Discover Market Pulse with Matt

Market Pulse with Matt

Market Pulse with Matt

Author: Market Pulse with Matt

Subscribed: 1Played: 2Subscribe

Share

© Market Pulse with Matt

Description

Hosts focus on macroeconomic and geopolitical events that drive changes in business, banking, and finance. The focus is primarily on how these changes influence the currency markets.

marketpulsewithmatt.substack.com

marketpulsewithmatt.substack.com

46 Episodes

Reverse

In today’s unpredictable economic climate, smart investors know the biggest opportunities often emerge from the biggest disruptions—and that’s exactly what we’re breaking down in this edition of The Market Pulse Podcast. From massive tariff shifts and geopolitical power plays to AI breakthroughs and energy revolutions, we’re not just watching the news—we’re dissecting how to profit from it.Here’s a quick breakdown of what we’ll cover:📦 Tariff Turmoil & Trade Tactics – Trump’s 90-day tariff pause (for some) and the pressure it’s putting on China, Mexico, and Canada.💰 The Great Debt Reset – How U.S. debt refinancing and bond market manipulation may set the stage for historic gains.📉 Tesla’s Political Freefall – Why Tesla’s stock has dropped—and why it could be the best buy in the EV market right now.🤖 AI Repricing: DeepSeek’s Disruption – China’s low-cost AI breakthrough could flip tech valuations upside down.🐎 Hydrogen Horsepower – Kawasaki’s robot horse isn’t just cool—it signals the next wave in green mobility.📦 Tariff Turmoil & Trade TacticsPresident Trump recently issued a 90-day tariff pause for over 75 countries. Notably excluded from this pause? China, Mexico, and Canada. This calculated move, announced via Truth Social, was explained as a reward to nations who haven't retaliated and have approached the U.S. for negotiations around trade, tariffs, and currency manipulation.“More than 75 countries have called Representatives of the United States … to negotiate... and have not... retaliated..” —Donald J. Trump- Video of Trump talking tariffs and white house Source: - CNBC TelevisionAlongside Trumps open door police to negotiate Tariffs, China missed the tariff deadline, leading to the implementation of a 145% reciprocal tariff. This directly impacts companies like BABA, China's equivalent to Amazon. Along with all other companies dependent of Chinese imports to the US. To give you the full breath of companies impacted by industry I have included data from these exports below for further review as you look for opportunities.- Image of Chinese Exports by percentage- Image of Chinese Exports by year and dollar amountAs you can see, China exports billions of dollars' worth of goods globally, with the United States being its largest trade partner—accounting for nearly 20% of all exports. The key question I'm focused on is: which stocks have experienced the steepest declines and are most likely to rebound once a favorable trade deal is struck?Trump is pushing for a better trade agreement, and it's likely that at some point, the U.S. will secure improved terms. When that happens, where will stock prices return to? This is why companies like Alibaba (BABA), which are heavily tied to the Chinese economy, have seen some of the sharpest declines—and are also among the most likely to bounce back strongly if a positive deal is reached.While many critics claim that Trump’s tariff strategy is harmful to the U.S. economy and accuse him of lacking direction, the emerging facts suggest otherwise. Here’s some evidence that much of the mainstream media isn’t highlighting:The European Union is already showing signs of concession. European Commission President Ursula von der Leyen recently proposed a "zero-for-zero" tariff agreement in an effort to prevent further escalation—a move that reflects a broader willingness among our trade partners to negotiate.- Video of European Commission President Ursula von der Leyen proposed a "zero-for-zero" Source: Hindustan TimesChina, on the other hand, has been slower to respond. This may be a calculated move to project strength, as Chinese leadership seeks to avoid appearing pressured or bullied into a deal. Still, signs indicate they will eventually come to the table, but likely on their own terms and timeline, to preserve national pride and political stability.💰 The Great Debt Reset What many critics overlook is Trump’s strategic long game to address the U.S. debt crisis. Here are a few critical factors you need to understand:* The U.S. is set to refinance nearly $9 trillion in debt in 2025.* Tariffs pressure the stock market, leading investors to seek safer assets like U.S. bonds. This increased demand helps drive bond yields lower.* Bond yields have already dropped to around 4%, and every 0.1% drop equates to roughly $9 billion in interest savings.