Discover Big Boss Interview

Big Boss Interview

Big Boss Interview

Author: BBC News

Subscribed: 2,895Played: 219,340Subscribe

Share

© (C) BBC 2026

Description

Big Boss Interview is where the most high-profile chief executives and entrepreneurs come to give you their insights and experiences of running the world's biggest and well-known businesses. The series is presented by Sean Farrington, Felicity Hannah and Will Bain, who you'd normally hear presenting the business news on BBC Radio 4's Today programme as well as BBC 5 Live's Wake Up To Money. Each week they'll be finding out just what it takes to run a huge organisation and what the day to day challenges and opportunities are. You can get in contact with the team by emailing bigboss@bbc.co.uk

245 Episodes

Reverse

Anthony Houghton, Chief Executive of Holland & Barrett, joins the Big Boss Interview as social media and online self-diagnosis reshape how consumers approach health and wellness.He describes a retail landscape where customers increasingly arrive in store — or online — having already decided what they need based on influencer content or digital health advice, not all of which is accurate or appropriate to their individual circumstances. In a £110 billion global health and wellness industry, the challenge for established retailers is navigating the gap between what customers believe products do and what they are legally permitted to claim.Holland & Barrett’s response has been a major internal reset. Three years ago, the company invested in a dedicated science team to review its entire range. Of approximately 4,500 core products, 2,700 have since been reformulated or upgraded. More than 1,000 own-brand products have been completely overhauled in the past 18 months alone. Labelling presents particular complexity. Products marketed for perimenopause, for example, may feature the term prominently on packaging to help customers find relevant items. Yet detailed ingredient information states that vitamin B6 contributes to hormonal regulation and iron supports normal cognitive function — without referencing perimenopause directly. Strict Advertising Standards Authority rules limit what retailers can claim about specific conditions, creating a disconnect between searchable labels and regulated ingredient statements. Houghton acknowledges many customers may not understand this distinction.The transformation has coincided with strong financial performance. Holland & Barrett reported 11% sales growth — its third consecutive year of double-digit increases — with digital sales up 20% overall and accounting for 21% of total revenue. However, £300 million invested over three years in store refits, supply chain upgrades and internal capability building has weighed on profit margins. Houghton describes the investment as “fixing the foundations”, with efficiency gains expected to restore profitability as the transformation programme matures.Despite digital growth, physical retail remains central to the strategy. The company operates 809 stores across the UK and Ireland, opened nine new sites this year and has completed a major refit programme. Houghton rejects suggestions that the High Street is dead, arguing that physical and digital channels are complementary rather than competitive. Stores now offer personal consultations, experiential elements such as yoga studios in selected locations, and partnerships with diagnostic provider Randox to deliver health MOT blood testing in a growing number of sites.Cost pressures remain acute. Minimum wage increases affect the majority of staff across hundreds of stores. Holland & Barrett pays above the statutory National Living Wage and plans to announce another rise shortly. Rather than passing those costs directly to customers through price increases, the strategy focuses on driving operational efficiencies elsewhere. At the same time, the company has increased investment in colleague training — requiring staff to complete health and wellness training before advising customers — even as many retailers are cutting back.Presenter: Sean Farrington

Producer: Olie D'Albertanson

Editor: Henry Jones00:16 Will and Sean intro pod

01:40 Anthony Houghton joins BBI

02:00 The growth of H&B

03:30 Self-diagnosing via social media

05:17 Decision to invest in dedicated science team

05:56 2,700 products reformulated in last couple of years

08:42 Which? found supplement doses higher than recommended intake

12:31 Product & label concerns

18:40 Growth in magnesium, creatine and fibre.

23:40 Loyalty schemes

29:31 The High St isn't dead

34:00 Impact of National Living Wage

41:00 Retail as a career choice

Nicole Melillo Shaw, Managing Director of Volvo UK, joins Big Boss Interview at a pivotal moment for the electric vehicle market, as the company recalls 10,500 EX30 electric cars following four battery fires globally.“It’s against everything we stand for,” she says, reflecting on a situation that challenges a brand built on nearly a century of safety leadership. Despite a global failure rate of just 0.02% and no fatalities, Volvo identified the root cause in late December and immediately instructed owners not to charge beyond 70% while a fix is implemented. Repairs are scheduled to begin in late March. For Volvo, the response reflects what she describes as a precautionary, safety-first culture, even when the commercial implications are uncomfortable.Melillo Shaw examines what the recall means for consumer confidence in electric vehicles — a technology already under heightened scrutiny — even though petrol vehicles statistically present a greater inherent fire risk due to flammable fuel systems.The recall comes as electric vehicle adoption remains slower than manufacturers once anticipated, despite annual growth exceeding 20%. Volvo’s UK electric sales peaked at 28% following the EX30 launch but have since stabilised at just over 22 per cent as more than 160 additional models enter the market and buyers opt for “one more petrol” or hybrid before fully switching.Range anxiety, she argues, is no longer the central issue, but infrastructure concerns persist. Confusing government messaging — pairing incentives with discussions of pay-per-mile charges and benefit-in-kind changes — continues to add to consumer hesitation.Global instability adds further complexity. Volvo has been regionalising production, partly in response to tariff pressures, building vehicles closer to the markets in which they are sold. That turbulence elevates the UK’s importance as Volvo’s third-largest market, where a direct-to-consumer model has delivered 40% growth and lifted market share from 2.5% to 3.5%.Government Zero Emission Vehicle mandates now require manufacturers to meet steep electrification quotas or face fines of £12,000 per non-compliant vehicle from November. Volvo discontinued diesel models in the UK in 2023 and says it could sell 100% electric vehicles tomorrow if demand existed. However, meeting regulatory targets while absorbing development costs and discounting pressures presents a commercial balancing act.Finally, Melillo Shaw reflects on her own trajectory — from Scunthorpe through healthcare brands to automotive leadership. Volvo deliberately recruited her because she had never bought a car, valuing the perspective of someone who understood the anxiety of a major purchase. She argues the industry must broaden access and challenge assumptions about who belongs in automotive careers, creating clearer pathways for talent from working-class communities.

