ORLY-EP0167A - Money: The Trump Tax Plan

Description

ORLY-EP0167A - Money: The Trump Tax Plan

Welcome to ORLYRADIO #167b recorded Friday, October 6th, 2017 - where we dismantle the current events for your edutainment through mostly rational conversations that make you go ‘Oh Really’! I’m your host Andy Cowen with my usual suspects, Daniel Atherton, Stephen Griffith, and Amber Biesecker.

We make mistakes. Please, if you find one, pause the podcast, and send us a note. orlyradiopodcast@gmail.com or phone it in 470-222-6759

Thank you to our Patreon Supporters!

Donald Davis

Melissa G.

Henry

Daniel Duncan (Problem Addict Podcast)

Following the Money - Market Watch:

<figure class="

sqs-block-image-figure

intrinsic

">

</figure>

http://money.cnn.com/data/markets/

https://finance.yahoo.com/quote/%5EDJI/history/

Aug: - Week 4 - 8/25/17:

Dow closed at 21,813.67 UP 139.16 DOWN 16.64 from July

Nasdaq closed at 6,265.64 UP 49.11 DOWN 109.04 from July

S&P closed at 2,443.05 UP 17.5 DOWN 29.05 from July

Sept: Week 5 - 9/29/17: https://www.zacks.com/stock/news/277326/stock-market-news-for-sep-29-2017

Dow closed at 22,381 UP $567.33 From August

Nasdaq closed at 6,453.45 UP $187.81 From August

S&P closed at 2,510.06 UP $67.01 From August

October Friday Closing changes week to week:

OCT:: Week 1 - 10/06/17: https://www.zacks.com/stock/news/278014/stock-market-news-for-oct-6-2017

Dow closed at 22,775.39 UP $394.39

Nasdaq closed at 6,585.36 UP $131.91

S&P closed at 2,552.07 UP $42.01

From Zacks: “The S&P 500 breached a 20 year record on Thursday after hitting record close for six days on the trot. Also, the Dow and the Nasdaq notched up all-time highs. Meanwhile, the House of Representatives passed a $4.1 trillion budget bill for 2018. This package also includes $1.1 trillion for non-entitlement spending which further includes the U.S. defense budget for 2018.”

Following the Money - OIL

<figure class="

sqs-block-image-figure

intrinsic

">

</figure>

http://www.nasdaq.com/markets/crude-oil.aspx

WTI (NYMEX) Price

July:

Week 4: $49.71 USD UP $3.94 From last week, UP $5.48 from the top of the month.

August:

Week 4: $47.87 USD DOWN $0.27 From last week, DOWN $1.81 from July.

September:

Week 5: $51.67 USD UP $1.01, UP $3.80 from August.

October:

Week 1: $49.29 USD DOWN $2.38 Back to July Prices.

Following the Money - Exchange Rates

<figure class="

sqs-block-image-figure

intrinsic

">

</figure>

International Monetary Fund (IMF) XDR/SDR Basket Currencies

Five most-traded currencies in the foreign exchange market referenced against the US Dollar.

July

Week 4: $1 USD = €0.85 Eur = ¥6.74 CNY = ¥110.63 JPY = 0.76 GBP = 0.00036 Bitcoin

August:

Week 4: $1 USD = €0.84 Eur = ¥6.65 CNY = ¥109.37 JPY = 0.77 GBP = 0.00023 Bitcoin

September:

Week 5: $1 USD = €0.85 Eur = ¥6.64 CNY = ¥112.46 JPY = 0.75 GBP = 0.00024 Bitcoin

October:

Week 1: $1 USD = €0.85 Eur = ¥6.57 CNY = ¥112.63 JPY = 0.77 GBP = 0.00023 Bitcoin

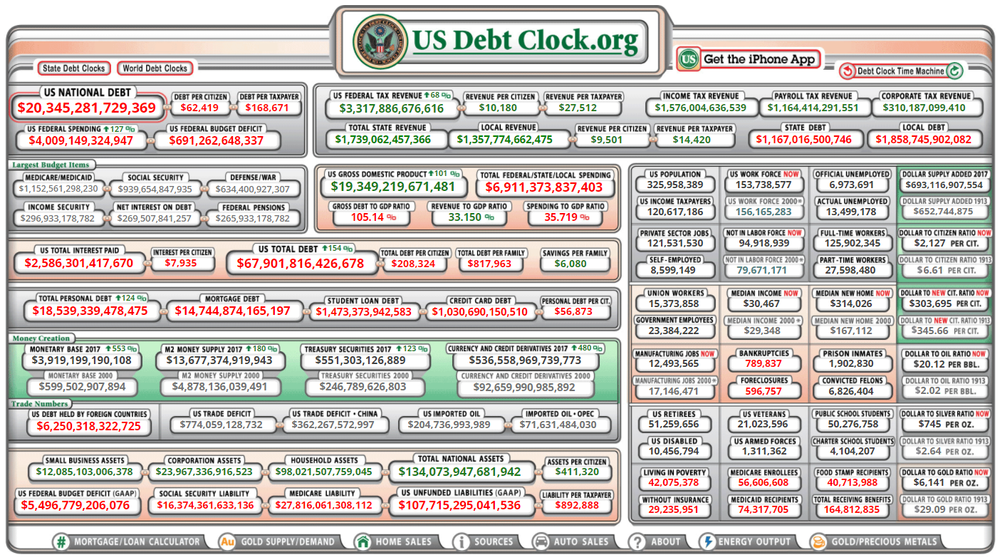

US National Debt Ticker

Watch that puppy grow! http://www.usdebtclock.org/

<figure class="

sqs-block-image-figure

intrinsic

">

</figure>

July 28: $19,967,603,583,206

August 25: $19,974,087,991,615 UP $68,048,025

September 29: $20,178,001,744,606 UP $5,251,427,833

October 6th: $20,345,281,729,369 UP $167,279,984,763

<figure class="

sqs-block-image-figure

intrinsic

">

<figcaption class="image-caption-wrapper">

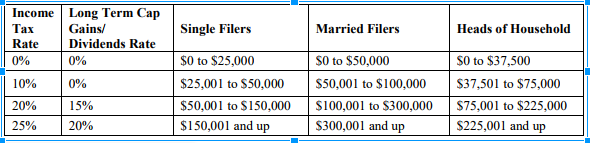

The proposed Brackets. A higher bracket is possible through Congressional action.

</figcaption>

</figure>

The Trump Tax Plan https://assets.donaldjtrump.com/trump-tax-reform.pdf

The Standard Deduction (as in non-itemized) will double. $12k for singles, $24k married.

Alternative Minimum (AMT)is removed

Increased Child Tax Credit (Under age of 17)

Adult Dependent tax credit of $500

Removal of the Estate Tax (or as they would like the american farmer to believe, the Death tax)

Deductions for State Income Tax are going away (Double taxation on income??)

Corporate Tax Rate is being cut from 35% to 20%

S-Corp an small business taxes are capped at 25%

How they propose to be “Fiscally responsible” and “The Trump tax cuts are fully paid for by”:

Reducing or eliminating deductions and loopholes available to the very rich, starting by steepening the curve of the Personal Exemption Phaseout and the Pease Limitation on itemized deductions. The Trump plan also phases out the tax exemption on life insurance interest for high-income earners, ends the current tax treatment of carried interest for speculative partnerships that do not grow businesses or create jobs and are not risking their own capital, and reduces or eliminates other loopholes for the very rich and special interests. These reductions and eliminations will no