Discover CleanTechies Podcast

CleanTechies Podcast

CleanTechies Podcast

Author: The #1 Podcast for ClimateTech Entrepreneurs

Subscribed: 17Played: 1,009Subscribe

Share

© CleanTechies LLC

Description

We are CleanTechies, the #1 Podcast for ClimateTech Entrepreneurs. Whether you’re an active ClimateTech entrepreneur, an aspiring one, an investor, a service provider…anything that touches supporting early stage climate tech, this is the place for you.

Each week, we publish two interviews with leading experts in the field telling their stories, insights, and advice to help ClimateTech Entrepreneurs like you be inspired by their successes and learn from their mistakes.

cleantechies.substack.com

Each week, we publish two interviews with leading experts in the field telling their stories, insights, and advice to help ClimateTech Entrepreneurs like you be inspired by their successes and learn from their mistakes.

cleantechies.substack.com

279 Episodes

Reverse

This is a free preview of a paid episode. To hear more, visit cleantechies.substack.comToday’s episode dives into the nuanced world of climate finance and infrastructure with Brendan Bell, Chief Operating Officer and Partner at Align Climate Capital. Unlike most investors who play in either venture or infrastructure, Align straddles both worlds—backing early-stage companies while also owning and operating clean energy assets.Brendan shares his unusual path from the Sierra Club to the U.S. Senate, the Department of Energy’s Loan Programs Office, and now into the private sector. Along the way, he offers candid insights into what makes a strong infrastructure investment, how venture-backed technologies eventually scale into bankable assets, and why understanding both sides of the capital stack is critical to accelerating the clean energy transition.This is a masterclass on the interplay between policy, venture innovation, and hard infrastructure. If you’ve ever wondered how moonshot technologies meet the realities of capital markets and project finance, this conversation will give you the inside view.

CleanTech founder Conor Madigan (Aether Fuels) reveals sustainable fuel tech breakthroughs, smart hiring, & building resilient climate startups.Join us as Conor Madigan, Founder and CEO of Aether Fuels, shares how their innovative tech is set to decarbonize aviation and shipping by drastically cutting costs and boosting fuel yield from waste streams. A second-time founder, Conor also unpacks his proven strategies for building high-talent, low-ego teams and fostering constructive tension for optimal results.Listen on: Apple Podcasts | Spotify | YouTube | Pocket CastsMemorable Quotes:"The overall result of that is to cut the capex of a plant by about 50%." — Conor Madigan"Until you've built a big network of your own... it's pretty invaluable to have a top-notch recruiter." — Conor Madigan"If you compare an electrified system versus a fired system, you can boost the output by about 20%." — Conor Madigan"I… try to create a constructive sort of tension inside of an organization by pairing together certain personality traits." — Conor MadiganIn this episode, we discuss:00:53 - Introduction to Conor Madigan and Aether Fuels03:55 - Aether Fuels' core technology and market05:27 - The innovation: cutting CAPEX and boosting yield28:00 - The year-long "funnel" to choose the right climate problem30:59 - Conor's philosophy on team building: high talent, low ego32:00 - Creating constructive tension in R&D vs. Engineering38:35 - Why senior hires need to be "player-coaches" at startups40:30 - Transparent communication during challenging times46:00 - Policy trends and market drivers for SAF49:50 - Cost parity expectations for Aether Fuels' productLinksConor Madigan | Aether FuelsConnect with Somil on LinkedIn | Connect with Silas on LinkedInFollow CleanTechies on LinkedInThis podcast is NOT investment advice. Do your homework and due diligence before investing in anything discussed on this podcast. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

00:00 – Intro: The $500M deal with Jupiter Power.02:15 – Landon’s Background: Lessons from Tesla and Northvolt.06:30 – The "Magnet Hire": How to attract A-Players by hiring one star first.12:00 – Why Sodium-Ion?: The cost and supply chain advantage over Lithium.18:45 – The Jupiter Power Deal: How they negotiated a massive off-take agreement.24:10 – "Engineering Bankability": Selling the manufacturing roadmap, not just the cell.32:00 – Supply Chain: Why Peak Energy avoids conflict minerals and China reliance.41:00 – The Grid Challenge: Why batteries need to last 25 years in the desert.48:00 – Scaling Speed: How to move faster than traditional industrial giants.53:00 – Hiring: The specific traits Landon looks for in executives. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

00:00 – Intro: Recording in-person at 9Zero in San Francisco.02:45 – Antonio’s Background: From Stanford PhD to Flow Batteries.06:00 – The History: What is the "Zebra Battery" and why did it fail in EVs?10:15 – The Chemistry: How Sodium, Iron, and Salt work together.12:30 – The Economics: Why $1/kWh material cost changes everything.17:00 – Safety First: No thermal runaway and safer than Lithium-Ion.22:00 – Manufacturing Strategy: Leveraging existing UK talent and factories.28:00 – The "Bankability" Challenge: Proving a "new" old technology.34:00 – Commercialization: Who buys these batteries? (Utilities vs Developers).41:00 – The Grid Reality: Why "Non-Wires Alternatives" are the immediate market.46:00 – Founder Advice: How to hire A-players for a hardware startup. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

