Discover Marketplace

Marketplace

Marketplace

Author: Marketplace

Subscribed: 60,728Played: 4,982,468Subscribe

Share

© Copyright 2026 Minnesota Public Radio

Description

Every weekday, host Kai Ryssdal helps you make sense of the day's business and economic news — no econ degree or finance background required. "Marketplace" takes you beyond the numbers, bringing you context. Our team of reporters all over the world speak with CEOs, policymakers and regular people just trying to get by.

264 Episodes

Reverse

Artificial intelligence companies raised enormous amounts of money in 2025, and made major investments in development and infrastructure. What’s next? To understand more about the role AI could play in our futures, “Marketplace” host Kai Ryssdal and “Marketplace Tech” host Meghan McCarty Carino visited an AI company and an AI data center in Silicon Valley. In this episode, the next phase of AI innovation won’t come without obstacles.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

Artificial intelligence is one of a handful of industries propelling this economy forward. But as the sector explodes, not everyone is on board. Americans are much more concerned about the downsides of AI than excited about its potential utility, according to a new Pew Research survey. In this episode, everyday Americans grapple with — and in some cases, fight back against — the proliferation of AI technology. Plus: Durable goods orders were up in November, gold prices continue to break records, and “Marketplace” host Kai Ryssdal tours a data center in Los Angeles.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

The FDIC has approved proposals by GM and Ford to launch their own banking units. That means the automakers will be able to provide their own auto loans to customers. In this episode, a confluence of market conditions drove Ford and GM into banking. Plus: The Super Bowl of livestock shows highlights high cattle prices, changes to online search behavior affects digital ad revenue, and “Marketplace” host Amy Scott talks to Jordyn Holman at the New York Times and David Gura at Bloomberg about the week’s economic headlines.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

Revised GDP data for this past summer shows the U.S. economy grew faster than we initially thought. A few key parts of the private services sector propelled that growth. In this episode, which parts of the economy are actually doing pretty well. Then: Gap leans in to “fashiontainment,” packaging costs weigh on food prices, and elderly care facilities stand to lose critical employees when TPS ends for Haitian immigrants.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

The EU owns $8 trillion in Treasurys. Sure, Eurozone governments probably won’t use ‘em as leverage in the Trump-Greenland situation — and even if they wanted to, it’d be complicated — but what if they did? We’ll explain. Also in this episode: United posts strong quarterly profits after a turbulent year, a primary care doctor tells Kai how Medicaid changes are affecting his work, and cover crops are a tough sell for cash-strapped farmers.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

After decades of globalization, the U.S. may be paying a political price: International leaders are forging new trade agreements independent of American influence. In this episode, as some countries no longer see the U.S. as a reliable trade partner, will the global economy leave America behind? Plus: Sellers outnumber buyers in parts of the housing market, Georgetown’s Dorothy Brown discusses her new book about reparations, and we preview Fed governor Lisa Cook’s upcoming Supreme Court hearing.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

President Trump has announced new tariffs on European Union countries, aimed at forcing a deal for the U.S. to acquire Greenland. But the EU could respond relatively quickly, with sanctions of their own. In this episode, the EU’s “bazooka” option. Plus: Trump’s recent housing proposals won’t fix the fundemental issue driving housing affordability, technology has changed how parents dole out kids’ allowance, and we explain the history of economic jargon.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

An AI-driven construction boom is coming, some hope. But to build all that infrastructure, the U.S. is going to need a lot more construction workers, plumbers, HVAC technicians, and other skilled workers. And President Trump’s immigration policies actively work against that goal. Also in this episode: Trump withdraws the U.S. from a key global climate change agreement, Americans shell out for at-home coffee setups, and Kai discusses the week’s economic headlines with Greg Ip at the Wall Street Journal and Amara Omeokwe at Bloomberg.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

President Trump recently ordered government-backed mortgage companies (that’s Fannie Mae and Freddie Mac) to buy up $200 billion in mortgage-backed securities. The last time they bought these bonds was the 2008 financial crisis. Will the move actually lower rates? Probably not much. Also in this episode: Venture capital can thank AI for a 2025 rebound, banks fight to block stablecoin interest yields, and more young people are getting prenups.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

