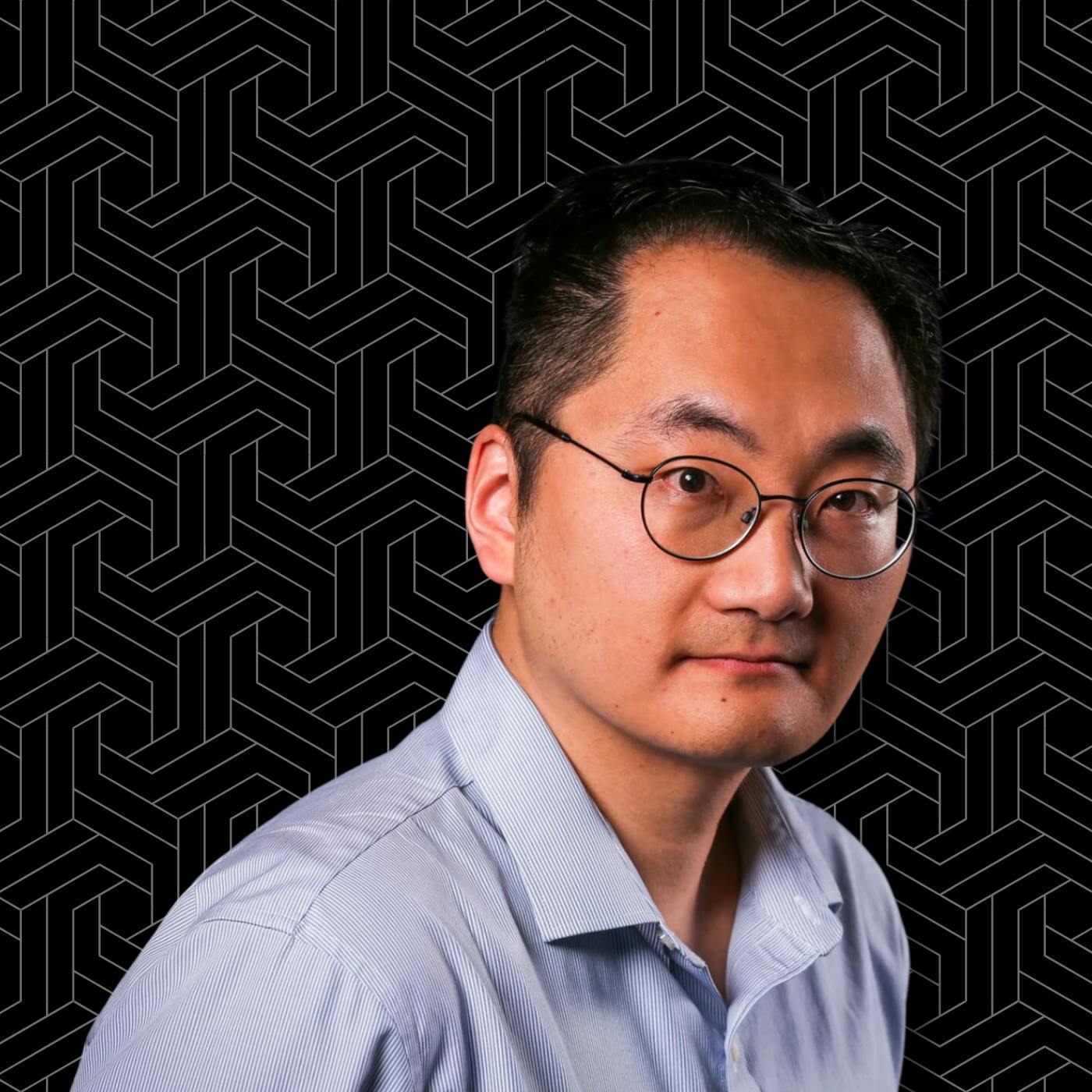

E103: Byrne Hobart on What The First AI Agents Will Do + China, Google Analysis

Description

This week on Upstream, Byrne Hobart and Erik Torenberg discuss the potential of AI agents in tech support, economic impacts of passive investing, historical financial strategies of Warren Buffett, and the implications of tariffs and technological developments in national wealth.

—

📰 Be notified early when Turpentine's drops new publication: https://www.turpentine.co/exclusiveaccess

🙏Help shape our show by taking our quick listener survey at https://bit.ly/TurpentinePulse

—

SPONSORS:

🤲🏼 GiveWell spends 50,000 hours every year doing deep-dives into different charitable programs to try to find the ways to do the most good for your dollar. GiveWell has now spent over 17 years researching charitable organizations and only directs funding to a few of the HIGHEST-IMPACT opportunities they’ve found. Visit https://www.givewell.org to find out more or make a donation. (Select PODCAST and enter Econ 102 at checkout to support our show.)

💥 Head to Squad to access global engineering without the headache and at a fraction of the cost: head to https://choosesquad.com/ and mention “Turpentine” to skip the waitlist.

—

LINKS:

Byrne’s writing: https://thediff.co

—

X / TWITTER:

@byrnehobart

@eriktorenberg

@turpentinemedia

—

HIGHLIGHTS FROM THE EPISODE:

- AI is most effectively being deployed first in customer service where outcomes can be clearly measured and tracked.

- Return on Equity (ROE) has become less relevant in modern markets where companies can easily raise capital and buy back shares.

- Google has evolved from being criticized for sitting on cash to making aggressive investments in innovation, as demonstrated by Waymo.

- Tariffs function as a transfer mechanism from consumers to workers, potentially helping build strategic industries despite some economic inefficiency.

- While passive investing continues to grow, there will always be a cyclical role for active trading to enable price discovery and market making.

- Meme coins and app-based stock trading represent newer forms of gambling that might be more socially beneficial than traditional sports betting.

- A new book reveals Buffett's early investment strategy combined detailed research methods with an evolution from pure value investing to investing in quality companies.

![E101: Wokeism & Class w/ David Sacks, Trump’s AI Czar [Upstream Archive] E101: Wokeism & Class w/ David Sacks, Trump’s AI Czar [Upstream Archive]](https://megaphone.imgix.net/podcasts/70d9cade-b45c-11ef-9415-074ef91a9991/image/29005ab4df0d303c15cbb5fbd52ccd3f.png?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)