Investing in Opportunity with Michelle Rhee

Description

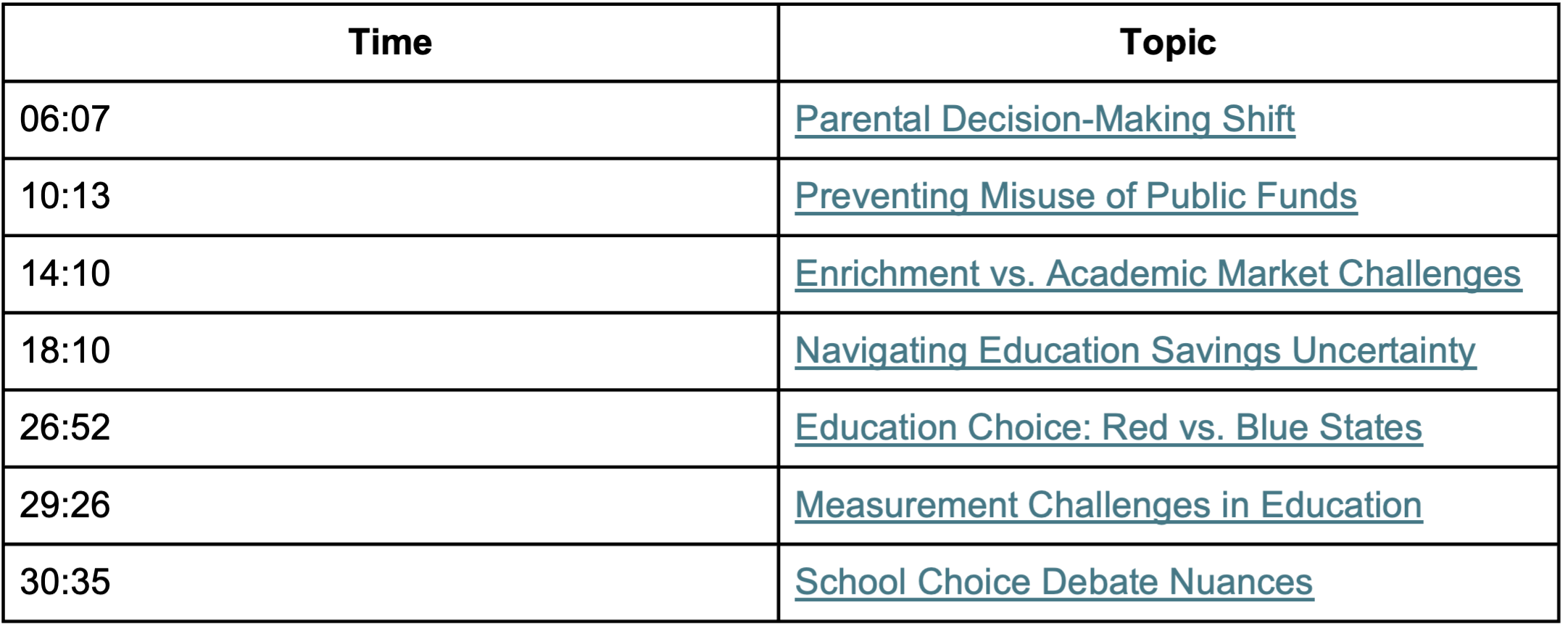

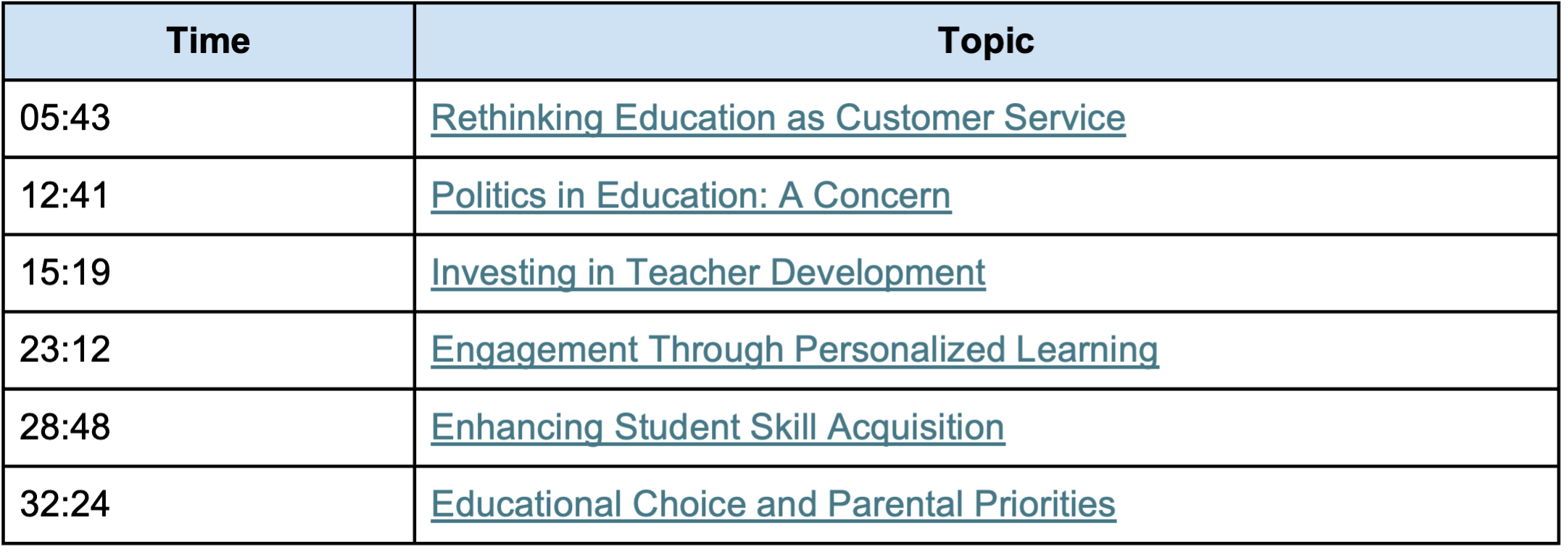

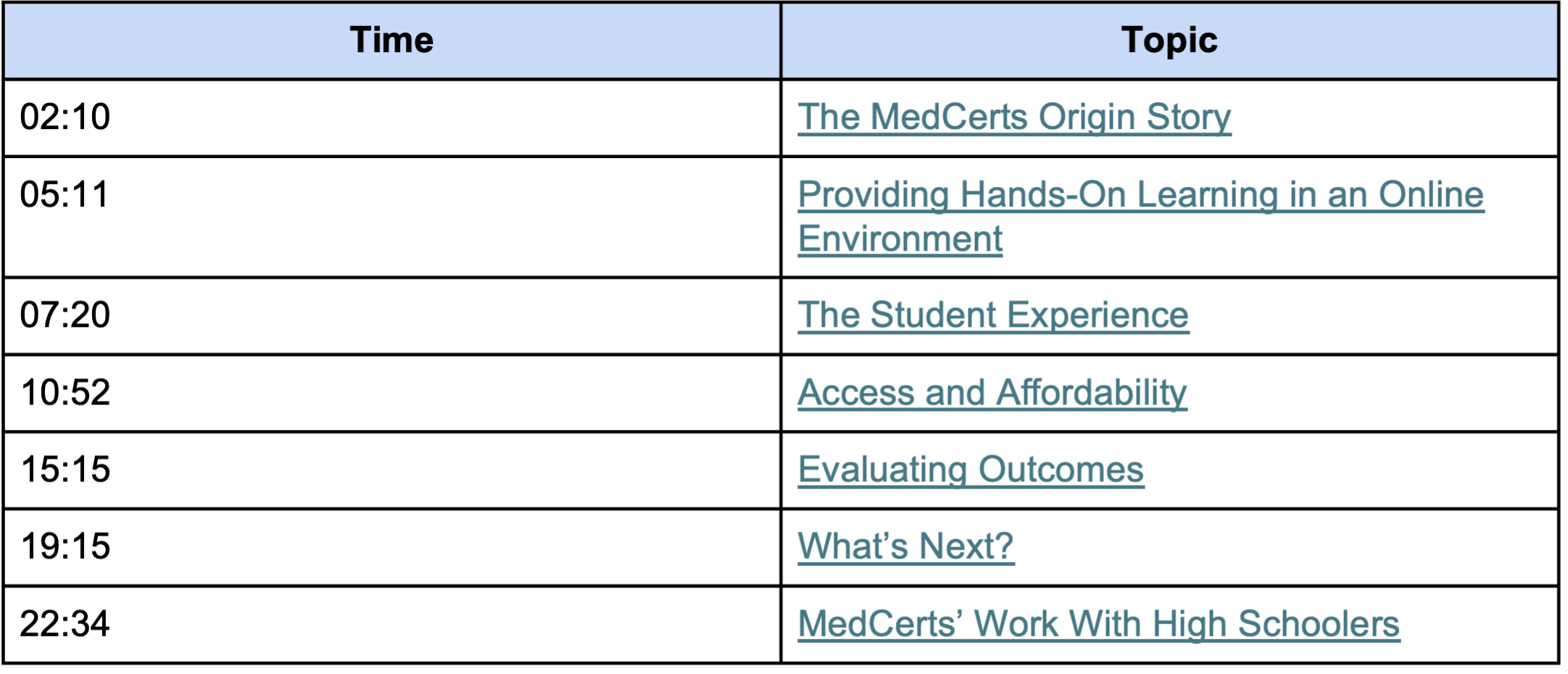

Michelle Rhee, former chancellor of D.C. Public Schools and now a venture partner at Equal Opportunity Ventures, joined me to talk about her own unexpected journey to venture capital and how she’s found reasons for hope and optimism among entrepreneurs. We also discussed EO Ventures’ unique thesis for accelerating economic mobility through market-driven solutions and highlighted some of their investments. Rhee also reflected on changing attitudes toward work among young people, which I found very interesting—as well as the importance of measurable social impact.

Michael Horn

Welcome to the Future of Education. I'm Michael Horn. And you're joining the show where we are dedicated to creating a world in which all individuals can build