Discover Managing Tech Millions

Managing Tech Millions

Managing Tech Millions

Author: Manage Your Millions; Define Your Legacy

Subscribed: 8Played: 136Subscribe

Share

© Christopher Nelson

Description

Real conversations with tech pros, private equity insiders, and investing experts to help you turn equity comp into generational wealth—and guide your transformation from money maker to money manager.

managingtechmillions.com

managingtechmillions.com

133 Episodes

Reverse

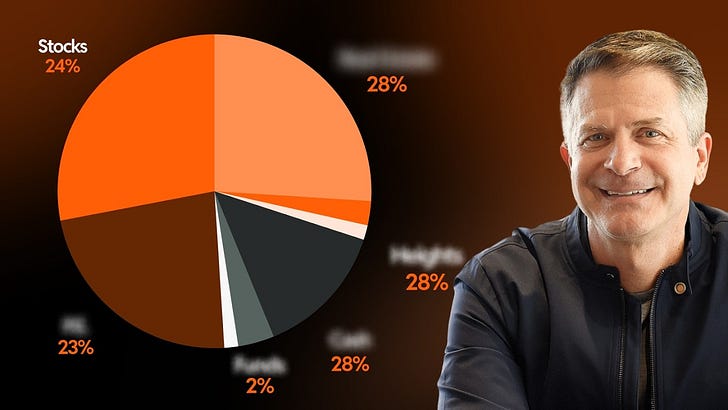

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 December 17th at 7pm to 9pm (Central US)Did you know that investors with over $20 million allocate only 23% of their portfolios to public stocks and 7% to bonds, while most financial advisors recommend 60% in stocks and 40% in bonds?In this episode, I share how the ultra-wealthy allocate the other 70% of their portfolios and how you can model their approach. We’ll dive into the key assets they use, such as real estate and private equity, and how these asset classes generate higher returns, offer tax advantages, and protect against market volatility.Follow along as I break down how you can implement these strategies and transform your portfolio into a wealth-building machine.Key Topics Covered:* How allocations in real estate and private equity generate passive income and hedge against inflation.* Why the ultra-wealthy allocate only 23% to public equities and how this can benefit you.* The importance of strategic financial planning and how to start applying these concepts to your own portfolio.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows👉 In just one session, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 December 10th and 11th at 7pm to 9pm (Central US)I made $3.3 million in five minutes during my first IPO. Six months later, I was lying in bed, staring at the ceiling, completely overwhelmed. I had always believed that seeing seven figures in my bank account would bring freedom—but instead, I had more anxiety than ever.Here’s the uncomfortable truth: making money and managing money are completely different skills.This video is a deep dive into the six most common—and most dangerous—mistakes I see first-time millionaires make. I’ve lived through all of them. I’ll also walk you through the practical, systematic framework that helped me turn chaotic wealth into a calm, income-generating portfolio.It all starts with Mistake #1: investing without first creating an Investment Thesis and a Legacy Statement. This one mistake can cost you more than any market downturn. When you skip the step of defining why you’re building wealth and how you’re going to do it, every investment becomes a guess. And guesswork is expensive.Mistake #2 is being overexposed to concentrated stock positions—especially common for tech employees. If your net worth is tied to one stock, you’re not building wealth, you’re placing a bet. Diversification isn’t just about risk management; it can also increase returns by up to 15%.Mistake #3: treating a multimillion-dollar portfolio like a side project. If you wouldn’t run a $5 million business without systems, strategy, and reviews, why are you doing that with your wealth? Without structure, you could be leaving up to 3% in annual returns on the table.Mistake #4 is treating tax planning as an afterthought. High-net-worth individuals who ignore tax strategy are giving away tens of thousands of dollars per year—sometimes more. Smart, proactive tax planning isn’t optional at this level. It’s essential.Mistake #5: settling for cookie-cutter financial advice. Most financial advisors are not equipped to serve clients in the $1–30 million range with real strategy. If you’re being offered a generic 60/40 portfolio, you’re likely getting advice designed for scale, not for success.That’s why I believe in building what I call a Micro Family Office. It’s a lean, tech-enabled version of a traditional family office that gives you access to the same tools, strategies, and investment opportunities that ultra-high-net-worth individuals use—but tailored to your portfolio size.Finally, Mistake #6 is the root of all the others: confusing making money with managing wealth. Just because you’re excellent at earning doesn’t mean you automatically know how to build lasting financial systems. They’re completely different mindsets, timelines, and skill sets.This video is the one I wish existed when I hit seven figures and had no idea what to do next. If you want to avoid years of trial and error, start by building your foundation—your Legacy Statement and Investment Thesis—and make every financial decision from there.