Discover FINTECHTALK

FINTECHTALK

FINTECHTALK

Author: Show about FINTECH, AI and Crypto

Subscribed: 2Played: 18Subscribe

Share

© iValley Innovation Center

Description

FINTECHTALK(TM) is show about FINTECH, AI and Crypto and how these are fundamentally changing our lives. The Future of knowledge work, the future with agentic AI, future of assets and how they will be transacted and leveraged. The Future of hyper-personalized entertainment and education, the workplace, and commerce. Tune into to my interviews with the CEOs of Unicorns, Future Unicorns, the Disruptors, and Big thinkers, and subscribe to our newsletter at Fintechtalk.substack.com

substack.fintechtalk.ivalley.co

substack.fintechtalk.ivalley.co

40 Episodes

Reverse

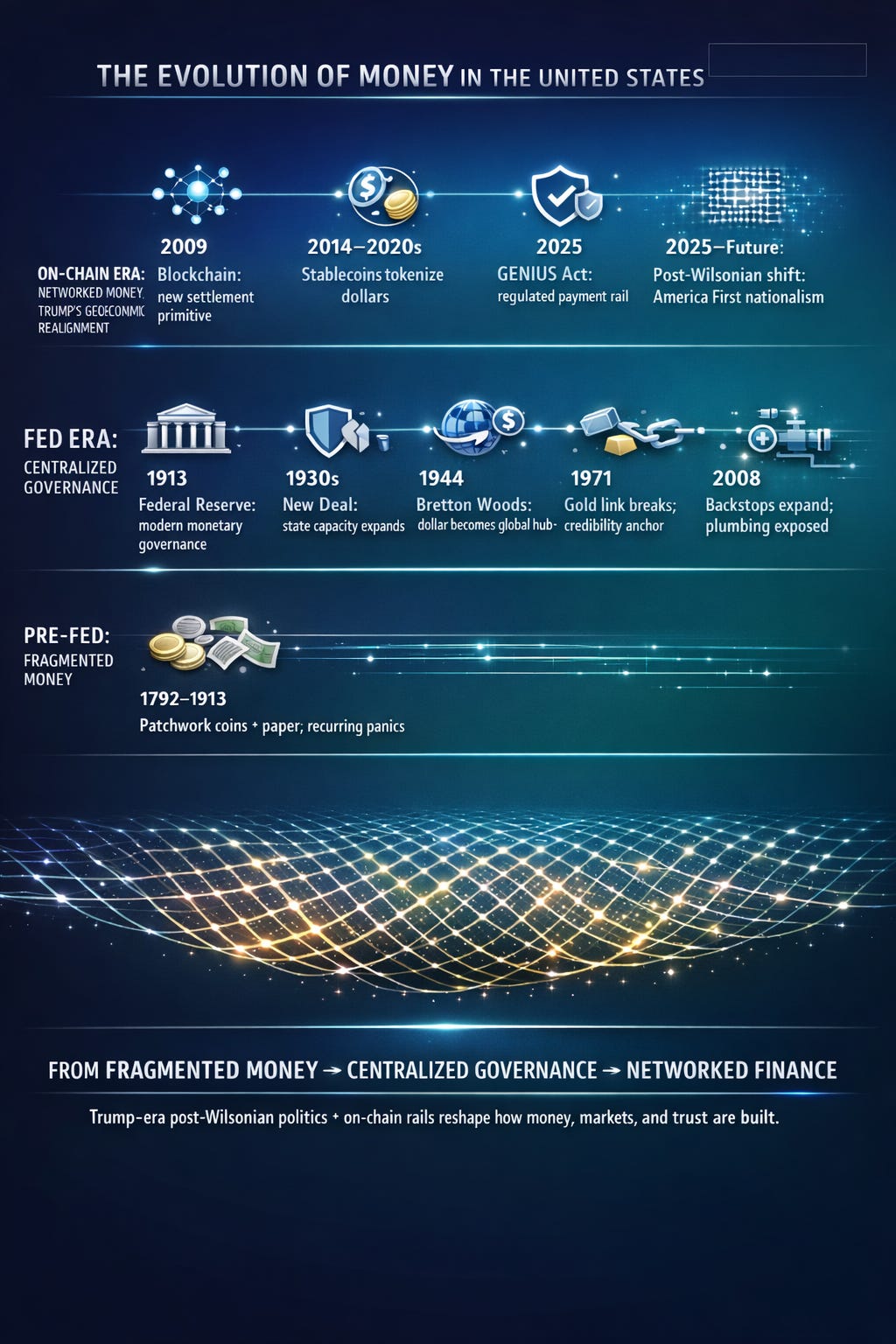

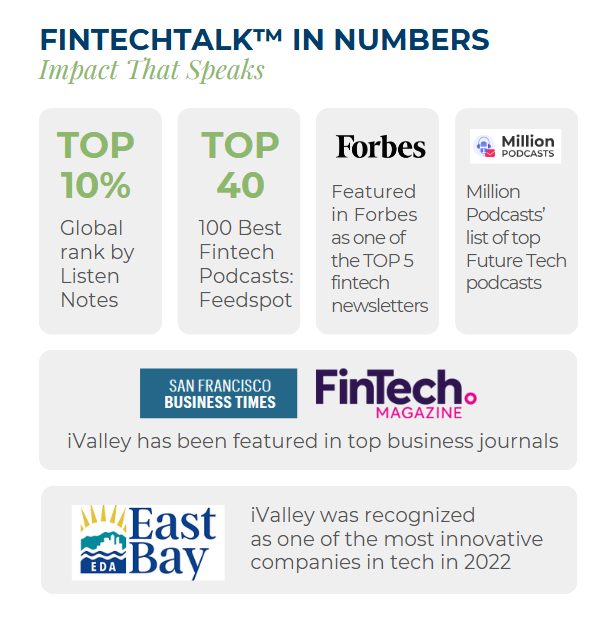

Welcome FINTECHTALKERS!Money is having a history moment again. Stablecoins, tariffs, reshoring, central bank independence, “Global South” monetary narratives—these aren’t disconnected headlines. They’re signals that the rules, rails, and power centers of money are being contested in real time.Money’s Long Arc, Stablecoins’ Next Level: Adam Braus on History, Hayek, and Innovation In this episode, I sat down with Adam Braus (Chair of Applied Computer Science at Dominican University of California)—a rare mix of engineer and economic-history mind, and a thoughtful skeptic (definitely not a crypto-maxi). Adam is a wealth of knowledge on how monetary systems actually form: what holds them together, what breaks them, and what replaces them. We covered stablecoins and onchain finance, but the real value was the way Adam kept pulling the discussion up a level—what money is for, who it serves, and how institutions evolve when trust fractures or geopolitics shifts. Adam didn’t just talk stablecoins—he walked us through 250 years of U.S. monetary history, explaining how each era of money was shaped by a mix of crisis, politics, technology, and institutional redesign: from coins and fragmented bank notes, to the Fed and the New Deal state, to Bretton Woods and the fiat turn, to the post-2008 legitimacy shock, and finally to blockchain and tokenized dollars. Along the way, he brought a distinctly Hayekian currency lens—focused on what happens when money becomes more competitive, more privately issued, and less monopolized by the state. Companies building the new financial fabric in banking and capital markets will benefit from Adam’s knowledge and perspective. A very brief 250 year Dollar historyListening back, the conversation maps onto a 250-year arc—money as a sequence of institutional upgrades and rails upgrades:* 1792–1913: a patchwork of coins and fragmented paper, with recurring panics.* 1913: Wilson’s architecture—Federal Reserve (and the broader fiscal state) begins modern centralized monetary governance.* 1930s: FDR’s New Deal expands state capacity to manage crises and shape the economic order.* 1944: Bretton Woods locks in the dollar as the hub of global trade and reserves—fueling a century of U.S.-led international order.* 1971: the gold link breaks; credibility and macro management become the anchor.* 1976: Hayek publishes The Denationalisation of Money—arguing that government monopoly over money should be challenged by competitive private currencies as a discipline mechanism against inflation and political cycles.* 2008: crisis backstops expand; the plumbing becomes visible; legitimacy debates intensify. 2008 forced the state to act as a bigger financial backstop, exposed the hidden mechanics of credit and liquidity, and sparked lasting fights over fairness, power, and trust in the system.* 2009: Satoshi introduces blockchain as a new settlement primitive—rules enforced by networks, not intermediaries.* 2014–2020s: stablecoins tokenize the dollar—same unit of account, new distribution and settlement rail—while tokenization begins spreading to Treasuries and beyond.* 2025: GENIUS Act—stablecoins get federal rules (reserves + oversight), legitimizing them as a regulated dollar payment rail.* 2025–Future: Trump-era “post-Wilsonian” money—tokenized assets and on-chain finance become the new fabric of markets, shifting monetary power outward as the central bank’s role is narrowed, contested, or re-architected.Editor’s Note (Post-Record Addendum):Wilson/FDR to Trump: Central Control → On-Chain Rails + Tokenized AssetsChallenging the Wilson–FDR Monetary StateTrump’s confrontation with the Federal Reserve is not just personality or politics—it’s a challenge to the Wilson-and-FDR architecture that defined the last century. Wilson—and FDR after him—expanded the federal government’s role as the referee of capitalism: permanent fiscal and monetary institutions built to fund a larger state, manage crises, and sustain an internationalist order. In that framework, interest rates—set by an increasingly powerful Fed—function like a kind of indirect taxation, shaping capital allocation across the economy and reinforcing a system optimized for macro-stability and global leadership.Is the Fed really independent?But I’d add one sharper layer: the Federal Reserve is not really “independent” in the way civics textbooks present it. It is structurally and culturally intertwined with the globalization project—and with the financial sector whose business model is advantaged by it: deep global capital markets, reserve-currency plumbing, and cross-border flows. Trump’s “America First” nationalism sits in direct contrast: he’s implicitly arguing for a regime where the reward function tilts upward for American producers—manufacturers, farmers, and entrepreneurs—relative to financiers. Here’s where I land after the discussion (not Adam’s opinion—just mine).America First vs Globalization FinanceTrump’s worldview starts from a different diagnosis: globalization is not a neutral efficiency machine—it’s a strategic threat. In his framing, decades of offshoring, trade deficits, and supply-chain dependence weakened the industrial base, hollowed out communities (especially across the Midwest), and ceded leverage to rivals. So his doctrine emphasizes nationalism as statecraft: reshoring, tariffs as leverage, deregulation, lower taxes, and attracting capital into U.S. assets and factories rather than overseas capacity.Reframing the Fed’s Mandate Through Industrial PolicyThat’s why Trump doesn’t treat the Fed’s dual mandate as “trade-policy neutral.” In his view, trade policy and industrial policy are upstream drivers of employment outcomes. If import competition and offshoring permanently reduce the number and quality of jobs in entire regions, then “maximum employment” becomes inseparable from the structure of trade and production. From that perspective, a central bank that focuses narrowly on inflation and aggregate employment while ignoring deindustrialization is missing the variable that determines whether employment is broadly distributed and politically sustainable.Rates as Strategy: Macro Stabilization vs Sovereign ReindustrializationHis battle with the Fed over rates follows logically. High rates are more than a technical tool—they are a barrier that diverts capital away from domestic rebuilding. They raise the hurdle rate for factories, new capacity, and risk-taking, and make it harder for reindustrialization to win against global arbitrage. So the conflict isn’t simply “Trump wants lower rates.” It’s a clash between technocratic macro-stabilization inside the Wilson/FDR framework versus sovereignty-first industrial revival that treats money, trade, and production as one integrated strategy.Perfect Storm: Trump-Era Nationalism + On-Chain Market InfrastructureAnd now layer on the other shift: onchain finance is no longer just stablecoins. The same tokenization logic is extending across Treasuries, equities, credit, derivatives, and real-world assets—transforming settlement and clearing, but also issuance, custody, compliance, and liquidity formation. If Wilson/FDR built the last century’s financial operating system, we may be entering a post-Wilsonian, post-New Deal — Trump era—with a new international order emerging as markets are rebuilt on programmable rails.The fight isn’t over rates—it’s over who America is built to serve.