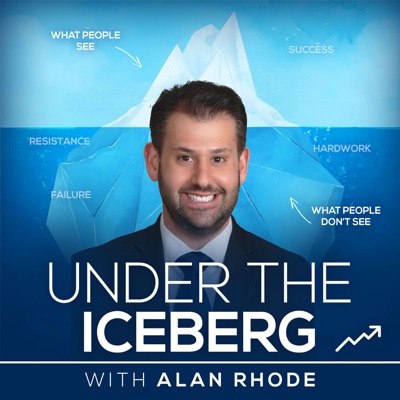

Under the Iceberg

Description

Under the Iceberg is hosted by Alan Rhode, a seasoned Private Wealth Advisor and CEO of Modern Wealth. It is your go-to podcast for diving deep into the world of Financial Planning and Wealth Management for Entrepreneurship and Small Business Ownership.

Join us as we explore these crucial topics in a format that’s both educational and engaging, tailored for Entrepreneurs and Small Business Owners looking to navigate the complexities of modern finance.

Disclaimer: “Under the Iceberg” is for informational purposes only and should not be considered professional financial advice. Consult with a qualified professional before making any financial decisions.

Content is believed to be accurate as of the publication date; however, no warranty of accuracy is given. External links are provided for convenience, with no endorsement implied.

For inquiries or feedback, reach out to alan@modernwealthllc.com.