Mark Allan, CEO of FTSE 100 property giant Landsec, tells Will Bain that much of the narrative around the UK’s commercial property market isn’t quite right. Demand for office space is robust: businesses are signing 15 to 20 year leases, and firms that downsized after COVID are reversing course. Even the fear that artificial intelligence will trigger mass job losses isn’t materialising just yet in leasing behaviour.He is bullish on the future of retail. Allan believes the shopping centre is firmly “back”, with sales and rents climbing again at major destinations such as Liverpool ONE and Bluewater. Retailers, he says, have become more selective - closing weaker sites while doubling down on the biggest and strongest locations. And with no new centres being built, the most successful ones are only becoming more valuable.But Allan is blunt about the challenges facing large scale development in the UK. The affordable housing market won’t improve until private development becomes financially viable again. Rising construction costs, slow and unpredictable planning processes and persistently high interest rates are making major projects far harder to get off the ground. His sharpest criticism, though, is for Westminster. Allan argues that political instability is damaging investor confidence and making long term planning extremely difficult. Allan says the business rates system is "crazily out of date". He welcomes the government’s ambition for planning reform, but says the UK keeps being dragged back into cycles of “permanent drama” that undermine efforts to fix the system.Presenter: Will Bain

Producer: Jeevan Nerwan

Editor: Henry Jones00:00 Sean and Will start pod

01:35 Mark Allan joins BBI

03:09 What does Landsec do?

04:56 Diversification into residential property

10:02 Gentrification

13:15 Investment outside of London and the South East

16:15 Affordable housing & planning

22:39 Demand for office space & AI

32:48 Shopping centres & the future of retail

39:43 Business rates

41:09: Government decision making & political instability

50:16 End of pod

Clive Chesser, chief executive of PureGym, says surviving cancer fundamentally changed him as a leader — deepening his empathy and reshaping how he approached life, including changing career..His diagnosis came during an extraordinarily difficult period in December 2021. While leading his then pub business through a complex private equity transaction, he was experiencing persistent breathlessness and fatigue he initially attributed to long COVID. After noticing swollen lymph nodes in his neck, members of his family — several of whom are senior doctors — urged him to undergo further tests. He completed them just before finalising the business deal.Christmas brought what he describes as an unimaginable sequence of events. On Christmas Day, his father-in-law died while his wife isolated at home with COVID. Shortly afterwards, Chesser received confirmation that he had cancer in his lymph nodes. The following day, he says, he faced the hardest moment of his life: telling his three teenage children he had cancer.At the time, Chesser was marathon-fit, training regularly and running annually. That physical condition proved critical during treatment. His fitness enabled him to tolerate more aggressive radiotherapy and additional chemotherapy rounds, improving his chances of full recovery — which he ultimately achieved. The experience, he says, transformed his sense of purpose and made his subsequent appointment as PureGym’s chief executive feel profoundly aligned with his personal journey.That personal conviction underpins what he describes as a broader fitness revolution reshaping the UK gym industry. Nearly half — 47% — of PureGym’s January 2025 joiners were aged 25 or under, reflecting what Chesser sees as a generational shift in attitudes to health. Younger members, particularly Gen Z and Gen Alpha, are integrating fitness into their social identity. Gyms are becoming social hubs, not simply places to exercise, where mental wellbeing and community sit alongside physical strength.He describes a trend he calls “fitness snacking” — members moving fluidly between gyms, boutique studios and fitness events before returning to a core membership. Despite this apparent transience, average tenure stands at 19 months and is rising. Most new joiners are returning members, a notable fact given PureGym’s no-contract, month-to-month model, where members actively choose to stay.Women are driving another significant shift in the market, moving away from cardio-dominated routines towards strength and conditioning. In response, PureGym has introduced more than 50 women-only workout spaces across the UK after research showed many women prefer environments where they feel more comfortable and less exposed. These areas exist nationwide and sit alongside screened lighter-weight zones designed to reduce intimidation for first-time users. While the majority of PureGym’s 456 UK sites remain mixed-gender spaces, Chesser argues that offering choice has been critical to growth and inclusion.Chesser also delivers a critique of the Labour government’s economic performance, arguing it has failed to deliver the long-term growth strategy promised before taking office. He points to National Insurance rises and the continued burden of business rates on bricks-and-mortar operators — including gyms and pubs — while online businesses face comparatively lighter structural costs.He draws a stark comparison between government and business leadership, noting that the UK has had six Prime Ministers in ten years — instability he likens to running a football club rather than a company built on rolling five-year strategies and careful succession planning. In his view, the government remains trapped in short-term crisis management rather than long-term economic planning.Presenter: Sean Farrington

Producer: Olie D'Albertanson

Editor: Henry Jones00:00 Fliss and Sean intro pod

01:50 Clive joins BBI

03:30 Growth on Gen Z gym users

10:20 Women only spaces and safety

16:00 Low cost model

25:20 Govt's 10 Year Health Plan

28:40 Clive's cancer journey

39:15 Frustration at govt's growth promises

Timo Boldt, founder and chief executive of Gousto, believes Britain’s food system is broken.He points to the growing economic burden of diet-related disease with Government figures suggesting obesity alone costs the NHS more than £11 billion a year, while broader estimates put the total economic cost of overweight and obesity at more than £100 billion annually once lost productivity and reduced quality of life are included.Boldt argues the problem begins with what Britons eat. Research suggests more than half of the calories consumed in the UK come from ultra-processed foods, rising to around two-thirds among children and adolescents.

