Discover HyperChange

HyperChange

373 Episodes

Reverse

My discussion with Ryan Tanaka, host of Neura pod about the rise of LLMs and how Neuralink will enable humans to communicate in new ways with AI. At first I was a Neuralink skeptic, but after realizing how much better it could make my life and the potential use cases, I've slowly come to the realization that I will probably get a brain chip in my lifetime, scary, but exciting. What are your thoughts on this upcoming sci-fi future? Will you be getting a Neuralink?Ryan Tanaka's channel on Neuralink, Neura Pod: / @neurapod 0:00 Intro1:56 Rise of LLMs, Tying is too slow6:20 Where is Neuralinks technology today? (Webgrid)9:35 What’s next for Neuralink10:37 Blindsight11:31 Neuralink progress ahead of expectations (international trials)12:41 Neuralink’s Impact on Patients14:51 Innovation in the BCI (Brain Computer Interface) Industry21:46 Seeing in Infrared with Neuralink25.09 Partial Teleportation with Neuralink & Tesla Optimus26:36 Humans becoming Cyborgs with Neuralink & Optimus30:55 Does Neuralink’s Sci-fi future scare you?33:50 How does Neuralink expand into millions & billions of patients?36:34 Will you get a Neuralink?37:52 Will Neuraink be worth $1 Trillion?39:12 Neuralink’s Incredible Impact on Humanity40:54 Will everyone get a brain chip?My X: / gfilche HyperChange Patreon :) / hyperchange Disclaimer: I'm invested in Neuralink through secondary transactions. This is not a recommendation to buy or sell securities.

The 11th installment of G 2 a Milly, where I open-source building my portfolio. In this episode I talk about the potential of Ethereum now that the GENIUS Act has passed, and how that created enough FOMO for me to buy BitMine Immersion Technologies (BMNR) Tom Lee's Ethereum Treasury company. Now I'm rethinking how to place the USDC boom and rising tide on Ethereum ... if you have any ideas let me know!! Also leave any questions in the comments and I'll try and answer them on the next episode :)Huge shoutout to our Sponsor The Rundown!! Go check them out on Spotify now :) https://open.spotify.com/show/0VYfS0q...0:00 Stats & overview1:14 Bitmine ($BMNR), Ethereum & GENIUS Act7:07 Coinbase ($COIN) Benefiting from Ethereum Run9:19 Bitcoin Worries11:09 Tesla Update ($TSLA) 13:16 The Rundown Sponsor13:52 What’s Tesla’s Next Catalyst?14:35 Viewer Q&A: Microstrategy ($MSTR)16:47 Viewer Q&A: Why no Rivian ($RIVN)?19:53 Viewer Q&A: Don’t Sleep on Lemonade ($LMND)22:53 Maybe AMD ($AMD) will be my next pick …

My conversation with snack industry LEGEND Josh Schroeter, the Founder and CEO of South 40 Snacks. South 40 Snacks is a Seattle-based snack startup selling fruit and nut bars. I've been invested in the company for almost 4 years now and have watched them grow from $1.5M in sales to ~$12M this year. I wanted to talk to Josh on HyperChange about what it's like to build a snack brand and why he thought he was going to be able to disrupt the nut bar category against giants like KIND bar and Peter Rahal's new David Bar. I'm a big fan of the snacks, especially the pistachio bar, mango bar and c cashews, I recommend you give South 40 a try!South 40 Snacks website: https://south40snacks.com/0:00 Intro0:55 The Snack Industry3:22 How Sahale Snacks Disrupted Trail Mix4:07 South’s 40’s Transparency & Simplicity5:33 What You See Is What You Eat8:22 Giant-Sized Cashews8:56 Telling The Sustainability Story9:41 South 40 Snacks Nut Bars 10:39 The David Bar by Peter Rahal11:24 Nut Bar for the Mainstream12:18 Fruit Bars16:22 Billion Dollar Snack Brand19:20 How Social Media Has Changed Marketing20:35 Innovative Distribution Strategy22:22 Why Are You Focused on Snack Bars?23:39 Upcoming Snack Bars From South 4026:05 Global Expansion26:58 Scaling Artisanal27:52 Natural Food RevolutionMy X: / gfilche HyperChange Patreon :) / hyperchange Disclaimer: I'm an invested in South 40 Snacks persoanlly and through my Venture Capital Firm HyperGuap.