* At the same time, Trump is leveraging this economic pressure to negotiate stronger trade deals. His background in dealmaking—captured in his book The Art of the Deal—is playing out on the global stage.His message to other nations is clear: “The deal on the table today won’t be there tomorrow.” Delaying negotiations will cost them. He’s making it known—postponement has a price.If Trump succeeds in securing more favorable trade agreements, stocks connected to Chinese exports could recover to pre-tariff valuations—or even exceed them. This move might be part of a broader strategy to trigger the most significant dollar realignment since the Bretton Woods system collapsed in 1971.But let’s not forget—Dalio misread 1971 too. He bet against the dollar when Nixon ended the gold standard and lost everything. He recounts this in his book Principles for Dealing with the Changing World Order. At the time, logic suggested the dollar would collapse without gold backing. But the opposite happened—the dollar became backed by the strength of U.S. productivity and GDP. The result? History speaks for itself. As shown in the chart below, the S&P 500 has climbed from around $105 then to roughly $5,400 today.So I take Dalio’s position with a grain of salt—he’s been wrong before, particularly during a similar turning point in 1971. Additionally, in this interview, there are signs of cognitive decline. Having watched my own father battle Parkinson’s, I noticed strikingly similar physical symptoms in this short clip. That said, I’m not dismissing Dalio’s broader concerns. His perspective is worth considering—but we’re entering uncharted territory. Tariffs have never been used quite like this—to strategically reposition the strength of the U.S. dollar on the global stage.📉Tesla’s Political Freefall Let me be clear—I trade without political bias. I say that because Tesla is undeniably caught in the political crossfire right now, as reflected in its recent price action. While part of the move down may be due to demand concerns and broader economic factors, there's a strong case to be made that politics are playing a major role. And that’s exactly what catches my attention. Historically, politically driven sell-offs often overcorrect, only to rebound as the noise fades and fundamentals reassert themselves.So, what’s behind Tesla’s recent drop?* Elon Musk has aligned himself with initiatives like DOGE, a federal task force targeting government waste, which the media has spun as oligarchic and deceptive.* Radical protests have escalated to acts of vandalism targeting Tesla vehicles to heighten this topic and trend on social media. * Once a long-time Democrat, Elon’s political shift has sparked backlash from the party he left—turning him into a target for criticism and retaliation.Despite all this, I believe we’re looking at one of the most attractive discounted buying opportunities for TSLA in recent history—both in terms of the stock and the cars. In fact, I’m seriously considering buying one myself.Remember Elon's words:"Once Tesla fully solves autonomy and has Optimus in volume, anyone shorting us will be obliterated."There’s growing evidence that this movement is nearing its end, as innocent bystanders are now being affected—and the vandalism is starting to backfire politically, proving to be more harmful than helpful to the cause. Below is a clip of exactly what I am talking about where a Democrat gets his car keyed by a “Resistance Fighter” from a fellow liberal. In addition, the Attorney General is cracking down on these acts of domestic terrorism which should put an end to this insanity. And here’s the irony: Democrats are selling Teslas at discounts — likely bought up by Republicans, reshaping the EV narrative entirely. This could shift environmental politics long term and guess who is the new party of environmental change? That’s right, Republicans. Again to show my political temperament when trading do you remember when conservatives boycotted Bud Light?The stock tanked. Conservatives vowed never to return. And then? Full recovery.Sound familiar? It’s the same playbook, just flipped. If history is any guide, Tesla is following a similar script—only this time, it's the other side that's upset.And now, there are signs Elon might distance himself from DOGE to ease political tensions. If that happens, the backlash could quickly lose momentum. 🤖 AI Repricing: DeepSeek’s DisruptionChina’s DeepSeek AI has reportedly built a ChatGPT-level model at just one-tenth the cost of Meta’s. As a result, markets are starting to reassess the true value of AI—and what these heavily invested tech giants are really worth.That revelation crushed AI valuations:* Microsoft: ⬇️ $200* Nvidia: ⬇️ $65* Amazon: ⬇️ $85Big AI names like those above have failed to produce equivalent ROI on their investments and investors are begging to recalibrate what it costs to create an LLM, let alone the long term return on this capital being deployed into these stocks. Major AI players have yet to deliver returns that justify their massive investments, and investors are starting to rethink the true cost of building large language models—let alone the long-term ROI of pouring capital into these stocks.DeepSeek’s low-cost breakthrough has exposed the overspending in U.S. AI development, forcing a shift in how value is measured across the sector. As the narrative shifts, attention is turning to where AI will have the most practical impact—robotics. It's quickly becoming a hotbed for investment as the tides begin to turn. 🐎 Hydrogen HorsepowerSince we’ve been talking about the shift from AI to robotics, I

