Discover Managing Tech Millions

Managing Tech Millions

Managing Tech Millions

Author: Manage Your Millions; Define Your Legacy

Subscribed: 9Played: 151Subscribe

Share

© Christopher Nelson

Description

Real conversations with tech pros, private equity insiders, and investing experts to help you turn equity comp into generational wealth—and guide your transformation from money maker to money manager.

managingtechmillions.com

managingtechmillions.com

146 Episodes

Reverse

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 February 25th at 7pm to 9pm (Central US)If you’ve been researching how wealthy families manage money, you’ve probably come across two terms over and over again: the Family Bank (also known as Infinite Banking) and the Micro Family Office.Most people assume they’re basically the same thing.They’re not.In this video, I break down the real difference between these two approaches—and why confusing them often leads high-net-worth professionals to buy financial products when what they actually need is infrastructure.You’ll learn why one is simply a tool, while the other is a full operating system for managing wealth.What you’ll learn in this episode:• What the Family Bank really is, how it works, and when it actually makes sense• Why Infinite Banking is a product strategy, not a wealth management system• What a Micro Family Office really looks like behind the scenes• The 7 core components that wealthy families use to run their money like a business• How financial products should fit inside a system—not replace one• Why first-generation wealth builders get stuck stacking tools without a blueprintThe key takeaway:Wealthy families don’t just buy products.They build systems.Then they place the right tools inside those systems so their wealth continues to operate—even if they’re no longer around to manage it.You might need a Family Bank.You might need a Micro Family Office.You might eventually need both.But the order matters.Foundation first. Tools second.If you have between $1M and $30M in net worth and want to stop buying disconnected products—and start building real wealth infrastructure—this video will help you see exactly where to start.Watch the full breakdown and decide which approach actually fits your situation.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 February 4th at 7pm to 9pm (Central US)You’ve worked hard, built up a $5 million net worth, and your financial advisor tells you that you need $7 million to retire comfortably. So, you keep working.But what if I told you that someone with only $3 million just walked away from their job— permanently? They’re generating $140,000 a year in passive income, paying almost no taxes, and their wealth is actually growing faster than yours. What do they know that you don’t?I’ve spent the last 10 years studying how ultra-wealthy families build and protect their wealth, and I’ve spent the last four and a half years running my own Micro Family Office. What I’ve learned is simple: retirement at this level isn’t about how much you save, it’s about how you architect your wealth.In today's episode I’m going to show you the four systems you need to build, why traditional retirement advice doesn’t apply to you, and how you can set up your wealth to work for you, not the other way around. By the end of this video, you’ll see why some people retire with $3 million while others with $10 million are still stuck working.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 February 4th at 7pm to 9pm (Central US)In 2025, 1,000 new millionaires were created every single day in the US. But here’s the problem—the moment you cross that threshold, you enter what I call the financial service desert. You’re too wealthy for cookie-cutter financial advisors, but you don’t have the $100 million minimum to access a traditional single family office.The result? Highly successful individuals get stuck in analysis paralysis or make bad investment decisions, which can lead to million-dollar mistakes.I’ve been there. In 2012, I made my first million and soon realized that the traditional wealth management options were not serving my needs. After talking to several wealth advisors, I realized no one had my best interests in mind. So, I studied how the ultra-wealthy manage their money through family offices—and built what I now call a Micro Family Office.Today, my portfolio generates over $200,000 annually in cash flow, while still growing, and I’ve been able to retire at 51 and focus on what truly matters to me: my family and health.In this episode, I’m breaking down the four-phase process I used to build my own Micro Family Office in 2026. These are the same steps you can use to manage your wealth like the business it truly is.Phase 1: ArchitectBefore you start building your system, you need to have a clear strategy. In the Architect phase, you define the foundation of your wealth management.Phase 2: BuildIn the Build phase, you transform your strategy into actual infrastructure:* Legal Structure.* Building Your Team.* Systems and Technology.Phase 3: RunOnce you’ve laid the foundation in Architect and Build, the Run phase is where your Micro Family Office becomes operational. The beauty of this phase is that if you did the previous phases correctly, running your family office will only take about 5 to 10 hours per week.Phase 4: SuccessionThis phase sets apart good wealth management from true generational wealth. The ultra-wealthy don’t just think about their own wealth—they plan for future generations. This means three key things:* Comprehensive Estate Plan.* Teaching the Next Generation.* Document Everything.What Does a Functioning Micro Family Office Look Like?A properly functioning Micro Family Office includes:* A clear strategy aligned with your life goals.* A diversified portfolio that generates consistent income—no more chasing paper gains.* A team of experts who report to YOU, not the other way around.* Systems that run smoothly without consuming your life.* Confidence in your decisions and knowing that your wealth is protected and will grow across generations.It’s about shifting your mindset from managing your wealth like a side hustle to running it like a business.Common MistakesHere are the six biggest mistakes people make when building their Micro Family Office:* Overconcentration in one stock.* No framework—winging it with scattered investments.* Wrong advisors—not having the right specialists in place.* Treating taxes as an annual event instead of year-round strategic planning.* Poor investment sizing—don’t put too much of your portfolio into one deal.* Managing millions like a savings account—shift from a drawdown to an evergreen portfolio.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