🎧Listen now for Adam’s Hayek-and-history lesson on money—how currency systems are built, why they fail, and what today’s experiments might be signaling.Timestamp Table0:00 – 2:30 — Opening thesis: Stablecoins as competitive currenciesStablecoins framed not as payments UX, but as the first mass-market step toward Hayek-style competitive money.2:31 – 6:00 — Trump, the Fed, and monetary tensionWhy the Trump–Federal Reserve conflict signals a deeper architectural shift, not just political noise.6:01 – 9:30 — From Woodrow Wilson to Bretton WoodsHow 20th-century monetary architecture shaped today’s centralized financial system.9:31 – 14:00 — Money as a technologyWhy money evolves like software—and why stablecoins are a protocol change, not a product.14:01 – 18:30 — Why stablecoins arrived nowSmartphones, APIs, crypto rails, and global demand converging at the same moment.18:31 – 23:00 — Private money vs state moneyHistorical parallels: free banking eras, private issuance, and why governments eventually respond.23:01 – 27:30 — Trust, legitimacy, and adoptionWhy people adopt currencies: reliability first, ideology second.27:31 – 32:00 — Banks’ existential dilemmaWhy banks can’t fully embrace stablecoins—but can’t ignore them either.32:01 – 36:30 — Stablecoins vs CBDCsWhy CBDCs solve control problems, not innovation problems.36:31 – 41:00 — Regulation as inevitabilityHow regulation will shape stablecoins without killing them—and who benefits.41:01 – 45:30 — The global south use caseWhy stablecoins matter more in unstable monetary regimes than in the U.S. or Europe.45:31 – 50:00 — Programmable money & economic coordinationWhat happens when money becomes composable infrastructure.50:01 – 54:30 — Inflation, debasement, and exit valvesWhy stablecoins act as pressure-release mechanisms in inflationary systems.54:31 – 58:30 — The long arc of monetary evolutionWhy this shift is generational, not cyclical.58:31 – 1:03:00 — What breaks firstLegacy banking rails, settlement delays, and policy lag.1:03:01 – End — Closing synthesisStablecoins as the bridge between nation-state money and network-native value systems.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand’s reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know

Welcome FINTECHTALKERS! This episode is a forward-looking roundtable on the 2025 → 2026 transition in financial services and fintech—where the arc from digital → mobile → embedded is now bending toward what comes next: agentic commerce and agentic banking, alongside the renewed momentum in stablecoins, tokenization, and programmable money.To get past the noise, Paddy sits down with three greats across financial services and fintech—each seeing the developments from a different lens:* Ron Shevlin — Chief Research Officer at Cornerstone Advisors; Senior Contributor at Forbes; Fintech Snark Tank. Brings the bank and credit union reality: boardroom priorities and open banking economics.* Steven Ramirez — CEO of Beyond the Arc. Focused on strategy-to-execution, customer experience, and change management.* Bradley Leimer — Strategic Advisor at Darrery Capital. Brings a fintech + venture + large-bank operating perspective, with a pragmatic lens on what becomes real infrastructure.Across an informal, end-of-year “friends getting together” conversation, they unpack what shifted in 2025—the thaw in fintech sentiment and exits, banks charging for data access, why banks feel increasingly defensive, and how the industry is moving toward convergence (fintech + banks) even as TradFi vs DeFi remains contentious.And then the big one: agentic AI—what it actually means, why governance becomes the bottleneck, and how customer experience may evolve when it’s your agent talking to the bank’s agent.🎧 Listen Now for a clear, grounded map of what matters heading into 2026—without the hype.Key takeaways* Fintech sentiment is shifting: IPO/exits and public-market appetite are back in the conversation—changing the mood heading into 2026.* Open banking is getting real about economics: charging for data access forces a reset from “free rails” to sustainable models.* Banks are in defensive mode: deposits and lending profitability dominate near-term priorities, especially for mid-sized institutions.* “Customer-first” isn’t a slogan—it’s the strategy: competitive advantage goes to whoever satisfies customer needs best (AI + human + execution).* Agentic AI = intelligence + tools + autonomous action: but autonomy, ROI, pricing models, and governance are the hard problems.* The CX interface is changing: from screen/menu navigation to conversational intent—and eventually agent-to-agent interactions.Editor’s Note (Post-Record Addendum):We need to bring the OGs back together—this was recorded before Venezuela, the proposed 10% credit-card APR cap, and a potential SCOTUS tariff ruling. There’s a lot more to unpack now.My quick take: agentic commerce—and the growing adjacency to DeFi—, will make a 10% credit-card APR cap more than a pricing headline; it becomes an accelerant for a structural rewrite of the card business. Issuers will deploy agents not only to streamline operating costs and improve risk management, but to open the floodgates of agentic commerce that changes where value is created.Just as digital wallets and services like Uber removed friction and reshaped the payment experience, the “AI Card” will do more than optimize checkout—it will transform how commerce is initiated, negotiated, and executed. And combined with DeFi, merchants can increasingly leverage their own balance sheets—not the banks’—to extend credit, further diminishing the role of interest income in credit card economics. The result is a shift from an interest- and interchange-centric model to a far more commerce-centric one, where the economic center of gravity moves upstream into discovery, intent, decisioning, and fulfillment.AI Cards + agentic commerce + stablecoins + DeFi = a wide-open greenfield for networks, fintechs, and issuers in 2026.Timestamp table 0:00 – 2:45 – Setup: The 2025→2026 transitionDigital → mobile → embedded → agentic + stablecoins/tokenization on the rise.2:46 – 8:10 – What changed in 2025IPO thaw, fintech winter easing, and bank-side surprises (including open banking/data access pressure).8:11 – 13:40 – The arc of fintech: where it’s actually headedWhy “% of fintech done” is the wrong question; the customer problems still aren’t solved.13:41 – 20:15 – Banks vs fintech: purpose, partnership, and realityFrom “banks are evil” narratives to collaboration—and why transformation takes longer than people think.20:16 – 27:55 – Convergence debate: Fintech + banks… TradFi + DeFi?Agreement on fintech-bank convergence; pushback on “TradFi-DeFi convergence” framing.27:56 – 37:30 – What banks are actually focused onDeposits, lending profitability, product vs experience debate, segmentation opportunities (incl. underserved niches).37:31 – 45:10 – Large bank lens: AI, investment patterns, and what funding signalsAI pilots, efficiency gains, leadership patience, and the post-2021 funding reset.45:11 – 49:10 – AI adoption reality checkFOMO deployments, slow approaches, and why governance becomes the 2026 story.49:11 – 56:20 – Agentic AI demystifiedThe three pillars, autonomy questions, ROI/pricing, and who governs agents inside institutions.56:21 – 1:03:30 – The durable advantage: serving customer needs bestWhy tech-first thinking fails; alignment and execution win.1:03:31 – 1:10:45 – The future CX interfaceFrom screen design → conversational intent → agent-to-agent banking interactions.1:10:46 – 1:15:53 – Bold predictions for 2026CX rises, AI embeds into products to take action, and regulation gets “funky.”FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand’s reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