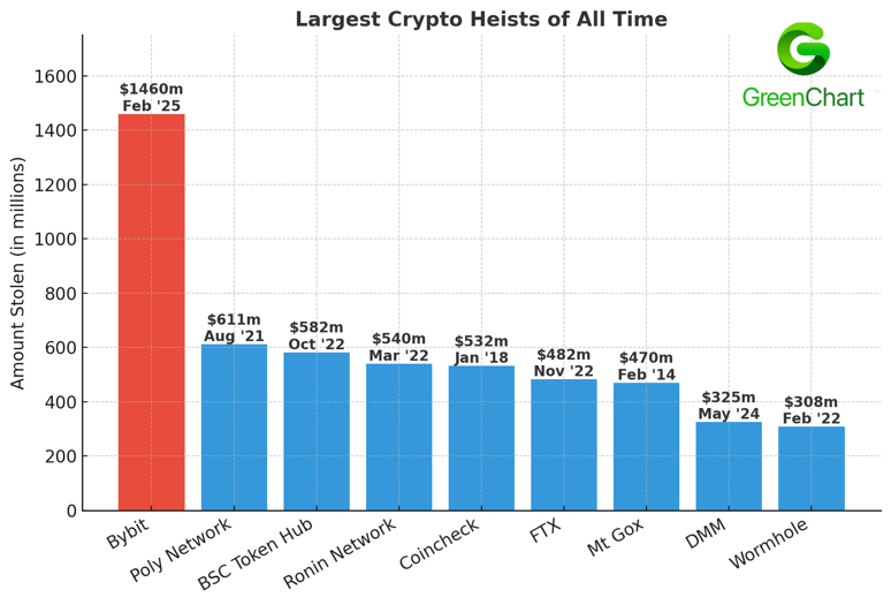

Listen now on Apple, Spotify, and YouTube. In today’s fast-moving world, staying ahead of market trends is crucial—and that’s exactly what we deliver in this, The Market Pulse Newsletter. Timing is everything. Even the best investment idea can be worthless—or worse, costly—if the timing isn’t carefully calculated. Whether it’s cryptocurrency movements, groundbreaking tech developments, government financial shake-ups, or real estate insights. The intention of this is to bring you unfiltered unbiased updates in real time! Here is a breakdown of what I will be covering: 💸 Bybit’s $1.46 Billion Crypto Heist – A record-breaking crypto breach shakes investor confidence. Could this be the wake-up call exchanges need?📉 Bitcoin’s Market Shake-Up – After a parabolic rise, Bitcoin is seeing a major correction. What’s next for crypto?🏛️ The Doge Department Exposés – Elon Musk’s latest initiative reveals shocking levels of government waste. What does this mean for taxpayers and the dollar?🔬 Quantum Computing’s Breakthrough Moment – Microsoft’s Majorana 1 chip is redefining AI and computing—how will this reshape the tech industry?🏡 Real Estate in 2025 – With interest rates unlikely to drop soon, what should homebuyers and investors expect in the housing market and interest rates?Bybit’s $1.46 Billion Crypto HeistAs Bitcoin adoption continues to rise, the journey remains nothing short of a roller coaster. Volatility has always been an inherent part of this emerging asset class, and while expected, it still catches investors off guard. This week was no exception, as Bitcoin faced a sharp correction following a record-breaking $1.5 billion hack of Bybit, a Dubai-based cryptocurrency exchange. The FBI has attributed the theft to North Korea’s sophisticated cybercrime unit, known as the Lazarus Group, marking it as the largest heist in crypto history—surpassing the previous record of $611 million stolen from Poly Network. Green Chart- Image of Largest Crypto Heists of All TimeThe FBI has labeled this form of North Korean cyber activity as "TraderTraitor", warning that the stolen assets are being rapidly converted into Bitcoin and other virtual currencies, dispersed across thousands of blockchain addresses, and laundered into fiat currencies. This revelation has heightened concerns about the security of centralized exchanges, triggering mass withdrawals from ETFs and reinforcing skepticism about exchange vulnerabilities.While Bitcoin’s core protocol remains untouched, the attack underscores the urgent need for stronger security measures in crypto platforms. Many exchanges continue to rely on outdated safeguards, making them prime targets for social engineering and advanced malware attacks—tactics that have become hallmarks of North Korea’s cyber operations. However, this crisis could serve as a catalyst for improved security protocols across the industry. Enhanced regulations, multi-signature authentication, and cold storage solutions are likely to become more widespread, bolstering investor confidence.Bitcoin’s Market Analysis (updated 3/3/2025)Highlights:* 1.46 billion dollar Heist drops Bitcoin price* Bitcoin drops below $79,000* Bitcoin erases 50% of its recent gains from $52K to $109K.* Institutional investors pull $937.90M from Bitcoin ETFs in a single day.* MicroStrategy’s latest Bitcoin purchase failed to boost price.* Is now the time to scale back into Bitcoin?As previously discussed, Bitcoins price is falling and much due to negative market sentiment caused by the recent Bitcoin Heist. As you can see in the image around 50% of the last 7 months gains were wiped out in just a few days following this attack. Many are left wondering will this bear market continue or if now is the time to start buying it back. I will provide some very insightful information to help you make a better educated decision but please remember to still do your own research as this is only for education purposes. Green Chart- Image of BTC-USD 50% retracement as of 3rd Mar 2025Now as we look at Bitcoin over a long period of time this recent drop is nothing out of the normal. In fact, it is very much inside the past bitcoin cycles regarding the halving cycles and parabolic cycles of the past. However, this recent shift in price has brought Bitcoin to a very vulnerable place from a technical stance. It entered what I call “No Man’s Land” and then today just jumped back out. This “No Man’s Land” term is a term that can refer to an area with no rules, or a situation without clear jurisdiction and likewise this area of price between $73,000 and $88,000 is not a place the price or investors know what to do because of the lack of price action from the past. You can clearly see back in November that the price climbed so fast so high that there was no price action for investors to reference strong support or resistance. So what typically happens in these cases is once in this price zone we often see the same movement in the opposite