Discover Competitive Compass

Competitive Compass

66 Episodes

Reverse

Gen Z and Millennials are doing great.Gen Z and Millennials feel fantastic about their financial situation. Please re-read the previous sentence. It’s easy to get caught in the doom loop that surrounds all of us. Doom & gloom gets more clicks, and we all know this, yet we allow the negativity to cloud our judgment.This summer, I wrote The Mythbuster Memo, my worst-performing newsletter for the year. One can’t make this up. Probably it was too positive for readers?IF you believe in data, then please consider that Gen Z andMillennials are feeling much better about their financial health. This helps explain the growth across the board, including premium cards, across various experiences, and new products.Patrick has a fantastic presentation on 2026 Financial Services Marketing Predictions. I’m happy to schedule this forthe first two weeks of December or in the new year. He identifies three key themes for next year:1. Control Amid ChaosContinued macroeconomic uncertainty, combined with adecreasing interest rate environment, will drive banking competitors to highlight budgeting tools and lenders to promote refinancing as a proactive form of reasserting control.2. Old Money, New TricksA surge in financial confidence among the youngest segments of adults will reshape brand strategy, as financial services companies target Gen Z adults as intrafamily influencers who can steer their parents to new products and planning techniques.3. Simpler Is SmarterPremium card relaunches are pushing the boundaries ofproduct complexity, causing competitors to use simplicity as a differentiator in marketing. As financial brands refocus on checking accounts and primary status, doing the basics better will be a recurring theme.

Targeting and Channel Strategy in Q3 2025. What the Data Tells us about Issuer Intent? Fulcrum Question: If discovery is shifting to GenAI andtrust is being built on the margins, where does competitive advantage come fromnext? I typically spend 4-6 hours putting this newsletter togethereach week. Sometimes, I take twice as much time (this happens quarterly).The reason is that these two reports I feature today capture so much incredible detail that I struggle to boil them down to the key takeaways. Pulling out just two or three takeaways is like trying to pick a favorite from a buffet where everything matters. That’s what makes this edition one of the toughest and most rewarding to write.1. Q3 2025 Credit Card Application Report2. Financial Profiles - Q3 2025I highly recommend reading both reports in full. But ifyou’re short on time, or just looking for a guided tour, here’s what you need to know. Below, I’ve laid out the key takeaways of how each issuer is playing the game.Bank of AmericaBofA hosted its investor day event this past week, markingnearly 15 years since its last one. You can view the full 300+ page deck here.My goal was to validate what I saw in Q3 activity with the broader vision, and there’s perfect alignment. BofA is focused on quality over quantity. Product cross-sell and relationship depth are key priorities.

Gen Z wants to borrow smarter, faster, and on their own terms.The opportunity? Build the tools that meet them where they are. Fulcrum Question: Does our product help a user make a smart choice right now, one they’ll feel good about tomorrow?I always smile when people say Gen Z doesn't like credit, as I know this is not true. Today, I have some statistics to back up that smile. Gen Z is reshaping credit, incorporating the best elements of debit as a component.Gen Z is not a generation of spenders or savers. It’s ageneration of choosers.They want tools that are simple, transparent, and seamlessly integrated into their existing shopping and payment processes. BNPL’s rise is about gaining control and confidence. The brands that appear at checkouts makeflexibility feel intuitive and win the current transaction, while also being front-runners in gaining long-term loyalty. BNPL’s Blueprint: Empowerment in Four TapsBNPL’s rise is not a fluke. What started as a short-term lending tool has evolved into a frictionless way for young consumers to gain greater control over their finances. And the numbers show it.The result: BNPL feels modern. It feels like it's been designedfor them.From Control to Confidence: Why This MattersDig beneath the behaviors, and a bigger motivation comes into view: control. And with it, something even more powerful: confidence. Gen Z doesn’t want to be told how to manage money. They want tools that work like the rest of their digital life: intuitive, transparent, and available instantly.That’s why the best BNPL providers are doubling down on clarity. Terms are easy to understand. Installments are visible at checkout. Alerts remind users what’s due and when. And if something slips? The UX doesn't punish, it guides.BNPL proves this: when you treat the user as capable and in control, they repay you with trust.The TakeawayThe future of credit isn’t about interest rates or APR calculators. It’s about trust at the moment of action.Whether your customer is buying sneakers or booking their dream vacation, they’re evaluating your product on one thing: Does this help me get what I want, without surprising me later?Get that right, and you don’t just win the transaction; you also win the customer.You earn the repeat. You earn the relationship. You earn the default position in their financial life.

