Discover The Saturday Sendout

The Saturday Sendout

The Saturday Sendout

Author: The Simple Side

Subscribed: 1Played: 15Subscribe

Share

© The Simple Side

Description

The Saturday Sendout is tradeable market news in one place. Get weekly financial information on insider, company executive, and politician trading plus tons of other insights.

thesimpleside.substack.com

thesimpleside.substack.com

69 Episodes

Reverse

This is a free preview of a paid episode. To hear more, visit thesimpleside.substack.comGelt is your partner in taxes: an AI-powered platform with an expert CPA team. Quarterly, we align entities, surface missed deductions, and keep estimates tight—turning tax drag into deployable capital with clear actions, predictable outcomes, and stronger cash flow.Reminders

- Disclosure is in the email footer

- You can copy trade our potfolios here

- You can get our daily news updates here

- You can see our stock research reports here

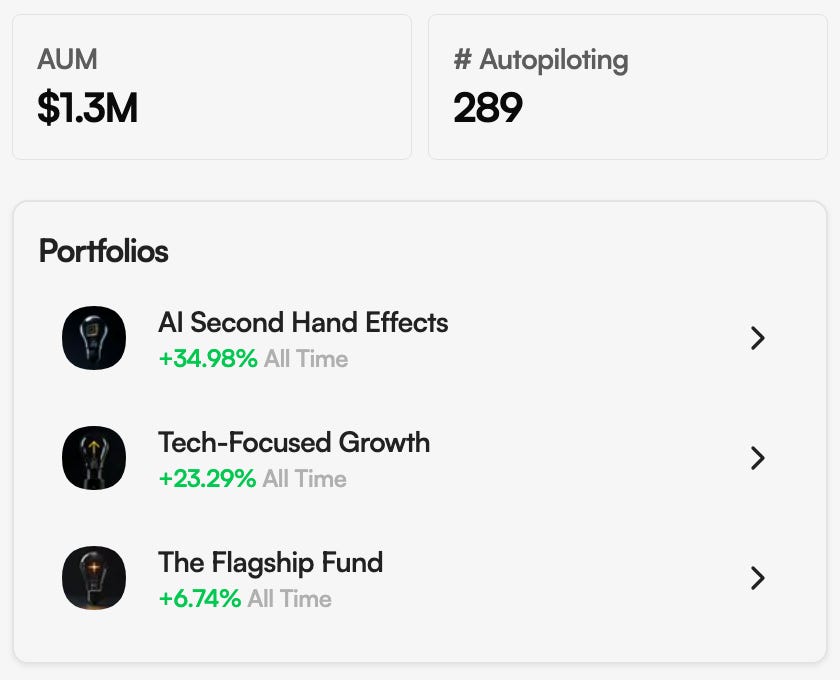

- Not all of these stocks make it into our portfoliosBefore we get into everything, I want to apologize for being behind on updating the Google sheet that holds all of our data. I am working on a solution that should make that much easier. I will get back in there and start making updates soon! Thank you all for your patience with me right now!Market Wisdom“[Mr. Market] has incurable emotional problems… [he gets] depressed and can see nothing but trouble ahead for both the business and the world. On these occasions he will name a very low price, since he is terrified that you will unload your interest on him.”— Warren BuffettWeekly RoundupS&P 500 fell roughly 2%Dow about -2%Nasdaq near -3%The 10-year Treasury yield edged down ~7 bps to ~4.07%The VIX finished in the low-23s after spiking midweek.Gold hovered a little above $4,050/oz.Oil drifted under $58–60. Bitcoin fell ~8–9% to the mid-$80Ks. The markets remained weak. Even solid numbers out of NVDA couldn’t help strengthen things.Returns this week were brought to you by… Extreme Fear.The AI euphoria phase is slowing down and of course people are terrified… try watching the news right now without being scared about the bubble popping. The reality is that it is all about perspective… Yes the past few weeks have been rough the SPY is down around 5% and my portfolios (in some cases) are down 10%.Why am I not sounding the alarm? Well, why would I?In the photo above, you can see earlier this year from Feb 19 to Apr 8. The market lost nearly 20% in those few short months. It then proceded to go on a 33% run, but again the media isn’t trying to sell you stability. They make more money when they sell fear and greed. We are in a fine position right now, yes, things are weak, but with nearly 50% of our cash on the sidelines I couldn’t feel more comfortable with this positioning. Nvidia sat at the center of everything. The company cleared a very high bar — Q3 revenue about $57B with data center north of $50B and Q4 guided near $65B — and still could not carry the market for long as traders faded the initial pop and leaned into “sell the news.” Again, the news is there to sell you on fear and greed.Around that, capital kept flooding into AI infrastructure and models: Google launched Gemini 3 across products, Brookfield outlined up to $100B for AI assets, Anthropic inked fresh multibillion-dollar compute commitments with Big Tech and chip partners, Saudi-linked groups announced large data-center plans, and Jeff Bezos surfaced with a new industrial-AI venture. Even bulls acknowledged froth risk — Sundar Pichai warned about “elements of irrationality” — and the market traded that way, with intraday reversals and sharp factor whips.What is my opinion here? Great, let the market fall — we are overvalued! I went ahead and put together a quick market indicator on my website: The Simple Signal that you can go check out. If you scroll down below this you’ll come across something called “The Buffet Indicator” which is a fancy way of looking at how overvalued stocks are relative to GNP. It should come as no surprise that we are wildly overvalued. The point is… we are 50% in cash because we don’t like the current market value, and would prefer to allocate capital when we get back down into the 113% - 138% range.Macro and policy pulled in opposite directions this week. October CPI and jobs were still disrupted, and investors were forced to handicap the December Fed meeting off partial and delayed inputs. Their meeting notes (aka the minutes) showed a wider FOMC split, but a late-week rate-cut nudge from NY Fed’s John Williams steadied risk (sending the 10-year a bit lower). Elsewhere, Japan approved a ¥21.3T stimulus that leaned into defense and industry, adding duration questions for JGBs. On the U.S. industrial side, rare-earth onshoring headlines resurfaced as policymakers try to cut China's exposure in magnets and materials.I would love to see some of the mineral stocks trade lower to allow us to make “value buys” in our AI Second Hand Effects portoflio with these. Walmart beat and raised on 28% U.S. e-commerce growth and share gains, while Target cut guidance and Home Depot missed again as big-ticket projects cooled; Lowe’s outperformed on cost control. Gap surprised with its best ex-pandemic comp growth since 2017. Early Black Friday promotions arrived across the board, but the University of Michigan sentiment gauge slid toward the low-50s, and a rise in household utility delinquencies hinted at stretched wallets. If there is a holiday winner’s circle, it is tilting toward value, essentials, and retailers with strong digital execution.As a reminder, markets are irrational. They are there to serve you, do not them control you (see the market wisdom above). Walmart has an incredible quarter, and I guarentee you that if the market continues down, WMT stock will end up lower than what it was before their earnings came out. Is that rational? No, but that is how you make money in this market. You wait and wait and wait, and when you finally see an incredible opportunity you make a move. We are in the waiting phase.Meta won a major antitrust case that removes a breakup overhang tied to Instagram and WhatsApp. Cloudflare resolved a broad outage tied to a configuration error, a reminder of how concentrated critical web plumbing has become. Speaking of which, Cloudflare is shaping up to be a “back up the truck” opportunity. We saw the exact same thing happen to Crowdstrike earlier in the year… I mean do people not think before they sell?Here is a July 19, 2025 article about Crowdstrike stock after their servers crashed:”The cybersecurity specialist’s share price was down 8.5% as of 11 a.m. ET, according to data from S&P Global Market Intelligence. Shares had been down as much as 15.4% earlier in the daily session.With a new update that it rolled out, CrowdStrike inadvertently triggered system locks for hardware using Microsoft‘s Windows operating system. The issue has caused massive global outages for information technology systems, and investors are dumping the company’s stock in response.”Sounds like a buying opportunity… not now, but soon.Roblox moved to age-verify chat and separate minors and adults, adding to a wider scrutiny cycle that also hit AI-enabled toys after an unsafe-content scare. In media, Warner Bros. Discovery formally drew multiple suitors for all or parts of the company, but financing and regulatory math will decide how real any bid is.Crypto traded like a high-beta macro asset and then some. Bitcoin knifed from the low-$90Ks to the mid-$80Ks before a small Friday bounce, dragging crypto-exposed equities and triggering forced deleveraging. MicroStrategy kept buying on weakness, but ETF outflows and tighter financial conditions outweighed dip demand this week.Stock ResearchOur stock research is meant to present subscribers with stocks that have the potential for outsized returns. Not all of these stocks make it into my portoflios, but some will every now and again. We started building out our stock research archive right before the market took its turn downward, so our track record doesn’t look incredibly stellar, but as time goes on and markets normalize, I expect this to catch up and turn around! Regardless, these research articles should be used as a tool to find potential new investments for your portfolio. We are keeping track of everything using the thesimpleside.news/stock-research website, and you can follow along there as well. Recent ArticlesNow, alongside these research articles, I am also tracking stocks I call “Berkshire Buy”, which I think are companies that the legendary Warren Buffett and his company Berkshire Hathaway might buy.Not all of these companies make it into my personal portfolios, but a few have, like OXY, NSSC, and QLYS.Portfolio InformationOverextended & Oversold PositionsYou can copy trade the portoflios by clicking here!These represent the 4-month average return of all investors who copy my portfolios.That means these will differ from the portfolio’s total returns since inception because everyone has different overall price averages, different DCA values and amounts, but these returns take into account all of that.Remember, that means that the Autopilot app won’t match 1:1 with your returns, but will show The Simple Side shareholder average.Free subscribers get direct access to all of these portfolios & real-time updates by joining paid here. Or you can directly copy trade by going here: Autopilot.Behind The Paywall