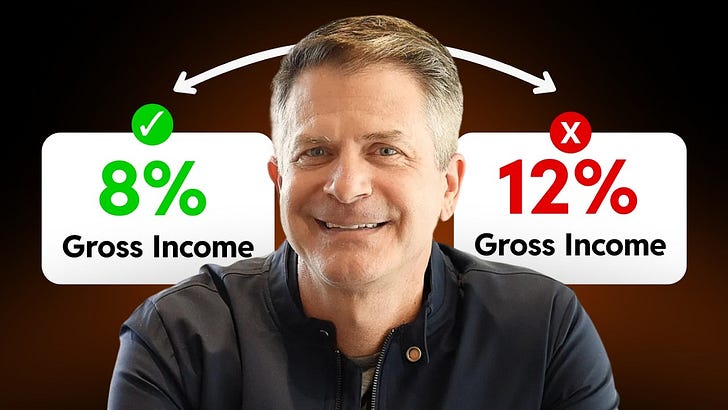

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 January 21st at 7pm to 9pm (Central US)How can an 8% return outperform a 12% return over time?The answer has nothing to do with taking more risk, and everything to do with what you actually keep.In this episode, I break down the concept of Structured Alpha—a framework used by ultra-wealthy families to measure after-tax performance instead of headline returns. Most investors obsess over gross returns, but taxes quietly erode 2–4% of their portfolio every year. Over decades, that can mean millions lost to inefficiency.You’ll learn why gross returns are misleading, how income type matters more than yield, and how combining income architecture with tax optimization can dramatically increase long-term wealth—without increasing market risk.We’ll walk through real examples across different portfolio sizes and show how investors with $1M–$30M can systematically keep more of what they earn, letting compounding do the heavy lifting.If you’re serious about building wealth like a business—and not leaving money on the table—this episode will change how you evaluate returns forever.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 January 21st at 7pm to 9pm (Central US)Most people listening to this episode should not build their own wealth management infrastructure. And hearing that upfront might save you from a very expensive mistake.Managing an $8M Micro Family Office has taught me something most content in this space avoids saying out loud: this approach is incredibly powerful—but only for a very specific type of person. If even one of five key conditions applies to you, building a Micro Family Office will likely create more friction than freedom. But if none of them apply, managing your wealth like a business may be the highest-return decision you ever make.In this episode, I walk through the five reasons you should not build a Micro Family Office—covering mindset, time commitment, tax strategy, portfolio structure, and asset scale. This isn’t hype or theory. It’s a reality check based on running my own portfolio with a CEO-level operating model, where income, growth, and preservation work together as a single system.You’ll hear why passive, “set it and forget it” investors are better served by traditional advisors, why proactive tax strategy can quietly add tens of thousands of dollars per year to your bottom line, and why portfolios under $1M usually don’t justify the infrastructure required. We’ll also break down the real weekly time commitment, what “active ownership” actually looks like, and the critical difference between drawdown portfolios and Evergreen Portfolios designed to fund life without selling assets.This conversation reframes wealth entirely: a multi-million-dollar portfolio isn’t just an account—it’s a business. One capable of generating six figures in annual income with a fraction of the effort most people spent building their careers. The question isn’t whether you’re capable of running it. It’s whether this model truly fits how you want to live, think, and engage with your money.If you’re frustrated with cookie-cutter advice, want real control over your financial future, and are serious about building generational wealth—not just spending it down—this episode will help you decide, clearly and honestly, whether a Micro Family Office is the right path for you.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

