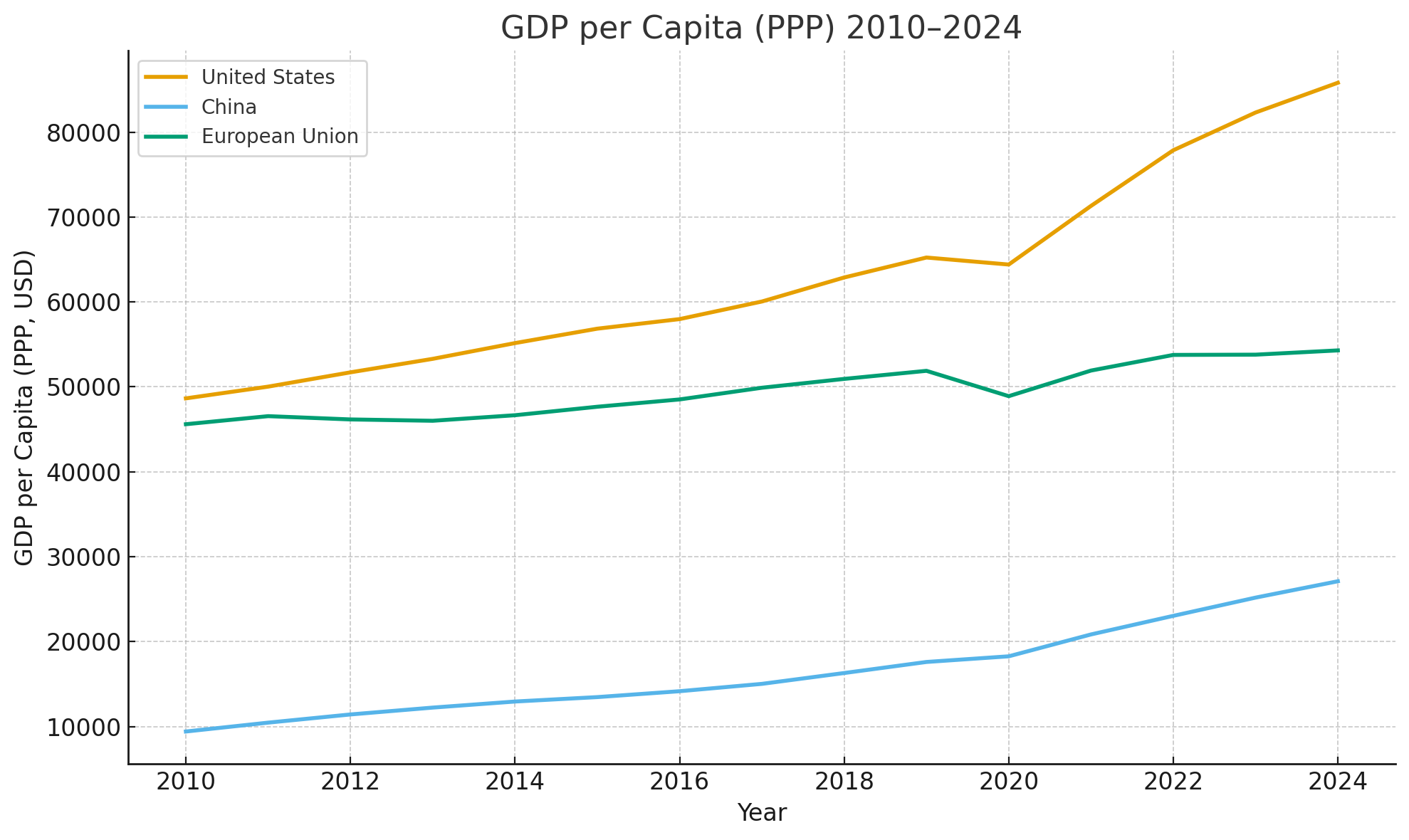

SEO Summary: An in-depth editorial exploring China’s rise in AI and GDP share, historical parallels to U.S. industrial dominance, and how cooperation—not rivalry—will define the next century of technological progress. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

Financial media loves the word “bubble.” It sells fear and draws clicks. But when it comes to AI, that narrative misses the mark. The surge in capital flowing into models, chips, and cognitive infrastructure isn’t speculative mania—it’s the next Enlightenment: a global reallocation of resources toward intelligence itself. This editorial argues that what critics call a bubble is actually a compounding moment of civilization-scale reinvestment. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

Who Decides AI Use Policy? Companies or Governments? This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

Human¹⁰⁰: Why This Week Proves AI Is Our Greatest Invention, Not Our ReplacementThis editorial argues that artificial intelligence is best understood as a powerful human multiplier, not a substitute for human labor or creativity. Drawing on recent productivity data, AI is already saving the average white-collar worker nearly an hour a day—worth more than $7,000 annually per employee—yet current AI pricing captures only a small fraction of that value. The result is a widening “AI value gap” that will reshape software pricing, bundling strategies, and enterprise adoption.The piece also highlights how the AI revolution is increasingly physical, not just digital. Massive investments in data centers, energy infrastructure, robotics, and compute signal that the next phase of AI growth depends on power, capital, and real-world systems as much as algorithms. From nuclear energy to purpose-built power generation, the infrastructure race is becoming central to AI leadership.The core conclusion: the most successful companies and societies will not be those that focus on replacing people with AI, but those that redesign work, organizations, and systems around AI-augmented humans. The future of AI is not artificial intelligence—it is amplified human intelligence. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

Is the chaos in the market actually a rational response to a new innovation curve? This week, we explore The Great Compression—a phenomenon collapsing the distance between venture capital stages, career ladders, and the way we access reality.We analyze why "$2 billion seed rounds" and the death of the billable hour aren't signs of a bubble, but symptoms of a "Winner Takes Most" AI curve. In this industrial-scale race, the system is squeezing resources into a "barbell distribution," forcing a choice between achieving massive scale or becoming obsolete. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

AI isn’t breaking the web or destroying jobs—it’s ushering in a new Age of Progress. Intelligent agents, robotics, and abundant compute are pushing us toward optional work, collapsing labor costs and reshaping the economics of wealth. The real challenge: whether society can build the policies and systems to distribute the coming abundance. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.thatwastheweek.com/subscribe