Welcome FINTECHTALKERS!In this episode, I sat down with Brandon Card, Founder & CEO of Terzo, to explore one of the most overlooked foundations of enterprise value: contracts.FINTECHTALK’s view: the future enterprise won’t be run by today’s ERP, CRM, or core banking stacks—it’ll be run by an AI orchestrator that coordinates value flows across agent-based suppliers, partners, customers, and internal functions like finance, with much of that value moving on-chain.The schematic below shows the future state. Left: an interim phase where existing workflows remain intact but gain an AI “overlay.” Right: the end state, where workflows are rebuilt into an on-chain exchange of value, dynamically executed and optimized by AI agents. Companies like Terzo are already building early versions of this future-state orchestrator engine.Figure 1 - FINTECHTALK’s view on future state Enterprise architectuer with AI agents and Blockchain based systems of value.While Wall Street debates tokenizing equities and increasingly exotic instruments, the real unlock for Main Street and enterprise businesses is happening elsewhere. It’s in what companies like Terzo are doing—turning buried enterprise assets like contracts into liquid, actionable value. This is where tokenization gets practical: Wall Street–grade capabilities such as pricing intelligence, risk visibility, and cash-flow foresight, brought to everyday businesses by structuring and activating their own data.Brandon’s journey—from Oracle and IBM to Microsoft—gave him a front-row seat to the same problem repeating at scale. Enterprises sign thousands of contracts worth trillions of dollars, yet the financial intelligence inside those agreements remains trapped in static PDFs, disconnected from finance, procurement, and ERP systems that actually run the business.With Terzo and its latest platform, NirvanAI, contracts become more than legal artifacts—they become financial assets. We discuss how core platforms like ERP, procurement, CRM, and banking systems will evolve into AI- and blockchain-native systems of value, not just systems of record. In doing so, enterprises gain access to tooling and insight that was once reserved for big banks and firms like Palantir—but now purpose-built for the Fortune 500 and beyond.If you care about enterprise AI, agentic systems, or how trillion-dollar businesses are quietly being re-architected from the inside out, this conversation is essential listening.🎧 Listen Now to hear how Terzo is building what Brandon calls “the Palantir for finance.”Timestamp Table0:00 – 2:00 – Welcome + Meet Brandon CardFrom Oracle to Microsoft to founding Terzo.2:01 – 5:30 – The Contract Blind SpotWhy finance teams don’t actually control their most valuable data.5:31 – 9:00 – $120 Trillion Locked in PDFsHow contracts quietly underpin revenue, spend, and partnerships.9:01 – 12:30 – Contracts as Financial AssetsWhy treating contracts as “legal documents” is a massive mistake.12:31 – 16:30 – Why ERP Systems Miss the MarkSAP and Oracle own transactions—but not the agreements behind them.16:31 – 20:30 – Introducing NirvanAITerzo’s financial command center for contracts, spend, and revenue.20:31 – 24:30 – Accuracy Over HypeWhy finance demands 99% accuracy—and most AI tools fall short.24:31 – 28:30 – Purpose-Built vs PlatformsWhy Terzo positions itself as the Palantir for finance.28:31 – 33:30 – Fortune 500 Go-To-MarketWhy Terzo focuses on the most complex enterprises first.33:31 – 38:30 – AI in Production, Not R&DWhat it takes to deploy AI systems enterprises actually trust.38:31 – 44:00 – The Future: Contracts on the LedgerSmart contracts, blockchain, and contract-to-payment automation.44:01 – 49:00 – The AI ERP OpportunityWhy the next Oracle won’t look like an ERP at all.49:01 – End – Raising Series B + Final ThoughtsBuilding a category-defining enterprise intelligence platform.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesIf you’re building the next-generation enterprise stack—disurpting ERPs, CRMs and Core banking—where AI + blockchain rewire how finance, procurement, supply chain, and operations actually run, FINTECHTALK helps you turn that vision into a category narrative, not just another pitch deck. We work with founders and innovators to translate your product thesis into a clear “why now,” a differentiated point of view, and a story the market can rally around.Through our Narrative Blueprint collaborations, over 4–6 weeks we help you:Run founder interviews and a positioning workshopCraft a 60–90 minute flagship episodePublish a 3–5k word Substack deep-diveProduce a crisp executive 2-pager and a “where you fit in the next-gen AI + blockchain enterprise stack” infographic.Ship a social pack of posts and clips your team can use across channelsWe also partner with PR/creative agencies via an affiliate model, and with VC & corporate innovation teams through a VC + Corporate Innovation Blueprint that links your fund thesis to an Insight Lab for your portfolio and strategic partners.If you see your company in what follows—or want to be on the 2026 watchlist—Schedule a scoping call today or email us at fintechtalk at substack dot comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