- Portfolio Weekly Returns

- Portfolio Holdings

- Portfolio Changes, Updates, New Investments

- Weekly Picks

- M&A Stock Picks

- Top Investment Stock PicksPortfolio Returns, Holdings & Updates

This is a free preview of a paid episode. To hear more, visit thesimpleside.substack.comThanks to Constant Contact for sponsoring today’s article!Reminders

- Disclosure is in the email footer

- You can copy trade our potfolios here

- You can get our daily news updates here

- You can see our stock research reports here

- Not all of these stocks make it into our portfoliosMarket WisdomMichael Burry just disclosed that he would be shutting down his fund Scion Asset Management.Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.— Michael Burry (October 31, 2025)This quote is actually in reference to WarGames — a 1983 movie where a super computer calculates that the only way to win a nuclear war is by not starting one in the first place.Quite a timely reference since the current race is to generate the most power (through nuclear) to power AI… That is all well and good (and nostalgic), but there are some much much more meaningful references in this quote as well. Sometimes, we see bubbles.This part of the quote references two main things: * The housing market bubble in 2008 * The current AI bubble that Burry has bet against. Sometimes, there is something to do about it.This part of the quote of course referencing that in 2008 there was something to do about the bubble (bet against it). What about the current bubble? Well, that leads into the final part of the quote: Sometimes, the only winning move is not to play.Where he says that even though he believes that the current “bubble” is real, there isn’t anything he believes he can do about it. It is clear to Burry that there is a bubble but he isn’t sure how or when it will burst. That means there is nothing left to do but not play. Now, Burry did mention that on Nov. 25th he would be making an announcement or “moving on to better things,” so we will have to pay attention to what he gets himself into next. Weekly RoundupStocks ripped early and faded late…S&P 500: -.7%Dow: +0.11%Nasdaq: -0.23% The 10-year hovered near 4.1%, the VIX pushed toward 20, oil stayed around $60, gold eased, and bitcoin slid about 10% after breaking below $100K.Returns this week were brought to you by AI whiplash, shutdown relief turning into rate-cut doubt, and a market that still lives and dies by a handful of mega caps.40% — that is how much of the S&P 500 is driven by the top 10 tickers (I say tickers because Google is in there twice). That’s right, 2% of the companies in S&P 500 drive 40% of the returns… yikes. The good news for us is that we aren’t invested in the SPY, nor are we heavily invested in the top 10 stocks as a whole. The bad news is that when the S&P 500 drops people FOMO sell and let the fear guide them and it ends up causing issues for all stocks in or out of the S&P. We at The Simple Side have been expecting this sort of drop for a while now which is why we have been riding with a 50% cash portfolio. Early strength this week came on hopes Congress would wrap the shutdown and on fresh AI deals: a large OpenAI–AWS capacity pact, strong Palantir numbers, and Microsoft winning U.S. licenses to ship tens of thousands of Nvidia GPUs to the UAE. Then the mood flipped — SoftBank dumped its Nvidia stake, CoreWeave flagged a data-center delay after touting a giant backlog, and AI leaders sold off midweek as investors questioned lofty multiples. AMD sketched bigger long-term AI targets, Anthropic laid out a massive U.S. build-out, and Microsoft formed a “superintelligence” group, but the bullish headlines couldn’t offset the valuation nerves.Fed rhetoric remained split and key October reports may never be fully published because of the data blackout, leaving rate-cut odds for December wobbling around a coin-flip. Speaking of which, Polymarket is a great resource to use when it comes to watching the rate cuts and the effect that the cuts have on the economy as a whole.Here you can see the current rate cut odds over the past 3 months. You may notice that over the past few weeks, the rate cut odds have started dropping, and what have we seen in the markets? The same thing, a dropping market. Current odd of a 25bps rate cut have dropped below 50% for the first time ever and right now that matters more than anything.Investors are betting big on the low rate environment helping companies grow quicker (justifying valuations sooner). If that happens, then the markets are safe, if not, then we are heavily overvaluing a majority of the market right now.Of course, there are ways to use these odds to help limit portfolio losses in the case that there is no rate cut, but we will get into that in another article.Consumer confidence remains soft right now, and the current sentiment around housing got weird: a floated 50-year mortgage drew pushback, and regulators mused about “portable” or assumable loans instead.Pfizer won the Metsera bidding war (obesity pipeline). Visa and Mastercard advanced a settlement that would trim interchange fees modestly and expand routing options (likely 2026–27). Merck agreed to buy Cidara for its long-acting flu program. Berkshire filled the last “Buffett-Driven report — adding Alphabet while trimming Apple (Greg Abel reaffirmed as successor). Walmart announced a CEO transition for Feb. 1 and Paramount Skydance laid out deeper cost cuts and price hikes while the sale of Warner Bros. Discovery drew suitor chatter.Target cut grocery prices into the holidays while early Black Friday deals hit Apple gear and more. Starbucks’ “Bearista” merch mania met a Red Cup Day strike; the company said sales still set records. Wendy’s plans to close hundreds of weaker stores to refocus.I think this is a sign that consumer spending is starting to weaken. Yes Starbucks may have set a record, but everywhere else seems to be slowing down a bit. Some fun stuffThe U.S. Mint made their last penny… (rounding to the nearest nickel becomes standard for cash), IRS lifted 2026 retirement contribution caps, and an infant-formula recall widened after botulism cases. Crypto spent the week bleeding as ETF outflows and risk-off tone weighed.Stock ResearchOur stock research is meant to be a tool for subscribers that allows them to read new ideas that we see, but we aren’t sacrificing portfolio positions to invest in. These research articles should be used to find potential new investments for your portfolio. We are keeping track of everything using the thesimpleside.news/stock-research website, and you can follow along there as well. Recent ArticlesThe two stocks we posted research about this week were NextEra Energy (NEE) and Western Digital (WDC) — both are strongly connected with the current AI stock bull market and have the potential to generate some serious returns if the market stays green. They both generate cash flow, have income hitting the bottom line and they both have the ability to capitalize on the AI arms race.Now, alongside these research articles, I am also tracking stocks I call “Berkshire Buy”, which I think are companies that the legendary Warren Buffett and his company Berkshire Hathaway might buy.Not all of these companies make it into my personal portfolios, but a few have, like OXY, NSSC, and QLYS.Portfolio InformationOverextended & Oversold PositionsYou can copy trade the portoflios by clicking here!These represent the 3-month average return of all investors who copy my portfolios.That means these will differ from the portfolios total returns since inception because everyone has different overall price averages, different DCA values and amounts, but these returns take into account all of that.Remember, that means that the Autopilot app won’t match 1:1 with your returns, but will show The Simple Side shareholder average.Free subscribers get direct access to all of these portfolios & real-time updates by joining paid here. Or you can directly copy trade by going here: Autopilot.Behind The Paywall

