Discover Stretch Four Podcast

Stretch Four Podcast

Stretch Four Podcast

Stretch Four Podcast

Author: Matthew Parker

Subscribed: 0Played: 1Subscribe

Share

© Stretch Four Media, LLC

Description

The Stretch Four Podcast is hosted by Matthew Parker and covers topics across his world of venture-backed startup building, performance and health, family life, and living in San Francisco. He is joined by occasional guests and high performers who share their knowledge on company building their lifestyle hacks. New episodes released every Monday at 8 AM PST.

stretchfour.substack.com

stretchfour.substack.com

48 Episodes

Reverse

Hey, Four Insights community,Matt Parker here, and I have missed sharing content. Let's dive into the latest developments shaking up Silicon Valley and beyond.This memo is presented by Flippa.Looking for your next big opportunity in the digital space? Check out this quickly growing fitness KDP business on Flippa:* 52 books in the fitness market* TTM revenue: $409.9K* Monthly profit: $22,264* 68% profit marginVisit Flippa.com for more exciting business opportunities like this and others!AI Reshaping SearchOne of the most intriguing stories this week comes from a report by The Information dating back to September 19th. It highlights how AI tools are displacing traditional web searches, which could have a drastic impact on how startups market their companies in the future. To even understand why AI chatbots have become so important is simply to realize that Google/Alphabet generated $48.5 billion in revenue on search in Q2 2024. This is their core business that pays for everything else, and ChatGPT and Perplexity-like apps are chipping away at this even if it is minuscule it has the potential to be a massive opportunity. Key findings:* 25% of respondents are using traditional search engines less due to generative AI* 40% reported using search engines 0-25% less* Top AI displacers: ChatGPT (76%), Perplexity (37%), Google's Gemini (36%)As a founder and content creator, I'm particularly interested in how this shift affects our ability to find credible information and reach our target audiences. This will be an ongoing development and I expect to see more and more innovation from all players including Google, who will likely stop at no costs to defend their search dominance at all costs.OpenAI's Record-Breaking Funding RoundSam Altman and OpenAI are making waves again with a potential $6.5 billion funding round, valuing the company at a staggering $150 billion. This would make OpenAI the second most valuable private company globally, behind only ByteDance (TikTok's parent company).The big question on everyone's mind, or at least mine: Will Sam Altman finally become a stakeholder in OpenAI? It's unusual for a CEO of such a valuable company to not have equity, especially in Silicon Valley where founder ownership is the norm. It feels so weird that Altman is not a shareholder with the tablestakes rising by the month. Sure Sam lives in a $30M home in Russian Hill, has a weekend ranch in Napa, and seemingly has a mult-million dollar car collection alone, but something is simply unsettling about him not being on the cap table.Visa Faces Antitrust LawsuitThe Justice Department is suing Visa, alleging monopolistic practices in the payment processing industry. With Visa controlling about 60% of debit card transactions in the US, this case could have far-reaching implications for the fintech sector.Key allegations:* Visa punishes customers for using competing services* The company coerces fintech firms to work exclusively with themAs someone who's been in the fintech world for seven years, I find this case fascinating. Visa's profitability per employee is astronomical, outperforming even its closest competitors. This lawsuit could potentially open up the market for new players in the payment processing space.These are just a few highlights. Listen to the rest of the episode for more insights on how these developments could impact startups and the tech ecosystem at large.This newsletter is also brought to you by Diginius.Whether you're looking to optimize your PPC campaigns or need help finding the right marketing agency, Diginius has you covered. Their platform offers powerful tools for digital marketing automation and analytics.For Four Insights listeners and readers, get a special 14-day free trial of Diginius. That's all for this edition! Don't forget to check out the latest episode of Four Insights on YouTube, where we dive deeper into these topics and more.Stay curious, Matt Parker Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Tuesday. In today's show and essay, I talk about the state of fundraising and the growing media war between All-In and Y-combinator. For more: How To Raise Millions For Your Startup in 60 Days | Youtube | InstagramIn this episode, I discuss the current state of fundraising and share key strategies for founders looking to raise capital. He highlights the challenges in the current fundraising market, such as increased selectivity from investors and longer fundraising cycles. I also provide eight strategies for founders, including preparing for a long fundraising cycle, casting a wide net, and creating urgency and momentum. In the second part of the episode, I talk about a growing rift between Paul Graham and David Sacks, two prominent figures in the venture capital world. He explores the drama and tensions between them, highlighting their different perspectives and successes.Sponsored by FlippaWhile you're sprinting towards your fundraising goals, don't forget about alternative paths to success. Flippa, the #1 platform to buy and sell online businesses, offers opportunities for both buyers and sellers in the tech ecosystem. Whether you're looking to acquire a promising startup or considering an exit strategy, Flippa provides a marketplace to explore your options.Takeaways* The current fundraising market is more challenging, with increased selectivity from investors and longer fundraising cycles.* Founders should prepare for a long fundraising cycle and optimize for a 60 to 90-day process.* Casting a wide net and creating urgency and momentum are important strategies for fundraising success.* Protecting the pitch and materials, being persistent with follow-ups, and considering alternative funding sources are also key strategies.There is a growing rift between Paul Graham and David Sacks, with tensions and differing perspectives in the venture capital world.Chapters00:00 Introduction and Overview02:21 The Current State of Fundraising08:48 Key Strategies for Fundraising Success15:22 The Drama and Tensions in the Venture Capital World21:10 The Rift Between Paul Graham and David SacksBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.* Thanks for reading! If you find this valuable, please share it with your network. Check out the YouTube channel | Leave us a rating on Apple Podcasts | Follow me on Twitter Get full access to Four Insights at stretchfour.substack.com/subscribe