00:00 – Intro: Why energy regulation is the "unsexy" bottleneck of the transition.03:11 – Hudson’s Background: From SEC Attorney to rewriting federal data laws.05:55 – What HData Does: The platform for rate cases, compliance, and wildfire plans.06:40 – The Natural Monopoly: Explaining the "Regulator vs. Regulated" conflict.10:13 – The Rate Case Process: How utilities get paid (and why it takes so much paper).14:00 – The ROI of AI: Moving from "Control-F" to vertical AI agents.22:20 – The Urgency: Why grid modernization creates a compliance explosion.35:00 – Hyperscalers & AI: How data center demand is changing the regulatory game.46:18 – The Future of Work: Will AI replace regulatory lawyers?48:00 – Founder Story: The 2022 cash crisis and the "Dark Night of the Soul."53:00 – Hiring Framework: The 3 motivations Hudson looks for in talent. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

What happens when an oil well dries up? Usually, it becomes a "zombie" liability—leaking methane and waiting to become a taxpayer burden. Kemp Gregory, CEO and Co-founder of Renewell Energy, joins the show to explain how he’s turning these multi-million dollar liabilities into clean energy assets.Renewell converts idle wells into mechanical gravity batteries. By using existing deep wellbores to raise and lower heavy weights, they’ve created long-duration energy storage that is cheaper than lithium-ion and uses the infrastructure we already have.Key Takeaways:The Problem: Why the "Orphan Well Pocalypse" is a looming global crisis.The Tech: How gravity storage works and why it doesn’t degrade like chemical batteries.The Business: Convincing oil companies to hand over wells instead of plugging them.The Grid: Why "stranded assets" are actually perfectly positioned for grid stability.Building Deep-Tech: Why "agency" is the #1 trait Kemp looks for in early hires.Timestamps:01:40 – Kemp’s journey from Oil & Gas to CleanTech.05:00 – The Scale: 900k active wells vs. 2 million idle wells.14:15 – Gravity storage vs. Lithium-Ion: Cost and mechanics.18:00 – Turning abandonment costs into revenue shares.40:15 – Hiring for "Evidence of Agency."Connect & Links:Guest: Kemp Gregory | Renewell EnergyHost: Connect with Silas on LinkedInCommunity: Follow CleanTechies on LinkedInWatch: Subscribe on YouTubeOur Sponsors:Climate Finance Solutions (CFS): Secure government grant funding with a 90% success rate. Learn more at ClimateFinanceSolutions.com.ErthSearch: Specialized CleanTech recruiting. Fast, accurate, and guaranteed. Get started with Silas today.Disclaimer: This podcast is NOT investment advice. Please do your own due diligence. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

Speed Strapping: How to Reach Breakeven on <$6MThe era of easy money is over. For CleanTech hardware startups, the old playbook—raise a Seed, build a prototype, and pray for a Series A—is leading companies straight off a cliff. Shaun Abrahamson, Managing Partner at Third Sphere, returns to the pod to unveil the "Speed Strapping" playbook: a survival guide for 2026.Shaun explains why the graduation rate from Seed to Series A has plummeted and why founders must stop building "bridges to nowhere." The new goal? Reach profitability on less than $6M of paid-in capital to control your own destiny.🎧 Listen on: Apple Podcasts | Spotify | YouTube | Pocket Casts💡 Key Takeaways:The $6M Limit: If you can’t reach breakeven on $5–$6M of capital, you are at the mercy of a volatile market.Avoid the CapEx Trap: Don't build a factory until you’re hitting $10M–$20M in revenue. Use contract manufacturers instead.The "LEGO" Strategy: Use existing, off-the-shelf components for your V1 instead of reinventing every part.Negative Churn: In hardware, losing a customer isn't just lost marketing spend—it often means getting a broken product back.📝 Key Moments:08:15 – Defining “Speed Strapping”: Why breakeven is the new Series A.15:58 – The “Bridge to Nowhere”: The danger of planning for non-existent funding.28:38 – The CapEx Trap: Why you shouldn’t build a factory too early.36:50 – The “LEGO” Strategy: Moving faster with existing parts.🗣️ Select Quote:"Most of the companies that we see failing right now are failing because they were building a bridge to a Series B that doesn’t exist." — Shaun Abrahamson🚀 Check Out Our Sponsors:Climate Finance Solutions (CFS): Secure government grants with a 90%+ success rate. ClimateFinanceSolutions.comErthSearch: Specialized CleanTech recruiting for sales, engineering, and execs. ErthSearch.comConnect with Silas: LinkedInFollow CleanTechies: LinkedInDisclaimer: This podcast is NOT investment advice. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