One of my most controversial ideas about Tesla yet .... will they enter the drone business, possibly in a collab with SpaceX? As discussions heat up between Elon Musk and Naval about the US falling behind in drone manufacturing capabilities (and the national security concerns that come with that) the obvious question arises, will Elon just fix this problem himself? Tesla has the battery, motor and manufacturing tech to pull it off, but is that the future we believe in?? What are your thoughts?My theory is Elon won't do drones if he doesn't own majority/more of Tesla.My X: / gfilche HyperChange Patreon :) / hyperchange Disclaimer: I'm long Tesla stock and nothing in this show is financial advice.

Asking the 21 year-old investing wiz Henry Invests about his thoughts on Tesla stock. We discuss the robotaxi launch and how Elon's politics and America party ambitions will effect the company. Henry is the founder of Maple Tree Capital and an investing influencer who has made a name for himself analyzing Upstart stock.Henry Invests on X: https://x.com/HenryInvestsMy X: https://twitter.com/gfilcheHyperChange Patreon :) https://www.patreon.com/hyperchange Disclaimer: This show is not financial advice. I'm long Tesla stock.

My conversation with Henry Invests from Maple Tree Capital. This up and coming 21 year-old financial influencer has made a name for himself covering Upstart stock. The software company uses AI to determine if customers are worth lending too, essentially creating it's own algorithm that is more accurate than the FICO score. Henry pitches us the stock and explains his bullcase. He believe Upstart could eventually be a $1,000 stock, if not more, if they can fulfill their potential as the AI credit platform of the future. What do you think of Henry's Upstart Bullcase?Henry Invests on X: https://x.com/HenryInvestsMy X: / gfilche HyperChange Patreon :) / hyperchange Disclaimer: Nothing in this show is financial advice.

Bringing back the podcast with a BANGER episode featuring Sam Korus of ARK Invest and Aaron Burnett of Mach33 research. They have teamed up to release potentially the most thorough and in-depth valuation model of SpaceX ever made public. Breaking down the value of Starlink vs the Launch business and how Mars takes the potential valuation to $10T and beyond. I learned a ton from their open-source model and would highly recommend checking it out. Sam Korus on X: https://x.com/skorusARKAaron Burnett on X: https://x.com/aarontburnettARK Invest SpaceX Valuation Model: https://www.ark-invest.com/articles/valuation-models/ark-expected-value-spacex-2030Mach33 SpaceX Valuation Blog: https://research.33fg.com/analysis/spacex-at-escape-velocity-ark-mach33-s-2-5t-2030-valuation-model0:00 Intro2:48 Are you invested in SpaceX?4:50 How is SpaceX worth $2.5T by 2030?7:00 Starlink Network Capacity & Global Pricing9:15 SpaceX Revenue Projections (Through 2030)10:28 Starlink Network Bandwidth12:19 Fiber vs Starlink15:15 Too Many Satellites?17:40 Starlink TAM20:42 Starshield Potential21:46 Laser Interconnects23:58 Starlink Cash Flow $70B by 203024:28 Starlink IPO?27:39 Starlink Profits Fund Mars29:59 What’s the market cap of Mars?35:11 What’s SpaceX plan for Mars?40:25 SpaceX Business MoonshotsMy X: https://twitter.com/gfilcheHyperChange Patreon :) https://www.patreon.com/hyperchange Disclaimer: I'm invested in SpaceX. This show is not financial advice.