episode of the End of the Day Show with Matt Parker discusses the return of venture capital funding and the focus on a specific type of founder. It also highlights two interesting fund announcements: Better Tomorrow Ventures and Slauson and Co. The episode provides insights into fundraising strategies and the importance of building a network. It concludes with a mention of the supporting sponsor, Flippa.venture capital, funding, founders, online businesses, valuation, fundraising, network, whales, Slauson and Co, Better Tomorrow Ventures, FlippatakeawaysVenture capital funding is back, with a surge in funding announcements and a focus on a specific type of founder.Online businesses have value beyond their content, and it's important to understand the analytics and potential for monetization.Fundraising requires building a network and targeting key investors, with warm introductions leading to higher conversion rates.Finding 'whales' or big checkwriters is crucial for fundraising success.Two interesting fund announcements: Wishoff Ventures and Slauson and Co.Flippa is a valuable platform for buying and selling online businesses, offering business valuations and other services.Chapters00:00 The Return of Venture Capital Funding01:00 The Focus on a Specific Type of Founder02:29 Agree: A Unique Business Model for E-Signature Services07:00 Fundraising Strategies: Insights from Nicole Wischoff14:54 Slauson and Co: A Venture Fund with a Friends and Family Program Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Wednesday. In today's show and essay, I talk about the Labor Day to Christmas sprint that exists in startups and venture capital. For more: How To Raise Millions For Your Startup in 60 Days | Youtube | InstagramThe Flippa AdvantageSponsored by FlippaWhile you're sprinting towards your fundraising goals, don't forget about alternative paths to success. Flippa, the #1 platform to buy and sell online businesses, offers opportunities for both buyers and sellers in the tech ecosystem. Whether you're looking to acquire a promising startup or considering an exit strategy, Flippa provides a marketplace to explore your options.While we were enjoying those last summer vibes this weekend, I was thinking about the intense fundraising season that's about to kick off, or well if you are reading this now it already has. As Alexis Ohanian tweeted on Tuesday:"It's officially the time of year when everyone (else) starts pushing - before the holiday slowdown - so take advantage of it."🕒 Timestamps: 0:00 - Introduction 1:30 - The Current Fundraising Landscape 3:45 - Why This Sprint Matters 7:15 - Tips for a Successful Fundraising Sprint 12:30 - The Flippa Advantage (Sponsor Segment) 14:00 - Final Thoughts and Q&AThinking of selling your business? There is only one way to sell an online business and that is with our friends at FlippaFinal ThoughtsRemember, this sprint isn't just about securing funding – it's about positioning your startup for long-term success. Stay focused, be persistent, and don't be afraid to pivot if necessary.Good luck with your fundraising efforts! If you want to dive deeper into fundraising strategies, I do a webinar each Wednesday and Thursday focused on fundraising tactics. Tonight I will be sharing a list of 66 investors actively seeking deals right now.Join me here on Wednesdays.Join me here on Thursdays. This one is private so you will need to email me for the code at matt@stretchfour.co.What are your thoughts on this fundraising sprint? Let me know in the comments! Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Tuesday. In today's show, I share my thoughts on the newest meme in technology and entrepreneurship: Founder Mode. For more: How To Raise Millions For Your Startup in 60 Days | YoutubeHey! I hope you enjoyed your extended Labor Day weekend. I spent mine in the Pacific Northwest and thinking about Paul Graham's Founder Mode essay. While I agree with several points, especially for the best founders, I think we need to take a step back.Not all founders are Steve Jobs, not all managers are John Sculley, and not all companies are Apple. Some companies may be better off in manager mode, or some kind of tweaner focus where you are not the founder that takes themselves so seriously! If you read it too, I'd love to hear your thoughts.Today's episode and memo dive into Paul Graham's viral Founder Mode essay. Let's unpack its key points, examine its implications for startup culture, and discuss why it might not be the universal solution it's being presented as.Was this forwarded to you?The Essence of Founder ModePaul Graham's essay on Founder Mode has taken Silicon Valley by storm. Here are a few key points:* Contrast between founder-led and manager-led companies* Critique of professional managers and MBAs* Examples like Steve Jobs and Brian Chesky as great leadersGraham argues that founders often feel gaslit when told to run companies like managers. He suggests that "Founder Mode" - a more hands-on, visionary approach - leads to better outcomes. The Risks of Over-Indexing on Founder ModeWhile there's merit to Graham's arguments, I believe we need to be cautious about applying these principles universally:* Not all founders are visionaries: Early-stage startups often need solid operational skills more than grand visions.* Success stories of manager-led companies: Look at Uber under Dara Khosrowshahi or Microsoft under Satya Nadella.* The danger of emulation: Young founders of small startups shouldn't try to lead like Steve Jobs or Brian Chesky prematurely. I think this is where the cultish brand of PG and his essays can do a lot of damage. How can you optimize for founder mode when you are in survival mode as many founders are until they reach a certain revenue or fundraising round that validates and de-risks their business?What Matters for Early-Stage StartupsIf you're running an early-stage startup, here's what I think you should focus on instead of worrying about "Founder Mode" (PG is in no way saying these things do not matter and he has likely written essays about many of these topics before)* Cash Management: Keep enough cash in the bank to reach your next milestone.* Product-Market Fit: Or in YC speak, “Make Something People Want” and understand and solve real problems for your customers. This is a priority over any type of founder-mode strategy for leading a team* Customer Service: Talk to customers, handle support tickets, learn, and iterate. If founders are doing this they will set an example and the best leaders lead by example not with overly aggressive micro-managing. If you are really in the weeds you can answer some support tickets and make a couple hundred cold calls a week.* Team Building: Hire slow, fire fast, and build a strong core team. Founder mode is more for when you have built out a team at scale, the example PG uses references Steve Jobs and his 100-person retreat.* Remember, even the most successful founders didn't start in "Founder Mode" - they grew into it as their companies scaled. The TakeawayWhile Paul Graham's essay offers valuable insights, don't get caught up in trying to emulate the management styles of billion-dollar company CEOs. Focus on what matters most for your stage of growth, and let your leadership style evolve naturally as your company grows.As I said in the episode:"In all in all, think founder mode's a great thing. It went viral, it got a lot of traction, but don't over-index on trying to do founder mode. You'll end up in flounder mode and you won't be successful with your company."What do you think about Founder Mode? Hit reply and let me know your thoughts!Enjoy Four Insights? Tell them to sign up. I'll send them next Monday's memo. Hit the link below to share:Thanks for reading Four Insights! This post is public so feel free to share it.Other News* Are you a founder raising venture capital right now? Check out my all-new Scorecard and get your score for free.* Less than two weeks until my Fundraising Course starts. Enroll now!Brought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.