Discover Oxford College Principles of Microeconomics Course

Oxford College Principles of Microeconomics Course

Oxford College Principles of Microeconomics Course

Author: Professor Daniel Ludwinski

Subscribed: 49Played: 402Subscribe

Share

©2021

Description

This is a collection of curated podcast episodes around the topic of economics, to expose the students of Oxford College of Emory's Principles of Economics course to podcasts that touch on economics and economic adjacent topics.

24 Episodes

Reverse

From Freakonomics radio:The banana used to be a luxury good. Now it’s the most popular fruit in the U.S. and elsewhere. But the production efficiencies that made it so cheap have also made it vulnerable to a deadly fungus that may wipe out the one variety most of us eat. Scientists do have a way to save it — but will Big Banana let them?

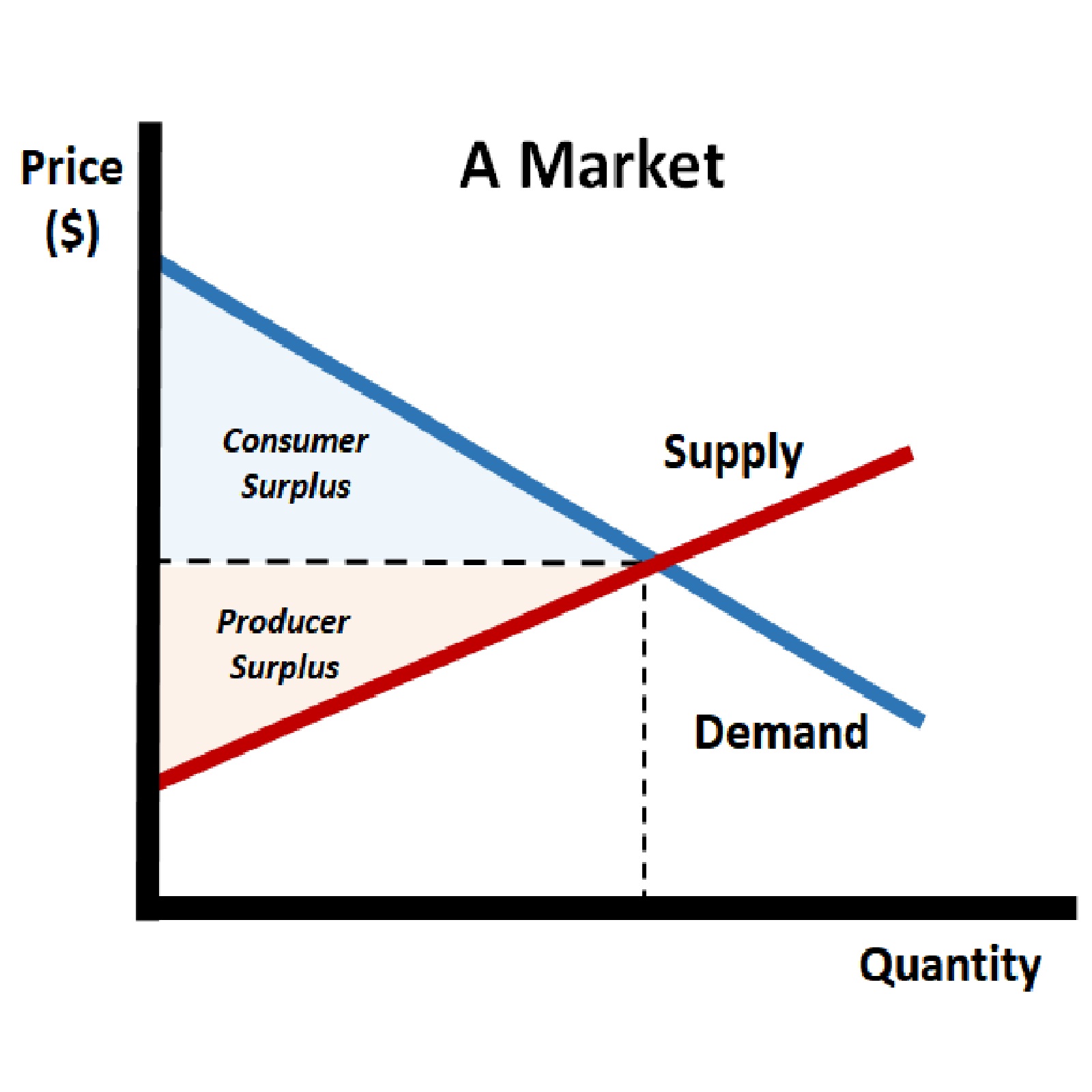