Welcome FINTECHTALKERS!Our thesis from our piece earlier - “We’re moving from “features on legacy rails” to programmable, money on increasingly on-chain infrastructure. Tokenization is a means; infrastructure is the story. Eventually, programmable money can think and choose with Agents.”If you’re building any piece of this on-chain financial fabric—stablecoins, RWA rails, prediction markets, treasury tools, or AI-native infrastructure—FINTECHTALK works with founders and innovators to turn your thesis into a category story, not just a pitch deck.If you see your company in what follows—or want to be on the 2026 watchlist—Schedule a scoping call today or email us at fintechtalk at substack dot comIn this episode, I sat down with Patrick Gerhart, President of Banking Operations at Telcoin, to explore how a crypto-era startup just made US banking history.Telcoin recently received approval to launch a fully regulated digital asset bank under Nebraska’s Financial Innovation Act — the first of its kind in the United States. Patrick shares how traditional banking meets blockchain through Telcoin’s new charter, the vision behind its dollar-backed stablecoin EUSD, and what it means for consumers, fintechs, and community banks.We also unpack the broader shift in financial infrastructure — from legacy cores and card rails to programmable, real-time settlement, where money moves as fast as data. Patrick explains why regulation is not a burden but an adoption catalyst, how state innovation is shaping federal policy, and why stablecoins could be the “credit card moment” of the 2020s.According to DeFiLlama, there are roughly $308B in stablecoins outstanding today—an increase of nearly 50% over the past year. Consider this Act I, Scene I of on-chain finance: the opening move in a world where TradFi and DeFi are starting to converge.If you’ve been watching the stablecoin and banking worlds converge, this conversation is your front-row seat to how on-chain infrastructure becomes the new financial fabric.If you’re building any piece of this on-chain financial fabric—stablecoins, RWA rails, prediction markets, treasury tools, or AI-native infrastructure—FINTECHTALK works with founders and innovators to turn your thesis into a category story, not just a pitch deck.Through our Narrative Blueprint collaborations, over 4–6 weeks we help you:Run founder interviews and a positioning workshopCraft a 60–90 minute flagship episodePublish a 3–5k word Substack deep-diveProduce an executive 2-pager and an “where you fit in the new financial fabric” infographicShip a social pack of posts and clips your team can use across channelsWe also partner with PR/creative agencies via an affiliate model, and with VC & corporate innovation teams through a VC + Corporate Innovation Blueprint that links your fund thesis to an Insight Lab for your portfolio and strategic partners.If you see your company in what follows—or want to be on the 2026 watchlist—Schedule a scoping call today or email us at fintechtalk at substack dot comBanking & Capital Markets: What We’ll Be Watching in 2026 on BlockchainOur thesis from our piece earlier (link here) - “We’re moving from “features on legacy rails” to programmable, money on increasingly on-chain infrastructure. Tokenization is a means; infrastructure is the story. Eventually, programmable money can think and choose with Agents.”Market Structure & PoliticsHow the Market Structure Clarity Act and Responsible Financial Innovation Act (RFIA) actually land—and the politics between Congress and regulators (SEC, CFTC, Fed, OCC, FDIC) and large incumbents and crypto natives (JPMorgan, Citi, Bank of America, Coinbase, Ripple, SIFMA, Blockchain Association) - Is AML/OFAC policy—and the control it enables in D.C.—becoming the ultimate “WMD” that secures just enough bipartisan support to stall financial innovation and block real market-structure reform? And if so, what levers does the industry still have to educate lawmakers and the administration?On-Chain Issuance & RWA Tokenization (Capital Markets Infrastructure)* Issuance & primary markets (on-chain):Platforms turning equity, credit, funds, and money markets into tokenized instruments: Securitize, Figure, Digital Asset, Blockstream, Ripple, Ondo, Tokeny, Polymesh.* Buy-side infrastructure:Asset managers and allocators building product on top of these rails—tokenized funds, on-chain share classes, and 24/7 liquidity from BlackRock (BUIDL), Franklin Templeton, WisdomTree, Hashnote, Ondo, family offices, and crypto-native funds.* Sell-side & market infrastructure:Trading, prime, and collateral plumbing that connects institutions to tokenized markets: FalconX, Coinbase Institutional, Anchorage Digital, Copper, BitGo, exchanges and ATS venues, as well as custody and collateral management stacks.Applications Across the Stack (Banking + Markets)* Cross-border payments & liquidity:Faster, cheaper flows using stablecoins and tokenized deposits via Wise, Ripple, Visa, Mastercard, SWIFT gpi banks, Thunes.* Corporate & institutional treasury (“Treasury 3.0”):Moving from siloed bank accounts to programmable liquidity on shared ledgers—Bitcoin on the balance sheet (e.g., MicroStrategy, Coinbase), then USDC/PYUSD/JPM Coin for payments and pooling, and ultimately AI-driven treasury playbooks executed via SAP, Oracle, Kyriba plus cloud/AI platforms (Microsoft, Google, OpenAI) and bank labs.* Buy-side use cases:Portfolio construction and risk management using tokenized funds, RWAs, and on-chain money markets, with integrated data and collateral workflows for asset managers, hedge funds, and corporate treasuries. The endgame is to deliver Wall Street–grade capabilities to corporates and Main Street—without the Wall Street overhead.* Sell-side services:Prime brokerage, financing, and structured products are being rebuilt on tokenized collateral and always-on markets (FalconX, Galaxy, Anchorage Digital, Coinbase Institutional, Copper, BitGo, bank desks). On-chain finance may blur the old lines—could corporates and Main Street one day operate as “sell side” liquidity and product providers themselves?Prediction & event markets as a new primitive:Platforms like Kalshi and Polymarket offering markets on macro, regulatory, and geopolitical outcomes—both as speculative venues and as signal feeds into AI-driven treasury, risk, and portfolio strategies.Regulation, Compliance & Market IntegrityTooling and rules for a converged TradFi–DeFi structure that now includes stablecoins, RWAs, DeFi protocols, and prediction markets—driven by SEC, CFTC, ESMA, FCA, FINRA and surveillance/compliance vendors (Chainalysis, TRM Labs, Elliptic, Eventus, Solidus Labs) plus in-house regtech stacks at major banks and broker-dealers.Timestamp Table0:00 – 1:00 – Welcome to the New Financial FabricSetting the stage for programmable money and regulated blockchain infrastructure.1:01 – 2:20 – Meet Patrick GerhartFrom traditional banker and policymaker to president of America’s first digital asset bank.2:21 – 5:50 – The Nebraska Innovation StoryHow local legislation and Congressman Mike Flood shaped the US digital asset framework.5:51 – 8:00 – From Telco Token to Bank CharterThe evolution of Telcoin — from crypto wallet to chartered financial institution.8:01 – 10:50 – Why Regulation Is a Growth StrategyHow embracing compliance and regulators builds trust and accelerates crypto adoption.10:51 – 14:30 – The Future Banking StackCombining legacy safety with blockchain speed and programmability.14:31 – 18:00 – Washington Gets OnboardInside the Genius and Clarity Acts — how D.C. is enabling innovation.18:01 – 21:20 – Main Street Banking ReinventedHow community banks can access blockchain rails through Telcoin partnerships.21:21 – 26:00 – EUSD: The Digital Cash ProductHow Telcoin’s stablecoin works — minting, reserves, and redemption explained.26:01 – 31:00 – Real-World Use CasesFrom cross-border transfers to merchant payments — cheaper, faster, safer.31:01 – 35:00 – De-Risking for Community BanksHelping smaller institutions onboard to blockchain rails without heavy lifts.35:01 – 40:00 – AI + Blockchain: The ConvergenceHow AI will transform compliance, KYC, and transaction monitoring.40:01 – 45:00 – Stablecoins as Payment RailsWhy stablecoins are the new ACH — programmable, self-clearing, and instant.45:01 – 50:00 – Building a Digital Asset Bank from ScratchLessons from the charter process — regulation, risk, and reinvention.50:01 – 54:00 – Future Vision: The Stablecoin EraHow stablecoins will become as common as debit cards within a decade.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesEnjoy and always Be in the Know.Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

Welcome FINTECHTALKERS!In this episode, I sat down with Toby Brown, who leads regulated industries at Google Cloud, to explore how AI in financial services has evolved from pilot projects to real deployments driving measurable ROI.Last year, the conversation was about proofs of concept. This year, it’s about deployment, integration, and scale. Toby explains how banks, fintechs, and exchanges are turning generative AI into productivity tools, compliance engines, and customer experience drivers—while building a framework for secure, regulated AI adoption.We also dive into Google’s emerging role in agentic commerce—from the Agent-to-Agent (A2A) protocol and Agentic Payments Protocol to the Google Cloud Universal Ledger, which enables programmable money movement and real-time settlement across industries.If you’re curious about how AI, Stablecoins, and distributed ledgers are converging to define the next generation of financial infrastructure, this episode paints the roadmap from assistive chat to autonomous finance.💡 Key Takeaways From the Episode* AI goes from pilot to production: Deployments are happening across productivity, customer service, and marketing use cases.* Agentic finance emerges: The next evolution—agents transacting, settling, and verifying autonomously.* Google’s A2A and payments protocols: Open frameworks enabling secure, verifiable agent-to-agent interactions.* Universal Ledger for programmable money: A distributed infrastructure built for compliance, throughput, and scale.* Risk & compliance first: New AI models like Gemini enable anomaly detection, KYC automation, and financial crime prevention.* Stablecoins’ institutional moment: Adoption is surging in B2B, remittances, and settlement—while consumer use cases are still forming.* Customer experience reimagined: From static dashboards to interactive, multimedia financial guidance powered by generative AI.* The future is hybrid: Human-in-the-loop systems for high-value transactions; autonomous AI for low-friction commerce.🎧 Listen now to the full episode⏱️ Timestamp Table0:00 – 2:00 – Welcome + Meet Toby BrownFrom 20 years in financial services to leading Google Cloud’s regulated industries team.2:01 – 4:00 – AI’s New VocabularyFrom pilots and proofs to deploy, integrate, measure.4:01 – 7:00 – Where AI Works TodayReal ROI in developer productivity, customer service, and marketing (with Klarna results).7:01 – 10:00 – Agentic Commerce Takes ShapeThe shift from assistive chat to autonomous money movement.10:01 – 13:00 – A2A & Agentic Payments ProtocolOpen frameworks for agent-to-agent trust and verification.13:01 – 18:00 – Universal Ledger + PartnersHow PayPal, AmEx, Etsy, and CME are piloting programmable money infrastructure.18:01 – 22:00 – Stablecoins in ContextEarly wins in B2B remittance and institutional settlement; consumer use cases still emerging.22:01 – 26:00 – AI for Risk, Fraud, and KYCFinancial crime detection and compliance automation with Gemini.26:01 – 29:00 – Reimagining Customer ExperienceFrom text and charts to interactive, multimedia financial guidance.29:01 – 31:00 – The Always-On Financial AdvisorAI-powered advisory and inclusion at scale.31:01 – End – Announcements + Where to Find MoreGoogle Cloud at Money20/20; Monday, Oct. 27 keynote.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand’s reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

