Discover Byted Size News

Byted Size News

121 Episodes

Reverse

Introduction:

In today’s episode, we delve into five pivotal developments shaping the global technology and innovation landscape. First, we examine China’s strategic move to weaponize its 92% monopoly on rare earth elements, creating a chokehold on critical tech and defense supply chains, and how this ‘knowledge embargo’ marks a turning point in techno-nationalism with profound implications for Western innovation. Next, we analyze OpenAI’s aggressive expansion of its $4.50 ChatGPT Go subscription plan into 16 emerging markets, a classic Silicon Valley land grab aimed at securing the next billion AI users and reshaping the global AI competitive arena. We then explore a landmark legal case where ChatGPT chat logs have become key evidence in a $150 billion arson investigation, raising urgent questions about AI user privacy and legal privilege. Following that, we discuss the controversy over a proposed $100,000 H-1B visa fee, spotlighting Nvidia CEO Jensen Huang’s personal story and the broader impact on talent acquisition and the US startup ecosystem. Finally, we cover Citi’s major investment in stablecoin firm BVNK, signaling a Wall Street gold rush into the $9 trillion digital payments market, driven by new regulatory frameworks and the future of global finance.

Content and Timestamp:

00:00:55 China Tightens Grip on Rare Earth Exports, Escalating Tech Trade War

00:04:49 OpenAI Expands Budget-Friendly ChatGPT Go to 16 More Asian Countries

00:08:19 ChatGPT Image Helps Nab Suspect in Deadly Pacific Palisades Fire

00:12:28 Nvidia CEO Jensen Huang: Trump's H-1B Fee Would Have Barred My Family's Immigration

00:16:12 Citi Backs Stablecoin Firm BVNK as Wall Street Embraces Crypto Payments

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we uncover some unsettling truths about the AI landscape and its broader implications. First, we examine Oracle’s AI cloud business, which operates on a strikingly low 14% gross margin—a loss-leader strategy aimed at capturing market share from more integrated cloud rivals. We explore why this razor-thin margin matters for Oracle’s financial health and competitive positioning. Next, we analyze the rise of private capital keeping unicorns away from public markets, with the median IPO age now at 13 years. This shift creates a two-tiered system that could reshape Silicon Valley, wealth inequality, and public investment returns. We then spotlight Zelda Williams’ powerful condemnation of AI recreations of her late father, Robin Williams, sparking a heated debate over digital necromancy, legacy, and the future of synthetic performers in Hollywood. Following that, we discuss Intel’s critical comeback strategy centered on its Panther Lake chip, which faces challenges due to a low yield on its advanced 18A manufacturing process. Finally, we reveal a disturbing new scam trend where AI-generated fake founders and fabricated tragic stories are used to sell cheap goods through bogus “family-run UK businesses,” exposing major regulatory blind spots in e-commerce and raising urgent questions about platform accountability.

Content and Timestamp:

00:00:56 Oracle's Cloud Margins Squeezed by Nvidia Chips: Profitability Concerns Arise

00:05:43 The Private Path: Why Startups Are Delaying IPOs and What It Means for Investors

00:10:32 Zelda Williams Pleads for End to AI-Generated Videos of Her Late Father, Robin Williams

00:14:16 Intel Bets Big on Panther Lake: A Critical Moment for Chipmaker's Comeback

00:18:48 AI-Generated Scams: Fake UK Businesses Lure Shoppers with Deceptive Imagery

Powered by voieech.com, producing personalized content just for you.

Introduction:

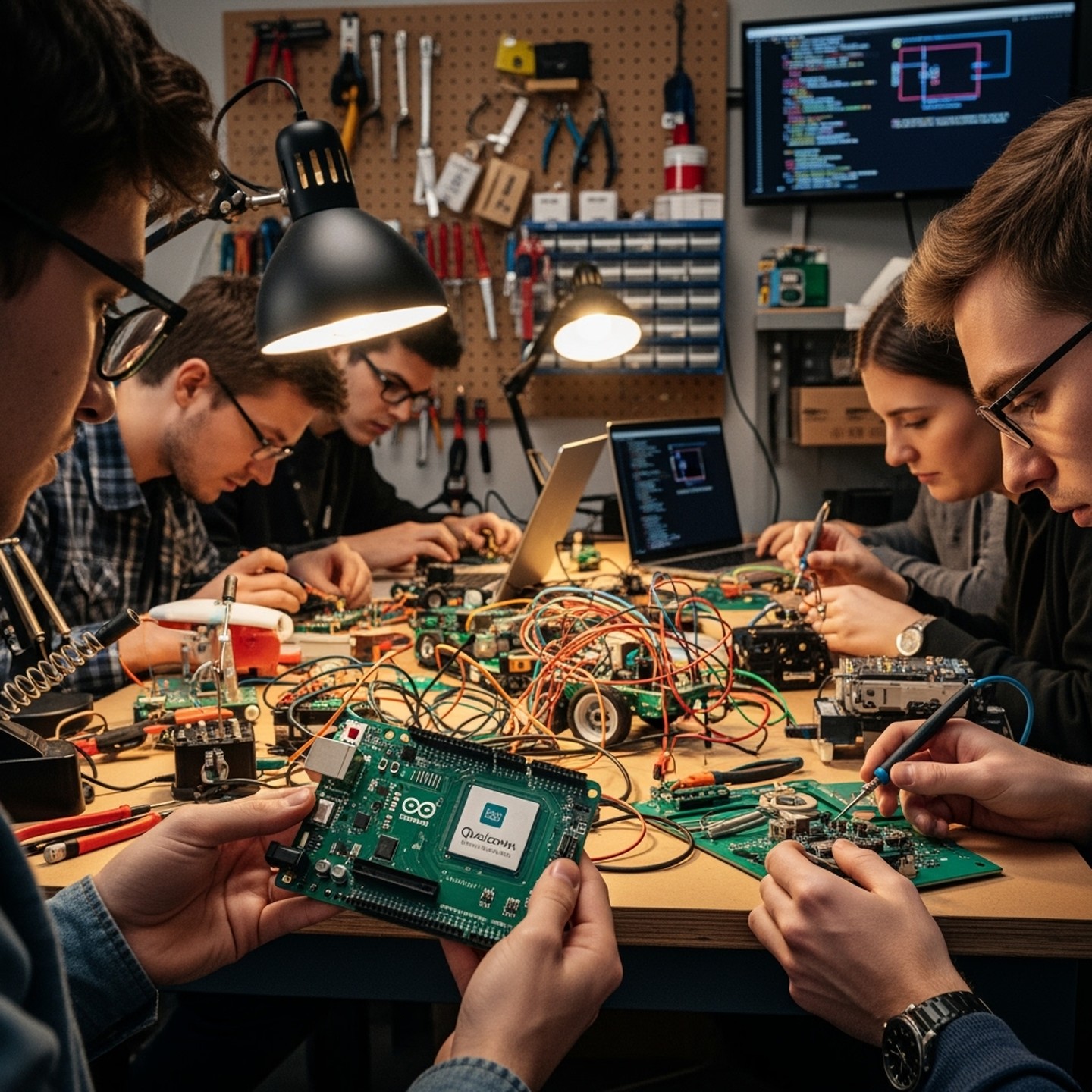

In today’s episode, we cover five compelling stories shaping the technology and innovation landscape. First, Qualcomm’s acquisition of Arduino signals a strategic move to challenge Nvidia by engaging the grassroots robotics community with a powerful $45 development board. Next, OpenAI’s integration with Figma sparks a 7% stock rally, hinting at the emergence of a conversational app store and opening new horizons for developers. Then, we reveal how tracking a single stolen iPhone led to the dismantling of a criminal ring smuggling 40,000 phones annually from the UK to China, exposing a complex illicit supply chain. Following that, a new opera frames the AI revolution as a modern iteration of a 200-year-old industrial conflict, questioning long-held assumptions about technological change and labor. Finally, Rivian’s $5 billion investment in a new factory underpins its ambitious push to mainstream electric vehicles with the affordable R2 model, marking a pivotal moment for the company’s global growth and profitability.

Content and Timestamp:

00:00:42 Qualcomm Acquires Arduino to Boost Robotics Presence and Diversify Revenue

00:04:18 Figma Stock Jumps on ChatGPT Integration Hype

00:07:00 One iPhone Leads to Bust of International Stolen Phone Ring Smuggling 40,000 Devices to China

00:09:19 New Opera Explores AI as the 'Modern Industrial Revolution,' Drawing Parallels to Luddite History

00:11:57 Rivian's Design Evolution: From Iconic Headlights to Broad Market Appeal with R2 and R3

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we delve into five pivotal developments shaping the future of technology and energy. First, OpenAI’s groundbreaking 6-gigawatt GPU deal with AMD challenges Nvidia’s long-standing dominance, marking a significant shift with the potential to establish a viable CUDA alternative. Next, Nvidia’s CEO candidly admits that China is only “nanoseconds behind” in chip development, highlighting the intensifying tech rivalry and its implications for global semiconductor supply chains. Then, a $1 billion federal loan is breathing new life into Michigan’s Palisades Nuclear Plant, spearheading a historic resurgence of nuclear energy to power the booming AI industry. We also explore how UK universities are leveraging AI-powered wargames to enhance national security strategies, signaling innovative applications of AI in defense. Finally, Amazon and Meta join forces to create a market for sustainable concrete, aiming to drastically reduce emissions from data center construction through a novel “book-and-claim” approach. Join us as we unpack these transformative stories that could redefine the technology, energy, and defense landscapes.

Content and Timestamp:

00:00:51 OpenAI to Acquire 10% Stake in AMD as Part of Major AI Chip Deal

00:05:08 China's AI Chip Ambition: Closing the Gap on Nvidia's Dominance

00:08:27 Nuclear Revival: Michigan Leads the Way with Recommissioned Plant and New Small Modular Reactors

00:11:40 UK Universities Harness AI for National Security 'Wargames'

00:14:24 Tech and Real Estate Giants Unite to Decarbonize Concrete Industry

Powered by voieech.com, producing personalized content just for you.

Introduction:

In this episode, we explore the rising trend of nearly half of Gen Z turning to AI for dating and relationship advice, raising concerns about outsourcing intuition and emotional development. We discuss why this phenomenon is a core feature of large language model design and its implications for cultivating real-world emotional skills. Next, we examine the surge in quantum computing stocks despite expert predictions that a true breakthrough is still years away, analyzing the disconnect between market hype and technical realities shaping the quantum architecture wars. We also break down Perplexity AI’s bold strategy in releasing its AI-native browser, Comet, for free after a $34.5 billion bid for Chrome, and what this signals for the future of AI-powered browsing. Additionally, we delve into the unprecedented $5 billion Nvidia investment in Intel, forming a ‘frenemy’ alliance aimed at securing US chip manufacturing, and the broader impact on industrial policy and national security. Finally, we investigate the recent crash of two Amazon high-tech delivery drones into the same crane, prompting federal investigations and raising critical questions about the future of autonomous logistics and public trust.