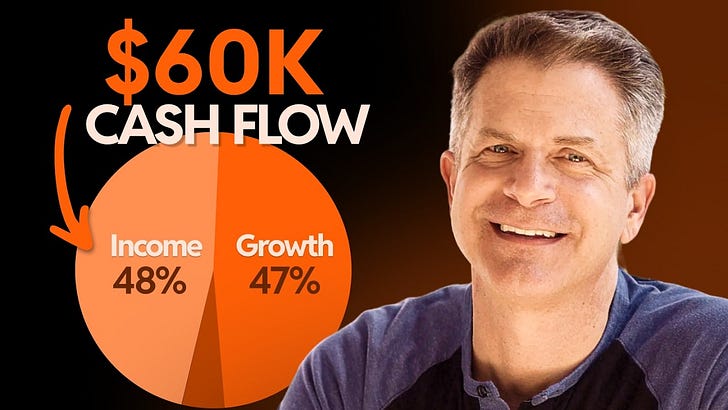

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 January 7th at 7pm to 9pm (Central US)At 51, I walked away from a tech executive career with $6M in my portfolio, but I wasn’t retiring because I had “enough.” I retired because my portfolio was generating income, not just sitting there as a big number on a screen. In this video, I share how I built my portfolio to produce cash flow and grow at the same time, allowing me to retire early. It’s not about saving more or hoping for market growth—it’s about structuring your wealth like ultra-wealthy families do.Most high earners face a common problem: they accumulate millions but have no plan for income replacement. They’re stuck in a “wealth trap” where the goalposts keep moving, and retirement seems always out of reach. For years, I followed the traditional advice—60/40 portfolios, the 4% rule—only to realize it wasn’t built for my goals. That’s when I started studying how ultra-wealthy families actually manage their wealth, and what I discovered completely changed my approach.Ultra-wealthy families don’t rely on selling assets to fund their lives—they build what I call the Evergreen Portfolio. This model includes three critical components: growth assets for long-term appreciation, preservation assets for safety, and income-generating assets that fund your lifestyle without tapping into principal. In this video, I break down how I applied this framework to my own portfolio, how I structured it, and how you can do the same.With this strategy, I was able to take $6M and structure it so that half of it generates steady income, allowing me to retire at 51 while still growing my wealth. I show you exactly how to build your portfolio with growth, preservation, and income—without relying on market timing or risky bets.If you’re ready to break free from the traditional retirement advice and start building a portfolio that works for you now, this episode is for you.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 January 7th at 7pm to 9pm (Central US)Four years ago, one decision changed everything. Walking away from a tech executive career at 51 looked reckless from the outside—especially when the portfolio at the time was half the size of peers who were still working long hours. But there was one critical difference: while their wealth was just a number on a screen, this portfolio was already generating meaningful cash flow. Four years later, it has grown by more than $2M and now produces over $200K per year in income—without selling assets.This episode breaks down why the traditional 4% rule quietly fails high earners and why so many people with millions still feel trapped in demanding careers. The 4% rule was never designed for people managing seven- and eight-figure portfolios, and it ignores one of the biggest risks retirees face: sequence-of-returns risk. When markets drop early in retirement, forced asset sales can permanently derail a portfolio—and most advisors still build plans that rely entirely on hope and market timing.The conversation pulls back the curtain on a massive gap in wealth management. If you have under $1M, personal finance advice works. If you have over $100M, you can build a full Single Family Office. But between $1M and $30M, most investors are pushed into generic 60/40 portfolios that generate little to no income while charging substantial fees. This is what creates dependence on a paycheck long after wealth has been built.The alternative explored in this episode is how ultra-wealthy families actually structure portfolios: never selling assets to fund life. Instead, they build Evergreen Portfolios designed around three coordinated categories—growth, preservation, and income. Growth assets compound long-term value, preservation assets protect liquidity and downside risk, and income assets generate consistent cash flow that funds living expenses regardless of market conditions. This structure allows families to ride out downturns without panic, selling, or lifestyle disruption.You’ll hear exactly how this framework was implemented step by step—divesting concentrated stock positions over time, increasing liquidity, and deliberately building income-producing assets such as real estate, private credit, and income-focused strategies. The result was financial independence achieved not by guessing market cycles, but by replacing drawdowns with durable cash flow.The episode also walks through the real-world math behind why this approach matters. In down markets like 2008 or 2022, portfolios dependent on withdrawals permanently lose ground, while income-driven portfolios continue operating and recover faster. Same starting numbers. Completely different outcomes.If you’re managing between $1M and $30M, sitting on concentrated equity, or questioning whether the traditional retirement playbook actually works for your situation, this episode offers a clear, practical alternative. It’s not about chasing higher returns—it’s about building a system that supports your life today while still compounding for the future.If you want to go deeper into how this Evergreen approach fits inside a Micro Family Office structure—and how to implement it systematically—this episode is the foundation.