He says these products are often engineered for what the industry calls the “bliss point” — the combination of salt, sugar and fat that keeps people coming back for more — and that the result is rising levels of obesity and diet-related illness.He defends Gousto’s typical price point of about £3.20 per meal per person, arguing that it compares favourably with supermarket shopping once household food waste, time spent planning meals and convenience are taken into account. The company cannot compete with the very lowest-cost diets, he admits, but says it is targeting the large proportion of households already spending similar amounts on evening meals.Boldt also argues that farmers sit at the weakest point in the food chain, squeezed by large manufacturers and retailers who dominate what ends up on supermarket shelves. He says the system would look very different if incentives favoured fresh produce rather than heavily processed foods.Government action so far — including the sugar tax and restrictions on junk-food advertising — is, in his view, only a start. He calls for a broader approach combining taxes on unhealthy products with subsidies for more nutritious farming, alongside tighter rules on product placement in supermarkets.If diet-related disease could be reduced, he argues, the savings for the NHS and the wider economy would be enormous. The long-term solution, he says, is to “go upstream” and change what people eat by reshaping the food system itself.Gousto grew rapidly through the 2010s, with annual growth of around 90% in its first decade. But the business faced a very different environment in 2022, as interest rates rose sharply and household budgets tightened. Boldt responded by expanding the range of recipes and focusing on value, while pushing the company towards profitability and self-funding.He started the business fifteen years ago after long hours in the finance industry left him eating poorly. In the early days he delivered boxes himself, handing out his personal mobile number to customers. Today, after expansion into Ireland, he says the next phase will be international — once the company has fully cracked its home market.Presenter: Sean Farrington

Producer: Olie D'Albertanson

Editor: Henry Jones00:00 Fliss and Sean start pod

01:39 Timo Boldt joins BBI

02:25 Obesity caused by ultra processed food and its impact

03:50 The cost of Gousto and whether it's too expensive

11:15 Farmer not paid enough.

19:56 Discount model in the industry

23:17 Setting up Gousto and hand delivering food

27:24 Tougher times and how they were navigated

32:20 Why is Gousto only in the UK and Ireland?

39:40 End of pod

Brian Niccol took over at Starbucks in 2024. He became CEO at a time profits had been falling and customers going elsewhere. He says Starbucks had got too distracted on efficiency and technology and lost focus on customers and experience.Starbucks has re-introduced things like handwriting on cups and ceramic mugs in a bid to win back customers, and has also given the menu and stores a makeover. It's already seen sales improve but Brian Niccol says they still need to do more..Technology is playing a big part in Starbucks plans to improve efficiency. It's using AI to take orders and allowing people to schedule their orders. It's also using technology to simplify the ordering process and stock. Niccol says this is allowing staff to spend more time to chat with customers. Presenter - Michelle Fleury

Producers - John Mervin and Justin Bones

Editor - Henry Jones01:40 Getting customers back to Starbucks. Says had lost focus and got distracted

07:22 Using technology such as AI taking orders and scheduling orders for customers

15:30 Partnering with 2028 LA Olympics

19:16 Should investors expect a slow rebuild or will the pace pick up this year

22:20 Giving power back to the storePicture: Reuters

As CEO of financial services giant Legal & General, António Simões plays a huge role in the UK economy, not to mention in the financial wellbeing of tens of millions of people. From managing pension funds to massive infrastructure spending around the country, he oversees well over a trillion dollars’ worth of UK assets. Simões took the top job at the beginning of 2024, and he tells Will Bain how from the start he has been dedicated to maintaining a corporate culture with a healthy work-life balance.Bullish on the UK economy, Simões says the country sometimes spends too much time ‘talking itself down’ and that with its fundamental strengths the UK is one of the most stable economies in the world. But, he says, there are still big worries for young Britons’ futures. He tells Will he’s concerned about the low levels of pension enrolment around the country and says more financial education is needed for people to understand the “eighth wonder of the world”: compound interest.He also tells Will about L&G’s massive investments around the country, from digital infrastructure and energy storage to affordable homes. And he says that despite a backlash against ESG and diversity programmes in recent years, he believes those are essential to ensuring returns for investors, and the country, far into the future. Presenter: Will BainProducer: Olie D'AlbertansonEditor: Henry Jones00:00 Sean Farrington and Will Bain introduce the episode02:00 António Simões interview begins02:21 Maintaining work-life balance and corporate culture05:30 Britons not saving enough into their pensions and the need for more financial literacy 08:40 Addressing low pensions auto-enrollment, challenges for employees and SMEs alike20:30 UK Growth - how to get there? 24:30 AI investments and 'bubble' fears 26:30 Government and private investments in new infrastructure around the UK40:00 The continued value of diversity schemes and ESG amid backlash 41:30 The politicisation of the economy 42:30 Low gender and LGBT representation in the C-suite