Content and Timestamp:

00:00:49 AI's Growing Role in Dating and Relationships: From Breakups to Boundaries

00:04:35 Quantum Computing Stocks Soar on Positive News and Major Investments

00:07:44 Perplexity AI's Comet Browser Goes Free Worldwide, Challenging Tech Giants

00:10:27 Intel's $16 Billion Surge: US Government Stake Jumps 50% Amid CHIPS Act Investment

00:13:30 Amazon Drone Crash: Two Delivery Drones Collide with Crane, Prompting Federal Probes and Service Pause

Powered by voieech.com, producing personalized content just for you.

Introduction:

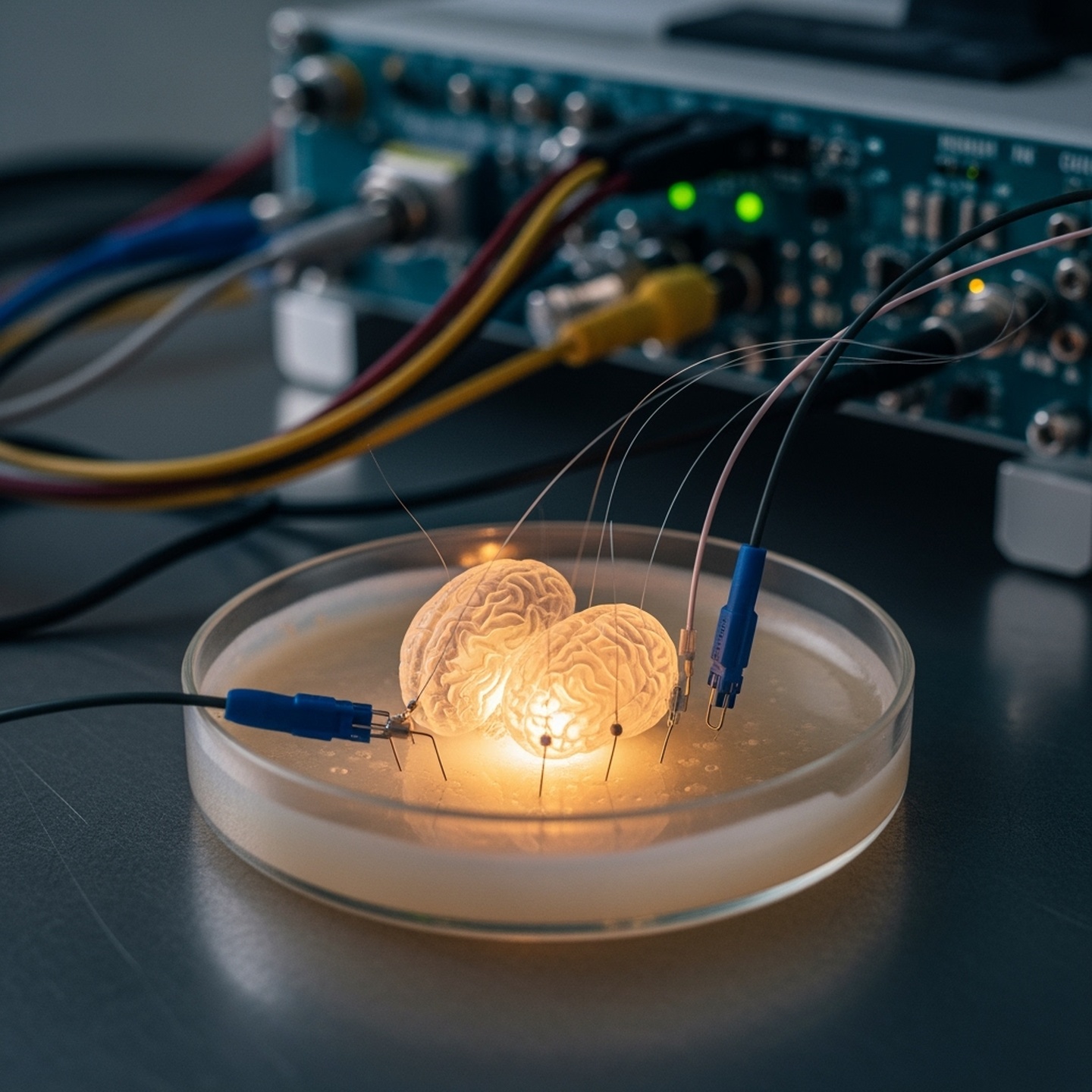

In today’s episode, we explore five critical stories shaping the future of technology and society. First, researchers have made groundbreaking progress in biocomputing by creating living computers from human brain cells—“wetware”—that challenge our understanding of AI and pose urgent ethical questions. Next, we examine how the United States dominates 97% of generative AI investment, creating a high-risk “Platform Trap” for European startups and raising concerns about Europe’s ability to compete globally. We then discuss Apple’s latest AirPods, which offer real-time translation capabilities, but face regulatory hurdles in the EU due to the Digital Markets Act, impacting industries from tourism to aviation safety. Fourth, AI chipmaker Cerebras Systems abruptly pulls its IPO plans after revealing that 87% of its revenue depends on a single foreign customer, highlighting the intense pressures in the AI hardware sector. Finally, we delve into a disturbing report revealing that TikTok’s algorithm is actively recommending pornography to children, even with safety settings enabled, putting the platform under scrutiny from the UK’s new Online Safety Act and raising the stakes for tech regulation worldwide.