Eclipse Energy: The $0.50/kg Geologic Hydrogen Breakthrough with Prab SekhonPrab Sekhon, CEO of Eclipse Energy (formerly Gold H2), joins us to detail their disruptive technology that is poised to solve the green hydrogen cost problem. Eclipse Energy is taking end-of-life oil fields—which are massive liabilities for oil and gas companies—and turning them into clean energy assets by producing Geologic Hydrogen at an unprecedented $0.50 per kilogram.Key Topics Covered in the Episode:Introduction and Rebrand (01:06, 05:16): Prab introduces himself and discusses the recent rebranding from Gold H2 to Eclipse Energy, reflecting a broader strategy to move beyond just hydrogen.The Moonshot Goal (06:54): Breaking down why the 50 cents per kilogram price is crucial and why their process avoids the high costs and potable water consumption associated with traditional Green Hydrogen.The Technology & Feedstock (08:38, 14:46): Learn how Eclipse Energy uses "uneconomic oil"—a waste stream—as a free feedstock. Prab explains the process using the "gut biome" analogy: injecting specific microbes into deep reservoirs to stimulate the bacteria to produce pure hydrogen.The Business Model & O&G (11:20, 49:10): Discover the "accidental" business model that allows oil companies to defer billions in Plug & Abandon (P&A) liabilities by transforming non-producing wells into 20-year assets. Prab also addresses the role of energy pragmatism in working with oil and gas incumbents.Energy for the Future (18:40): Hear about the Armada partnership to co-locate data centers directly on-site, using the hydrogen to power the AI boom off-grid, and the benefit of hydrogen combustion producing water for cooling.Costs and Macro Trends (21:00, 42:55): A comparison of hydrogen costs (Gray at $1-$1.5/kg vs. Eclipse's $0.50/kg) and an update on the core macro trends in the global hydrogen space.Talent & Scaling (26:50, 54:10): Insights on the "niche field of petroleum microbiology," why the best talent for the energy transition comes from the oil and gas industry, and their partnership with Weatherford to help scale and deploy.Guest: Prab Sekhon, CEO of Eclipse EnergyA quick shoutout to our sponsors: Climate Finance Solutions and ErthSearch. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

JOIN US FOR THE HACK SUMMIT!The HackSummit returns to Newlab on December 10-11, bringing together 500 founders, funders, and industry leaders in Climate Deep Tech. Together we’ll explore abundance, alongside Founders and Investors at Andreessen Horowitz, Brimstone, Crux, DCVC, Durin, Earth AI, Endolith, Navier, Radical AI, Rainmaker, Voyager Ventures and SOSV. Sign up for 10% off here.How Ivy Energy Finally Cracked the Code on Multi-family SolarIf you’ve ever looked at a massive apartment building and wondered why the roof is empty… yeah, Dover Janis wondered the same thing.Except instead of complaining about it, he built a company to fix it.Dover — co-founder and CEO of Ivy Energy — joined me on the show to break down how his team solved one of the most stubborn problems in clean energy: getting solar onto multi-family buildings where the owner pays the bill, the tenant gets the savings, and everyone assumes it’s impossible.Turns out it wasn’t impossible. It was just missing the right business model.Dover calls the untouched roof on apartment buildings the “naked rooftop.” Owners had zero reason to install solar because they’d get zero financial benefit. And tenants couldn’t install it themselves. So the whole market was stuck.Ivy Energy flipped the entire equation by building a platform that makes solar a new revenue stream for the building owner — not a charity project for tenants. The magic is their software layer, something Dover describes as the “easy button” that tracks energy production, energy use, utility bills, and every transaction between the owner and the tenant. In other words, a virtual grid inside each community.And it’s not just bookkeeping. It’s defensible, transparent financial settlement that regulators trust and tenants benefit from. Owners install solar, tenants keep a slice of the savings, and owners pocket the rest. Profit. Every year. No more split incentives. No more naked rooftops.The wildest part? Investors realized they could install solar, run it for a year, boost the building’s NOI — and then sell the property at a higher valuation. In some deals, that means an instant return before factoring in any long-term cash flow.Ivy’s model is simple: SaaS fees per unit, plus a planning product that uses their massive dataset to help investors deploy capital smarter across their entire portfolio. And the market is huge — 27 million renter households, with more than half viable for on-site energy.They’ve already scaled to 400 communities and 60,000 households, and they’re moving fast through channel partners instead of trying to educate every owner one by one.What’s next? Dover wants Ivy to become the transaction engine for shared energy communities — not just solar, but EV charging, storage, and anything that touches the building’s energy ecosystem. And he’s building the team to get there, hiring people who treat the mission like an inevitability.If you want to understand how one software layer can open wide gigawatts of clean energy on buildings that were previously untouchable, give this episode a listen. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

JOIN US FOR THE HACK SUMMIT!The HackSummit returns to Newlab on December 10-11, bringing together 500 founders, funders, and industry leaders in Climate Deep Tech. Together we’ll explore abundance, alongside Founders and Investors at Andreessen Horowitz, Brimstone, Crux, DCVC, Durin, Earth AI, Endolith, Navier, Radical AI, Rainmaker, Voyager Ventures and SOSV. Sign up for 10% off here.Imagine if every commercial building and data center in a city acted like a smart, flexible battery. That’s the world Charles Conwell is building.Charles, CEO of Novele and a former commercial real estate guy turned energy founder, joined me on the show to break down how they’re transforming buildings from passive energy hogs into active grid assets. And his insight into how the built environment actually works will probably change how you think about energy forever.Novele’s system starts inside the building, at the point of consumption. Their Energy Boards are these thin, wall-mounted batteries that slip into unused space instead of eating up rentable square footage. But the real unlock is the software, a “swarm architecture” that syncs hundreds of distributed devices in real time. Instead of reacting to energy spikes, the system predicts them and reshapes load before it ever hits the meter.Why does this matter?Because commercial buildings have been stuck in a broken model for decades.Charles explained how landlords constantly overbuild electrical capacity because tenants wildly overestimate their needs. Add in the classic “split incentive”, landlords pay for upgrades, tenants reap the savings, and no one invests in efficiency. The result? Massive waste and massive bills.But the world changed. Fast. New rules like Local Law 97 created real financial pain for inefficient buildings. Energy prices started climbing double digits. Demand charges blew past the cost of the energy itself. And suddenly Novele’s solution went from “interesting” to “we need this yesterday.”The kicker?Novele runs on a Hardware-as-a-Service model. No CapEx fight. No landlord-tenant politics. Just a monthly fee that’s usually covered. Customers are seeing IRRs in the 20–30% range.We also got into Novele’s Ripple Board for data centers and why AI’s power spikes are becoming one of the biggest electrical problems no one is talking about. Charles lays out how distributed storage smooths those swings and why storage + nuclear is the most underrated combo in clean energy.If you want to understand better where urban energy is heading and why buildings are about to become one of the most important assets on the grid, tap play for this episode. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