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 January 7th at 7pm to 9pm (Central US)Managing an eight-figure portfolio isn’t about chasing the highest returns — it’s about making deliberate, CEO-level decisions that reduce risk, increase liquidity, and ensure your wealth can compound through every market cycle. In this episode, the focus is on the biggest changes being made to an $8M portfolio heading into 2026, including which investments are being exited, where capital is being redeployed, and the annual decision-making framework that drives those moves with clarity and confidence.For many high earners, early success comes with mistakes: overconcentration in company stock, chasing hot deals, reacting emotionally to market noise, and operating without real systems. The shift happens when wealth stops being treated like a side project and starts being run like a business. That’s where the Annual Portfolio CEO Review comes in — a structured process that looks at three critical areas every year: portfolio strategy, operational efficiency, and succession planning. Every decision flows through a clearly defined Investment Thesis, acting as a north star for what the portfolio is optimizing for and how success is measured.Looking ahead to 2026, the priorities are clear: reduce risk, increase liquidity, and diversify income streams. That means closing out underperforming private investments where cash flow is unpredictable or capital is trapped, doubling down on proven private-market operators who consistently hit distribution targets, and increasing exposure to public-market income strategies like covered call ETFs and dividend-focused investments. The goal isn’t aggressive growth — it’s building a resilient portfolio that compounds steadily while remaining flexible and liquid.Operational simplicity is another major focus. Over time, complexity quietly builds as accounts multiply and tools pile up, pulling attention away from actual investing. The 2026 plan includes consolidating brokerage platforms, auditing every tool and subscription, and eliminating anything that doesn’t earn its place. Just like refactoring code, the objective is the same functionality with cleaner architecture — less friction, more focus.Succession planning rounds out the framework, an area most people delay until it’s too late. This includes actively involving family members through charitable decision-making, hands-on investment education, and structured family governance meetings. The goal isn’t to turn the next generation into portfolio managers, but to ensure they understand that wealth is a responsibility, not just an inheritance.The biggest lessons moving into 2026 are simple: priorities evolve as life evolves, simplicity beats complexity, and family involvement compounds just like capital. Anyone managing between $1M and $30M can apply this same three-part review by asking three questions: where to divest and invest, what to simplify operationally, and how to future-proof the portfolio for the next generation. If you want to enter the new year with a clear strategy instead of reactive decisions, this episode lays out the exact framework to do it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 January 7th at 7pm to 9pm (Central US)In 2012, 97% of one portfolio was tied to a single stock—a position that created incredible highs when the market was up and intense anxiety when it wasn’t. That level of concentration is a time bomb, and yet it’s exactly where many high earners find themselves after a liquidity event or years of accumulating company equity. Traditional advisors didn’t have answers beyond a generic 60/40 allocation and a “withdraw 4% in retirement” plan, none of which solved the real challenge: how to reduce concentration risk, generate income today, and still grow wealth over time.Most investors are taught the drawdown model—accumulate during your working years, then start selling assets in retirement. But this structure exposes you to sequence-of-returns risk and forces you to hope the market cooperates. The Evergreen model replaces hope with intention by organizing assets into three categories with clear jobs: growth assets that appreciate over time, income assets that generate cash flow today, and preservation assets that protect against downside risk. It’s the difference between treating your portfolio like a grain silo that empties over time and an orchard that produces fruit indefinitely without cutting down the trees.The