Discover The Contrarian Capitalist Podcast

The Contrarian Capitalist Podcast

The Contrarian Capitalist Podcast

The Contrarian Capitalist Podcast

Author: Protect your wealth. Defend your freedom. Outsmart the system with contrarian market insights, gold, silver, commodities, Plan B strategies, and exclusive expert podcasts. Join thousands taking back control — subscribe today!

Subscribed: 18Played: 916Subscribe

Share

© Rob Smallbone

Description

Protect your wealth. Defend your freedom. Outsmart the system with contrarian market insights, gold, silver, commodities, Plan B strategies, and exclusive expert podcasts. Join thousands taking back control — subscribe today!

https://contrariancapitalist.substack.com/

contrariancapitalist.substack.com

https://contrariancapitalist.substack.com/

contrariancapitalist.substack.com

274 Episodes

Reverse

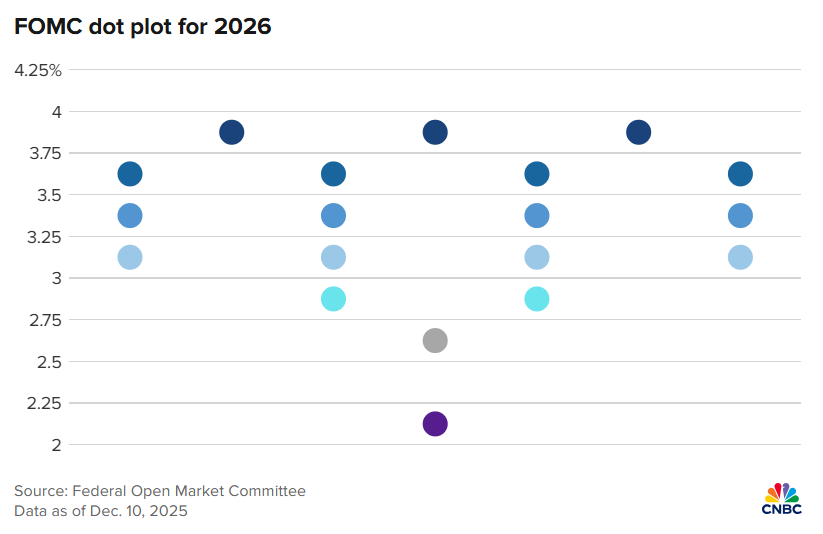

Today’s episode features Gold Investor Research author Chris Rutherglen.Gold Investor Research provides unique and in-depth analysis of the gold market based on data-driven research. The intention is to provide fellow investors with analysis to help them make informed decisions and set forecast expectations on the cyclical path of the gold price.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Thursday 22nd January 2026 AMTopics covered in this podcast/video include:* Why short-term T-Bills are showing that rate cuts in Jan & Mar 2026 are not likely to happen* How Gold is intertwined with the Fed Funds Rate Cycle and the QE cycle* Commitments of Traders (CoT); what it is and why it matters* M2 Money Supply and what it shows long-term for gold and silver prices* ICL’s, ICH’s and Long-Term cycle levels for gold and silver* The instantaneous price-to-revenue ratio that can help you to evaluate miners more effectively* And much moreContact InformationYou can connect with Chris on Substack at Gold Investor ResearchUnlock Paid AccessPaid subscribers receive high-conviction written research, weekly commodity and market wraps with clear traffic-light signals, and early access to podcasts and bonus macro insights, all designed to support capital protection and asymmetric opportunity spotting.Thank you for being part of The Contrarian Capitalist community!DISCLAIMER: Nothing in this podcast should be construed as financial or investment advice. All content is provided for educational and informational purposes only. The views expressed are solely those of the author and do not constitute investment advice, a recommendation, or a solicitation to buy or sell any financial instruments. Always do your own research and consult with a qualified financial advisor before making investment decisions. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s episode features Tom Bradshaw, an independent macro strategist and financial markets commentator. He is also the author of the ‘Beyond the Headlines’ newsletter, where he provides historical, data-driven insights on global macro trends, markets, and systemic financial risks.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Wednesday 21st January 2026 AMTom discusses:* Recessionary Indicators that show that a US recession is very likely to happen* How long and deep a coming US recession will likely be* Treasury, Gold, Silver & Oil predictions for 2026* Will there be a liquidity panic driven sell off in gold this year?* Why the DXY could surprise to the upside in 2026* Potential portfolio positioning for 2026 and beyond* And much moreContact Information & Previous ConversationYou can connect with Tom on Substack at Tom Bradshaw and also on LinkedIn.Our previous conversation from December 2025 is below:Upgrade to PaidThis is a decision-support service. Paid subscribers get conviction-driven research, clear traffic-light guidance on markets and commodities, and early access to podcasts and macro insights. Not noise, not narratives.Thank you for being part of The Contrarian Capitalist community!DISCLAIMER: Nothing in this podcast should be construed as financial or investment advice. All content is provided for educational and informational purposes only. The views expressed are solely those of the author and do not constitute investment advice, a recommendation, or a solicitation to buy or sell any financial instruments. Always do your own research and consult with a qualified financial advisor before making investment decisions. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Welcome to Mid-Week Macro for Wednesday 21st January 2026.Protect your wealth. Defend your freedom. Outsmart the system.This post and video are FREE for everyone, and discusses:* Trump, tariffs, markets and mechanics* Davos, Greenland, NATO and the EU* A look in at commodities markets and other markets of notes thus far* Why your eyes should be on Japan* And much moreNB - Apologies if you heard any banging or crashing during the course of this video. My delightful and wonderful neighbours were cleaning or just banging around for fun!Upgrade to PaidHigh-conviction research, traffic-light market guidance, and early access to podcasts and macro insights, built for investors who prioritise capital protection and asymmetric opportunities.Thank you for being part of The Contrarian Capitalist community!Mid-week Polymarket marketThank you Polymarket for sponsoring the mid-week macro.My computers screenshot taker has decided not to work, but the market of the week is looking at whether or not Trump/USA will acquire Greenland before 2027. There is currently a 20% chance of this happening. I have a feeling that this will actually happen somehow!Please do subscribe to Polymarket on Substack.Podcasts & PostsNews LinksTrump, Davos and Greenland latestUkraine Is Defending Itself With Money Europe Doesn’t HaveUK households to get £15bn for solar and green tech to lower energy billsGovernment to offer cash payouts for people in financial crisisUpgrade to PaidHigh-conviction research, traffic-light market guidance, and early access to podcasts and macro insights, built for investors who prioritise capital protection and asymmetric opportunities.Thank you for being part of The Contrarian Capitalist community! This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s episode features Paul Musson, a professional investor managing $10 billion in assets and also with over 30 years of experience. Paul is also the author of Capital Offence: Why Some Benefit at Your Expense.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Monday 19th January 2026 PMTopics covered… This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s guest is Jon Forrest Little, publisher of The Silver Academy.Jon Forrest Little is a distinguished precious metals analyst, historian, and investigative journalist renowned for his interdisciplinary expertise and groundbreaking theories.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Monday 19th January 2026 AMIn another straight talking and no holds barred episode, Jon dives into:* China launching QE as of Jan 2026* The industrial and retail demand cases for Silver* Price distortions between Eastern and Western Silver, and what they mean* Why Gold breaking out from equities is a crucial indicator for Silver* Why exposure to miners could be more profitable than holding physical Silver* The Fourth Transformation and why this matters for Mexican miners* Potential Nationalisation of mining companies/resource companies* 4 mining companies to keep an eye on* And much moreContact InformationYou can connect with Jon at The Silver Academy.The Silver Academy articles mentioned include:Upgrade to PaidThis is a decision-support service. Paid subscribers get conviction-driven research, clear traffic-light guidance on markets and commodities, and early access to podcasts and macro insights. Not noise, not narratives.Thank you for being part of The Contrarian Capitalist community!DISCLAIMER: Nothing in this podcast should be construed as financial or investment advice. All content is provided for educational and informational purposes only. The views expressed are solely those of the author and do not constitute investment advice, a recommendation, or a solicitation to buy or sell any financial instruments. Always do your own research and consult with a qualified financial advisor before making investment decisions. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s podcast guest is Ted J Butler, Independent Analyst & Sound Money Advocate and also co-writer at the Sound Money Report.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Friday 16th January AMLAST CHANCE - Annual Subscription → Normally $110 → Now Just $55!Lock in lifetime access to conviction-driven research, weekly commodity and market wraps, and high-conviction investment insights at 50% off.This 50% discount applies to all annual subscriptions taken before Saturday 17th January 2026, and once subscribed, your rate remains fixed for as long as you wish to remain a Contrarian Capitalist!This podcast episode reveals:* The shifting political tides from left to right in South America* Ted’s current thoughts on Silver and why the mining stocks might be better for silver exposure moving forwards* Why the RIGI (Argentina) is important for business and what you need to know about it* 1 potentially bearish signal for silver* Ted and Rob’s potential Oil plays* One potential company to keep your eyes out for* And much moreContact Information & Previous RecordingTed J Butler is also a senior analyst for The Silver Advisor and a contributing writer for The Morgan ReportYou can also connect with Ted J Butler on LinkedIn.Please do check out the Sound Money Report too.Our previous conversation can be found belowDisclaimerNothing in this podcast/video should be construed as financial or investment advice. All content is provided for educational and informational purposes only. The views expressed are solely those of the author and do not constitute investment advice, a recommendation, or a solicitation to buy or sell any financial instruments. Always do your own research and consult with a qualified financial advisor before making investment decisions. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s podcast guest is Laurent Lequeu aka The Macro ButlerAUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Wednesday 14th January PM Eastern TimeAnnual Subscription → Normally $110 → Now Just $55!Lock in lifetime access to conviction-driven research, weekly commodity and market wraps, and high-conviction investment insights at 50% off.This 50% discount applies to all annual subscriptions taken before Saturday 17th January 2026, and once subscribed, your rate remains fixed for as long as you wish to remain a Contrarian Capitalist!In this podcast/video, you will learn:* The case for Platinum to Gold ratio going back to 1:1* 10 Macro Butler Financial Forecasts for a Fiery 2026* Why Energy stocks are primed to rip in 2026* Oil and gas sectors, why they are unloved and why the opportunities are great* 2 potentially beneficial Oil ETF's - XLE & XOP* 1 potentially beneficial wheat/agricultural ETF - MOO * The Macro Butler’s oil price prediction for 2026* Latest geopolitical developments and what could happen next* And much moreContact Information & Previous RecordingsYou can connect to The Macro Butler on Substack.For HNWI’s that would like to connect with The Macro Butler then you can do so by e-mailing info@themacrobutler.comWebsite - www.themacrobutler.comYou can also listen to our previous conversations using the links below: This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Welcome to Mid-Week Macro for Wednesday 14th January 2026.Protect your wealth. Defend your freedom. Outsmart the system.This post and video are FREE for everyone and looks at:* $90 Silver and is Copper going to double top?* Mid-week snapshot of equities and commodity markets* A massive warm welcome to all founding members, paid subscribers and free subscribers. Thanks to you, the Contrarian Capitalist is now a best seller!Thank you for participating in the quick 5 question questionnaire last week. The feedback was excellent and more in-depth analysis into various companies/contrarian opportunities as a result.Annual Subscription → Normally $110 → Now Just $55!Lock in lifetime access to conviction-driven research, weekly commodity and market wraps, and high-conviction investment insights at 50% off.This 50% discount applies to all annual subscriptions taken before Saturday 17th January 2026, and once subscribed, your rate remains fixed for as long as you wish to remain a Contrarian Capitalist!Mid-week Polymarket marketThank you Polymarket for sponsoring the mid-week macro.As much as this makes sense, I doubt that it will happen before 2027.Please do subscribe to Polymarket on Substack.Podcasts & PostsArticles/News LinksTen things about Venezuela: on oil, geopolitics and drugs | LinkedInEU waters down plans to end new petrol and diesel car sales by 2035Trump insists US needs Greenland for security ahead of White House talks - live updates - BBC NewsIndia Plans Coal Expansion Through 2047 Despite Supposed “Climate Goals”Thank you WEST ASIAN UNITY, Steven Morgan, Tom Weiss, Bob, Andy, and many others for tuning into my live video! Join me for my next live video in the app! This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s podcast guest is Juan Pessolani, real estate entrepreneur, architect, and co-founder of Proinvest and Nuevo Concepto.With currencies in their end game, real assets such as real estate are drawing a lot of attention. This episode focuses on Paraguayan real estate and the opportunities that are available to everyone.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Monday 12th January 2026 AMAnnual Subscription → Normally $110 → Now Just $55!Lock in lifetime access to conviction-driven research, weekly commodity and market wraps, and high-conviction investment insights at 50% off.This 50% discount applies to all annual subscriptions taken before Saturday 17th January 2026, and once subscribed, your rate remains fixed for as long as you wish to remain a Contrarian Capitalist!In this podcast/video, you will learn:* Juan’s background, previous and current project(s)* Why Asuncion (capital of Paraguay) is potentially an excellent city to invest in* Why traditional financing doesn’t work in the Paraguayan real estate market* How deals are structured and how investors could potentially profit* Potential yields