Legal News for Weds 11/12 - SCOTUS Snap Ruling, Former CFPB Alums Launch Lawsuits, NCAA "Volunteer" Coach Settlement, and MX Flawed VAT Fraud Solution

Description

This Day in Legal History: Clean Air Act Amendments of 1990

On November 12, 1990, President George H.W. Bush signed the Clean Air Act Amendments of 1990 into law, enacting one of the most ambitious environmental regulatory packages in U.S. history. The amendments addressed a broad range of air quality concerns, including acid rain, smog in urban areas, and emissions of hazardous air pollutants. At the time, the legislation was notable for its bipartisan support and its embrace of both traditional regulation and market-based solutions. Among its most innovative features was the introduction of a cap-and-trade program to reduce sulfur dioxide emissions, the primary cause of acid rain. This program placed a national cap on emissions and allowed utilities to buy and sell allowances, incentivizing the adoption of cleaner technologies and practices.

The legislation also directed the Environmental Protection Agency to regulate 189 toxic air pollutants, a massive expansion from the original eight. It required cleaner gasoline in high-pollution areas and set deadlines for phasing out ozone-depleting chemicals. States were mandated to submit detailed plans for meeting federal air quality standards, significantly increasing local accountability. The law established a new operating permit system for major sources of air pollution, centralizing compliance efforts. It also increased civil and criminal penalties for violators and expanded the public’s right to sue polluters and the government for non-enforcement.

The amendments reflected growing public concern about environmental degradation and represented a turning point in how the federal government approached pollution control. By pairing stricter standards with economic incentives, the 1990 law helped redefine regulatory strategy in environmental law.

The U.S. Supreme Court extended a temporary pause on a lower court order that would have required the Trump administration to fully fund SNAP benefits during the ongoing government shutdown. The administration is currently withholding approximately $4 billion from the program, which supports 42 million low-income Americans. Justice Ketanji Brown Jackson, who initially granted the pause, stated she would have denied the request to extend it further. The pause is now set to expire Thursday, though an end to the shutdown could render the legal fight moot. Meanwhile, the Senate has approved a bipartisan bill to end the shutdown, which has become the longest in U.S. history. The lapse in SNAP funding marks the first such disruption in the program’s six-decade existence, prompting recipients to rely on food pantries and cut back on essential expenses like medications.

US Supreme Court extends pause on order requiring Trump to fully fund food aid | Reuters

Three former senior enforcement officials from the Consumer Financial Protection Bureau have launched a new legal initiative aimed at holding corporations accountable in the absence of federal action. The project, backed by the advocacy group Protect Borrowers, will focus on bringing strategic lawsuits against companies accused of exploiting consumers, workers, and small businesses. The team—Eric Halperin, Cara Petersen, and Tara Mikkilineni—previously held top roles at the CFPB before it was effectively sidelined by the Trump administration.

The CFPB’s enforcement and supervision functions were largely dismantled this year, leaving a vacuum in consumer protection at the federal level. In response, consumer advocates and state officials have begun stepping in to fill the enforcement gap. Halperin emphasized that rising corporate profits alongside deepening financial stress for ordinary Americans is no coincidence, pointing to a lack of oversight that enables corporate misconduct to go unchecked.

Former top enforcers at US watchdog join project to bring pro-consumer lawsuits | Reuters

The NCAA has agreed to a $303 million settlement to resolve claims from over 7,700 current and former Division I coaches who say they were illegally denied pay under a now-repealed policy that barred compensation for so-called “volunteer” coaches in all sports except baseball. Filed in federal court in Sacramento, the proposed class action settlement still requires approval from U.S. District Judge William Shubb. If approved, no coach will receive less than $5,000, with average payouts expected to be around $39,260 before fees, and some six-figure awards anticipated.

The plaintiffs argued the NCAA and its member schools violated antitrust laws by maintaining the compensation ban, a rule repealed in 2023. The NCAA denies wrongdoing but said the deal provides “certainty and clarity.” The lawyers representing the coaches plan to seek up to 30% of the settlement—around $90.9 million—in legal fees. This case follows a $49 million NCAA settlement with baseball coaches over similar claims and comes amid broader legal pressure on the NCAA, including a pending $2.8 billion settlement allowing schools to pay student-athletes directly.