turning point came from building an Investment Thesis—a strategic blueprint that defined goals, risk tolerance, allocation strategy, and return targets. Without this, most high earners wander from one idea to the next, reacting to market noise instead of executing a cohesive plan. After creating the thesis, a multi-year reallocation began, reducing concentrated equity positions and redeploying capital into a balanced structure aligned with the Evergreen model. The result was a portfolio with 47.5% in growth assets, 47.5% in income assets, and 5% in preservation, producing more than $200,000 per year in cash flow while still increasing in total value by over $2 million in just a few years.This video breaks down exactly how that transformation happened, why the traditional financial system fails individuals with $1M to $30M, and how the Micro Family Office approach allows high earners to run their wealth like a business rather than a side project. It’s a scalable framework used by families at the highest levels—and it works just as effectively for those managing portfolios in the seven- and eight-figure range.If you’re looking to reduce concentration risk, generate meaningful passive income, and build a portfolio that can support your lifestyle without selling off your future, this breakdown will show you the exact system that makes it possible.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 January 7th at 7pm to 9pm (Central US)Here’s something most high earners discover the hard way: once you cross the $1M mark, traditional wealth management stops working.Advisors keep offering the same 60/40 portfolio they use for clients with $200K, while you’re navigating concentrated stock positions, liquidity events, complex taxes, and investment opportunities they’ve never evaluated. You’re no longer in the personal-finance world… but you’re also not in the $100M+ family office world.You’re in the financial services desert.This week’s episode breaks down the solution: the Micro Family Office framework — the system designed specifically for people with $1 to $30 million who want professional-grade wealth management without the cost of a traditional family office.What You’ll Learn in This 14-Minute Breakdown• Why the industry isn’t built for people at your wealth levelOnce you cross seven figures, your opportunities — and risks — get more complex. Traditional advisors simply aren’t equipped for it.• The origins of the family office modelFrom 6th-century estate stewards to Rockefeller’s 1882 office to today’s $10T global family office ecosystem — and why these structures consistently outperform the market.• Why $1–$30M investors are completely underservedToo sophisticated for generic advice, not large enough for a $2M-per-year Single Family Office.• What a Micro Family Office actually isA streamlined, efficient system that gives you:– Strategic planning– Tax and legal protection– Unified reporting– Fractional expert support– A CEO-level operating cadence for your wealth• The WealthOps Framework: Architect → Build → RunA clear blueprint for designing, structuring, and operating your personal wealth like a real business.• The 7 Components of a Micro Family OfficeVision & StrategyPortfolio StructureLegal & Tax ProtectionOperational ProcessesPerformance & DataTeam & AdvisorsExecutive Governance• Why this model outperforms traditional advisorsBecause it’s custom-built around your goals — not a standardized risk questionnaire.When you build your Micro Family Office, you’re not “managing accounts.”You’re running a wealth operating system that improves decision-making, reduces risk, increases tax efficiency, and supports long-term generational strategy.It’s the same systematic approach family offices use — now accessible at your scale.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 January 7th at 7pm to 9pm (Central US)For more than 1,400 years, the world’s wealthiest families have used a structured system to preserve, protect, and grow their wealth across generations. From the major-domos of the 6th century to the Rockefellers in the 1880s to the more than 10,000 family offices operating today, this model has quietly powered the longest-lasting fortunes on earth.But here’s what almost nobody talks about:If your net worth is between $1 million and $30 million, you’ve been completely locked out of this proven system. You’re too sophisticated for generic personal finance advice, yet not large enough for a traditional family office with multimillion-dollar annual operating costs.This episode breaks down why a Micro Family Office fills that gap—and why this moment in history makes it essential. With $124 trillion set to transfer across generations in the next two decades, and millions of new millionaires being created through tech equity and liquidity events, the need for structured wealth management has never been