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 November 12th and 13th at 7pm to 9pm (Central US)If you think hitting $1 million means you’re financially free, think again. That might’ve been true in 1980, but today? That barely puts you in the top 10% of net worth in America—and it’s not enough to stop working. In todays episode, I break down the exact net worth thresholds for the top 10%, 5%, and 1% in the U.S.—both total net worth and investable net worth. I’ll also share where I personally stand, how wealth strategies evolve at each level, and what it really takes to break into the top 1%. Using fresh data from the Federal Reserve’s 2022 Survey of Consumer Finances, we’ll walk through how wealth changes—not just in amount, but in structure. You’ll see why the climb from median net worth to the top 10% is steep, but getting from 10% to 1% is an exponential leap. And here’s the big insight: the difference between owning assets and owning capital. Most people in the top 10% are “house-rich,” but not capital-rich. Nearly 60% of their wealth is tied up in a primary residence that doesn’t generate income. Meanwhile, in the top 1%, nearly half of net worth comes from private business equity—not real estate or stocks. We’ll also unpack what I call The Great Decoupling—the moment the truly wealthy shift their wealth strategy entirely. It’s not about more assets—it’s about different kinds of assets, systems, and mindset. If you’re a high earner or successful professional feeling stuck—even with a $2M+ portfolio—this is your wake-up call. You may already be in the top 10%, or even top 5%, but if you’re still using the wrong wealth management playbook, you’ll never break into the top 1%. Whether you’re just starting to think about investable net worth, or already building legacy-level wealth, this video is your roadmap for moving from income dependence to true financial independence—and eventually, to becoming the CEO of your wealth.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 October 22nd and 23rd at 7pm to 9pm (Central US)After growing my portfolio to over $8 million while living off the cash flow, I’m here to share the real truth about investing—and why the advice to “trust your gut” and “do more research” is actually holding you back from success.In this video, I’ll debunk the biggest investment myths that keep high earners stuck in a cycle of bad decisions. You’ll learn why trusting your instincts can lead to major losses, and why doing endless research doesn’t always bring better results.I’ll also introduce the decision-making framework that ultra-wealthy family offices use to make smart, emotion-free investment choices. This includes two key documents—the Legacy Statement and the Investment Thesis—that guide every investment decision. Once you have these, your decisions will be clear and confident.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 October 22nd and 23rd at 7pm to 9pm (Central US)A few years ago, I stood at a crossroads with my portfolio.Option one: do what most people do—dump it all into index funds and ETFs, hope the market performs, and wait 30 years.Option two: deploy capital like the wealthy do—across multiple asset classes, focused on income, with strategic allocations that actually pay you now.I chose option two.While still working in tech, I built an income-focused portfolio with $530,000 across 9 investments, and it generated $57,000 in annual income. That portfolio became the foundation for what now brings in over $200,000/year in passive income.But here’s the real value of this video—I’m not just showing you what I did. I’m breaking down what I’d do differently today if I were starting over with the same $500K.This isn’t theory. These are hard-earned lessons from millions deployed, simplified into a refined framework that anyone can follow—without needing to be a real estate expert, financial advisor, or full-time investor.In this video, I walk through:* What I originally invested in (with numbers)* What worked, what didn’t, and why* The 5-part framework I’d follow today to generate more income with less stress* How I went from complexity to a scalable, boring machine that prints incomeIf you’re sitting on $500,000 or more and want to build a portfolio that pays you to live—not 30 years from now, but today—this video will walk you through the exact strategy I’d use.