Content and Timestamp:

00:00:46 Scientists Develop 'Wetware': Mini Human Brains Powering Computers

00:04:57 Europe's AI Ambition: Can It Keep Pace with US Innovation and Investment?

00:08:35 Real-Time Translation: A Travel Revolution with Hidden Costs?

00:11:19 AI Chipmaker Cerebras Withdraws IPO After $1 Billion Funding Round, Citing Outdated Prospectus and Market Shift

00:14:23 Report: TikTok Algorithm Recommends Pornography to Children, Despite Safety Settings

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we dive into the latest developments shaping the tech landscape and the graduate job market. First, we explore OpenAI’s turbulent launch of its video app Sora 2, sparking debates on the risks of its “synthetic data flywheel” approach and the broader implications for US-China AI competition. Next, we examine Sony’s strategic pivot after the failure of its multiplayer-heavy Concord project, shifting focus to $200 million single-player blockbusters like ‘Ghost of Yōtei’ in a bid to recapture PlayStation’s cinematic roots. Then, Jeff Bezos weighs in on the AI boom, calling it an “industrial bubble” fueled by inflated valuations, yet argues this surge is a productive phase paving the way for long-term infrastructure gains. We also highlight the rise of Silicon Valley’s “neoprimes” — agile, software-first defense startups attracting $38 billion in venture capital and challenging legacy giants in AI-driven warfare. Finally, we address the grim reality facing recent graduates, as tech entry-level hiring plunges 50% amid AI-driven productivity gains, degree inflation, and “ghost jobs,” reshaping perceptions of STEM degrees and career prospects.

Content and Timestamp:

00:00:53 OpenAI's Sora 2: Viral AI Videos Spark Safety Debate and Deepfake Concerns

00:04:57 PlayStation's 'Ghost of Yōtei' Signals Return to Single-Player Blockbusters

00:07:54 Bezos: AI in 'Industrial Bubble,' But Society Will Reap 'Gigantic' Benefits

00:11:39 Silicon Valley's 'Neoprimes' Reshape Defense Tech with Billions in Funding

00:15:13 College Degrees Lose Luster: New Grads Face Toughest Job Market in Decades

Powered by voieech.com, producing personalized content just for you.

Introduction:

In this episode, we dive deep into some of the most compelling stories shaping the future of technology and finance. First, Thomas Wolf, co-founder of Hugging Face, challenges the prevailing optimism in Silicon Valley by arguing that current AI models, including those from OpenAI, are unlikely to deliver Nobel Prize-level scientific breakthroughs. He highlights a fundamental limitation: AI’s focus on predicting the "most likely next word" rather than disrupting existing scientific paradigms. Next, we explore Microsoft’s bold strategic pivot as CTO Kevin Scott reveals plans to develop custom AI chips, aiming to reduce dependence on Nvidia and AMD amid a growing compute capacity crunch. We then turn to Robinhood CEO Vlad Tenev’s prediction of unstoppable asset tokenization transforming global finance, with Europe leading the charge while the U.S. lags behind. Following that, we analyze the surge in South Korean chipmakers SK Hynix and Samsung after partnering with OpenAI on the $500 billion Stargate project, a move intensifying the race for high-bandwidth memory chips critical to AI development. Finally, we break down Elon Musk’s milestone of becoming the first individual with a net worth over $500 billion, fueled by investor confidence in Tesla’s AI and robotics ambitions—and what this means for innovation and corporate leadership going forward.

Content and Timestamp:

00:00:52 Hugging Face Co-founder: Current AI Models Won't Achieve Scientific Breakthroughs

00:05:03 Microsoft's AI Chip Ambition: Shifting Away From Nvidia and AMD

00:10:06 Robinhood CEO: Asset Tokenization is an "Unstoppable Freight Train" for Global Markets

00:14:00 SK Hynix and Samsung Soar as OpenAI Partnership Fuels AI Chip Race

00:18:30 Elon Musk Shatters Wealth Records, Becomes First Half-Trillionaire

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we dive into five groundbreaking developments shaping the future of technology, defense, and finance. First, discover how California-based startup Aetherflux is revolutionizing solar energy by beaming power from space to Earth using infrared lasers, backed by $60 million in funding and targeting U.S. military applications. Next, we analyze Palantir’s astonishing 1,700% stock surge to a $432 billion valuation, driven by its controversial “Team West” AI strategy and unique AIP Ontology platform, and what this means for enterprise AI competition. Then, we explore the legal battle ignited by Disney’s cease and desist order against Character.AI over AI-generated copyrighted characters, highlighting the evolving landscape of intellectual property rights in generative AI. Following that, we examine Meta’s new AI policy that leverages all user conversations for targeted advertising with no opt-out option, raising important privacy and monetization questions. Finally, we review how a Trump-linked crypto firm is expanding into tokenized oil, gas, and everyday crypto spending with a stablecoin now valued at $2.7 billion, blurring the lines between private enterprise and national policy.