- Portfolio Weekly Returns

- Portfolio Holdings

- Portfolio Changes, Updates, New Investments

- Weekly Picks

- M&A Stock Picks

- Top Investment Stock PicksPortfolio Returns, Holdings & Updates

This is a free preview of a paid episode. To hear more, visit thesimpleside.substack.comThanks to Percent for sponsoring today’s article!Reminders

- Disclosure is in the email footer

- You can copy trade our potfolios here

- You can get our daily news updates here

- You can see our stock research reports here

- Not all of these stocks make it into our portfoliosMarket Wisdom“Everyone has the brain power to make money in stocks. Not everyone has the stomach.”- Peter LynchAbout 10 people copying my trades stopped copying them this week, and about 3 people unsubscribed from the newsletter this week. This is a common trend I notice every time the market dips. People forget that markets take dips, both short and long. Some will happen now, and others will happen later, but they are bound to happen regardless. There are drawdowns, there are setbacks, there are recessions, and there are depressions. To make money, you need to be able to stomach a loss here and there. I’ve done it a few times, and pretty notably in 2022.This graphic shows my portfolio returns from 2020 to the present. What you might notice is that we have experienced a 414% total return over that time periodThese are stellar returns.What you might also notice is that in 2022, I experienced a 30% drawdown… this meant that I underperformed the S&P 500 by 12%. It also brought my overall portfolio returns down from 93% to 34%. A tough loss, but if I decided to sell out of everything I would have missed a 103% return in 2023.That being said, let’s get into the news from this past week. Of course, if you are a paying subscriber, you should be able to jump down towards the bottom of this email to see our portfolio news and performance. Weekly RoundupStocks finally exhaled. After a hot stretch for mega-cap tech, the market spent the week trending lower as the AI trade wobbled and breadth stayed weak. By Friday’s close, the S&P 500 was down roughly 2% on the week, the Nasdaq lost ~3% (worst week since April), and the Dow slipped a bit over 1%. The 10-year yield hovered a touch above 4%, the VIX pushed toward the low 20s passing the 22 mark on Friday. Oil slid to just under $60, and bitcoin broke below $100K midweek before bouncing.Returns this week were brought to you by heavy AI headlines colliding with valuation reality and the long lasting Govenment shutdown. Early on, bulls cheered a seven-year, $38B OpenAI–AWS capacity deal, Palantir’s beat/raise, and U.S. licenses for Microsoft to ship tens of thousands of Nvidia GPUs to the UAE. Regardless of the good news, traders questioned stretched multiples after AMD/AI names ran hot, and the Nasdaq’s leaders gave back gains into Thursday/Friday.Days/weeks like this make it feel great to see 50% of your cash on the sidelines “doing nothing.” If you have cash like this on the sidelines, then there isn’t a need to “panic sell.” In fact, drops in the market are exciting! Now one thing that I am not sure about is whether this selloff is going to be longer standing or if it is a “one time scare.” As with all else, only time will tell. That being said, we are so well positioned with the portfolios we have built. We own some of the most quality stocks the market has to offer right now. The gains in these portfolios will be built over the next few years and a week dip doesn’t make me nervous.Palantir raised its outlook on strong U.S. gov/commercial demand. AMD topped estimates and guided higher, but investors nitpicked margins and the pace of the data-center ramp. Uber beat on trips and revenue yet slipped on spending plans. Consumer bellwethers showed the same K-shaped pattern we’ve seen all year — resilient higher-income spending and softer traffic at the low end — while McDonald’s and Starbucks highlighted value hunting (and, yes, a holiday-cup frenzy).Policy and macro didn’t help risk appetite. The FAA began phasing a shutdown-related 10% air-traffic reduction at major airports, forcing schedule cuts. Mixed Fed speak (one governor urging faster cuts, others counseling patience) left rates near 4% but sentiment fragile. Layoff headlines flared again — even as private payrolls data showed modest job growth — and consumer sentiment slid toward cycle lows.Autos and health care each had their own plotlines. EV demand cooled after credit expirations (hybrids are holding up). Tesla shareholders approved a performance-based package for Musk tied to aggressive product and market-cap milestones. In GLP-1s, Lilly and Novo moved toward lower list prices and broader 2026 coverage, while Big Pharma M&A chatter stayed hot (and the Metsera bidding war escalated).Novo is startrting to look like a very investable stock. The company is down 68% from their high and is closing in on a single digit PE ratio. That being said, they just recently lost the fight for Metsera. Just hous ago it was annouced that MTSR would take Pfizer’s bid over Novo’s citing potential anti-trust issues with Novo.Deal and corporate maneuvering rounded out the week. Kimberly-Clark moved to buy Kenvue. Disney pressed YouTube TV to restore ABC for election coverage amid a blackout. Shein pulled sex-doll listings under French scrutiny. Millennium sold a minority stake in its management company. And a Commerce-backed plan aimed to jump-start U.S. rare-earth magnet capacity—small headline, big supply-chain implications.The race for rare earths is really starting to blow up and could become a very investable sector. Tickers like UUUU (Energy Fuels) have run up over 300% from their lows, but along with ohter stocks have been dropping over the past few weeks. UUUU is down 40% from its ATH on October 15. Under the surface, leadership stayed narrow. Mega-cap AI and cloud names still set the tone day-to-day, but when they sag, the equal-weight S&P can’t pick up the slack. Defensives didn’t save anything, either; the better cushion came from falling oil (easier input costs, softer inflation optics) and a still-contained rate backdrop.The only thing that makes me nervous is that oil is already cheap so falling oil prices can’t hold up the markets forever. Overall, I think we are starting to see a bit of the uneasiness hidden below the market starting to show its ugly head.Stock ResearchOur stock research is meant to be a tool for subscribers that allows them to read new ideas that we see, but we aren’t sacrificing portfolio positions to invest in. These research articles should be used to find potential new investments for your portfolio. We are keeping track of everything using the thesimpleside.news/stock-research website, and you can follow along there as well. Here is our most recent research article…This was the research article that we posted earlier this week, which highlighted Wayfair (W) and called for a 23% return with a target date of Q3 2026. Now, you may remember that in last week’s newsletter, we actually highlighted 3 stocks that have been included in our research article tracking website.Those stocks are Wayfair (W), Nice Ltd (NICE), and Bloom Energy (BE). Currently, only one of these stocks has a positive return (Bloom Energy), but all of their target dates are about 1 year out. As a reminder, you can now follow along with all of these research reports by going here: https://thesimpleside.news/stock-researchNow, this week I have even more trade ideas coming at you… one is an energy play and the other is hardware, but I guess I will keep those articles for this week…If you are or aren’t liking these research articles, let me know by clicking the button below and leaving me a message saying so.Now, alongside these research articles, I am also tracking stocks I call “Berkshire Buy”, which I think are companies that the legendary Warren Buffett and his company Berkshire Hathaway might buy.Not all of these companies make it into my personal portfolios, but a few have, like OXY, NSSC, and QLYS.Now, you can’t make things like this up… last week I called out QLYS. I said…Currently, one of the stocks on this list stands out to me… QLYS. It is a quality company, with great-looking metrics, yet it seems to be struggling. The company is down 40% from its high in 2023. Since then, it has grown its revenue, its net income, and bought back shares, and grown its assets by $200M. This company may become a holding in the Flagship Fund when we rebalance the portfolio for 2026.We proceeded to make the stock the second-largest holding in our Flagship Fund… and here is how that ended up for us…A gain like this in the face of an SPY ending negative is a huge win.Portfolio InformationOverextended & Oversold PositionsPortfolio Returns (these represent the past 3 months)You can copy trade the portoflios by clicking here!Here are our current 3-month returns! These represent the average return of all investors who copy my portfolios. That means these will differ from the portoflios total returns since inception because everyone has different overall price averages, different DCA values and amounts, but these returns take into account all of that.Remember, that means that the Autopilot app won’t match 1:1 with your returns, but will show The Simple Side shareholder average.Free subscribers get direct access to all of these portfolios & real-time updates by joining paid here. Or you can directly copy trade by going here: Autopilot.Behind The Paywall

- Portfolio Weekly Returns

- Portfolio Holdings

- Portfolio Changes, Updates, New Investments

- Weekly Picks

- M&A Stock Picks

- Top Investment Stock PicksPortfolio Returns, Holdings & Updates

This is a free preview of a paid episode. To hear more, visit thesimpleside.substack.comThanks to Avalara for sponsoring today’s article!Quick Reminders:* Our disclosure is in the email footer* Portfolio copy trading is available here* You can find our podcast on YouTube, Spotify, Apple Music, and here on Substack! * You can get daily market news from: The Simple Side Daily newsletter.* Use this button to leave me comments about what you want to see in the newsletter.FIND ALL OF OUR STOCK RESEARCH ARTICLES HERE: LINK