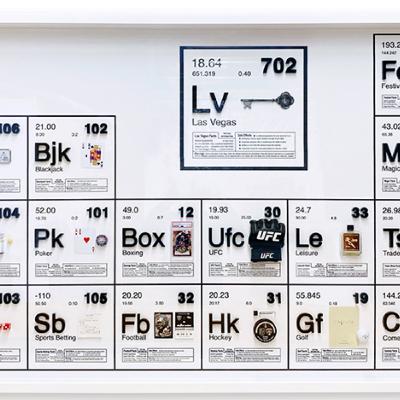

The New Chemistry of GrowthMoney 20/20 this year was less about competition and more about connections/partnerships; everyone’s finding their element. Walking the expo floor at Money 20/20 in Las Vegas thisweek, it struck me that the word “alone” is fading from the payments vocabulary. Wallets are partnering with AI firms, banks are collaborating with crypto firms, fintechs are teaming up with banks and brands, and even credit unions are forming partnerships with one another.Fulcrum Question: If you’re in cards, retail banking, or payments, the question to be asking is, “Who will partner fastest and smartest?”Conclusion: The Chemistry LessonIf Money20/20 taught us anything this year, it’s thatgrowth is no longer a solo pursuit; it’s a shared reaction. The future of commerce won’t be written by isolated innovators but by the bonds they form.Every partnership, whether PayPal bonding with OpenAI, Amex linking with Coinbase, or Comperemedia fusing with Equifax, adds a new element to the ecosystem.The most potent compounds are those in which each elementamplifies the other.That’s the chemistry of 2025.That’s the new formula for growth.Find your element. Form your bond. Start your reaction.

Today’s edition covers two big moves in cards and banking.A deep dive with Citi’s Pam Habner on the launch of Strata Elite and the premium card renaissanceA fast read on the Q3 earnings momentum that is reshaping card marketing and product strategy Fulcrum Question: Are you building for the earn and burn of today, or the yearn and AI-driven journeys of tomorrow? Andrew interviewed Pam Habner, Head of US Branded Cards and Lending for Citi, and I’d recommend you skip reading my takeaways and watch the full video here. This conversation is a masterclass from one of the most influential voices shaping the future of cards today.1. The Premium Card Renaissance: Flexibility Over "Coupon Books" The definition of "premium" is shifting, demanding greater simplicity and user control. Affluent consumers, especially Millennials, will pay steep annual fees if the value is clear. Strata Elite proves that premium is aboutdelivering freedom, control, and experiences that matter.The "Earn, Burn, and Yearn" Hierarchy: Premium today is built on three layers. Earn is strong rewards. Burn is the ability to redeem. But it is the Yearn that now drives the category forward; exclusive access, hard-to-get reservations, and cultural experiences that resonate with younger cohorts. The future of premium lives in the Yearn.2. Strategic Partnerships as the Ultimate DifferentiatorCiti is leveraging its partnership assets to create a unique value proposition that is difficult for competitors to replicate.