* Thanks for reading! If you find this valuable, please share it with your network. Check out the YouTube channel | Leave us a rating on Apple Podcasts | Follow me on Twitter Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Friday. In today's show, we dive into Carta’s new report on pre-seed funding in 2024, Twitter/X is forced to reveal their investors. For more: How To Raise Millions For Your Startup in 60 Days | YoutubeEOD Show 019 - Detailed Podcast Show NotesHost: Matt ParkerEpisode OverviewIn this episode, Matt Parker dives into the latest trends in pre-seed funding, reveals the surprising list of Twitter X acquisition backers, and discusses recent economic data affecting the startup ecosystem.Key Topics1. The State of Pre-Seed Funding in 2024 (Carta)* SAFEs dominate early-stage funding:* 90% of rounds under $1 million use SAFEs* Preferred for rounds under $3 million* SAFE characteristics:* 85% are post-money SAFEs* 57% have only a valuation cap* 35% have both a valuation cap and a discount* 7% offer only a discount* Valuation trends:* Median valuation cap for $1 million raise: $10 million post-money* $500K raises see valuation caps around $7-8 million* Changes in check sizes:* Small checks under $25K are becoming scarcer* Larger checks taking a bigger slice of investments* Discount rates:* A median discount of 20% when present* Convertible notes:* Interest rates increased to 7.8% in Q2 2024 (up from 6.8% in Q2 2023)2. Twitter X Acquisition Backers Revealed* High-profile investors include:* Andreessen Horowitz* Sequoia Capital* Fidelity* Larry Ellison* Prince Alwaleed Bin Talal of Saudi Arabia* Binance (cryptocurrency exchange)* Sean "Diddy" Combs* Matt's insights:* Demonstrates the complex web of relationships in major tech deals* Importance of building a diverse investor list for fundraising3. Economic News and Job Market Shifts* Labor Department revision:* 818,000 fewer jobs were added in the year ending March than previously reported* Suggests cooling the job market* Impact on startup ecosystem:* Challenging job market for tech workers* Shift from abundant opportunities to more network-based hiring* Insider connections are becoming more crucial for job seekers4. Startup Funding Highlight: Lettuce* San Francisco-based automated tax and accounting system* Raised $15 million in Series A funding from Zeev Ventures* Targets businesses of one, helping with tax and accounting automation* Indicates continued investor interest in fintech and automation startupsCall to Action* Check out Matt's new fundraising course on Maven* Free webinar every Thursday related to fundraising strategies* Subscribe to the End of Day Show on YouTube and podcast platforms* Follow For Insights media platform for more startup and tech newsClosing ThoughtsMatt emphasizes the changing landscape of startup funding and job markets, encouraging founders to stay informed and adapt their strategies accordingly.* 📺 YouTube: FourInsights* 📸 Instagram: @FourInsights* 🌳 LinkTree: mattaparker* 🐦 X (Twitter): @mattaparker* 🎵 TikTok: @mattaparkerStay curious,Matt ParkerThe End of Day Show is hosted by Matt Parker and airs four times a week on YouTube and Substack. Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Thursday! In today's deep dive, we unpacked the fascinating saga of Bolt and its founder, Ryan Breslow. This story is a masterclass in startup resilience, founder and investor tactics, and the high-stakes game of venture capital. For more: How To Raise Millions For Your Startup in 60 Days | Youtube EpisodeThroughout the show, we hear from our sponsors:* Quickbooks - Save 30% on Quickbooks for 6 months* Apollo.io - AI-powered sales intelligence platform* ZoomInfo - Comprehensive database of business information for prospectingIn this episode, I discusses the story of Ryan Breslow and his company Bolt. I exploring the learning points for founders from the negotiating tactics and PR strategies used by Breslow, as well as the risks and benefits of aggressive deals. I also talk about founder compensation and incentives, highlighting Breslow's requests for a return bonus, back pay, and the option to sell 10% of his shares. We touch on the topic of managing multiple ventures as a founder and the importance of media coverage for startups. Overall, the episode provides valuable insights for founders and entrepreneurs.Takeaways* Negotiating tactics and PR strategies can be effective in raising funds and maintaining a strong presence in the startup ecosystem.* Aggressive deals, such as pay to play provisions, can help founders maintain control and ownership of their companies.* Founder compensation and incentives should be carefully considered, taking into account the company's financial situation and past actions.* Managing multiple ventures as a founder requires balancing commitments and leveraging one's personal brand.* Media coverage is crucial for startups to gain visibility and tell their story.Sound Bites* "Bolt is up to allegedly raise an additional $450 million." * "Pay to play provisions require current investors to participate in the current round." * "Ryan Breslow is asking for a return bonus of $2 million."Chapters00:00 Introduction and Background00:59 The Story of Ryan Breslow and Bolt04:41 Aggressive Deals: Pay to Play Provisions08:25 Founder Compensation and Incentives10:45 Managing Multiple Ventures as a Founder15:31 The Importance of Media Coverage for Startups18:55 Sponsor Message19:27 Conclusion and Key LessonsCheck the show notes for today's key takeaways and timestamps. Please review us on Apple Podcasts or Spotify to support our content. Until next time, keep striving for success!* 📺 YouTube: FourInsights* 📸 Instagram: @FourInsights* 🌳 LinkTree: mattaparker* 🐦 X (Twitter): @mattaparker* 🎵 TikTok: @mattaparkerStay curious,Matt Parker Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Tuesday! In today's show, I share Carta’s report and startup shutdowns, three funding sources founders can apply for right now, and my rule on how much of your round you should spend. For more: My Course Is Live: How To Raise Millions For Your Startup in 60 Days | Tech Billionaires' Twitter WAR Shocks Silicon Valley | YoutubeIn this episode, I discuss several topics related to startups and fundraising. I highlight the increasing number of venture-backed startups that are shutting down and share some strategies for startup founders. I then mention three opportunities for funding, including Berkeley's Skydeck program, the AI grant, and Y Combinator. I also talk about the importance of maximizing online media presence as a founder and introduce Flippa, a platform for buying and selling digital businesses. Takeaways* The number of venture-backed startups shutting down is increasing, making it a difficult time for many founders.* There are several opportunities for funding, including Berkeley's Skydeck program, the AI grant, and Y Combinator.* Maximizing online media presence is crucial for founders and platforms like Flippa can help in valuing and selling digital businesses.* To make a startup more attractive to investors in a tough market, founders should focus on growth benchmarks, market potential, and building relationships.Titles* Maximizing Online Media Presence as a Founder* Flippa: Valuing and Selling Digital BusinessesSound Bites* "Venture shutdowns are increasing, making it a difficult time for many founders."* "Funding opportunities: Berkeley Skydeck, AI grant, and Y Combinator."ChaptersIntroduction and OverviewIncreasing Number of Venture-Backed Startups Shutting DownOpportunities for Funding: Berkeley Skydeck, AI Grant, and Y CombinatorMaximizing Online Media Presence as a FounderFlippa: Valuing and Selling Digital BusinessesMaking a Startup Attractive to Investors in a Tough MarketConclusionBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love. Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Thursday! In today's show, I give commentary on Eric Schmidt’s latest comments and Michael Rubin’s comments on black culture. For more: The Founder's Fundraising Blueprint: From Cold Email to $1M in 60 Days | The $48B Fast Fashion King | YoutubeSummaryIn this episode, Matt Parker discusses controversial statements made by two billionaires, Eric Schmidt and Michael Rubin. Schmidt, the former CEO of Google, sparked controversy when he claimed that most companies like Google have a culture where people aren't working hard and work-life balance has become a priority. Parker believes that this is how many wealthy people in Silicon Valley think. Rubin, the founder and CEO of Fanatics, made statements about black culture and the dissension within it. Both Schmidt and Rubin quickly retracted their statements after receiving backlash.TakeawaysMany wealthy people in Silicon Valley believe that most companies have a culture where people aren't working hard and work-life balance is prioritized.Controversial statements made by powerful individuals often get retracted quickly due to backlash.There is dissension within black culture, particularly in the entertainment and sports industries.Open and honest discussions about work culture and societal issues are important, even if they are uncomfortable.Building relationships with influential individuals is crucial for people of color to access economic opportunities.Sound Bites"Most companies like Google have a culture where people aren't working that hard and work-life balance has become a very large part of the conversation.""Work from home won't be around in 2025. If you're a company, you're not gonna hire people that can't come into your office."Chapters00:00 Introduction and Overview02:18 Controversial Statements on Work Culture in Silicon Valley06:10 The End of Work from Home07:54 Dissension within Black Culture10:07 Powerful Individuals and Their Views12:00 Building Relationships for Economic Opportunities13:06 ConclusionBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.How would you rate today's show?👍🏾or 👎🏾Was this forwarded to you?Four Insights is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.Check out the YouTube channel | Leave us a rating on Apple Podcasts | Follow me on Twitter Get full access to Four Insights at stretchfour.substack.com/subscribe