Our goal is to be the most transparent, open & honest finance newsletter out there. All of our researched stocks (good and bad). Will be published here after the article is written! Portfolio Overextended & Oversold PositionsMarket WisdomI call investing the greatest business in the world because you never have to swing. You stand at the plate, the pitcher throws you General Motors at 47! U.S. Steel at 39! and nobody calls a strike on you. There’s no penalty except opportunity lost. All day you wait for the pitch you like, then when the fielders are asleep, you step up and hit it.”- Warren BuffetI think Buffett gets quoted and used as a headline far too often in the finance world, but can you blame anyone? He is the Michael Jordan of the finance world, or maybe Michael Jordan is the Warren Buffett of the basketball world… either way, his advice still rings true today. Today’s market wisdom quote is so important in the investment environment. There is so much fear & green being thrown at us as investors all the time. I can’t go more than a few minutes without seeing a post about the bubble. Here is the bad news: you can’t avoid a bubble unless you want to put $0 in equities. Here is the good news: you aren’t required to put all your money in equities! We here at The Simple Side are 50% in cash right now, just waiting for good opportunities to come across our radar. Needless to say, relax. Take a breath, go for a walk, ignore the media for a bit. If you are stressed about your portfolio, take some chips off the table! If you think you’re missing out on returns, throw some chips on the table!Remember, if you have cash on the sidelines, you can stand at the plate for weeks, months, years, and you’ll never be called out. Okay, let’s get into the news!Weekly RoundupStocks climbed to fresh records, powered (again) by mega-cap tech. The S&P 500, Nasdaq, and Dow all finished higher, but breadth stayed narrow: the market-cap indexes outpaced the equal-weight S&P, which tells you the biggest names did most of the lifting. That narrow leadership matters because it makes the tape look strong even when many stocks are just okay.Here is something a lot of people don’t understand when it comes to investing & it will be beneficial for you to see. What you are looking at is a graph of the median returns of each sector compared to the S&P 500. Tell me what you notice…If you are wondering how the S&P 500 was up this week and the median returns across all sectors was negative, DING DING DING. This shows the current intense concentration that the indexes have on mega-cap companies. The big takeaway here is 2 fold* Investing in the index is becoming an increasingly risky proposition and will begin to underperform in the coming years. * If and when mega-caps start to underperfrom it will bring the whole market down with it. This is bad for those who think the SPY is safe, but good for people like us with cash on the sidelines!The Fed cut 25 bps but warned the next cut isn’t guaranteed. The 10-year hovered near ~4%. Lower/steady long rates boost the value of future earnings, which favors growth and AI leaders. Volatility stayed contained in the mid-teens, a sign dip-buyers remain confident.The market is still experiencing an incredible “buying pace” — aka, people still cannot get enough of equities, so everything seems to remain “bullish” for equity investors (at least through the next few months). AI spending kept showing up in hard numbers. Nvidia pushed to new highs, guided to enormous chip orders into 2026, and extended partnerships from data centers to networking. Microsoft and Alphabet reported strong cloud/AI demand. Meta also grew, but its bigger-than-expected AI capex spooked investors. Useful reminder: the winners of this build-out (chips, racks, power, cooling, interconnects) can rally even when platform owners debate the payback timeline.Earnings flow backed the rally. Amazon beat with an AWS re-acceleration and raised capex for AI. Apple beat and guided to record holiday sales. Industrial and travel names posted solid prints (Honeywell, Las Vegas Sands), while a few payments and software names disappointed (Fiserv reset guidance). The “soft-landing + AI investment” narrative is still intact, but stock-by-stock results matter.Commodities were friendly for risk assets. Oil hovered around ~$60 — a low price for this cycle that eases costs for consumers, transports, and manufacturers (but pressures energy producers unless margins/volumes offset). Gold near ~$4,000 stayed elevated. High gold while stocks rise basically says: investors are willing to take risk, but they’re also hedging against policy/geopolitical surprises.This is something we have seen for weeks now, clearly, not everyone behind the scenes is 100% confident that the current market run can go on forever.Policy and trade headlines lowered tail risk. Washington and Beijing stepped back from fresh escalation and paused new rare-earth export curbs for a year. That reduces near-term supply anxiety for chip and EV supply chains, even if existing controls and scrutiny remain.Amazon announced deeper headcount cuts to streamline layers and steer more dollars to AI. On the deal front, Novartis’ buyout of Avidity lit up small-cap biotech, banks combined to gain scale (Huntington–Cadence), and two major water utilities agreed to merge — evidence of ongoing consolidation across sectors.Crypto was a sideshow: Bitcoin drifted around the low-$100K mark. Institutions keep normalizing the asset class, yet flows remain choppy. It’s acting more like a risk asset than an inflation hedge week-to-week.Insider Trade UpdatesWe keep track of all of these trades on our Google sheet (available to paid subs), and then insider returns are quite astounding… (I have been removing quite a few of the penny stocks/ super risky investments to make the returns more normalized.)The current insider buy/sell ratio is sitting at 0.22, which is relatively low. Over the past 5 years, I have seen the average go as high as 0.81 in May of 2022 (a strong buying signal), and as low as 0.17 (a sell/hold signal). Whale BuysOct 30, 2025* MLPT — MapLight Therapeutics, Inc. · 10% Owner · 5,441,176 @ $17.00 ($92.50M) · holdings +38.17%.* NVCT — Nuvectis Pharma, Inc. · 10% Owner · 154,770 @ $6.18 ($957.08K) · holdings +5.01%.* IRDM — Iridium Communications Inc. · Director · 30,000 @ $17.49 ($524.70K) · holdings +11.22%.Oct 29, 2025* KMI — Kinder Morgan, Inc. · Executive Chairman · 1,000,000 @ $25.96 ($25.96M) · holdings +0.39%.* ASA — ASA Gold & Precious Metals Ltd · 10% Owner · 28,500 @ $44.08 ($1.26M) · holdings +0.56%.* EBC — Eastern Bankshares, Inc. · Executive Chair · 50,000 @ $17.21 ($860.50K) · holdings +13.99%.* NSC — Norfolk Southern Corp · Director · 2,600 @ $281.86 ($732.82K) · holdings +59.09%.* BWB — Bridgewater Bancshares Inc · Director · 30,000 @ $17.45 ($523.54K) · holdings +3,409.09%.Oct 28, 2025* SMMT — Summit Therapeutics Inc. · Director · 533,617 @ $18.74 ($10.00M) · holdings +1.69%.* VRDN — Viridian Therapeutics, Inc. · Director · 454,545 @ $22.00 ($10.00M) · holdings +13.14%.* ASA — ASA Gold & Precious Metals Ltd · 10% Owner · 41,507 @ $46.09 ($1.91M) · holdings +0.83%.* FCN — FTI Consulting, Inc. · CEO/Chairman/President · 7,500 @ $151.12 ($1.13M) · holdings +2.62%.* FMNB — Farmers National Banc Corp (OH) · Director · 73,500 @ $13.59 ($998.87K) · holdings +38.63%.* KO — Coca-Cola Co. · Director · 14,267 @ $70.00 ($998.68K) · holdings +1,276.00%.* GAM — General American Investors Co Inc · (N/A) · 7,208 @ $24.98 ($180.06K) · holdings +5.98%.Officer Skin in the game* EBC — Eastern Bankshares, Inc. · Executive Chair · 50,000 @ $17.21 ($860.50K) · Oct 29.* EBC — Eastern Bankshares, Inc. · Chief Financial Officer · 20,000 @ $16.98 ($339.60K) · Oct 30.* OBK — Origin Bancorp, Inc. · Chief Financial Officer · 4,500 @ $34.88 ($156.94K) · Oct 30.* FCN — FTI Consulting, Inc. · CEO/Chairman/President · 7,500 @ $151.12 ($1.13M) · Oct 28.Largest % Buys* BWB — Bridgewater Bancshares Inc · Director · 30,000 @ $17.45 · holdings +3,409.09% · Oct 29.* KO — Coca-Cola Co. · Director · 14,267 @ $70.00 · holdings +1,276.00% · Oct 28.* NWFL — Norwood Financial Corp · Director · 3,800 @ $26.71 · holdings +264.07% · Oct 29.* TTRX — Turn Therapeutics Inc. · Director · 20,202 @ $4.95 · holdings +202.02% · Oct 28.* NSC — Norfolk Southern Corp · Director · 2,600 @ $281.86 · holdings +59.09% · Oct 29.* RFM — RiverNorth Flexible Municipal Income Fund, Inc. · (N/A) · 3,216 @ $14.30 · holdings +41.69% · Oct 28.* EBC — Eastern Bankshares, Inc. · CFO · 20,000 @ $16.98 · holdings +71.37% · Oct 30.* MLPT — MapLight Therapeutics, Inc. · 10% Owner · 5,441,176 @ $17.00 · holdings +38.17% · Oct 30.* OBK — Origin Bancorp, Inc. · CFO · 4,500 @ $34.88 · holdings +34.29% · Oct 30.* MRP — Millrose Properties, Inc. · Director · 7,500 @ $32.52 · holdings +32.38% · Oct 30.Stock Research & Berkshire BuysYou all likely saw my most recent stock research report on RTX.As a reminder, you can now follow along with all of these research reports by going here: https://thesimpleside.news/stock-researchI went through some of my old newsletters and populated the website with a few of my previous trades — so we have a backlog — but every research article I post will now be able to be seen here (along with some stats).I have 3 more research reports on the way — I am having a lot of fun putting these together! As a reminder, these stocks are