direction at about the same amount of speed. This may create a short-term bearish sentiment scenario, while the values and long-term outlook of bitcoin is bullish for end 2025.So, if this bearish trend continues there is very strong support at $73,000. This support would be much better timing to scale back in however the price may never get that low. For this reason, a more sectional scaling would be appropriate to possible buy back in at three different levels. Around $85,000, just below $80,000 and lastly just below $75,000. This allows you to buy some now and if the price doesn’t reach the later you at least got in a Low/Low. Waking up today obviously makes this a little more difficult with the price around $90,000 again. However I would not be surprised to see the price go back into this zone which is good if you are wanting a discount to today's price. Green Chart- Image of BTC-USD No Man’s Land Institutional ActivityThe large ETF outflows suggest institutional sentiment is shifting, adding pressure to Bitcoin’s price action. Experts across multiple investment firms are betting on a $70,000 drop. With this we have seen a $1 billion outflow from ETFs and a likely transition to the futures market until the next bull run presents itself. MicroStrategy Inc HODLMicroStrategy continues to purchase Bitcoin in the midst of this short-term bear market and will continue to HODL. In fact, as of Feb. 17, the company said it owned 478,740 bitcoins, which were purchased for a total of $31.1 billion and an average price of $65,033 per bitcoin. Michael Saylor, Former CEO of MicroStrategy, has predicted in recent days that he believes the price of Bitcoin could soar to $13 million per unit. This is likely why there was no hesitation to buy at recent bitcoin highs around $100,000 a coin. Key Takeaway: Caution Before Scaling In* A strategic approach would be to add positions incrementally for every $3,000–$5,000 dip below $88,000 while monitoring sentiment.* If Bitcoin goes above $95,000 by Wednesday March 5th the bear case could be invalidated.* This is not trade advice but for educational purposes only. Do your own research. The Doge Department and Government Spending ExposésNext, we turn to The Doge Department—why? Simple. The U.S. dollar is losing value, and as of August 29, 2024, the U.S. credit rating was downgraded from AAA to AA+, making U.S. Treasury notes and the dollar less attractive on the global stage. In response to a deepening debt spiral—one we may never have been able to escape—DOGE is the only thing I’ve seen that might actually have a chance to save the dollar and our existing financial system.That said, what’s happening right now affects everything tied to interest rates and the dollar. Markets like FOREX, where USD is a key player, are already feeling the impact. Over time, the policies and adjustments being made today will shape GDP, national spending, and debt. The bond market and countless other sectors will be affected, as everything in the U.S. operates within a network effect linked to the dollar—unless, of course, it’s denominated in crypto.Now enter Elon Musk, the face of this new department, who is committed to exposing wasteful government spending. Unsurprisingly, he’s uncovering massive amounts of taxpayer waste and fraud. Here are just some of the latest findings:* $10 billion in empty federal office buildings: Buildings that sit unused while taxpayers foot the bill.* $2 billion “misplaced” by Housing and Urban Development: The money was just found—how do you misplace $2 billion?* $20 billion sent to climate activists: Funds going to activist groups instead of direct environmental initiatives.* $40 billion in federal credit card spending: More credit cards than government employees! Audits reveal 12% of travel charges violated spending policies.* $1.9 billion in fraud and abuse found by the U.S. Treasury with Doge’s help.While critics argue about Musk’s role in this, one fact remains: government overspending is unsustainable. With the U.S. debt nearing $1 trillion just in interest payments, these cuts are necessary for economic stability.What makes this initiative unique is its transparency. Traditionally, government inefficiencies are buried in bureaucratic processes, making them difficult to trace. Now, we are seeing real-time reporting on expenditures that previously flew under the radar. The question is: Will Congress act on this information, or will these revelations simply add to public outrage without policy change?One this is certain we are at a critical moment in the US concerning our debt and dollar usage, and some experts have said we may even still be too late. Majorana 1: Quantum Computing’s Breakthrough MomentMicrosoft just made history with the Majorana 1 chip, a quantum computing breakthrough that is shaking up the tech world. This innovation is powered by topological qubits, a concept that was only theoretical until now.This breakthrough allows a million qubits on a single chip, unlocking:*