End of the Day Show - Episode 14 Show NotesDate: August 14, 2024 (Wednesday) Host: Matt Parker Location: San FranciscoEpisode SummaryIn this episode, Matt Parker discusses two key stories shaping the tech landscape: the rise of coaching in Silicon Valley and the debate surrounding AI companies' use of Wikipedia data.Key Topics1. The Coaching Phenomenon in Silicon Valley. Coaches become influential in how companies are built and founders operate. Coaching as a replacement for traditional therapy2. AI Companies and Wikipedia Data (AI-cyclopedia). AI companies using Wikipedia as a primary data source for training. Debate over the use of public data for commercial AI development. Wikipedia's response: developing an enterprise product for AI companies. Comparison to Reddit's $60 million deal with Google for data access. Discussion on the future of AI training data sources. Mention of the debate between using synthetic data vs. internet data for model trainingResources MentionedNew York Times article on Silicon Valley coachingJerry Colangelo's book "Reboot""The Trillion Dollar Coach" book about Bill CampbellBill Walsh's book "The Score Takes Care of Itself"TLDR.tech newsletterSherwood News article on "AI-cyclopedia"Subscribe to the show on YouTubeLeave a review on Apple Podcasts or SpotifyCheck out the accompanying Substack newsletter for additional information and linksNext EpisodeTune in tomorrow for the next episode of the End of the Day Show!The End of the Day Show is brought to you by Four Insights. For more in-depth analysis and daily tech updates, visit fourinsights.comBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.How would you rate this week's memo?👍🏾or 👎🏾Was this forwarded to you?Four Insights is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.Check out the YouTube channel | Leave us a rating on Apple Podcasts | Follow me on Twitter Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Tuesday! In today's show, we honor a legend who succumbed to her two-year battle with cancer, I discuss the NBA’s future post-KD-LeBron-Steph, and The Cloud 100 2024 is worth $820 billion in market value. For more: The Founder's Fundraising Blueprint: From Cold Email to $1M in 60 Days | The $48B Fast Fashion King | YoutubeSummaryIn this episode, Matt Parker discusses three main topics. First, he commemorates the passing of Susan Wojcicki, the former CEO of YouTube, and highlights her career guidance and mentorship as her key contributions. Second, he talks about the business of basketball and the evolution of the game, particularly in terms of individualism and branding. Lastly, he discusses the Cloud 100 report, which showcases the top 100 cloud companies in Silicon Valley and highlights the dominance of AI companies and the rapid scaling of these companies.KeywordsSusan Wojcicki, YouTube, Silicon Valley, basketball, NBA, business, Cloud 100, AI, scalingTakeawaysSusan Wojcicki was a highly influential leader in Silicon Valley, known for her leadership at YouTube and her emphasis on career guidance and mentorship.The business of basketball has evolved over the years, becoming more individualistic and focused on branding. The future of the NBA and its importance in 20 years is a topic of debate.The Cloud 100 report highlights the rapid growth and dominance of AI companies in Silicon Valley, with a record valuation of $820 billion for the top 100 cloud companies.Companies in the cloud industry are scaling faster than ever, reaching $100 million in annual recurring revenue in about 7.8 years.The trends in Silicon Valley and the cloud industry show the rapid evolution and change in the tech landscape.TitlesThe Evolution of Basketball: Individualism and BrandingThe Cloud 100: Rapid Growth and Dominance of AI CompaniesSound Bites"Susan Wojcicki valued time over money.""Susan Wojcicki left a great legacy in Silicon Valley.""The business of basketball has become more individualistic and focused on branding."Chapters00:00 Remembering Susan Wojcicki: A Legacy of Leadership07:20 The Changing Landscape of the NBA12:02 The Rapid Growth of Cloud CompaniesBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.These three stories, while distinct, point to a common thread: the increasing importance of individual impact, whether it's in leadership, personal branding, or rapid company scaling. As we navigate this new landscape, it's crucial to consider how these trends will shape the future of business, technology, and entertainment.Four Insights is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.How would you rate this week's show?👍 or 👎Was this forwarded to you?Four Insights is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.Check out the YouTube channel | Leave us a rating on Apple Podcasts | Follow me on Twitter Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Friday! In today's show, we're diving into some fascinating developments that go far beyond the sports arena. From China's new e-commerce billionaire to the mass exodus of car YouTubers, there's a lot to unpack. For more: The Founder's Fundraising Blueprint: From Cold Email to $1M in 60 Days | Yesterday’s Show On The Olympics | YoutubeMatt Parker00:00 - 00:30: Introduction and show overview00:30 - 02:28: China's new richest person - Colin Huang and e-commerce trends02:28 - 04:48: YouTube car creators leaving their channels, private equity acquisitions04:48 - 07:12: Discussion on Elon Musk, Tesla, and X.ai07:12 - 09:27: Sam Lessin's essay on "price of intent" in digital advertising09:27 - 11:45: Analysis of attention economy and targeted advertising11:45 - 14:05: Venture capital trends and recession fears, advice for founders14:05 - End: Closing remarks, promotion of ebook and upcoming courseBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.How would you rate this week's memo?👍 or 👎Four Insights is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.Check out the YouTube channel | Leave us a rating on Apple Podcasts | Follow me on Twitter/X Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Thursday. In today's show, I share some insights on what is happening at the Olympics and it does not just include the sports, millions are being earned by creators. Was anybody else on the edge of their seat with the ending of the USA vs Serbia Men’s Basketball game today? What a performance by Stephen Curry “30” For more: Top 10 Black-Led VC Funds Guide | My premium subscription to investor lists, course access | YoutubeBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.Let's break it down:* BiggerPockets' Big Break: The real estate education platform just landed a major private equity investment. What does this mean for niche content platforms? We're seeing a shift towards more specialized, community-driven content – and investors are taking notice. Source: Exclusive: BiggerPockets nets majority investment from TCG (Fortune)* Olympics Go Social: The 2024 Olympics are proving that social media is the new primetime. With 80% of viewers aged 14-45 tuning in via social platforms, we're witnessing a revolution in sports coverage. Athletes are becoming content creators, giving us unprecedented behind-the-scenes access. Source: The Paris Olympics Is Minting New Creators (The Information)* Opal's $60M Series B: This hardware startup, backed by top creators and OpenAI, is set to revolutionize content creation. As a creator myself, I'm excited to see how AI will streamline the content production process. Source: OpenAI Makes a $60 Million Hardware Startup Bet (The Information)* Founder Alert: If you're looking to raise venture capital in the next 6-12 months, I've got something special for you. I'm launching an immersive program to help founders master the pitch and navigate the VC landscape. Check out stretch4.co to book a 15-minute slot with me and learn more. Source: The Founder's Fundraising Blueprint: From Cold Email to $1M in 60 DaysRemember, in today's digital age, every company is becoming a tech company, and every individual has the potential to be a creator. Stay curious, keep innovating, and don't forget to tune in to our daily updates!* 📺 YouTube: FourInsights* 📸 Instagram: @FourInsights* 🌳 LinkTree: mattaparker* 🐦 X (Twitter): @mattaparker* 🎵 TikTok: @mattaparkerCatch you tomorrow,Matt Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Wednesday. Matt Parker here, bringing you the hottest tech and VC news straight from the heart of Silicon Valley. Today's newsletter is packed with game-changing insights you won't want to miss, especially if you are a founder. For more: Top 10 Black-Led VC Funds Guide | My premium subscription to investor lists, course access | Youtube🔥 Top Stories:Turing's Incredible Pivot: From Dev Shop to AI Powerhouse I once thought Turing was “just another dev shop” back when I used their service in 2019. Well, they've pulled off one of the most impressive pivots I've seen. They're now one of the secret weapons behind ChatGPT's success and many other foundational model companies.Here's the scoop:* Originally provided software engineers to startups* Now supplying critical coding data to OpenAI, Anthropic, and other AI giants* This pivot has made them a major player in the AI revolutionKey Takeaway: Sometimes, your most valuable asset isn't what you think it is. Turing found gold in their data, not just their talent pool.Source: Inside the company that gathers ‘human data’ for every major AI company (Semafor)Y Combinator Triples Down: New Fall Batch Announced! YC is shaking things up again. They're launching a fall batch, potentially funding up to 300 startups a year. Here's what you need to know:* Applications due: August 27th* The program starts: on September 29th* Offering: $500,000 investment + $1M in credits* Bonus: Access to dedicated GPU clustersKey Takeaway: The competition for early-stage funding is heating up. YC's move signals a bullish outlook on AI startups.Source: YC Fall 2024 batch applications due by 8/27 (Company website)💡 Founder's Corner: Turning Failure into FuelSpeaking of pivots, I've shared a personal story in today’s show that I am still working through being comfortable talking about. Recently, I had to tell investors that we are not going to make and become what we thought we would at the beginning of the year. Tough pill to swallow, right I am still working through it personally, financially, and professionally. But here's the silver lining:* Each failure is a learning experience* Investors value founders who've been through the wringer* Your network grows with each attempt* You gain invaluable insider knowledgeRemember, many successful founders had multiple failures before their big break. Stay persistent!🚀 Exclusive Offers for EOD Subscribers:* Free Guide: "Cold Email Your Way to Millions" - My step-by-step playbook for landing VC meetings. [Download Here]* Limited Time Offer: Book a 15-minute call with me to discuss your fundraising strategy. Only 5 slots are available this week! [Book Now]* New Course Alert: I'm launching a comprehensive fundraising course at stretch4.co. Early bird discount for newsletter subscribers! [Get on the Waitlist]📺 Don't Miss Our Latest YouTube Video!We break down Turing's pivot and YC's expansion in detail. Plus, there's a secret tip at the end for nailing your YC application! [Watch Now]That's all for today! If you found this valuable, please share it with a friend who might benefit. Let's grow this community together!Do questions or topics you want covered? Hit reply and let me know!Keep hustling,Matt Parker Get full access to Four Insights at stretchfour.substack.com/subscribe

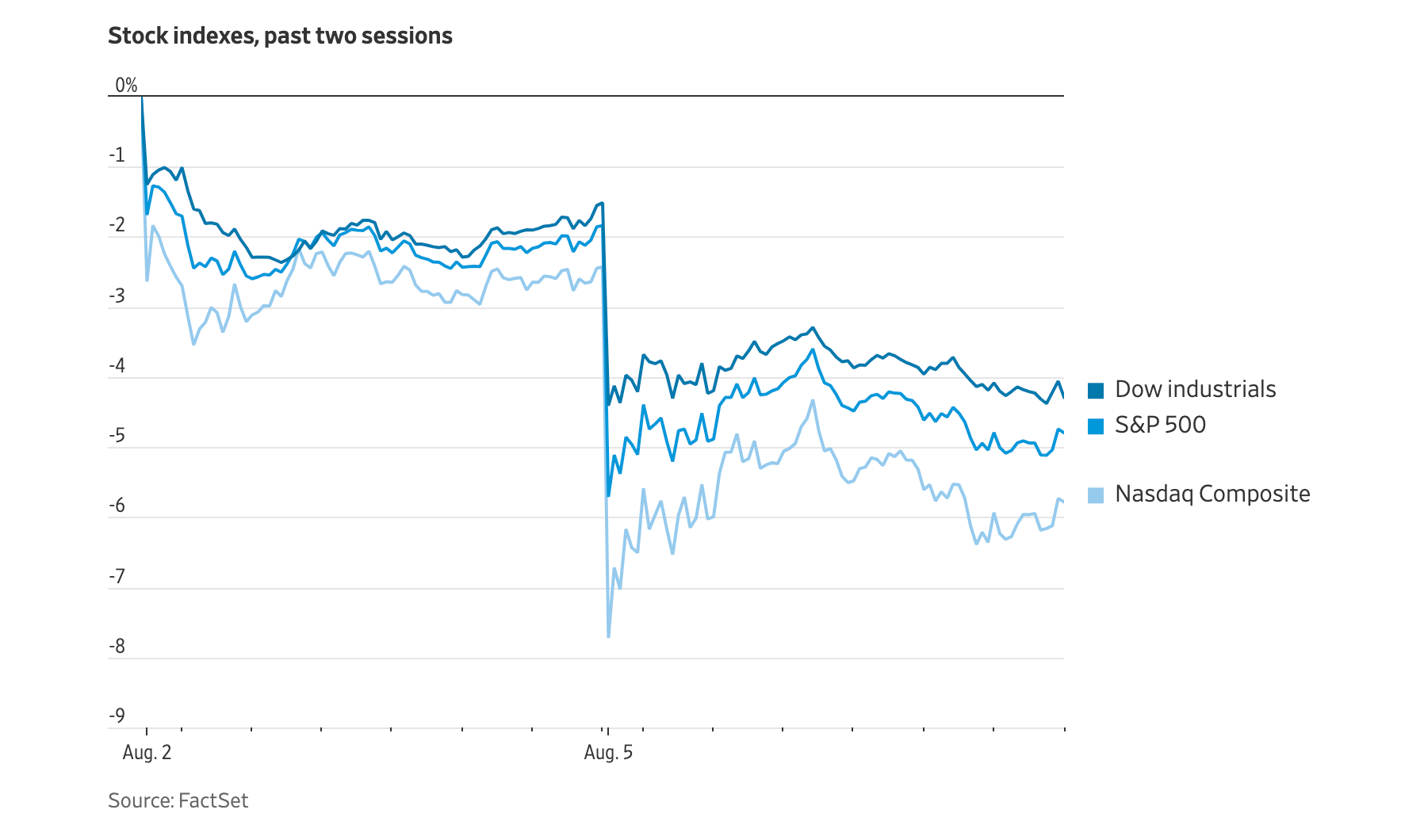

Happy Tuesday. In today's show, we dive into the latest upheaval in Silicon Valley. OpenAI, the AI powerhouse behind ChatGPT, is facing a significant brain drain as three more executives, including co-founder John Schulman, head for the exit. Adding fuel to the fire, Elon Musk is renewing his lawsuit against the company he helped create. For more: Top 10 Black-Led VC Funds Guide | My premium subscription to investor lists, course access | YoutubeBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.The OpenAI Exodus: A Sign of Things to Come?OpenAI, the current darling of the AI world and all of technology right now, is facing turbulent times. The company that brought us ChatGPT, the fastest-growing app in the history of consumer technology is now grappling with a series of high-profile departures. Three executives, including co-founder John Schulman, have left the company, well Greg Brockman say his leave is only temporary. The most alarming part of this for OpenAI and Sam Altman is that, Schulman is heading to Anthropic, OpenAI's main competitor, in a move that has raised eyebrows across the industry.This exodus comes on the heels of last year's dramatic firing and rehiring of Altman, the earlier departure this year of Ilya Sutskever adding to the sense of instability surrounding the company. Meanwhile, Elon Musk, an original co-founder of OpenAI, has renewed his lawsuit against the company, further complicating matters.These developments raise critical questions about OpenAI's future. Has the company peaked? With increasing competition from tech giants like Meta and emerging players like Anthropic, can OpenAI maintain its position at the forefront of AI innovation?Market Turbulence: The Ripple Effect on StartupsThe recent sell-off in public markets, led by Warren Buffett's Berkshire Hathaway offloading $50 billion in Apple stock, has sent shockwaves through the tech industry. This downturn is not just affecting public companies; it's casting a long shadow over the startup ecosystem, particularly the so-called "unicorns" - private companies valued at over $1 billion.The golden age of unicorns, which peaked in 2021 with over 2000 such companies, seems to be waning. In the past three years, only three of these companies have gone public, creating a bottleneck of highly valued private companies with limited options for liquidity.This situation poses a significant challenge for startups at all stages. Without clear paths to liquidity or IPO, many unicorns are facing tough choices: pursue down rounds, seek acquihires, or potentially wind down operations. For earlier-stage startups, this environment makes it increasingly difficult to project optimistic growth trajectories and secure funding.Silver Linings: Innovation in Challenging TimesDespite the gloomy outlook, pockets of innovation and success stories continue to emerge. Take Savvy Wealth, for instance. This fintech startup, led by a three-time founder, recently secured a $26 million Series A2 round. Their success in raising capital in a challenging market, especially in the fintech sector, demonstrates that there's still an appetite for innovative ideas and strong teams.Savvy Wealth's AI-powered platform aims to streamline wealth management, addressing pain points in an industry ripe for disruption. Their success highlights a key lesson for startups in these turbulent times: focus on solving real problems with innovative technology, and funding can still be secured.Upcoming: Exclusive Fundraising ImmersiveWe're excited to announce a new comprehensive fundraising immersive specifically designed for venture-backed founders. Stay tuned for more details on how this program can help you:* Meet with founders who have done it and raised $10M or more for their startups* Get real-time feedback on running your fundraising process* Access real-time lists of investors who are actively investing year-round.Start August 15 (use code: NEWSLETTER30 at checkout for a discount)Sign up for the Raising Venture Capital Immersive waitlistThat's all for today, insiders. Have a great Tuesday and we will see you here tomorrow.* 📺 YouTube: FourInsights* 📸 Instagram: @FourInsights* 🌳 LinkTree: mattaparker* 🐦 X (Twitter): @mattaparker* 🎵 TikTok: @mattaparkerStay curious,Matt Parker Get full access to Four Insights at stretchfour.substack.com/subscribe

Happy Friday! Today’s show is a special one as we had some big news during our recording. Another heavily funded AI company is getting acquired by big tech. This time it is Character.ai and their founders heading back to Google. For more: Top 10 Black-Led VC Funds Guide | My premium subscription to investor lists, course access | YoutubeBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.1. Google Snaps Up Character AI: A Win for Big TechGoogle's making moves in the AI space, and their latest play involves Character AI, the chatbot maker that's been turning heads. Here's the scoop:* Google's paying a licensing fee for Character AI's tech* They're bringing the co-founders back into the Google fold* Many of Character AI's researchers are joining Google tooThe deal values Character AI at 2.5x its Series A valuation from 2023. But here's the million-dollar question: Is this a win for VCs, or just another big tech acqui-hire?The InformationTechcrunch2. Eric Schmidt's $140M Startup DramaEx-Google CEO Eric Schmidt is no stranger to headlines, but his latest venture is raising eyebrows for all the wrong reasons. Here's the tea:* Schmidt invested $140M in a startup incubator led by Michelle Ritter* The venture is now crumbling amidst personal and professional drama* It's a cautionary tale about mixing business with pleasure in Silicon ValleyThis story is a stark reminder that in the startup world, it's not just about your product – it's about who you know and how you navigate complex relationships.The Information3. Amazon's AI Power Play with AdeptNot to be outdone by Google, Amazon's making moves too. They've scooped up Adept AI in a deal that mirrors the Character AI acquisition. It's becoming clear: the AI talent war is heating up, and big tech is pulling out all the stops.The VergeWhat's Next?I'm thrilled to announce our upcoming Venture Capital Bootcamp! If you're a founder looking to navigate the complex world of VC funding, this is for you. We'll cover everything from crafting killer pitches to understanding term sheets.Sign up for the Raising Venture Capital Immersive waitlistAlso, check out these free resources:* VCs for Kamala: A curated list of active VCs supporting diverse founders* Cold Email Ebook: Master the art of outreach for capital raisingThat's all for this week, insiders. Have a great weekend.Cheers, Matt Parker Get full access to Four Insights at stretchfour.substack.com/subscribe

Hey there! I'm Matt Parker and welcome to the latest edition of The End of the Day Show and accompanying newsletter. Four days a week, I break down the hottest stories in tech, startups, and venture capital, providing insights you won't find anywhere else with my commentary, scoops, and stories. From AI breakthroughs to fundraising strategies, we've got you covered. For more: Top 10 Black-Led VC Funds Guide | My premium subscription to investor lists, course access | YoutubeBrought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.Interview Highlight: Andrew Firestone, CEO of Mermaid ChartAndrew Firestone recently led Mermaid Chart, an AI-powered visual collaboration tool, to a $7.5M seed round. Here are some key takeaways:* The Power of Open Source: Mermaid Chart leveraged its 65,000 GitHub stars and 4 million users to attract investor interest. Lesson: Traction speaks volumes.* AI as a Differentiator: By integrating AI into its core product, Mermaid Chart positioned itself uniquely in the market. Lesson: Identify your tech edge.* Fundraising Process:* 300 meetings over several months* 50 meetings per week during peak periods* Importance of refining your pitch with each meeting* Location Matters: Andrew moved from NYC to San Francisco, citing it as crucial for tech career growth and fundraising opportunities.* Working with Tech Giants: Insights on collaborating with Sid Sijbrandij (GitLab CEO) through OpenCore Ventures.Why This Matters for Our Upcoming CourseAndrew's experience underscores many of the principles we'll be covering in our fundraising course:* The importance of traction and unique value propositions* Strategies for efficient fundraising processes* Leveraging industry connections and location advantagesComing Soon: Comprehensive Fundraising CourseStay tuned for the launch of our fundraising course, where we'll dive deeper into:* Crafting the perfect pitch* Building and leveraging networks* Understanding investor psychology* Negotiating terms and closing dealsAre you ready to supercharge your fundraising efforts? Reply to this email with your biggest fundraising challenge, and we might address it in our upcoming course!Here's to your funding success,Matt Get full access to Four Insights at stretchfour.substack.com/subscribe

Hey there, tech enthusiasts!Today's End of The Day Show packed a punch with some eye-opening stories:Brought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.* A brief overview of today's key stories: Friend.com's launch and Microsoft's earningsFriend.com: A Masterclass in Viral Product Launches* Avi Schiffman's background and previous viral projects* Breakdown of the Friend.com launch strategy* Analysis of the $1.8 million domain investment* The product: An AI-powered wearable "friend"* Social media impact and potential pre-order successMicrosoft's AI Earnings: Big Numbers in a Competitive Landscape* Azure AI services' $5 billion run rate and 900% YoY growth* GitHub and Co-Pilot's impressive performance* AI's impact on developer tools and enterprise adoption* Market reaction and implications for the AI industry* Looking Ahead* Upcoming earnings reports from Meta and Amazon* The evolving landscape of AI product adoption in enterprises* Closing Thoughts* Synthesis of Friend.com's viral strategy and Microsoft's AI growth* Implications for startups and established tech companies* Catch the full episode on our YouTube channel or listen on your favorite podcast platforms like Apple or Spotify!* 📺 YouTube: FourInsights* 📸 Instagram: @FourInsights* 🌳 LinkTree: mattaparker* 🐦 X (Twitter): @mattaparker* 🎵 TikTok: @mattaparkerStay curious,Matt Parker Get full access to Four Insights at stretchfour.substack.com/subscribe