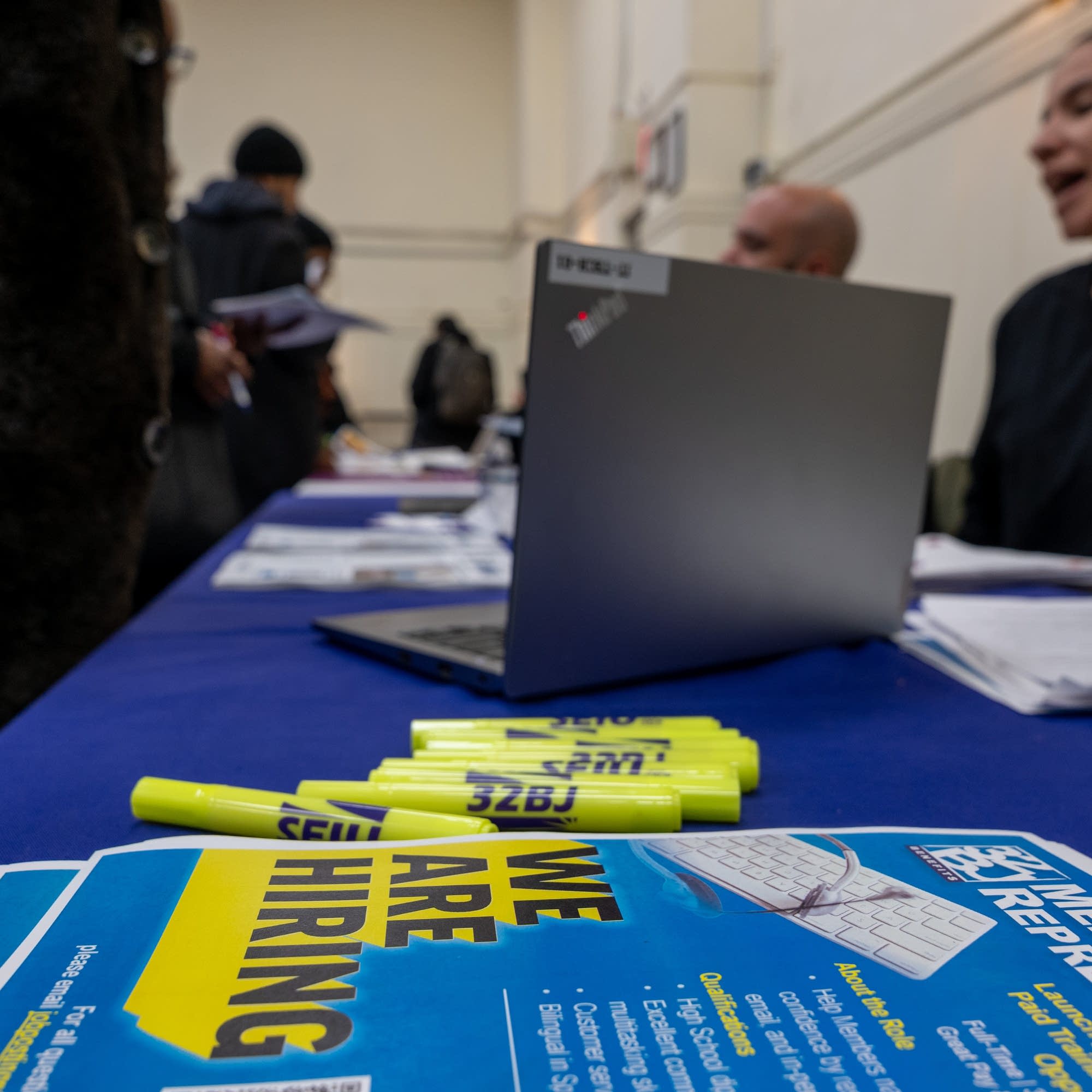

The unemployment rate in December among people aged 20 to 24 was 8.2%. That’s up nearly a full percentage point from 2024, and much higher than the overall unemployment rate of 4.4%. The job market is tough, and getting tougher, but why is it particularly hard for Gen Z? Also in this episode: Trump’s focus on Venezuelan crude could redirect Canadian oil, companies use surveillance data for “personalized” pricing, and China’s trade surplus grew by 20% last year, in spite of U.S. tariffs.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

The cost of food consumed at home was up 0.7% month-over-month in December, and 2.4% year-over-year. Go back five years, and grocery prices are up 25%. And like so many things in this economy, the rising cost hurts the poorest Americans most. Also in this episode: Americans carry credit card debt longer than they used to, two ultra-low-cost U.S. airlines make plans to merge, and we get an update from Kansas grain farmers.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

The Department of Justice has opened an investigation into the Federal Reserve and Chair Jerome Powell, a move Powell has since called "an unprecedented action [that] should be seen in the broader context of the [Trump] administration's threats and ongoing pressure" to lower interest rates. We take a closer look at what’s happening from inside the Fed, and look at the implications for the economy as a whole. Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

The rate of jobless Americans who’ve been out of work for over 27 weeks — also known as “long-term unemployed” — hit 26% in December, according to the latest jobs report. That’s the highest it’s been since February 2022. In this episode, why the rate is rising and what it says about the broader economy. Plus: Businesses curb 2026 growth plans, a farmer discusses AI in agriculture, and we check in with an Asheville, North Carolina, tea company over a year since Hurricane Helene.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

Labor economists will tell ya, productivity growth leads to more hiring. The idea is, once a company is operating more efficiently, they’ll try expanding, which usually comes with new jobs. But in this frustrating and bizarre economy, data show major productivity gains and a stagnant labor market … coexisting? Also in this episode: New York City expands a free child care program, one reporter tries to do the job(s) of the federal government, and economists expect a less-grim December jobs report.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

