#36 Back to Basics - Income, Business, Taxes & More!

Description

It's a new year which means a reset to yearly earnings and a new opportunity to do things differently.

So in this episode, I take a deep dive into the most common reporting forms: the W-2 and 1099, the differences and how even a side hustle can help you can take advantage of the tax code which is most favorable to business owners.

But you need to make some decisions on the front end about what type of business and who will run it, and I get into that and how that decision determines your tax outcomes the following year.

Build a business? Or bank a paycheck? Either way, this will give you the "know how" you need to decide.

0:00 Episode Preview - Sole Proprietor & Self Employment Tax

1:00 Welcome to Money Talk! for the "Modern" Entrepreneur

2:09 What type of Earner Are You? W2 or 1099

4:15 1099s Give You Control

5:46 1099s - The Responsibilities

6:53 Types of Businesses You Can Have

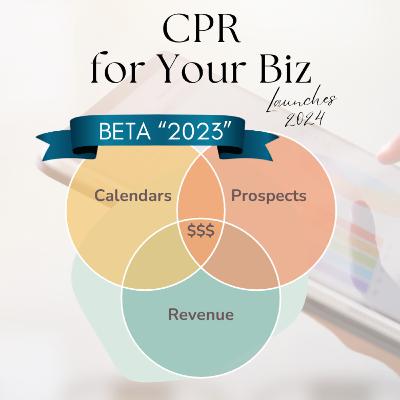

16:16 Keeping Organized - "Shortcut 6"

19:49 Bank Statements & Receipts

22:21 Reach Out to Us on Social Media For Help

Links mentioned:

IRS guidance - determining employee or independent contractor

https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee