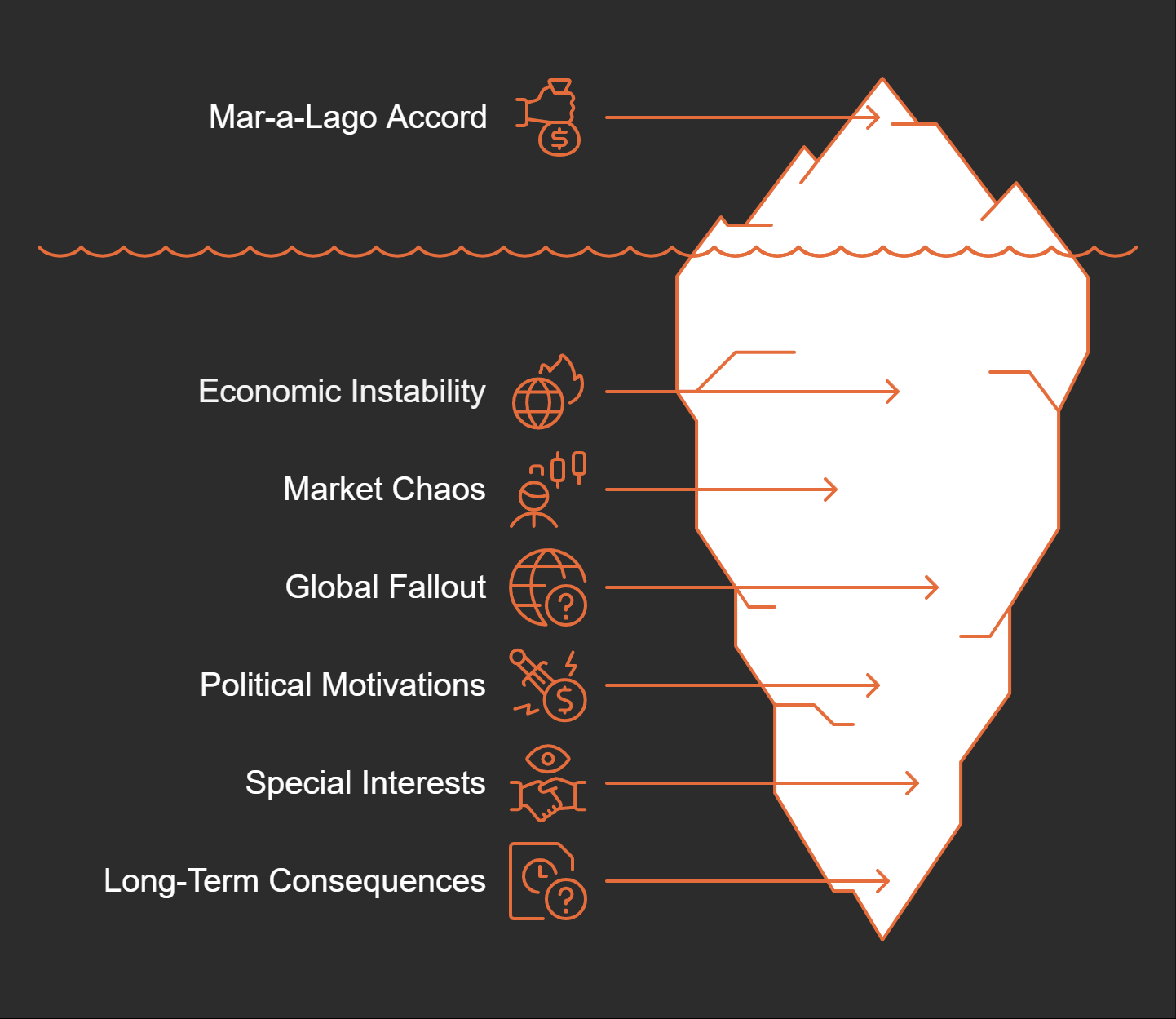

The Mar-a-Lago Accord: Echoes of Economic History

Description

In 1985, an intense oratory echoed through the opulent halls of New York’s Plaza Hotel, where finance ministers believed they held the reins of the global economy in their hands. I can’t help but recall my own trepidation observing the stock market crash on Black Monday just two years later, a stark reminder of the fragility inherent in economic interventions. Today, as discussions around the Mar-a-Lago Accord emerge, I find myself thinking, has history forgotten its lessons?

Thanks for reading Geopolitics Talk! Subscribe for free to receive new posts and support my work.

The Past Haunts the Present: Lessons from the Plaza Accord

In 1985, a pivotal moment in global finance occurred at the Plaza Hotel in New York. Finance ministers from the world's largest economies gathered to sign an accord that aimed to deliberately weaken the US dollar. They believed this would save American manufacturing and fix trade imbalances. However, the outcome was far from what they envisioned. Just two years later, the 1987 Black Monday crash wiped out 22% of the stock market in a single day. Could we be witnessing a similar situation today?

The Ghost of the Plaza Accord

Reflecting on the Plaza Accord, we can't help but remember Mark Twain’s words:

“History doesn't repeat itself, but it often rhymes.”

