Gold, Silver & PGM's all shining with a lot of room to run!

Description

Welcome to The Contrarian Capitalist.

Protect your wealth. Defend your freedom. Outsmart the system.

This post will look at a Polymarket market as well as look at the latest on Gold, Silver and Platinum. Palladium is mentioned very briefly too. They all have very powerful factors working in their favour!

This article and video is FREE for everyone.

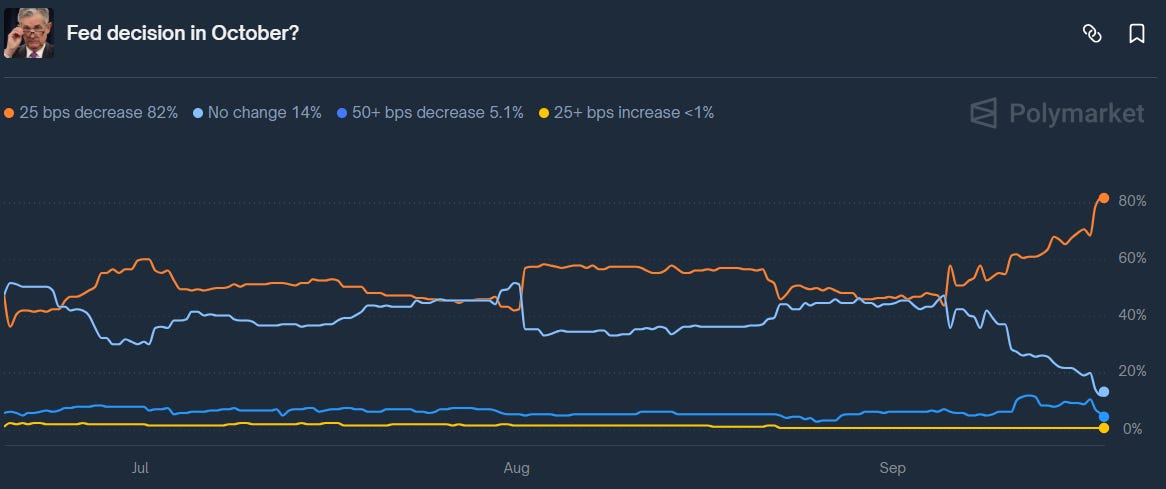

CC’s Polymarket mid-market of the week

Gold

Here are 5 reasons why the price of gold is going to increase:

1) More people will start to wake up and smell the coffee

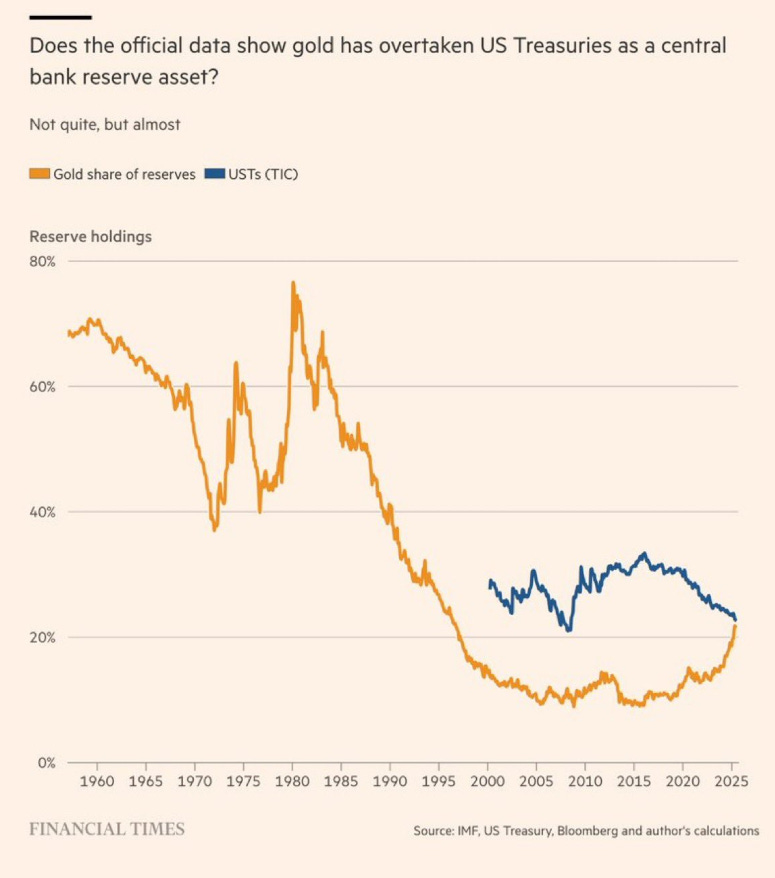

The world is not a healthy place at the moment. More people are realising what the central banks are doing (i.e. buying more gold) and more people want a piece of the price action. Hedge funds et al all seem to be asleep at the wheel. This just creates more opportunities for the likes of you and me. The minute hedge funds start to realise that gold is the place to be, the price will skyrocket.

2) War

Some will say that war has already started. Some believe that a wider conflict is imminent. Regardless of what is happening or what is happening, currency will shift to a safe haven and shift to true money. That safe haven and true money is gold. This demand influx will increase the price.