NCAA agrees to $303 million settlement with unpaid college coaches | Reuters

My column for Bloomberg this week looks at Mexico’s latest attempt to crack down on value-added tax (VAT) invoice fraud—and why it misses the mark. The new measure shifts enforcement burdens onto digital platforms like Amazon and eBay, criminalizing them for fraud they are neither equipped nor authorized to detect. Instead of building a real-time fiscal invoicing system that validates transactions as they occur, the government is digitizing enforcement without changing the underlying system that enables fraud in the first place.

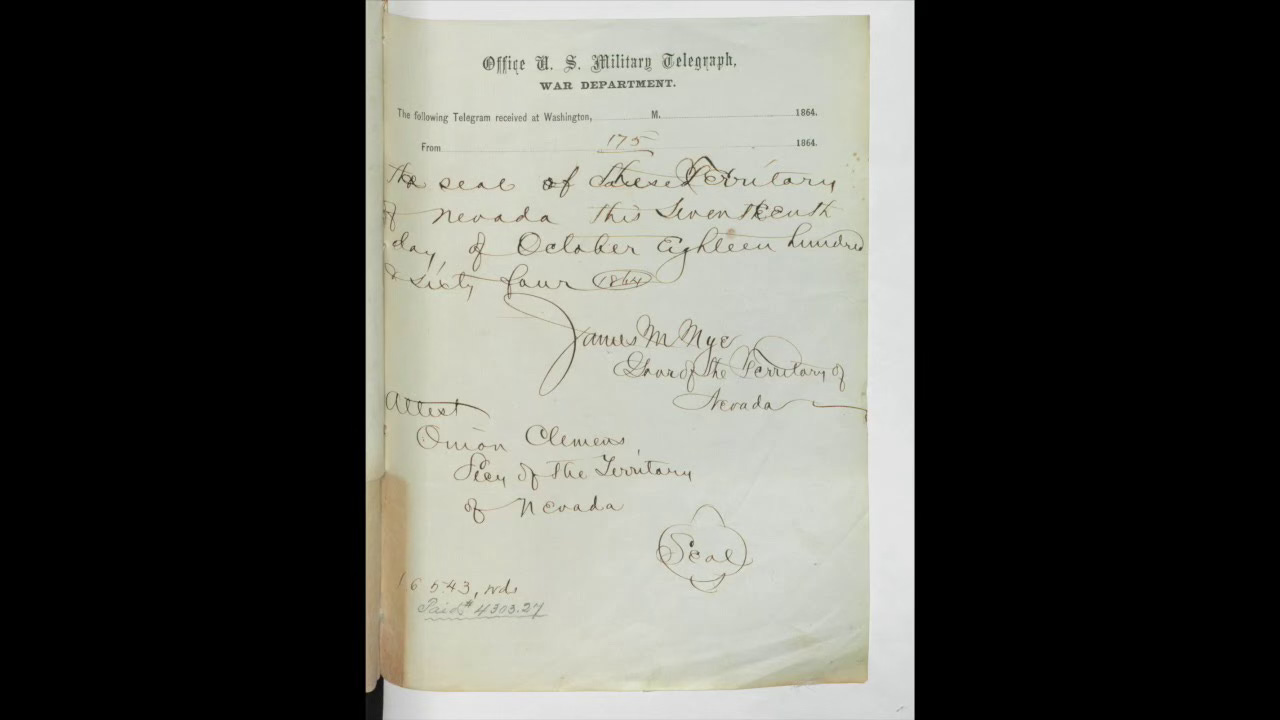

False VAT invoice fraud in Mexico typically involves shell companies, or factureras, issuing legally compliant but entirely fictitious receipts that allow taxpayers to inflate deductions or claim improper refunds. The fraud takes root not in shady ads or informal platforms, but in a tax infrastructure that fails to verify the legitimacy of transactions in real time. Despite having a digital identity framework and certified validators in place, more than 8,000 shell entities have used these tools to issue fake invoices that are indistinguishable from valid ones.

The government’s move to deputize digital platforms sidesteps the real problem: the lack of a transactional choke point where the buyer, seller, and tax authority all converge—namely, the point of sale. Countries like Brazil and Italy have shown that embedding validation at checkout prevents fraud from scaling. Until Mexico adopts this kind of infrastructure, enforcement efforts will continue to target the periphery while the core system remains vulnerable.

Mexico Effort to Curtail VAT Fraud Needs Real-Time Verification

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.minimumcomp.com/subscribe