Hey everybody! It’s Thanksgiving week, and I’m shooting a short, solo episode to share some gratitude for an incredible year and drop a few major announcements.Podcast Announcements* Farewell to Somil: Our co-host, Somil, is moving on! He accepted an amazing offer in the fast-growing AI space with Decagon to advance his product management career. We’re sad to see him go, but wish him the best! He deserves a lot of credit and thanks for helping us kick the podcast into high gear and grow our listenership.* The Podcast is Now Part of ErthSearch: ErthSearch (my cleantech recruitment firm, formerly ErthTech Talent) has acquired the podcast, bringing everything in-house under one P&L. The content won’t change, but we have more resources and are exploring deep-dive content on hiring, talent, and team building.* A Little Surprise is Coming! We have a new project brewing, and we’re hoping to launch it before the end of the year. If you’re a loyal listener and want to get early access and give us some feedback, please reach out to me directly via info@cleantechiespod.com or LinkedIn DM.* Moving to Nashville: I’m moving to Nashville in January! I’ll be traveling in NYC for most of December. This means posting may be a bit less frequent throughout the holidays, and any content created will have lower audio quality until I rebuild the studio. Thanks for your patience!A Look Back and Forward* Gratitude for the Past Year: It’s been an absolute pleasure to build this podcast over the last (almost) five years. We’ve continued to grow our listenership, hosted two live pods (in Houston with Energy Tech Nexus and during Climate Week), and invested more heavily in our social media content.* Optimism for Cleantech: Despite some of the bad news, I’m seeing massive growth coming for cleantech. Founders are building strong business models and making real money—it’s not just a “green premium” frenzy anymore. Companies are investing heavily in teams, and while we’re seeing fewer “climate tourists,” there are still plenty of jobs and growth opportunities!Support the Show* Sponsorship: We have a few anchor sponsor openings for the first half of next year. Our audience is primarily CleanTech investors and founders in the US and Europe. Reach out to discuss rates if you’re looking to sell to this audience! info@cleantechiespod.com * Thank You to Our Sponsor: A huge shout-out to our current anchor sponsor, Climate Finance Solutions, who has helped cleantech startups raise $1.6 billion in grant funding since 2020.* Join Us at Climate Hack Summit: Don’t forget to register for the Climate Hack Summit on Dec 10th and 11th at New Lab in NYC. We’ll be there creating content!Happy Thanksgiving to you all! We’ll see you next week on CleanTechies. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

JOIN US FOR THE HACK SUMMIT!The HackSummit returns to Newlab on December 10-11, bringing together 500 founders, funders, and industry leaders in Climate Deep Tech. Together we’ll explore abundance, alongside Founders and Investors at Andreessen Horowitz, Brimstone, Crux, DCVC, Durin, Earth AI, Endolith, Navier, Radical AI, Rainmaker, Voyager Ventures and SOSV. Sign up for 10% off here.What happens when an ex–Amazon Robotics leader looks at the housing crisis and says, “Yeah… I can fix that”?You get Reframe Systems. And honestly, this might be one of the boldest climate-tech swings happening right now.Vikas Enti joined me on the show, and within five minutes, it was clear: the home construction industry we have is broken. Slow builds. Sky-high costs. Massive waste. Homes are leaking energy like crazy. And absolutely zero scalability.Reframe Systems is flipping the entire industry on its head.They’re building homes like you’d build hardware: in micro factories, with robots, software, and tight quality control. Their houses use about 80 percent less energy, slash embodied carbon, and cut the chaos of job-site construction. And they’re doing it with these insanely flexible robotic work cells that cost under $200k and fit inside a garage.Here’s another thing that will blow your mind away.They cracked the code on mass customization. Everyone else tries to copy-paste the same house. Reframe built the software that turns any custom design into robot-ready instructions.The economics hit just as hard. Developers are paying $350 to $450 per square foot today. Reframe comes in at $275 to $325 — and builds faster. Their long-term target? Under $100 per square foot. If they get to hit that, game over. Housing changes forever.Also… insurance companies are pushing this wave faster than anyone. With wildfire and climate risk exploding, insurers want buildings that actually perform. Reframe homes check every box: airtight, fire-rated, flood-resilient, and way cheaper to run.Vikas and the team built their first full micro factory and delivered a permitted home in just 18 months. Now they’re scaling through joint ventures and laying the tracks for a network of small, fast factories that can pop up anywhere housing is needed.If you care about climate tech, housing affordability, robotics, or the future of cities… this is really one of those episodes you should listen to. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