This is a free preview of a paid episode. To hear more, visit thesimpleside.substack.comThanks to Percent for sponsoring today’s article!Quick Reminders:* Our disclosure is in the email footer* Portfolio copy trading is available here* You can find our podcast on YouTube, Spotify, Apple Music, and here on Substack! * You can get daily market news from: The Simple Side Daily newsletter.* Use this button to leave me comments about what you want to see in the newsletter.Portfolio Overextended & Oversold PositionsWeekly RoundupReturns this week were brought to you by… …calmer rates, resilient earnings, and a handful of headline-grabbing corporate moves that kept risk appetite alive.Stocks finished higher overall. The S&P 500 and Dow both notched weekly gains of about 1%, while the Nasdaq did a bit better and small caps popped at mid-week before cooling. The 10-year Treasury yield hugged the ~4% line and even dipped below it at times. That matters because lower (or steady) long-term yields increase the present value of future profits. This tends to support higher equity valuations — especially for growth and tech. This is something that many “dumb money” investors do not understand right now. There is almost always an inverse relationship between these two metrics.This is the same reason why so many people seem to be so good at investing right now. Rates have been “coming down” since late 2023 (yes there have been ups and downs since but 2023 was peak).Oil spent the week around the high-$50s to low-$60s per barrel. That’s a relatively low price for this cycle and generally eases costs for transportation, manufacturing, and consumers; it’s a headwind for energy producer earnings unless volumes or refining margins make up the difference. Gold hovered near an extraordinary ~$4,100 – $4,300. Elevated gold usually signals investors are still buying insurance against policy surprises or geopolitical risk, even as stocks climb. The 3% selloff we saw this week is small relative to the 54% returns gold has had this year. Volatility cooled: the VIX slid back into the high-teens, a sign the market’s immediate fear level eased after the early-October wobble. Bitcoin held near the $110K area; more on why that mattered below.Earnings helped to do a bit of the heavy lifting this week. General Motors beat and raised guidance, showing that core auto profits can hold up even as the EV transition zigzags. GE Aerospace lifted its outlook again on strong jet-engine demand tied to robust global travel and aircraft production. Honeywell, Las Vegas Sands, and several chip-exposed names posted solid reports, helping industrials and tech lead. Defensive pockets like consumer staples and utilities lagged — classic price action when investors are leaning into growth and cyclicals. Don’t forget what’s important here… the buyers. Are retail investors the ones pumping growth and selling defensives, or is institutional money selling defensives and buying growth? To me? Looks like retail is the one selling defense and buying growth. This is a trend that has been going on for weeks now, and it is a clear signal to me that things big money is positioning itself for market drop. Tracking retail vs institutional volume is hard, but somewhat doable. Two ways I do it: Robinhood offers looks at their investors volume and market moves pre/post market. Tech stayed front and center for reasons both good and cautionary. Apple shares were helped by strong iPhone data and news it’s shipping AI servers from a new Texas facility. Nvidia and semi equipment names drew support from ongoing AI data-center spending. On the flip side, an AWS outage reminded everyone how concentrated the internet’s plumbing has become. America runs on Dunkin’ and the internet runs on AWS. It’s clear that when a major cloud region stumbles, downstream apps from trading to ride-hailing feel it. The takeaway isn’t “avoid the cloud”; it’s that reliability, multi-cloud setups, and redundancy remain investment priorities for enterprises.Another note from me here. I think there are going to be investment opportunities generated from this news. Of course, there is the classic buy AMZN because it is clear how many things rely on it. The other take is that we should be looking at and buying cloud backup & data protection companies: RBRK and CLVT are great examples.Autos and mobility mixed the near-term with the long-term. Tesla outlined aggressive production and software ambitions and reported record quarterly deliveries, but it also dealt with a safety recall and the air pocket that can follow expiring EV incentives. Rivian tightened its belt with layoffs and settled a legacy investor suit to clear the decks before its mass-market launch. Airlines like American beat expectations as travel demand stayed durable.Deal-and-capital headlines cut across sectors. Kering sold its beauty unit to L’Oréal to refocus on fashion and shore up the balance sheet. JPMorgan prepared to accept Bitcoin and Ether as collateral for institutional loans.This sounds like small news, but assuming all things go well, this could bode extremely well for anyone long BTC or ether. Coinbase kept expanding with another acquisition, while data-center landlords such as Digital Realty raised guidance thanks to record AI-driven bookings. Pipeline giant Kinder Morgan outlined a large slate of gas projects tied to LNG exports and the power-hungry AI build-out—one more link between semiconductors and old-school energy infrastructure.Kinder Morgan could become a great investment play. At a PE ratio of 21 it seems fairly valued, and a potentially massive player in the world of powering AI with many calling for “co-generation” being the first step between now and the nuclear power takeover. Okay, quick summary…Steady-to-softer yields are a tailwind for stocks. Cheaper oil cools inflation and helps most sectors’ costs & help to keep rates coming down. High gold says not everyone feels safe in the market.Calmer VIX means pullbacks can be shorter and more orderly—until a surprise hits. Put together, this week looked like “risk-on with hedges,” powered by earnings and underpinned by the idea that further rate cuts are on the way. Overall, I remain skeptical and happy with the large amounts of cash we are keeping on hand. Insider Trade UpdatesWe keep track of all of these trades on our Google sheet (available to paid subs), and then insider returns are quite astounding… (I have been removing quite a few of the penny stocks/ super risky investments to make the returns more normalized.)The current insider buy/sell ratio is sitting at 0.21, which is relatively low. Over the past 5 years, I have seen the average go as high as 0.81 in May of 2022 (a strong buying signal), and as low as 0.17 (a sell/hold signal). Buy The Dip Tracker* None that I liked this week.Whale Buys* LAW — CS Disco, Inc.Director bought 24,831 @ $5.95 ($147.8K).* THFF — First Financial CorporationDirector bought 2,295 @ $52.25 ($119.9K).* FAX — Abrdn Asia-Pacific Income Fund IncDirector bought 534 @ $15.57 ($8.3K).* IAF — Abrdn Australia Equity Fund IncDirector bought 910 @ $4.50 ($4.1K).Officer Skin in the Game* CSX — CSX CorporationPresident & CEO bought 55,000 @ $36.87 ($2.03M).* CNS — Cohen & Steers, Inc.Executive Chairman bought 40,539 @ $70.21 ($2.85M).* GRF — Eagle Capital Growth Fund, Inc.CFO/CCO/Secretary/Treasurer bought 9,850 @ $10.59 ($104.3K).Interesting Trade Ideas & Berkshire BuysI have received numerous emails from people requesting that I write more research articles on stocks and the state of the economy. I have previously stated that I prefer writing about the stocks I own and producing research only on stocks I buy. I think this approach is more genuine, and I feel that it is combative against many of the fake gurus who post multiple “stock picks” a week and then choose to only talk about the best ones. The original name of this newsletter was “Simple Side Research.” I shifted away from the “research” name and writing style because it felt too “stock picky.” However, with my current portfolios existing and available to track, and the returns speaking for themselves, I feel comfortable going back to my old “research” version of writing. I am not 100% certain how this will look over the next few months and weeks, but come 2026, I should have a good grip on how I want to do everything! I will continue to write “Berkshire Buy” articles as I see fit. These companies are ones that I believe fit Buffett’s criteria for investing (not always perfectly), and are analyzed from that exact viewpoint. Not all of these companies make it into my personal portfolios. Currently, I own OXY and NSSC in my Flagship Fund.Portfolio PerformanceYou can copy trade the portoflios by clicking here!Here are our current 3-month returns!These represent the average return of all investors who copy my portfolios. That means the returns in the Autopilot app won’t always match 1:1 with your returns, but show The Simple Side shareholder average.Free subscribers get direct access to all of these portfolios & real-time updates by joining paid here. Or you can directly copy trade by going here: Autopilot.* Behind the paywall…* Portfolio Holdings & Updates* Portfolio Strategies, Updates & New Bets* Our Weekly Picks* Mergers & Acquisitions Picks* Top Stock PicksPortfolio Holdings & Updates

