Discover Story Worthy

Story Worthy

Story Worthy

Author: Christine Blackburn

Subscribed: 70,951Played: 1,887,145Subscribe

Share

Copyright © 2010-2024 Story Worthy Media. All rights reserved.

Description

Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify.

Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? https://bit.ly/3Qk5UeL It always helps, thank you!

And join the mailing list! https://www.storyworthypodcast.com/

Follow Christine’s new show, My Life In 3 Songs. Christine talks to comedians about the 3 songs in their lives that have impacted them, then they listen to the song. Listen exclusively on Spotify-https://spoti.fi/3dpHX5X

Find My Life In 3 Songs on social media @MyLifeIn3Songs and at the website https://www.mylifein3songs.com/

PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube- https://bit.ly/39OoTdw

Story Smash website- https://www.storysmashshow.com

And here's Christine everywhere- https://linktr.ee/ChristineBlackburn

THANK YOU!

Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? https://bit.ly/3Qk5UeL It always helps, thank you!

And join the mailing list! https://www.storyworthypodcast.com/

Follow Christine’s new show, My Life In 3 Songs. Christine talks to comedians about the 3 songs in their lives that have impacted them, then they listen to the song. Listen exclusively on Spotify-https://spoti.fi/3dpHX5X

Find My Life In 3 Songs on social media @MyLifeIn3Songs and at the website https://www.mylifein3songs.com/

PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube- https://bit.ly/39OoTdw

Story Smash website- https://www.storysmashshow.com

And here's Christine everywhere- https://linktr.ee/ChristineBlackburn

THANK YOU!

798 Episodes

Reverse

Story Smash The Storytelling Game Show was played live at the Lyric/Hyperion in Los Angeles Saturday December 6th, 2025. Listen to Host Christine Blackburn with Expert Judges Writer Danny Zuker, Comedian Blaine Capatch and Author/Playwrite Sandra Tsing Loh. The contestants spinning the wheel were comedians Rosa McKenzie, Andrea Abbate, Elijah Wolf and our audience member was Vanessa Lorenzo. You won't believe what happened! Listen to the drama, the funny, and the peculiar stories on STORY SMASH! SPIN THAT WHEEL! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

