Discover The Clever Girls Know Podcast With Bola Sokunbi

The Clever Girls Know Podcast With Bola Sokunbi

The Clever Girls Know Podcast With Bola Sokunbi

Author: Clever Girl Finance

Subscribed: 4,403Played: 120,331Subscribe

Share

© 2025

Description

The Clever Girls Know Podcast is brought to you by Clever Girl Finance, one of the largest personal finance media/education platforms for women in the U.S. that empowers women to ditch debt, save money and build real wealth in order to live life on their own terms!

Hosted by founder and CEO of Clever Girl Finance, Bola Sokunbi, the podcast shares open and honest conversations with real women at different stages of their financial and life journeys to inspire and motivate other women on their own journeys too!

Get the Clever Girl Finance Roadmap today! It's completely free! Plus get our free budgeting & debt prioritization worksheets too: https://www.clevergirlfinance.com/financial-roadmap/

Hosted by founder and CEO of Clever Girl Finance, Bola Sokunbi, the podcast shares open and honest conversations with real women at different stages of their financial and life journeys to inspire and motivate other women on their own journeys too!

Get the Clever Girl Finance Roadmap today! It's completely free! Plus get our free budgeting & debt prioritization worksheets too: https://www.clevergirlfinance.com/financial-roadmap/

409 Episodes

Reverse

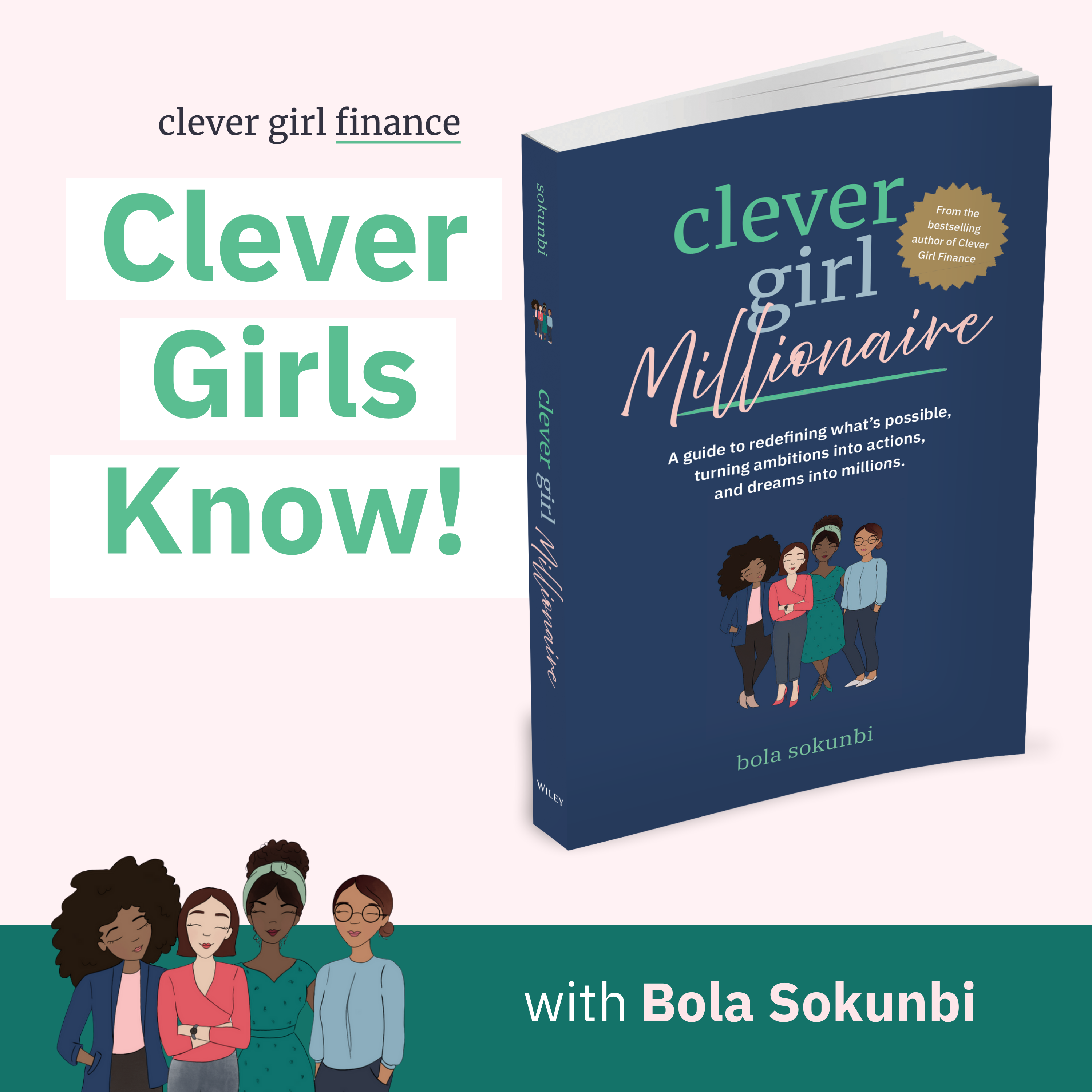

New Book - Clever Girl Millionaire; A Guide to Redefining What's Possible, Turning Ambitions into Actions, and Dreams into Millions - Available to pre-order now A lot of people think budgeting only works with a steady paycheck.If your income changes month to month (freelance, commissions, motherhood seasons), this episode breaks down the only approach that actually worked for me. On this episode of the podcast, I'm breaking down how to budget when life keeps changing and your income isn't consistent. You'll learn practical, flexible budgeting strategies that help you stay in control of your money, even when your paycheck isn't predictable. WHAT YOU'LL LEARN: How to create a baseline (bare‑bones) budget Why you should budget based on your lowest income months How to use a buffer account to smooth out income swings How to prioritize spending when money is tight Why sinking funds are essential for unpredictable expenses How to automate