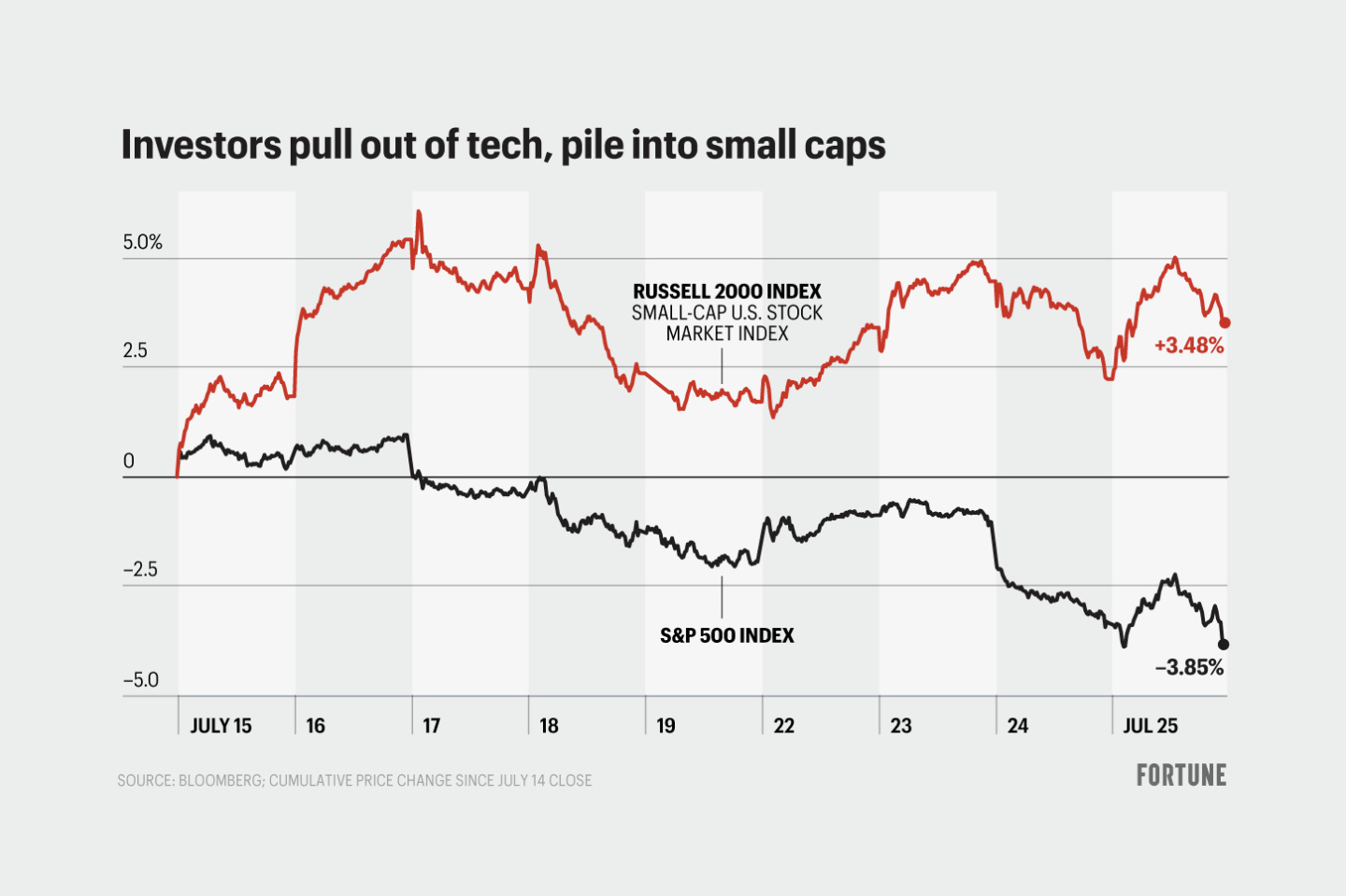

Hey there, tech enthusiasts!Today's End of The Day Show packed a punch with some eye-opening stories:Brought to you by:* First Meeting — Tracking enterprise AI budgets, spending patterns, and decision-making processes.* OpenPhone —brings your business calls, texts, and contacts into one delightful app that works anywhere.* Webflow — Design and develop at the same time.—Run reliable, impactful experiments* Navan — the leading travel and expense platform that employees love.* 🔍 Humane's Hard Times: Remember that AI pin everyone was buzzing about? Well, Humane might be looking for a buyer. We dive into what went wrong and what it means for hardware AI startups. (The Information)* 💼 Rillet's $13.5M Bet on AI Accounting: Can AI automate away all our accounting woes? We break down the opportunities and challenges in this space. (A16z Report)* 📈 The Russell 2000 Rebellion: Small caps are having their moment! We explore why investors are flocking to these smaller companies and what it could mean for startup founders.* 💰 America's Millionaire Club: 1 in 15 Americans are millionaires? We unpack the latest UBS wealth report and what it means for the future of wealth creation.Plus, don't miss our insights on Nvidia's projected $105 billion revenue for 2024 and what it says about the AI hype cycle.Catch the full episode on our YouTube channel or listen on your favorite podcast platforms like Apple or Spotify!* 📺 YouTube: FourInsights* 📸 Instagram: @FourInsights* 🌳 LinkTree: mattaparker* 🐦 X (Twitter): @mattaparker* 🎵 TikTok: @mattaparkerStay curious, Matt Parker Get full access to Four Insights at stretchfour.substack.com/subscribe

Welcome to this week's tech news roundup, brought to you by Matt Parker's "The End of the Day Show". Let's dive into the biggest stories and insights from the tech world.🚀 Earnings Season CountdownBig week ahead as we enter earnings season for notable tech companies. Here's what to watch:* Tuesday: SoFi, AMD, Microsoft, PayPal, Pinterest* Wednesday: Arm, Meta, Carvana* Thursday: Amazon, Apple, Intel, CoinbaseWhy it matters: Earnings calls provide crucial insights into company performance and industry trends. They're especially important for startups to understand market dynamics and potential opportunities.💡 AI in Focus* Will AI continue to dominate earnings call discussions?* OpenAI just announced its search product* Keep an eye on how companies like Microsoft, Meta, and Amazon discuss their AI initiativesThank you for reading Four Insights. This post is public so feel free to share it.📊 Carvana's Comeback Story* Carvana stock is up 173% this year alone* 219% increase in the last six months* A reminder of the unpredictable nature of the stock market🗓️ 2025 Budget Planning for U.S. Enterprises* Shared services typically make decisions from July to October* Business units decide from September to November* Critical for startups to align their sales strategies with these cycles💼 Spotlight: Powder's $5M Funding Round* Building AI agents for precise document analysis in wealth management* Founded by ex-Addepar talent* Backed by Y Combinator and other notable investors🔮 Looking AheadStay ahead in tech and startups with companies and ventures I support:• ModernTax: Revolutionizing tax services with API access and automated analysis• FirstMeeting: AI-driven pitch optimization for founders and sales teams• Fundraising Course: Accelerated 60-day program to raise capital efficientlyWhether you're raising funds, optimizing operations, or seeking insights, I am involved in these ventures. Stay tuned for more insights and analysis in our next edition!Thank you for reading Four Insights. This post is public so feel free to share it. Get full access to Four Insights at stretchfour.substack.com/subscribe