Discover Breaking Banks Africa

Breaking Banks Africa

Breaking Banks Africa

Author: Provoke.fm

Subscribed: 1Played: 0Subscribe

Share

© 649161

Description

The African Edition of Breaking Banks dives into the vibrant world of African fintech and entrepreneurship, showcasing the continent’s groundbreaking innovations and transformative stories. With a spotlight on the challenges, untapped opportunities and triumphs of African entrepreneurs, it’s a journey through the heart of Africa’s economic evolution, hosted by some of the most inspiring voices in the space. Produced in cooperation with Timepledge.org.

12 Episodes

Reverse

This episode of Breaking Banks Africa features Anie Akpe, founder of LumoHubs.com and African Women in Technology (AWIT). The conversation explores how Lumo Hubs is shaping the future of work in Africa by partnering with universities to equip students and communities with hands-on digital, vocational, and AI-driven skills. Anie highlights the importance of adaptability, continuous learning, and building solutions locally - especially as AI accelerates global change. She also discusses the challenges faced by women in tech, ongoing funding gaps, and the crucial role of community-driven support in times of shrinking foreign aid. The episode emphasizes collaboration across African regions, the power of technology to bridge language and geographic barriers, and the need to invest in rural inclusion. Anie shares how AWIT has empowered women for a decade and outlines LumoHubs’ vision to nurture future innovators across the continent.

Connect with Anie: https://www.linkedin.com/in/anie-akpe-abb48312/

In this episode of Breaking Banks Africa, Executive Producer Matteo Rizzi sits down with Sandra Yao, Group Head: Cross Border Remittance, Payments & BaaS (Fintech) at Ecobank. With 20 years of experience driving fintech and payment innovation across Africa, Sandra brings a unique “builder’s mindset” into one of the continent’s largest financial institutions, operating in 39 markets. From pioneering mobile money to tackling fragmented infrastructure and regulatory environments, Sandra shares how interoperability, accessibility, and digital transformation are reshaping the future of payments in emerging economies. She also reveals how Ecobank is empowering young African talent, forming major tech partnerships (including Google), and creating API-first solutions to help fintech founders scale across borders. A must-watch for anyone passionate about Africa’s digital growth story, inclusive innovation, and the people turning vision into execution—from Nairobi to the world.

In the new episode of Breaking Banks Africa, host Nadine Zoro explores how Wave, a mobile money company, is breaking barriers to financial inclusion across Francophone West Africa. Guest Coura Carine Sene, General Manager WAEMU Region, Wave Mobile Money, shares her journey from studying and working in France to returning to Senegal to drive change. Wave prioritizes affordability and simplicity—lowering transaction fees from as high as 12% to just 1%—to make digital finance accessible for underserved communities. Their approach builds trust by focusing on user-friendly services for people new to financial tools, many of whom are illiterate or lack smartphones. Wave innovates with solutions like QR-coded cards that work offline, enabling rural users to transact through agents. The episode also highlights the challenges of navigating regulation and partnering with telcos, stressing the importance of collaboration with regulators to scale services. Overall, Wave demonstrates how fintech can foster inclusion, economic activity, and empowerment through practical, low-cost innovation.

Connect with our guest:

https://www.linkedin.com/in/coura-carine-tine-sene

In episode 8 of Breaking Banks Africa, host Matteo Rizzi speaks with Kigali-based entrepreneur Philip Ngarambe, now Entrepreneur in Residence at ALX Ventures. Philip recounts his journey with AC Group, the company that transformed urban transport in Rwanda by introducing digital “tap & go” bus payments. What began as a mobility solution quickly evolved into a driver of financial inclusion, proving how everyday services can seamlessly bring people into the digital economy.

Philip reflects on scaling a disruptive business, the importance of mentorship, and why investing in youth-led ventures is vital for Africa’s future. At ALX Ventures, he supports young founders in turning ideas into sustainable companies, while emphasizing AI, bottom-up innovation, and solving non-obvious but high-impact problems.

The episode also highlights upcoming opportunities for collaboration, including the Global SME Finance Forum in Johannesburg (September 2025)—a key event for exploring fintech, inclusion, and SME growth on the continent.

In this episode, Matteo Rizzi sits down with Artur Pereira — entrepreneur, speaker, SWIFT specialist, and CEO of D-Evo — to explore Africa’s journey from legacy banking systems to digital excellence. Drawing from his extensive experience in Portugal, Angola, and across the continent, Artur unpacks the unique challenges and opportunities in African payments: from interoperability gaps and cross-border complexities to the promise of instant payments, blockchain, and stablecoins. The conversation dives into the role of the African Union in setting standards, the power of data and unified IDs, and why regulatory collaboration is key to scaling FinTech. Artur shares success stories like M-Pesa and Karingo, while advocating for sustainable investment models that empower local talent and entrepreneurs. Together, they highlight why innovation, trust, and regional cooperation are the cornerstones of Africa’s next leap in financial services.

