The Simple Side's Saturday Sendout: New Portfolio Updates & Outperformance

Description

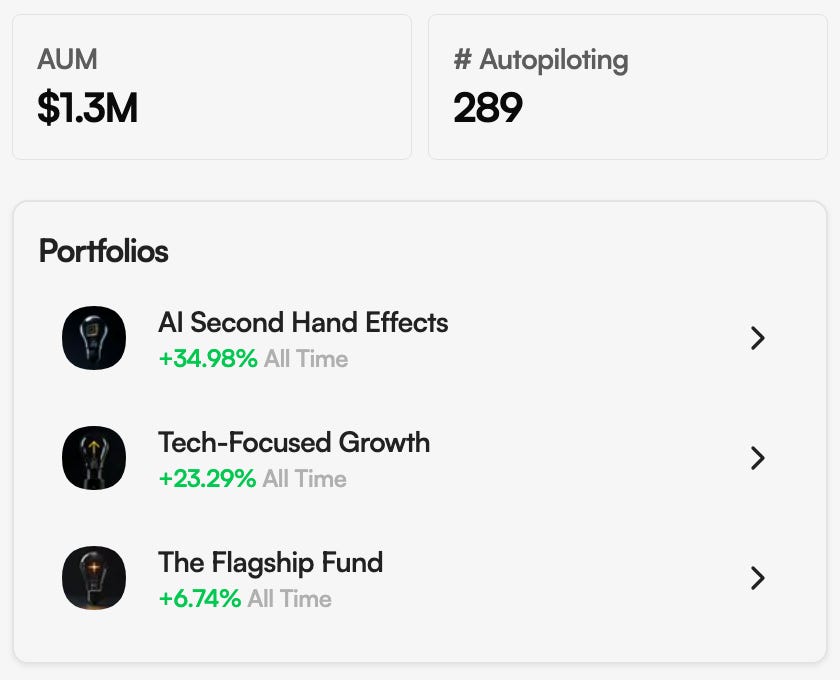

Quick Reminders:Our disclosure is in the email footerPortfolio copy trading is available here

To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout. As a reminder, you can find our podcast on YouTube, Spotify, Apple Music, and here on Substack!

Updates

The new format going forward will look similar to this in our weekly updates:

* FREE

* Market Commentary & News

* Quick Insider Trade Updates

* Interesting Trade Ideas

* Portfolio Performance

* PAID

* Portfolio Holdings & Updates

* Portfolio Strategies, Updates & New Bets

* Our Weekly Picks

* Mergers & Acquisitions Picks

* Top Stock Picks

As a reminder, all of this will be accessible to you via copy trading. Remember that these portfolios ARE NOT GET-RICH-QUICK portfolios. I am focused on long-term market outperformance.

There will be updates made to the paid subscriber spreadsheet as well, but I will likely update everyone on those when they are completed!

Market Commentary

The week in one glance

* Stocks notched fresh highs Tuesday–Thursday and then cooled on Friday as profit-taking hit mega-cap tech, semis, and cyclicals. Breadth quietly improved midweek with small and mid-caps outrunning the giants, a sign the rally can walk and chew gum at the same time.

* Rates drifted rather than lurched, keeping the soft-landing story intact and September cut odds lofty. Oil hovered near $64, gold firmed, and the VIX stayed sleepy until a Friday yawn.

Macro & rates

* Growth looked sturdier than feared with Q2 GDP revised to 3.3% while weekly jobless claims stayed low, the combination investors usually order when they want easing without the drama. Two-year yields meandered around 3.62%–3.73% and the 10-year around 4.21%–4.33%, leaving the door open for a modest Fed trim next month if PCE doesn’t misbehave.

* Housing stayed mixed and consumer gauges were fine, not fantastic; in market terms that’s “just right” because it cools the inflation talk without chilling earnings.

Sectors & flows

* Communication services led thanks to steady strength in Alphabet and Meta, while energy caught a bid as crude inched higher and balance sheets kept doing the heavy lifting.

* Defensives lagged as investors rotated toward risk, and retailers turned in a patchwork quilt where great execution mattered more than category. The equal-weight S&P perked up midweek, hinting that leadership isn’t only a two-stock show.

AI, chips & cloud: hype met housekeeping

* NVIDIA delivered record revenue and a huge networking print, then reminded everyone that China is complicated and guidance can be… responsible. Shares flinched before the market remembered AI datacenters don’t build themselves.

* Marvell’s outlook knocked the wind out of semis on Friday, a reminder that not every AI dollar shows up on the same quarter’s P&L. Dell talked up a path to $20B in AI server sales next year, HP pushed AI PCs past a quarter of its mix and sharpened the cost pencil, and SK hynix flexed with a 321-layer QLC part that doubles capacity—because storage wants in on the AI party too.