greater.Here’s what you’ll learn:* The “financial services desert” that exists for people with $1M–$30M* How family offices evolved from medieval stewards to modern wealth engines* Why traditional advisors give the same advice to a $100K client and a $10M client* The three wealth management structures—and the limitations of each* What a Micro Family Office actually is and how it operates* The four phases of the WealthOps Framework: Architect, Build, Run, and Succession* How to build a lean, efficient wealth management system using fractional experts* What it really costs to run a Micro Family Office I will show you how to take control of your wealth, reduce complexity, and build a system that supports both your lifestyle and your legacy. You don’t need $100 million to think like a family office—you just need the right structure, strategy, and operational cadence.If you’re ready to understand how sophisticated wealth is actually managed—and how to apply those principles at your scale—this video is your starting point.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 December 17th at 7pm to 9pm (Central US)What if I told you that a $1.5M portfolio could generate $120K a year in income… pay less than $10K in taxes… and never require you to sell a single asset?In this video, I break down the exact Evergreen Portfolio model I personally use to generate over $200,000 per year in portfolio cash flow—without withdrawals, without relying on the stock market, and without slowly draining my net worth over time.Most high earners and tech professionals are stuck in the traditional “grow and drawdown” retirement model. Your financial advisor builds a big nest egg… then you spend the next 30 years selling pieces of it just to live. It exposes you to sequence-of-returns risk, high taxes, and the real possibility of running out of money.That’s not how ultra-wealthy families manage their wealth.In this 16-minute breakdown, I’ll show you how to build what I call an Evergreen Portfolio—a wealth system designed to generate monthly income while your principal continues to grow. You’ll learn the same asset allocation principles used by TIGER 21 members and $20M+ family offices, adapted for individuals with $1M to $30M in assets.Here’s what we’ll cover:* The failure points of the traditional 4% withdrawal model* How sequence-of-returns risk quietly destroys retirements* Why portfolios built only on stocks, index funds, and bonds underperform* The three Evergreen asset categories: Income, Growth, and Capital Preservation* How to target 6%–12% annual yields with the right income assets* How tax optimization can add 2%–3% in returns every year* The four pillars of an Evergreen portfolio: selection, tax planning, risk management, and operational cadence* A real allocation example of a $1.5M Evergreen Portfolio producing $143,000 in annual income* How to start transitioning your own portfolio in a tax-efficient way* The mindset shift from being a portfolio “consumer” to becoming the CEO of your wealthIf you’ve built a seven- or eight-figure net worth but your portfolio isn’t giving you the freedom you want, this video will completely change how you think about investing, cash flow, and long-term wealth.This is the exact framework I use. It’s how I built my own Evergreen Portfolio. And it’s how sophisticated investors protect and grow their wealth for generations.If you want to stop relying on hope, stop selling assets, and start running your portfolio like an operating business, this video is your roadmap.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 December 17th at 7pm to 9pm (Central US)If your net worth is over $1 million, I’m about to show you how the ultra-wealthy turn their portfolios into cash flow machines—and why your financial advisor will likely never teach you this.Most traditional advisors will put you in a 60/40 portfolio and tell you to keep growing your net worth until retirement. The goal? Just get a bigger number on the screen. Then, maybe, if the market plays nice, you can start pulling 4% a year at 65.But here’s what they don’t tell you: families managing $100+ million aren’t waiting until 65. They’re generating income today—and their wealth is still growing.Now, you might be thinking, “But I don’t have $100 million. Can I still do this?”That’s the exact question I spent the last 10 years answering. A few years ago, my portfolio was 98% in public stocks—and it produced zero cash flow. Today, that same portfolio pays me over $200,000 a year in income without selling assets, without touching principal, and it has grown by over $2 million in value.In this video, I’m going to walk you through the three-step process I used to transform my portfolio into what I call an Evergreen Portfolio—a strategy designed to generate income today and build long-term wealth.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

