Discover Tokenomics DAO Podcast

Tokenomics DAO Podcast

43 Episodes

Reverse

Listen to this insightful discussion of Goralces tokenomics.Tokenomics DAO has gone through a full audit and you can see the summary of Goracles tokenomics on Tokenomics Hub:https://tokenomicshub.xyz/goracle-network Get full access to Forgd at tokenomicsdao.substack.com/subscribe

During this Community Talk, Arielfleite walks us through the Brave browser and its Basic Attention Token (BAT). We invite you to follow the presentation as the community dives deeper into the following talking points:* What is Brave? A web3 browser with a product stack that could make Google envious* What is BAT? The token that rewards user attention for watching Brave Ads * BAT Tokenomics: rewarding users, donating to creators, selling ads... pretty cool, but maybe lacking some more utility? * Liquidity: the top 1% individual wallets hold 66% of all 1.5B BAT tokens... WTF!? * Value creation & value capture: awesome products, creating BAT demand through buybacks from ads revenueResources:Presentation tweeted out during the live session: Tokenomics 101 article: Tokenomics Hub Report: https://www.tokenomicshub.xyz/posts/basic-attention-tokenDiagram: https://viewer.diagrams.net/?tags=%7B%7D&highlight=0000ff&edit=_blank&layers=1&nav=1&title=BAT%20Tokenomics%20v3.drawio#Uhttps%3A%2F%2Fdrive.google.com%2Fuc%3Fid%3D1OSo0MOKF86A-ZLnQ2nhWRnOnSnNGXKTL%26export%3DdownloadTwitter Thread: Watch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This recording is not tax advice. Talk to your accountant. Do your own research. None of this is legal advice. This community talk is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

During this Community Talk, Pablo walks us through the workings of the Osmosis DEX Protocol. We invite you to follow the presentation as the community dives deeper into the following talking points:* What is the Cosmos ecosystem and what is its thesis?* What are key features of the Cosmos Ecosystem?* What special metrics do arise from this infrastructure?* Whats is the Osmosis chain and DEX?* What problem does Osmosis solve?* What is the business model of Osmosis?* Superfluid staking and Mesh Security* What is the token model of Osmosis?* Supply, inflation rewards, utility and value capture* What is the current state of Osmosis? TVL, Decentralization, Chain-connectivity and projects in developmentResources:Presentation tweeted out during the live session: Tokenomics 101 Article: Tokenomics Hub Report: https://www.tokenomicshub.xyz/posts/osmosisDiagram: shorturl.at/fjpqwDiagram walkthrough: Twitter thread: Watch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This recording is not tax advice. Talk to your accountant. Do your own research. None of this is legal advice. This community talk is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

What is the most cost effective way to go about buying a large amount of tokens? Why is this important you may ask? Be it a protocol, exchange or humble whale; knowing how to execute large orders in decentralised finance can be difficult due to a multitude of different factors that have to be considered such as MEV, liquidity, different exchange models, slippage and price impact to name a few. During this Tokenomics DAO Study Group, Mason Fasco tries to shed some light on this topic. Enjoy!Outline:* Objective: to acquire large amount of token with lowest price impact* How does TradFi do it (trading algos)?* How do we dot it in crypto (CLOB vs AMMs and their respective problems)?* Onchain methods (TWAMM & Concentrated Liquidity)* Other solutions to investigate (Inverse Bonds & rLBPs)Resources:* Algorithmic trading definition: https://en.wikipedia.org/wiki/Algorithmic_trading* What is MEV: https://getblock.io/blog/what-is-mev-miner-extractable-value-mev-explained/* Front Running and Sandwich Attack Explained: https://quillaudits.medium.com/front-running-and-sandwich-attack-explained-quillaudits-de1e8ff3356d* Backrunning in DeFI: https://medium.com/@m.vanderwijden1/backrunning-in-defi-301f3cade30a* Sandwich MEV: https://eigenphi-1.gitbook.io/classroom/mev-types/sandwich-mev* TWAMM: https://www.paradigm.xyz/2021/07/twamm* Concentrated Liquidity in Uniswap 3: https://www.paradigm.xyz/2021/07/twammWatch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