In this episode of Breaking Banks Africa, we sit down with Melanie Keita, co-founder and CEO of Melanin Capital, a groundbreaking fintech on a mission to become Africa’s first carbon digital bank. Melanie shares her journey from pitching at the EcoBank Fintech Challenge to raising capital and scaling a platform that combines climate finance, SME lending, and carbon credit trading. With a focus on agricultural and renewable energy businesses, Melanin Capital is bridging the financing gap for Africa’s green economy while tackling real-world regulatory and funding challenges. From partnering with agritechs to empowering women-led cooperatives, Melanie unpacks how innovation and grit are key to building Africa’s climate resilience.

Tune in to hear how fintech meets sustainability—and what’s next for Melanin Capital in Africa’s trillion-dollar receivable finance market.

In the 4th episode of #BBA, hosts Matteo Rizzi and Nadine Zoro are joined by John Brittell from Side B Ventures to explore the shift from aid-based funding to equity-driven investments in Africa. With a background in development finance, John shares his transition from working in aid and grants to focusing on private sector investment. The conversation dives into the challenges faced by local entrepreneurs, particularly in markets like Ivory Coast, where many are unfamiliar with the startup ecosystem. John emphasizes the need for access to capital as a key factor for entrepreneurial success. Together with Matteo and Nadine, they discuss how a hybrid model, combining experienced and emerging founders, could empower startups across Africa. This episode advocates for sustainable growth through equity investment, moving beyond traditional aid to foster long-term innovation and economic development on the continent.

Follow John: https://ug.linkedin.com/in/johnbrittell

In this third episode, we welcome Nadine Zoro as she makes her debut as a podcast host, co-hosted by Matteo Rizzi. Our guest, Divine Muragijimana, brings her expertise in brand storytelling, product marketing, and fintech growth to the conversation. She shares insights on how strategic branding empowers African entrepreneurs, the intersection of media and fintech marketing, and key takeaways from #IFF2025. Matteo also leads a discussion on the role of talent upskilling in driving fintech innovation. With an integral (no cuts) for Nadine’s first episode, join us while diving into an insightful discussion on African fintech’s evolving landscape.

Follow Divine:

https://www.linkedin.com/in/divinemuragijimana

In this episode of Breaking Banks Africa, host Matteo Rizzi engages in an insightful conversation with key figures from the fintech and financial inclusion landscape in Africa. Guests include Thelma Quaye, Director of Digital Infrastructure, Skills, and Empowerment at SmartAfrica; Kosta Peric, Deputy Director of Inclusive Financial Systems at the Gates Foundation; Leila Rwagasana, FinTech Secretariat Lead at Rwanda Finance Limited; and Christian Kajeneri, Director of Payment Systems at the National Bank of Rwanda.

The discussion explores the evolution of financial inclusion and fintech in Africa, with a focus on Rwanda's digital transformation. Highlights include the launch of the Rwanda National Digital Payment System (RNDP 2.0), the success of Mojaloop in facilitating payment system interoperability, and the inspiring stories of local innovators and entrepreneurs. The episode also touches on the challenges and opportunities for youth, particularly women, in the fintech sector. Through personal anecdotes and professional insights, the episode emphasizes the power of perseverance, passion, and seizing opportunities to drive change in Africa's financial ecosystem.

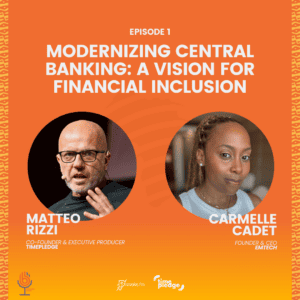

In the first episode of Breaking Banks Africa, we explore the transformative impact of digital assets and CBDCs (Central Bank Digital Currencies) on financial inclusion and regulatory frameworks across Africa. Our guest Carmelle Cadet - CEO & Founder of EMTech, shares insights into the role of regulators in adapting to innovation, using tools like the sandbox to manage risks without waiting for full legislation. Highlighting real-world examples, we discuss the Bahamas' blockchain solution for island-wide financial access and Ghana's CBDC initiative to streamline government payments. The conversation delves into the unique opportunities for Central Banks to issue digital currencies, fostering financial inclusion without requiring traditional banking infrastructure. The discussion also touches on the evolving regulatory landscape, with a focus on Africa's potential to lead in fintech innovation. Acknowledging the challenges of trust and currency volatility, the episode emphasizes how blockchain and tokenization may offer solutions, creating a more resilient financial system for the continent’s future.