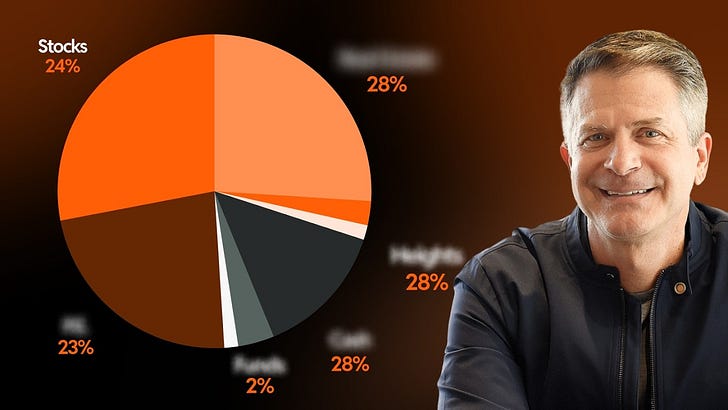

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 December 17th at 7pm to 9pm (Central US)Did you know that investors with over $20 million allocate only 23% of their portfolios to public stocks and 7% to bonds, while most financial advisors recommend 60% in stocks and 40% in bonds?In this episode, I share how the ultra-wealthy allocate the other 70% of their portfolios and how you can model their approach. We’ll dive into the key assets they use, such as real estate and private equity, and how these asset classes generate higher returns, offer tax advantages, and protect against market volatility.Follow along as I break down how you can implement these strategies and transform your portfolio into a wealth-building machine.Key Topics Covered:* How allocations in real estate and private equity generate passive income and hedge against inflation.* Why the ultra-wealthy allocate only 23% to public equities and how this can benefit you.* The importance of strategic financial planning and how to start applying these concepts to your own portfolio.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 December 10th and 11th at 7pm to 9pm (Central US)I made $3.3 million in five minutes during my first IPO. Six months later, I was lying in bed, staring at the ceiling, completely overwhelmed. I had always believed that seeing seven figures in my bank account would bring freedom—but instead, I had more anxiety than ever.Here’s the uncomfortable truth: making money and managing money are completely different skills.This video is a deep dive into the six most common—and most dangerous—mistakes I see first-time millionaires make. I’ve lived through all of them. I’ll also walk you through the practical, systematic framework that helped me turn chaotic wealth into a calm, income-generating portfolio.It all starts with Mistake #1: investing without first creating an Investment Thesis and a Legacy Statement. This one mistake can cost you more than any market downturn. When you skip the step of defining why you’re building wealth and how you’re going to do it, every investment becomes a guess. And guesswork is expensive.Mistake #2 is being overexposed to concentrated stock positions—especially common for tech employees. If your net worth is tied to one stock, you’re not building wealth, you’re placing a bet. Diversification isn’t just about risk management; it can also increase returns by up to 15%.Mistake #3: treating a multimillion-dollar portfolio like a side project. If you wouldn’t run a $5 million business without systems, strategy, and reviews, why are you doing that with your wealth? Without structure, you could be leaving up to 3% in annual returns on the table.Mistake #4 is treating tax planning as an afterthought. High-net-worth individuals who ignore tax strategy are giving away tens of thousands of dollars per year—sometimes more. Smart, proactive tax planning isn’t optional at this level. It’s essential.Mistake #5: settling for cookie-cutter financial advice. Most financial advisors are not equipped to serve clients in the $1–30 million range with real strategy. If you’re being offered a generic 60/40 portfolio, you’re likely getting advice designed for scale, not for success.That’s why I believe in building what I call a Micro Family Office. It’s a lean, tech-enabled version of a traditional family office that gives you access to the same tools, strategies, and investment opportunities that ultra-high-net-worth individuals use—but tailored to your portfolio size.Finally, Mistake #6 is the root of all the others: confusing making money with managing wealth. Just because you’re excellent at earning doesn’t mean you automatically know how to build lasting financial systems. They’re completely different mindsets, timelines, and skill sets.This video is the one I wish existed when I hit seven figures and had no idea what to do next. If you want to avoid years of trial and error, start by building your foundation—your Legacy Statement and Investment Thesis—and make every financial decision from there.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 November 12th and 13th at 7pm to 9pm (Central US)If you think hitting $1 million means you’re financially free, think again. That might’ve been true in 1980, but today? That barely puts you in the top 10% of net worth in America—and it’s not enough to stop working. In todays episode, I break down the exact net worth thresholds for the top 10%, 5%, and 1% in the U.S.—both total net worth and investable net worth. I’ll also share where I personally stand, how wealth strategies evolve at each level, and what it really takes to break into the top 1%. Using fresh data from the Federal Reserve’s 2022 Survey of Consumer Finances, we’ll walk through how wealth changes—not just in amount, but in structure. You’ll see why the climb from median net worth to the top 10% is steep, but getting from 10% to 1% is an exponential leap. And here’s the big insight: the difference between owning assets and owning capital. Most people in the top 10% are “house-rich,” but not capital-rich. Nearly 60% of their wealth is tied up in a primary residence that doesn’t generate income. Meanwhile, in the top 1%, nearly half of net worth comes from private business equity—not real estate or stocks. We’ll also unpack what I call The Great Decoupling—the moment the truly wealthy shift their wealth strategy entirely. It’s not about more assets—it’s about different kinds of assets, systems, and mindset. If you’re a high earner or successful professional feeling stuck—even with a $2M+ portfolio—this is your wake-up call. You may already be in the top 10%, or even top 5%, but if you’re still using the wrong wealth management playbook, you’ll never break into the top 1%. Whether you’re just starting to think about investable net worth, or already building legacy-level wealth, this video is your roadmap for moving from income dependence to true financial independence—and eventually, to becoming the CEO of your wealth.