Content and Timestamp:

00:00:51 Aetherflux to Beam Solar Power from Space to Earth via Lasers

00:05:08 Palantir's Meteoric Rise: From Direct Listing Doubts to $432 Billion Valuation in Five Years

00:09:24 Disney Issues Cease and Desist to Character.AI Over Copyrighted Characters

00:12:36 Meta to Use AI Chat Interactions for Targeted Ads and Content

00:16:06 Trump-Linked Crypto Firm Expands with Debit Card and Tokenized Commodities

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we dive into five major stories shaping the future of technology, finance, and global security. First, JPMorgan Chase is revolutionizing Wall Street by integrating OpenAI’s large language models to automate junior banker tasks, challenging the traditional apprenticeship system and potentially reshaping financial careers. Next, the U.S. government is pressing Taiwan to achieve a 50-50 split in semiconductor production, aiming to reduce reliance on Taiwan and bolster national security through a $500 billion investment plan, raising significant geopolitical stakes. Then, China’s startup DeepSeek disrupts the AI landscape by introducing a highly efficient, cost-cutting model that runs on domestic Huawei chips, creating a sanction-proof ecosystem—though questions about reliability remain. We also cover the landmark $55 billion leveraged buyout of Electronic Arts by a Saudi-backed consortium including Jared Kushner’s Affinity Partners, a move that saddles EA with $20 billion in debt and sparks fears about the future of creative freedom in gaming. Finally, we highlight the cybersecurity sector’s growing burnout crisis, driven by relentless cyberattacks and staffing shortages, with serious implications for national security and workforce regulation.

Content and Timestamp:

00:00:53 JPMorgan Chase's AI-Powered Future: A Blueprint for the First Megabank

00:06:21 US Pushes for 50% Domestic Chip Production, Asks Taiwan to Shift Investment

00:12:02 DeepSeek Unveils Cost-Cutting, Efficient AI Model Amid Safety Concerns

00:16:59 Gaming Giant EA Acquired in Record-Breaking $55 Billion Deal, Raising Industry Concerns

00:20:26 Cybersecurity's Hidden Crisis: Burnout Plagues Defenders on the Digital Front Lines

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we explore the seismic shifts shaping the future of AI and its impact on the global economy and workforce. First, we dive into Anthropic’s dramatic $5 billion revenue surge and its bold strategy to triple its international workforce and expand its applied AI team fivefold in 2025. This move positions Anthropic to leapfrog competitors like OpenAI by capturing 32% of enterprise clients with a high-touch, global approach. Next, we examine Ford’s CEO’s stark prediction that AI will replace half of white-collar workers, highlighted by a 38% drop in vulnerable job listings in London, raising critical questions about the future of work and entry-level career pathways. We then investigate a troubling flaw in AI travel planners, where hallucinations generate fake destinations, affecting a third of users and posing significant risks to user safety and travel technology’s credibility. Shifting gears, we analyze GM’s CFO’s forecast that electric vehicle demand will “drop precipitously” as US federal incentives expire, forcing automakers to pivot back toward profitable hybrids and reshaping the US auto market landscape. Finally, we unpack a warning from the head of France’s state investment bank about Europe being “doubly colonized” by US tech and Chinese industry, due to capital flight and a reluctance among European investors to fund homegrown deep tech innovation—a critical challenge for Europe’s competitive edge in AI.

Content and Timestamp:

00:00:51 Anthropic's Global AI Offensive: Tripling Workforce and Expanding Internationally to Challenge OpenAI

00:05:33 AI's Dual Impact: Job Disruption and Enhancement in London

00:10:05 AI's Travel Troubles: Fake Destinations and Dangerous Misinformation

00:14:33 EV Market Faces "Natural Demand" Test as Federal Incentives End

00:18:57 Europe 'Doubly Colonized' by US and China, Warns French Sovereign Wealth Chief

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we delve into five major stories shaping the tech and finance worlds. First, Xiaomi’s ambitious $7 billion, 10-year chip development strategy challenges Apple’s dominance by rejecting the annual upgrade cycle, focusing instead on quality and long-term profitability. Next, former Meta chief Nick Clegg warns that the TikTok deal is triggering a global wave of data localization, risking the fragmentation of the open internet amid escalating US-China tech tensions. Then, we spotlight Brian Lovern, a former weatherman turned trader who achieved a 140% gain and secured $3 million in backing from FundSeeder, a platform using algorithms to disrupt Wall Street’s talent monopoly. Following that, YouTube TV’s 10 million subscribers face a looming blackout as negotiations with NBCUniversal stall over streaming rights and pricing, a conflict that may reshape the TV landscape. Finally, we examine a new ETF that democratizes access to the private credit market, while raising concerns about liquidity mismatch risks reminiscent of pre-2008 financial engineering. Stay tuned as we unpack these stories and their wider implications.

Content and Timestamp:

00:00:54 Xiaomi's Strategic Chip Development: A Long-Term Play, Not a Yearly Race

00:05:10 Former Meta Global Affairs Chief Warns Tech Against Political Intervention Amid TikTok Deal

00:08:37 From Weatherman to Wall Street: FundSeeder Unearths Hidden Trading Talent Globally

00:11:35 YouTube TV and NBCUniversal On Brink of Blackout: What You Need to Know

00:15:05 Private Credit for the Masses: New ETF Opens Door for Retail Investors

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we delve into five critical stories shaping the intersection of technology, investment, and market dynamics. First, Minnesota is proposing a $500,000 fine targeting the creation of AI deepfake pornography through 'nudify' apps, aiming to close a significant legal loophole by shifting liability from distribution to creation. We explore how this legal evolution could influence AI platform regulation and content moderation policies. Next, a Goldman Sachs report reveals that ultra-wealthy family offices are increasingly favoring public stocks and energy sector investments over high-risk private AI startups. We discuss why this strategic shift marks a turning point in AI venture funding. Third, Honeywell introduces its new SURF-A cockpit alert system designed to prevent runway collisions amid a decade-high surge in near-misses, potentially transforming airport safety protocols and pilot workflows. Fourth, Tesla faces a steep 32.6% decline in European sales, driven by Elon Musk’s controversial political stance and intensified competition from Volkswagen and BYD. We analyze the implications of this slump for Tesla and the broader European EV market. Finally, Xiaomi challenges Samsung in Europe with its affordable flagship 15T series smartphones and a new integrated 'Human x Car x Home' ecosystem powered by HyperOS, signaling a bold push beyond traditional smartphone markets.