This is a free preview of a paid episode. To hear more, visit thesimpleside.substack.comThanks to Cash App for their continued support of this newsletter!Quick Reminders:Our disclosure is in the email footerPortfolio copy trading is available hereYou can find our podcast on YouTube, Spotify, Apple Music, and here on Substack! You can get daily market news from: The Simple Side Daily newsletter.Use this button below to leave me comments!Quick UpdateI am out on vacation this weekend, so today’s newsletter will be quite quick. Two things* If the volatility this week made you queasy, then you need to reassess your risk tolerance and take some $$$ off the table. * I am currently around 50% in cash and find this positioning comfortable.* Go and read this post from this past week; it might help your mindset a bit.Weekly RoundupMonday, Oct 13Stocks bounced back after last week’s tariff scare eased. Lower bond yields (the 10-year slipped toward 4.06%) make future profits look more valuable, so growth names—especially big tech—led. Gold stayed near record levels, which usually means investors are still paying for protection even as stocks rise. Oil hovered just under $60; that’s cheap fuel for airlines, shippers, and consumers, but it can also point to slower global growth or ample supply.Broadcom jumped after teaming with OpenAI to build custom accelerators. Seems like OpenAI wants purpose-built chips, and Broadcom gets a multiyear, high-margin hardware pipeline. NVIDIA rose on fresh ties with Meta and Oracle. Retailers that source heavily from China (Best Buy, Burlington) rallied as trade fears cooled. Banks firmed up into earnings (Goldman, JPMorgan, Citi), which is typical when investors expect solid net-interest income and trading fees. One blemish: industrial distributor Fastenal slid after missing a soft read-through on factory demand.Tuesday, Oct 14Momentum faded. The S&P and Nasdaq slipped while the Dow eked out a gain as money rotated into “boring but steady” areas after strong bank prints from JPMorgan and Wells Fargo. That mix, financials up, megacap tech soft, yields down again near 4.02%, often means rate-cut hopes are helping cyclicals, but investors are taking some profit in the AI leaders.Google’s $10B India data-center/AI hub shows the arms race to build compute and power in lower-cost markets with friendlier permitting. Ford flagged production cuts after a key aluminum supplier’s plant fire; for a truck maker that leans on aluminum, that’s a near-term margin and volume headwind. GM took a $1.6B charge to slow its EV ramp after incentives changed, code for “match supply to demand so we don’t build inventory.” Timber REITs popped on merger talk (PotlatchDeltic/Rayonier), land plus mills equals scale and steadier cash flows. Navitas soared on higher-voltage power chips for NVIDIA-class data centers; more efficient power conversion is a real bottleneck as AI campuses scale.Wednesday, Oct 15Markets clawed higher as yields hugged ~4.01% and Fed chatter kept cut odds alive. Under the hood, companies kept repositioning for the AI build-out and slimmer cost bases. Amazon prepared another round of corporate layoffs—painful news for staff, but a signal to investors that management is protecting margins while it spends heavily on data centers. Microsoft expanded an enormous GPU commitment with partners across the U.S. and Europe. ASML and Bank of America both beat on earnings quality metrics, supporting the “semis equipment and big banks are fine” narrative. In energy and industrials: a judge blocking the restart of a key California oil pipeline hit Sable Offshore; liquid-cooling and power-efficiency names (Asetek, others) benefited from the same AI-power theme that’s lifting chips.Thursday, Oct 16Risk appetite cooled again. Small caps slumped, and regional banks slid after Zions and Western Alliance disclosed fraud-related losses, never a good look for confidence in the sector. When financials wobble, the rest of the market typically trades more cautiously. The 10-year yield dipped under 4% at points (a safety bid into Treasuries), gold stayed elevated (hedge demand), and oil drifted lower (growth concerns plus adequate supply).TSMC’s big revenue jump said plainly that AI chip demand is still strong. First Solar rallied as analysts leaned into its U.S. manufacturing and backlog, AI data centers don’t run without lots of power, and utility-scale solar is part of that build-out.Nestlé announced major job cuts to lift efficiency, a classic “shrink to grow” move.Salesforce raised a long-term revenue bar on data + AI products. NIO fell on an accounting dispute with a major investor, a headline risk that can weigh on all China EVs. Tesla headed back to court over Elon Musk’s pay plan, a governance overhang. Beyond Meat bounced on a debt extension (less near-term default risk, even if the core business still needs fixing). MGM sold a property operation to raise cash and streamline, as well as a balance-sheet tidy-up.Friday, Oct 17Finished green as yields ticked back near 4%. When rates aren’t climbing and there’s no fresh policy shock, dip-buyers tend to show up. Gold eased a bit (less panic), oil stayed in the high-$50s (cheap energy, but also a soft-growth tell).Infrastructure and geopolitics drove headlines. Meta lined up a record private-capital financing for a massive Louisiana data center, important because it shows Wall Street is willing to fund the power-hungry AI build with creative structures. Micron said it would stop supplying server chips to data centers in China because of ongoing restrictions, while still selling to Chinese firms operating outside the mainland, one more example of supply chains re-routing around policy lines. BYD and Ford announced big recalls; recalls are costly in the short run and can dent brand trust, though they’re usually manageable for balance-sheet-healthy automakers. Boston Scientific bought a neuromodulation startup to deepen its pain-management line. Rare-earth exposure lifted Ramaco on hopes that the U.S. will onshore more critical minerals supply.Portfolio PerformanceYou can copy trade the portoflios by clicking here!The returns shown are screenshots from Autopilot (the place where you can copy my trades). These represent the average return of all investors who copy my portfolios. That means the returns in the Autopilot app won’t always match 1:1 with your returns, but show The Simple Side shareholder average.Weekly Picks PerformanceI am debating pausing or stopping the weekly picks. We have done incredibly well with them thus far, but I think the time for them to perform so well is relatively over. If you would like me to continue, please fill out the form in the button below and mention that you want them to stay.We have generated excess returns of 77% on these weekly picks alone.Weekly Picks