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 October 22nd and 23rd at 7pm to 9pm (Central US)After growing my portfolio to over $8 million while living off the cash flow, I’m here to share the real truth about investing—and why the advice to “trust your gut” and “do more research” is actually holding you back from success.In this video, I’ll debunk the biggest investment myths that keep high earners stuck in a cycle of bad decisions. You’ll learn why trusting your instincts can lead to major losses, and why doing endless research doesn’t always bring better results.I’ll also introduce the decision-making framework that ultra-wealthy family offices use to make smart, emotion-free investment choices. This includes two key documents—the Legacy Statement and the Investment Thesis—that guide every investment decision. Once you have these, your decisions will be clear and confident.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 October 22nd and 23rd at 7pm to 9pm (Central US)A few years ago, I stood at a crossroads with my portfolio.Option one: do what most people do—dump it all into index funds and ETFs, hope the market performs, and wait 30 years.Option two: deploy capital like the wealthy do—across multiple asset classes, focused on income, with strategic allocations that actually pay you now.I chose option two.While still working in tech, I built an income-focused portfolio with $530,000 across 9 investments, and it generated $57,000 in annual income. That portfolio became the foundation for what now brings in over $200,000/year in passive income.But here’s the real value of this video—I’m not just showing you what I did. I’m breaking down what I’d do differently today if I were starting over with the same $500K.This isn’t theory. These are hard-earned lessons from millions deployed, simplified into a refined framework that anyone can follow—without needing to be a real estate expert, financial advisor, or full-time investor.In this video, I walk through:* What I originally invested in (with numbers)* What worked, what didn’t, and why* The 5-part framework I’d follow today to generate more income with less stress* How I went from complexity to a scalable, boring machine that prints incomeIf you’re sitting on $500,000 or more and want to build a portfolio that pays you to live—not 30 years from now, but today—this video will walk you through the exact strategy I’d use.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 October 22nd and 23rd at 7pm to 9pm (Central US)In 2012, I watched my net worth jump by $3 million in just minutes after my company went public. I should’ve been celebrating—but instead, I was overwhelmed. What was I supposed to do with this money? I assumed the experts at Morgan Stanley would help me figure it out. But the advice they gave me was the same cookie-cutter portfolio they hand to someone with $100K in a 401K. That’s when I realized something was seriously broken.This week I’m going to walk you through the exact 3-phase blueprint I used to escape the Financial Dead Zone and scale my portfolio to over $8 million—while generating over $200,000 a year in passive income and covering all my family’s living expenses.This isn’t about risky bets or timing the market. It’s about taking the systems and strategies of the ultra-wealthy and scaling them down to fit your level of assets.Here’s what we’ll cover:* Why traditional advisors can’t help you scale from $1M to $10M+* The real cost of staying in the Financial Dead Zone* The 3 phases of building your own Micro Family Office: Architect, Build, Run* How to create a custom Investment Thesis aligned with your goals* Why proper infrastructure and a fractional expert team changes everything* How to implement systems and processes that treat your wealth like a businessI’ll also show you how this system made my life simpler, not more complicated—removing the stress and emotion from money decisions, and replacing it with clarity, control, and predictable growth.Whether you’re aiming for financial freedom, generational transfer, or lifestyle flexibility—this is the strategy that works.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 October 22nd and 23rd at 7pm to 9pm (Central US)Becoming a millionaire overnight doesn’t mean you automatically know how to manage wealth. In this video, I break down the 4 biggest mistakes new millionaires make—and how to avoid them.After my IPO at Splunk, I realized the financial industry wasn’t built for people with $1M–$30M net worth. Instead of cookie-cutter advice like “60/40 portfolios” and “withdraw 4%,” I learned the hard way that the wrong moves can cost you millions.Here’s what you’ll discover: * Why buying liabilities like houses and cars too early destroys long-term wealth * How “knee-jerk investing” leads to massive portfolio risk * Why tax strategy must come before financial advice * The danger of listening to advisors who’ve never built wealth themselves If you’ve built wealth through equity compensation, a business exit, or years of saving and investing, this guide will help you protect it, grow it, and manage it like a business.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com