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 October 22nd and 23rd at 7pm to 9pm (Central US)In 2012, I watched my net worth jump by $3 million in just minutes after my company went public. I should’ve been celebrating—but instead, I was overwhelmed. What was I supposed to do with this money? I assumed the experts at Morgan Stanley would help me figure it out. But the advice they gave me was the same cookie-cutter portfolio they hand to someone with $100K in a 401K. That’s when I realized something was seriously broken.This week I’m going to walk you through the exact 3-phase blueprint I used to escape the Financial Dead Zone and scale my portfolio to over $8 million—while generating over $200,000 a year in passive income and covering all my family’s living expenses.This isn’t about risky bets or timing the market. It’s about taking the systems and strategies of the ultra-wealthy and scaling them down to fit your level of assets.Here’s what we’ll cover:* Why traditional advisors can’t help you scale from $1M to $10M+* The real cost of staying in the Financial Dead Zone* The 3 phases of building your own Micro Family Office: Architect, Build, Run* How to create a custom Investment Thesis aligned with your goals* Why proper infrastructure and a fractional expert team changes everything* How to implement systems and processes that treat your wealth like a businessI’ll also show you how this system made my life simpler, not more complicated—removing the stress and emotion from money decisions, and replacing it with clarity, control, and predictable growth.Whether you’re aiming for financial freedom, generational transfer, or lifestyle flexibility—this is the strategy that works.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 October 22nd and 23rd at 7pm to 9pm (Central US)Becoming a millionaire overnight doesn’t mean you automatically know how to manage wealth. In this video, I break down the 4 biggest mistakes new millionaires make—and how to avoid them.After my IPO at Splunk, I realized the financial industry wasn’t built for people with $1M–$30M net worth. Instead of cookie-cutter advice like “60/40 portfolios” and “withdraw 4%,” I learned the hard way that the wrong moves can cost you millions.Here’s what you’ll discover: * Why buying liabilities like houses and cars too early destroys long-term wealth * How “knee-jerk investing” leads to massive portfolio risk * Why tax strategy must come before financial advice * The danger of listening to advisors who’ve never built wealth themselves If you’ve built wealth through equity compensation, a business exit, or years of saving and investing, this guide will help you protect it, grow it, and manage it like a business.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 September 24th and 25th at 7pm to 9pm (Central US)If you've built a seven — or even eight-figure net worth but still find yourself approaching wealth with a middle-class mindset, you're not alone — and it’s costing you. I’ve worked with countless high earners who’ve mastered complexity in their careers, yet when it comes to managing their personal wealth, they unknowingly fall back on outdated strategies designed for $50k incomes. This mindset trap often leads to massive opportunity loss, increased risk, and delayed financial freedom.Here’s the harsh truth: you can't build generational wealth using accumulation strategies built for retirement consumption. That “buy and hold forever” mentality, the obsession with minimizing fees, or blindly sticking with 60/40 portfolios—these are small-money strategies being misapplied to big-money problems.In this content, I break down the key differences between a middle-class money mindset and wealth-building thinking: how to allocate assets, reduce taxes, generate passive income, and build your own Micro Family Office.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 September 24th and 25th at 7pm to 9pm (Central US)Most people don’t realize this, but the same wealth strategy that helps you build your first $100K is exactly what holds you back at $1M. And once you hit $5M? That strategy can actually become a risk.In this episode, you'll learn why your financial approach must evolve as your net worth grows—and how staying in your comfort zone could be costing you millions.We break down the key mindset and strategy shifts that should happen at three major milestones: $100K, $1 million, and $5 million. If you’re using the same tactics at every stage, you’re likely plateauing without even realizing it.Here’s what you’ll discover:* Why the Foundation Phase isn’t just about saving and budgeting—it’s about building the habits of a wealth CEO* What changes once you hit $1M and become an accredited investor* How to run your wealth like a business once you pass the $5M mark* The most common (and costly) mistakes people make at each phaseThis isn’t financial theory or Wall Street jargon. It’s a practical roadmap to upgrade your systems, your thinking, and your execution—so your money actually works for you.Once you understand what’s needed at each level, you’ll never look at wealth building the same way again.