JOIN US FOR THE HACK SUMMIT!The HackSummit returns to Newlab on December 10-11, bringing together 500 founders, funders, and industry leaders in Climate Deep Tech. Together we’ll explore abundance, alongside Founders and Investors at Andreessen Horowitz, Brimstone, Crux, DCVC, Durin, Earth AI, Endolith, Navier, Radical AI, Rainmaker, Voyager Ventures and SOSV. Sign up for 10% off here.Hey everyone, Silas here. Welcome back to CleanTechies, the show where we talk with the founders, funders, and visionaries building our clean future.In today’s episode, we’re heading deep (literally) into one of the most untouched frontiers on Earth. My guest, Oliver Gunasekara, is the co-founder and CEO of Impossible Metals, a company on a mission to mine the ocean floor without wrecking the planet.Now, before you picture some massive vacuum ripping up the seabed, forget it. That’s how it’s always been done for fifty years. Impossible Metals flipped the script. Instead of tractors and dredges, they’ve built fleets of autonomous underwater robots. Battery-powered, self-piloting, and armed with computer vision, these things hover above the seabed, picking up polymetallic nodules one by one like it’s a sci-fi claw machine.These nodules are loaded with four critical metals: nickel, copper, cobalt, and manganese. The stuff that powers EVs, wind turbines, batteries, and AI data centers. Every piece of the clean economy runs on metals like these. But here’s the problem: land-based mining is running out of high-grade ore. It’s also slow, expensive, and environmentally brutal.Oliver’s approach? Ten times cheaper. Zero deforestation. No child labor. And every operation runs off clean electricity.The world needs metals but we need a better way to get them.The geopolitical angle makes this even crazier. China currently controls between 40 and 90 percent of the world’s mineral supply. Deep-sea mining could flip that balance, giving the West a new, independent source of critical minerals.Impossible Metals already secured its own licensed exploration area through the Kingdom of Bahrain. And since the US never signed the UN’s Law of the Sea, it’s basically a two-track race to secure access. Oliver says the deep ocean is “the new real estate rush” and his team’s staking claim on the highest-grade zones before anyone else.And here’s the kicker: the market is massive — a half-trillion-dollar metals industry today that’s projected to hit a trillion by 2035.Oliver’s story goes beyond the tech, though. We talk about what it takes to build world-class teams, people who are “orders of magnitude better,” as he puts it, and how to align them on mission. We talk about fundraising clarity, why first-of-a-kind technologies need patient capital, and what it means to build something the world has literally never seen before.It’s a conversation about innovation, geopolitics, and the future of clean materials.Make sure to hit follow or subscribe wherever you’re listening, because we’ve got a huge announcement coming this quarter. Enjoy listening! This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

JOIN US FOR THE HACK SUMMIT!The HackSummit returns to Newlab on December 10-11, bringing together 500 founders, funders, and industry leaders in Climate Deep Tech. Together we’ll explore abundance, alongside Founders and Investors at Andreessen Horowitz, Brimstone, Crux, DCVC, Durin, Earth AI, Endolith, Navier, Radical AI, Rainmaker, Voyager Ventures and SOSV. Sign up for 10% off here.Hey everyone, welcome back to the podcast where we talk to founders, investors, and leaders building the future of climate tech. I’m Silas Mahner, the host of Cleantechies and today we’re diving into one of the biggest climate opportunities, clean steel.If steel were a country, it’d be the third largest emitter in the world, right behind China and the U.S. And 90% of those emissions come from one step — ironmaking.That’s exactly where Electra comes in. Co-founded by Sandeep Nijhawan, Electra is rethinking how we make iron from the ground up, literally. Instead of melting ore in a 1600°C blast furnace, they’re doing it at 60°C using a unique process.Think about that for a second: they’re turning iron ore into pure metallic iron without the heat, smoke, or fossil fuels that have defined the industry for centuries.That shift paves the way to a few massive advantages such as slashing energy use and cost and it works with intermittent renewables like solar and wind. It can also process low-grade ores that miners usually throw away, turning waste into value.Sandeep also talks about the economics of clean iron, how Electra’s modular design lets them scale like solar, and how they’re partnering with major players in steel and mining to prove that clean iron can be cost-competitive today. We also get into:How the automotive and data center industries are driving demand for low-carbon steel.What it takes to innovate in a commodity market where “cost parity” is king.Why Sandeep focused early on building a “minimum viable ecosystem” And what it means to be intentional about your team, investors, and mission when you’re building something this big.This episode is a masterclass in scaling deep tech and rebuilding the raw materials that make our world. So, if you’ve ever wondered how we’ll clean up one of the dirtiest industries on Earth, this conversation is going to open your eyes. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