Britain's education system stands accused of failing to prepare young people for careers by Neil Clifford, Chief Executive of Kurt Geiger. He tells Will Bain in this episode of BBI that the current education system is "not really fit for purpose" in preparing people for life after education. His own school journey saw him leave with a single O-level in art, achieved by drawing a Dunlop Green Flash trainer that he now keeps displayed in his office. The spurred him on to create the Kurt Geiger Academy, a government-recognised educational institution built within the company's London HQ.Clifford questions the usefulness of teaching history in school and wonders if the emphasis on mathematics - championed by former Prime Minister Rishi Sunak - is wise, seeing as "we can't out mathematics India or China". Instead he says the UK should focus on sectors where it maintains global leadership, pointing to creative industries as areas where Britain would be World Champions. Clifford describes how the company has moved from a struggling British shoe retailer into an international fashion company. The brand has undergone a dramatic shift, with American operations now generating 70% of sales from handbags rather than shoes and individual stores producing twice the profit per square foot compared to UK locations. This was a move that saved the company as he says the COVID-19 pandemic brought the company within weeks of bankruptcy, with profits collapsing from £41 million in 2019 to just £6 million.Presenter: Will Bain

Producer: Olie D'Albertanson

Editor: Henry Jones00:00 Fliss Hannah and Will Bain introduces the episode

01:31 Neil Clifford interview begins

02:46 Kurt Geiger's transformation from shoes to handbags

05:18 ADHD and dyslexia impact

07:52 Failed attempts at handbags and US expansion

09:30 Strategy acceleration during pandemic

11:29 Trump tariffs discussion

15:34 UK vs international growth

20:03 50% higher conversion in US stores

23:21 Russell and Bromley discussion

24:05 One O-level in art

27:26 Academy origins from COVID

29:45 Education system "not fit for purpose"

35:37 UK hasn't grown in 10 years

35:54 - Brexit: "wasted 10 years"

John Vincent, founder and chief executive of Leon, joins the Big Boss Interview to explore how the rapid rise of weight-loss medications could reshape the food industry—and how Leon intends to position itself to benefit.Vincent returned to the business in October 2025, four years after selling it, having grown disillusioned as a minority shareholder. He says he lacked the board control needed to run the company how he wanted.Following its sale to the Issa Brothers and subsequent ownership by Asda, Vincent argues Leon became an “orphan child” inside a larger corporate structure, losing what he describes as its “chutzpah, leadership and confidence” and drifting away from its original sense of purpose. So, Vincent has returned, and immediately put the company into administration, but says all suppliers have been protected and will be paid in full, though admits landlords are “probably less happy”. His strategy now involves scaling the business back initially, before rebuilding to around 100–200 restaurants focused largely on London, alongside expansion through franchise partnerships at service stations, airports and train stations, and growth in grocery and direct-to-consumer channels.He also delivers a blistering critique of government policy towards hospitality, describing what he calls an “incredibly toxic tax regime”. His warning is stark: only restaurants “selling crap food” will survive, because quality ingredients are no longer economically viable, and further chain failures are inevitable.Presenter: Will Bain

Producer: Olie D'Albertanson

Editor: Henry Jones01:40 John Vincent joins the pod

03:00 Establishing Leon in 2004

11:20 Selling Leon to Issa brothers

15:00 Repurchasing Leon and taking it into administration

19:00 "Toxic tax regime" impacting industry

23:30 Expanding to direct to consumer model

24:40 Winner and losers of going into administration

25:50 Impact of weight loss medications on industry

32:00 Vincent's love of music and impact of ADHD

Tom Beahon, co-founder and co-chief executive of premium sportswear firm Castore, joins Sean Farrington on this week’s BBI to tackle some of the most contested questions facing sport, retail and work—including a debate that many families and fans discuss: why replica football kits now cost what they do, and whether supporters are being priced out of the game.Beahon pushes back against the idea that brands are inflating prices arbitrarily, arguing that higher costs reflect inflation, rising material prices and unprecedented global investment in elite sport. He maintains that if consumers genuinely could not afford official merchandise, the market would force prices down. He also outlines how Castore is responding to affordability concerns through entry-level product ranges designed to keep official kits within reach, while defending the idea that premium pricing reflects economic reality rather than corporate opportunism.The conversation then turns to how technology could reshape fan engagement and brand loyalty. Beahon explores the potential for embedded chips in official merchandise—technology that could unlock exclusive digital access to teams and events, while also helping brands combat the growing problem of counterfeit kits. He suggests this convergence of physical products and digital experiences may become increasingly central to how sports brands connect with supporters.Beahon also describes a striking shift in consumer behaviour: the resurgence of physical retail at a time when many brands are retreating from the high street. Castore has seen bricks-and-mortar stores outperform its e-commerce channels in recent months, reversing a trend that dominated much of the past decade. Rising footfall and in-store spending have prompted significant investment in the company’s retail estate.Founded in 2016, Castore is approaching its tenth anniversary as a billion-pound business, following its acquisition of heritage brand Belstaff. Beahon reflects on the balance between legacy and agility, explaining how established brands bring credibility and depth, while Castore’s rapid ascent demonstrates the value of entrepreneurial speed and a willingness to challenge convention. Positioning itself against global giants such as Nike and Adidas, Castore sees its challenger status as an advantage.On the future of work, Beahon delivers one of the starkest warnings of the interview arguing that artificial intelligence and automation are already reshaping how businesses think about staffing, predicting that 2026 could mark a tipping point for job losses in the UK. He says that as many as 80% of the chief executives he speaks to are planning for leaner workforces. These decisions, he suggests, are being driven by rapid advances in AI alongside rising employment costs, including national insurance—raising difficult questions about how workers, businesses and policymakers adapt to a rapidly changing economy.Presenter: Sean Farrington