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 September 24th and 25th at 7pm to 9pm (Central US)Every year, headlines spark outrage when names like Donald Trump, Jeff Bezos, Elon Musk, Michael Bloomberg, and George Soros appear alongside one shocking number: $0 in federal income taxes.Most people assume this must be illegal, or at the very least, reserved for those with tens of billions of dollars. But here’s the truth: it’s 100% legal, and the real tragedy isn’t that billionaires pay too little—it’s that most high earners are paying way too much.After three IPOs and more than a decade studying wealth management, I’ve discovered that the strategies billionaires use aren’t out of reach. In fact, anyone with $1–30 million in net worth can start applying these techniques today to cut their tax bills by six figures every single year.In this post, I break down the four core strategies billionaires use to protect and grow their wealth:* The Buy, Borrow, Die Method – How Bezos avoids selling stock, sidesteps capital gains, and borrows at low rates while compounding his wealth.* Strategic Tax-Loss Harvesting – How Elon Musk offset millions in gains by strategically realizing losses, and how you can use the same approach with concentrated stock positions.* Real Estate Depreciation – Trump’s favorite tool, using paper losses from real estate to wipe out taxable income—even while properties grow in value.* Debt Structuring & Interest Deductions – How Bloomberg and Soros borrow to invest, deduct interest, and unlock preferential tax treatment on returns.Here’s the surprising part: you don’t need billions to use these strategies. Whether you have a $3M stock portfolio, a few rental properties, or a concentrated equity position from your tech career, these same principles apply.I’ll also share a real-world example from a tech executive client who was paying $400K annually in taxes before implementing these strategies. By restructuring his investments and tax planning, he cut his bill by $175K in the first year alone—and those savings compound year after year.The bottom line is this: these tax strategies are not loopholes. They’re intentional incentives built into the tax code to encourage investment, growth, and entrepreneurship. The only question is whether you’ll take advantage of them—or continue overpaying out of habit and misinformation.If you want to learn how to systematically implement these methods and manage your wealth like a business, I’ve created the WealthOps framework—a step-by-step system to build your own micro family office.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 September 24th and 25th at 7pm to 9pm (Central US)If your net worth is between $1M and $30M, chances are you’re stuck in the financial dead zone. You’ve outgrown basic financial advice, but you're still not being served by the exclusive strategies reserved for ultra-wealthy families.That’s exactly why I created the Wealth Ops Framework — a practical system that lets you operate like a full-scale family office, without needing $100M or a full-time staff.The structure is built around three simple phases:* Architect – Define your strategy through a clear legacy statement and investment thesis.* Build – Create a business structure for your portfolio, assemble fractional specialists, and set up an operational launch plan.* Run – Manage your wealth with a predictable rhythm, track results, and make smart decisions based on data.The focus is on cash flow generation, tax efficiency, and scalable growth. And it’s all done at a fraction of the cost of a traditional family office — with far more control.Once the system is in place, it takes just 8 to 12 hours per month to keep everything running smoothly. You step into the role of CEO of your wealth, making strategic decisions with clarity, metrics, and momentum.The result? More control, more efficiency, and true peace of mind. Your portfolio stops being a mystery and starts working for you — consistently and intentionally.