and exit strategies* Why skin in the game is very important for building trust in projects* How to potentially obtain Paraguayan residency through real estate investing in Paraguay* And much moreContact InformationYou can connect with Juan on X, the Proinvest website, and his other contact details can be found on Stitch.If you have any questions about investing in Paraguayan real estate and obtaining Paraguayan Residency at the same time, then you can also send me a direct message on Substack, and I will happily answer any questions.DisclaimerNothing in this podcast/video should be construed as financial or investment advice. All content is provided for educational and informational purposes only. The views expressed are solely those of the author and do not constitute investment advice, a recommendation, or a solicitation to buy or sell any financial instruments. Always do your own research and consult with a qualified financial advisor before making investment decisions. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s podcast guest is Don Durrett of Don’s Newsletter and of goldstockdata.com.AUDIO IS AVAILABLE HEREPlease SUBSCRIBE, LIKE AND SHARE THIS PODCASTNB - Recorded on Thursday 8th January 2026 PMUnlock Exclusive AccessBecome a paid subscriber to gain early access to expert interview podcasts, the Friday Commodity Wrap, Sunday Market Wrap, and premium insights like the new short & long-term traffic light system, bonus audios and exclusive mid and end month macro videos. Starting at just $9.17/month, it’s your edge for protecting wealth, spotting opportunities, and staying ahead of the markets.In this video, you will discover:* Why all eyes have to be on gold and not necessarily silver* Whether its gold or the S&P 500 that is lying* Why the Russell 2000 could be considered a train wreck* Don’s updated price targets (upside and downside) for gold and silver for 2026* Key numbers to watch out for in the S&P 500 in 2026* The most important chart that you need to keep your eyes on* Why the future is very bright for the miners* Don’s 2-fold potential in crypto* And much moreContact InformationYou can find Don Durrett, at Don’s Newsletter, X, at www.goldstockdata.com and also on YouTube.Our previous 3 conversations are below.As well as the most recent mid-week update from Don Durrett Don also recommended his book but suggested to wait to February. I’ve linked to the current book. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Welcome to Mid-Week Macro for Wednesday 7th January 2026.Protect your wealth. Defend your freedom. Outsmart the system.This post and video are FREE for everyone and looks at:* The latest commodity news, including Uranium, Oil and more* Equities markets and what to look out for in 2026* Updated thoughts on US/Venezuela. BRICS for the Americas?* And much morePlease take 1 minute to help shape the future of The Contrarian Capitalist by completing the simple 5 question questionnaire in the article below.Upgrade to paid today!Become a paid subscriber to gain early access to expert interview podcasts, the Friday Commodity Wrap, Sunday Market Wrap, and premium insights like the new short & long-term traffic light system, bonus audios and exclusive mid and end month macro videos. Starting at just $9.17/month, it’s your edge for protecting wealth, spotting opportunities, and staying ahead of the markets.Mid-week Polymarket marketThank you Polymarket for sponsoring the mid-week macro. Today’s market looks at who the leader of Venezuela will be at the end of 2026. Delcy Rodriguez is at 50% at the time of writing this. I think this is undervalued as I don’t see significant regime change happening in 2026, Maduro won’t be back and the US will have likely learnt its lessons from IraqPlease do subscribe to Polymarket on Substack.Podcasts & PostsPaul from The Sirius Report dived into USA, Venezuela and WHY the events have taken place. This covers everything from basic geopolitics to Oil. And below are my 6 crazy predictions for 2026!News LinksThis guy gets it! A massive warning sign!Orano USA and Centrus Energy Corp., have strong ties to Oak Ridge and netted $1.8 billionOn a more sobering noteTrump says Venezuela will be ‘turning over’ up to 50 million barrels of oil to USHeating up in the AtlanticMamdani’s Clown Show Offers Its Opening ActThank you Steven Morgan, Tide Traders, Bob, and many others for tuning into my live video! Join me for my next live video in the app. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s podcast guest is Paul from The Sirius Report. Independent website with the aim of providing analysis and insight into current affairs and global events that we believe are shaping a new political, economic and social paradigm in the 21st century.