Financial Tip: She developed a process to simplify scholarship applications and avoid student loan debt.

Update: 2025-11-21

Description

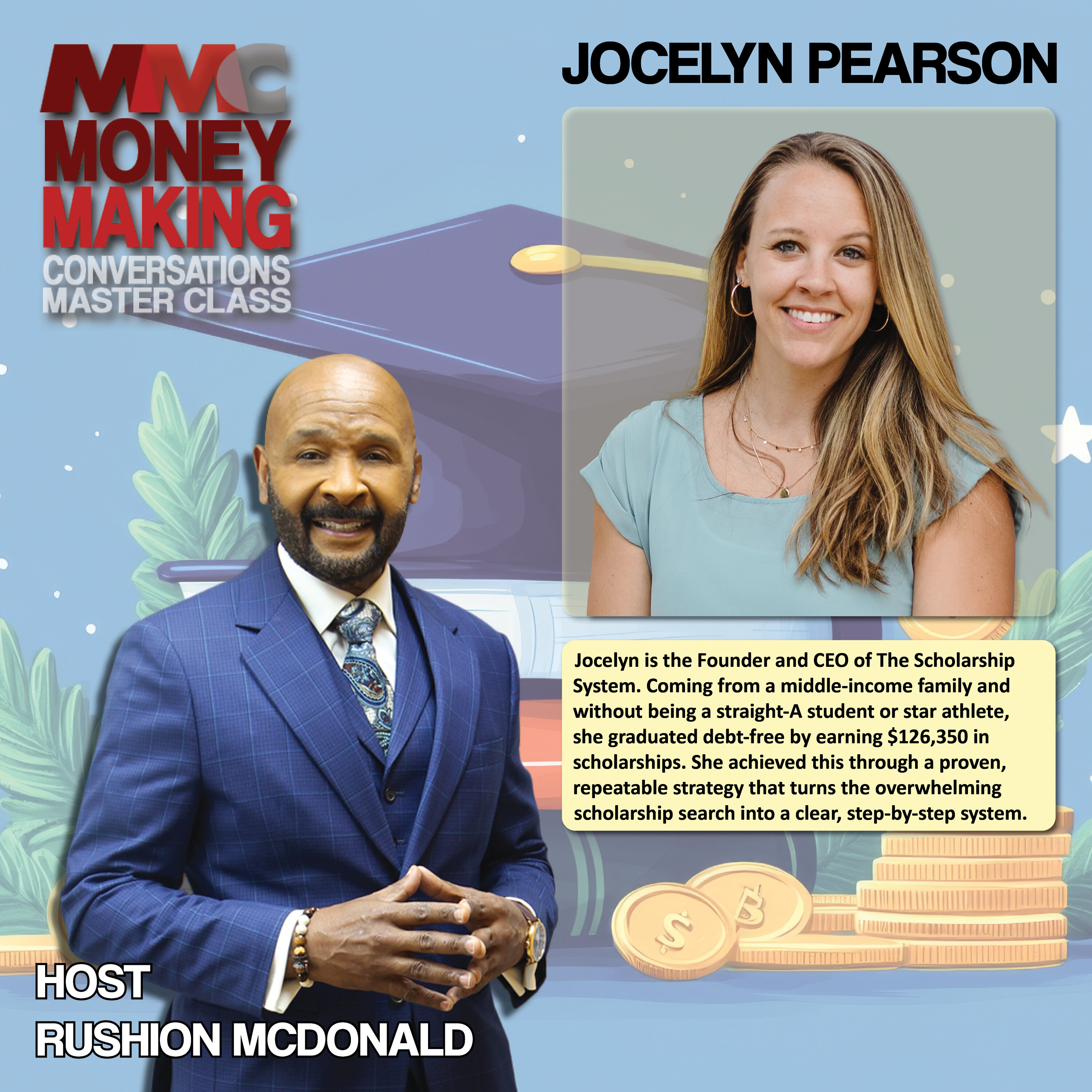

Jocelyn Pearson.

Purpose of the Interview

The interview on Money Making Conversations Masterclass with Rushion McDonald and Jocelyn Pearson aimed to:

- Share Jocelyn’s journey of graduating debt-free by securing $126,350 in scholarships.

- Educate families on how to avoid student loan debt through her proven system, The Scholarship System.

- Dispel myths about scholarships and provide actionable steps for parents and students.

Key Takeaways

-

Scholarship System Approach

- Jocelyn developed a six-step process to simplify scholarship applications and avoid overwhelm.

- Focus on breaking the process into small, manageable steps rather than a vague “go get money” directive.

-

Common Myths Debunked

- Too early or too late to apply: Start by junior year; it’s never too late—even college seniors can apply.

- Only perfect students or low-income families qualify: Many scholarships don’t require high GPA or athletic ability.

- All good scholarships are gone: Smaller, local scholarships ($500–$5,000) add up over time.

- It takes too much time: With a system and reusable materials, effort decreases each year.

-

Avoiding Scholarship Scams

- Beware of “easy,” “enter to win,” or sweepstakes-style scholarships—they often sell personal data.

- Real scholarships require effort and personalization.

-

Role of Parents

- Parents should help with planning and identifying legitimate scholarships but not complete applications for students.

- Committees can detect when parents write essays.

-

AI in Scholarship Applications

- Jocelyn warns against copy-pasting AI-generated essays.

- Her platform introduced TESS, an AI assistant for ethical guidance and support.

-

Financial Aid Basics

- Submit FAFSA even if you think you won’t qualify; some colleges and states require it.

- Combine all sources—government aid, institutional aid, and private scholarships.

-

For Current College Students

- Check with financial aid offices, academic departments, and organizations for scholarships available after freshman year.

-

Entrepreneurial Journey

- Jocelyn turned her passion into a business by starting with a book, building an email list, and launching webinars.

- She emphasizes persistence and ignoring naysayers.

Notable Quotes

- “I had to accumulate my way to getting college paid for—the mere mortals’ way to going to college without tons of debt.”

- “Most families want scholarships, but they get stuck in the overwhelm.”

- “There’s no big red easy button—but with clear steps, it feels less daunting.”

- “We’re saying no to the broken system… It takes, on average, 21 years to pay off student loans.”

- “With great power comes great responsibility—AI can help, but only if used ethically.”

#SHMS #STRAW #BEST

Steve Harvey Morning Show Online: http://www.steveharveyfm.com/

See omnystudio.com/listener for privacy information.

Comments

In Channel