Discover Asia Centric by Bloomberg Intelligence

Asia Centric by Bloomberg Intelligence

Asia Centric by Bloomberg Intelligence

Author: Bloomberg

Subscribed: 73Played: 1,546Subscribe

Share

© 2025 Bloomberg

Description

Some of the world's largest and fastest-growing markets, economies and companies are in Asia. Every Thursday, John Lee from Bloomberg Intelligence and Katia Dmitrieva from Bloomberg News speak with experts and newsmakers about the big ideas and trends moving money across the region.

112 Episodes

Reverse

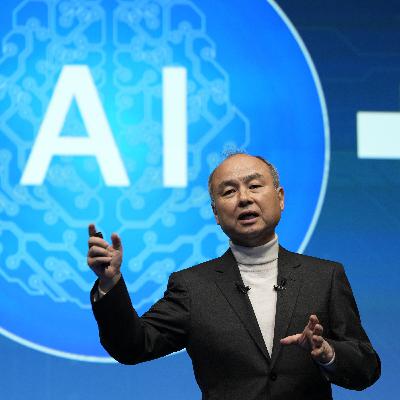

SoftBank is doubling down on artificial intelligence with a $30 billion commitment to OpenAI and ambitious plans for Stargate – even as risks mount. After a 200% surge earlier this year, shares tumbled 40% in November when Google’s Gemini 3.0 gained traction, threatening ChatGPT’s dominant position in the AI race. Credit stress is rising, with CDS widening to nearly 300 basis points as funding concerns build. Investors and creditors are increasingly uneasy as OpenAI now accounts for about 20% of SoftBank’s net assets, turning what was once seen as a bold growth play into a potential source of concentrated risk. Bloomberg Intelligence equity analyst Kirk Boodry and credit analyst Sharon Chen join John Lee on the Asia Centric podcast. Together they unpack SoftBank’s AI ambitions, its reliance on margin loans and the implications of circular financing. They also weigh up Masayoshi Son’s track record – spectacular wins such as Alibaba and painful failures like WeWork – against his latest AI gamble.See omnystudio.com/listener for privacy information.

It’s time to look ahead and make bold predictions for Asia in 2026. After a standout year, Asian equities are on track to beat the S&P 500 by the widest margin in eight years. Can the rally continue, and which markets will lead? Are investors overlooking US funding stress, potential QE, and the risks behind multi-decade tight credit spreads? And what’s next for Asian currencies and gold? Asia Centric convenes Bloomberg Intelligence strategists for a forward-looking discussion. Host John Lee is joined by Senior Equity Strategist Marvin Chen, Chief Asia FX Strategist Stephen Chiu and Senior Credit Strategist Timothy Tan as they unpack AI-driven growth, shifting currency dynamics, structural liquidity risks, and the potential repatriation of trillions in global capital back to Asia.See omnystudio.com/listener for privacy information.

Regulators around the world, from the US to Singapore and Australia, are trying to revive initial public offerings. The London Stock Exchange raised less than $2 billion since the beginning of 2024, its worst drought since 1998, while the number of publicly listed companies in the US has halved from 8,000 in 1996. Regulatory burdens, litigation risks and abundant private capital have pushed companies to remain private. Paul Atkins, chairman of the US Securities and Exchange Commission, has vowed to "make IPOs great again". But what can regulators do to entice companies to list? And why is Hong Kong bucking this trend – the city is on track to raise more than $40 billion this year and has a pipeline of more than 300 mainland Chinese firms seeking listing. Larry Tabb, Bloomberg Intelligence head of market structure research, and Sharnie Wong, BI senior analyst – diversified financials, joins John Lee on the Asia Centric podcast.See omnystudio.com/listener for privacy information.