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Monday 5th January 2026 AM ET - before President Maduro appeared in a New York Court Unlock Exclusive AccessBecome a paid subscriber to gain early access to expert interview podcasts, the Friday Commodity Wrap, Sunday Market Wrap, and premium insights like the new short & long-term commodity traffic light system, bonus audios and exclusive mid and end month macro videos. Starting at just $9.17/month, it’s your edge for protecting wealth, spotting opportunities, and staying ahead of the markets.In this wide-ranging podcast, we look at:* The main reasons why the US has done what it has done* If the Venezuelan government is illegitimate, then why is it still in charge sin Maduro? Have lessons been learnt from Iraq?* De-dollarisation, Venezuela being too cosy with China and Russia and why the latter have not let Venezuela down* Why the US is not able to properly invade Venezuela* All things Oil. Heavy Oil, flooding the market with oil, and why you shouldn’t believe the first headlines you read. Oil volume growth will cost billions to bring onto the market. Why would the US do this and effect their own shale industry?* Why Paper reserves are not the same as having actual physical reserves* Is the US looking to create an American BRICS?* Is Greenland next? And what would that mean for NATO?* A quick look into what is happening in Iran and the relations between Iran and the US* And much moreContact InformationYou can connect with The Sirius Report on XOr on YouTube at The Sirius ReportWebsiteOr on Substack at The Sirius ReportOur previous conversation from October 2025 is below:Useful MapsThe South of the USA and VenezuelaVenezuela & GuyanaVenezuela, Colombia and EcuadorMap of the Americas. American BRICS? This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Welcome to the 2025 predictions REVIEW! Audio above and written post below.Happy New Year!This post will look at what I said would happen in 2025, as well as a scoring system for those predictions.Spoiler alert - Just like the NY Jets, I didn’t exactly excel in 2025.Before we crack on, just a reminder that the 6 ‘crazy?’ predictions for 2026 post and audio can be accessed below.Back to the 2025 review and the predictions from 2nd January 2025 are below.2025 predictions REVIEW!I will give one point to myself for every correct answer and half a point if the prediction has partially been successful.1 - Gold to top $3,000 and then sell off back down to $2,200The thought process behind this was that there would be a worldwide recession that would make 1929 look like a walk in the park. That did not materialise and so the latter part of this prediction now looks a bit silly.Gold certainly topped $3,000, dipped below it very briefly in April and it never looked back!Result = 0.5 points2 - Worldwide recession which might be worse than 1929April 2025 and ‘Liberation Day’ could have been the start of something gnarly, but some swift back peddling by the current US Administration meant that the markets saw a swift rebound and more than perfect V shaped recovery,Onwards and upwards was the theme from April 7th!Result = 0 points3 - Keir Starmer to be ousted as Prime MinisterMany people would have liked to have seen this happen, and I am sure that many people would still like to see this happen.Despite a plethora of mistakes and mind-boggling decisions, he is still Prime Minister.Result = 0 points4 - Oil to drop down to $50 a barrel (Brent Crude)The idea for this was tied into a worldwide recession. This did not materialise, but Brent Crude has had a very poor year none the less. I think that Oil is setting up for a potentially huge couple of years ahead!Result = 0 points5 - Bank of England base rate down to 4% and inflation to creep up againReducing rates whilst in the midst of an inflationary environment is NOT a good idea. That being said, I am not a central bank! The Bank of England base rate started 2025 at 4.50% and finished the year at 3.75%.The annual inflation rate for the UK was 3.5% in November 2025 and have put a couple of links below.CPIH ANNUAL RATE 00: ALL ITEMS 2015=100 - Office for National StatisticsConsumer price inflation, UK - Office for National StatisticsResult = 1 point6 - A new international monetary system will be officially announcedBRICS rumblings were here and there throughout 2025, but no new international monetary system was officially announced as far as I’m concerned.On BRICS, and they made massive strides in 2025 by completing their supply and payment chains and thus pushing metals pricing power eastwards. You can read more about that here.Result = 0 pointsOverall = 1.5 points out of 6 points availableBetter luck in 2026!This Substack is reader-supported. To receive new posts and support my work, consider becoming a free or paid subscriber. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