their passions, fulfill their potential, and live lives of purpose, which unfortunately is not the world we are living in today, but to help us think through how we can better get there and talk about some of her moves to do so. I'm delighted. We have a very special guest today, Michelle Rhee, venture partner at EO Ventures. And I'm sure many of you know her as the former chancellor of Washington, D.C. Public Schools, of course. Michelle, thank you so much for joining us. Great to see you.

Michelle Rhee

Thank you for having me. I'm excited to be here.

Michael Horn

No, I'm, I'm, I'm delighted to talk about, frankly, this new chapter, relatively speaking, of your career with EO Ventures, a venture firm that supports some really interesting entrepreneurs and portfolio companies. Maybe let's start there. Just what is EO Ventures and talk about your path there. Because obviously after you left D.C. Public Schools, you started Students First, you had a long run there, and then have taken a couple other steps. But I think people would be curious why venture capital and why into this step?

Michelle Rhee

Absolutely. So it's been a circuitous path. And certainly if you had have told me, you know, two decades ago that I was going to end up being a venture capitalist, I would have told you that you were crazy because this is not sort of the obvious next career choice. But, you know, so I, after D.C. Public Schools, I started Students First, which was a political advocacy organization focused on education and education reform. And after spending a few years at Students First, I actually left the education arena completely. I really felt like I was not being helpful in the education conversation because it had, in my opinion, become so polarized and divisive. And I really felt like me being in the conversations was not helping.