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 August 27th and 28th at 7pm to 9pm (Central US)There are 70 million millionaires in the world — but only about 30,000 qualify for a single family office with a $100M minimum. That means 99.95% of millionaires are either stuck in the wrong wealth management system or don’t even realize there’s a better way.Most people think you need a huge fortune and a full-time team to manage wealth like the ultra-rich. But that’s just not true.A single family office gives full control and privacy, but the $2–$5M annual cost makes it impractical unless you're in the top 0.01%. On the other hand, multi-family offices offer shared resources, but you lose control, customization, and still pay high fees — often hundreds of thousands per year — for cookie-cutter strategies designed for groups, not individuals.That’s why the micro family office exists — and why it’s the best-kept secret for the 99% of millionaires with $1M to $30M in net worth.This lean, strategic model allows full control over wealth decisions while leveraging top-tier experts only when needed. No bloated payroll, no compromises, no “one-size-fits-all” plans. You become the CEO of your financial future, using battle-tested systems to manage everything from investments to tax planning to estate strategy — tailored entirely to your goals.I personally cut over $200,000 in annual wealth management costs by building my own micro family office. Instead of outsourcing control, I built a flexible and scalable framework that adapts to my life, grows with my wealth, and delivers real results — faster and with greater clarity.The truth is, most millionaires are still using wealth management models built for a world that no longer exists. Today, the best strategy is one that runs like a business: efficient, data-driven, and designed for your unique situation. You don’t need $100M to do it — just the right framework.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 August 27th and 28th at 7pm to 9pm (Central US)Despite building a $7M cash-flowing portfolio and going through three tech IPOs, none of it prepared me for the realization that I might be raising kids who would destroy it all.Living in Silicon Hills—Austin’s tech bubble—my three sons were growing up in luxury, worried more about iPad batteries than anything real. Like many high-earning parents, I thought I was doing enough: financial literacy apps, savings accounts, investment talks. But I realized I was actually creating entitled kids, not financially responsible ones.That’s when everything changed.Instead of taking a $15,000 vacation to Disneyland, my wife and I made a controversial choice: we flew our kids to Uganda. Not for fun. For service. That trip shattered their worldview—and mine.They met kids their age walking miles for clean water, missing school to help their families survive. For the first time, my boys saw that money isn’t just for spending—it’s a tool that can solve real problems and transform lives.That one decision led to a massive shift in how we parent, how we give, and how we build our legacy.I call it the Four Pillars of Wealth Responsibility:* Global Perspective – Regular exposure to how the rest of the world lives, works, and overcomes challenges.* Impact Investing Mindset – Treating giving like investing, with outcomes, metrics, and accountability.* Problem-Solving Development – Training kids to see challenges as opportunities to create solutions.* Intentional Legacy Building – Teaching that inheritance isn’t just money—it’s responsibility and mission.These shifts didn’t come from lectures or apps. They came from lived experiences—service trips, real conversations, and mindset changes. And the best part? You don’t need to fly overseas to start this journey.From local food banks to community projects, there are ways to help your kids break the entitlement cycle and see wealth as something to grow and share—not just consume.This approach not only transformed our family—it’s reshaping how I advise other high-net-worth families through WealthOps. When your kids start asking, “How much impact could this create?” instead of “How much does this cost?”, you know you're building a legacy that will last.