your finances without creating stress How to stay consistent, even when your income isn't Inconsistent income doesn't mean inconsistent progress. With the right systems and mindset, you can build stability, reduce anxiety, and make steady financial progress, no matter how much you earn each month. More Clever Girl Finance Resources: ❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe On this episode of the podcast, we're joined by Dr. Paris Woods, bestselling author, financial educator, and founder of Freedom Unlimited LLC, for an inspiring conversation about helping students start early and build wealth. Known for her breakout book The Black Girl's Guide to Financial Freedom, Paris returns with her newest release, The Student's Guide to Financial Freedom, written to empower first-gen, low-income, and BIPOC students with the tools they need to make confident money decisions early in life. With a background in education and a passion for equity, she breaks down the money myths young people face, offers actionable advice for avoiding common financial traps, and shares how students can lay the foundation for long-term financial success, starting right now. What Dr. Paris Woods Discussed on the Podcast: Her mission to help young people build financial freedom and what inspired her to focus on student audiences. What led to the creation of The Student's Guide to Financial Freedom as a follow-up to her bestselling book. Gaps in traditional financial education and how her book fills them for first-gen, low-income, and BIPOC students. Why it's crucial for students to start learning about money in high school or college. Small but impactful steps students can take now to begin building financial independence. Common money myths and traps to avoid, especially around student loans and credit cards. How her book helps students who don't see themselves reflected in traditional financial advice feel seen and supported. Ways parents, educators, and mentors can support students in becoming financially confident early on. One lesson or habit every student should adopt to set themselves up for lifelong financial freedom. AND SO MUCH MORE How to Keep Up With Dr. Paris Woods: Website: pariswoods.com Instagram: @authorpariswoods TikTok: @authorpariswoods Facebook: Author Paris Woods YouTube: Author Paris Woods Channel More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