* Software stole a few scenes: MongoDB ripped after a clean beat, Box nudged guidance higher as larger enterprises lean in, Snowflake and Nutanix talked bigger pipelines as AI-heavy workloads move from slides to spend, and CrowdStrike kept stacking ARR while bolting on data plumbing.

Earnings & movers

* Dollar General topped estimates and lifted guidance, proving value retail can still find value. Victoria’s Secret tightened execution and raised its sales view. Pure Storage impressed with margin and backlog momentum, which is what you get when customers need faster pipes for smarter apps.

* Alibaba missed at the headline but showed double-digit growth ex-disposals and highlighted another quarter of triple-digit AI cloud revenue, then set to refinance a chunky loan—housekeeping that keeps optionality alive.

* Caterpillar raised the tariff hit for the year, a useful tell for anyone modeling industrial margins into autumn.

Autos, EVs & mobility

* Tesla fought a two-front war: deep UK lease discounts and a European sales slump on one side, a jury verdict tied to Autopilot on the other. Plans for a lower-priced model in 2025 remain the demand valve, but competition isn’t waiting. GM recalled Corvette units for a fuel issue and Nissan slipped after Mercedes moved to exit a longstanding stake—classic reminder that strategic ties aren’t forever.

Deals, capital & policy moves

* Keurig Dr Pepper moved toward buying JDE Peet’s as investors did the spreadsheet and marked the stock down; bold portfolio reshapes usually come with upfront sticker shock.

* Energy and defense stayed busy: Crescent Energy agreed to acquire Vital Energy in all-stock fashion to fatten free cash flow, RTX won a big F135 engine order, and Boeing secured maintenance work even as labor talks crept on. AT&T lined up $23B of spectrum to feed its 5G and fiber ambitions—because the network is the business model.

* Terumo reached for OrganOx to deepen transplant tech, AbbVie bought rights to a mid-stage depression asset from Gilgamesh, and MannKind added scPharmaceuticals to bulk up in cardiometabolic. In healthcare, Eli Lilly posted positive Phase 3 obesity-pill data and an overall-survival win for Verzenio, while Regeneron and Alnylam advanced an RNA therapy in myasthenia gravis—clinical readouts that point to revenue mix shifting further toward specialty therapies.

Oddities & outliers

* Charter sweetened Spectrum bundles with Disney’s streaming stack at no extra cost for eligible plans, a tacit nod that “cable vs. streaming” is turning into “connectivity plus content, don’t make me choose.”

* Box scores aside, Canada Goose and Aspen Insurance drew buyout chatter and deals, proof that private capital still likes cash-flow stories with a winter coat.

Insiders don’t always get it right… but they do get the best seats in the house. Here are this week’s trades that made us raise an eyebrow (and maybe place a limit order).

We keep track of all of these trades on our Google sheet, and then insider returns are quite astounding…

Buy the Dip Tracker

Insiders buying after meaningful drawdowns — percent and window included.

* ECIA — Encision Inc.CEO bought 1,000,000 @ $0.10 after a 42.35% one-month drop. Surgical entry at penny-stock prices; treat $0.10–$0.12 as the tug-of-war zone.

* ECIA — Encision Inc.Director bought 750,000 @ $0.10 after a 42.35% one-month drop. Cluster buying amplifies the signal.

* ECIA — Encision Inc.10% Owner bought 2,000,000 @ $0.10 after a 42.35% one-month drop. When both insiders and a 10% holder step in, floors often form.

* NTLA — Intellia TherapeuticsDirector bought 100,000 @ $10.03 after a 22.02% one-month slide. Gene-editing dip buy; look for a higher low above ~$10.

* FFAI — Faraday FutureGlobal President bought 10,560 @ $2.33 after a 21.31% one-month drop. High beta, high drama—trade the tape, not the story.

* CLDI — Calidi BiotherapeuticsDirector bought 150,000 @ $2.00 and 250,000 @ $2.00 after a 43.33% one-week drop. Two prints into a faceplant; watch for base-building above $2.

* COTY — Coty Inc.Chief People & Purpose Officer bought 30,000 @ $3.84 after a 24.54% one-week drop.CEO bought 260,000 @ $3.92 after a 24.54% one-week drop. When the C-suite buys the beauty dip, momentum traders bring mirrors.

* AFCG — Advanced Flower CapitalDirector bought 375,147 @ $4.07 after a 52.37% one-year drawdown. Deep value or value trap—let price action decide.

* STSS — Sharps TechnologyDirectors bought 400,000 / 100,000 / 80,000 / 40,000 @ $6.41 after a 99.13% one-year collapse. That’s not catching a falling knife; that’s restocking the cutlery aisle.

* GMGI — Golden Matrix GroupCFO bought 25,000 @ $1.30 after a 21.34% one-month drop. Finance chief averaging down—eyes on follow-through.

Standout Size ($1M+)

Large checks that can tilt order books, even without explicit “dip” tags.

* CEPF —