Shutdown, Executive Order 14210, Planned RIF, Setting The Stage, Peace Through Strength – Ep. 3741

Description

Watch The X22 Report On Video

2 videos found

<figure class="wp-caption alignleft" id="attachment_27284" style="width: 300px;">

<figcaption class="wp-caption-text" id="caption-attachment-27284">Click On Picture To See Larger Picture</figcaption></figure>

<figcaption class="wp-caption-text" id="caption-attachment-27284">Click On Picture To See Larger Picture</figcaption></figure>Trump is now moving forward with additional tariffs, the other tariffs have proven not to cause inflation like the Fed had said and now Trump is free to move with additional tariffs. Switzerland wants to help with gold refining to help with their tariffs. Gold could be revalued and this will change everything. The [DS] believe they have trapped Trump in a Gov shutdown. This is being driven by Soros and Trump was expected this. He created EO back in Feb for this very reason to drain the swamp quickly. Trump is now setting the stage to shutdown their riots and stop WWIII they are trying to start. Trump has issued a peace plan with Gaza and Israel, it is now up to the [DS] stated funded terrorists. Peace through Strength.

Economy

Switzerland’s pitch isn’t just gold—Bern is offering a U.S. gold refinery (or capacity expansion) plus more U.S.-made pharma, defense purchases, and LNG deals to win relief from the 39% tariff imposed Aug. 7; talks remain confidential but active.

— Briefing Block (@briefing_block_) September 29, 2025

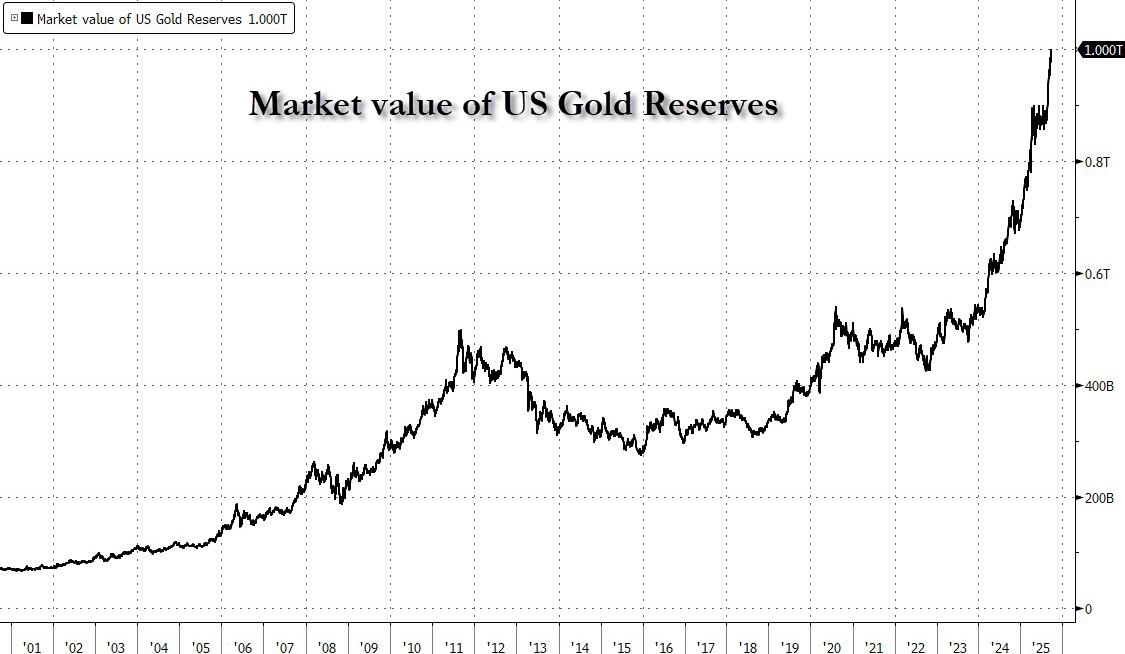

Gold Revaluation Imminent? US Treasury Hoard Tops $1 Trillion For First Time

- On the back of a 45% surge in the price of gold this year, the US Treasury’s hoard of the barbarous relic has surpassed $1 trillion in value for the first time in history.

- That is more than 90 times what’s stated on the government’s balance sheet and is reigniting speculation that Treasury Secretary Bessent could revalue (mark to market) the massive pile of precious metal

- Unlike most countries, the US’s gold is held by the government directly, rather than the central bank.

- The Fed instead holds gold certificates corresponding to the value of the Treasury’s holdings, and credits the government with dollars in return.