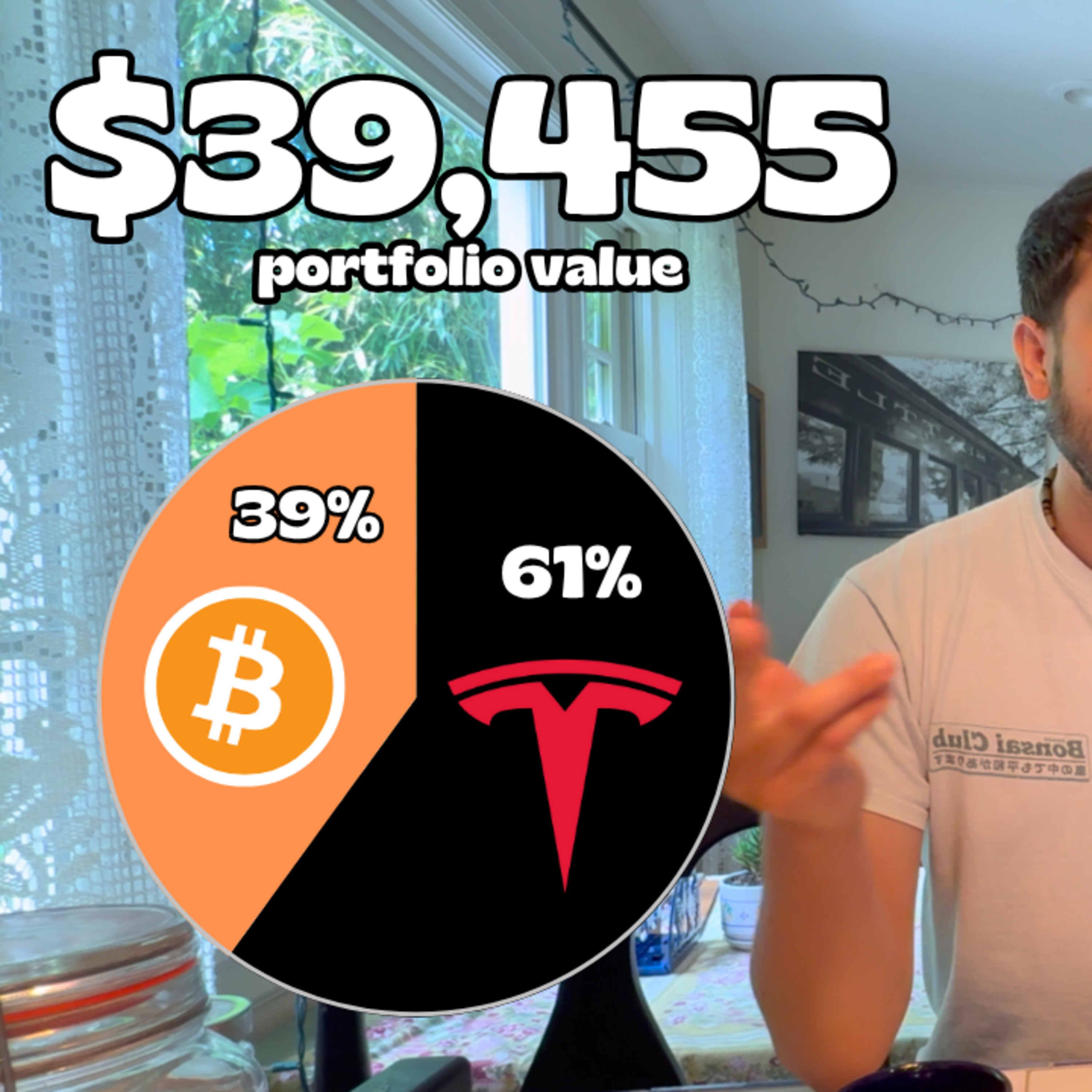

G 2 a Milly update! The show where I open-source building my investment portfolio. In today's update, I discuss cashing out of Airbnb and Coinbase stock to move into Bitcoin. I've been slowly nibbling on Tesla shares but am hesitant to go all-in (despite amazing potential) because of the volatility around the Robotaxi ramp. Bitcoin feels like a safe/almost cash like place to keep my capital for now. If you have any ideas for new companies to buy or questions/ideas for me to discuss on the show let me know in the comments below!!0:00 Performance/Stats2:55 Why I Bought Bitcoin5:19 Why I Sold Coinbase 6:08 Why I Sold Airbnb7:52 Critical Moment for Tesla9:36 Tesla Robotaxi Business Potential12:19 Tesla & Bitcoin just getting started My X: / gfilche HyperChange Patreon :) / hyperchange Disclaimer: This show is not financial advice. I'm not a financial advisor. I may update the portfolio at anytime without warning.