Producer: Olie D'Albertanson

Editor: Henry Jones00:00 Pod start

02:04 Tom Beahon joins the pod & discusses Xmas performance

07:12 Physical stores outperforming e-commerce

08:46 Technology, AI, and the future of retail

13:43 CEOs are preparing for AI-Driven Job Losses in 2026

23:57 The Northwest as a hub for innovation

35:37 The challenger brand mindset

39:47 The cost of replica kits and counterfeits

Mark Constantine, founder and chief executive of Lush, discusses the Christmas rush, family run businesses, being "woke" and his love of birdsong in an amazing interview for Big Boss. He offers a festive perspective on the realities of retail during the Christmas season and describes the intense preparations for the holiday rush as akin to “preparing for war,” highlighting the logistical challenges and the need for resilience as customers descend on shops in the final days before Christmas.He also discusses the importance of personal support in business, revealing that he works with a psychologist who helps him navigate the complexities of leadership and decision-making. He explains how regular sessions provide accountability and clarity, underscoring the value of ongoing self-development for business leaders.Mark founded Lush with his wife, Mo, and their children have all been involved in the company in various ways. He reflects on the significance of family businesses in the British economy, outlining the strengths and challenges of running a family enterprise and considering succession, longevity, and the unique dynamics that shape these organisations.Mark has followed in the footsteps of his business mentor and confidante Anita Roddick (Body Shop founder) and decided early on that you can run a business and be outspoken about the issues you care about. As well as shutting his shops in the UK for 24 hours to protest against the war in Gaza, Lush has also been vehemently opposed to animal testing from the outset, and even closed down its social media presence—despite costing the company £9 million annually in lost revenue. He explains the reasoning behind this move, citing concerns about the impact of social media on young people and the company’s commitment to ethical responsibility.He also reveals a deep personal interest in both poetry and birdsong, describing the former as a source of wisdom and a means of distilling complex thoughts into concise, memorable lines, noting its value for those in business. He is a self-confessed nerd who loves learning and maintains one of the world’s largest private collections of birdsong recordings

Rupert Soames speaks to Felicity Hannah for his final interview before he stands down as Chair of the Confederation of British Industry (CBI). He describes his surprise at the limited understanding many ministers and policymakers have of the realities faced by business leaders, particularly when it comes to employment, investment, and economic growth. With the Employment Rights Bills ping-ponging its way between the House of Lords and the House of Commons, Soames expresses concern over measures that have increased the cost and risk of employing people, particularly younger workers. He points to the Bill as a source of uncertainty, saying that while compromise was reached on some aspects, the overall effect may be to discourage job creation and make it harder for those with gaps in their employment history to find work, especially post-covid. Brexit and its economic consequences are explored with Soames describing the outcome as “really, really, really bad" for the UK’s economic prospects. However, he acknowledged the need to move forward and reset the UK’s relationship with the European Union, but expresses concern about the slow pace of doing so, and the persistence of unproductive patterns in UK-EU relations, calling this "Code Red".Soames does credit the Labour government with progress in areas such as global trade agreements and regulatory reform, insisting they've done better in this regard than many before, but highlights a persistent gap between rhetoric and action. The interview also covers the challenges faced by Soames when he joined the CBI in 2024, following allegations of sexual abuse that were reported April 2023 in the Guardian. He reflects on restoring the reputation of the organisation and convincing swathes of major organisation to re-join, after many quit or suspended their memberships.Presenter: Felicity Hannah

Producer: Olie D'Albertanson

Editor: Henry Jones00:00 Sean Farrington and Fliss set up interview

02:40 Rupert Soames joins pod and discusses CBI scandal

13:40 Budget impact on business

20:00 Employment Rights Bill

23:55 Is government creating climate for growth?

25:00 Civil service has grown too large

27:15 Shocking how little government understands business

29:00 Government doing better than EU and US on AI adoption

30:00 Some people were seduced by then opposition govt; It was performative

32:53 Brexit has played out really, really, really badly

38:00 What is Rupert optimistic about?

Dame Emma Walmsley, Chief Executive one of Britain's biggest pharmaceutical companies GSK (GlaxoSmithKline), says the company is prioritising the United States for product launches and investment, citing its scale, commercial opportunities and favourable business environment. She confirms GSK will invest four times more in the US than in the UK over the coming years, making America the company’s primary growth and innovation focus.Explaining GSK’s investment strategy, Dame Emma Walmsley points to the US market’s scale and competitiveness, boosted by recent government policy. She welcomes a new UK-US agreement removing tariffs and recognising pharmaceutical innovation, but warns of challenges for Britain’s life sciences sector. Despite the UK’s strong scientific heritage, she notes it accounts for just 2% of GSK’s sales, compared with more than half in the US.Dame Emma Walmsley stresses the UK must stay competitive to attract foreign investment, warning that other countries increasingly treat life sciences as a strategic industry. She confirms the UK will pay more for medicines under the new agreement, with NHS costs for new drugs expected to rise by 25%. While medicines make up only 9% of NHS spending—lower than in many countries—she acknowledges budget pressures and the need for careful prioritisation.Dame Emma Walmsley also reveals GSK is close to winning approval for the world’s first six-monthly asthma drug, expected to cut the most severe attacks requiring hospitalisation by more than 70%. She calls the breakthrough a major advance for patients and healthcare systems, with the potential to deliver significant cost savings and improve quality of life for millions worldwide. She also comments on the surge in obesity and weight-loss treatments, noting GSK is not a major player but admires the scientific progress. Instead, the company is focusing on high-burden diseases such as liver disease and chronic obstructive pulmonary disease (COPD), with trials under way and hopes for further breakthroughs.Finally, Dame Emma Walmsley reflects on a turbulent period when activist investors questioned her leadership and forced her to reapply for her own job, amid concerns over GSK’s share price performance versus rivals.Presenter: Simon Jack