Welcome FINTECHTALKERS!In this episode, I sat down with Nick Christian, Head of National Fintech and Specialty Finance at Silicon Valley Bank, to break down the bank’s freshly released Future of Fintech Report 2025—a data-packed field guide to what’s real and what’s next in fintech.SVB has long been the industry’s early-warning radar and reality check for fintech. With decades of category focus, deep relationships across founders, CFOs, VCs, and operators, and a vantage point informed by real transaction flows—treasury, credit, payments, and venture activity—SVB consistently spots signal before the headlines do. Their thought leadership isn’t armchair analysis; it’s grounded in data, deal flow, and daily conversations with the builders. That’s why the Future of Fintech report reads less like a prediction and more like a field guide to what’s actually working—and what’s next.After a turbulent few years, fintech is back on solid ground. Investments are up, cash burn is down, and profitability is improving. As Nick puts it, the sector is “skipping the AI hype cycle in favor of real revenue.” We discuss why fintech is outperforming other venture sectors, how embedded finance continues to expand across verticals, and where crypto, regulation, and infrastructure innovation intersect.We dive into:* The macro shifts: rate cuts, tariffs, and changing regulatory regimes under the new administration.* The resurgence of crypto & stablecoins: fueled by the Genius Act and global use cases in cross-border payments.* AI in fintech: where adoption is deliberate, not frenzied—focused on fraud, KYC, and operations rather than front-end automation.* M&A and IPOs: why exits are reopening, capital is flowing back to LPs, and a new generation of startups is forming.* TradFi + DeFi convergence: how stablecoins and blockchain rails are bringing both worlds together.From crypto-backed mortgages to tokenized assets and agentic banking, this conversation captures the pulse of fintech’s comeback moment—anchored by data and real market traction.Founders: if you’re building in payments, lending, infrastructure, or anything at fintech, stablecoins or AI, reach out to Nick Christian and the SVB fintech team to compare notes and explore partnerships. They’ll be on the ground at Money20/20 Las Vegas hosting and popping into multiple meetups, roundtables, and happy hours—perfect touch points for warm intros and real feedback. DM Nick on LinkedIn or connect via SVB.com to line up time; tell them you’re a FINTECHTALK listener so they know to roll out the red carpet.🎧 Listen Now to the full episodeKey Takeaways From the Episode* Fintech is stabilizing: Investment is rebounding, burn is down, and profitability is improving across key segments.* Payments & lending lead growth: Embedded finance and verticalization are expanding faster than other categories.* Infrastructure’s quiet rise: Legacy modernization is the next major wave of disruption.* Crypto & Stablecoins surge: Cross-border payments are the top use case, driving new banking partnerships.* Regulatory clarity returns: The Genius Act and Clarity Act unlock new confidence and innovation.* AI finds its lane: Adoption remains pragmatic—fraud, KYC, AML—rather than autonomous decision-making.* M&A & IPO revival: Figure, Circle, Chime, and Klarna signal liquidity is back, fueling new fund formation.* TradFi meets DeFi: Stablecoins, tokenized assets, and blockchain rails are merging both ecosystems.* Nimbleness wins: The best fintechs of 2026 will pivot fast, diversify, and master unit economics. Download the Future of Fintech Report on SVB.comTimestamp Table0:00 – 2:30 – Welcome + Meet Nick ChristianHead of National Fintech & Specialty Finance at Silicon Valley Bank—introducing the 2025 Future of Fintech Report.2:31 – 6:00 – The State of Fintech in 2025After a volatile few years, the data says it all—investment is up, cash burn is down, and fintech is outperforming other venture categories.6:01 – 10:00 – Fintech’s Maturity CurveWhy the industry is moving past hype cycles into sustainable, revenue-driven growth.10:01 – 15:00 – Macro Factors Shaping 2025Rate cuts, tariffs, new administration priorities, and the regulatory tone reset.15:01 – 20:00 – Crypto’s Resurgence & The Genius ActStablecoins, tokenization, and the global use cases reviving digital assets.20:01 – 24:30 – TradFi + DeFi ConvergenceWhy banks are now adopting blockchain rails instead of resisting them.24:31 – 30:00 – AI in Fintech: Real Use CasesFraud, KYC, AML—AI is transforming risk management, not replacing humans.30:01 – 34:00 – Infrastructure Is Sexy AgainThe modernization boom: from core banking stacks to middleware layers driving embedded finance.34:01 – 38:30 – M&A and IPOs: The Return of ExitsCircle, Chime, Klarna, and Figure mark the beginning of a new liquidity cycle.38:31 – 42:00 – The Next Fintech BuildersWhy the best founders will be multi-disciplinary, data-native, and regulatory fluent.42:01 – 45:00 – Closing Thoughts & Where to Learn MoreHow to access the full SVB 2025 Future of Fintech Report and key takeaways for founders and investors.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand’s reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

Welcome FINTECHTALKERS!The greatest show in financial services—Money20/20—raises the curtain in Las Vegas in less than a week. For over a decade—and still today—it’s the byword for the industry’s future. In this episode, I sat down with Zach Anderson Pettet, VP of Fintech Strategy at Money20/20. Zach curates the storylines, steers the content, and keeps a finger on the pulse of what’s real vs. hypeZach shares how Money20/20 evolved from a small payments conference into the global fintech platform, with events from Las Vegas to Amsterdam to Riyadh, where industry-defining conversations happen every year. He previews the trends this year — from the comeback of Stablecoins and tokenized assets to AI agents reshaping commerce, Zach explains why this year’s show is more than just a reunion—it’s where the future of finance takes shape.We discuss:* How Money20/20 acts as both a mirror and a molder of fintech’s evolution.* The resurgence of Stablecoins amid regulatory clarity and the Genius Act.* Why AI + blockchain could lead to self-driving money.* How the lines between TradFi and DeFi are disappearing.* The launch of the new Intersection Stage, where both worlds meet.* Sneak previews of keynote appearances from Max Levchin (Affirm), Jennifer Bailey (Apple Pay), Congressman Mike Flood (Genius and Clarity Act and coming on the FINTECHTALK show next week), and Michael Saylor (MicroStrategy).As Zach puts it, fintech has grown up—it’s not just disruption anymore. “We’re not fintech; we are financial services now.”It’s still not late to be part of the show. https://www.money2020.com/🎧 Listen now to the full episode⏱️ Timestamp Table0:00 – 2:00 – Welcome Zach!Zach Anderson Pettet on how Money20/20 became fintech’s global platform.2:01 – 6:00 – The Fintech Family ReunionHow networking and serendipity at Money20/20 drive real deals and ideas.6:01 – 10:00 – From Payments to PlatformsHow Money20/20 evolved into a mirror—and driver—of fintech transformation.10:01 – 14:00 – Global Fintech PulseRiyadh, Bangkok, Amsterdam, and Vegas—why global collaboration matters now more than ever.14:01 – 20:00 – Startup Momentum & EvolutionWhat it means to be a startup in the age of $100M Series A rounds and AI-built companies.20:01 – 27:00 – Embedded Finance & The Creator EconomyHow fintech is becoming hyper-segmented—solving problems for creators, freelancers, and gig workers.27:01 – 33:00 – The Stablecoin ResurgenceHow banks, regulators, and startups are aligning around tokenization and blockchain rails.33:01 – 39:00 – Policy, Regulation & The Genius ActCongressman Flood, deregulation, and a new tone in Washington toward digital assets.39:01 – 46:00 – TradFi Meets DeFiHow “coopetition” is replacing competition, and why the Intersection Stage represents the future of finance.46:01 – 53:00 – AI Takes the Main StageFrom Anthropic’s Mike Krieger to OpenAI’s leadership, exploring how UX and design are reshaping AI in finance.53:01 – 1:02:00 – Autonomous Finance & Agentic BankingThe vision of “self-driving money” and the trust frameworks forming around AI agents.1:02:01 – 1:07:00 – Big Names, Big MomentsJennifer Bailey (Apple Pay), Max Levchin (Affirm), and Michael Saylor (MicroStrategy) headline this year’s show.1:07:01 – End – Final Thoughts & InvitationWhy every fintech founder, operator, and investor should be in Vegas this October.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand’s reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