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 August 27th and 28th at 7pm to 9pm (Central US)Eight years ago, I was stuck in a Manhattan office despite having millions in the bank. Today, I’m unemployed by choice because my portfolio—40% private equity—covers all my living expenses. But before you jump into private equity, you need to know the four benefits that convinced me to invest heavily… and the four costly mistakes that nearly wiped me out.In this video, I share how I turned IPO windfalls and real estate into consistent cash flow, why private equity can outperform public markets, and the risks that cost me $300,000. You’ll learn how to identify good deals, avoid common traps, and apply my Wealth Ops Framework to manage your investments like a CEO.If you want to escape the “accumulation trap,” generate real monthly income, and protect your wealth, this is the roadmap I wish I had when I started.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 August 27th and 28th at 7pm to 9pm (Central US)What if you could generate over $250,000 in annual income from a $3 million portfolio — without selling assets and paying less than $10,000 in taxes?That’s exactly what I’ve structured through the Evergreen Income Framework, designed for people who feel stuck in the middle: too wealthy for typical advisors, but not quite large enough for traditional family offices. If you’re sitting on $1 million to $30 million in assets, you’ve likely felt this gap.Most financial advice follows the outdated growth and drawdown model — work for decades, invest in index funds, then start selling pieces of your portfolio to fund retirement. The problem? You expose yourself to inflation, market volatility, and eventually asset depletion.Instead, I focus on asset operation, not accumulation. The Evergreen model targets income-producing investments:* Private equity real estate like commercial buildings, self-storage, and mobile home parks* Private credit offering monthly cash flow* Energy infrastructure with special tax advantagesThese assets generate strong cash-on-cash returns, typically in the 8–12% range. Combined with smart tax strategies — such as depreciation and depletion allowances — it’s possible to reduce your effective tax rate to as low as 3–5%.I also walk through risk management, diversification across geography and asset types, and maintaining liquidity buffers for both safety and opportunity. With a clear operational cadence, including quarterly income reviews and annual rebalancing, the goal is to create a system that generates predictable income and long-term wealth.This is exactly how ultra-wealthy families operate. The difference isn’t just the assets — it’s the system. They build family offices to manage investments, taxes, risk, and estate planning as one unified platform. But until now, those tools were only accessible to those with $50M+.That’s why I created the Micro Family Office framework — bringing the same structure to professionals managing between $1M and $30M.This includes:* Investment architecture to access private markets* A tax engine that integrates with your estate planning* Operational infrastructure for performance tracking and decision-making* A continuous improvement loop with quarterly reviews and market updatesIf you’ve built a career mastering complex systems, this approach makes sense: treat your wealth like a business, with reliable income, strong risk management, and a structure that can be passed on for generations.You’re not just creating a portfolio — you’re building a financial engine designed to grow, compound, and operate independently of public market swings.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 July 30 and 31st at 7pm to 9pm (Central US)Most people spend their entire careers chasing higher salaries. I used to be one of them—until I realized I was playing the wrong game. Wealth isn’t built through salary alone. It’s built through equity.In this episode, I’ll share the wealth strategy no one talks about—but that transformed my life. Through smart use of equity compensation, I built a $6 million net worth, retired early, and created the freedom to truly live life on my terms.I break it all down with real-world examples. You’ll meet Sarah, who focused on maximizing her salary, and Jessica, who played the equity game. Even though Jessica earned less in salary, she ended up nearly $1 million ahead—because she understood how stock grants and equity refreshes compound over time.This isn’t just for tech executives or startup founders. Whether you're an engineer, a product manager, or anyone with access to stock-based compensation, this could be your most powerful wealth-building tool.So if you’ve ever asked yourself, “How do people actually get rich without starting a company?”—this is the video for you. I’ll walk you through how equity works, how to negotiate for it, and why it might be more valuable than your paycheck.