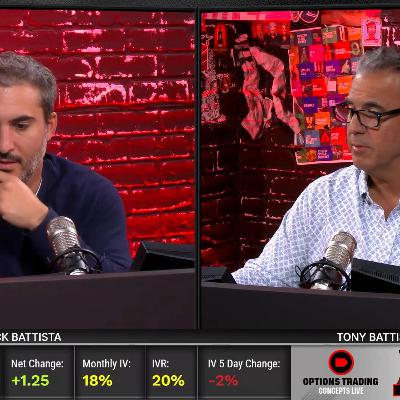

Market Measures - October 20, 2025 - When Traders Panic: What IVR and Volume Reveal

Update: 2025-10-20

Description

A market measure segment analyzed how volatility and trading volume interact in SPY over a five-year period. The research confirms that when implied volatility (IVR) spikes, trading volume typically increases, signaling genuine fear in markets.

The most significant finding: days with both high IVR and high volume create ideal short-volatility setups, as these conditions typically lead to rapid volatility contraction within 24-48 hours. This pattern creates what traders call "the juiciest short vol opportunities."

The study reinforces that crowd behavior drives the volatility cycle, once everyone reacts to market panic, there's no one left to sell, creating mean reversion. Low IVR periods offer minimal reward for volatility sellers due to limited expected movement.

The most significant finding: days with both high IVR and high volume create ideal short-volatility setups, as these conditions typically lead to rapid volatility contraction within 24-48 hours. This pattern creates what traders call "the juiciest short vol opportunities."

The study reinforces that crowd behavior drives the volatility cycle, once everyone reacts to market panic, there's no one left to sell, creating mean reversion. Low IVR periods offer minimal reward for volatility sellers due to limited expected movement.

Comments

In Channel