Welcome FINTECHTALKERS!In this episode, I sat down with Han Park, Founder & CEO of Payment Labs, to explore how payments innovation is reshaping the worlds of sports, Esports, and the creator economy. From paying athletes across 180+ countries and 150+ currencies to handling compliance, KYC, and taxes seamlessly, Payment Labs is solving one of the hardest challenges in global finance: frictionless payouts.Han shares his journey from Wall Street to Samsung to Esports, and how the pain of slow, fragmented tournament payouts led him to build Payment Labs. We dive into:* Why esports was the perfect storm that exposed broken payment rails.* How Payment Labs became the Stripe for sports — powering payouts for Microsoft, X Games, and Sega.* The explosive growth of emerging sports like pickleball and flag football, and why they need modern payment infrastructure to scale.* The rise of sportsfluencers in the NIL era, and how student-athletes are becoming mini-entrepreneurs.* What verticalized embedded finance means for the future of fintech.Han’s story is one of timing, grit, and foresight — spotting the payments crisis in Esports years before the gig economy and NIL brought it mainstream.The infographic titled “Major Payment Innovations Across Web Eras” illustrates the evolution of payment technologies and platforms from Web 1.0 to Web 3.0, highlighting how each digital era transformed how money moves online. At the forefront of this new wave is PaymentLabs, a platform purpose-built for emerging sports, eSports payouts, and evolving NIL (Name, Image, and Likeness) models, reflecting how digital payment infrastructure is expanding into new creator and athlete-driven economiesSportsTech—and the broader sports industry—has seen a notable uptick in investor interest. Recent moves in the private equity space highlight this momentum, with CVC Capital Partners announcing a $14 billion dedicated sports fund and Apollo unveiling a $5 billion sports investment vehicle. These developments underscore the growing institutional appetite for sports as a scalable and high-yield asset class. As professional leagues such as the NFL begin opening up to private equity participation, the next wave of growth may emerge in the very segments that Han and Payment Labs are focused on — emerging sports like Pickleball, Flag Football, NIL (Name, Image, and Likeness), and eSports.Listen now to the full episode!Timestamp Table0:00 – 2:00 – Welcome + Meet Han ParkFrom Wall Street to Samsung to esports — Han’s unconventional path to fintech.2:01 – 6:00 – Why Esports Exposed the Payments ProblemTournament prize money delayed for months — and how that sparked Payment Labs.6:01 – 10:30 – Building the Stripe for SportsHow Payment Labs handles payouts across 180+ countries and 150+ currencies.10:31 – 15:00 – Compliance as a ServiceEmbedding KYC, AML, and tax reporting into every payout flow.15:01 – 20:00 – Big Names, Big PartnershipsWorking with Microsoft, X Games, Sega, and top esports leagues.20:01 – 24:00 – The Rise of Emerging SportsWhy pickleball, flag football, and drone racing need scalable payment infrastructure.24:01 – 29:00 – NIL and the Sportsfluencer EraHow Payment Labs empowers student-athletes to become global earners.29:01 – 33:00 – Verticalized Embedded Finance in ActionWhy niche verticals like sports and esports are the next wave for fintech.33:01 – 36:00 – Future RoadmapExpanding beyond sports into adjacent creator and gig economy payouts.36:01 – 38:00 – Closing Thoughts + How to ConnectHan’s vision for Payment Labs and where to learn more.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand’s reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

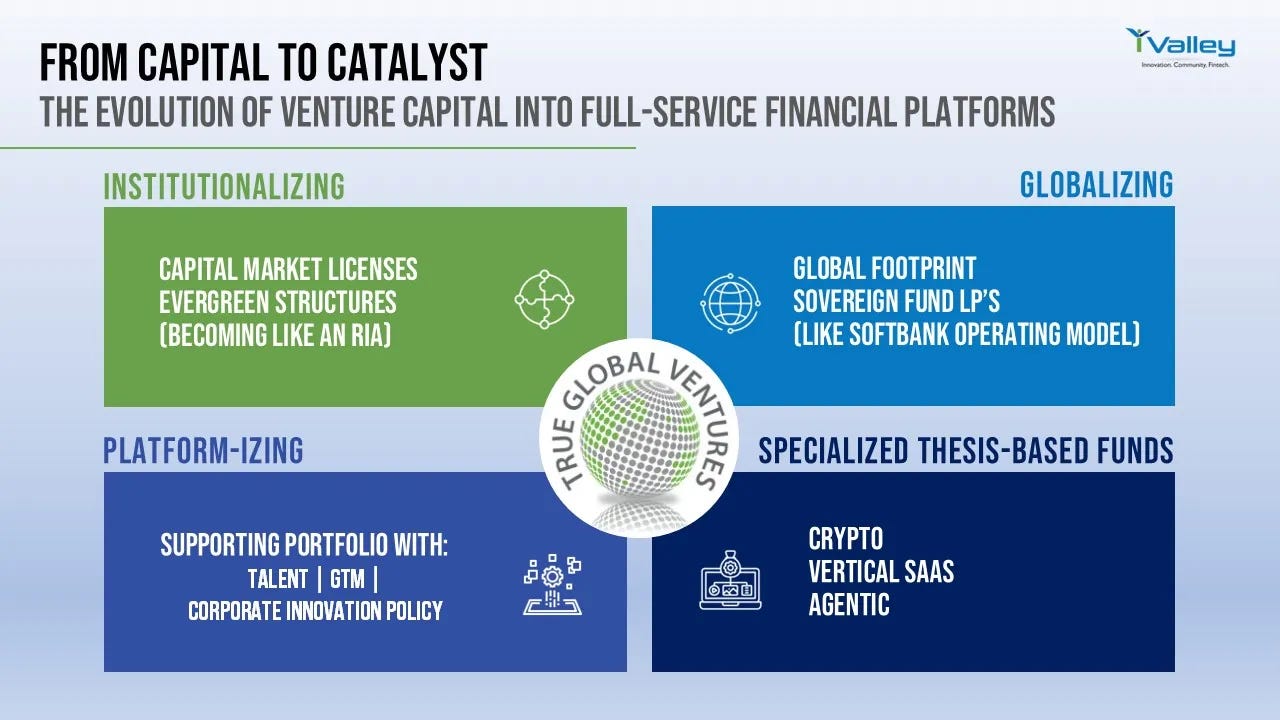

Welcome FINTECHTALKERS!In this episode, I sat down with Beatrice Lion, CEO and General Partner at True Global Ventures (TGV), to explore how they are part of bigger trend in venture capital of is evolving into a full services financial services platform - multi-stage, multi-instrument, global, services platform with thesis based funds. TGV now operates with RIA-like flexibility, much like leading Silicon Valley firms (Sequoia, a16z, Lightspeed, General Catalyst, Bessemer, Founders Fund). This evolution in Venture capital gives the firms flexibility to hold non-traditional assets and manage capital in more evergreen/long-horizon ways—balanced by heavier compliance.Beyond adopting RIA-style structures, venture firms are increasingly differentiating themselves through full-service platforms for portfolio companies—covering talent, go-to-market (GTM), and policy/lobbying support—alongside global footprints and specialized, thesis-driven funds as depicted in the infograph below.From Singapore to San Francisco, Beatrice has helped shape TGV into one of the most globally connected VC firms, with investments in Animoca Brands, Sandbox, Forge Global, Ledger, and more. With TGV’s new Capital Market Services license in Singapore—the equivalent of a U.S. RIA license—the firm can now invest across asset classes including secondaries, continuation funds, crossover funds, and even crypto.We dive into Beatrice’s journey—from her early start in venture investing to leading TGV since 2017—and unpack what makes their model different: 25–35% GP commitments, high-touch engagement in the first 12–18 months post-investment, and a platform that connects founders to deep networks across eight global cities.💡 Key Takeaways from the Episode* A different VC model: Partners commit up to 35% of fund capital—far above the industry norm.* License to scale: New MAS license enables TGV to invest in secondaries, public markets, and crypto—beyond traditional VC.* Eight-city footprint: San Francisco, New York, London, Paris, Stockholm, Singapore, Hong Kong, Dubai.* Portfolio powerhouses: Investments in Animoca Brands, Sandbox, Forge Global, Ledger.* High-touch playbook: Most value delivered in the 12–18 months after investing—then handing off to growth-stage funds.* Platform advantage: 71+ curated events, 16,000+ contacts, BD intros, and debt financing support for portfolio companies.* Trends to watch: Stablecoins, digital asset treasuries, and real-world asset tokenization in blockchain; consolidation and productivity ROI in AI.🎧 Listen Now to hear how Beatrice Lion and TGV are reshaping the VC landscape with a full-stack, global, high-touch model.www.tgv4plus.comTimestamp Table0:00 – 2:00 – Welcome + Meet Beatrice LionFrom early career in venture to leading TGV since 2017.2:01 – 6:30 – What Makes TGV DifferentWhy partners commit up to 35% of fund capital and how that changes incentives.6:31 – 11:00 – The License to ScaleTGV’s new Capital Market Services license in Singapore and what it unlocks—secondaries, public equities, and digital assets.11:01 – 15:30 – A Global FootprintEight cities, one platform—how TGV connects founders to networks in San Francisco, New York, London, Paris, Stockholm, Singapore, Hong Kong, and Dubai.15:31 – 20:00 – Portfolio HighlightsAnimoca Brands, Sandbox, Ledger, Forge Global, and how TGV backs global category leaders.20:01 – 25:00 – The High-Touch PlaybookWhy the first 12–18 months matter most, and how TGV supports founders with business development, fundraising, and debt financing.25:01 – 30:00 – Events, Networks, and Community71+ curated events, 16,000+ contacts, and how portfolio companies tap into the ecosystem.30:01 – 35:00 – AI and Blockchain TrendsConsolidation in AI, productivity ROI, stablecoins, real-world asset tokenization, and digital asset treasuries.35:01 – 38:00 – Secondaries and Continuation FundsHow TGV is leaning into crossover opportunities and the next frontier in venture.38:01 – 40:00 – What’s Next for TGVBeatrice’s vision for the next stage of global, multi-instrument venture investing.40:01 – 42:00 – Closing Thoughts + How to ConnectWhere to find Beatrice Lion and learn more about TGV.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand's reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