During this Community Talk, @masonfasco walks us through the workings of the Reverse Liquidity Bootstrapping Pool (rLBP). We invite you to follow the presentation as the community dives deeper into the following talking points:- What are Smart pools? (pools with adjustable parameters) - What is the weight parameter in a smart pool and why is it important? (determines value assumption) - What is an LBP? (Smart pool where weight parameter changes over time) - Benefits of the LBP and use cases (good for fair token launches) - What are rLBPs? (possible new buyback mechanism) - Benefits of rLBPs (fair market buyback mechanism, prevent bots) - Downsides of rLBPs (Maybe less cost efficient)Resources:* Published article - * Twitter thread - Watch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This recording is not tax advice. Talk to your accountant. Do your own research. None of this is legal advice. This community talk is strictly educational. Talk to your lawyer. Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

In episode 29, Flo and Lovis walk through the major developments inside Tokenomics DAO. We are completely unaffected by FTX melting down and other web3 drama. We see ourselves as an on-ramp into the space, without the hype, and without get-rich-quick schemes. We help builders and investors cover any gaps they may have in their Tokenomics. We uncover, simplify and share Tokenomics know-how on a level that anyone can understand, without an econ degree. We are growing and evolving what we are doing very quickly.Show notes:* Sign up for our online course if you want a good foundation in Tokenomics FAST! → Intro to Tokenomics* Check out the tools we’ve built to help you create better Tokenomics for your project. → Tokenomics Tools* Get a sneak peek of our latest prototype - the evolution of our 101 articles, the new github/wikipedia of Tokenomics. → Tokenomics Hub* Are you excited about this? Why or why not? → Share your feedback directly!Watch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