JOIN US FOR THE HACK SUMMIT!The HackSummit returns to Newlab on December 10-11, bringing together 500 founders, funders, and industry leaders in Climate Deep Tech. Together we’ll explore abundance, alongside Founders and Investors at Andreessen Horowitz, Brimstone, Crux, DCVC, Durin, Earth AI, Endolith, Navier, Radical AI, Rainmaker, Voyager Ventures and SOSV. Sign up for 10% off here.Hey everyone, welcome back to CleanTechies!Today, we’re diving into one of the most overlooked but fast-growing parts of climate tech right now: grid resilience. When we think about the clean energy transition, most of the attention goes to building more solar, more batteries, more generation. But what about protecting the systems we already have from extreme weather?That’s where Rhizome comes in.My guest today, Mishal Thadani, is the Co-Founder and CEO of Rhizome, a climate resilience software company helping utilities prepare for the future. Their platform helps grid planners and operators assess vulnerabilities, model investment scenarios, and understand how climate change will hit their systems over time.In simple terms: they’re helping utilities figure out where to spend every dollar smarter so they can keep the lights on when the next hurricane, wildfire, or heatwave hits.We dig into:How Rhizome turns weather data, climate projections, and utility failure history into real, actionable investment mapsWhy insurers and credit agencies are pushing utilities to start taking climate risk seriouslyThe behind-the-scenes of selling into utilities — and why a 6–12 month sales cycle isn’t for the faint of heartHow Mishal’s background in engineering and regulatory strategy shaped Rhizome’s design from day oneHow rising energy prices and the AI data center boom are reshaping utility priorities, putting a new spotlight on affordable solutions like energy efficiency and demand response.And here’s what I love best about this conversation: Mish shows how the climate tech space is expanding, showing adaptation and resilience. If you’re building in climate tech, especially in data, software, or infrastructure, this episode will give you a front-row seat into where the next wave of opportunity is.P.S. We’ve got a big announcement coming this quarter, stay tuned and keep listening so you don’t miss it. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

JOIN US FOR THE HACK SUMMIT!The HackSummit returns to Newlab on December 10-11, bringing together 500 founders, funders, and industry leaders in Climate Deep Tech. Together we’ll explore abundance, alongside Founders and Investors at Andreessen Horowitz, Brimstone, Crux, DCVC, Durin, Earth AI, Endolith, Navier, Radical AI, Rainmaker, Voyager Ventures and SOSV. Sign up for 10% off here.Hey everyone, welcome back to CleanTechies!Today, we’re diving into one of the biggest non-dilutive funding opportunities out there: the EU Innovation Fund.We’re talking about €40 billion euros being deployed between now and 2030 to scale up the world’s most promising low-carbon technologies…and the crazy part? Only a fraction of it has been spent.To break it all down, I’m joined by Joel Armin-Hoiland, Founder and CEO of Climate Finance Solutions, and the go-to expert on non-dilutive funding.You might remember Joel from Episode 258, where we unpacked critical minerals funding from the DOE, and now he’s back to take us global.In this episode, Joel explains how the EU Innovation Fund is fueling deployment-ready tech (think steel, cement, hydrogen, CCUS, renewables, and energy storage) and how founders can actually win a slice of that €40 billion.We talked about several things such as the €5.5 billion call expected to drop this December and why the EU is favoring commercial-scale over early R&D. Plus Joel’s insider advice on how to phrase your applications because yes, reviewers are literally searching for keywordsSince 2020,CCUSJoel and his team have already helped raise over $1.6 billion with a 90% success rate, so if you’re serious about securing non-dilutive capital, this is a must-listen.Tune in today because this funding window is opening fast, and the founders who prepare well are the ones who’ll win big later. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

JOIN US FOR THE HACK SUMMIT! The HackSummit returns to Newlab on December 10-11, bringing together 500 founders, funders, and industry leaders in Climate Deep Tech. Together we’ll explore abundance, alongside Founders and Investors at Andreessen Horowitz, Brimstone, Crux, DCVC, Durin, Earth AI, Endolith, Navier, Radical AI, Rainmaker, Voyager Ventures and SOSV. Sign up for 10% off here.Silas here! 👋 Before we jump into today’s episode, quick shoutout to Goodwin Law, CSC Leasing, and ErthTech Talent, the backbone behind our CleanTechies Live Podcast at Climate Week. (If you haven’t listened to that yet, check it out first — I’ll be referencing it a lot in this recap.)Quick plug: We also caught a bunch of raw takes from founders and investors between panels and events through candid man on the street interviews you’ll definitely want to see.I’ve finally had some time to process New York Climate Week. This solo episode is part recap, part reflection, but more importantly, it’s my honest take on where we are as a space and why I’m more bullish than ever on clean tech, and here are some of the things that stood out: I’ve never seen founders and investors this locked in. Everyone there was focused, sharp, and hungry. It honestly felt different this year, like the movement finally grew up.Let me walk you through it.Over the past year-ish, people have been asking:“Is the hype gone?”“Will funding drying up?”“Is the climate space cooling off?”What I saw at Climate Week says the exact opposite.Now is the best time to build if you’re a founder.In this episode, I break it down into a few key reasons, but before you dive in, chew on this:“When things get harder, only the best founders stay at the party.”The hype-cycle might be over, but that’s because we’re entering a much more mature version of the movement. So stick around for the mission.P.S. CleanTechies, we have some exciting news for you in the coming weeks/months, so be sure to stick around for that. Check Out Our Sponsor! ErthTech Talent: Affordable CleanTech Search FirmTo build a successful CleanTech startup, you need the right people. Affordable: Our search fee is 12-15% of first-year base salary (most charge 25-30%).Specialized: We ONLY work with CleanTech startups. Proven: 70+ placements since 2020 (Aypa Power, ChargeScape, QCells, & more). Save time and money when you work with ErthTech Talent. Plus, Silas runs it, so you already know him. — Reach out today and tell him you saw this ad. Get Started TodaySupport the show! Upgrade to paid today! It’s $10/month or $100/year. You probably spent that much on random amazon stuff last week. What’s stopping you from upgrading to paid? Upgrade to Paid📺 Watch on YouTube | 🍎 Apple Podcasts | 🎧 Spotify | 🗣️ Join the Slack Channel📝 Show Notes:Topics 00:00 – Intro and Sponsor Shoutouts02:35 – Energy Recap of Climate Week 2024Why this year felt “different” — investors and founders were laser-focused, no fluff, no tourists.04:55 – From Insecurity to CertaintyHow the climate space matured — no longer driven by hype, but grounded in conviction and real results.06:10 – Oil, Defense, and Climate Tech?A fascinating shift, former “outcasts” from oil and defense now welcome in clean tech spaces, blending worlds for impact.07:13 – Inside the Climate Capital SummitOne of my personal favorites event this year— a reunion of world-class founders and investors09:40 – Founders More Bullish Than EverThe main-character energy is real — the best founders are staying in the game and hungrier than ever.10:30 – Why Now Is the Best Time to Be a Climate Tech FounderWhere I break down the five powerful reasons driving opportunity right now.11:00 – Reason #1: A Mature Capital StackInvestors have learned, the ecosystem is organized, and strong capital flows continue despite a cooling market.11:50 – Reason #2: Energy Prices Fuel AdoptionHigh costs are pushing consumers and corporations toward electrification and renewables faster than ever.13:00 – Reason #3: Co-Motivating Factors Beyond ClimateNational security, insurance, supply chain, and convenience are all now aligned with climate tech solutions.14:44 – Reason #4: Ruthless Competition Breeds Excellence17:30 – “Climate Tech” Is Dead — Long Live the Chameleon EraThe term “climate tech” no longer fits. Founders are now building in energy, defense, materials, and national security , adapting like chameleons to each industry they serve.19:30 – The Challenge of FragmentationWith so many new labels, finding “your people” might get trickier, but the mission remains united.LinksConnect with Silas on LinkedInFollow CleanTechies on LinkedInThis podcast is NOT investment advice. Do your homework and due diligence before investing in anything discussed on this podcast. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