Hello FINTECHTALKERS!In this episode, I sat down with Sharon Rodriguez, CEO of HighPeak AI and venture partner at 1843 Capital, to explore how data, AI, and deep insurance insight are transforming long-term care planning. Backed by Prudential and built on three decades of claims and underwriting data, HighPeak is rethinking how Americans plan for healthcare, retirement, and the silver economy. Sharon shares her journey from MetLife’s global IT strategy to startup success, and how HighPeak is creating tools that deliver hyper-personalized financial forecasting and remove the anxiety from aging.We talk a lot about wealth creation, but what about wealth preservation?Sharon Rodriguez joins us on FINTECHTALK to unpack the massive opportunity—and the growing anxiety—around healthcare and long-term care costs in the U.S., especially for aging Americans. HighPeak AI is addressing this challenge with a solution that blends predictive analytics, Monte Carlo simulations, and 30 years of claims data to deliver personalized insights to financial advisors, insurance agents, and broker-dealers.Key takeaways from the episode:* The $80 trillion silver economy is grossly underserved* 90% of people feel lost when it comes to long-term care planning* HighPeak's platform enables advisors to give clients a customized, data-driven picture of health and care costs over time* The AI models factor in demographics, health, lifestyle, and even geographic choices (like retiring in Georgia vs. New York)* Advisors are equipped not just to plan, but to explain, bridging the trust gap in an emotionally complex space* Future insurance and wealth products will be shaped by consumer expectations for personalization and transparencyWe also discuss how AI will evolve the advisor’s role, not eliminate it, and how the future of wealth management will be hybrid, empathetic, and insight-led.Listen now and discover how Sharon and her team at HighPeak are reframing longevity, not as a liability, but as a solvable planning challenge.www.highpeak.aiTimestamp Table0:00 – 1:15 – Welcome + Meet Sharon RodriguezFrom MetLife to HighPeak: Sharon’s journey across IT, insurance, and investing.1:16 – 6:00 – Why Long-Term Care Is the Elephant in the Room$80 trillion in retirement wealth at risk—yet most Americans avoid planning for care.6:01 – 11:30 – How HighPeak Works: Monte Carlo + AI + Real Claims DataThree decades of data and stochastic modeling fuel the platform’s deeply personalized planning tools.11:31 – 15:00 – What Advisors Actually NeedTools that explain—not just compute—complex financial futures, in plain language clients understand.15:01 – 19:45 – The Future of Wealth and Insurance ProductsExpect hybrid models, emotional intelligence, and full transparency as table stakes.19:46 – 24:00 – Use Cases and PartnershipsWorking with broker-dealers, insurers, and advisors to embed AI without replacing the human connection.24:01 – 28:00 – Shaping the Next Generation of Fintech LeadersAdvice for fintech builders entering regulated, emotionally complex markets.28:01 – 30:00 – What’s Next for HighPeakProduct expansion, broader partnerships, and continuing to empower advisors to lead conversations about aging.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand's reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

HELLO FINTECHTALKERS!In this episode, I sat down with Sebastien Borget, the visionary co-founder and COO of The Sandbox, a platform that has redefined gaming by turning players into creators, users into owners, and digital assets into economies.Sebastien shares his journey from a teenage gamer to a serial entrepreneur who pioneered one of the most active decentralized gaming platforms in Web 3 — now with over 6 million wallets, major brand partnerships like Jurassic World, Snoop Dogg, Warner Music, and Deepak Chopra, and a creator economy powered by NFTs, AI tools, and player-owned virtual real estate.We also explore the evolution of the gaming industry, from console and mobile to play-to-earn and to how AI in changing game development. Plus: a behind-the-scenes look at Alpha Season 5, The Sandbox’s most immersive launch yet, featuring flying avatars, virtual dino parks, and over $1M in prizes.By some estimates, gaming is a $500 billion global market and continues to grow. Blockchain and NFTs have already reshaped the industry's business model, shifting control from developers to players. AI is now poised to drive the next wave of change through hyper-personalization. Sebastian talks about this trend, and we also explored it in our own article on how AI will personalize entertainment here at 6.1.Timestamp Table0:00 – 1:15 – Welcome + Meet Sebastien BorgetPaddy introduces Sebastien, co-founder of The Sandbox and a key figure in Web3 gaming.1:16 – 5:00 – How Sandbox Was BornFrom building pixel games on mobile to creating one of the first user-powered metaverse economies.5:01 – 9:00 – Why Blockchain and NFTs Were a GamechangerThe turning point: solving monetization for creators using Web 3, starting with CryptoKitties.9:01 – 12:00 – Sandbox by the NumbersOver 6M wallets, 50% new to Web3, and collaborations with Jurassic World, Warner Music, Ubisoft, and more.12:01 – 17:00 – The Evolution of Gaming (and What Comes Next)Console ➝ Mobile ➝ Free-to-Play ➝ Web3. Why play-to-earn was just the beginning, and why 2024 was a turning point.17:01 – 22:00 – What AI Is Unlocking in GamingSmart NPCs, player-generated games, 3D worlds from prompts — and how AI is opening a new frontier of gameplay.22:01 – 28:30 – Alpha Season 5 and the Future of the MetaverseJurassic World, Snoop Dogg, Steve Aoki, and K-pop icons collide in 44 sandbox experiences. Includes flying avatars and dino breeding.28:31 – 33:00 – DAOs, Digital Nations, and the Future of GovernanceEvery game is a digital country. Here’s how The Sandbox is letting players shape its future through real voting rights.33:01 – 36:30 – How to Get Involved in The Sandbox (Even If You’re Not a Gamer)From fintech firms like DBS to first-time creators — anyone can start building in the metaverse with free tools and community support.36:31 – 37:39 – Final ThoughtsGaming, governance, and financial literacy — why the next frontier is interactive, immersive, and community-owned.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand's reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