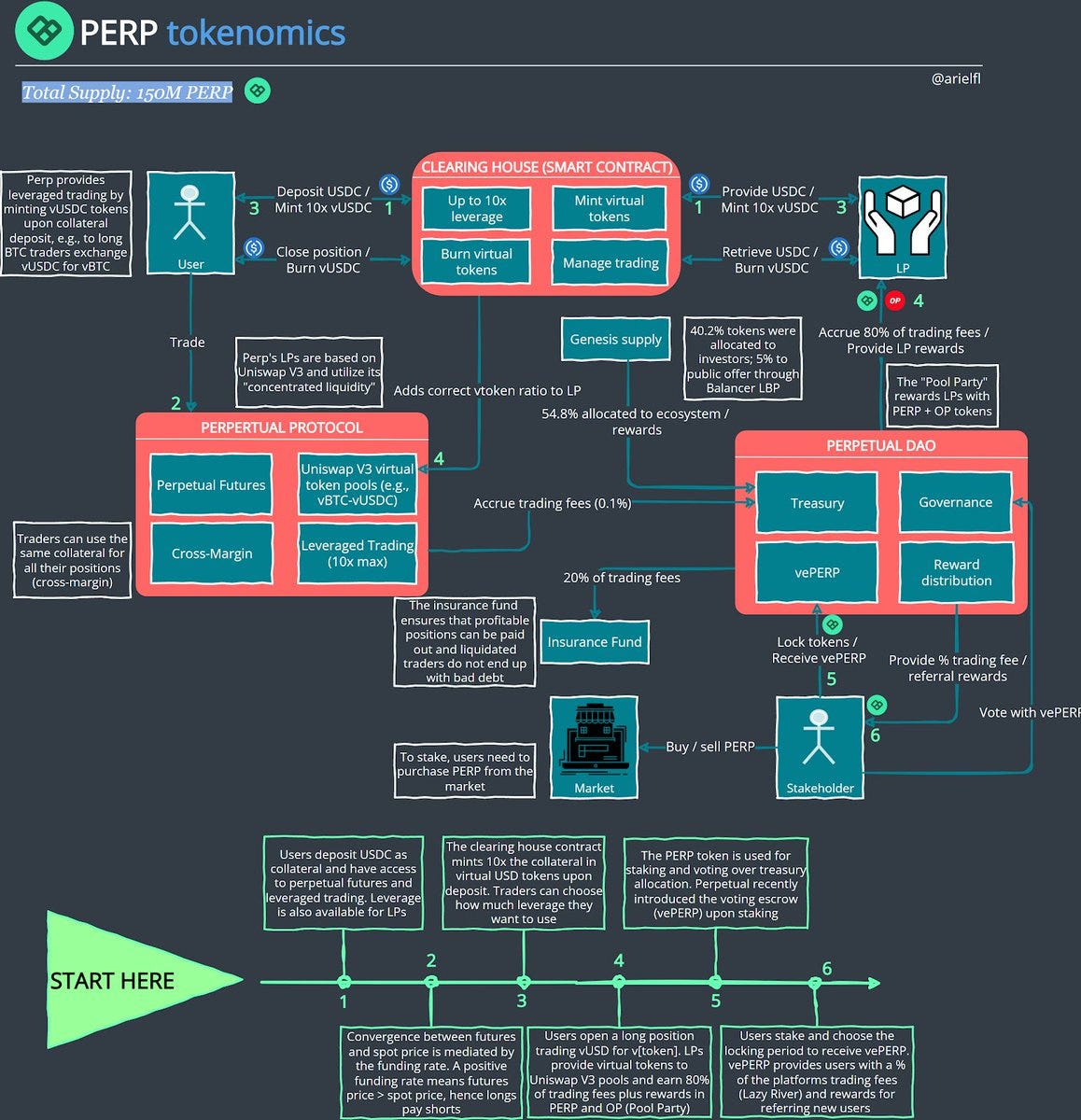

During this Community Talk, @arielfliete walks us through the workings of the Perpetual exchange and the PERP-Token with special guest @JHolme5 from perp.com. We invite you to follow the presentation as the community dives deeper into the following talking points:What is Perpetual?* Decentralized Exchange (DEX) - users have self-custody over assets* Perpetual futures (no expiration) & up to 10x leverage* Builder-ready composability - other protocols can build on top of the exchange (e.g., structured products, add exchange to metaverse)Tokenomics:* PERP is the governance token* Perpetual supports USDC, FRAX, ETH and OP as collateral* The clearing house smart contract manages trading and LPing via virtual tokens* PERP holders lock tokens and receive vePERP, which enables them to receive rewardsUpdates:* Implemented the voting escrow (vePERP)* vePERP improves governance by granting extra voting power to long-term ho* vePERP holders can earn referral rewards and 10% of protocol fees (in PERP)* Protocol fees will be distributed to users in USDC in the future to improve yield quality* Perpetual will increase vePERP utility by requiring it to distribute LP rewardsValue Creation:* Liquidity / financial products* Market making* Composability* Deployed on Optimism* Uniswap V3 liquidity poolsValue Capture:* Trading fees (0.1%)* Fees accrue to traders / LPs* USDC yield switchResources:* Published article - * Twitter thread - Watch this episode on YouTube:Disclaimer: Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This recording is not tax advice. Talk to your accountant. Do your own research. None of this is legal advice. This community talk is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