Tesla's Q2 2025 Delivery & Production report is hot off the press! Just released this morning, Tesla announced 384,000 deliveries for the quarter and production of 410,000. This was better than the 365,000 in prediction markets, and the stock is rallying ~4% on the news. I thought the numbers we're ok, it was nice to see a rebound from Q1, but the year over year declines from Q2 last year and Q2 23 were real. My theory is as Robotaxi ramps up it will begin to organically drive demand for Tesla vehicles.

Sam Korus from ARK Invest joins the show to give his initial take on Tesla's Robotaxi launch in Austin, and the expectations for a broader rollout. We were recording a SpaceX episode (will be released soon)m but I couldn't resist asking him about Tesla's Robotaxi launch. This was our quick discussion about how the first Robotaxi rides have gone so far, and the JUST announced first autonomous Tesla delivery to a customer somewhere in Texas. Exciting times! Shoutout to Sam, hope to get him on a full podcast soon!!Sam Korus on X: https://x.com/skorusARKMy X: / gfilche HyperChange Patreon :) / hyperchange Disclaimer: I'm invested in Tesla, nothing in this show is financial advice.

We're just a couple weeks away from Tesla's Q2 delivery report. Prediction market Kalshi is estimating deliveries of 358,000 for the quarter (would represent a 19% decline from 444,000 in Q2 last year). But the truth is ... no one seems to care about Tesla's deliveries. All eyes are on the Robotaxi launch coming late in June (tentatively). The new metric to focus on will be Robotaxi Rides not Cars Delivered. We are entering a new era for Tesla!

Everyone's hyped on OpenAI, ChatGPT, Grok, XAI, etc ... but the company powering them all is making all the guap. Nvidia has printed over $100B in AI profits in the last 6 quarters alone and is showing now signs of stopping. Top-line growth was 69% last quarter. Despite this rapid growth and dominance in AI, Nvidia trades for 43X trailing earnings, and maybe around 30X forward earnings (depending on growth). This is nowhere near bubble territory. With Owner/Operator/Founder Jensen Huang continuing to innovate at a breakneck pace, why is the market skeptical this growth will continue? Isn't the AI revolution just getting started? Maybe it's because Nvidia relies on TSMC to make their chips and Grok/ChatGPT to build the UI for consumers ... let me know your thoughts on Nvidia stock in the comments below.

WOW. The Big Beautiful Bill has opened up an incredible rift between Elon Musk and Donald Trump. In just the past few hours things have escalated to an insane level. The bromance is over, and they appear to be in all out war/enemies. This is a time of peak uncertainty for Tesla shareholders, SpaceX government programs .. and frankly, American politics as a whole. Elon is accusing Trump of hiding the Epstien files because he's in them, and so much more drama. The situation appears to be heating up by the second.The root of the issues stem from Elon Musk's concern America is going bankrupt and the new bill Republicans are passing that will balloon spending. This is going directly against all his work for DOGE and what Donald Trump was elected to do. So now the beef is on. I'm very curious what will happen next & wishing the best for Tesla, SpaceX, Elon and America.

We are less than two weeks away June, when Tesla will be launching its Robotaxi network in Austin, Texas! This marks an exciting new chapter for the company as they begin to rollout an autonomous vehicle service. Elon Musk just went on TV today saying he expects there to be 1,000 Tesla robotaxis within just a few months of launch. This could quickly accelerate Tesla's revenue growth. In addition, Optimus continues to make rapid progress. The potential for Cybercab's to deliver packages with Optimus is very exciting and may be here sooner than we think. I'm getting more excited about Tesla, and FOMO is ramping for not having enough shares as they company enters this exciting new growth phase. Ron Baron said they are on the verge of big profits!! We'll see ...