Inflation has returned to Japan after decades of near-zero price growth, with consumer prices rising close to 3% – the fastest since the 1980s. The cost-of-living squeeze, driven by food prices, helped topple the previous administration and propel Sanae Takaichi to power as Japan's first female prime minister. Her pro-growth, big government stance promises fiscal stimulus, but risks complicating the Bank of Japan's efforts to contain sticky inflation. Taro Kimura, Japan senior economist at Bloomberg Economics and Bank of Japan veteran, joins John on the Asia Centric podcast. He explains why inflation may be higher for longer and what Takaichi's policies mean for BOJ independence. He also covers the prime minister's remarks on Taiwan that sparked tension with Beijing, adding a geopolitical layer to Japan's economic challenges.See omnystudio.com/listener for privacy information.

South Korea's Kospi Index has surged about 70% this year, driven by AI-linked tech stocks such as Samsung Electronics and SK Hynix. Retail investors, who poured more than $100 billion into US equities since the pandemic, are now turning their attention homeward. President Lee Jae Myung's pro-market and corporate governance reforms, including dividend tax cuts from 49% to a proposed 25%, are reshaping investor sentiment and capital flows. Peter Kim, managing director and investment strategist at KB Securities, joins John on the Asia Centric podcast. Kim discusses the sustainability of South Korea's rally, Seoul's overheated property market and the geopolitical balancing act between China and the US.See omnystudio.com/listener for privacy information.

China's AI rollout diverges sharply from the US, favoring open-source models and broad adoption over high-cost infrastructure. China's top tech firms including Tencent, Baidu and Alibaba will invest less than 10% of the $370 billion that US hyperscalers plan to spend on AI capex this year. This cost-conscious approach aligns with Beijing's AI Plus strategy, aiming to embed AI across all sectors by 2027 to boost productivity. Who will win the AI race? And are we in a bubble in AI infrastructure spending? Robert Lea, senior tech analyst at Bloomberg Intelligence, joins John to discuss why China's broader economy, rather than its tech companies, may be the main beneficiary of the nation's AI rollout.See omnystudio.com/listener for privacy information.

Some of the world’s largest companies by revenue – such as Vitol, Trafigura, and Cargill – operate outside the public eye, trading oil, metals and grains at scale. These private firms have quietly become central to global supply chains, recording substantial profits since 2022 as wars and sanctions re-routed flows. Giovanni Serio, former global head of research at Vitol, joins John and Katia to unpack how commodity traders operate, why scale and flexibility matter, and how satellite data and real-time analytics have transformed market transparency. Serio also discusses oil price dynamics, the rise of non-OPEC supply, and why most trading firms remain private despite their size.See omnystudio.com/listener for privacy information.

The world's demographic shift is often framed as a looming crisis, but new data suggests a more nuanced outlook. Hong Kong leads the longevity frontier with an average life expectancy of 86 years, having steadily increased by 0.25 years annually for over 150 years. Meanwhile, a landmark IMF study finds that today's 70-year-olds have the same cognitive ability as 53-year-olds in 2000, underscoring how healthier aging is reshaping workforce dynamics. Kevin Daly, managing director and senior economist at Goldman Sachs, joins John and Katia to discuss why aging may not be economically detrimental, how healthier lives extend workforce participation, and why the “silver economy” narrative oversimplifies consumption trends. Read Goldman Sachs’ related research: The Path to 2075 — The Positive Story of Global Aging (https://www.gspublishing.com/content/research/en/reports/2025/05/20/2d3fe290-10b1-44be-8d0e-77b8d303928f.html)See omnystudio.com/listener for privacy information.

In this live episode, recorded at Bloomberg's Investment Management Summit in Singapore, we sit down with Matthew Michelini, head of Asia-Pacific business for Apollo Global Management. We explore his optimism about Japan, driven by its corporate governance reform and the vast $7.5 trillion in consumer deposits. We also discuss how private capital is shaping asset allocation and the challenges posed by intense competition in the private-equity industry. See omnystudio.com/listener for privacy information.

Singapore’s government is investing heavily to become a global hub for finance, commodities and transportation. The spending includes $3 billion for Changi airport’s terminals and infrastructure and equity market reform to attract more capital. Singapore’s household assets could nearly double to $4 trillion by 2030 and the MSCI stock index is set to double in the next five years, according to Morgan Stanley. Nick Lord, research director for the Asean research department at Morgan Stanley and who authored a report this year on the subject, says the equity market reforms are key to unlocking growth. He discusses the latest developments in the city state with John and Katia.See omnystudio.com/listener for privacy information.