One of our most downloaded podcast episodes is “Intro to Tokenomics”. Because of that, we decided to provide more opportunities for our community to get educated on Tokenomics. So, we recorded a total of five live sessions in the last 2 months, explaining Tokenomics from first principles. The recordings of these sessions are now edited and available as a self-service online course that anyone can consume on demand.In this episode, we cover 20 questions that were asked during the education sessions, discussing them in detail, and providing several online resources that will help you during your own project research. Enjoy!Resources:* Intro to Tokenomics Podcast* Basics of Tokenomics Course* Education Chat Discord ChannelShow notes:Basics* Difference of Tokenomics of DAOs and Tokens/Coins* How are tokens different from a shares or equity? Can a token have similar equity properties as a share? * Can a share have the same utilities as a token? Could that be added?* Why is it important to do tokenomics correctly? There are many articles detailing how bad tokenomics lead to poor outcomes.* How does an increase in supply affect the price? (IPO compared to token launch, how is the share price found early on)Protocols specific* Is Ethereum 2.0 inflationary or deflationary?* https://ultrasound.money* What type of effect on price do you expect with Eth 2.0 change?* In case of Uniswap, how does the treasury ever increase? Since all there’s in it is UNI (https://tokenomicsdao.xyz/blog/tokenomics-101/tokenomics-101-uniswap-uni/)Valuation* What are good metrics to value early projects?* How are projects making more money every year? Where does the money come from that pushes the token prices up?Vesting Allocation* Vesting periods: what happens when the un-locking time is near? https://www.coingecko.com/en/coins/chainlink/tokenomics* How does the allocation to the community affect the price because the majority of protocols allocate a lot to the community? Is it good or bad?* What happens when a seed investor sells locked tokens to another investor, how would this affect the price of the token?* Instead of vesting tokens, why don't projects lock them in an immutable treasury and only pay out staking rewards?Mechanism* Can you give an example of why buying a token and then burning it is a powerful mechanism? (https://www.placeholder.vc/blog/2020/9/17/stop-burning-tokens-buyback-and-make-instead)* Because regulatory clarity of token burning is missing, do you feel like there could be another solution that you could send a token to until there is a green light from regulators?* How does staking for governance rights work? Who benefits?* How can we predict that burning this amount of tokens at a specific market cap would result in this effect on price? https://ultrasound.money* What is the alternative way for the protocol to provide rewards after the tokens all get vested?* How do you create a token with a mix of projects so that we can be insulated from an event such as the blow-up of Terra/Luna?Watch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

During this Community Talk, 0xEnes walks us through the workings of the Uniswap exchange and the Uni-Token. We invite you to follow the presentation as the community dives deeper into the following points:What is Uniswap?* Decentralized Exchange (DEX)* Automated Market Maker (AMM)* Total Value Locked (TVL) : $5.2bUniswap Versions* V1: ERC20-ETH (Nov 2018)* V2: ERC20-ERC20 (May 2020)* V3: Concentrated Liquidity (March 2021)Uni Tokenomics* Supply * Uni Treasury* GovernanceResource:Published article: https://tokenomicsdao.xyz/blog/tokenomics-101/tokenomics-101-uniswap-uni/Watch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This recording is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This community talk is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

During this week’s community talk, we briefly walkthrough the dYdX tokenomics. Discussing investment catalysts, Protocol improvements, and bring up the value capture and demand drivers. We invite you to follow the conversation as the community dives deeper into the following talking points:* Briefly walk through the diagram* Utilities* soft governance* holding tokens to reduce fees* psydo staking* FDMC* lots of tokens to enter the market ~90% over the next 5 years* demand for that has to come from somewhere* Catalysts* Unlocks coming up in January 2023 with quite a lot of tokens potentially entering supply* Governance over treasury as revenue streams come to treasury.* Demand drivers* reduction of transaction fees* speculation over revenue streams going to treausury* more trade volume more revenue* Value creation* decentralised trading of perpetuals, leverage etc. with a real order bookResources:Published article: Diagram walkthrough:Listen to this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This recording is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This community talk is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

During this week’s community talk, Florian shared his insights from the recent article that was published comparing traditional businesses using shares versus a crypto project using tokens. We invite you to follow the conversation as the community reflects on the following points:* Supply: Pay extra attention in crypto. Inflationary supply does not need to be bad, if the business grows with it.* Utility: Mechanisms is where the main difference is, but I feel the crypto world knows this.* Fundamentals of a crypto/traditional business: Should deserve more attention!* How stocks are evaluated: Various metrics exist and we can adopt them to crypto.* How to evaluate tokens?: Evaluating crypto businesses like stocks is not enough. The token, in most cases, plays a significant role.* Governance: If the business is good, governance tokens can be a proxy.* Supply: Pay extra attention in crypto. Inflationary supply does not need to be bad, if the business grows with it.Resources:* Token Terminal: https://tokenterminal.com/terminal* Example of how token incentives affect revenue: https://tokenterminal.com/terminal/projects/looksrare* Uniswap article: https://medium.com/tokenomics-dao/tokenomics101-uniswap-uni-2cd203f3d61c* Resonate Finance: https://www.resonate.finance/Listen to this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This recording is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This community talk is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