New Book - Clever Girl Millionaire; A Guide to Redefining What's Possible, Turning Ambitions into Actions, and Dreams into Millions - Available to pre-order now Struggling to budget because you feel like you don't have enough money? You're not alone, and this is exactly when budgeting matters most. On this podcast episode, I'm walking you through how to budget when you have no money using 8 practical steps that will help you take control, reduce stress, and create a financial plan even if you're starting from zero (or less). Whether you're dealing with debt, inconsistent income, or just feel like you're stuck, this episode is for you. WHAT YOU'LL LEARN: How to assess your finances when you're broke How to create a bare-bones budget that helps you survive and rebuild Ways to cut expenses fast without shame Simple strategies to track small wins and increase your income How to stay consistent, even when progress feels slow Budgeting isn't just about dollars, it's about direction. The sooner you get a handle on what's coming in and going out, the sooner you can create a plan to move forward. Even if all you have is $5, this episode will show you how to make it work for you. More Clever Girl Finance Resources: ❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

Big news, friends! Today's episode is a little different, and deeply special to me. I am officially announcing my brand new book, Clever Girl Millionaire: A Guide to Redefining What's Possible, Turning Ambitions into Actions, and Dreams into Millions! This is my sixth book (technically my seventh!), and it represents years of lived experience, real mistakes, and the steady discipline required to build wealth in a way that feels aligned and sustainable. In this episode, I'm pulling back the curtain on: Why I wrote this book: I didn't write this to sell you a dream or an overnight success story. I wrote it to show you how wealth can be built intentionally through mindset, systems, and patience. Sowing the seeds: Why your financial wellness is non-negotiable and how to start "Chapter 1" of your own millionaire mindset and millionaire journey. The Pillars of Prosperity: A sneak peek into the core areas I have focused on to become a millionaire: Earned Income, Investing, Real Estate, and Entrepreneurship. How you can help this book succeed! I'm sharing why pre-orders are the single most important way to support this message and help us reach more women! If Clever Girl Finance has played a part in your journey, I would be so honored if you supported this launch! 👉 PRE-ORDER YOUR COPY HERE: https://amzn.to/49M4J13 More Clever Girl Finance Resources: ❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe Feeling stuck with your finances, even when you're trying your best? Sometimes, it's not just about what you do with money... it's about what you believe about money. In this episode, I'm sharing 5 toxic money beliefs that kept me financially stuck for years, and the mindset shifts that helped me break free. These aren't just budgeting tips. They're the internal narratives that quietly sabotage your goals and block your abundance. WHAT YOU'LL LEARN: The money lies we tell ourselves (and how to reframe them) How mindset directly impacts your saving, spending, and wealth-building What to believe instead so you can finally make consistent financial progress More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe On this episode of the podcast, we're joined by Melissa A. Rowe, M.Ed., award-winning Scholarship Specialist, College Coach, and founder of Capture Greatness!, to explore how students can graduate from college without the debt. Melissa has helped students secure over $12 million in scholarships, including multiple Gates Millennium Scholars, and gain acceptance to elite institutions like Yale, UPenn, Cornell, Howard, and Morehouse—all while keeping their families financially secure. As the author of Scholars Get Dollars and a Certified Financial Education Instructor™, Melissa believes college should be a legacy-building experience, not a lifelong financial burden. She shares practical strategies to find scholarships, busts myths about who qualifies for them, and explains how to turn the college journey into a launchpad for long-term wealth. What Melissa Discussed on the Podcast: Her journey into college coaching and why she's passionate about helping students graduate debt-free. The secret to standing out in the scholarship application process. Common myths about scholarships, and why they're not just for straight-A students. Where to find scholarships and how to start the search effectively. How she helps students get into top-tier schools with a financial strategy in place. What it really means to treat college as a wealth-building opportunity. Common mistakes families make when planning for college and how to avoid them. How she integrates financial education into the college planning process. Simple, actionable steps for families who feel behind or overwhelmed by college costs. A success story of a student who used scholarships to build a legacy, not just fund their education. AND SO MUCH MORE How to Keep Up With Melissa: Website: CaptureGreatness.org LinkedIn: Melissa A. Rowe Instagram: @CaptureGreatnessScholars YouTube: Capture Greatness Scholars More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe Did the past year leave your finances feeling off track; unexpected expenses, plans falling apart, or goals you just couldn't reach? If so, I want you to hear this first: You're not alone, and you're not stuck. On this episode, I'm walking you through a 6‑step financial comeback plan to help you reset your finances after a rough year, without shame, guilt, or unrealistic pressure. This is about regrouping, rebuilding, and moving forward with clarity and confidence. You'll learn how to: Forgive yourself and reframe your money story Audit your finances and face the numbers with confidence Create a realistic "comeback budget" for your current season Rebuild a mini emergency fund, even if you're starting small Set clear, achievable financial goals for the next 3, 6, and 12 months Reset your finances with support, not shame This reset isn't about perfection, it's about progress. Small steps taken consistently can completely change where you are a year from now. More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe It's a brand new year, and that means a fresh start, new goals, and big dreams. But before you try to do everything all at once… let's slow down. In this episode, I'm sharing a gentle but powerful reminder: sustainable progress is so much better than quick burnout! You'll learn 4 simple things you can do this week to build real momentum with your money, no pressure, no overwhelm. Don't forget to check out the replay of our Goal Setting Call on YouTube for an extra dose of motivation to kick off your year strong: https://youtube.com/live/q8kt06jBUBU Be sure to grab your copy of My Wealth Plan Workbook to map out your year with intention: https://amzn.to/4qsAvHd Ready to reset and refocus? Let's go! More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

** Subscribe to the Clever Girl Finance newsletter: https://clevergirlfinance.com/subscribe 🎉 Welcome to our annual goal-setting session at Clever Girl Finance! This isn't about resolutions; it's about creating meaningful goals that align with the life (and money) you actually want. As we close out 2025, this is your space to reflect, reset, and start building your 2026 blueprint, with clarity, peace, and purpose. In this live session replay, we'll walk through: What 2025 taught you (and what to leave behind) Clearing out mental and emotional clutter Choosing your 2026 *word of the year* to stay grounded Simple, specific goals and habits to focus on Whether you're starting over, shifting gears, or staying the course, you're right on time. This call will help you reconnect with your why and map out your next steps with intention. 📝 Grab a journal and join the conversation. NEW BOOK AND RESOURCES: Clever Girl Millionaire is now available for pre-order (out March 31, 2026!): https://amzn.to/4p6Y2wf Join our 26-Week Savings Challenge: https://learn.clevergirlfinance.com/dashboard/space/26-week-savings-challenge/home Our new course platform + community is live; sign up today: https://clevergirlfinance.com/courses LINKS TO CASH ENVELOPES BOOK AND STICKERS: Savings Challenge Envelopes Book: https://amzn.to/4jp4pbs Motivational stickers: https://amzn.to/4k5Nk7A Black girl christian stickers: https://amzn.to/3FaLO55 Let's make 2026 your most grounded and powerful year yet. 💫 ❤ Subscribe to the weekly Clever Girl Finance Newsletter for financial motivation: https://clevergirlfinance.com/subscribe ❤ Get the best-selling Clever Girl Finance Books: https://clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: https://clevergirlfinance.com/course-packages ❤ Schedule a 1-on-1 coaching call with team CGF: https://www.clevergirlfinance.com/coaching ❤ Read the Clever Girl Finance Blog: https://clevergirlfinance.com/blog ❤ Follow us on Instagram: http://instagram.com/clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe In this end-of-year episode, I'm reflecting on a season that stretched me in ways I never expected. Losing my dad in August made 2025 one of the hardest years of my life, and navigating grief while showing up for my family, my business, and this community wasn't easy. I share some of the bright spots that brought me grounding this year, and the incredible opportunities that continued to come to Clever Girl Finance even in a difficult season. I'm stepping into 2026 with intention. Thank you for being here. Thank you for giving me grace. And thank you for being such a meaningful part of my journey. I'm excited for what we're building together in 2026. More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe Only have $100 to invest and wondering where to start? You're not alone, and yes, you can begin your wealth-building journey with just that! In this beginner-friendly episode, I'm sharing exactly what I'd do if I only had $100 to invest, step by step. WHAT YOU'LL LEARN: How to start investing with as little as $100 Ideas of index funds to get started with (like FZROX, VTI, FXAIX, and more) How to build momentum and confidence as a first-time investor The importance of consistency over perfection AND MORE More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe You've probably heard it all before, "Just stop buying lattes." "Get a better job." "Cut out everything non‑essential." But what if some of the most popular money advice doesn't actually work, at least, not for real life or in your current season of life? On this episode, I'm breaking down six common pieces of financial advice that sound good but often fall flat, plus what to do instead to actually make progress with your money. WHAT YOU'LL LEARN: Why "stop buying coffee" won't make you rich Smarter ways to increase your income (beyond "get a better job") The truth about saving vs. investing How to cut expenses without feeling deprived Why it's never too late to start building wealth How talking about money openly can transform your finances AND MORE Real wealth isn't built on trendy tips, it's built on smart, sustainable habits. Take the advice that fits your life, leave what doesn't, and keep moving forward. More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe On this episode of the podcast, we're joined by Tracy Coenen, a forensic accountant with over 25 years of experience uncovering financial secrets in everything from corporate fraud to high net worth divorces. Tracy didn't originally plan on this path, she once dreamed of becoming a prison warden and pursued a criminology degree. But a college class on financial crime reignited her childhood love for solving mysteries, leading her to become a CPA and expert in finding hidden money. Today, she's best known for helping women navigate the financial side of divorce with clarity, confidence, and the tools to protect themselves when trust has been broken. What Tracy discussed: Her unique journey from criminology student to forensic accountant. The