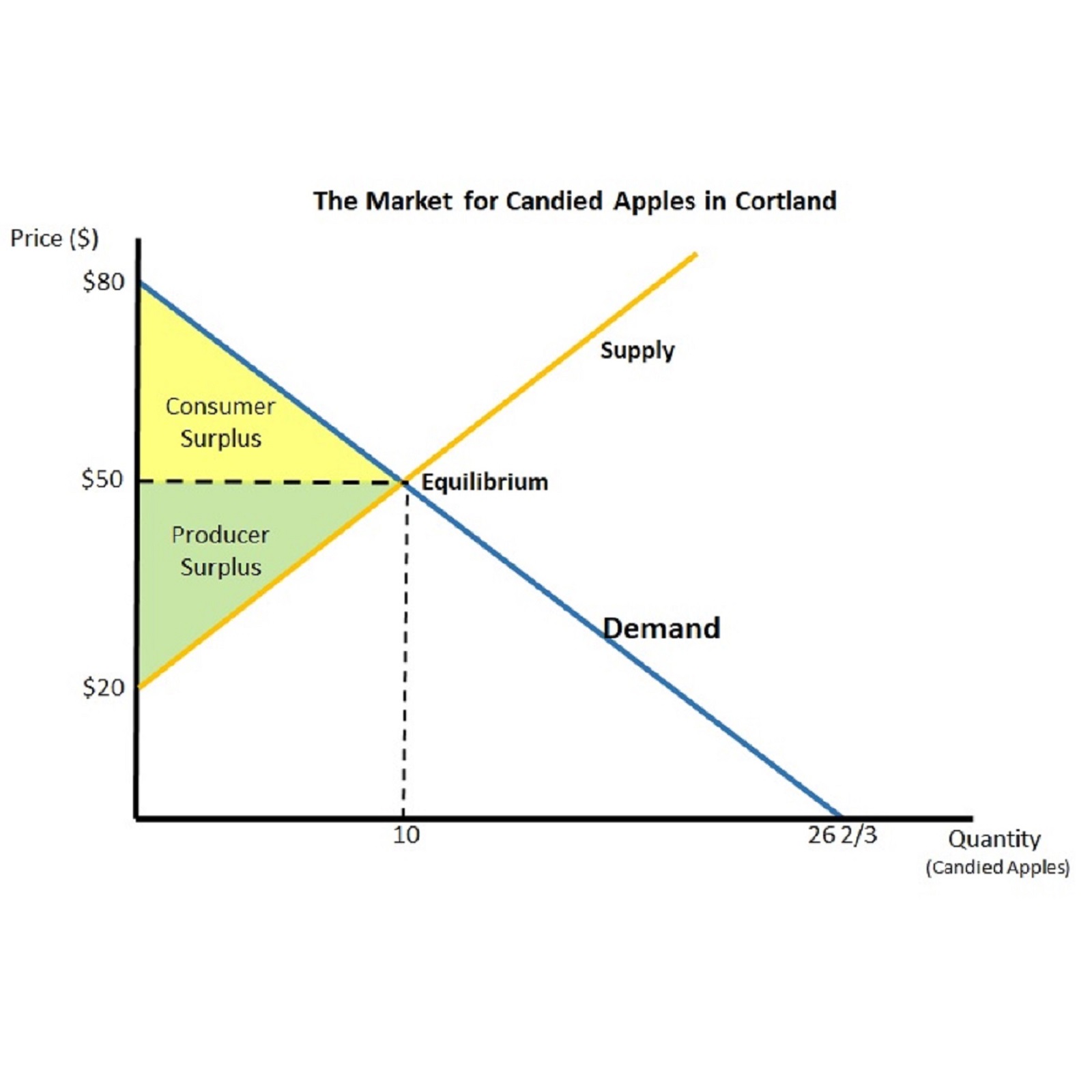

From Planet Money:In our second class, we find markets everywhere and discuss what makes them work and when they fail. We start off with the basic tools to understand a market: supply and demand. We find that the price of an item isn't just about money; a price reflects all the information inside a market, from a buyer's willingness to pay to a supplier's cost to make that item. Then, we put the concepts to work with the parable of the pickles. A food bank in Alaska gets sent a truckload of pickles, more than it could ever use. A food bank in Idaho gets sent a truckload of potatoes, the last thing it needs. With the help of economists, the food banks figure out a way to create a trading market, complete with information sharing and prices. We see how that works out as the food banks compete for the most coveted prize of all: a shipment of breakfast cereal.