This is a free preview of a paid episode. To hear more, visit thesimpleside.substack.comQuick Reminders:Our disclosure is in the email footerPortfolio copy trading is available hereYou can find our podcast on YouTube, Spotify, Apple Music, and here on Substack! You can get daily market news from: The Simple Side Daily newsletter.Recent Updates:I added to the paid subscriber spreadsheet to track positions across all my portfolios that are “overextended” or are “oversold.” Here are some of those stocks:Use this button below to leave me comments!Weekly RoundupReturns this week were brought to you by early-week record highs powered by AI and rate-cut hopes—and a late-week trade-war shock that flipped it all red.Oh how we haven’t learned…. does no one remember all of the trade war antics that happened earlier this year? Does no one remember how they tanked the market just for it to recover weeks later? Nothing burgers. We know how this story goesBig threat → Big Market Drop → Nothing Major Happens → Stocks ReturnsRemember that “Trade Wars” sell great in the news, but the news doesn’t make its money investing. The media makes its money selling fear or greed. When the sell fear, buy. When they sell greed, sell. The Nasdaq and S&P 500 notched fresh intraday records as investors leaned into Big Tech and semis. Treasury yields hovered a little above 4.1% on the 10-year and drifted lower midweek, which usually helps growth stocks. Oil spent most of the week around $61–62 a barrel—cheap versus the past couple of years—which eases costs for shippers, airlines, and consumers but can pressure energy company profits. Gold stayed near an all-time high (around $4,000/oz), which tells you some money is still buying insurance against political and economic shocks even while indexes are near highs.Then Friday hit. A fresh threat of “massive” U.S. tariffs on China sent risk assets into reverse: the Nasdaq dropped about 3.5% on the day, the S&P 500 fell nearly 3%, and the Dow slid close to 2%. When investors fear slower global trade and higher costs, they dump cyclical and mega-cap winners first, buy safer assets, and mark down anything tariff-exposed. You saw what happened: the 10-year yield slipped toward ~4.06% (a safety bid into Treasuries), gold popped, oil sank below $60 as growth worries rose, the dollar eased, and crypto struggled to maintain values.Now remember what I called out last week! The shift in institutional money to defensives (specifically healthcare). We saw tons of retail investors selling CNC, UNH, MOH, etc… No surprise that they shift to defensives just in time for growth/cyclicals to tumble. Big Company MovesBanking got bigger. Fifth Third agreed to buy Comerica in an all-stock deal valuing Comerica at roughly a 20% premium, creating the 9th-largest U.S. bank by assets if regulators sign off. Divestitures are common in big deals like this, and we will likely see the same here.Chips and AI stayed center stage. AMD ripped higher after OpenAI committed to deploy roughly six gigawatts of AMD GPUs—a huge signal that AI spending is shifting from demos to data-center build-outs. Nvidia grabbed its own headline later in the week with U.S. approval to ship certain AI chips to the UAE as part of a broader investment pact. Taiwan Semi’s September sales jumped more than 30% year over year, another sign the AI parts pipeline is still humming—right up until tariff worries sparked a broad semi sell-off on Friday.Tesla teased a cheaper Model Y configuration after posting record quarterly deliveries; an attempt to keep volume growing now that a key $7,500 EV incentive has expired. Ford faced a potential material squeeze after a major aluminum supplier’s plant fire—important because modern pickups are aluminum-heavy. Boeing, meanwhile, is preparing to lift 737 MAX production (subject to FAA sign-off), a needed step to refill airline fleets and repair margins.Deal and policy tape bombs kept coming. HSBC floated a plan to take Hang Seng Bank private, simplifying its Asia structure. Novo Nordisk moved to buy Akero to deepen its metabolic disease pipeline. Microsoft is baking Harvard Health content into Copilot so health answers are sourced and safer. Those same late-day Friday, tariff headlines led the entire market lower: megacap tech, semis, retailers and import-heavy names fell the most; classic “defensives” like consumer staples held up better (Pepsi kept rallying after an earnings beat and a CFO change).Lot’s of things mentioned above — but a few things really stand out as opportunities to me: NVO’s purchase of Akero, and Pepsi’s movement.Starting with Novo — their acquisition of AKRO is interesting to me, but could have large potential payoffs. AKRO, while not profitable, holds nearly no debt relative to their cash (36M in debt to 743M in cash). NVO stock is down 52% YoY but revenue growth still looks solid. Things slowed in Q1 of 2025, but seem to be pick up a bit of steam.Pepsi’s recent moves should come as no surprise. The company owns around 11% of Celsius stock (which has been growing unreasonably quick), and still has very stable revenues, and margins. In fact, net margin even looks to be increasing! I think as/if things continue to shift defensive, PEP will be seen as an undervalued defensive play and will outperform in a bear market. The End of The RoadTwo forces are pulling in opposite directions. On one side, falling—or even just stable—rates and real AI orders are good for profits and valuations. On the other, new tariffs would raise input costs, risk retaliation from China, and could re-ignite inflation just as the Fed inches toward cutting. That mix explains why gold is elevated (hedge demand), oil is soft (growth worries plus ample supply), and the VIX perked up into the weekend (investors paying for protection).In the near term, price movements will be driven by 3 things:* Trade headlines: tariff size, timing (Nov. 1 was floated), and any talk of carve-outs. Bigger, sooner, and broader equals more earnings risk for import-heavy sectors and semis with China exposure.* Earnings season: banks first (a quick read on loan demand, credit quality, and deposit costs), then megacap tech and chipmakers where guidance will matter more than backward-looking beats.* Yields: if the 10-year drifts lower, long-duration assets (software, semis, select biotech) can find their footing again; if tariffs push inflation fears up and yields back higher, expect another rotation into defensives and cash-flow compounders.Like always, the actual path forward is anyone’s guess. I would assume the following going into the end of the year: * China tariffs = nothing burger* Rates probably cut this month & yields likely decreasingInsider Trade UpdatesAs a side note, I try to stay away from insiders buying up their penny stock company. While these can still be great signals, the risk-to-reward ratio isn’t one I find favorable.We keep track of all of these trades on our Google sheet (available to paid subs), and then insider returns are quite astounding… (I have been removing quite a few of the penny stocks/ super risky investments to make the returns more normalized.)The current insider buy/sell ratio is sitting at 0.21, which is relatively low. Over the past 5 years, I have seen the average go as high as 0.81 in May of 2022 (a strong buying signal), and as low as 0.17 (a sell/hold signal). Buy the Dip Tracker* KMX — CarMaxDirector bought 10,816 @ $46.21 after a 22.88% one-month slide.* FDS — FactSet ResearchCFO bought 370 @ $275.48 after a 25.01% one-month drawdown. Whales & Standout Size ($1M+)* SRRK — Scholar RockDirector bought 500,439 @ $37.58 ($18.81M).* BGC — BGC GroupDirector bought 8,973,721 @ $9.21 ($82.63M). Potential dividend reinvestment/tax-related.* GWRS — Global Water ResourcesDirectors bought 728,197 @ $10.30 ($7.50M) and 154,026 @ $10.30 ($1.59M).* ASA — ASA Gold & Precious Metals10% Owner bought 46,649 @ $46.50 ($2.17M) as part of a steady schedule. Slow, relentless accumulation — like gold itself on a treadmill.Officer Skin-in-the-Game* ADC — Agree RealtyPresident & CEO bought 3,528 @ $70.63.* CALM — Cal-Maine FoodsChief Strategy Officer bought 2,800 @ $92.36. Interesting Trade Ideas & Berkshire BuysLast week we picked up KVUE at $15.86 on market open Monday and the stock is up about 5% since then (now $16.65/share). I sold some covered call options on the shares I purchased, a few of them at the $16 range that expired today. Thankfully, none of my shares were assigned, so I get to keep the $10 per contract and the gains from this past week. If, for some reason, my shares were assigned and the transaction hasn’t been processed yet, I will be forced to take about a 1% return on some shares. If that happens, then I hedged this week’s losses with some small KVUE gains! I would also like to note that anyone who picked up KVUE with me was able to beat the S&P 500 this week by around 8%. Kenvue was one of the few companies that ended in the green this week, only dropping about 1% on Friday.As always, I am on the lookout for my next “Berkshire Buy” stock. These companies fit Buffett’s criteria for investing (not always perfectly), and are analyzed from that exact viewpoint. Not all of these companies make it into my personal portfolios. Currently, I own OXY and NSSC in my Flagship Fund.I have been looking at a company to write an article about and you should see that hit your inbox in the next couple of weeks!Portfolio Performance & Forward-Looking Market StatementsYou can copy trade the portoflios by clicking here!The returns shown are screenshots from Autopilot (the place where you can copy my trades). These represent the average return of all investors who copy my portfolios. That means the returns in the Autopilot app won’t always match 1:1 with your returns, but show The Simple Side shareholder average.We have over $1M in AUM! Thank you to everyone who has joined the autopilot and now copies my portoflios! As you can see a