Today we are sharing a pretty big update about the org structure of Tokenomics DAO, how we distribute cash rewards to contributors, and how we are thinking about the distribution of token ownership. At Tokenomics DAO we are doing things backward (for web3). We have revenue, but no token yet. Naturally, the token launch is a high priority for us so we want to keep things simple, practice what we preach to our clients, and focus on the core value driver in our DAO: We want to retroactively reward value creation by contributors with ownership in the DAO. Please listen in to learn our latest thoughts on discord roles. Can we work together efficiently without hierarchy? If you are part of the Tokenomics DAO this episode is a must-listen, as it affects you directly. Show notes:We were inspired by - https://foryouandyourcustomers.comWorking in Tokenomics DAO: https://www.notion.so/Working-in-Tokenomics-DAO-bfba84098656490bbe3edb176346c9d6If you would like to borrow our token distribution google sheets as templates for your own project, please DM us on discord or send an email to lovis@tokenomicsdao.comJoin our Discord: https://discord.gg/D2n35G92BYWatch this episode on YouTubeDisclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

During this Tokenomics DAO Community Talk session, Mason Fasco presents the findings from the published article - Tokenomics 101: Convex Finance. The presentation covers what Convex is, what Curve is, and reviews the Tokenomics of $CVX. Following the presentation, there is a community discussion regarding open questions from the group.Time stamps to navigate:00:00 - Presentation 22:30 - Q&A sessionResources: Published article: https://tokenomicsdao.xyz/blog/tokenomics-101/tokenomics-101-convex-finance/ Diagram walkthroughPresentation Points:What is Convex?* Yield Optimiser* Bribe MarketplaceCurve Primer* What is Curve?* Why demand for $CRV?* Pain PointsYield Optimiser* For LPs* For CRV holdersTokenomics of $CVX* Supply* DemandWatch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This recording is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This community talk is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

On today’s episode of the Tokenomics DAO podcast, Lovis is having a conversation with Rockwell Shah from Starship Guild. In the crypto sphere, Rockwell is the co-founder of Starship Guild and Invisible College. He understands the NFT game better than most and is giving us deep insights into the “meta” of the NFT space.Only about 8% of NFT traders are profitable. How come? What is the game that is currently being played in the NFT markets? And more importantly, what are strategies that may work to make NFT projects sustainable and successful long-term?Please enjoy this conversation ranging from the Tokenomics of NFTs in general to Art NFTs, as well as, the dream of play-to-earn and the problems that currently plague most web3 gaming economies.Show Notes:* Invisible College - https://www.invisiblecollege.xyz/* Starship Guild - https://starshipguild.com/* Tokenomics:* is the study of token-based incentive design* Tokens create owners, not renters - at least that’s the dream* NFTs:* What is the game that is played in the Art NFT world?* Only if you understand the game, can you correctly identify the incentives driving the market.* Club CPG - one of the “realest” NFT Art collections, punished by the market* There are probably only 10k heavy NFT traders and maybe only 1-10M people who have ever owned an NFT* Because of this global game of Hot-Potato people ask for the meta, they care about the liquidity and are mad when it is wiped off the table.* Royalties are not baked into the smart contract layer of NFT trading, it is baked into the exchanges. Some exchanges are not paying royalties anymore.* Gaming economy:* There are too many value extractors and not enough value creators in the gaming economy of Axie at the moment.* Starship built its guild on top of Axie Infiniti and rode grew from 0 to 7M ARR within 6 months* Sustainable crypto games are Bitcoin Miner and Neopolis with Neoland* The key to a successful gaming economy are: 1) Players want to own the gaming assets 2) Players want to transact the gaming assets to enhance their experience.Watch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