Producer: Ollie Smith/ Olie D'Albertanson00:00 Sean Farrington and BBC Business Editor Simon Jack intro pod

03:00 Dame Emma Walmsley joins the pod

03:53 Change agenda & US market focus and investment

07:18 New asthma drug approval on the horizon

08:19 GSK’s scale and global impact

12:03 GSK to invest four times more in the US than the UK

14:54 UK to pay more for drugs after UK-US deal

16:56 GSK new asthma drug breakthrough

19:48 GSK’s approach to obesity and weight loss drugs

28:23 Women in leadership at GSK

32:47 Shareholder revolt and leadership challenges

James Daunt, CEO of Waterstones and Barnes & Noble, offers his take on the evolving landscape of bookselling in the United Kingdom and United States. Whilst he has a "natural and instinctive disdain" for literature generated by AI, he says that if they are clearly labelled as such he would sell them, if people wanted them. The conversation also examines the economic environment for bookshops, with Daunt commenting on Chancellor Rachel Reeves' budget and its implications for the high street. He acknowledges what he see's as the positive impact of government policy on business rates and retail sustainability, suggesting that these measures could contribute to a more vibrant and resilient high street.Daunt also covers the reading habits of young people, noting a sustained interest in books among younger generations, despite the proliferation of digital media. He says young readers continue to engage with literature, supporting the ongoing relevance of physical bookshops, but he bemoans the closure of libraries as this has stopped some younger people being able to access free books.And as a self proclaimed "professional reader" also tells us what books he's currently reading, and flags up some to be aware of in 2026; but also admits he has a terrible habit of not finishing books he's started. Presenter: Fliss Hannah

Producer: Olie D'Albertanson

Editor: Henry Jones

Speculation surrounding the UK budget hurt the UK pension industry, that's according to Mark Fitzpatrick, Chief Executive of St. James’s Place, the UK's biggest wealth management company. He highlights how uncertainty in government policy has led to premature pension withdrawals, with many individuals acting on speculation rather than long-term strategy. Fitzpatrick also delivers a comparison between the UK and the USA investors saying there's a marked difference in cultural attitudes towards investing. He observes that Americans are more likely to discuss and celebrate investment, viewing wealth as a sign of progress and success, while in the UK, there is a greater tendency towards risk aversion and reluctance to talk about money. This cultural divide is reflected in the proportion of adults investing in stocks, with the US showing much higher participation rates. The conversation also turns to the role of technology and the potential for an artificial intelligence bubble and its impact on the investment world. He considers whether current enthusiasm for AI could lead to overvaluation and what measures they've taken to soften the impact of any AI bubble bursting. The interview explores the impact of AI on personal finance, the importance of human relationships in financial advice, and the need for balanced perspectives as technology continues to shape the future of investing and pensions.0:00 – Fliss and Sean welcome

2:30 – Mark Fitzpatrick joins the pod & discuss UK attitudes toward investing

10:00 – Growth of female investment

14:00 – Crypto investing & generational wealth

18:00 – Budget impact on pensions

27:00 – SJP fees issue and cultural changes

36:00 – Ai bubblePresenter: Sean Farrington

Producer: Olie D'Albertanson

Editor: Henry Jones

Vodafone’s chief executive, Margherita Della Valle, highlights the growing risks to Europe’s submarine cables, and calls for international cooperation to ensure the security and resilience of digital infrastructure. Addressing the recent threats posed by Russia, she calls for cross-border collaboration, and the implications for national and European security. Discussing the impact of the merger with Three, Della Valle examines the UK’s persistent “not spots”—areas with little or no mobile coverage—and the company’s commitment to eliminating these gaps through an £11billion pound investment. Della Valle also notes that Vodafone is set to launch a rival to Elon Musk's Starlink in 2026, providing total broadband coverage to the UK via satellite to standard mobile phones. Launching this first in the UK, she says you will even be able to get the internet at sea and in the most remote parts of the UK.The demands of artificial intelligence on telecoms infrastructure are also addressed, with Della Valle acknowledging that while progress has been made, the UK’s mobile networks are not yet fully prepared to support the scale and speed required for widespread AI adoption.The interview also addresses the reduction in the number of female chief executives in the FTSE 100, and the ongoing challenges faced by women in senior roles, with 00:00 Sean Farrington and Will Bain introduce BBI

02:04 Start of Interview with Margherita & early days at Vodafone

07:56 Impact of the UK merger with Three

09:29 Eliminating Not Spots in the UK

11:12 Satellite Technology & competition to Elon Musk's Starlink

19:00 Infrastructure for mobile use of AI is not there yet.

26 - Female FTSE CEOs

34 - the need to work closer with Europe on sea-cable/telecoms security co-operationPresenter: Will Bain

Producer: Olie D'Albertanson

Editor: Henry Jones

The UK automotive sector is navigating a period of significant change, with government policy, economic pressures, and international competition shaping the landscape. Ford UK boss Lisa Brankin outlines the risks posed by reported government measures, including a “pay per mile” on EVs, one of the measures the Chancellor is supposedly looking to address. Brankin tells Sean Farrington that these changes could further suppress demand for electric vehicles at a time when the market is already fragile. She also draws attention to the role of employee car benefit schemes, explaining that any reduction in these incentives could have a substantial impact on the auto industry.Ambitious climate targets set by the government are juxtaposed with the realities of consumer demand, as Brankin describes a market where regulatory ambition outpaces public appetite for electric vehicles. She calls for a coordinated and consistent approach to policy, stressing that ongoing government support is essential for the industry to meet net zero objectives. The interview also addresses the effects of economic uncertainty and the increasing influence of Chinese car manufacturers, which present additional challenges for established brands like Ford.Presenter: Sean Farrington

Producer: Olie D'Albertanson

Editor: Henry Jones00:00 Introduction and welcome from Fliss and Sean

02:39 Lisa Brankin joins pod discusses tough UK car industry

06:36 Electric vehicle targets and government policy impact

15:29 Chinese car manufacturers and competition

21:21 Brand loyalty and UK manufacturing footprint

26:16 Northern Ireland’s economy and opportunities

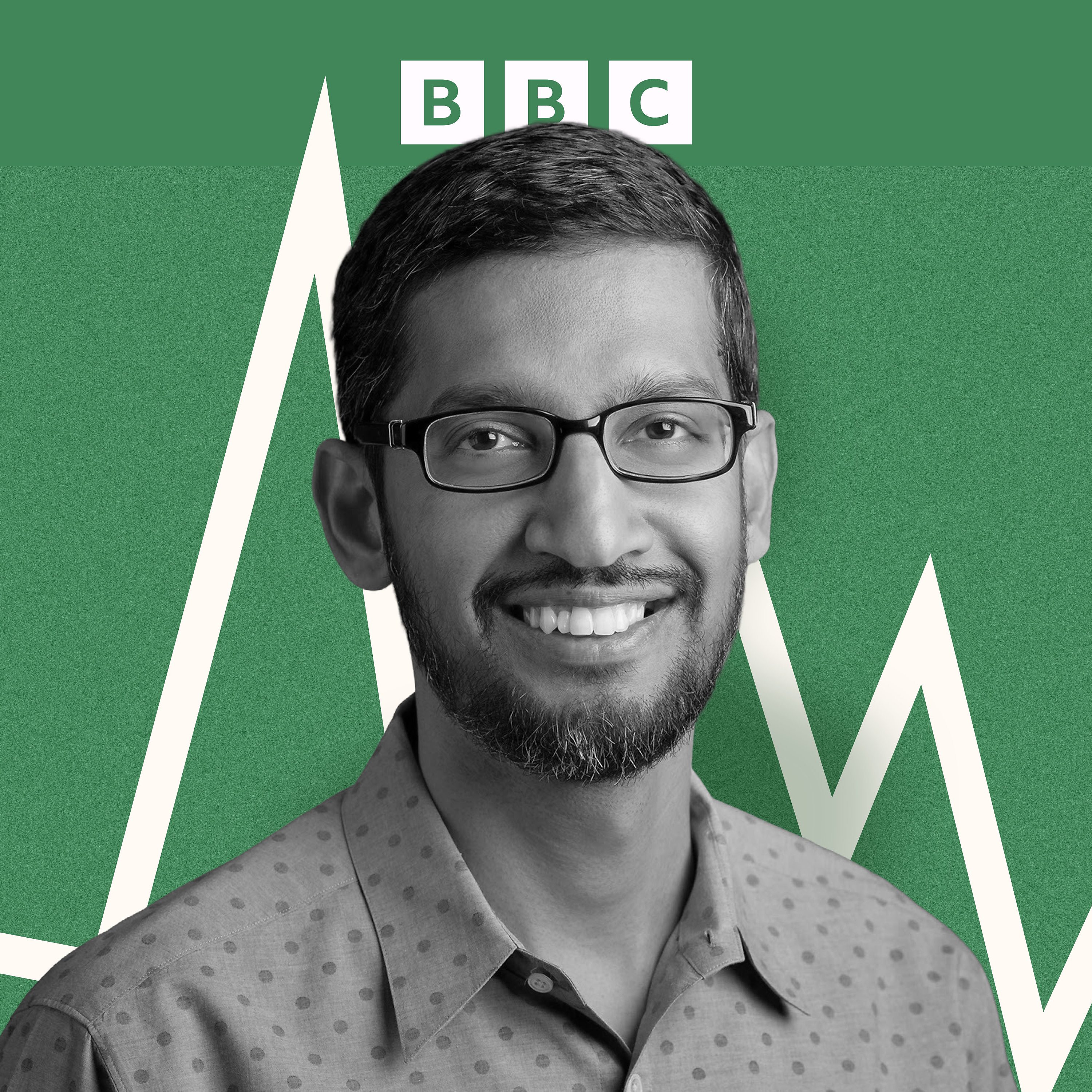

Sundar Pichai, chief executive of Google and Alphabet, acknowledges that no company is immune from the risks of an AI investment bubble, including Google itself, and warns that the rapid growth of artificial intelligence will lead to significant societal disruptions. Speaking to BBC Economics Editor Faisal Islam he explains that, despite the company’s scale and diversified approach, overinvestment in artificial intelligence could still require Google to navigate challenging phases, just as any other business would. This admission comes as Google’s annual AI infrastructure spending surpasses $90 billion, reflecting the extraordinary scale and pace of global investment in the sector.The interview explores the implications of this rapid growth, with Pichai highlighting the unprecedented demand for energy and the need for new sources of power to support AI development. He outlines Google’s efforts to invest in renewables, nuclear, and geothermal energy, and describes the company’s commitment to achieving 95% carbon-free operations in the UK by 2026. Pichai notes that the speed of AI expansion is testing the limits of existing sustainability targets, but maintains that technological progress can support both economic and environmental objectives.He also addresses the evolution of copyright frameworks, and the responsibilities of technology companies. He discusses the UK’s ambition to become an AI superpower, the importance of scaling energy infrastructure, and the need for responsible development to ensure that the benefits of AI are widely shared.00:20 Felicity and Faisal set out interview

02:00 Sundar Pichai joins the interview

03:30 Google now spending 90 billion dollars annually on AI

04:05 Is AI a Bubble?

05:51 Google’s AI strategy

07:03 The power and potential of AI agents

08:34 Automation, jobs, and societal Impact

11:07 Advice for the next generation

11:50 AI accuracy, and truth

14:22 Energy demands & climate impact

16:48 Google’s UK investments

18:25 Copyright issues

22:26 Immigration, talent, and innovation

23:12 AI as Open Source

25:31 Quantum computing & future technologies