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 July 30 and 31st at 7pm to 9pm (Central US)Did you know that you might already qualify as an accredited investor—but no one ever told you what that actually means or how to take advantage of it?I used to think that growing wealth meant sticking to index funds and stock options. But once I discovered how Rule 506(b) and Rule 506(c) work, it unlocked a completely different financial world. A world filled with exclusive investment opportunities—private equity, hedge funds, commercial real estate syndications, and high-yield alternative assets—that most people never get to see.In this walkthrough, I break down the key differences between 506(b) and 506(c). I explain how each rule affects your access to unregistered securities, what kind of documentation is required, and how to verify your status with minimal friction—whether through tax returns or a simple letter from your CPA or attorney.Being accredited isn’t just a legal status. It’s a gateway to strategic wealth building. I learned this firsthand after an IPO left most of my net worth tied to one volatile stock. I started diversifying into private investments that generated consistent, tax-advantaged income—independent of the stock market’s daily swings.But access alone doesn’t guarantee results. That’s why I also share the risks: limited liquidity, less regulation, and the importance of having a clear allocation strategy. I talk about what separates successful accredited investors from those who just have access. Hint: it’s not complexity—it’s clarity, structure, and education.I also go a step further and explore the next level: becoming a qualified purchaser with $5 million+ in investable assets, and how that changes the game entirely. This knowledge helped me design my micro family office, plan for the next 10 years, and shift from just making money to actually managing and growing it.If you're a high-earning tech professional or entrepreneur, this is exactly the kind of financial architecture you need to build. Because accredited investing is just one piece of a much bigger strategy—one that treats your portfolio like a business and puts your wealth to work.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 July 30 and 31st at 7pm to 9pm (Central US)Most people talk about passive income like it's a magic solution: do something once, and money just keeps rolling in. But the reality is a lot more complex — especially when it comes to how different types of income are taxed.What many don't realize is that there’s a huge difference between portfolio income (like dividends or capital gains) and what the IRS truly considers passive income (like rental income). Misunderstanding these terms can lead to overpaying taxes — sometimes by tens of thousands of dollars.In this breakdown, I walk through how the IRS classifies income, what truly counts as passive, and why some “passive income” strategies are actually active businesses in disguise — and taxed accordingly. That course that teaches you to build a digital product and call it passive? It might actually be a high-tax hustle if you’re not careful.I also share some practical insights on how to build income streams that are not only sustainable but also tax-efficient. Whether you’re looking at rental properties, investments, digital products, or royalties, understanding how income is taxed is just as important as generating it.By the end, you'll have a clear understanding of:* What truly counts as passive income* How portfolio income is taxed differently* How to avoid common mistakes in income classification* Legal strategies to reduce your tax burden with smarter planningThis is the kind of foundational knowledge that can transform how you approach financial freedom — not just how you earn, but how much you actually get to keep.* What’s the difference between passive income and portfolio income?Passive income includes rentals and royalties; portfolio income includes dividends and capital gains.* Is selling a course or digital product considered passive?Usually not. If you maintain it, provide support, or keep marketing, it’s considered active income.* How can I lower taxes on my income?By structuring your income properly and knowing how the IRS classifies each type.* Are rental properties always passive income?Often yes, but it depends on how involved you are — active management can change the classification.* Why does income classification matter for taxes?Different types are taxed at different rates. Misclassification could lead to a higher tax bill.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