The competition is intensifying among global hedge funds giants to attract top traders and analysts. There's particularly high demand for talent at "pod shops", which allow portfolio managers to run their own strategies and manage allocated capital. High-profile managers with strong track records can command pay packages in the tens of millions of dollars. "The type of manager we're trying to hire, they are hiring us. It's not [us] hiring them", says Jay Luo, President of Dymon Asia Capital, a regionally focused alternative manager with about $5 billion in assets. He likens managing a pod shop to running a high-performance sports team and shares his insights on competing against global hedge funds like Millennium and Point72 -- with hiring the right person sometimes years in the making. He joins John and Katia on the Asia Centric podcast.See omnystudio.com/listener for privacy information.

Hong Kong's financial sector is roaring back, with IPOs surging and the city's exchange leading the world in public fundraising. The Hang Seng Index is up more than 30% this year, driven by biotech and tech stocks, while new stablecoin regulations are positioning Hong Kong as a digital-assets hub. Billions in untapped funds from mainland China are flowing in, fueling a wave of new family offices and a generational shift in wealth management. Vivien Khoo, CEO of the Private Wealth Management Association in Hong Kong and a member of the government's Web3 task force, joins John Lee to discuss the drivers behind the city’s comeback. She shares insights into Hong Kong’s evolving role as a global connector, the rise of next-gen investors and the impact of digital-asset regulation.See omnystudio.com/listener for privacy information.

A seismic shift is underway in global finance, led by a new breed of trading firms. Electronic market makers such as Jane Street and Citadel Securities are outpacing traditional Wall Street banks with cutting-edge technology, aggressive hiring strategies and lower regulatory burdens. In 2Q alone, Jane Street generated more than $10 billion in net trading revenue, eclipsing all of Wall Street's banks including JPMorgan and Goldman Sachs. Should Wall Street be worried? And can these companies continue to expand into Asia? Earlier this year, Jane Street was banned from trading in the Indian securities market for alleged market manipulation, which the firm denies. Larry Tabb, head of market structure research at Bloomberg Intelligence, joins John and Katia on the Asia Centric podcast.See omnystudio.com/listener for privacy information.

For all the doomsaying about US President Donald Trump's trade and economic policies, the world's biggest economy has held up relatively well, at least on the surface. Markets are up, trade demand remains firm and the Federal Reserve is moving toward interest rate cuts, which could spur more activity. But Steven Okun, founder and CEO of APAC Advisors, warns that the worst is yet to come. Global exports that surged in the run-up to August’s reciprocal levies are cooling, the US labor market is slowing, and markets will react once the data confirms economists’ warnings, he says. Though the slew of global levies provides some clarity, questions remain over Trump's motivations on trade policy and his tendency to upend matters with one social media post. Okun speaks with John and Katia from Singapore. Join us for Bloomberg's Investment Management Summit in Singapore on Oct. 7, featuring leading investors, asset managers and experts, to unlock insights and strategies for geopolitical volatility, technology innovation and sustainable growth. Also catch John and Katia for a live episode recording with Matthew Michelini, head of Asia-Pacific at Apollo Global Management. See you there!Register here for this exclusive event: https://events.bloombergevents.com/0BAkqmSee omnystudio.com/listener for privacy information.

The Genius Act in the US and a new regulatory framework in Hong Kong have helped legitimize stablecoins, potentially setting the stage for increased usage. The two largest issuers of dollar-backed stablecoins, Tether and Circle, hold more than $270 billion in US treasuries. At least one person – US Treasury Secretary Scott Bessent – sees that rising to $2 trillion. This should reinforce the dollar's role as the world's reserve currency while disrupting the global banking and SWIFT payments system, says Yat Siu, co-founder of Animoca Brands, which has $1.8 billion in digital assets. He breaks down what's next for stablecoins and digital assets – and reveals why his company tokenized a 1708 Stradivarius violin. Siu joins John and Katia on the Asia Centric podcast.See omnystudio.com/listener for privacy information.