I sit down with Public Co-Founder/CEO Jannick Malling to discuss the company's breakout 2024, competing with Robinhood, surviving the market/startup crash of 2021/2022, crypto, a new bond offering & so much more! I've been working with Public for years and it's been impressive to see them hit 1M users and continue to double revenue every year (even through the market downturn). I'm excited to see what features they launch next. Testing out alpha has been a lot of fun.Sign up for a new Public account & get $25 for free using my link: https://public.com/hyperchange0:00 0:00 Public’s Breakout 20243:00 History of Public App3:54 The Great Wealth Transfer5:35 Bonds & Interest Rates7:40 $100T in Baby Boomers Portfolios10:12 Disrupting Vanguard & Fidelity, etc12:12 How do you compete with Robinhood?15:12 Alpha: Public’s AI for Investing (like ChatGPT)23:30 What’s The Next Market Trend29:34 Bond/Treasury Ladders31:01 Public’s Next Big FeaturesMy X: / gfilche HyperChange Patreon :) / hyperchange Disclaimer: I'm an investor in Public personally and through my VC Firm HyperGuap. Nothing in this show is financial advice.

Markets were down huge today on fears of a trade war and recession. Tesla stock traded down 15% to ~$221 per share, it's lowest point of the year. Drama around Elon Musk continues to heat up (per usual), and investors are worried it could impact near term sales. I wanted to share my thoughts as a long term investor holding through turbulent times. Let me know what you think in the comments below!!

Tesla stock's volatility has been heating up. After a massive run post-election, shares are settling back down as markets correct, and Elon Musk protests erupt at Tesla stores (and even SpaceX) across the US. The question on everyones mind is how this sentiment will affect vehicle sales, especially in the US and Europe. This comes at fascinating time for Tesla, with the Robotaxi launch in Austin just months away, and Optimus making more progress than ever. Will excitement about these new products be able to hold the stock up through a period of depressed earnings and cashflow (if that were to happen) and the robotaxi ramp? What are your thoughts??

At Tesla's AI day a few years ago Elon Musk unveiled Optimus, Tesla's humanoid robot program. This has quickly become an even more exciting long-term bull thesis than even the Cyercab, as Elon says it will make Tesla the world's most valuable company by far. In this Bros, Brews and Big Ideas I sit down with Aidan to analyze Tesla's Optimus, and the much hyped Figure Robot, which has created a splash on social media and is let by Bret Adcock. Figure claims to be bringing robots into the home later this year or next, while Tesla plans to have 1,000+ robots walking around its factory this year. Who is ahead in this race? Is Figure to be taken seriously at all? Let me know what you think in the comments below.

Bros, Brews & Big Ideas. Schemin live from Austin, Texas, we break down the future of the self-driving car economy. How Tesla's Cybercab launch in June of this year could quickly scale into millions of rides and become a bigger network than Waymo. Tesla's vertically integrated approach could end up being a major pricing advantage over Waymo who is buying 3rd party cars, using Uber's network, etc ... What are your thoughts on the future of the self-driving revolution? When will Tesla surpass Waymo in terms of Autonomous rides, if ever? Let us know your prediction in the comments below.

A very bittersweet moment. With 90% of my personal capital invested in Tesla & SpaceX (Elon Musk companies), and needing cash to pay rent/my bills in the next 6 months I made the extremely difficult decision to sell a chunk (about 10%) of my Tesla holdings. This comes at a time where I'm more bullish on the companies long term future than ever with Cybercab and Optimus. But with the reality of the world's geopolitical situation and Elon's government involvement ... I realized I would feel a lot better to sell some stock now to have cash rather than be forced to sell in 6 months at a potentially lower price. As always this is not financial advice, just me documenting my investing journey. My support for Tesla, it's employees, and mission is stronger than ever, but personal financial freedom and living stress free is the most important thing in life. Don't really know what to say, because it bums me out so much to make this video, but had to keep it real with y'all.

United States

United States

Rivian a very expensive version of Nikola and Lordstown, yes Tesla can sell every EV if people want them , Tesla is the one and only Rivian another hype job. https://youtube.com/channel/UCmHMRNnKiyBiQ49M8frVakQ

my 2 heros telling the truth breaking the CNBC monopoly.

my 2 heros telling the truth breaking the CNBC monopoly.

Incredible, incredible episode. Emanuel is humble, intelligent, and highly respectable for the approach to building out the Bubble vision