From Throughline:The Great Depression was a revolutionary spark for all kinds of things — health insurance, social safety nets, big government — all of which were in response to a national crisis. Through the personal accounts of four people who lived during the Great Depression, we look back at what life was like back then and what those stories can teach us about the last time the U.S. went through a national economic cataclysm.

From Econtalk:Robert Frank of Cornell University talks with EconTalk host Russ Roberts about inequality. Is there a role for public policy in mitigating income inequality? Is such intervention justified or effective? The conversation delves into both the philosophical and empirical evidence behind differing answers to these questions. Ultimately, Frank argues for a steeply rising tax rate on consumption that would reduce disparities in consumption. This is a lively back-and-forth about a very timely topic.

From Vox Talks:At the heart of policy debates about our collective responses to climate change is the issue of risk and uncertainty - ‘unknown unknowns’ about the impact of global warming. In this Vox Talk, Gernot Wagner - co-author with Harvard’s Martin L. Weitzman of 'Climate Shock: The Economic Consequences of a Hotter Planet’ - argues for Pigovian taxes and carbon pricing, against geoengineering solutions, and why 'we need to stick it to CO2, not to capitalism’.

From Hidden Brain:We don't always behave the way economic models say we will. We don't save enough for retirement. We order dessert when we're supposed to be dieting. We give donations when we could keep our money for ourselves. Again and again, we fail to act rationally and selfishly — the way traditional economics expects us to. We've seen this during the coronavirus crisis: People selflessly mobilizing to help each other, like the retired Kansas farmer who sent an N95 mask to New York to help a nurse or a doctor. At the same time, though, we've also seen some people do exactly what economic theory assumes they will: Place their own self-interest above everything else. There are those who have even tried to profit from the pandemic, like the man in New York accused of stockpiling N95 masks to sell at an inflated price. Think about this man who hoarded masks and the man who donated a mask. In almost every sphere, our public and economic policies are designed around the assumption that most of us are going to behave like the first man. Legislators pass laws that take aim at transgressors. Regulators and police departments come up with rules that punish lawbreakers. Parents and teachers discipline truants.

From Planet Money:On today's show, we ask: What does full employment really look like? NPR sent reporters across the country, including to Ames, Iowa, the city with the lowest unemployment rate, to find out. The unemployment rate is just 3.6% in the U.S., a 50-year low. People think we are at, or near, full employment. That's the lowest the unemployment rate can go without triggering inflation. And when the labor market is that tight, power shifts from employers to workers. When unemployment is low, workers can threaten to quit and their bosses have to take that threat seriously. That's what leads to raises.

From Econtalk:Bloomberg Opinion columnist and economist Noah Smith talks with EconTalk host Russ Roberts about corporate control, wages, and monopoly power. Smith discusses the costs and benefits of co-determination--the idea of putting workers on corporate boards. The conversation then moves to a lively discussion of wages and monopoly power and how the American worker has been doing in recent years.

From Freakonomics radio:As cities become ever-more expensive, politicians and housing advocates keep calling for rent control. Economists think that’s a terrible idea. They say it helps a small (albeit noisy) group of renters, but keeps overall rents artificially high by disincentivizing new construction. So what happens next?

From Planet Money:A famous biologist, Paul Ehrlich, predicts that overpopulation will lead to global catastrophe. He writes a bestselling book — The Population Bomb — and goes on the Tonight Show to make his case.An economist, Julian Simon, disagrees. He thinks Ehrlich isn't accounting for how clever people can be, and how shortages can lead to new, more efficient ways of doing things. So Simon challenges Ehrlich to a very public, very acrimonious, decade-long bet. On today's show: The story of that bet, and what it tells us about the future of humanity.

From WSJ - The Journal:Demand for oil has plummeted as the coronavirus has shut down much of the world, but most producers are still pumping. WSJ's Russell Gold explains the global game of chicken inside the oil industry.