We recently launched our first product! It is based on the experience we collected from completing Tokenomics consulting projects. We are productizing our specific knowledge to help others create DIY Tokenomics with lower risk.In this episode, the two creators of our Tokenomics Design Framework (TDF) walk us through the whole thing. We talk about why we created this framework, who it is for, and the bigger plan behind this new product.Get a free copy of the framework here: https://tokenomicsdao.xyz/tokenomicshub/Share direct feedback: https://docs.google.com/forms/d/e/1FAIpQLScG687AcUW0fO4Uz87D2Qb6vISrqwdUscYsg00YyyrYVUcy2Q/viewformJoin the conversation on Discord: https://discord.com/channels/915731508789141564/928221303649992744/1017422468174057514Watch this episode on YouTube:DisclaimerNot financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

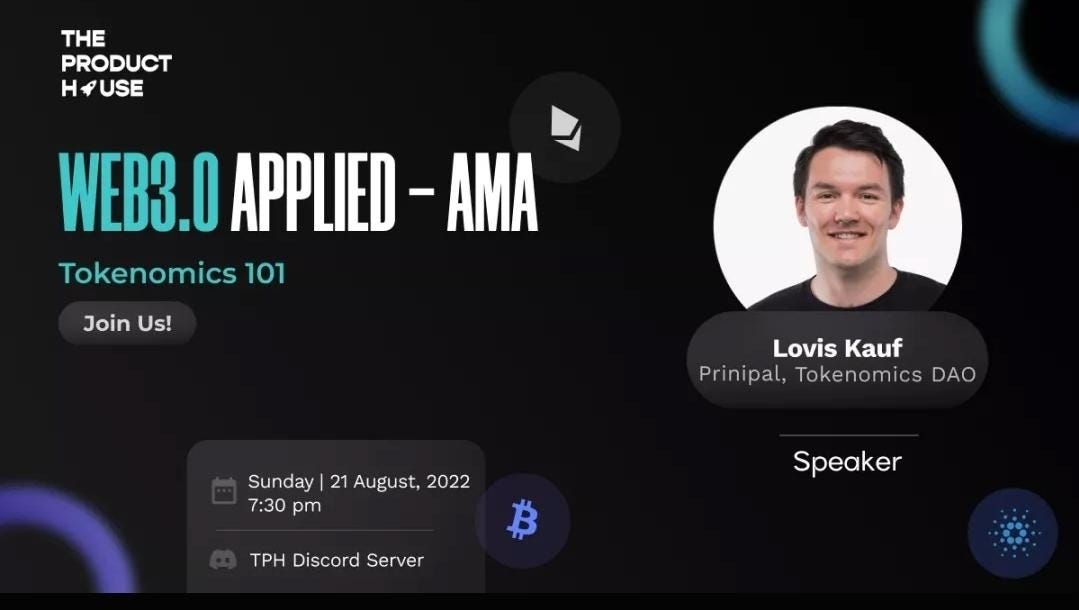

This conversation followed an invitation to join a Twitter Space (recording unfortunately no longer available) with The Product House. This time it was on TPH’s discord server and we managed to record it properly :) Tokenomics was the most requested topic by the TPH community and we were happy to give some answers and explanations. This is entry-level tokenomics and web3 know-how but the fundamentals are arguably probably the most important to be able to join general conversations in the web3 space. We think it is worth your time to take a listen. Thanks, and enjoy! Get full access to Forgd at tokenomicsdao.substack.com/subscribe