So I completely left education. About a little over four years ago, I co founded a tech startup with a colleague of mine and it was called BuildWithin. And it was not in the education space. It was actually in the workforce arena. BuildWithin is a software platform that helps employers to start and manage apprenticeship programs. So even though it wasn't in education, there was sort of a very obvious connection into workforce development and so stayed with that company for a number of years. And that was my first foray into like startup land, which was so different from anything that I had ever experienced before.

And I was super fortunate in that my co-founder, Ximena Hartsock was a serial founder. And so she kind of taught me the ropes and made sure that the organization and company was being set up well. But after that I left BuildWithin and for a little while was just kind of living my best housewife life for a few months. And then got a call from Roland Fryer. So Roland and I had known each other since my DC days. You know, I met him when he was a 27-year old newly tenured professor.

Michael Horn

Say newly genius tenured professor.

Michelle Rhee

Yeah, exactly. So he was the youngest black tenure professor ever at Harvard at the ripe old age of 27. And that's when I met him. And he sort of, he had called me at the tail end of my time with BuildWithin and he's like, I didn't know you had a startup. Like I have a venture firm, we want to write you a check, you know, that sort of thing. And after I left BuildWithin, and he was like, that's great because now you can come on board and join us. And I said, doing what, sir? I don't know anything about the venture capital world. And he's like, we just raised $100 million third fund and we'd love you to come on board and run a fund within the fund that is focused on education investments.

To which I promptly said, no, thank you, I'm out of education. I love being out, I never want to get back in. And I said, well, maybe something having to do with workforce development. He was like, sure, come on board, do whatever you want. Yeah. And it was, that's such an odd thing to say, but it's very on brand for Roland. And then I talked to Bill Hellman. So Bill is the co-founder of EO Ventures and he spent 35 years at Greylock, 15 of those as managing director.

And I had not met Bill before. And so in our first conversation together, I said, I don't understand why you want me for this job. I said, I don't know anything about investing, I've never done it before. Surely you can find somebody who's more qualified than me. And he said to me, he's like, you know, yes, there's venture stuff that you're going to have to learn. He's like, but it's, it's, you know, you're smart, you can figure it out. He said, really this is a business about picking people and you know how to do that. And I just found it so interesting.

It's so refreshing. That somebody with the storied sort of, you know, career in venture like, Bill would think that an old woman like me could learn how to do something new and do. Do it well. Right. So I was intrigued by both of them and, and their confidence that I would be able to do this. And so I was like, all right, I'll.

I'll give it a shot. And so I'm. I've been doing this for about 10 months now, and I have to say that I love it. I. Absolutely. Every job that I've ever had, I always knew that I was doing, like, I'm just, you know, doing good for the world. Right.

And hoping, hopefully making it a better place. But this is the first job that I've ever had that is genuinely so much fun. And every day I wake up and I almost feel guilty. I'm like, are you supposed to have this much fun when you're working? So it's been a fantastic experience so far.

Michael Horn

That's amazing. I'm. I'm sure this is off. This is with my Job Moves hat on at the moment. Like, what about the job is really lighting a fire under you that you wake up every day energized, and I've got to keep doing this. Like, what are the sets of things you get to do that you're like, wow, this. This is really energizing me.

Michelle Rhee

Well, first of all, on day three, being on the job, Roland had me sit in on the board meeting of one of our education portfolio companies. And I came out of that meeting, I was like, oh, I need to talk to him about this. I need to introduce that person. And I came out of the meeting and I was like, I guess I have to do education stuff. And Roland was like,

Michael Horn

Hook, line and sinker.