This is a free preview of a paid episode. To hear more, visit thesimpleside.substack.comQuick Reminders:Our disclosure is in the email footerPortfolio copy trading is available hereYou can find our podcast on YouTube, Spotify, Apple Music, and here on Substack! You can get daily market news from: The Simple Side Daily newsletter.Recent Updates:I added to the paid subscriber spreadsheet to track positions across all my portfolios that are “overextended” or are “oversold.” Here are some of those stocks:Use this button below to leave me comments!Quick Portfolio Highlights: Copy My Trades By Clicking HereWeekly RoundupReturns this week were brought to you by……record-breaking AI, healthcare’s hot streak, and “shutdown? shrug.” The S&P 500 and Nasdaq notched fresh highs even with Washington closed for business. Big tech rode AI demand (hello, Nvidia’s $4.5T market cap), while healthcare ripped on drug-price headlines and fresh approvals. Small caps finally joined the party. Energy lagged as oil slipped into the low-$60s.Now, I try to offer just the facts when I do my weekly roundups, but I am going to start inserting my opinions in these quick sections where I feel it is valuable. In this instance, I see two market events that could spell a market top. One, healthcare stocks seeing large amounts of capital flooding in shows investors are running to defensive sectors. Now, when I say investors, I mean big-time smart money investors. Go look at the retail sentiment around healthcare… in fact, here is a screenshot from the robinhood app on Centene (CNC), Molina Healthcare (MOH), and UnitedHealth (UNH) stocks: Institutional money is getting defensive and retail is going risk on... who is right?Stocks pushed to new peaks this week. Investors seem to be increasingly confident that Federal Reserve rate cuts are in our future. Yields on 10-year Treasuries hovered above 4.1% and slipped late in the week, which tends to help growth stocks. We saw and felt this in both of our growth portfolios “AI-Second Hand Effects” and the “Tech-Focused Growth,” which had big runs on Thursday and Friday.Oil drifted in the low-$60s, which is on the cheap side for this cycle—good news for shipping, travel, and input costs—while less great for energy company profits. Gold stayed near the very high end of its range, around $3,900, a sign that some money is still buying insurance against policy and geopolitical risks even as stocks climb.In technology, Nvidia set a fresh milestone with a market value north of $4.5 trillion as demand for AI hardware and full-stack systems stayed strong. Just as important, companies are starting to place orders for AI projects — so the dollars are showing up in bookings and revenue for IT and chip suppliers.Healthcare was the week’s standout. Policy headlines on drug pricing, a handful of positive trial readouts, and new approvals lifted large drugmakers and biotech. This sector behaves defensively (steady cash flows) but still gets upside from successful medicines, which is a rare mix when the economy is slowing but not falling into recession.Again, this is likey institutional money look for “undervalued safe havens” before the market starts to turn.Autos delivered mixed signals. Tesla posted record quarterly deliveries as buyers rushed to capture a soon-to-expire $7,500 EV incentive, but it then raised U.S. lease prices after the credit lapsed. Ford and GM are using their finance units to keep lease math attractive by fronting incentives themselves. The near-term risk is that EV demand cools without subsidies; the longer-term support is that production costs are still trending down.The auto industry seems like a very “sketchy” place to be investing right now. Eveyone seems to be in an EV fight, but no one seems to be making real money from it other than Tesla. Of course, autonomous vehicles are becoming everyones target for success. I think this is extremely bullish for companies like Uber, Lyft, etc. If everyone is trying to “rent” their autonomous cars out, I would want to be the company taking no risk and all the reward (aka the “marketplace”). Industrial and energy news pointed to long-run investment, even with softer oil. Boeing lined up major aircraft orders and is exploring a new single-aisle jet that aims to be roughly 10% more fuel-efficient than today’s models—useful for airlines’ costs and emissions targets. BP approved a $5 billion deepwater Gulf project and outlined asset sales to cut debt, while TotalEnergies sold half of a North American solar portfolio to a financial partner but kept operating control. Pipeline and power deals (for example, Ares buying into key natural-gas infrastructure) underscored steady cash flows in the “picks and shovels” of energy.It is hilarious to see everyone calling energy the “picks and shovels” now. Back in 2024 I was calling for this. In fact, I wrote an article that said “when everyone chases gold, sell them the shovels” in refrence to AI energy demand. Look where we are now. China headlines were a mixed bag. Alibaba said it will spend even more on AI infrastructure and is adding office space in Hong Kong, signaling long-term commitment. BYD reported its first quarterly sales drop since 2020 amid intense price competition, while peers NIO, XPeng, and Li Auto each logged record deliveries. The takeaway: China’s EV market is still growing fast, but the fight for share is squeezing margins.A few prices help frame the road ahead. If Treasury yields drift lower from here, rate-sensitive and long-duration stocks (tech, software, select biotech) should stay supported. Cheaper oil eases inflation pressure and helps most sectors’ costs, but it can weigh on energy earnings unless offset by buybacks or higher volumes. Elevated gold says not everyone believes the “soft landing” is a sure thing—so expect quick rotations if the next data point disappoints.Insider Trade UpdatesNow, something that I will happily tell you more about is insider trades. I have been tracking insider trades in detail for months personally, and I finally decided to keep track of them in our paid subscriber sheet as well. Insiders don’t always get it right… But they do get the best seats in the house. Here are this week’s trades that made us raise an eyebrow. As a side note, I try to stay away from insiders buying up their penny stock company. While these can still be great signals, the risk-to-reward ratio isn’t one I find favorable.We keep track of all of these trades on our Google sheet, and then insider returns are quite astounding… (I have been removing quite a few of the penny stocks/ super risky investments to make the returns more normalized.)Buy-the-Dip Tracker* $FBYD — Falcon’s Beyond Global, Inc.10% Owner bought 4,092,326 shares at $5.00 (≈$20.46M) after a −29.58% week. Note: classified as a dividend reinvestment—signal quality is lower than a pure open-market buy, but the check size is still eye-catching.* $TONX — TON Strategy CompanyDirector bought 70,000 shares at $7.11 (≈$498K) after a −52.41% month. * $NEXT — NextDecade Corporation10% Owner bought 1,001,329 shares at $7.00 (≈$7.01M) after a −31.98% month.* $UUU — Universal Safety Products, Inc.Director bought 25,010 shares at $4.28 (≈$107K) after a −30.82% week. Whales & Standout Size* $MBX — MBX Biosciences, Inc.Director bought 666,666 shares at $18.00 (≈$12.0M). No “dip” tag, just size. * $FBYD — Falcon’s Beyond Global, Inc.10% Owner DRIP buy $20.46M at $5.00 (also in Buy-the-Dip). * $NEXT — NextDecade Corporation10% Owner $7.01M at $7.00 (adds to multiple recent buys). * $PTRN — Pattern Group Inc.10% Owner bought 302,256 shares at $12.77 (≈$3.86M). * $OPEN — Opendoor Technologies Inc.Director bought 300,752 shares at $6.65 (≈$2.0M). * $UAMY — United States Antimony CorporationChairman & CEO bought 100,000 shares at $6.13 (≈$613K). Cluster & Repeat Buying (Always Worth a Look)* $COO — The Cooper Companies, Inc.Director bought 2,000 at $68.39. This marks the 5th insider buy in 30 days. When multiple people at the same table reach for the breadbasket, there’s probably butter.* $MSIF — MSC Income Fund, Inc.Director bought 3,700 at $13.55; 4th insider buy in 30 days. Quiet accumulation in income-land.* $WOR — Worthington Enterprises, Inc.Director bought 10,000 at $52.95; 2 insider buys in 30 days. Steel nerves? Perhaps.Smaller but Notable Nibbles* $FAX Director 600 at $16.78* $IAF Director 1,500 at $4.66* $AWP Director 2,000 at $4.00* $AOD Director 500 at $9.48* $ASIC Director 9,920 at $19.45Interesting Trade Ideas & Berkshire BuysLast week, I had 4 different names for you; this week, I have one. Paying subscribers will be getting a full deep dive/ investment analysis on this company next week. That company is KVUE: Kenvue. Kenvue is now down over 40% since the company spun off from Johnson & Johnson. The majority of this drop off, of course, is coming from the recent Tylenol-Autism link claims. However, current analyst predictions call the company undervalued. By how much? Around 36%, and I tend to agree with these projections. The company has been hit with claims that Tylenol causes autism in children when used by pregnant mothers — a claim that was previously refuted by a judge in 2023. There were further studies in 2024 that made the same claim, but things aren’t always as they seem.Recently, the main researcher (the one who published the study against Tylenol in 2024) said his subsequent analysis shows the usage of Tylenol was not causative of autism.Dr. Brian Lee, a professor of epidemiology at Drexel University, co-authored a 2024 study that initially showed a small statistical association between acetaminophen (Tylenol) use during pregnancy and an increased risk of autism and ADHD. However, his subsequent analysis showed that the link was not causal and likely a statistical artifact.The stock currently yields a 5.22% dividend, which outranks over 82% of similar companies. While the name Kenvue may not be known by a majority of con