Discover tastylive: Bootstrapping In America

tastylive: Bootstrapping In America

tastylive: Bootstrapping In America

Author: tastylive

Subscribed: 48Played: 3,343Subscribe

Share

© ℗ & © copyright 2013 - 2025 tastylive. All Rights Reserved.

Description

Some of the most interesting stories around are from entrepreneurs willing to take an idea and turn it into a business. From web apps to workouts to Barron's and babies, we’ve got it covered.

2299 Episodes

Reverse

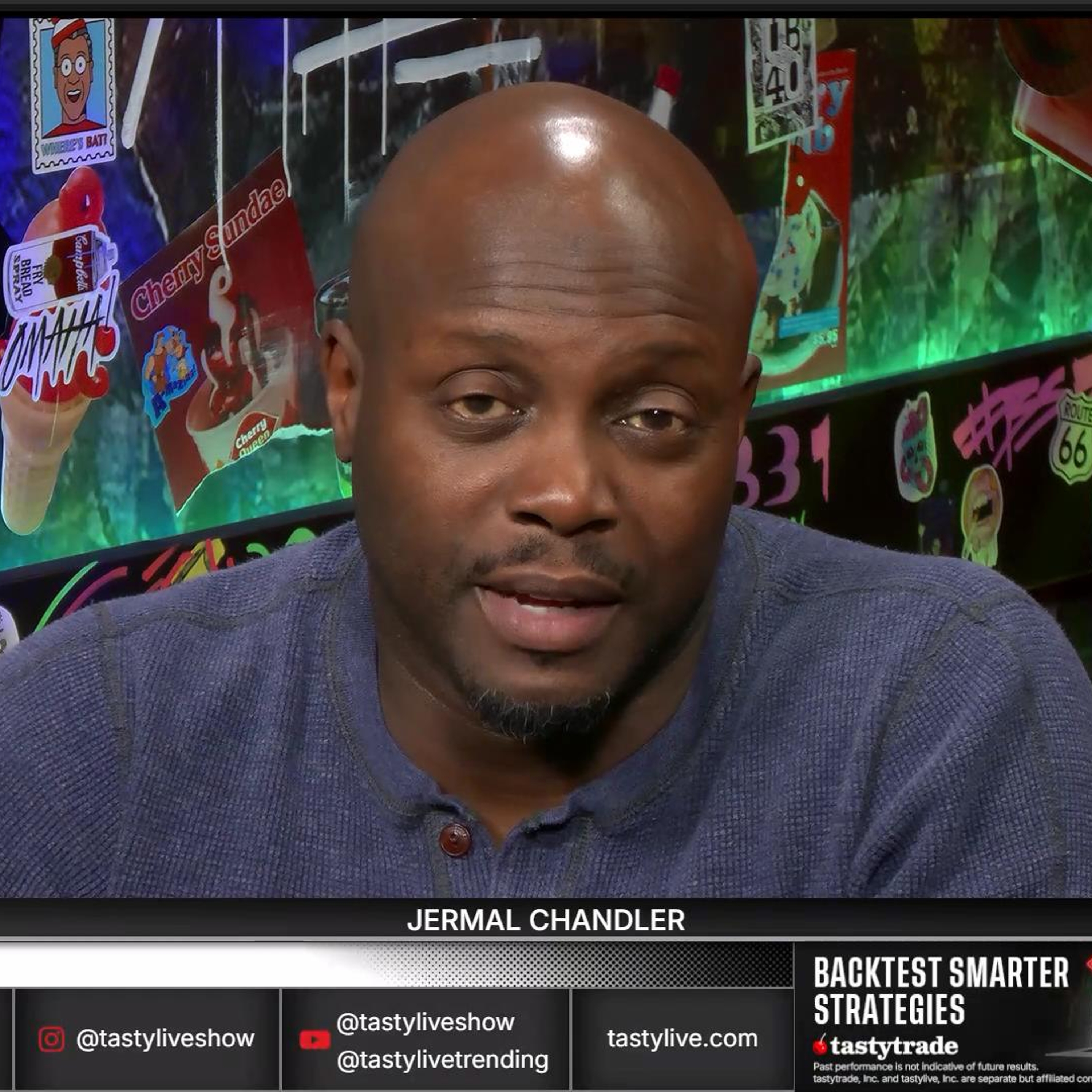

Jermal Chandler and Gus Downing discuss recent significant market movements, particularly in gold and quantum stocks. Jermal highlights a recent drawdown in gold prices following a significant rally, while Gus shares his short position in silver and critiques the valuation of Rigetti Computing (RGTI). They explore the volatility in sectors like rare earth metals and nuclear energy, emphasizing the importance of understanding market momentum. Both traders express cautious optimism about potential opportunities amidst the fluctuating market conditions and earnings releases.

This episode of From Theory to Practice explains how traders can exploit the phenomenon of rising implied volatility before earnings reports and its subsequent decline post-announcement. We explore strategies for selling premium, including short vertical spreads and iron condors, to maximize opportunities in the market. Learn how to manage risk effectively while navigating this crucial trading period.

TP and Jermal Chandler analyzed three trending market sectors: rare earth minerals, nuclear energy, and quantum computing. They examined potential options trades in stocks like MP Materials, Cameco (CCJ), and Oklo (OKLO).

TP demonstrated a unique calculation comparing theta to buying power effect when evaluating trades. This ratio helps determine whether to use naked puts or put spreads based on account size. For MP, with 94% implied volatility, a short put offered significant positive theta relative to capital requirements.

Both TP and Jermal noted bullish skews in these high-volatility stocks, suggesting market sentiment leans positive despite recent pullbacks. They recommended working limit orders between bid-ask spreads to avoid slippage, especially in less liquid names.

China dominates rare earth mineral reserves with 44 metric tons, while France leads in nuclear energy production. The quantum computing market is projected to grow substantially despite skepticism about near-term viability.