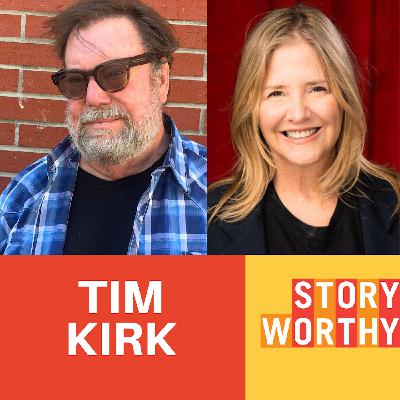

Author Tim Kirk (All His Damned Mothers Sun, The Feral Boy Who Lives In Griffith Park, Burnt, Christ Never Showed Up, AND films- The MIami Vice Incident, The Nightmare, The Mystery of Durango, Sex Madness Revealed, Room 237, Shudder, The El Duce Tapes) was disgusted with club promoters ripping off bands on the Sunset Strip, so he decided to play them at their own game. Tim gathered his friends to "play" in his band, got a few wigs and turned up to rock Gazzarri's night club. The result is hilarious! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Story Smash The Storytelling Game Show was played live at the Lyric/Hyperion in Los Angeles Friday June 6th, 2025. Listen to Host Christine Blackburn with Expert Judges Writer Danny Zuker, Comedian Blaine Capatch and Author/Playwrite Sandra Tsing Loh. The contestants spinning the wheel were comedians Jimil Anne Linton, Chris Cox, Josh Mann, and our audience member was Joe Felix. You won't believe what happened! Listen to the drama, the funny, and the peculiar stories on STORY SMASH! SPIN THAT WHEEL! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Comedian/Weatherman Fritz Coleman (The Comedy Store, Unassisted Living) shares the story of his relatively short rise to weatherman on KNBC in Los Angeles, for just short of 40 years. And to think, he wasn't even a meteorologist! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Story Smash The Storytelling Game Show was played live at the Lyric/Hyperion in Los Angeles Saturday April 5th, 2025. Listen to Host Christine Blackburn with Expert Judges Writer Danny Zuker, Comedian Blaine Capatch and Actress Wendi McLendon-Covey! The contestants spinning the wheel were comedians Josh Sager, Denny Siegel and Sean Mahoney. Our audience member was Julia Lechner. And you won't believe what happened! Listen to the drama, the funny, and the peculiar stories on STORY SMASH! SPIN THAT WHEEL! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Writer/Comedian Mike Drucker (Full Frontal with Samantha Bee, The Tonight Show, Jimmy Fallon, Adam Ruins Everything) grew up playing video games and crushing on a little girl in elementary school. He dressed as Mario to impress her and went to her house. It did not go as planned. Listen to this hilarious story from the author of "Good Game, No Rematch: A Life Made of Video Games." Listen to the entire episode wherever you hear podcasts or right here on YouTube! If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? https://bit.ly/3Qk5UeL It always helps, thank you! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Writer Rick Mitchell (The Ellen Show, co-author of "How To Write A Speech" with Carol Leifer,)TMZ) shares a pivotal moment in his life running for student council in elementary school. Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Story Smash The Storytelling Game Show was played live at the Lyric/Hyperion in Los Angeles Saturday February 1st, 2025. Listen to Host Christine Blackburn with Expert Judges Writer Danny Zuker, Comedian Blaine Capatch and Actress/Author Annie Korzen! The contestants spinning the wheel were comedians CM Gorham, Mike Pi, Debi Bradshaw, and our audience member was a long winded guy named G.D. Wright! Listen to the drama, the funny and the peculiar stories on STORY SMASH! SPIN THAT WHEEL!! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Comic/Actress Mollie Heckerling had a babysitter, Barbara, who decided to take on their close family friend, Gilbert Gottfried. This hilarious argument landed them on the Howard Stern Show for many episodes! Listen to Mollie recount this and many more stories growing up with her mom Amy Heckerling. Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify. Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Host Christine Blackburn hosts a solo episode to talk about about the fires in LA, the community of LA County, and her recent cochlear implant activation. Listen to Story Worthy anywhere you hear your podcasts! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify. Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Host Christine Blackburn hosts a solo episode to ring in 2025! Christine talks about the Rose Parade, Christmas, and her recent cochlear implant surgery. Listen to Story Worthy anywhere you hear your podcasts! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 15 years of podcasting in July 2025 and has over 850 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify. Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Story Smash The Storytelling Game Show was played live at the Lyric/Hyperion in Los Angeles Saturday December 21, 2024. Listen to Host Christine Blackburn with Expert Judges Writer Danny Zuker, Comedian Blaine Capatch and Actress Wendi McLendon-Covey! The contestants spinning the wheel were comedian Joe Felix and Storytellers Kona Morris and Taylor Rockwell! Our audience member was a fabulous guy from Block Island, RI named Sean T. Mahoney. Listen to the drama, the funny and the peculiar stories on STORY SMASH! SPIN THAT WHEEL!! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Host Christine Blackburn hosts another solo episode about her upcoming cochlear implant surgery, letters she received about being cut out of her friend's will, and shows in 2025. Listen to Story Worthy anywhere you hear your podcasts! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Host Christine Blackburn hosts a solo episode about her hearing loss, cochlear implant surgery, and one of her best friends passing away. Listen to Story Worthy anywhere you hear your podcasts! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Join us for storytelling with the best talent in Los Angeles at Flappers Comedy Club, Sunday November 17th. Enjoy true stories from Christine Blackburn, Tom Farnan, David Neale, Jen Curcio, Katya Duft, Lauri Fraser, John Flynn, and Julia Lechner. Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Host Christine Blackburn hosts a solo episode about the election, what to do now, and her hearing loss. Listen to Story Worthy anywhere you hear your podcasts! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Story Smash The Storytelling Game Show was played live at the Lyric/Hyperion in Los Angeles Saturday October 12th, 2024. Listen to Host Christine Blackburn with Expert Judges Writer Danny Zuker, Comedian Blaine Capatch and Comedian Abby Schachner. The contestants spinning the wheel were comedian Mike Bassano and Storytellers Brandee Stilwell and Jonathan Tipton Meyers! Our audience member was a fabulous girl named Stef that made everyone laugh. Listen to the drama, the funny and the peculiar stories on STORY SMASH! SPIN THAT WHEEL!! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Host Christine Blackburn hosts a solo episode about her experience in Block Island, Rhode Island and her recent hearing loss. What's not to love? Listen to Story Worthy anywhere you hear your podcasts! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Story Smash The Storytelling Game Show was played live at the Lyric/Hyperion in Los Angeles Saturday August 10th, 2024. Listen to Host Christine Blackburn with Expert Judges Writer Danny Zuker, Comedian Blaine Capatch and Comedian Abby Schachner. The contestants spinning the wheel were comedians Chili Davidson, Kelly Spillman and Jonathon Hollis! Our audience member was a fabulous girl named Falyn! Listen to the drama, the funny and the peculiar stories on STORY SMASH! SPIN THAT WHEEL!! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? https://bit.ly/3Qk5UeL It always helps, thank you! And join the mailing list! https://www.storyworthypodcast.com/ Follow Christine’s new show, My Life In 3 Songs. Christine talks to comedians about the 3 songs in their lives that have impacted them, then they listen to the song. Listen exclusively on Spotify-https://spoti.fi/3dpHX5X Find My Life In 3 Songs on social media @MyLifeIn3Songs and at the website https://www.mylifein3songs.com/ PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube- https://bit.ly/39OoTdw Story Smash website- https://www.storysmashshow.com And here's Christine everywhere- https://linktr.ee/ChristineBlackburn THANK YOU!