Centrica CEO Chris O’Shea provides a comprehensive overview of the challenges and opportunities facing the UK energy sector. He begins by addressing the recent collapse of Tomato Energy, emphasising that when energy suppliers fail, the costs are ultimately borne by consumers. He calls for stronger regulation and greater financial resilience among energy companies, criticising Ofgem for a lack of transparency. He argues that the current system allows "profits to be privatised while losses are socialised".O’Shea discusses the government’s net zero by 2030 target, describing it as “unbelievably ambitious” but necessary to drive progress in the industry. He stresses the importance of a balanced and paced transition, warning that moving too quickly could leave communities behind, as happened with the closure of coal mines in Fife. The interview explores the decline of the North Sea oil industry and its impact on Aberdeen, with O’Shea noting that the full effects on jobs have yet to be felt. He highlights Centrica’s commitment to job creation and apprenticeships, aiming to take on one apprentice every day for the next decade.Drawing on his own experience of job insecurity as a graduate, he underscores the need for careful planning and investment in skills to ensure a just transition. He also addresses the challenges of the energy transition, acknowledging that it will be neither cheap nor easy, but insisting that it is essential for the country’s future.Presenter :Sean Farrington

Producer: Olie D'Albertanson

Editor: Henry JonesTimecodes:

02:54 Collapse of Tomato Energy

05:52 Regulation and financial resilience in the energy sector

12:05 Centrica’s investment strategy and shareholder returns

14:07 Profits in energy retail vs. other business segments

21:15 Net Zero 2030 aspirations

24:36 Government policy on renewables, net zero, and North Sea licenses

29:39 The impact of the North Sea’s decline on Aberdeen and job creation

34:00 Graduate programs and youth employment

37:19 Redundancies and management cuts

Julian Dunkerton co-founded Superdry and took it to a £2billion market cap at its height in 2010 - within years the company was fighting for survival, and in 2018 he walked away. A decision he says he regrets. But with Superdry now valued at just £8million and looking like it might fail, he returned just one year later and wrestled back control of the company he set up, and began turning it around. After a restructuring, renegotiating rent, and now a rebrand, Superdry has just turned a profit once again.This is the story of that turn around.In it he calls for town centre regeneration and a High Street Renaissance, warning that current policies and Brexit have left British retailers at a disadvantage. He highlights the economic impact of leaving the EU, citing lost free trade and increased costs, and argues that the UK has “gone backwards” since Brexit. In fact he believes a free trade relationship with the EU is possible, and also imperative. Dunkerton also challenges the narrative that young people only shop online, stating that teenagers value physical retail and social experiences, and credits this demographic with driving Superdry’s renewed success on the high street.00:00 Sean Farrington and Will Bain introduce the podcast

02:30 Julian Dunkerton joins the podcast, discusses the rise of Superdry

05:25 Stepping aside as Chief Executive & company changes

06:35 Return to profitability

08:44 The turnaround and rebrand of Superdry

10:56 What makes a good shopping experience

13:20 Branding & product quality

14:42 Policy, Brexit & business challenges

20:35 High street policy ideas & town centres

27:24 Tax, globalisation & retail trends

32:13 The future of Superdry & personal projectsPresenter: Will Bain

Producer: Olie D'Albertanson

Editor: Henry Jones

lk no+#

These new technologies are changing how banks produce and deliver financial services to their customers, and are driving the involvement and provision of these services by fintechs and large technology companies. I recommend you read more about it here https://www.eliftech.com/insights/open-banking-regulations-and-psd2-explained/

why is the news in the podcast?

the guest speaker is ignorant and arrogant. but very confident about his view

I have heard it before!

is this the wrong podcast?