OpenAI's $5B Burn vs. Fathom's $2M Customer Love: AI Startups profit beyond Hype

Description

The billionaire AI game is on, with OpenAI scoring $6 billion while burning $5 billion.faster than a Tesla on ludicrous mode.

In the other corner, Fathom, a scrappy upstart that's actually, you know, making money. The kind you should listen to, based on building businesses by listening to their customers who love them so much, they invested $2M in Fathom.

Today, we're dissecting these two AI growth engines to see what makes them tick, and more importantly, what makes one of them hemorrhage cash.

OpenAI is selling a dream so big it makes the metaverse look like a kid's sandcastle.

They're chasing the holy grail of artificial general intelligence (AGI) with a $157 billion valuation and promises that would make a politician blush.

Meanwhile, Fathom's Richard White is over here building something people use.

That approach is making a comeback as the AI Bubble begins bursting.

Richard White is founder and CEO of Fathom.video, a free app that records, transcribes & highlights your calls so you can focus on the conversation instead of taking notes.

Fathom was a part of the Y-Combinator W21 batch, is one of only 50 Zoom App Launch Partners, and is one of a small handful of companies Zoom has invested in directly via their Zoom Apps Fund.

Prior to Fathom, Richard founded UserVoice, one of the leading platforms that technology companies, from startups to the Fortune 500, use for managing customer feedback and making strategic product decisions.

UserVoice was notable for being the company that originally invented the Feedback tabs shown on the side of millions of websites around the world today.

Connect with Richard White on LinkedIn

OpenAI is betting the farm on becoming the Microsoft of AGI, creating an impenetrable moat in an industry that moves faster than Mark Zuckerberg pivoting to the next big thing.

Fathom? They're just solving real problems for real people, growing steadily, and — wait for it — closing in on being profitable.

It's almost like they're running a business or something. We're about to see if the real future of AI is being built by the companies listening to their users.

Fathom secured a modest but impressive $17 million Series A, with $2 million coming directly from their loving customers.

OpenAI can learn from what Fathom is doing as a small startup, building on loyalty and retention instead of selling their hope of the future.

Behind Fathom - Early AI Startup Success

It's 2019, and Richard White, CEO of Fathom, is drowning in Zoom meetings, frantically typing notes while trying to pay attention.

That's when lightning struck. Richard shares:

"Right before Covid, I was actually doing a lot of product research at Uservoice.

And so then I was on a bunch of zoom meetings, and like I was trying to talk to people and take notes at the same time, and I'm like, hurry typing up notes.

And then after the meeting, I'm like, cleaning up those notes so that they make any sense.

And I just felt like this is such a terrible process."

Richard noticed that existing solutions were expensive and focused solely on salespeople.

He had a hunch: transcription costs were about to plummet thanks to AI. So, what did he do?

"This is a product that people were charging $150 a month for.

But we said we're going to give it away for free.

Because we think that cost curve will catch up by the time we're have enough usage, the cost curve will come down."

Richard's team decided to offer their service for free, believing that by the time they had significant usage, AI would make it cost-effective. And did that bet pay off.

Fast forward to today, and Fathom's growth is a 90x increase in revenue and a 20x boost in usage over the past two years.

Probably from a low baseline, right? Fair point. But with 8,500 users cited via HubSpot (likely higher-paying business accounts), they're onto something big.

The Fundraising Game - Hot Markets, Cold Realities

Richard's approach to fundraising is refreshingly grounded:

"I don't think through the first three years of the company we ever had more than like 12 months of runway, like we actually.

So, you know, we announced we raise that much.

We actually, before this most recent round, raised $10 million over three and a half years, but we basically raised it $1 million at a time, like every six months or something."

This steady, measured approach stands in contrast to the "raise big or go home" mentality we often see in Silicon Valley.

But it wasn't always smooth sailing. Richard admits:

"And frankly, in 2022, we actually had planned to go raise our Series A just on usage growth alone without even monetizing yet.

And quickly, the market change was great. Well, that's off the table, right.

We've now got to go get revenue."

The market shift forced Fathom to pivot from growth-based fundraising to revenue-focused strategies.

It's a sign of their adaptability and focus on building a sustainable business.

In a world where startups often chase venture capital like it's the holy grail, Fathom's customers believed in them so much that they invested their own money.

And not just pocket change – they got the same preferred stock terms as the big-shot investors.

Contrast this with OpenAI. They just raised a whopping $6.6 billion while burning through $5 billion.

It's like watching someone win the lottery and immediately book a trip to Vegas.

The promises are big, the expectations are astronomical, and the pressure? Off the charts.

How Fathom is similar to OpenAI

So, what's the endgame here? For OpenAI, it's all about building what Silicon Valley loves to call a "moat" – an unassailable competitive advantage.

(unless of course you have the digital version of Game of Thrones dragons)

They're betting big on becoming the undisputed leader in artificial general intelligence (AGI). It's a high-stakes game with a simple premise - be the best, or bust.

But here's the billion-dollar question: Do moats even exist in the age of AI?