China's consumers are a powerful force – the world's second-biggest spenders after the US. Officials want to harness this to transform the nation into a "mega-sized consumer powerhouse," and there are some initial signs of success with increased spending on home appliances, toys and jewelry. But how sustainable is this uptick in conspicuous consumption, and how much should investors worry about the Chinese consumer being fundamentally changed by the pandemic and real estate crash? Despite policymakers efforts to create a consumer-based economy, it still only accounts for about 39% of GDP, significantly below the OECD average of 54%. This week we take a deep dive into the Chinese consumer with Catherine Lim, senior analyst for consumer and technology at Bloomberg Intelligence, and Anson Bailey, head of Asia Pacific consumer and retail at KPMG. They speak with John and Katia.See omnystudio.com/listener for privacy information.

US tariffs are seen as broadly inflationary at home and disinflationary abroad, so countries across Asia – where central banks have already begun a cycle of easing – face increased pressure on economic growth and prices. The levies loom at a time when China is mired in deflation, and Japan is trying to reinflate prices that are also weak in other Asian economies. Should investors be worried about disinflation across the region? How will that influence central bank decisions? And does it complicate the path forward for Japan's policymakers? Gareth Leather, senior Asia economist at Capital Economics, joins John and Katia to discuss China's overcapacity, the government's failure to address the issue, how it could export deflation to the region, and Japan's success at engineering price growth.See omnystudio.com/listener for privacy information.

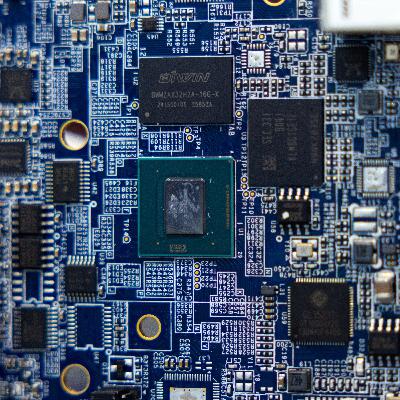

Advanced semiconductors, the tiny components crucial for everything from smartphones to national defense, are at the heart of US-China geopolitical rivalry. It's no wonder, then, that the US has increasingly restricted China's access to these chips, while Beijing fights back with its own trade barriers. So where are we in the great chip war? Why are they so important and difficult to make? And what are the prospects for new alliances as chip-hungry countries navigate the new AI world? Chris Miller, author of Chip War and professor of international history at Tufts University, sits down with John and Katia for a crash course on this technology and what lies ahead.See omnystudio.com/listener for privacy information.

China has a near monopoly on rare earths due to decades of government foresight. The country controls 70% of mining and nearly all processing of the vital minerals used in cars, data centers and defense equipment. It's one of the biggest cards China can play in trade talks with the US. When China restricted its flow of rare earths to the US earlier this year, companies shuddered. Ford had to stop production at some plants. How did China come to dominate this industry? Can companies in the US, Japan, South Korea and elsewhere replicate China's success? And what are the roadblocks? Curtis Moore, senior vice president at uranium-miner Energy Fuels, joins John and Katia to break down the global rare earth industry.See omnystudio.com/listener for privacy information.

US President Donald Trump's trade war on the world and the Federal Reserve has increased investment risk. But it's only the latest overhang for the US, with ongoing concerns about high fiscal debt exacerbated by the passage of Trump's $3.4 trillion tax and spending package. That's prompted Idanna Appio, portfolio manager and economist at First Eagle -- a $161 billion investment manager -- to look increasingly outside the US for value. In her view, investors are too complacent about these risks, as they have yet to see the full effect of tariff and other policies on growth and inflation. She joins John and Katia to talk about where she sees value in Asia, the many risks ahead and how she allocates money as a long-term investor.See omnystudio.com/listener for privacy information.