The Simple Side's Saturday Sendout: Copy Trading For Paying Subscribers & A New Interesting Trade Idea*

Description

To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout. As a reminder, you can find our podcast on YouTube, Spotify, Apple Music, and here on Substack!

Updates

The new format going forward will look similar to this in our weekly updates:

* FREE

* Market Commentary & News

* Quick Insider Trade Updates

* Interesting Trade Ideas

* Portfolio Performance

* PAID

* Portfolio Holdings & News (copy trading links)

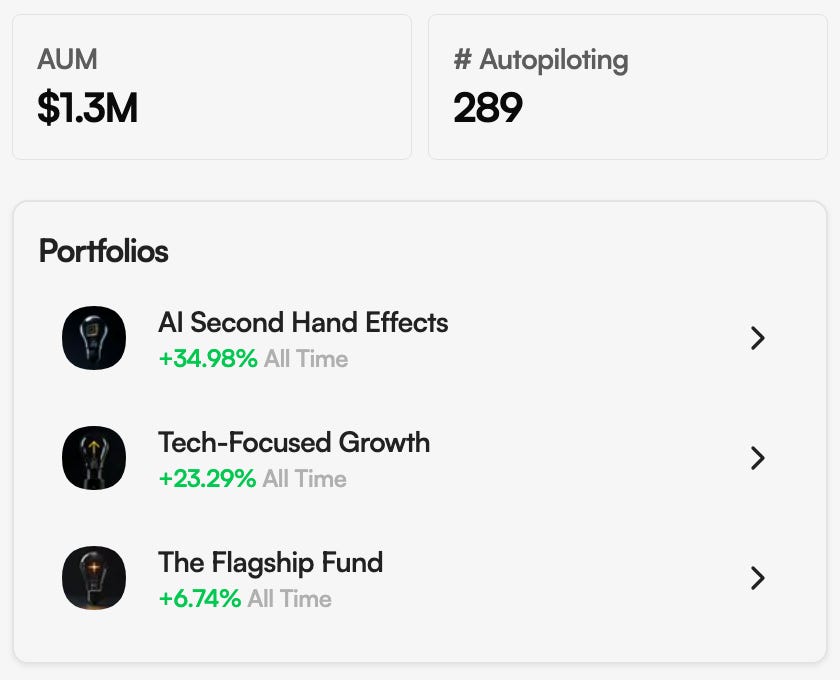

* Flagship Fund, AI-2nd Hand Effect, Tech-Focused Growth

* Portfolio Strategies, Updates & New Bets

* Our Weekly Picks

* Mergers & Acquisitions Picks

* Top Stock Picks

As a reminder, all of this will be accessible to you via copy trading. Remember that these portfolios ARE NOT GET-RICH-QUICK portfolios. I am focused on long-term market outperformance.

There will be updates made to the paid subscriber spreadsheet as well, but I will likely update everyone on those when they are completed!

Market Commentary

Big picture

Chop early, rally late. Mega-cap tech slumped midweek, while small/mid caps, homebuilders, and cyclicals quietly outperformed; Friday finished with a broad risk-on pop.

* Week-to-date:

* Russell 2000 +3.3%

* S&P Mid Cap 400 +2.6%

* Dow +1.5%

* S&P 500 +0.3%

* Nasdaq −0.6%.

* Rates/vol

* 2-yr ~3.69% (down into Fri)

* 10-yr ~4.26%

* VIX eased back to ~14 after a Thursday spike.

Macro & policy

* Jackson Hole anticipation dominated flows; futures still lean toward a 25 bp cut in September.

* Data mix

* NAHB at 32

* housing starts +5.2% m/m

* permits −2.8%

* jobless claims 235k

* PMIs showed expansion (Mfg ~53, Svcs ~55).

Sector moves

* Leaders: Energy, Financials, Materials; Consumer Discretionary (retail/homebuilders) firm.

* Laggards: Information Tech (semis and megacaps), parts of Consumer Staples after a big-box wobble.

Notable tape & deals (highlights)

AI / Semis / Cloud

* Intel +5% after SoftBank’s ~$2B equity buy; Arm hired Amazon’s AI chip lead.

* Nvidia: working on a China-compliant Blackwell-based part (B30A) while halting H20 production per reports.

* Meta + Google inked a 6-year, $10B+ cloud pact; Workday, Zoom, Intuit all lifted AI-tinted outlooks; CrowdStrike added to the IVES AI 30.

M&A / PE & financing

* Thoma Bravo circling Dayforce; Goldman lining up ~$6B debt.

* Nexstar to buy Tegna (with a competing Sinclair proposal still swirling).

* Cenovus to acquire MEG Energy (C$7.9B) in oil sands consolidation.

* Private/go-privates: Soho House near a take-private; Ross Stores expanding footprint; multiple smaller tuck-ins (Pentair→Hydra-Stop; Assa Abloy→SiteOwl; Rubicon→Janel).

* Defense: RTX/Diehl to co-produce Stingers; Lockheed won Trident II work.

Consumer / Retail

* Target modest beat; TJX, Lowe’s firm; WH Smith flagged an accounting error.

* Dick’s + Foot Locker announced a merger plan.

* Walmart initiated a shrimp recall across 13 states following FDA testing.

Autos / Industrials

* Tesla slashed UK lease pricing amid weak July UK sales; later raised the Cybertruck “Cyberbeast” price with added features.

* NIO unveiled an ES8 refresh; XPeng deliveries surged.

* Boeing: China order chatter; separate labor action hit St. Louis defense lines.

Regulatory/legal

* Google fined A$36M in Australia over search preinstalls.

* Masimo sued U.S. Customs over Apple Watch import approvals.

* Microsoft to limit China access to vuln data; Visa shuttered its U.S. open-banking unit.

The read-through

Breadth improved as investors rotated beyond mega-cap tech into domestically sensitive and rate-levered areas. Lower yields into Friday helped the pivot. AI infrastructure remains the secular anchor, but export-control headlines keep semis choppy.

What I’m watching next

* Powell follow-through and PCE next week for confirmation of a September cut.

* Semis: China-compliant SKUs, datacenter order visibility, and optical supply tightness (Fabrinet momentum).

* Cyclicals vs. megacaps: does small-cap leadership and homebuilder strength persist if yields back up?

* Retail: guidance quality vs. resilient consumer narrative.

Insiders don’t always get it right… but they do get the best seats in the house. Here are this week’s trades that made us raise an eyebrow (and maybe place a limit order).

Buy the Dip Tracker

Insiders buying after meaningful drawdowns — percent and window included.

* LINE — Lineage, Inc.Co-Executive Chair bought $499K @ $40.44 after the stock fell 53.0% over the past year. Buying into a bruised chart; watch for a higher low above the print.

* AVNS — Avanos MedicalDirector bought $659K @ $10.99 after a 51.47% one-year slide. Classic mean-reversion setup if shares can base above $11.

* EONR — EON ResourcesCFO bought $35.9K @ $0.36 after an 84.69% one-year drawdown. Micro-cap with fireworks; follow-on insider prints would strengthen the signal.

* UAA — Under ArmourDirector bought $493K @ $4.93 after a 24.30% one-month drop, and $520K @ $5.20 after a 25.95% one-month drop. Two bites in 72 hours suggest real conviction; bias long on a firm reclaim of $5.20.

* QRHC — Quest Resource HoldingDirector bought $25.4K @ $1.70 after a 33.33% three-month decline. Small check, but paired activity on the tape matters.

* EOLS — EvolusDirector bought $204K @ $6.82 after a 27.28% one-month slide. Look for a push back above the 20-day with volume.

* ACDC — ProFrac Holding10% Owner bought $10.0M @ $4.00 after a 36.78% one-week drop; a second $10.0M @ $4.00 allocation printed as well. Size into stress; $4 looks like the battleground.

* OMI — Owens & Minor10% Owner bought $4.39M @ $5.37 after a 26.90% one-month decline, plus $3.71M @ $5.15 as an additional allocation. Scaling into weakness; a third print would upgrade the signal.

* MKZR — MacKenzie Realty CapitalGeneral Counsel/Secretary bought $96.9K @ $4.84 after a 25.10% one-month decline. Quiet cluster forming; verify liquidity before acting.

Whale Buys (>$10M)

Size that can set floors — even without an explicit “dip” tag.

* BHC — Bausch HealthDirector bought $312.5M @ $9.00 and lifted vested holdings by 96%. A forklift, not a shopping cart.

* MDGL — Madrigal PharmaceuticalsDirector bought $36.9M @ $380.58 and $25.0M @ $364.04. Back-to-back eight-figure conviction in a clinical name.

* REZI — Resideo Technologies10% Owner bought $20.7M @ $31.60. Strategic holder adding to the stack.

* ATAI — Atai Life Sciences10% Owner bought $19.0M @ $2.19. Big ticket in a beaten-up biotech.

* TBCH — Turtle BeachDirector bought $10.0M @ $14.41, lifting stake by 622%. That’s a remodel, not a touch-up.

* SHCO — Soho HouseDirector bought $26.4M @ $6.00 via purchase agreement. Large print that still tilts the order book.

Officer Skin-in-the-Game

Executives opening their own wallets — historically higher signal than directors.

* VVV — ValvolineCFO bought $501.5K @ $39.41, increasing holdings by 2,456%. CFOs see the cash; he backed it.

* TPVG — TriplePoint Venture GrowthCEO bought $662K @ $6.30, increasing holdings by 44.9%. Management leaning in on the book.

* EFOI — Energy FocusCEO bought $500K @ $1.89, increasing holdings by 13.9%. Small-cap swing with insider alignment.

* LLY — Eli LillyCFO bought $494.6K @ $691.79. Rare officer buy at a megacap leader.

Interesting Trade Ideas

I am going to be placing a small bet on Business First Bancshares (ticker: BFST) Monday at mar