Content and Timestamp:

00:00:52 Friends Fight Back: The Alarming Rise of AI "Nudify" Deepfakes and the Push for Legal Accountability

00:04:27 Ultra-Wealthy Family Offices Favor Public Stocks Over Startups for AI Investments

00:08:21 Honeywell's New Cockpit Alerts Aim to Prevent Airport Collisions

00:11:41 Tesla's European Sales Slump and Musk's Controversial Politics Impact Stock

00:14:46 Xiaomi Challenges Samsung with New 'Affordable Flagship' Smartphones and Appliances

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we dive into some of the most impactful tech and science developments shaping the future. First, we explore Google's dramatic shift in content moderation, as YouTube reverses its misinformation policies, sparking a brand crisis and raising questions about a fragmented global internet. Next, we analyze Accenture’s bold ultimatum to its workforce: reskill in AI or face exit, highlighting a massive talent transformation in tech consulting. Then, we spotlight a biotech breakthrough where engineered E. coli bacteria convert plastic waste into valuable painkillers, challenging the dominance of traditional microbial platforms. We also examine Anthropic’s record-breaking $1.5 billion copyright settlement for using pirated books to train AI models, a landmark moment redefining data sourcing in AI development. Finally, we discuss OpenAI’s $22.4 billion partnership with CoreWeave, signaling a strategic shift in AI computing power beyond Microsoft and intensifying the AI infrastructure race.

Content and Timestamp:

00:00:44 Google's Policy Pivot: From Fact-Checking to Free Expression

00:04:43 Accenture's AI-Driven Reskilling: 'Exit' Strategy for Non-Adaptable Staff

00:08:28 From Plastic Waste to Painkillers: The Unsung Heroism of E. coli in Biotechnology

00:12:46 Anthropic's $1.5 Billion Copyright Settlement: A Landmark for AI and Authors

00:16:10 CoreWeave and OpenAI Cement Massive $22.4 Billion AI Infrastructure Partnership

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we dive into five major stories shaping the future of technology, activism, and industry resilience. First, Databricks has committed $100 million to a direct partnership with OpenAI, bypassing Microsoft and intensifying the enterprise AI battle against Snowflake. We’ll explore why this deal marks a critical turning point for OpenAI’s independence and the competitive dynamics in the cloud AI ecosystem. Next, Generation Z activists across Asia are using AI and decentralized technologies to mount powerful anti-corruption protests that challenge traditional state censorship. We’ll unpack this emerging digital activism playbook and its implications for governments and tech platforms worldwide. Then, Danish AI startup Light raises $30 million to revolutionize financial workflows with its innovative “numbers as text” model, aiming to disrupt giants like Oracle and SAP. We’ll examine how this “Great Unbundling” could reshape AI-driven auditing and enterprise software. Following that, X suffers a landmark legal defeat in India over its battle with government-mandated content takedowns, threatening its legal safe harbor and setting a global precedent for platform regulation. Finally, we analyze the UK government’s bold plan to financially support Jaguar Land Rover suppliers hit by a crippling cyberattack, exposing vulnerabilities in just-in-time manufacturing and raising urgent questions about industrial cyber resilience.

Content and Timestamp:

00:00:54 Databricks Commits $100M to OpenAI, Forging Key AI Partnership

00:04:33 Gen Z's Social Media Uprising Against Corruption in Asia

00:08:37 AI Finance Startup Light Secures $30 Million, Eyes US Expansion

00:13:27 India Rules Against X in Free Speech Battle Over Content Takedowns

00:17:04 UK Government Considers Bailout for JLR Suppliers Amid Cyberattack Fallout

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we dive into five compelling stories that highlight both the challenges and opportunities at the intersection of technology and humanity. We begin with NASA’s Artemis II mission, set for February 2026, which marks the first crewed lunar journey in half a century. This ambitious public-private collaboration with SpaceX could redefine the future of space exploration. Next, we examine a groundbreaking AI achievement—advanced models passing the elite CFA Level III exam in mere minutes—raising important questions about AI’s role in high-stakes professional fields like finance. Then, we take a nostalgic turn to explore how a simple coding bug in the original 1985 Super Mario Bros. created the legendary “Minus World,” forever changing gaming culture and quality assurance practices. Our fourth story highlights Bollywood stars’ fight against AI deepfakes exploiting a legal loophole in India, emphasizing the urgent need for personality rights legislation in the age of AI-generated content. Finally, we analyze how Micron’s soaring sales in AI memory chips, alongside a decline in traditional data center business, signal a significant shift in IT spending and competitive dynamics within the semiconductor industry. Join us as we unpack these stories and explore how humans can still stay ahead in an increasingly automated world.

Content and Timestamp:

00:00:54 Nasa Targets February 2026 for First Crewed Moon Mission in 50 Years

00:04:53 AI Masterminds CFA Level III in Minutes: A Game Changer for Finance?