This is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to the Monthly Wrap for December 2025, featuring The Contrarian Capitalist and LiveSquawk Commodity Corner.A Happy Christmas and a Happy New Year!5 small bits of housekeeping* This video was recorded AM on 31st December 2025* There is no full chart deck today* Please do provide feedback by leaving a comment below or sending one of us a DM. We want to make sure that you are getting what you want!* NB - No…

Welcome to the 2026 Contrarian Capitalist predictions post and audio. The written predictions are below, and the audio is above.2026 will certainly be an interesting year to say the least! A lot will happen and there will very likely be increased volatility worldwide.NB - Gold and Silver calculations done after market close on Friday 26th December 20252026 Predictions1 - Gold to reach at least $7,828 an ounceGold has been on a relatively explosive run since 2024, and I don’t see any sign of this slowing down into 2026. A potential revaluing (see below) would further add pressure to the gold price.In simple terms though, if you believe the value of your fiat currency is going to go down, then the price of gold will go to the upside.I’ve used $4,532 as the baseline number and a 72.72% increase as the barometer as this was where gold was at the close of play on Friday 26th December 2025. I’ve then rounded it up to the nearest whole number.2 - Silver to reach at least $218 an ounceThe metal darling of 2025 will continue to strike whilst the iron is hot. There is a lot of room to run here in Silver, and I think that it will smash through triple digits ($100) before continuing to march higher.I’ve used $79.32 as the baseline number and a 174.62% increase as the barometer as this was where silver was at the close of play on Friday 26th December 2025. I’ve then rounded it up to the nearest whole number.3 - WTI to drop to $45 before finishing the year higher than $80There is a big bear narrative out there and this will feed into the hands of those that are paying attention.There is likely more room to run to the downside in the short term for Oil, thus catching contrarians off guard. Mid-term elections combined with a potential ‘behind closed doors’ oil deal between President Trump and the Saudi’s likely means that Oils upside could be limited.Once the mid-terms are done then I expect to see a spike to the upside.We’ve not even begun to touch on any other possible ‘geopolitical news’ either!4 - 250th 4th July celebrations will see a major monetary reset, or something pegged against the dollar. Maybe revaluing of gold? Something along those lines.Something monetary wise is lined up for 4th July 2026! I’m not 100% what it is but I expect it to be announced on 4th July 2026.5 - Democrats to take back the house AND senate in the mid-termsThis is more of a Contrarian hunch and the democrats taking back both the house and senate would have major ramifications for the USA (and the world) moving forwards. 6 - Brazil will win the world cupAs much as I’d love to say England here, I’m working on the basis that a European team has never won the World Cup when it has been hosted in North America (Brazil won in Mexico 1970 and USA 1994, Argentina won in Mexico 1986).Therefore, I will plump with Brazil to win the World Cup in 2026.Bonus PredictionThis is reverse psychology at play here. The New York Jets will NOT make the playoffs in the 2026 NFL season. What do you think will happen in 2026? What predictions do you have? Leave a comment below! This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Welcome to Mid-Week Macro for Wednesday 24th December 2025.Protect your wealth. Defend your freedom. Outsmart the system.This post and video are FREE for everyone. There will NOT be a Mid-Week Macro on Wednesday 31st December 2025. This is because Chris Stadele of LiveSquawk Commodity Corner and I will be recording the end of month (and year) macro.NB - Substack live cut off the first few minutes of the recording last week, hence why the first minute or so is a bit slow on this video. Hopefully it all works out.Become a paid subscriber and get early access to expert interview podcast as well as access to the Friday Commodity Wrap, Sunday Market Wrap and much more. Starting at just $9.17 per month, it’s exceptional value to protect your wealth, defend your freedom, and outsmart the system.Mid-week Polymarket marketThank you Polymarket for working in partnership with The Contrarian Capitalist. You can connect with Polymarket on Substack!Something different this week as we look at the Super Bowl Champion odds for the game on 8th February 2026. My team (New York Jets) don’t believe in playoff football.I said to a friend at the start of the season that the Green Bay Packers will win the Super Bowl. Due to injuries, I am not convinced that that will happen. My sneaky pick would be the San Francisco 49ers (7% chance). This is because the Superb Bowl will be in their home stadium and they are just playing good solid ball!Podcasts & PostsNews LinksThis has been making me laugh much more than it should be!Still, it could be worseAnd a Christmas classic won’t be quite the same this year2-Hour Private Strategy Call with The Contrarian CapitalistA focused two-hour session covering anything you want, including commodities, macro, Plan B strategies, residency, property, precious metals or geopolitics. You set the agenda and get clear, actionable guidance. $147, valid until 31st Dec 2025PAID SUBS GET A DISCOUNT (behind the paywall in the Friday Commodity Wrap)NB - I am not a financial advisorThank you Rob Burke, Garry B Lindboe, and many others for tuning into my live video! Join me for my next live video in the app. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