Market Pulse Podcast: December HighlightsBy Matthew PollWelcome back to another edition of Market Pulse Podcast, your comprehensive breakdown of the week’s top financial and economic news. As always, we aim to uncover the stories shaping markets and highlight trends you might have missed. Let’s dive into the headlines! - That Thing That Took Over The World And Will Eventually Destroy Us All -Drone Swarms in New Jersey: A National Security MysteryOver the past weeks, New Jersey residents and government authorities have reported eerie sightings of six-foot-wide drones—far larger than typical recreational models—flying over residential areas, businesses, and even restricted military zones. These drones, often seen at night with their lights off, have sparked concerns about national security and surveillance.Rumors have swirled about a potential foreign operation involving a mothership stationed off the East Coast, but the Pentagon and other agencies have denied evidence of foreign involvement. Despite FBI investigations and high-profile Congressional meetings with state officials, no individual or group has been identified as responsible.Theories range from domestic top-secret operations to covert surveillance by foreign nations. Meanwhile, concerns mount about the lack of transparency and preparedness from national defense agencies. Could these mysterious drones represent a new type of warfare or intelligence gathering? The coming weeks may hold answers—or more questions.- What The Nerds Are Up To -The Doge Department: A New Chapter in Government EfficiencyElon Musk and Vivek Ramaswamy are making waves with their bold initiative to overhaul federal government operations. Dubbed the "Doge Department," the program aims to eliminate waste, streamline regulations, and reduce the federal workforce, with a potential annual savings of up to $2 trillion.Three key pillars of the initiative include:1. Regulatory Precision: Cutting thousands of outdated regulations to encourage business growth and reduce bureaucratic overreach. An example cited is California's requirement for three separate permits to repair a garage door—a symbol of unnecessary red tape.2. Administrative Reductions: Downsizing the federal workforce by up to 75%, with stricter in-office requirements to encourage voluntary departures and performance-based evaluations.3. Cost Savings: Targeting inefficient spending, with Senator Joni Ernst estimating $2 trillion in potential annual cuts.Musk’s involvement, given his successful downsizing of Twitter (now X) from 7,500 to 1,300 employees, inspires confidence that similar efficiencies could be achieved at the federal level.Interestingly, the initiative has fueled speculation in the cryptocurrency market. Dogecoin, the meme coin closely tied to Musk, has surged 355% since September, with rumors suggesting Musk’s involvement may create long-term buzz. Whether the Doge Department becomes a case study in government reform or a missed opportunity remains to be seen.- You Can’t Take That To The Bank -Corporate Tragedy: UnitedHealth CEO’s Shocking DeathThe tragic murder of UnitedHealth CEO Brian Thompson has left both the corporate world and investors reeling. Luigi Mangione, the alleged perpetrator, was arrested with weapons, a silencer, and a manifesto detailing his animosity toward the U.S. healthcare system. Mangione’s back injury, combined with frustration over medical bills and denied coverage, may have motivated the crime.This incident has had a direct impact on UnitedHealth's stock (UNH), which has dropped 17% since the event. Analysts predict continued volatility as the trial unfolds, with hearings likely to dominate headlines in the coming months. Investors are advised to avoid the stock in the short term, with potential opportunities emerging only once the trial concludes and the news cycle quiets.- S'News You Lose -Market Watch: The Dogecoin Surge and Its ImplicationsDogecoin has been making headlines following the election of President Trump and the buzz around the Doge Department. The coin’s price has jumped from $0.10 to $0.45—a 355% increase—since September.With Elon Musk’s public history of supporting Dogecoin and its close association with his initiatives, speculation about the coin's future continues to grow. Analysts predict the coin could see further adoption and price increases over the next four years, as the Doge Department gains visibility.While Dogecoin remains a speculative asset, its unique position as both a meme and a symbol of Musk’s influence makes it one to watch.- Bulls, Bears And Brain Farts -Financial Wisdom: Lessons from Warren BuffettIn turbulent markets, Warren Buffett’s timeless advice offers a guiding light:"The stock market is filled with individuals who know the price of everything but the value of nothing."Buffett’s focus on intrinsic value over short-term trends emphasizes the importance of understanding a company’s fundamentals. He advises investors to avoid market noise and adopt a long-term perspective.A key question to consider: If the market closed for 10 years, would you still want to own this asset? For believers in crypto, AI, or blockchain, the answer reflects their conviction in these emerging technologies’ transformative potential.Spotlight: Matthew Poll’s Book & Tools for SuccessUnlock the power of personal growth with Matthew Poll’s latest book, Find Your Hidden Strengths: Unlock the Power of the Four Archetypes for Success and Personal Growth. This insightful guide offers tools to identify and overcome the blind spots holding you back in life and business.This podcast is sponsored by GreenChart! For market enthusiasts, check out the charts I use, a powerful tool featured on the Market Pulse podcast. It’s your go-to resource for tracking stocks, cryptocurrencies, and economic trends with precision.Thank you for reading Market Pulse With Matt!Stay informed, stay strategic, and as always, trade wisely. Share this newsletter with friends and colleagues, and don’t forget to subscribe for next week’s insights!Thanks for reading Market Pulse with Matt! Subscribe for free to receive new posts and support my work. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In this episode of Market Pulse Podcast, host Matthew Poll dives into the latest market insights, from Bitcoin nearing $100K to the shifting dynamics of AI investment. Discover how global events, including escalating tensions between Ukraine and Russia, are shaping economic forecasts. Plus, practical advice for investors navigating the AI hype cycle and the power of rethinking strategies in uncertain times. Whether you're a seasoned investor or just curious about the financial world, this episode is packed with insights and actionable takeaways. Tune in for all this and more before the holiday season kicks off! Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In this episode of the Market Pulse Podcast, host Matthew Poll discusses the latest economic news, including the conviction of former President Trump, unexpected inflation data, and the hidden truths about the current state of the economy. Poll highlights the paradox between the booming stock market, which is at an all-time high, and the average American's perception that the country is in a recession.Poll dives into the latest inflation data, explaining how the core PCE price index, personal income, and personal spending have all shown concerning trends. The core PCE price index came in lower than expected, personal income growth is minimal, and personal spending has significantly decreased, indicating that consumers are feeling financially strained. This contrast between positive economic data and the public's perception is explored in detail.The discussion moves to the disparity between nominal household net worth and adjusted net worth when considering inflation. Poll shows that while nominal values appear to have grown, adjusted for inflation, household net worth has actually declined, supporting the public's sentiment that economic conditions are tougher than official reports suggest.In addition, Poll covers the political implications of Trump's recent conviction and its impact on fundraising efforts, noting that the conviction has surprisingly boosted Trump's campaign donations, with a significant portion coming from new donors.The episode concludes with a segment on the psychological aspects of success, particularly in relation to work ethic and long-term planning. Poll discusses the concept of payoffs versus costs, encouraging listeners to focus on long-term goals rather than short-term rewards. He highlights the impact of environment on success, suggesting that changing one's environment can lead to significant improvements in various aspects of life, including financial well-being.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