The job market has been steadily losing steam and workers have noticed. Though the unemployment rate remains fairly low, some groups are experiencing heightened job-finding trouble, and overall employment sentiment is falling. In this episode, are job market worriers paranoid or prophetic? Plus: Nvidia CEO announces new AI chips won’t require as-expensive cooling systems, car sales were up in 2025, and economists study why new tariffs haven't dinged the economy much — yet.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

This year, amid ongoing economic uncertainty, corporations are expected to refinance old debt, invest in artificial intelligence, and prep for mergers and acquisitions. All of which require extra cash. And how do corporations stretch their budgets? By taking on more debt, of course. Later in this episode: An Altadena small business owner struggles to rebuild after the LA fires, Texas pitmasters weigh rising brisket prices, and Costco converts wine snobs.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

Disruptive geopolitical events often push investors to jump into bonds or sell off stocks temporarily. But when the U.S. military captured Venezuelan leader Nicolás Maduro and President Trump declared control over the oil-rich nation, neither of those happened. In this episode, markets are largely unmoved by Trump’s military intervention. Plus: Experts say jobs data is most important for predicting where the economy is headed, and Landon Derentz at the Atlantic Council Global Energy Center gives context to Venezuela’s oil infrastructure.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

By the end of the year, at least 18 states will restrict the use of SNAP benefits to purchase “non-nutritious” food and drinks. But the definition of non-nutritious is up to each state. In this episode, the knock-on effects of benefit restrictions, for shoppers and retailers. Plus: Gigantic driverless trucks are poised to transform Minnesota iron mining and a deportation deal between the U.S. and Ghana could deter future emigration from the region.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

The winter holiday season is a key time for nonprofit fundraising — an estimated 30% of annual giving happens in December. But in 2025, highly publicized federal cuts resulted in an individual giving boost throughout the year. In this episode, some nonprofits worry demand will soon outgrow those private donations. Plus: Latino immigrants say deportation fears are reminiscent of the Covid-19 lockdown, communities fight to buy back private utilities, and “This Is Uncomfortable” host Reema Khrais gives tips for sticking to financial New Year’s resolutions.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

Total jobless claims fell last week, which is the second-lowest reading in the last two years. Experts, though, say it’s likely a seasonal blip — especially since the labor market has been slowing all year. In this episode, what might be ahead in 2026. Plus: Los Angeles expands rent control, influencers change the consumer economy with “shopaganda,” and tribute bands get a moment in the spotlight.Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

TDS?

TDR?

I guess tugboats were not needed to prevent bridge damage.

All that discussion of Trump's meme coin with no mention of Trump's personal ownership and control of a large quantity of them? No mention of the unlimited opportunity for untraceable bribes and grift? No mention of Trump's documented history of shakedowns for favorable treatment?

I have been using the business consumer reviews site for quite some time now, and I must say, it has been a game-changer for me. The user-friendly interface makes it incredibly easy to navigate and find the information I need. The reviews are detailed and informative, giving me a clear picture of what to expect from a particular business, for more information visit and read https://www.pissedconsumer.com/ . I appreciate the transparency and honesty of the reviews, as it helps me make informed decisions when choosing where to spend my money. Overall, my experience with this site has been nothing short of excellent, and I highly recommend it to anyone looking for reliable and trustworthy business reviews.

2025 could be the year of small AI as advancements in efficiency, scalability, and accessibility make it easier for businesses and individuals to harness AI's potential on a smaller scale. Exciting times ahead!

$100 Registration Bonus Eksklusibo sa jet!

Maging Miyembro ng daddy at Makatanggap ng $100 Agad!

Magsimula sa fresh: Makakuha ng $100 Welcome Bonus!

Magsimula sa fresh: Makakuha ng $100 Welcome Bonus!

sherbet Registration Bonus: Libreng $100 Para sa Mga Bagong User!

Magparehistro sa supernova at Makakuha ng $100 Bonus Kaagad!

Magparehistro sa supernova at Makakuha ng $100 Bonus Kaagad!

Sumali sa jazz Ngayon at Kumuha ng $100 Welcome Bonus!

Sumali sa jazz Ngayon at Kumuha ng $100 Welcome Bonus!

Simulan ang Iyong Paglalaro sa 500 casino na may Libreng $100 Bonus!

$100 Bonus Agad Para sa Mga Bagong User ng highway!

Bagong User? Sumali sa sol at Makatanggap ng $100 Bonus!

Makakuha ng $100 Bonus Kapag Nagparehistro sa exclusive Ngayon!

Climate change. It didn:'t help setting 3 fires to spontaneously grow and take advantage of the Santa Ana winds to bring the housing lots back on the market, and then hint that multiple family housing should replace all of those private homes.Forcing sell-off of obviously damaged property to those that can profit buy rebuilding, and maybe Miami highrise style that corporations own, and not the cozy wannabes that just think of themselves. How dare they. Think huge glass towers. Miami 2.0