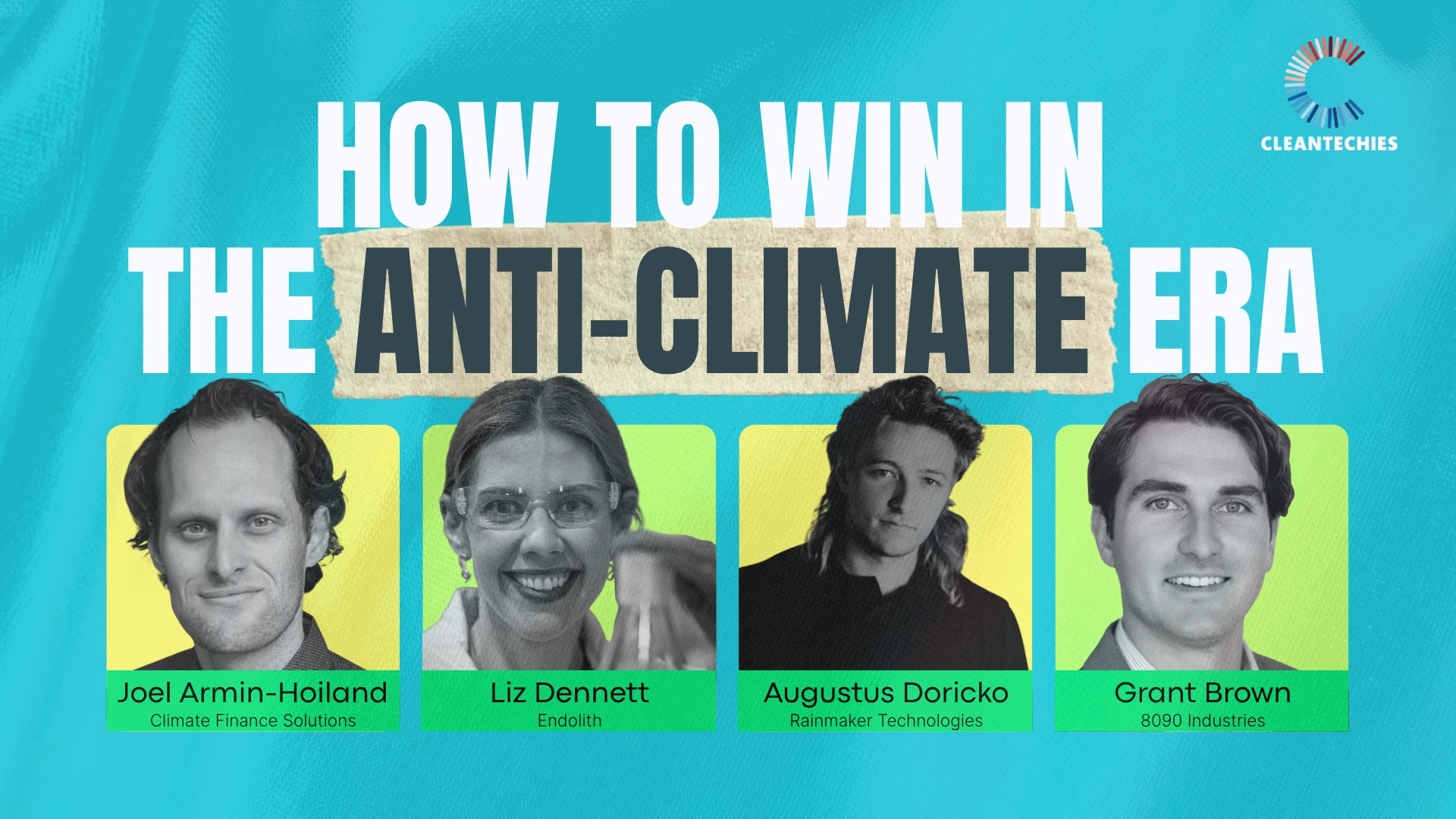

Below are the show notes for the audio RSS feed version of the episode.Listen on: Apple Podcasts | Spotify | YouTube | Pocket CastsEpisode Summary:With the massive increase in demand for electricity, having the capacity to flex the grid is more important than ever. To date, utility-scale energy storage uses lithium-ion technology, but there's a problem: lithium-ion needs perfect conditions to work.There is a solution, and that's what we're talking about today. Cameron Dales, co-founder of Peak Energy, is pioneering sodium-ion utility-scale battery storage to solve the needs of the grid. He discusses the economics of battery storage, the advantages of sodium-ion technology, and Peak Energy's strategy for scaling up.NY Climate Week Event: How to Win in the Anti-Climate EraJoin our panel during climate week with Augustus from Rainmaker, Liz from Endolith, Grant from 8090, and Joel from Climate Finance Solutions. Register TodayShout out to our sponsors: ErthTech Talent, Goodwin, and CSC Leasing.Sponsor:ErthTech Talent: Affordable CleanTech Search FirmTo build a successful CleanTech startup, you need the right people. ErthTech Talent is an affordable and specialized search firm that works ONLY with CleanTech startups. Reach out today and tell them you saw this ad.Support the show!Upgrade to paid today! It’s just $10/month or $100/year. Upgrade to PaidLinks:Cameron Dales: LinkedIn | Peak EnergyConnect with the hosts: Somil on LinkedIn | Silas on LinkedInFollow the podcast: CleanTechies on LinkedInThis podcast is NOT investment advice. Do your homework and due diligence before investing in anything discussed on this podcast. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

Episode Title: How to Win in the Anti-Climate Era (Live from NY Climate Week!)This week, we're sharing our live audience podcast from NY Climate Week: "How to Win in the Anti-Climate Era."We assembled a fantastic panel to discuss the strategies founders need to thrive in this new landscape:Augustus Doricko (Founder, Rainmaker)Liz Dennett (CEO, Endolith)Grant Brown (Partner, 8090 Industries)Joel Armin-Hoiland (Founder, Climate Finance Solutions)🔑 Key Discussion Topics Include:Strategies for Winning in the Anti-Climate EraAdapting to Talent & Hiring ChallengesNavigating Government Relations and Bipartisan IssuesCritical Minerals, National Security, and Public PerceptionThe Role of Tech and Innovation⚠️ Producer's Note on Audio Quality: Due to unexpected technical difficulties, the