The latest Market Pulse Podcast hosted by Matthew Poll discusses critical market updates and insights. The podcast covers rising gas prices and the Biden administration’s decision to release one million barrels of oil from the strategic reserves to curb these prices. Poll argues that this measure is insufficient to make a substantial impact, considering the national demand and current low reserves.Poll also highlights advancements in AI technology, particularly the release of OpenAI's GPT-4 Omni, which integrates text, audio, and visual capabilities. He shares examples of its applications in education and real-time translation, emphasizing its potential to revolutionize various fields.Furthermore, Poll explores the psychological aspects of trading and personal growth. He discusses his new book, "Find Your Hidden Strengths," which aims to help individuals unlock their potential quickly and effectively. Poll encourages readers to focus on meaningful relationships and personal fulfillment over material wealth, cautioning that the latter does not necessarily lead to true happiness.He concludes with motivational insights, stressing that genuine success often goes unnoticed until fully achieved, and that the desire for others to fail can stem from their own fear of taking risks. Poll emphasizes that valuable aspects of life, such as relationships and peace of mind, are often easily attainable and should not be overshadowed by the pursuit of harder-to-obtain material gains.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In the latest episode of the Market Pulse Podcast, host Matthew Poll discussed a variety of current economic issues affecting both the U.S. and global markets. The podcast covered topics such as real estate trends, bank closures, the state of the housing market, and the impacts of inflation and high interest rates.Matthew began by warning of potential weekly bank closures, highlighted by the comments from billionaire Barry Sternick. He emphasized the challenges facing regional and community banks due to the current real estate crisis, compounded by high interest rates and inflation. Sternick’s predictions were supported by an article from Business Insider, which Matthew pointed out was difficult to locate on CNBC's website, suggesting a possible downplay of the news by major media.The podcast also delved into the implications of these economic conditions on the housing market. Matthew described a “house of cards” scenario where high interest rates are making it difficult for owners of multifamily properties to refinance their debt, which could lead to further financial instability.Matthew also touched on broader economic indicators and their impact on personal finance. He discussed how current economic policies and market conditions are influencing investment decisions and the broader financial landscape. His goal throughout the podcast was to equip listeners with the information necessary to navigate these turbulent economic waters effectively.By providing a blend of current news analysis, expert commentary, and practical advice, the Market Pulse Podcast aims to help listeners make informed decisions about their investments and personal finance strategies amidst ongoing economic uncertainty.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In this podcast episode, the host, Matthew Poll, discusses various pressing issues in the financial markets and global economy, providing an unscripted, candid perspective. He addresses several major topics, including widespread corporate layoffs and downsizing projected throughout 2024, first-quarter financial reports, and underreported bank closures expected to rise throughout the year.Poll touches on the significant issue of JP Morgan Chase's near half-billion-dollar asset seizure by Russia, highlighting the mainstream media's reluctance to cover this story. He claims that this is part of a broader narrative where the media avoids topics that could negatively influence public opinion during an election year.The podcast also covers the impact of digital currencies and financial moves by Russia that suggest a war on the US dollar, reflecting on how these actions circumvent traditional financial systems like SWIFT, potentially leading to a broader devaluation of the dollar and impacting global economic stability.Additionally, Poll discusses the release of the AI model "Llama 3" by Meta, emphasizing its potential to disrupt the AI market due to its open-source nature and cost-effectiveness compared to other models like ChatGPT-4. This segment illustrates the shift towards more accessible AI technologies and the implications for businesses and developers.Throughout the episode, Poll interweaves these discussions with broader economic indicators, corporate strategies, and personal anecdotes from his coaching experiences, using these to draw conclusions about the state of global finance, the influence of media on public perception, and the technological advancements shaping industries. His narrative is aimed at uncovering less-discussed but impactful developments in a world where economic and political dynamics are increasingly intertwined.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