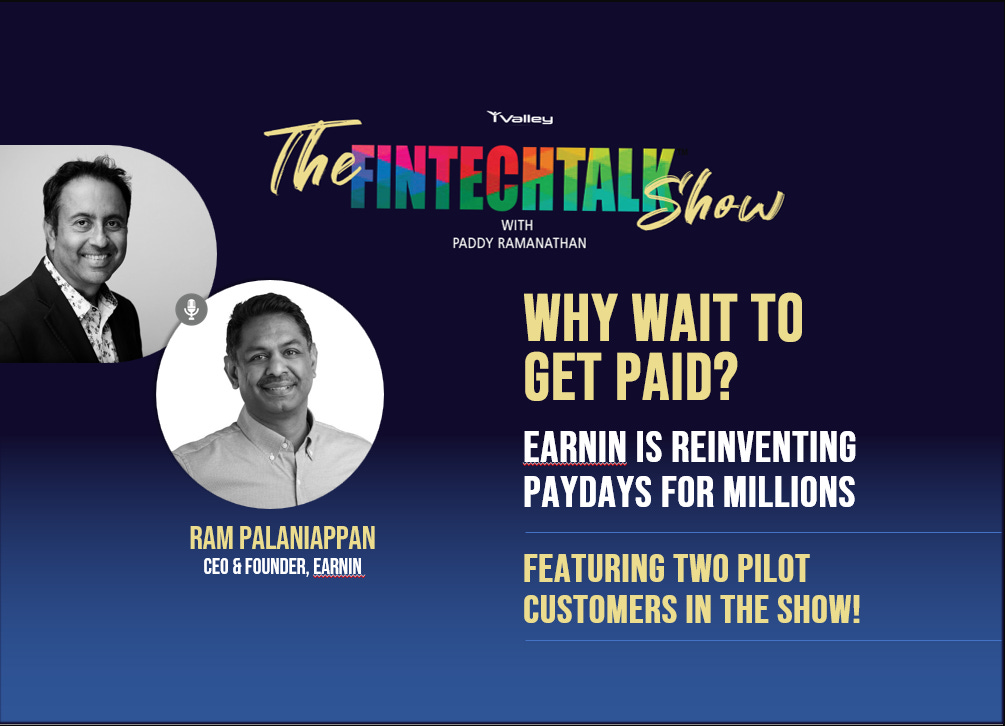

HELLO FINTECHTALKERS,In this episode, I sat down with Ram Palaniappan, CEO of EarnIn, to discuss something that touches all of us — getting paid. But not in the old way. Ram and his team are flipping the script on payday with Early Pay, a new feature that gets users access to their paycheck two days ahead of time, with zero hassle and maximum flexibility.And what made this episode extra special — we were joined by Madeline and Mike, two longtime EarnIn users who shared, first-hand, the life-changing impact of getting paid early. From avoiding overdrafts to finally saving up for a vacation, their stories reflect a deeper shift in how we think about time, money, and agency.EarnIn’s story is more than just a fintech innovation. It’s about restoring financial dignity — giving people control over what they’ve already earned, and empowering them with tools to plan better, live lighter, and save smarter.A clear trend is emerging in fintech: established players are broadening their value propositions to resemble full-fledged financial institutions. Revolut, once a challenger bank, now offers wealth management services. Robinhood, originally a trading app, has entered the realm of private banking. In this evolving landscape, EarnIn has a unique opportunity to capture the mindshare of its target segment by positioning itself as the go-to lifestyle app. In a world where fintech and legacy finance love to virtue-signal about financial inclusion, Ram and his team stand apart—they don’t just talk, they deliver. Their impact is tangible, felt directly in the lives of real users. EarnIn isn’t just an app; for its growing base of loyal users, it’s become a way of life—a core part of their financial ecosystem. That’s the difference between making noise and making a difference.0:00 – 1:15 – Welcome + Meet Ram (Again)Second-time guest Ram Palaniappan is back to share what’s new at EarnIn — and he’s brought customers with him.1:16 – 5:00 – Why He Started EarnInA deeply personal origin story: from helping an employee with an overdraft to founding a company that now helps millions.5:01 – 8:30 – Meet Madeline: Payday Anxiety, GoneGetting paid two days early transformed her stress, her planning, and her weekends. “I’m finally saying yes to life again.”8:31 – 12:00 – Meet Mike: No More Overdraft FeesHow one paycheck hitting early saved him from hundreds in fees. Plus: the community-first philosophy that won his trust.12:01 – 16:30 – New Habits, New PossibilitiesFrom budgeting better to using the “Tip Jar” feature to save for a vacation, EarnIn becomes a hub for healthier money habits.16:31 – 21:00 – Customer-Driven InnovationMadeline and Mike share their wishlist: unified dashboards, smarter insights, and automated goal tracking.21:01 – 26:00 – Early Pay, ExplainedHow it works, why it matters, and why you shouldn’t have to wait days for your own paycheck in the digital age.26:01 – 30:00 – Why Innovation Starts with EmpathyRam breaks down how real-time customer feedback drives product evolution, including direct interactions and data loops.30:01 – 36:00 – From Cash Flow to Financial EcosystemEarnIn isn’t trying to be a bank — it’s something better: a cash flow ally that works with your existing bank, not against it.36:01 – 40:00 – The Bigger Picture: Financial Access, ReimaginedWhy EarnIn is built for everyone managing tight cash flows — from middle-class families to side hustlers and gig workers.40:01 – 45:00 – The AI Moment: A New Printing Press?Ram shares his reflections on AI, crypto, and the future of knowledge — from LLMs to wealth democratization.45:01 – 48:49 – What’s Next + How to ConnectNew features, new partnerships, and open roles. Ram shares how to get involved, collaborate, or explore opportunities with EarnIn.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.Ranked by ListenNotesLooking to amplify your brand's reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

HELLO FINTECHTALKERS,In this episode, I had the pleasure of speaking with Veer Gidwaney, founder and CEO of Ansel. With a strong entrepreneurial background and a successful exit from Maxwell Health to Sun Life, Veer’s passion for solving healthcare challenges is evident.Ansel is redefining the world of supplemental insurance by covering 13,000 conditions—far more than traditional offerings—and providing proactive claims payments. That means insured individuals often receive financial support without even filing a claim. Veer shares how Ansel’s model leverages diagnostic codes, eliminates unnecessary friction, and brings innovation to a sector long overdue for disruption.We also dive into the shocking reality of 100 million Americans living with medical debt and how Ansel's solution offers both financial relief and peace of mind.If you're a fintech founder, CXO, or someone passionate about how tech and insurance can change lives, this episode is a must-listen!Timestamp Table0:00 – 1:20 – Welcome + Meet Veer GidwaneyFrom a college dropout to a repeat founder—Veer’s entrepreneurial journey and his mission with Ansel.1:21 – 5:07 – Why Supplemental Insurance is BrokenThe staggering reality of medical debt in the U.S. and why traditional supplemental insurance products fail consumers.5:08 – 10:25 – Ansel’s Mission: Health Hardships Shouldn’t Mean Financial HardshipsHow Ansel provides financial relief by covering a wider range of conditions and automating claims for faster payouts.10:26 – 17:00 – Automation and Claims InnovationHow Ansel uses diagnostic codes to process claims without consumer intervention, providing immediate financial relief.17:01 – 24:00 – Product DifferentiationVeer breaks down how Ansel’s model results in higher utilization rates compared to traditional insurers.24:01 – 29:30 – Tech and Insurance: Perfectly AlignedWhy integrating AI and data-driven automation is key to solving long-standing issues in insurance.29:31 – 34:00 – From Concept to ScalingAnsel’s partnerships with Fortune 500 companies and how employers are funding supplemental plans as a valuable benefit.34:01 – 37:00 – Future VisionVeer shares his belief that the future of supplemental insurance will look a lot like Ansel—and how the company is inviting partners to join this transformation.37:01 – 43:30 – Get InvolvedWhether you’re a broker, insurer, employer, or potential investor, learn how you can collaborate with Ansel.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and CryptoLooking to amplify your brand's reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comAsk for our Media Kit - Email usEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe

HELLO FINTECHTALKERS,In this episode, I sat down with Chandini Jain, CEO of Auquan, to explore the real-world application of agentic AI in financial services. Auquan is an enterprise AI platform that builds domain-specific agents for capital markets, automating time-consuming workflows like deal screening, credit analysis, due diligence, and compliance reporting.Chandini walks us through her journey from IIT Kanpur to Deutsche Bank, and how her love for math and problem-solving ultimately led her to entrepreneurship and building AI tools that free up professionals from the grind of routine work.We unpack how Auquan’s AI agents operate like supercharged analysts—reading documents, cross-referencing databases, and generating investor-ready memos—while keeping humans in the loop where it matters. If you’re an innovator in private equity, investment banking, or asset management, this episode is loaded with insight.As AI continues to evolve, we will witness a Cambrian explosion of agents, as shown in the figure below, shaping the future of applications and architectures both within and beyond the enterprise. Just as the shift to Service-Oriented Architecture (SOA) decades ago catalyzed digital transformation, the emergence of Agentic architecture will drive a profound shift in knowledge and workforce dynamics. Agentic back offices, such as those powered by Auquan, will not only enhance efficiency but also fundamentally reshape value chains, rendering certain software and functions obsolete. For instance, an AI-powered mortgage sales and origination agent could seamlessly integrate sales, origination, and securitization functions that are typically handled by three different systems —eliminating the need for real estate agents and streamlining the entire process. Startups that develop platform-based solutions will evolve into the next generation of enterprise platforms, much like today’s ERP, CRM, and digital platforms.Timestamp Table0:00 – 1:20 – Welcome + Meet Chandini JainFrom IIT to Wall Street to AI startup founder—Chandini’s backstory and her early realization that most of finance is "smart people doing repetitive work."1:21 – 6:45 – The Spark Behind AuquanHow building scrappy data tools at her trading desk in Amsterdam turned into a product idea. Why financial workflows are still held back by PDFs, Excel sheets, and human bottlenecks.6:46 – 10:25 – The Shift: From Systems of Record to Systems of ActionChandini introduces a new architectural layer: “systems of action”—autonomous agents that not only read and interpret data, but also take action toward a defined outcome.10:26 – 17:00 – What Is an AI Agent (Really)?Breaking down the difference between RPA, LLMs, and true AI agents. Why verticalization matters. Why fuzzy inputs + fuzzy paths = real agentic intelligence.17:01 – 24:00 – Agent Design + Training = Replicating a Human MindsetHow Auquan designs agents to think like analysts. Why mapping the "theory of mind" is essential. The hidden power of internal workflows, checklists, and feedback loops.24:01 – 29:30 – Will Agents Replace Knowledge Workers?Chandini explains why agents won’t replace analysts—they’ll free them to do more strategic and rewarding work. “Minds are made to perform, not grind.”29:31 – 34:00 – Top Use Cases: Private Credit, Compliance, RFPsHow Auquan’s agents are already delivering ROI by automating:* Credit profile generation* Regulatory and compliance checks* Investor DDQs and RFP responses* Portfolio monitoring and valuation34:01 – 37:00 – Who Should Reach Out to AuquanIf you’re in private equity, asset management, banking, or insurance—and you're manually reviewing documents or juggling messy data—Chandini wants to hear from you.37:01 – 43:30 – The Future of AI: Intent-Based EverythingWhere the world is headed: agents that listen to your intent and make things happen autonomously—across work and life. From fixing your WiFi to pricing complex derivatives.FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and CryptoRanked by ListenNotesLooking to amplify your brand's reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.comEnjoy and always be in the know,Paddy RamanathanFounder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.Thanks to ChatGPT for suggestions.(Violin piece in podcast, courtesy of my daughter Ilina) This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit substack.fintechtalk.ivalley.co/subscribe