audio quality for this episode is below our usual standard, as we had to use a backup recording. We are confident the exceptional content will make up for the low audio. Thank you for your understanding!SPONSORS: This live event was supported by:Goodwin (goodwinlaw.com) — Legal partner for Climate Tech.CSC Leasing (CSCleasing.com) — Non-dilutive equipment financing.ErthTech Talent (ErthTechTalent.com) — Specialized climate tech recruiting.Mark Your Calendars! We're partnering with Climate Hack at HackSummit NYC (Dec 10-11) for founders & funders in Climate Deep Tech. Get 10% off your sign-up [link to sign-up for 10% off].Listen on: Apple Podcasts | Spotify | YouTube | Pocket CastsThis podcast is NOT investment advice. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe

Below are the show notes for the audio RSS feed version of the episode.Listen on: Apple Podcasts | Spotify | YouTube | Pocket CastsEpisode Summary:With the massive increase in demand for electricity, having the capacity to flex the grid is more important than ever. To date, utility-scale energy storage uses lithium-ion technology, but there's a problem: lithium-ion needs perfect conditions to work.There is a solution, and that's what we're talking about today. Cameron Dales, co-founder of Peak Energy, is pioneering sodium-ion utility-scale battery storage to solve the needs of the grid. He discusses the economics of battery storage, the advantages of sodium-ion technology, and Peak Energy's strategy for scaling up.NY Climate Week Event: How to Win in the Anti-Climate EraJoin our panel during climate week with Augustus from Rainmaker, Liz from Endolith, Grant from 8090, and Joel from Climate Finance Solutions. Register TodayShout out to our sponsors: ErthTech Talent, Goodwin, and CSC Leasing.Sponsor:ErthTech Talent: Affordable CleanTech Search FirmTo build a successful CleanTech startup, you need the right people. ErthTech Talent is an affordable and specialized search firm that works ONLY with CleanTech startups. Reach out today and tell them you saw this ad.Support the show!Upgrade to paid today! It’s just $10/month or $100/year. Upgrade to PaidLinks:Cameron Dales: LinkedIn | Peak EnergyConnect with the hosts: Somil on LinkedIn | Silas on LinkedInFollow the podcast: CleanTechies on LinkedInThis podcast is NOT investment advice. Do your homework and due diligence before investing in anything discussed on this podcast. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit cleantechies.substack.com/subscribe