role a forensic accountant plays in helping women uncover financial deception and protect their assets during divorce. A powerful case example where she helped a woman navigate the financial side of divorce. Red flags that may indicate financial dishonesty in a relationship—even before divorce. First financial steps women should take when preparing for or going through divorce. How women who haven't managed household finances can begin to take ownership during divorce. Unique challenges faced by high-income women and how to protect their assets. The difference between a divorce attorney and a forensic accountant—and how they work together. Common financial mistakes women make during divorce and how to avoid them. How to financially rebuild after divorce, especially from a place of uncertainty or limited income. What to do if you suspect your partner is hiding money but don't know where to start. AND SO MUCH MORE How to Keep Up With Tracy: Follow on Instagram: @divorcemoneyguide Learn more: divorcemoneyguide.com and sequenceinc.com ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe On this episode of the podcast, we're joined by Lauren Morley, creator of The 20 Outfit Wardrobe, a simple and effective system designed to help women streamline their closets, feel confident in their personal style, and stop the cycle of overspending on clothes they never wear. Lauren shares how her own journey of wardrobe overwhelm and emotional shopping led her to develop a system that prioritizes intentionality, confidence, and financial clarity. Whether you're tired of staring at a full closet with "nothing to wear," or you're ready to make more mindful money decisions around fashion, Lauren's approach will help you simplify your style—and save your wallet in the process. What Lauren discussed: Her background and the inspiration behind creating The 20 Outfit Wardrobe system. How simplifying her own wardrobe helped her stop overspending and feel more confident. The first step to take when simplifying a closet to save money and reduce clutter. Common financial mistakes people make with their wardrobes and how to avoid them. A breakdown of how the 20 Outfit Wardrobe system works and why it's effective. How a simplified wardrobe can reduce decision fatigue and make daily life easier. Tips for shifting from emotional or impulsive shopping to intentional, value-based purchases. How to build a wardrobe that aligns with your real lifestyle—not just online aesthetics. Ways to make your closet more sustainable for your budget and the environment. Advice for women who feel overwhelmed by their closets but don't know where to start. AND MUCH MORE How to keep up with Lauren: Follow on Instagram: @twentyoutfitwardrobe Learn more: www.twentyoutfitwardrobe.com Explore her guides: stan.store/twentyoutfitwardrobe ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe It's time to shift away from all-or-nothing thinking! Do you ever think, "If I can't save $500, what's the point of saving anything at all?" Or "If I messed up my budget once, I might as well give up"? That, my friend, is all-or-nothing thinking, and it's quietly sabotaging your financial progress. So in this episode, I'm sharing how to break free from the perfection trap and finally make progress with your money (and your mindset). Because truthfully? Small, consistent steps matter more than perfect ones. What you'll learn: How to stop giving up on your goals when things don't go perfectly Why flexible budgets work better than "perfect" ones How to reframe your negative self-talk about money The importance of celebrating small habits, not just big milestones The power of adopting an "all or something" mindset AND MORE Whether you're saving, budgeting, paying off debt, or trying to build consistency with your finances, this video will help you stay on track without shame or guilt. More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation! clevergirlfinance.com/subscribe No Savings. No Investments. Here's Exactly What I'd Do To Start Over! What would I do if I had to start over, with $0 in savings, no investments, and no financial cushion? On this episode, I'm walking you through the exact money plan I'd follow to rebuild my finances from scratch. Whether you're starting over after a setback or just beginning your financial journey, this step-by-step plan will help you move from survival mode to stability, and then to success. What you'll learn: How to assess your real financial starting point How to cut expenses and survive on the bare essentials Creative ways to generate fast cash flow How to build a starter emergency fund (even on a low income) A simple budget formula that actually works Choosing the best debt payoff method for your situation The importance of rest and celebrating small wins AND MORE This is a realistic, actionable plan for anyone rebuilding from $0. Start where you are. Use what you have. And take the next right step! More Clever Girl Finance Resources: ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