Anti-Algorithm: Empowerment Over EfficiencyConsumers are pushing back against black-box systems. They don’t want to be told “the algorithm knows best.” They want personalization with transparency and control over their choices.In finance, this shift is stark. Algorithms drive credit decisions and product recommendations, but today’s consumer asks: are you empowering me, or just automating me? That’s the fulcrum every CMO faces.Flexibility is winning loyalty.Programs that let people pick their own rewards outperform one-size-fits-all offers. That’s why customizable rewards cards and subscription-style memberships like SoFi Plus, Robinhood Gold, or, like we discussed last week, Coinbase One resonate: they monetize loyalty while giving consumers agency.The future will go further. Imagine a banking app where you can tweak the algorithm yourself: setting the parameters for your robo-advisor or your budgeting tips. Mintel forecasts consumers will demand this level of explainability and co-creation.Strategic takeaway: Highlight empowerment. Make transparency, choice, and explainability visible features.The brands that invite customers into the process will feel like partners. The ones that don’t risk feeling manipulative.Will your customers sense a guiding hand, or invisiblestrings?The New Young: The Ageless ConsumerLife stages are blurring. Longevity is rising, milestones are shifting, and consumers are redefining what it means to be “young.” The old playbook: designing products by age bracket, no longer holds.A retiree might open a robo-advisor account for the first time. A millennial might delay homeownership into their 40s. A 65-year-old could be starting a business. The message is clear: design for life needs, not life stages.This shift shows up in credit cards. Premium cards are simplifying, not complicating. Citi Strata Elite and Capital One Venture X succeed with clarity. Simplicity resonates across generations, whether you’re 25 or 55.Another example is intergenerational money flow. Cash App thrives by making value exchange seamless across ages, from splitting dinner with friends to sending money to family. Consumers want brands that work across their entire lives, not just one chapter.Strategic takeaway: Retire the retirement talk. Position products around mindsets and moments, not birth years. Build offerings that flex as customers evolve.Are your products built for life stages that no longer exist?The Affection Deficit: Craving Connection in a Digital WorldIn a world optimized for speed and automation, consumers are lonely. Mintel calls it an affection deficit. Efficiency has stripped away human touch, leaving people craving warmth and recognition, even in financial services.Banking is no exception. Seamless digital apps are wonderful, but they risk invisibility.When a fraud scare hits or a savings milestone is reached, people don’t just want efficiency; they want reassurance, empathy, and acknowledgment.Even digital-first players recognize this. Robinhood added 24/7 live support after realizing chatbots couldn’t calm customers in moments of panic. American Express leans on its “membership” ethos to cultivate belonging. These examplesremind us that trust is emotional currency.Design for affection. A proactive note congratulating a retiree. A celebratory message when a savings goal is reached. A human advisor call at key stress points. These aren’t extras: they’re signals that your brand sees the person, not just the account number.Strategic takeaway:Reintroduce humanity into digital services. Blend tech and touch.Can empathy become a part of your KPIs?

Fifteen seconds change everything.Once you feel instant access, you expect it everywhere. After that speed, you don't want to go back to the old way.Last week, I tried something that left me genuinely amazed. I applied for the Coinbase Card, expecting the usual processof filling out details, approvals, and delays. Instead, what I got was a journey that lasted all of fifteen seconds. A few screens later, I had a brand-new credit card ready in my Apple Wallet; no waiting for plastic (or metal, in this case) to arrive in the mail. BTW, the card is beautifully designed, and I could spend a newsletter on just the story behind it and itsdesign. Fulcrum Question: When instant becomes normal, what becomes the moment only you can own? Behind the curtain, this experience is crafted by Cardless, Coinbase, and Amex, and it is how financial services should feel. It’s quick, it’s seamless, and it makes you wonder whyall cards aren’t issued this way already.Yes, I know “tech” is expensive, and we move with caution. However, here’s the deal: Amex’s Agile Partnership Platform, Cardless, Coinbase, and, don’t forget, First Electronic Bank all had to come together to create this seamless experience.

We are in a moment where the Top 10% continue to remain strong, and the Bottom 10% have seen the most significant increase in their wages. I like to think of this as a moment where the edges are defining the next leg of the credit cardjourney. I touched on this idea in “Strength at the Edges,” and today we build on it.The Amex Platinum Refresh is setting the tone. That said, the center, prime and mainstream cashback are helping set the pace. And finally, the other edge, subprime, reveals where the next wave of product design may emerge.My goal is to identify the signals that matter so you can connect them to your reality. Fulcrum Question: If status is the spark and cashback is the engine, what keeps customers with you?