On this episode Lucas and Nihar from Jump Crypto join the Tokenomics DAO podcast to discuss their recent article “Token Design for Serious People”.Read it here: https://jumpcrypto.com/token-design-for-serious-people/We cover the core aspects, producing common goods and rewarding value creation. We dive into identity, reputation, governance, sustainable Tokenomics and Tokenomics beyond the cold start problem.For more content from Jump and from Lucas and Nihar make sure to follow them on twitter:* https://twitter.com/jump_* https://twitter.com/theshah39* https://twitter.com/SansGravitasWatch this episode on YouTube:DisclaimerNot financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

On todays episode Icedcool from the Bankless DAOs Tokenomics Department joins us to talk about how the BANK token is evolving, what the team is doing to increase value accrual and improve liquidity.Bankless DAO:* https://www.bankless.community/* https://twitter.com/icedcool_ethShow notes:* Value accrual* Call option on the future of BANK - like UNI who hasn’t flipped the fee switch yet?* Infrastructure* Utilities / Engineering Functionality - composing BANK to have new functionality* Are you actively seeking out that utility?* Value escrow BANK* Distribution of value* Add time to holding bank* Bottom Up vs. top down adoption within the DAO* Role of the Tokenomics Guild* Proposal / Draft for what to do with Tokenomics* Reputation* Many are building up skills, yet bDAO only has BANK which can be traded.* Any thoughts on non-tradable tokens paired with BANK?* Problems with BANK* What are the biggest issues the DAO sees with the token / how could the be addressed?Watch this episode on YouTube:DisclaimerNot financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

Flo and Jason sit down with Aleksa Mil from WACEO to discuss a range of topics around DAOs and decentralisation. From getting more women into Web 3, to compliance and risk management issues associated with running DAOs in a traditional world. They discuss WACEO’s ‘shield up’ program, which aims to simplify access for DAOs looking to get traditional services such as legal advice, and how using WACEO token as a reserve currency might be a solution for DAOs in paying for such services. Aleksa also touches on the differences between jurisdictions for incorporation and the ever changing nature of the legal landscape for DAOs looking for a home.Show notes:* WACEO - DAO Governance Regulation and Crypto ComplianceWACEO is a DAO focused non-profit that gives blockchain-based projects support to developing crypto compliance, Tokenomics, regulation and governance with litigation. DAO of DeFi Litigation & Compliance Professional.* WACEO Token - A Legal Reserve Currency empowering DAOsWACEO is building a community-driven, asset-backed decentralised legal reserve currency. The utility of this asset-backed legal reserve currency is to become a means of payment & provision for your future legal or compliance needs of Web3Watch this episode on YouTube:Disclaimer:Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research. None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

On this episode we explore the difference between shares and tokens. We look into how they are evaluated, the regulatory differences, the barrier of entry, how ownership works, why they each have value, the history and the future potential.Show notes: * Shares are like tokens, but how do they differ?* Amazon doesn’t pay a dividend yet trades at a high market cap.* Tokens often do too but I feel people have more critic for a governance token e.g. it’s not attached to any value etc.* Tokens are more advanced: programmability: burn, mint, lock up all automated* Tokens often evaluated based on mechanism (governance) than on the business* Stocks are evaluated based on cash flow, potential future cash flow* What makes stocks valuable? Amazon vs. dividend corporation* Value and growth stock* How to profit from stock - selling it holding Amazon for three years won’t give you anything* Ownership in a business* Can’t cash out any piece of itI* Metrics of earning income eps, P/E ratio* Tokens are not evaluated on cash flow enough* What if we had two businesses with similar cash flows and other metrics. One would have a token one shares, what would be the difference?* If in the traditional equity/share world a corporation doesn’t pay any dividend or reduce supply or increase demand that’s not a problem, but if the same is done in crypto, people would be careful to invest.* But enough tokens shares to influence governance* What does ownership really meanWatch this episode on YouTube:DisclaimerNot financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.None of this is legal advice. This podcast is strictly educational. Talk to your lawyer.Sound Logo Attribution - It Starts Here - https://www.fiftysounds.com Get full access to Forgd at tokenomicsdao.substack.com/subscribe

neat. following and looking to connect.