Market volatility has increased significantly in 2025, with daily price movements up 2.4x and percentage changes up 1.5x compared to 2015-2024. This has prompted traders to consider legging in and out of positions to capitalize on market swings.

Our research study analyzed SPY data over 10 years, comparing 45-day strangle strategies managed as whole positions versus managing each leg independently at 50% profit. Results show managing positions as a whole slightly outperformed the legging approach.

When legging out, traders should aim for 75-90% profit on the untested side rather than just 50%, as buying back options with substantial remaining value adds risk to the overall position. The study concludes that while legging can work in certain scenarios, it increases management complexity and directional risk exposure.

Hosts Nick and Mike conducted a highly successful Fast Market session capturing 8 of 10 viewer trades as volatility collapsed dramatically during the risk-on rally. The standout trades included an MCL crude oil 55-65 iron condor with $1-wide wings at $3.10 credit (Nick legging in by adding 67-69 call spread to existing put spread), CoreWeave November 100 puts at $3.15 after stock surged $6 on the day, Micron 185-250 10-point wide iron condor at $6.50 in November monthly (avoiding December earnings), TLT call zebra 90-91 for $2.34 representing "stock rental" for 200 bucks versus full share capital, and NVIDIA 200-strike November-December calendar with Mike doing diagonal variant. The session emphasized smart capital allocation, with Nick explaining why zebras and poor man's covered calls make sense in low-vol products like TLT (13% IV) versus tying up capital in shares. Reddit contributor "Avocado" received praise for multiple winning suggestions including VST which gained significantly. The hosts warned about position sizing in volatile names like IONQ and USE, noting Jamal's 40-strike calls sold at $2.20 now dramatically lower, while markets showed unusual strength with Russell and NASDAQ leading gains despite bond weakness.

On today's Engineering the Trade, Jermal Chandler discussed the rumor of the U.S. government potentially buying stakes in quantum computing stocks. Chandler also noted oil's recent surge due to sanctions on major Russian oil companies from the Trump administration due to their lack of commitment on ending the war in Ukraine. Finally, Jermal examined whether or not the CPI report will have an effect on the market after being delayed for two weeks. Watch this episode for these topics and even more trade ideas.