3) Currency printing

This can cover a wide range of subjects. Those wind-turbines to be built on the North Sea? Highly Subsidised! All that green and clean power that we need/want to generate to make our citizens poorer? Highly Subsidised! All those public sector pay increases? Highly Subsidised! Although taxes will increase, a majority of this currency will be printed, thus lowering the value of the £ (or whatever currency you are in) and thus push up the price of gold simultaneously.

4) A potential new BRICS currency backed by gold.

This may happen but it is a bit up in the air at the moment. If this does happen then it is possible that gold is revalued, and this revaluation would send the yellow metal higher.

5) A potential revaluation of gold in comparison to existing debt around the world.

This would likely be an accounting exercise in order to balance the books but it has the potential to send the price of gold much higher. I forget the chaps name but read his article and that indicated that a revaluation based on the current worldwide debt would result in 6 FIGURE GOLD.

$141,501 oz gold? It’s possible. Here’s how!

Numerous podcasts have also been recorded about Gold. I recommend that you take time to listen to them.

The pros and cons of bullion coins and bullion bars – Listen HERE

Advantages of owning Gold + Silver – Listen HERE

Do’s and Don’t of Bullion Storage – Listen HERE

UK Gold - 1 BIG Tax Advantage! – Listen HERE

Silver

Silver is surging and it has a LOT of room to run! 5 main reasons why physical silver are

1. Structural Supply Deficit

Silver mine production has been flat-to-declining for years, while industrial demand (solar, electronics, EVs, medical uses) is climbing. The Silver Institute projects continued structural deficits, which historically puts upward pressure on prices.

2. Monetary Hedge & Safe Haven

Like gold, silver is seen as protection against inflation, currency debasement, and systemic risk. With ballooning government debt, persistent deficits, and fiat debasement, investors are likely to start seeing silver as an easier entry to a monetary hedge.

We are starting to see signs of this, despite the main use of silver being industrial at present.

3. Green Energy & Technology Demand

Silver is critical for solar panels (photovoltaics), EVs, and 5G/AI-driven electronics. The energy transition is structurally increasing demand, and silver has no easy substitutes. Silver is also used for war machines too.

4. Historically Undervalued vs. Gold

The gold-to-silver ratio sits at 85.51. This is currently well above historical averages, which therefore suggests silver is cheap relative to gold. See chart below (correct as of Wednesday 24th September 2025). It is a 50-year chart.

Silver tends to outperform gold in commodity bull markets. It catches up violently once momentum builds. That momentum also violently disappears too, which is why timing is very important.

5. Low Above-Ground Stockpiles

Inventories on COMEX and LBMA have been declining, with significant amounts flowing East. When investment and industrial demand collide, this should trigger a sharp price squeeze.

Take control of your financial future with The Contrarian Capitalist. Paid members get commodity and market insights, exclusive macro videos, early interviews, and the tools to build, protect, and grow wealth in uncertain times.

Starting at just $9.17 per month, less than a couple of coffees, it’s exceptional value to protect your wealth, defend your freedom, and outsmart the system.

Platinum

I deep dived into Platinum back in April.

$1,500 Platinum is something that has not been seen since 2014 and more and more people are talking about it.

4 Main uses of Platinum are:

* Industry

The current biggest use of Platinum is for catalytic converters. Catalytic converters help to reduce harmful emissions by converting them into less toxic substances. For example, turning carbon monoxide into carbon dioxide.

Platinum is also widely used in the green hydrogen economy as it is used as a catalyst for electrolysers. Platinum is a critical catalyst in hydrogen fuel cells, especially Polymer Electrolyte Membrane fuel cells (PEMs), which are used for clean transportation.

It can also be used in both petroleum refining and glass manufacturing.

* Investment

As mentioned in the GSR article, Platinum can potentially be a very good investment for those not wanting to purchase gold. You can probably buy physical platinum from a number of coin dealers. These will likely be in the form of both coins and ingots.

It is not traded or purchased as regularly as gold or silver. Please always do your own homework and research before making your investment decisions.

* Medical Applications

Platinum is a biocompatible metal, meaning that it does not react in the body. That is NOT an excuse to eat any physical platinum that you might have sat around by the way!

Because of its biocompatibility, it can be used for implants, pacemakers and even cancer drugs.

* Jewellery

Platinum is a very popular form of jewellery use in Asia. Its rarity and shine makes it very attractive to wear. Its durability is also a contributing factor for its jewellery use.

A massive key factor to mention is supply.

Supply

Platinum is extremely rare and makes up less than 0.003% of the Earth’s crust.

The 4 main countries that supply Platinum are:

* South Africa (approx. 70% of the world’s supply)

* Russia - mainly via the Norilsk Nickel mines

* Zimbabwe

* Canada

Combine the supply areas with the demand factors and it is no wonder that we are seeing Platinum surge. 20-year Platinum chart in USD is below.

Palladium

I deep dived into Palladium back in April 2025!

Take control of your financial future with The Contrarian Capitalist. Paid members get commodity and market insights, exclusive macro videos, early interviews, and the tools to build, protect, and grow wealth in uncer