What's Your Assumption: Nine Trades as Mag 7 Earnings Week Begins

Update: 2025-10-29

Description

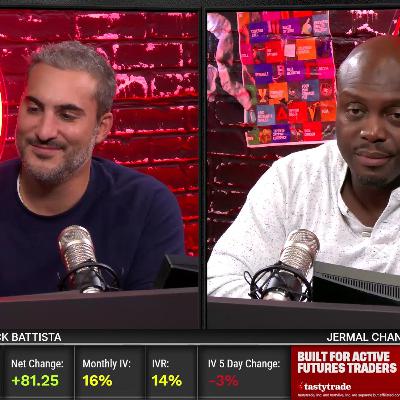

Hosts Nick and Tony conducted a successful What's Your Assumption session executing 9 of 10 viewer trades ahead of massive Mag 7 earnings week. The standout trades included a CRM "Super Bowl" structure (formerly called "stupid") at $2.65 credit combining 240 November puts with 255-260 weekly call spread to capitalize on ServiceNow earnings spillover, gold GLD December 380/November 395 diagonal at $6.49 playing into 1% rally, Chipotle 39 puts at $1.16 for potential wheel strategy through tonight's earnings, and Amazon November 210 puts at $3.25 providing downside protection since stock hasn't participated like Microsoft. The Roblox discussion highlighted extreme two-day volatility (130% IV) with 30 Delta 130 puts trading at $8 for Halloween earnings, leading to a 120-115 put ratio spread attempt at $1.50. Reddit contributor "Avocado" received continued praise for VST winner (Nick made another $2 on top of initial $2 gain). The session passed only on live cattle futures deemed too risky, while deferring QQQ diagonal and Google/Meta trades until after Fed announcement and earnings moves materialize, with Charles Stewart's strategy of waiting for post-Fed vol spike to sell credit spreads earning enthusiastic support.

Comments

In Channel