Market Pulse Podcast host, Matthew Poll, dives into significant market trends and economic insights, aiming to educate his audience on complex financial dynamics using layman's terms. This episode covers a broad spectrum of topics including the FTC's ban on non-compete clauses, indicators of persisting inflation, the adverse positioning of the Federal Reserve, and an argument for Bitcoin's performance against traditional markets. Poll provides a detailed analysis of current economic challenges such as inflation and the bond market's outlook, and shares personal insights on the implications of these trends on investments and market behavior. Furthermore, he discusses the personal growth aspect through discovering one's 'why', emphasizing the importance of understanding personal motives and passions to drive success and make informed decisions.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In a recent Market Pulse Podcast, host Matthew Poll discussed various topics related to technology, finance, and personal experiences. He shared insights from a recent visit to an innovative theater in Las Vegas called the Sphere, highlighting its immersive visual effects and 3D planetary documentary, despite its financial challenges.The discussion also included a critical review of recent economic trends, such as inflation rates and Federal Reserve policies. Poll criticized the Federal Reserve's handling of the inflation predictions and expressed skepticism about the effectiveness of current economic policies under the leadership of Jerome Powell.Matt highlighted a significant opportunity in the market concerning Apple Inc., noting a considerable drop in its stock price due to public perception of its limited involvement in artificial intelligence (AI). Despite this, he expressed confidence in Apple’s strategic approach to product development and user interface, suggesting that Apple is not as far behind in AI as perceived. He speculated that upcoming developments revealed at Apple’s Developer Conference might significantly impact its stock value, akin to the introduction of the iPhone in 2007. Poll emphasized the counterintuitive nature of stock trading, where market rumors and the timing of buying or selling (buy the rumor, sell the news) play crucial roles in investment decisions.In the latter part of the webinar, Matt explored the implications of cryptocurrency and blockchain technology on future investments. He highlighted the process known as 'Bitcoin halving' and speculated on its potential impact on Bitcoin’s value and the broader cryptocurrency market.The webinar concluded with the host encouraging viewers to embrace technological advancements and consider diversifying their investment portfolios to include emerging technologies and digital currencies. He emphasized the importance of staying informed and adaptable in a rapidly changing economic landscape.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In this episode of the "Market Pulse" podcast, host Matthew Pole delves into significant economic developments, focusing on the latest inflation report. The podcast outlines a concerning rise in inflation rates, highlighting a 3.5% month-over-month increase which has led to fears in the market and pessimism regarding the lowering of interest rates by the Federal Reserve. Matthew points out that such economic conditions could delay any decisions by the Fed to reduce rates, emphasizing the broader implications on the economy, particularly the stock market and interest rates.The discussion shifts towards the potential long-term impacts of inflation, suggesting that the influx of 'funny money' into the market could lead to subsequent financial waves, affecting various types of investments and savings accounts. Matthew predicts significant market movements as money shifts in response to changing yields, impacting overall market values and possibly leading to increased investments in different sectors as traditional avenues become less attractive.Matthew also addresses the political implications of rising inflation, noting the challenges it poses for current and future administrations, especially concerning reelection prospects amid economic discontent. The conversation in this segment wraps up with insights into personal financial planning in times of inflation, urging listeners to consider broader economic indicators and personal investment strategies in light of fluctuating economic conditions.The host introduced his newly published book, "Find Your Hidden Strengths," featuring prefaces and forewords by notable figures like Ron McMillan and Jay Abraham. McMillan, a renowned author himself, praised the book for its profound impact on personal and professional development, aligning well with his own work on crucial conversations. The book promises to extend these themes, offering readers fresh insights and practical tools to navigate important life moments effectively.Matt also shared enthusiastic words from Jay Abraham, a top executive coach who has personally guided him. Abraham's forward highlights the book's ability to uncover the often-overlooked obstacles posed by one's strengths and offers strategies to overcome them. This section of the podcast not only underscored the book’s potential to transform its readers' lives but also served as a platform for the host to express gratitude towards his mentors and friends who contributed to the work, illustrating a deep connection between personal growth teachings and real-life applications.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In this episode of the "Market Pulse" podcast, host Matthew Poll covers a variety of topics including the sentencing of Sam Bankman-Fried, Trump's SPAC, the national debt spiral, and the surge in cocoa prices which could impact chocolate lovers significantly. Matt provides analysis of the U.S. budget and national debt, expressing concern over the lack of public and political attention to the growing national deficit and its potential impact on inflation and economic stability. He presents charts and data to illustrate the alarming trend of increasing government debt and interest payments, advocating for a reduction in government spending and a more efficient allocation of resources to stimulate economic growth. Additionally, Poll delves into the valuation of Trump's SPAC and its implications for political and financial markets, suggesting that speculative trading is becoming more prevalent over traditional value-based trading. This episode also features a brief look at the future of cocoa prices and their potential impact on the cost of chocolate, encouraging listeners to consider trading opportunities in the cocoa market.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In this episode, host Matt Poll provides a comprehensive analysis of the current state of the automotive market and specifically addressing inventory levels at dealerships and their impact on car prices. Matthew presents data from Cox Automotive, showing how inventory days vary across brands, influencing pricing strategies and buyer opportunities. He predicts an increase in dealer incentives for brands with higher inventory, suggesting a favorable market for buyers in the near future.Matt notes a decline in average listing prices, suggesting a potential leveling out of prices soon. He encourages listeners to consider market data before making car purchase decisions, leveraging such insights for better financial outcomes.Matt then touches on the challenges facing the Social Security system, citing demographic shifts and financial mismanagement as core issues. He argues that reliance on Social Security for retirement is increasingly untenable and stresses the importance of personal financial planning.Matt introduces his new book, "Find Your Hidden Strengths," which explores achieving success across various life domains. He also delves into the psychology of trading, sharing quotes from renowned traders to emphasize the importance of emotional discipline and risk management in achieving long-term trading success.This episode of "The Marketplace" not only offers valuable market predictions and investment advice but also provides listeners with strategic insights into making informed decisions in both the automotive market and personal finance.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In the March 22 episode of the Market Pulse podcast, host Matthew Poll delves into critical economic indicators and market dynamics that suggest the U.S. might be on the brink of a recession, a topic largely ignored by mainstream media. Highlighting the coincident index from the Philly Feds, Poll points out that only 20 states show economic growth, historically a recession predictor. Amidst these concerns, the Federal Reserve's announcement of potential interest rate cuts, more than previously anticipated, signals a proactive attempt to soften the recession's impact. This move aims to stimulate the economy but raises concerns about fueling inflation.Additionally, Poll discusses a landmark settlement in the real estate industry that could revolutionize the market by significantly reducing broker fees. This change, expected to benefit buyers and sellers by lowering transaction costs, could also disrupt the traditional role of real estate agents, potentially diminishing their earnings.The episode also touches on the psychological aspects of trading, emphasizing the importance of emotional discipline over intelligence for success in the market. Through insights from notable traders, Poll underscores the dual challenge of managing fear and boredom in investment decisions, highlighting the nuanced balance required for financial success.Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In the latest episode of the Market Pulse podcast, host Matthew Pohl dives into the obscured state of market news, emphasizing the trend of significant news being hidden or underreported. Highlighting the importance of transparency, Pohl discusses the potential manipulation of market sentiment for political gains, especially evident in the context of the upcoming elections. He shares a personal anecdote about a friend, an influencer, who was offered money by a political campaign to portray the markets positively, underscoring the ethical dilemmas faced in the media landscape.Pohl transitions to discussing TikTok's scrutiny in the U.S., where bipartisan concerns over data privacy and national security have led to discussions about banning the app. He critically examines the arguments for and against the ban, including the potential for VPNs to bypass it, and reflects on the broader implications for digital sovereignty and the protection of user data.The podcast also touches on the topic of inflation, with Pohl expressing surprise at the lack of coverage by legacy media outlets. He provides an analysis of recent inflation reports, suggesting that the economic indicators could have significant implications for future market conditions and investment strategies.Pohl delves into the advancements in AI and robotics, sharing insights into the potential of these technologies to transform everyday life and the workforce. He also discusses the legal battle between Elon Musk and OpenAI, highlighting the complexities of AI governance and the ethical considerations of AI development.The episode offers a comprehensive overview of the current digital and economic landscape, urging listeners to stay informed and critically engaged with the forces shaping our future. He concludes with review and analysis of the gold and S&P 500 financial markets. Watch this Podcast on YouTubeWhy GreenChart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