Today’s episode features Giacomo Prandelli of the popular The Merchant's News newsletter on Substack. Giacomo Prandelli is a commodity analyst and geopolitical strategist who connects energy market movements with global events.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Wednesday 17th December AMThe following topics are covered:* The short, medium and long-term outlook for Oil* Venezuela. From sanctions to opportunity!* Maduro. Trump. Where the political game stands now* Why Venezuela’s heavy crude still matters so much for US Gulf Coast refineries* The importance of the news headlines and why we should be focused on the fundamentals* Russia. Ukraine and the shadow fleet* How the sanctions architecture actually works in practice* Shadow fleet mechanics. STS transfers. opaque ownership. price cap leakage* What could realistically tighten the screws and what that would do to crude and products flows* Guyana. the new offshore oil frontier* Exxon’s dominance so far, and the entry of other players* How Guyana changes the Atlantic Basin balance vs Brazil. US Gulf. West Africa* Key risks & potential border tensions with Venezuela* Europe’s gas and LNG outlook* How dependent Europe now is on US LNG. and how stable that flow really is* General EU Nat Gas dynamics* Is Colombia next?Map showing the south of the USA and the shipping channel to South AmericaExample of recent news - Trump orders ‘blockade’ of sanctioned oil tankers leaving, entering Venezuela | ReutersContact InformationYou can connect with Giacomo Prandelli on Substack at The Merchant's News, and also on X and LinkedIn.2 recent articles to check out are:ALL interview podcasts are released to PAID SUBSCRIBERS first.Take control of your financial future with The Contrarian Capitalist. Paid members get commodity and market insights, exclusive macro videos, early interviews, and the tools to build, protect, and grow wealth in uncertain times.Starting at just $9.17 per month (less than a couple of coffees), it’s exceptional value to protect your wealth, defend your freedom and outsmart the system.Thank you for being part of The Contrarian Capitalist community! This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