00:09:01 The Enduring Legacy of Super Mario Bros.' 'Minus World' Glitch

00:12:46 Bollywood Stars Fight Deepfakes and Misuse of Image, Pushing for Stronger Personality Rights in India

00:17:04 Micron Soars on AI Boom: Earnings Beat and Robust Forecast

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we explore some of the most pressing developments shaping technology, finance, and the automotive world. First, we dive into the staggering $3 trillion AI data center boom—an infrastructure race on par with the Apollo program—that is driving unprecedented demand for power, water, and private grids, while raising new geopolitical risks of “digital colonies” and shaking global energy markets. Next, we analyze Zerohash’s landmark $1 billion valuation following a $104 million investment from Morgan Stanley and other Wall Street giants, uncovering how their “invest-to-own-the-stack” strategy could accelerate crypto adoption in mainstream finance. Then, we examine Amazon’s FTC lawsuit, which exposes the company’s so-called “Iliad” cancellation process designed to trap millions of Prime customers, and discuss the broader implications for product design ethics in Silicon Valley. We also take a closer look at Chinese EV giant BYD’s contingency plan to ditch Nvidia chips, challenging the US chipmaker’s dominance and signaling a potential “AI Splinternet” in the automotive industry. Finally, we focus on Porsche’s recent decision to slash profit forecasts and slow its electric vehicle rollout amid intense competition from Chinese manufacturers, investigating how this pivot back toward combustion engines and e-fuels could reshape the luxury auto market’s electrification race.

Content and Timestamp:

00:00:54 The Trillion-Dollar Challenge: Unpacking the AI Data Centre Boom

00:07:15 Crypto Infrastructure Startup Zerohash Secures $104M Funding, Valued at $1 Billion

00:11:10 Amazon on Trial: FTC Alleges 'Deceptive' Prime Practices and 'Labyrinthian' Cancellations

00:14:46 BYD Prepares for Nvidia Chip Cutoff, Citing In-House Tech as Backup

00:19:43 Porsche's EV Slowdown: A Reality Check for Luxury Automakers?

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we dive into some of the most significant shifts shaking the tech and investment landscapes. First, we examine the emerging “patriot” consortium led by Rupert and Lachlan Murdoch, along with Larry Ellison and Michael Dell, as potential buyers of TikTok’s U.S. operations—a move stirring concerns about control over social media algorithms and the broader implications for digital influence. Next, we explore OpenAI’s bold expansion into hardware through a partnership with Apple supplier Luxshare and the acquisition of Jony Ive’s design firm for $6.4 billion, signaling a fierce new front in the consumer AI device race. We then analyze Berkshire Hathaway’s quiet exit from its remarkably profitable Chinese electric vehicle investment BYD, reflecting growing geopolitical tensions and a strategic retreat from the region. The episode also covers Apple’s decision to withhold new AI features in Europe, critiquing the EU’s Digital Markets Act for stifling innovation and altering the competitive landscape. Finally, we highlight a pioneering AI transcription tool developed by the University of Surrey that is improving accuracy and transparency in UK Supreme Court hearings, raising important questions about bias and the future of justice systems.

Content and Timestamp:

00:00:50 Murdochs, Ellison, and Dell Tapped for US TikTok Deal, Trump Reveals

00:05:28 Apple Supplier Luxshare Soars on Report of OpenAI AI Device Deal, Challenging Apple's Siri

00:09:37 Berkshire Hathaway Fully Exits Long-Held, Profitable BYD Stake

00:13:01 Apple Escalates Feud with EU Regulators Over 'Walled Garden' Ecosystem

00:17:34 AI Tool Boosts Transparency in UK Supreme Court Hearings

Powered by voieech.com, producing personalized content just for you.

Introduction:

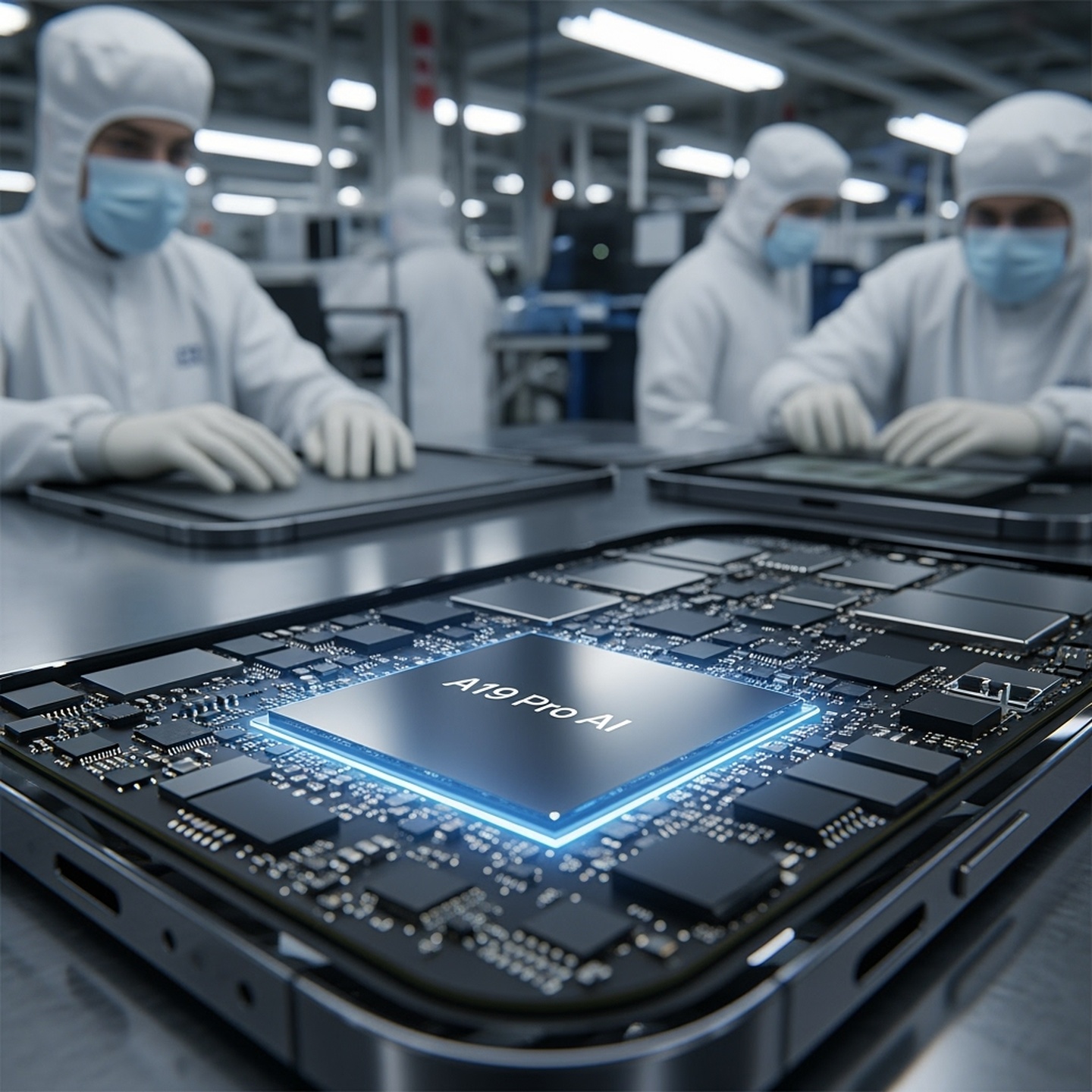

In this episode, we explore some of the most significant developments at the intersection of AI and industry innovation. Apple’s new A19 Pro chip integrates AI directly into its GPU, marking a strategic shift away from longtime partners Qualcomm and Broadcom and signaling a new era for on-device AI performance and future AI-native applications. We then turn to Navan, the travel tech startup that now handles 50% of its user interactions through AI as it files for a Nasdaq IPO, challenging incumbents like SAP Concur with a high level of automation that could reshape enterprise software competition. Next, we examine Airbus’s pause on its CityAirbus electric plane due to battery density challenges, and how US-backed startups are gaining momentum by pivoting to hybrid propulsion systems—an engineering compromise that may redefine the future of sustainable aviation and innovation leadership. CrowdStrike’s ambitious projection to hit $10 billion in revenue by 2031, driven by acquiring AI security platform Pangea and launching a new AI Detection and Response category, highlights a bold AI-native security strategy poised to disrupt rivals such as Palo Alto Networks. Finally, we discuss how a dramatic 98% cost reduction in AI model adoption is pushing fashion brands toward automation, sparking protests from creatives and calls for UK regulation, reflecting the broader debate on AI’s impact on copyright and the creative industries’ future.

Content and Timestamp:

00:00:54 Apple's iPhone Air prioritizes AI with new custom chips, taking control from Broadcom and Qualcomm

00:04:18 Navan Files for IPO Amidst Resurgent Tech Market, Reporting Strong Growth and AI Integration

00:07:42 Electric Aviation's Battery Breakthrough: The Race for Greener Skies

00:10:46 CrowdStrike Soars on Bullish Long-Term Guidance and AI Acquisitions

00:13:38 David Gandy Leads Push for AI Regulation in Fashion, Citing Existential Threat to Human Models and Industry Jobs

Powered by voieech.com, producing personalized content just for you.

Introduction:

In today’s episode, we dive into the extraordinary growth of the private AI market, which has nearly doubled to an astonishing $1.3 trillion, driven by seven leading private AI companies including OpenAI. Despite OpenAI CEO Sam Altman acknowledging this rapid expansion as a potential bubble, massive investments continue to pour into the sector, reshaping the investment landscape. We also explore Nvidia’s surprising $5 billion investment in competitor Intel, a strategic move aimed at countering TSMC’s chip manufacturing dominance and its implications for the global semiconductor supply chain. Next, we take a closer look at Alibaba’s bold $53 billion AI pivot with a breakthrough PPU chip that matches the performance of sanctioned Nvidia GPUs at a significantly lower cost, signaling a strong push toward China’s tech self-sufficiency. Additionally, we analyze Elon Musk’s denial of reports that xAI is raising $10 billion at a $200 billion valuation, unpacking the impact of this controversy on investor confidence and the AI competition. Finally, we discuss how AI tools, intended to reduce workplace burnout, may ironically be increasing it for many users, connecting this phenomenon to a longstanding economic theory and what it means for the future of enterprise AI adoption.

Content and Timestamp:

00:00:55 AI Fuels $1.3 Trillion Surge in Private Tech Market, Led by OpenAI

00:04:54 Wall Street Doubles Down on Chip Stocks: New ETFs Offer Concentrated AI Bets

00:08:22 Alibaba's Billion-Dollar AI Bet: From E-commerce Giant to Tech Powerhouse

00:11:57 Elon Musk's xAI Reportedly Seeks $10 Billion at $200 Billion Valuation, Amidst Controversy and Musk's 'Fake News' Claim

00:14:56 AI's Double-Edged Sword: Fighting Burnout or Fueling It?

Powered by voieech.com, producing personalized content just for you.