- That means, as we detailed previously, that an update of the reserves’ value in line with today’s prices would unleash roughly $990 billion into the Treasury’s coffers, dramatically reducing the need to issue quite so many Treasu

![Obama Panics Over The Military, [DS] Weakened, Strings Have Been Cut, Peace WW – Ep. 3751 Obama Panics Over The Military, [DS] Weakened, Strings Have Been Cut, Peace WW – Ep. 3751](https://x22report.com/wp-content/uploads/2025/10/podcast_art-8-300x298.jpg)

![[DS] Panics, Shutdown Not Working,Judicial System Tested,Swamp Draining,Message Received – Ep. 3750 [DS] Panics, Shutdown Not Working,Judicial System Tested,Swamp Draining,Message Received – Ep. 3750](https://x22report.com/wp-content/uploads/2025/10/podcast_art-7-300x298.jpg)

![[DS] Panic, The People Are Being Prepared, House Cleaning, Caught Them All, Red October – Ep. 3747 [DS] Panic, The People Are Being Prepared, House Cleaning, Caught Them All, Red October – Ep. 3747](https://x22report.com/wp-content/uploads/2025/10/podcast_art-4-300x298.jpg)

![[DS] Is Fighting Back,They Are Forming The Insurrection,Trump Setup The Path To Destruction – Ep. 3746 [DS] Is Fighting Back,They Are Forming The Insurrection,Trump Setup The Path To Destruction – Ep. 3746](https://x22report.com/wp-content/uploads/2025/10/podcast_art-3-300x298.jpg)

![[DS] Pushing A Hybrid War, Trump Is Using The Shutdown To Defund The [DS], Timing, Peace – Ep. 3745 [DS] Pushing A Hybrid War, Trump Is Using The Shutdown To Defund The [DS], Timing, Peace – Ep. 3745](https://x22report.com/wp-content/uploads/2025/10/podcast_art-2-300x298.jpg)

![Shutdown Distracts From The [DS] WWIII Push, Right On Schedule, No War, We Will Win – Ep. 3744 Shutdown Distracts From The [DS] WWIII Push, Right On Schedule, No War, We Will Win – Ep. 3744](https://x22report.com/wp-content/uploads/2025/10/podcast_art-1-300x298.jpg)

![Eric Trump/Clay Clark – Bitcoin Is Digital Gold,[DS]/D’s Push Their Attacks,The Country Is Waking Up Eric Trump/Clay Clark – Bitcoin Is Digital Gold,[DS]/D’s Push Their Attacks,The Country Is Waking Up](https://x22report.com/wp-content/uploads/2025/09/x22_studio_splash_screen_eric_clay-150x150.jpg)

![As The [DS] Is Indicted,[DS] Unleashes Antifa,Trump Counters With The Military,Buckle Up – Ep. 3740 As The [DS] Is Indicted,[DS] Unleashes Antifa,Trump Counters With The Military,Buckle Up – Ep. 3740](https://x22report.com/wp-content/uploads/2025/09/podcast_art-19-300x298.jpg)

![Sheriff Mack – The [DS] One World Gov Is Over, Trump Is Shifting Us Back To The Constitution Sheriff Mack – The [DS] One World Gov Is Over, Trump Is Shifting Us Back To The Constitution](https://x22report.com/wp-content/uploads/2024/12/x22_studio_splash_sheriff_mack-150x150.jpg)

![[DS] Is Moving From An Info War To A Physical War,Insurrection,[C] Before [D],The Start – Ep. 3739 [DS] Is Moving From An Info War To A Physical War,Insurrection,[C] Before [D],The Start – Ep. 3739](https://x22report.com/wp-content/uploads/2025/09/podcast_art-18.jpg)

![[DS] Pushed Down The Path Of War, Anti-Scale Fencing In DC, Judgement Is Coming – Ep. 3738 [DS] Pushed Down The Path Of War, Anti-Scale Fencing In DC, Judgement Is Coming – Ep. 3738](https://x22report.com/wp-content/uploads/2025/09/podcast_art-17.jpg)

![[DS] Will Try To Shift Narrative To Weather The Storm, The Problem, We Are The Storm – Ep. 3736 [DS] Will Try To Shift Narrative To Weather The Storm, The Problem, We Are The Storm – Ep. 3736](https://x22report.com/wp-content/uploads/2025/09/podcast_art-15.jpg)

![Cyber Attack On EU Airports,[DS] 16 Year Plan Is Being Shutdown,Justice Must Be Served,Now-Ep. 3735 Cyber Attack On EU Airports,[DS] 16 Year Plan Is Being Shutdown,Justice Must Be Served,Now-Ep. 3735](https://x22report.com/wp-content/uploads/2025/09/podcast_art-14.jpg)