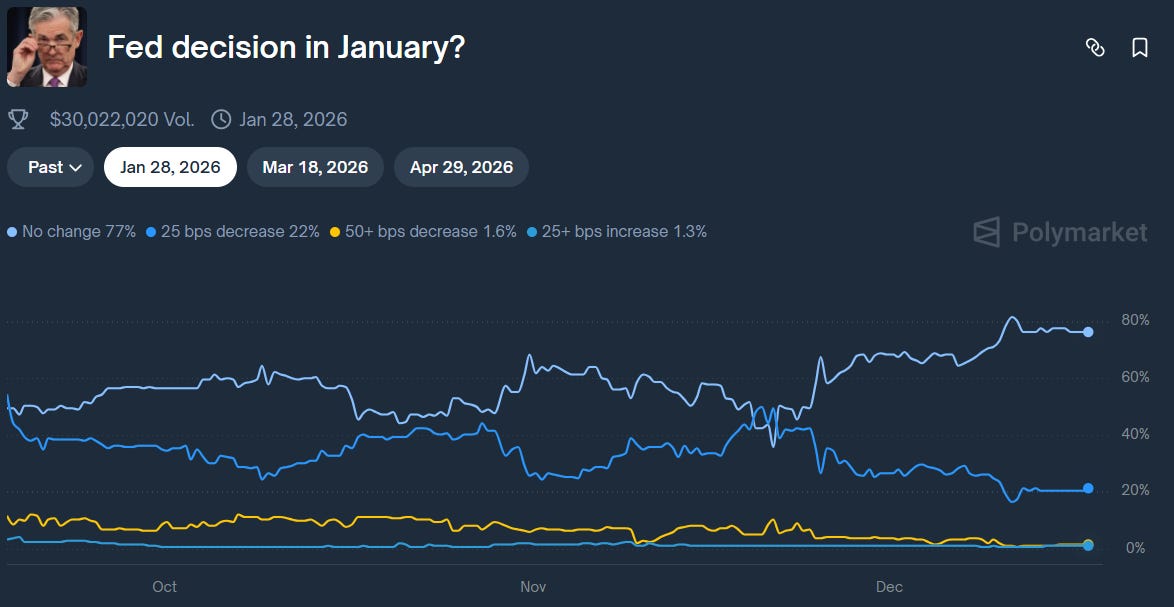

Welcome to Mid-Week Macro for Wednesday 17th December 2025.Protect your wealth. Defend your freedom. Outsmart the system.This post and video are FREE for everyone. There WILL be a Mid-Week Macro on Wednesday 24th December 2025.NB - Substack live has seemingly cut off the first few minutes of the recording. Apologies for that. The first few minutes looked at the variety of recordings and posts on CC this week. These links are further on below.Become a paid subscriber and get early access to expert interview podcast as well as access to the Friday Commodity Wrap, Sunday Market Wrap and much more. Starting at just $9.17 per month, it’s exceptional value to protect your wealth, defend your freedom, and outsmart the system.Mid-week Polymarket marketThank you Polymarket for working in partnership with The Contrarian Capitalist. You can connect with Polymarket on Substack!Even with the weak jobs data, there is currently a 77% chance of ‘‘no change’’ to the Fed rate come January. This seems about right to me at the time of writing.Podcasts & Posts2 excellent guest posts that are worth reading (and they are free) are from Guardian Research….And Tom Bradshaw….Giacomo Prandelli from The Merchant's News outlined his short, medium and long-term price targets for Oil.News LinksBank of Japan expected to hike rates to 30-year highBank of England poised for Christmas interest rate cut after inflation slowsTrump is good news for Nato, Mark Rutte tells BBC - Is it really?On the other hand…..Weak Hiring Data Underscore Fed’s Room to ManoeuvreWTI Holds ‘Venezuela Blockade’ Gains After Small Crude Draw, Record US Production2-Hour Private Strategy Call with The Contrarian CapitalistA focused two-hour session covering anything you want, including commodities, macro, Plan B strategies, residency, property, precious metals or geopolitics. You set the agenda and get clear, actionable guidance. $147, valid until 31st Dec 2025PAID SUBS GET A DISCOUNT (behind the paywall in the Friday Commodity Wrap)NB - I am not a financial advisor This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe

This is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to Mid-Month Macro with Chris Stadele of LiveSquawk Commodity CornerAs per usual, there is a LOT to talk about!5 small bits of housekeeping* None of this is to be constituted as investment or trading advice. We are NOT financial advisors.* This video was recorded just after 09:00 ET on Monday 15th December* The Monthly Wrap for December will be recorded on 31st December 2025* Please continue to provide feedback as it helps us to continue to provide as much value to you as possible* Please subscribe to both The Contrarian Capitalist and LiveSquawk Commodity Corner using the buttons belowCharts looked at today include Gold, Silver, Copper, Palladium, Platinum, VIX, DXY, S&P, NASDAQ and WTI Oil.NB - Apologies for the charting issues with TradingView today.The Macro Turning Point Most Investors Are Missing

Today’s podcast guest is Adam Rozencwajg.Adam Rozencwajg is the Co-Founder and Managing Partner of Goehring & Rozencwajg (G&R), a leading natural resource investment firm headquartered in New York City. With nearly two decades of experience in commodity and natural resource investing, Mr. Rozencwajg is widely regarded as an authority in the field, known for his contrarian deep-value approach and rigorous, original research across long-term commodity cycles.AUDIO IS AVAILABLE HEREPlease LIKE, SHARE AND SUBSCRIBE TO THE CONTRARIAN CAPITALISTNB - Recorded on Thursday 11th December AMIn this wide-ranging podcast, Adam A. Rozencwajg discusses: * The carry cycle and its correlation with commodities* Whether Gold is currently cheap or expensive* The Gold to Oil ratio and what its current level tells us* Is oil supply being overstated?* Demand and land factors affecting oil* Why there is still some potential room to run in coal* Copper outlook* What Silver is telling us at the moment* And much moreContact InformationYou can download the excellent Q3 Commentary by visiting https://www.gorozen.com/commentaries/2025-q3Goehring & Rozencwajg manages a global, long-only natural resource strategy designed to provide broad, diversified exposure to the full natural resource complex. The firm is distinguished by its original research, decades of sector expertise, and long-term track record across multiple market cycles.ALL interview podcasts are released to PAID SUBSCRIBERS first.Take control of your financial future with The Contrarian Capitalist. Paid members get commodity and market insights, exclusive macro videos, early interviews, and the tools to build, protect, and grow wealth in uncertain times.Starting at just $9.17 per month (less than a couple of coffees), it’s exceptional value to protect your wealth, defend your freedom and outsmart the system.Thank you for being part of The Contrarian Capitalist community! This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit contrariancapitalist.substack.com/subscribe