Fulcrum Question: How do you justify a premium price to an aspirational market that just wants to "shop like a billionaire?" Breaking News: The Amex Platinum Refresh is set to launch on September 18.This week, the financial world is buzzing with news of the upcoming American Express Platinum card refresh,rumored to launch on Thursday, September 18, with a potential new annual fee of $895. In an economy where consumers are supposedly tightening their belts, aprice hike of this magnitude seems counterintuitive. But it’s not. It’s a calculated, strategic bet based on a fundamental rewiring of what "luxury" means to the modern consumer.To understand why Amex is making this move, we need to look beyond the fee and into the converging worlds oftravel, consumer psychology, and the universal desire to live an elevated life. A Historic Move on a Historic DayIt’s no coincidence that the refresh is slated for September 18th. That date marks the 67th anniversary of the "Fresno Drop," the day in 1958 when Bank of America mailed 60,000unsolicited BankAmericards to residents of Fresno, CA.This event created the first mass-market credit card and ignited the consumer credit revolution. The BankAmericard eventually became Visa, and September 18th is, in essence, the birthday of the modern financial landscape.By choosing this date, Amex, which launched its own charge card just weeks later on October 1, 1958, is making a powerful statement.This isn't just an update; it's a reinvention, a milestone intended to redefine the role of a premium card for a new generation.Disclaimer: This remains speculative, but after hours of scouring the depths of Reddit, I have gained enough confidence to make this bold claim. Why Amex is Doubling Down on the New Luxury DreamAmex Platinum isn't just a card; it's a statement. It represents a shift in consumer behavior that's perfectly captured by Temu's viral tagline, "shop like a billionaire."While many people might scoff at the mention of Temu, dismissing it as just another fast-fashion app, itsmarketing team has created one of the smartest taglines of this current moment. The phrase speaks directly to the modern consumer's desire for luxury and exclusivity, but at a more accessible price point.While operating at the opposite end of the price spectrum, Temu’s tagline taps into the core desire animating the entire luxury market: everyone wants a taste of the good life. Amex Platinum provides access to a world of elevated experiences, making premium perks feel within reach. The card's appeal lies in its ability to deliver an aspirational lifestyle. It grants consumers the kind of access and benefitsthat were once reserved for a select few, offering a taste of luxury without needing a billionaire's bank account.This is where the “coupon book” may initially receive adverse reactions, but I have consumer data to support my claim that showing value is the most innovative way to sell luxury.The move to an $895 annual fee isn't a sign of being out of touch. It's an incredibly astute reading of the new luxury landscape. Amex is betting that on the anniversary of thetool that democratized spending, it can successfully redefine the tool that curates aspiration. By offering demonstrable value, Amex is positioning the Platinum card not as an expense, but as an essential investment for anyonewho wants to "live like a billionaire," even if only for a weekend.

Week at a Glance: Financial ProfilesApplication Behavior ReportUpgrade's New Card Chief on Blending Discipline with FlexibilityFulcrum Question: What offer at the edges earns the nextwave of applications. Or does a simplified middle offer win because the field is clear. I was at the US Open this week, watching Djokovic vs Fritz. The match delivered. The other contest was American Express vs. Chase. The two blues owned the grounds. Youmet one of them at every turn. Each moment offered a small welcome. A place to sit. A nudge to spend with a perk that felt timely. Staff pointed to the benefits before you asked.The lesson is simple. Share of mind becomes share of wallet when presence meets service in the flow of the day. I’m constantly asked how Amex has such a high in-person card acquisition rate.Their presence at these events is the easiest way to offset the lack of branches. Amex staff were diligently scanning “leads.”This is a playbook. Treat an event as discovery, activation, and retention in one venue. Surprise at the moment of intent. Carry the same cadence into everyday channels with clear value and fast follow-through.

Week at a Glance: The Evolution of CobrandCo-branded Card 2025 Competitive Intelligence TrendsCo-branded Card Predictions for 2025All That Glitters Is Not Gold: Sometimes It’s SapphireFulcrum Question: Who owns the future of co-brand: issuers, brands, or ecosystems?Bonjour, I am back after a two-week break and re-energized, raring to go. Time away always sharpens perspective, and this week’s edition is all about co-brand. It was hard for me to miss the “usual” ads that I saw at JFK, and interestingly, CDG and NCE were no different; a reminder that cobrand messaging truly travels across borders.One story that caught my eye during the break was Imprint’srecent Rakuten co-brand. Reportedly, Imprint beat out a number of traditional banks to land this partnership. Not bad for a five-year-old credit card startup that is now valued at $900 million. For context, consider Cardless, another fintech challenger that already has major co-brands in its portfolio. The fact that merchants are entrusting these partnerships to young entrants rather than legacy issuers shows just how much the ground is shifting.Speaking of shifting ground, Alaska and Hawaiian are nowmoving closer together, and with Bank of America’s launch of the Atmos Rewards cards, the combined airline is doubling down on loyalty alignment. This is not just a merger of fleets but a merger of ecosystems, with co-brand as a central pillar.