In the latest episode of the "Market Pulse" podcast, we delve into this week's groundbreaking market news, with a particular focus on the AI craze and its influence on stock performances. A significant highlight is OpenAI's recent unveiling of Sora, touted as the most substantial AI advancement in the past year, marking a pivotal moment for the market. The discussion extends to the psychological aspects of trading, exploring the dynamics in sectors currently undergoing downturns. Additionally, we provide an in-depth trade analysis, spotlighting the S&P 500 and gold, and shares his market trend predictions, alongside a reflection on the accuracy of his previous forecasts. A surprising advancement by Nvidia also captures attention, underscoring the episode's emphasis on staying abreast of crucial market developments to navigate the volatile trading landscape effectively.Why Greenchart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

Today we dive deep into the heart of finance and economic news on Market Pulse, where we break down complex market data into understandable and actionable insights. This episode offers a comprehensive analysis of current financial trends, including the alarming increase in consumer and household debt, the implications of recent inflation rates, and a detailed look at the Child Tax Credit bill. Discover how these factors could impact your financial planning and decision-making. Plus, don't miss our unique segments on the psychology of trading and an honest look at personal integrity in financial success. Equip yourself with the knowledge to navigate the financial landscape confidently. Listen now for a masterclass in financial literacy and empowerment.Why Greenchart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe

Today we explore how understanding psychology aspects of trading can significantly influence your investment success. We discuss strategies to navigate the psychological challenges and opportunities in the market, offering insights to enhance your trading decisions. Also, some news updates in general for the markets.State safe. Happy investing. Why Greenchart?GreenChart is your ultimate trading and market analysis ally: Advanced web-based tools for real-time and historical insights. Our edge? We seamlessly merge top-tier charting with trader-centric education. Born from real trading experiences, GreenChart is designed to give you the advantage against trading giants. With GreenChart, you're not just getting a platform; you're embracing a partnership for financial success. Elevate your trading game with us. Get full access to Market Pulse with Matt at marketpulsewithmatt.substack.com/subscribe