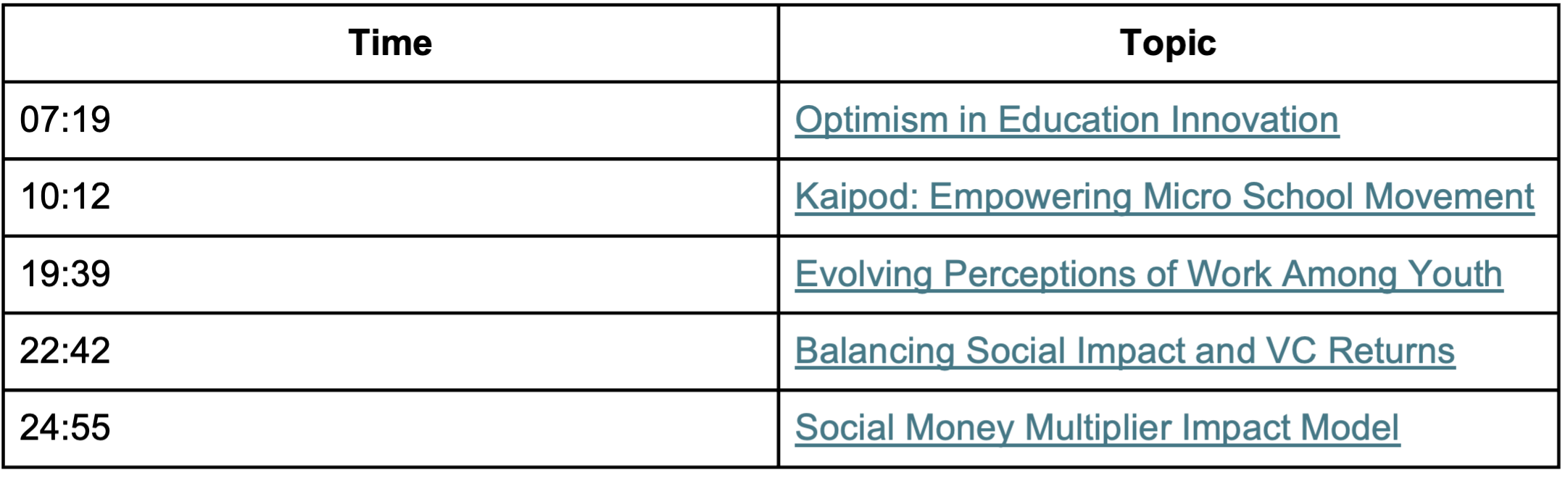

Optimism in Education Innovation

Michelle Rhee

Yep. Yeah. So I, you know, I am in education, but what I have found to be sort of most fascinating about the work is that I got to a place in education, quite frankly, where I had become a curmudgeon. I was like, you know, what? We actually know in this country what we need to do, and we just refuse to do it. And I don't know that anything is ever going to change. And so I was pretty pessimistic about what the possibilities were to fundamentally change the education landscape, the public education landscape in this country. And I find that now, I mean, what better job could you have that every day I get to meet with people who are pitching me and they feel like they're going to change the world and make it a better place through this idea that they have. And you know, sometimes I'm like, love the idea, not sure about the founder.

Sometimes I'm like, oh, amazing founder. I'm not sure about the idea. Right. But every now and again I meet people who I genuinely think, oh my goodness, like you could seriously change the game. And it's just incredibly inspiring and it has turned me into an optimist again.

Michael Horn

That's awesome. I mean, I think that's the. It's interesting. You're probably in a very similar place to me at the moment in terms of outlook on K12 education, which is kind of pessimistic about the changing the existing system. But I see all these things coming from the outside and the entrepreneurs and I know you all have Kaipod learning in your portfolio and it does make me optimistic about this movement that's growing on these fringes that's sort of outside, if you will, the traditional discourse of ed reform. And so I'm sort of curious. You have Kaipod learning, like what's the basic hypothesis certainly behind that investment, but maybe more broadly in the fund. Right.

Like what sorts of things are you guys looking to back?

Michelle Rhee

Yeah. So the thesis of the firm is that market forces can significantly accelerate the economic mobility of the populations that we're focused on when done in the right way. So as long as a company aligns with that thesis, we're sector agnostic. We have portfolio companies in housing, healthcare, govtech, fintech, education, workforce and, and more. And so. And we also have something called the social money multiplier. This is a model that Roland came up with which basical