The Micro‑Entrepreneur MandateThe American small business is no longer the corner shop or the family franchise.The new face is the micro‑entrepreneur.The delivery driver. The online seller. The creative freelancer. This is not a side hustle economy. This is the engine of modern entrepreneurship. Almost half of consumers now consider gig work necessary to support themselves. For struggling households, it rises to six in ten. This is no niche. This is the new mainstream of small business.Fulcrum Question: Do you see the gig worker at the margins, or at the center?

Why Every Launch and Refresh Strengthens the MarketWe're witnessing an extraordinary moment in premium credit cards, a moment defined not by competition, but by precision, innovation, and strategic clarity. Each refresh and launch not only enhances the issuer's proposition but also elevates our entire industry.Let's unpack the strategic moves reshaping our landscape. Citi Strata Elite: Precision with PurposeCiti’s Strata Elite exemplifies strategic precision. By securing exclusive 1:1 transfer capabilities with American Airlines AAdvantage, Citi has designed a laser-focused proposition for high-value travelers and affluent Citigold clients. Every feature, from Admirals Club access to Citigold integration,reinforces Citi’s commitment to specificity over scale. This targeted re-entry does not just fill a niche; it creates one.Strata Elite marks Citi’s return to the premium travel arena with a differentiated playbook. Instead of chasing breadth through multiple airline and hotel partners, Citi is doubling down on exclusivity and loyalty stickiness. The AAdvantage tie-up positions Strata Elite as the only true premium bridge to American Airlines, appealing directly to the frequent flyer segment that values certainty over optionality. Layering this with Citigold banking integration elevates the card from a travel perk vehicle to a holistic wealth-and-travel platform.The choice of Mastercard Legend as the network reinforces Citi’s premium intent. Legend adds a layer of elite services, concierge access, and travel protections to the offering.The early response suggests that Strata Elite’s strength lies not in trying to serve everyone, but in speaking directly to the needs of the frequent traveler who is already deeply invested in Citi and American Airlines. For this consumer,Strata Elite is the logical next step. In many ways, Strata Elite is Citi’s statement that precision can be as powerful as breadth. By anchoring the card to a clearly defined consumer and delivering depth of value rather than sheer variety, Citi has set the stage for Strata Elite to become a durable success story within its premium portfolio. Amex and Chase: Ecosystem ArchitectsAmerican Express Platinum and Chase Sapphire Reserve continue to define premium through expansive lifestyle ecosystems:Amex Platinum remains synonymous with status andbreadth, expertly balancing aspirational value with exclusive access. Its ongoing refreshes maintain prestige while methodically expanding into dailylifestyle integration.Chase Sapphire Reserve builds an all-encompassing ecosystem where travel, dining, entertainment, and daily habits merge seamlessly. Chase has transformed its card into a curated life subscription, making customer loyalty both immersive and frictionless.Each ecosystem approach represents intentional strategic depth designed to captivate distinct customer segments. Capital One: The Simplicity StrategyCapital One’s Venture X reflects a profound understanding of modern premium preferences, simplicity, and clarity. By offering straightforward, instantly justifiable value, itaddresses the cognitive load consumers increasingly seek to minimize. Its continued evolution will likely reinforce simplicity, enhancing clear and immediate value without sacrificing prestige. BofA: Relationship ReinforcementBofA’s Premium Rewards Elite capitalizes on asset-linked loyalty, uniquely positioned to reward existing high-net-worth relationships. The model is strategic and deliberate: it enhances returns precisely in line with client value. ExpectBofA to deepen this strategy further, fortifying its "relationship moat."

The brands winning today are sharper, not louder. They listen with intent, decode signals quickly, and act with precision. Every click, pause, and swipe from your customers is a message. It is direction. The challenge is the discipline to interpret the insight before the moment passes.Relevance does not wait. It belongs to those who read the market in motion and move with purpose.Fulcrum Question: Are you reading your customers closely enough to stay meaningful?Gen Z Banking Begins Before the First PaycheckAndrew’s recent interview with the CEO of Step reveals a shift that deserves every CMO’s attention. The conversation outlines a model built around early engagement, not traditional timelines. Step is building credit history before teens can earn income. It is embedding financial behaviors at the point of curiosity, not just capability.Gen Z does not separate financial activity from digital life. Step understands this and builds accordingly.The distribution model prioritizes creator partnerships and platforms like Snapchat. Marketing leaders should treat this as both a case study and a call to action. The next generation is not waiting for onboarding. They are already operating with intention. The question is whether we are willing to participate in those early moments or observe them from a distance.

Week at a Glance:Marketing Momentum Is RealCredit Card Debt, ReconsideredInstitutional Crypto Quietly Goes MainstreamLast week, I made the case for an explosion in marketing in 2H 2025.The response? Strong opinions on all sides.Many asked, “In this macro environment?” Fair question.But here’s something to consider: there has neverbeen a moment in time that wasn’t clouded by uncertainty.And when caution becomes consensus, sometimes the best position is to lean forward.This week, I invite you to examine three common narratives with fresh eyes. Not because I want to win a debate, but because the data tells a different story.Three exhibits. One request: please read with curiosity, then make a decision.Fulcrum Question: What if the bearish sentiment is already priced in, and the real contrarian move now is optimism?

Marketing as Signal | H1 2025 Spend Sets the Stage:First-half 2025 data shows financial marketers ramping up spend (overall +11% YoY) even as credit card promo budgets took a brief breather. Now, a wave of product refreshes and record budgets from the likes of Chase and Amex signal that the second half of 2025 will be a marketing blitz of historic scale, one aimed at brand identity as much as customer acquisition.SoFi’s CMO for Lending on Storytelling | Inspiration as Strategy:Andrew’s interview with SoFi’s marketing chief for Lending, Meera Iyer, offers an energizing reminder: great marketing in financial services isn’t just aboutproducts, it’s about purpose. From building trust through education to turning data into compelling member stories, her playbook challenges every CMO to lead with mission and imagination. Fulcrum Thought: The next era of marketing won’t be measured by accounts acquired, but by identities inspired. Is your brand inspiring one?

The definition of value is undergoing a fundamental shift, driven by a new generation of consumers and transformative technology.For leaders in the financial sector, this represents a tremendous opportunity. Understanding how consumers perceive value, from the demand for authentic marketing to the redefinition of premium rewards and the very assets people can own, is the key to building brands that resonate and lead in this new era.Fulcrum Thought: Your customers are already living in the future of value. Is your brand building it with them?Another way to test this thought is: If your brand disappeared tomorrow, what value would your customers truly lose?Marketing to Gen Z: Authenticity is Your Brand's MirrorGen Z navigates a world of financial stress with a demand for radical transparency and genuine connection. They are wary of traditional advertising. To win with this generation, our marketing must be a mirror, reflecting their world with empathy and authenticity. We must create content and experiences that feel personal, valuable, and, above all, real.The "So What": To connect with this generation, your brand's message must be authentic and genuinely reflect their values and anxieties. Move beyond generic campaigns to create content and experiences that feel personal and prove you understand their world.

Why ‘Boring’ Is The New BoldPNC’s Counter-Play: How a "Brilliantly Boring" card is chasing relationships, not rewardsPaid Search in the Age of AI: Shifting from broad keywords to deep conversationsWealth Management's Two Fronts: The battle betweenchallenger hype and legacy reassuranceThe CURB Advantage: Why local focus is delivering national-level resultsHow Black Swan Data is helping your competitors?The strategies emerging in 2025 show the market isn't just expanding; it's bifurcating. On one side is the loud, expensive race for mass acquisition. On the other is a quiet, deliberate pursuit of deep relevance. From PNC’s focus on relationships to the shift toward conversational search, the signal is clear: the loudest voice doesn't always win. The most resonant one does.The question is how you're choosing to grow. Are you building a brand that shouts, or one that's worth listening to?