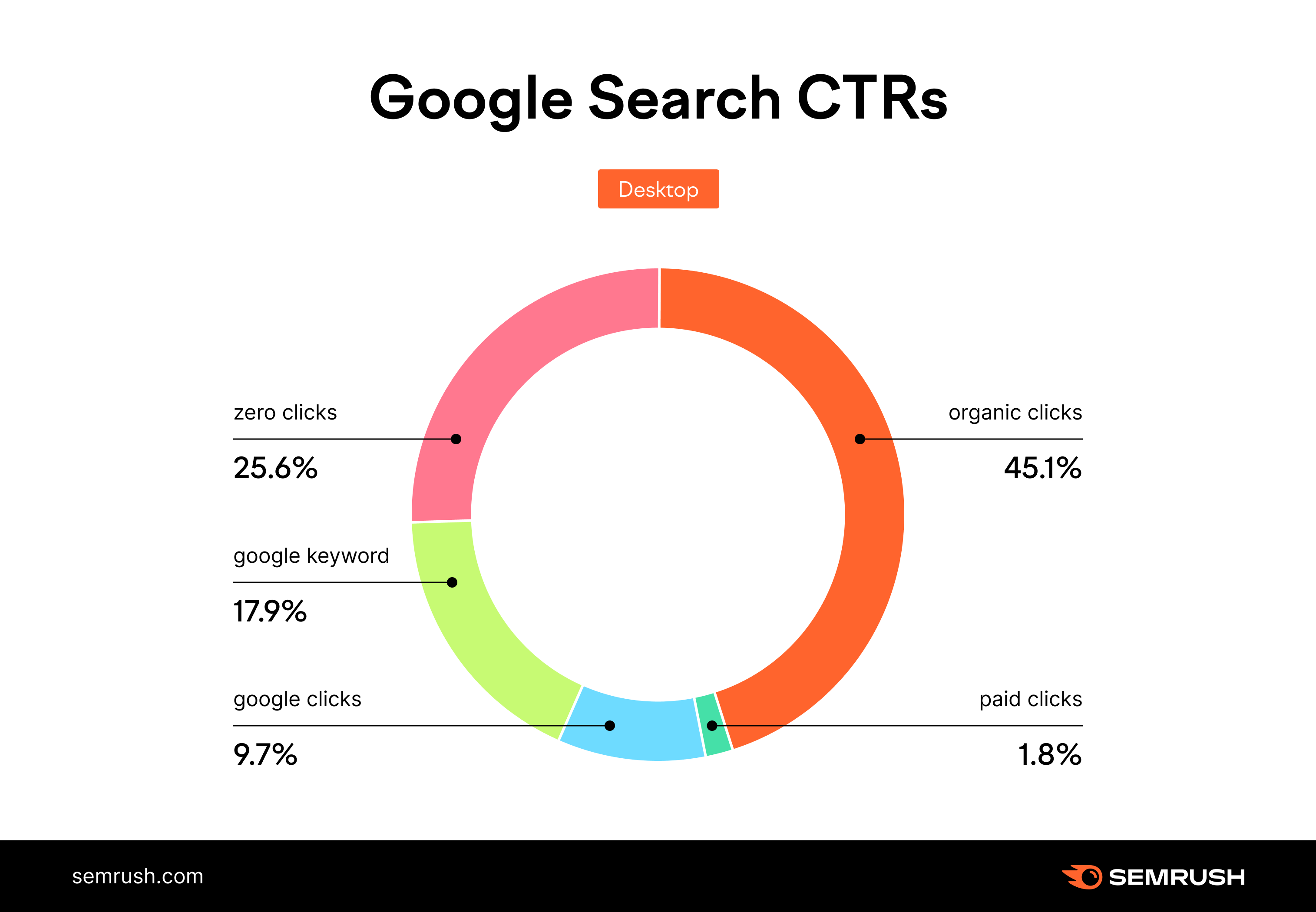

Google's search dominance seemed unshakeable for years, but look at the landscape now. Is OpenAI's strategy a relic of a bygone era?

Fathom is playing a different game entirely. They own their technology, have scalable growth in related markets, and most importantly, are loved by their customers.

Will ChatGPT's current popularity stand the test of time in the same way?

OpenAI's Product Dev: Delayed Monetization

OpenAI's success hinges on two critical factors. First, they need to dramatically lower compute costs.

Second, they must emerge as the undisputed leader in AGI. And the clock is ticking.

Their latest funding round is reportedly contingent on becoming a for-profit company within two years!

Meme showing the exodus of key OpenAI employees, leaving only Sam Altman.

Fathom presents a clearer picture. They're an attractive acquisition target with proprietary tech and a growing, loyal customer base.

It's a more traditional path for a smaller company, but one that's been proven time and time again.

The AI landscape is shifting faster than we can blink. OpenAI has seen a revolving door of top executives and faced whispers of potential doom from number-crunching investors.

Meanwhile, every AI startup CEO I talk to won't even hazard a guess at what the next five years might bring.

And yet, OpenAI's dream is built on creating a moat and reaching numbers five years out that no one else dares to project.

OpenAI's Investments: Save the world, Build a Moat

To understand this, let's go back to 2015. This dream started as a nonprofit to be able to stand up for people, for humanity and create an artificial general intelligence that was both competitive to Google and was available, and about $1 billion was invested into it.

But in 2019, they saw their transformer models were really starting to do something special.

And that's when Microsoft came in with another billion and started seeing this, as OpenAI continues to be nonprofit because remember this stage that's about four years into the business, right where Fathom is now.

No profitability. And as a nonprofit, it implied that they were more of a research arm, more of something good for humanity, which is one of the reasons Musk has tried to sue them and other people are sort of upset.

How do you make that transition?

They've done it with loads of money. Billions from Microsoft in the upcoming years. And as ChatGPT came out, you've all seen it. This is getting bigger and bigger.

But the key is as Fathom grew, its model was based on $150 transcription cost going to nothing by AI.

Simple right? All the AGI companies see this huge training cost, the cost of compute. Almost all the investment goes towards the training cost and the heavily expensive engineering talent. That's being incredibly competitively paid.

It’s a mix of expensive engineers and an increase in compute costs that isn't going down. And you have people like Microsoft having to run electricity off of Three Mile Island nuclear plant, and you see a business with expenses that way over pace revenue.

Something’s got to change, and they are all banking on making more money.

Are AI Mo