On this episode of the podcast, we're joined by Deon Stokes, MBA—entrepreneur, speaker, strategist, and founder of The Ambition Brand—for a powerful conversation about what it really takes to reinvent yourself at 40 (or any age). Deon shares her own journey from political campaigns to building successful businesses in media, strategy, and tech, and now dedicates her platform to helping ambitious women design lives and careers that align with their purpose and financial goals. With nearly two decades of experience, Deon breaks down the mindset shifts, planning tools, and practical strategies women need to confidently pivot, whether they're launching a new business, starting over after a setback, or simply craving a life that feels more aligned and fulfilling. What Deon Discussed on the Podcast: Her personal story and how it shaped her mission to help women reinvent themselves. What reinvention looks like after 40 and why this stage of life is so powerful for transformation. Key financial mindset shifts women need to make before leaping into a new career, business, or passion project. How to craft an intentional reinvention plan that aligns with ambition and financial wellness. Using planners, clarity exercises, and income projections to map out a new chapter. Encouragement for women who feel it's "too late" to make a bold pivot. The role of discipline in turning purpose into sustainable financial and personal progress. The first three steps to take when ready for reinvention but unsure where to start. AND SO MUCH MORE How to Keep Up With Deon: Follow Deon on all platforms: @TheFaceOfAmbition ❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation: clevergirlfinance.com/subscribe ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