Comic Shane Rogers (Midnight Snacks For Insomniacs Podcast) grew up in a travelling circus. On today's show, Shane talks about circus life and then tells a story that happened in college. Shane was an excellent student and working in the dorms as an RA (resident Assistant.) One night Shane was off campus with friends and partied a little too hard. When he returned to the dorms, he did something very unlike an RA would do. Uh oh! Each week Hollywood’s most talented people in the entertainment industry share true, personal stories on the Story Worthy Podcast. Story Worthy celebrates 14 years of podcasting in July 2024 and has over 800 episodes recorded. Christine Blackburn is the creator, host and producer of Story Worthy, Story Smash the Storytelling Game Show, and My Life In 3 Songs exclusively on Spotify. Listen to the entire episode wherever you hear podcasts. If you get a chance, will you please give Story Worthy 5 stars and a good review on Apple Podcasts? It always helps, thank you! And join the mailing list! Follow Christine’s new show, My Life In 3 Songs. Independent Podcast Producer Christine Blackburn talks to comedians about the 3 songs in their lives that have impacted them, not necessarily their favorite songs, but songs that paint a picture of the of the comedian and where they're from. Listen exclusively on Spotify Find My Life In 3 Songs on Insta and at the website ! PLUS! Watch Story Smash The Storytelling Game Show! Comedians spin a wheel and tell TRUE 1-3 minute stories on the topic they land. You can watch episodes from the pandemic and from summer 2023 right now on YouTube. See Story Smash LIVE at the Lyric/Hyperion Theater in Los Angeles now! Check the website for upcoming dates and tickets! And here's Christine everywhere. THANK YOU!

Be careful when dealing with these guys.

All you crypto bros might not like this being pointed out, but everyone should expect many more of these since the Orange Clown's sons are now big in Crypto and have inside information. I expect them to be super aggressive, too, since the DOJ will never prosecute them, and Daddy will be giving them blanket pardons and pocket pardons at the end of his term regardless. Thanks Hunter Biden.

Didn't finish listening to the episode. Luca sounds like some disciple of a fake Satoshi who has had way too much Flavor Aid..

Don't worry. "Fight, fight, fight" untill there's no more appeals, and then just negotiate yourself a Trump pardon. That's what the US is all about nowadays.

won't work

Its hard listening to these guys who, 6 months earlier, were claiming Trump to be some kind of hero just because he said he supported crypto.

Stick with crypto guys. You obviously know nothing about macroeconomics, tariffs, or global trade.

sad that a podcast about bitcoin and crypto has turned into a political Trump Maga show.

w,,,,,, ,

w,,,,,,

4 minutes just to get to the topic.

another great episode. i feel love is in the air

Wow, Shaun talks as if Trump is George Washington and cannot tell a lie. Is representative of Crypto Bros? That's insane!

I guess it’s over for this playlist on this app?

Great interview. Nice to know their isn't a major difference between grass finish and grain finished beef

I love these guys, great show, but lately they're really over advertising the stem cell stuff. For many of us real truthers, we aren't fans of this level of eugenic science. Just being open & honest. It may seem like low level science, but it creates a huge controversial legal market & illegal black market of organ harvesting.

Ryan Dawson is smart, not arguing that. But, for someone that smart, you would think that he would be more open-minded. Especially, when presented with factual data & models that prove otherwise. Idk, maybe I'm too critical but these days it's key to be open-minded given the proven lies we've been fed for generations by greedy corrupt power hungry individuals. Great work Eddie. Best epeisode ever was with My Lunch Break.

I was very early into crypto, but it's hard to listen to these people talking like it is fine for some billionaires to f-up the country for the sake of making a quick buck

ai voice was really bad in this episode

deftones been my favorite band since I was 9. its probably the greatest feeling ever knowing that your heroes since day one are 100% down with the shits!!