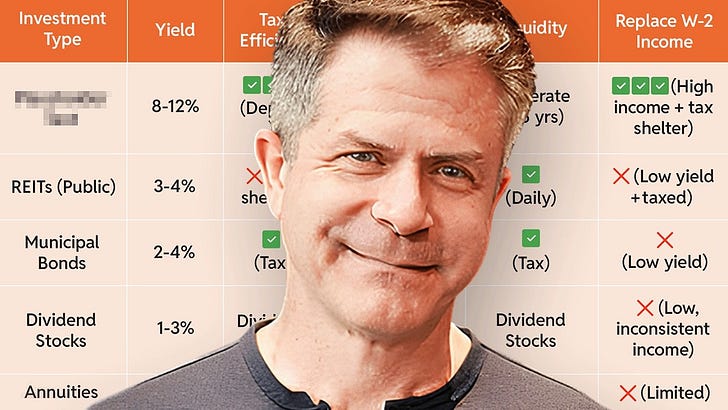

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 July 30 and 31st at 7pm to 9pm (Central US)If you're looking for a way to replace your paycheck—whether it's $150K or $200K a year—with consistent income from investments, you're in the right place. I want to share how I personally made that transition using private equity real estate. This isn't just theory—I've replaced my W-2 income with $175,000 annually, and it's all thanks to this strategy.Private equity real estate has long been the go-to strategy for the ultra-wealthy. It's not only a powerful income generator, but it's also a smart way to reduce taxes and build long-lasting, generational wealth. I want to break down why this approach works so well and how you can start applying it yourself—even if you're just beginning.The truth is, many traditional income investments simply don’t work for high earners. Bonds, savings accounts, and even dividend-paying stocks can fall short. Yields are typically low, and worse, the income is taxed at ordinary rates. That’s why it’s time to look at what really works: private equity real estate.What makes it different? First, it offers strong, recurring cash flow. Second, there are powerful tax advantages—depreciation, cost segregation, and other strategies can significantly reduce your taxable income. Third, it's a tangible asset that builds equity over time. And perhaps most importantly, it's scalable. Whether you're aiming for a few thousand a month or a full income replacement, private equity real estate can grow with your goals.Through this conversation, I’ll show you why I—and many others—believe this is the best income engine for financial independence. You’ll get insights into what to look for in an investment, the typical returns you can expect, and how to manage risk in this asset class. I’ll also discuss what makes a good operator, the difference between active and passive investing, and how to start building your portfolio today.The journey to financial freedom starts with knowledge and action. I’m here to share the lessons I’ve learned so that you can take your own steps with clarity and confidence. Whether you're a tech professional, a business owner, or simply someone seeking better ways to grow and protect your wealth, private equity real estate might be the key you've been missing.* What is private equity real estate?It's investing in income-producing properties through private deals, often outside the public markets.* How much do I need to start?Entry points vary, but many funds or syndications start around $50,000.* What are the risks?Market conditions, operator performance, and deal structure are key risks—but these can be managed with due diligence.* Is this only for accredited investors?Many opportunities are, but there are also options for non-accredited investors if you know where to look.* How does it compare to stocks or bonds?Private equity real estate typically offers higher cash flow, lower volatility, and unique tax benefits compared to traditional investments.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomWhen? 📆 July 30 and 31st at 7pm to 9pm (Central US)Have you ever wondered how the ultra-wealthy consistently earn 15% to 25% returns while most investors settle for just 7% to 10% from stocks and index funds? This content dives deep into private equity investing—what it is, how it works, and why it's become a powerful tool for building wealth that many high-earning professionals still overlook.You’ll get a clear explanation of what makes private equity such an attractive asset class, how it compares to traditional investments, and the risks and rewards involved. If you’ve ever felt like there’s a hidden side to how the top 1% grow their money, this breakdown will open your eyes.With straightforward examples and insights, you’ll gain the confidence to evaluate if private equity fits into your long-term investment strategy. This is about discovering options beyond the usual stock market path—opportunities that can offer significantly higher returns if approached wisely.By the end, you’ll understand how private equity can potentially enhance your portfolio—even if you’re not ultra-rich—and why it might be the missing piece in your financial growth plan.* What is private equity investing?It’s investing directly in private companies, often through funds, with the goal of high long-term returns.* Is private equity only for the ultra-rich?While traditionally limited to wealthy investors, there are now more accessible options for accredited investors.* What are the risks of private equity?Lack of liquidity, longer holding periods, and the possibility of company underperformance.* How do private equity returns compare to stocks?Historically, they’ve outperformed public markets but with higher risk and less liquidity.* Can tech professionals invest in private equity?Yes, and many are starting to use it as a way to diversify and grow their portfolios more aggressively.Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.👉 In just two sessions, you’ll:* Clarify your long-term vision* Define your next best investment move* Build the system that turns wealth into freedomSpots are limited—and the clarity you’ll gain? Game-changing.Let’s build your portfolio like it’s your next great company.If you like the podcast, support us by letting us know what you think (one click); please do that now!Loading...PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.And whenever you are ready, there three ways I can help you:* Start up-leveling your knowledge - 🎧️ Follow our Podcast* Get our detailed How To Videos- 📺️ Subscribe to our Channel* Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps WayDisclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit managingtechmillions.com