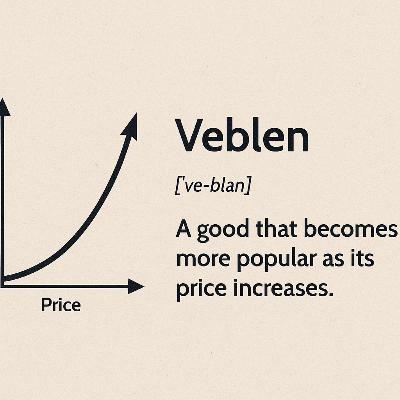

The New Math of Exclusivity: Why We Pay for PrestigeThis section breaks down the consumer psychology and market trends that make a $795 annual fee not only palatable but also desirable. It’s less about the math and more about the meaning.● Credit Cards as Veblen Goods: The core principle is that for certain goods, demand increases as the price rises. The high annual fee isn't a bug; it's a feature. It signals exclusivity,quality, and status. The price tag itself becomes part of the product's value proposition.● The Psychology of the "Coupon Book": Consumers arewilling to pay high fees if they believe they can "beat the system." The complex web of credits ($300 for travel, $189 for CLEAR, etc.) transforms the fee into a challenge. For many, the satisfaction of optimizing perks to offset the cost provides a psychological win that transcends the actual dollar value.● The Rise of the Experience Economy: Younger, affluentconsumers, particularly Millennials and Gen Z, increasingly prioritize spending on experiences over material goods. Card issuers have become brilliant aggregators of these experiences, bundling travel access, dining perks, andwellness benefits into a single, aspirational product.● Identity as a Benefit: In a world where every perk can be copied, the brand itself becomes the key differentiator. Owning a Sapphire Reserve or Amex Platinum isn't just about travel; it's about signaling a certain lifestyle and identity. The card is a membership card to a club of savvy, affluent individuals. The Titans of T&E: A Luxury Brand PlaybookThe strategies employed by Chase, Amex, and now Capital One are directly lifted from the playbooks of the world's most successful luxury houses. Understanding these analogies reveals their long-term game. ● Chase as LVMH: Chase is the master of the brand portfolio. Just as LVMH owns everything from Tiffany & Co. to Louis Vuitton, Chase has a card for every consumer (Freedom, Slate, Ink). Their strategy is to acquire customers at all levels and systematically move them up the value chain, with the Sapphire Reserve as their flagship, aspirational product.● American Express as Hermès: Amex is the heritage brand. Like Hermès with its iconic Birkin bag, Amex cultivates an aura of extreme exclusivity with its Centurion (Black) Card. This creates a powerful halo effect, making their more accessible products (like the Platinum and Gold cards) highly desirable symbols of taste and status.● Capital One as Apple: Capital One is the design and tech-driven disruptor. Like Apple, which fundamentally redefined personal electronics through an obsessive focus on a seamless user experience, Capital One is leveraging its tech DNA to challenge the legacy players. Their move into the premium space with the Venture X is less about old-world prestige and more about intuitive design and a brilliantly simple interface. They are capturing the "hidden affluent" who value smart, elegant functionality over traditional statussymbols.How Black Swan Data Can Help?That’s why we’re expanding what Comperemedia can offer. Through our acquisition of Black Swan Data, we can now help you decode not just what your audience is doing, but what they’re about to do. Whether you're targeting high-net-worth individuals, Gen Z creators, small business owners, or mass affluent families, we can help predict the next desire curve before it forms.What’s emerging, what’s accelerating, what’s about to tip?We can help you anticipate it and tailor your proposition accordingly.If you're curious about what this could mean for your audience, reach out and let’s explore it together.

Week at a Glance:Entry is Easy – But Winning is NotEntry is Easy – But Retention is the GameEntry Is Easy – But Bundles Bind Fulcrum Thought: The next great credit card won’t just bechosen. It will be joined. Is yours worth joining?Entry is Easy — But Winning is NotThe Chase Sapphire Reserve refresh just raised the stakes.New cards are launching weekly. The barrier to entry has dropped. But the bar for differentiation has never been higher.If you're leading card strategy, product, or marketing, you need to be thinking bigger than just your next perk.That’s why Andrew Davidson’s upcoming session, “CreditCard Premiumization: Projecting the Future of Affluent-Driven Innovation,” is a must-see.In a market where everyone’s upgrading, this session is your edge.