From Planet Money:Prices go up. Occasionally, prices go down. But for 70 years, the price of a bottle of Coca-Cola didn't change. From 1886 until the late 1950s, a bottle of coke cost just a nickel. On today's show, we find out why. The answer includes a half a million vending machines, a 7.5 cent coin, and a company president who just wanted to get a couple of lawyers out of his office

From Today in Focus (The Guardian):The world economy may have dramatically dipped and the price of oil crashed, but one commodity is seeing an unprecedented boom: the face mask. Samanth Subramanian explores the newly distorted marketplace for masks and the lengths some will go to get them When the coronavirus began spreading beyond China in January, the race to buy up any available protective face masks went global. It caused a frenzy of buying as prices rocketed and suppliers were overwhelmed by the demand. For one man, Ovidiu Olea, a businessman in Hong Kong, it was the start of a wild ride from mask buyer to mask dealer to ultimately, mask producer. The Guardian writer Samanth Subramanian caught up with him as he begins production. He tells Rachel Humphreys about how distortions in the mask market have led to diplomatic incidents. But with mask sales rocketing and many governments starting to either recommend or insist on their use, the evidence about their efficacy is still inconclusive. And some fear that widespread rush to buy up stocks will prevent them reaching the people who need them most: frontline workers and medics.

From Planet Money:In 1976, Jimmy Carter made a campaign promise: I'm giving dairy farmers a break. And after he won, he set out to raise the price of milk. But that's easier said than done. The government couldn't just buy milk. They had to buy something storable that used a lot of milk. So the government started buying up as much cheese as people wanted to sell at the new price. The government wound up spending a lot of cheddar on a lot of cheddar, billions of dollars. Eventually, they bought so much cheese, they had to rent caves to store it all. And when they started giving it away, they unintentionally created a cultural phenomenon: ""Government cheese"" shows up in comedy sketches, songs, even a cooking show by Martha Stewart and Snoop Dogg. Today on the show, how a well-intentioned program to help out farmers turned into a slow-moving economic trainwreck... and some pretty tasty cheese.

The ways people and sometimes policymakers respond to disasters can have hidden and unintended consequences. And sometimes those consequences can be tragic. On today's show, our old friend Tim Harford, an economist and host of the Cautionary Tales podcast, joins us to talk about unintended consequences. FWe discuss how our minds are better at solving problems that we can see directly than they are at anticipating problems and risks that our decisions might be creating further down the line. And we talk about how a better understanding of unanticipated consequences and the ""identifiable victim effect"" can help us respond to the coronavirus pandemic in ways that can make it less likely that those consequences will be fatal.

Demetri speaks with Steve Keen, one of the few economists to correctly anticipate the Global Financial Crisis of 2008. The two discuss Keen’s latest work modeling the impact of climate on economic output, as well as debunking some of the common misperceptions about money and credit held by Keynesian and Austrian theorists alike.

David Ricardo was the first economist to think rigorously about international trade, and his theory of comparative advantage has stood the test of time. So why do so many politicians ignore it? And what would he do about Brexit? Peter Neary of the University of Oxford talks to Tim Phillips.

Nobel Laureate Alvin Roth of Stanford University talks with EconTalk host Russ Roberts about his work on matching markets. Examples include marriage, matching kidney donors to kidney recipients, and students to schools in cities that allow choice in their public school systems. Roth also discusses repugnance--the unease some people have with allowing buying and selling of some goods and what it's like to watch a kidney transplant knowing your research has helped make the surgery possible.

The field of economics studies what people do in a world of scarce resources. One of the biggest scarce resources is time. There are only 24 hours in a day, and we have only so many days on earth. The question of what we do with that time has puzzled philosophers, artists — and economists. Today on The Indicator, we talk to economist Daniel Hamermesh, whose new book Spending Time examines time's complicated relationship to money, stress, and gender.

Drag out those leggings and chain mail armor, folks. We're going medieval, specifically the 12th and 13th centuries. Before governments had regulators with suits and briefcases, says William and Mary history professor Philip Daileader, they had knights. The Lancelots of real life went around the kingdom forcing people to pay whatever the knights decided they owed. It was a brutal economic approach. If you think the knights were tough, be thankful you never faced the guild system. It existed to eliminate competition and benefit producers at the expense of consumers. Craftspeople fought each other for control and tried to limit access to the market — at their own expense, it turned out.