Tired of complicated budgeting systems that never stick? On this podcast eisode, I'm sharing my exact monthly budgeting routine; from reviewing last month's numbers to planning for irregular expenses and closing out the month with reflection. This is a realistic, flexible approach to budgeting that actually works. Whether you're just getting started or want to refresh your process, these steps will help you stay consistent without feeling overwhelmed. What you'll learn: How I start with a financial reflection, not shame My method for planning income (even with variable pay!) Why I budget for my goals first before any expenses How I build a realistic, values-aligned spending plan The importance of planning for irregular expenses Why I track my budget weekly (not daily!) How I close out each month to stay consistent This budgeting routine is simple, sustainable, and designed to help you make real financial progress. No perfect templates. Just a system that works. ❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation: clevergirlfinance.com/subscribe ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

On this episode of the podcast, I'm breaking down 7 everyday financial habits that seem harmless—but are quietly draining your bank account, delaying your progress, and keeping you stuck in stress mode. From only saving what's left over, to using credit cards like income, to ignoring your actual numbers, these habits might be the reason you're not hitting your financial goals. No judgment, just real talk and practical fixes to turn things around. You'll Learn: Why paying yourself first is a game changer How minimum payments are costing you thousands What to do instead of emotional sale shopping Why lifestyle inflation keeps you stuck How to shift from credit card dependency The power of knowing your numbers Why you don't need a lot of money to start investing 🎯 These are the mindset shifts and action steps that will help you build real wealth—starting now. ❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation: clevergirlfinance.com/subscribe ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

On this episode of the podcast, we're joined by powerhouse entrepreneur and Fortune 500 sales veteran Mara Dorne to talk about going From Rock Bottom to $1B. Mara shares her incredible journey from financial struggle to building a billion-dollar sales career and becoming a self-made millionaire by 35. She opens up about the mindset shifts, intentional money moves, and fearless leadership strategies that helped her rise in a male-dominated industry. As the founder of the BILF (Boss I'd Like to Follow) podcast and leader of a nationwide team of over 1,500 health insurance agents, Mara is on a mission to empower women to lead boldly, build wealth with purpose, and redefine what success looks like, on their own terms. What Mara Discussed on the Podcast: Her personal story, career background, and the defining moments that shaped her journey. How hitting rock bottom sparked the transformation that led to $1B+ in sales. The financial mindset shifts that were key to building lasting wealth. Lessons learned from leading large teams as a woman in a male-dominated industry. The impact of the 2008 financial crisis on her approach to money, risk, and resilience. Encouragement for women looking to lead with confidence despite fear, finances, or imposter syndrome. How she cultivates high-performing teams and integrates financial education into leadership. What intentional money management looks like in both her personal and professional life. How to turn purpose into profitable and sustainable business ventures. AND SO MUCH MORE How to Keep Up With Mara: Follow on Instagram: @maradorne Listen and follow the podcast: @bilfpod ❤ Subscribe to the Clever Girl Finance newsletter for weekly motivation: clevergirlfinance.com/subscribe ❤ Get the best-selling Clever Girl Finance Books: clevergirlfinance.com/books ❤ Get access to 30+ free courses, worksheets, savings challenges, and our favorite banking resources: clevergirlfinance.com/course-packages ❤ Read the Clever Girl Finance Blog: clevergirlfinance.com/blog ❤ Follow us on Instagram: @clevergirlfinance

I have been feeling so much doubt in myself. Can I make the money I need to make? Will my clientele find me? How do I work on my mindset? Thank you for this 😊

Loved this episode. Having to budget to help family and overcoming financial trauma really resonated with me.

Great show boloe, but when I tried the thrive website, it was a code design website. Not sure what went wrong but can you clarify the website. Thank you

Awesome Podcast Ladies Thank You Deb😉👍✌

This episode was really inspiring.

Thank you for this Bola, this is timely. I am not one to worry or go into panic mode, but the way people around are acting and being afraid, this is just a great way to encourage people right now, particularly in the area of finances. Tuning off from the news from time to time is good.

Hi Bola how do you add the right people to your bus

That was such an AMAZING show! Yezman was great and so funny. I love love love it. You ladies touched on so many different things.

This is sooooooooooooooooooooooooooooooooooooooo great. Thank you. Working on my estate plans as of 7.19.19. Thank you!

hi, hello. Thanks very much for sharing-

thank you i have so much to look forward to this year to help myself and friends.