This sentiment rings true when we consider the recent economic discussions surrounding the Mar-a-Lago Accord. Both plans share a dangerous premise—the manipulation of currency. But history has shown us that such interventions can lead to chaos.

Consequences of Currency Manipulation

Let’s break down what happened after the Plaza Accord:

* Initial Stability: For a short period after the accord, markets appeared stable. This, however, was merely a facade.

* Investor Nervousness: The manipulation of the dollar created uncertainty. Investors felt uneasy, leading to a massive sell-off.

* Market Collapse: On that fateful day in October, the Dow Jones plummeted. It was a stark reminder of how currency manipulation can destabilize markets.

Investor Psychology and Market Reactions

What drives investor behavior? Often, it’s fear and uncertainty. After the Plaza Accord, many investors panicked. They sold off assets as if their financial futures depended on it—because they did. The psychological impact of market manipulation is profound. The fear of losing money can lead to irrational decisions, causing further market instability.

In today’s economic climate, we see echoes of the past in proposed policies that aim to artificially manipulate the dollar's value. The idea that we can control global markets, much like turning a dial, is naive at best. When will we learn that such interventions often backfire?

As we move forward, we must remember the lessons of the Plaza Accord. The consequences of manipulating currency are not just theoretical; they are real and damaging. In the quest for short-term gains, we risk long-term chaos. Let's not forget: history has a way of repeating its lessons if we fail to heed them.

Contradictions Abound: The Flawed Logic of the Mar-a-Lago Accord

When we look at the proposed Mar-a-Lago Accord, the contradictions are as glaring as a neon sign in the dark. It's hard to believe that, in an age of advanced economic theories, we are revisiting strategies that have failed in the past. Let's unpack the economic contradictions that this plan presents.

Unpacking the Economic Contradictions

The first contradiction lies in the strategy itself. The plan aims to weaken the dollar to enhance American manufacturing, yet it also proposes massive tariffs. But here's the kicker: tariffs actually increase the demand for the dollar. How can one expect to devalue the currency while simultaneously strengthening it? It's like trying to hold onto a rope from both ends—something has to give.

Stephen Miran, an expert at Hudson Bay Capital, argues that the strong dollar is hurting U.S. exports. While I can see where he's coming from, the solution he proposes doesn’t add up. Tariffs on imports will only amplify the dollar's value, as importers will need more dollars to pay those tariffs. It's an economic paradox that leaves us scratching our heads.

The Implications of Tariffs on Currency Value

Tariffs are often seen as a way to protect domestic industries. However, they come with unintended consequences. When tariffs are imposed, goods become more expensive for consumers. This leads to an increased cost of living, hitting lower and middle-income families the hardest. Think about it: if you increase the price of goods, who do you think pays the price? Spoiler alert: it’s not the foreign producers.

In essence, the Mar-a-Lago Accord appears to be a gamble, where the odds are stacked against the average American. The promise of revitalized manufacturing jobs feels more like a mirage. History shows us that when tariffs go up, consumer prices follow suit. What’s left in the end? A potential economic downturn driven by higher costs and less purchasing power.

Potential Outcomes of Conflicting Policies

So, what can we expect from these conflicting policies? The outcomes could be dire. Economists like

Professor Dr. Christian Rieck

have pointed out that this kind of economic incoherence could lead to instability. When you mix currency manipulation with protective tariffs, you are essentially inviting chaos into the financial system.

In summary, the Mar-a-Lago Accord isn’t just a flawed plan; it’s a blueprint for economic confusion. The contradictions within it signal a lack of understanding of global markets. This isn't just about politics; it's about the economic future of everyday Americans.

The Ripple Effect: Tariffs and Their Forgotten Costs

Understanding the Economic Burden

When we talk about tariffs, we must understand their impact. Tariffs are a tax on consumers; no one else pays them. This statement rings true, as the economic burden falls directly on American households. Every time the government imposes a tariff on imported goods, those costs trickle down to us—the consumers.

Think about it: when tariffs make foreign products more expensive, the price tags on our favorite goods rise too. That's money out of our wallets. If you’re like me, you feel it every time you go grocery shopping or fill up your cart online.

Lessons from Trump's Tariffs

During Trump's presidency, tariffs were introduced with the promise of revitalizing American manufacturing. But what really happened? The data tells a stark story. In fact, a comprehensive Federal Reserve study revealed that the average American household paid over $800 annually due to these tariffs. That’s not chump change!

* Higher prices on everyday products.

* Manufacturing jobs didn’t surge back as promised.

* Many companies relocated, but overall employment remained static.

When tariffs were slapped on Chinese imports, American consumers bore the brunt. So, how can we trust new tariff proposals to be any different? The history of tariffs during this period serves as a cautionary tale, showing us the truth behind the promises.

Retaliatory Measures: A Global Perspective

Let’s not forget the international response. When the U.S. imposed tariffs, countries like China retaliated. They didn’t just roll over; they hit back with their own tariffs targeting American products. This tit-for-tat escalated tensions and decreased demand for U.S. goods abroad.

American farmers, for example, found themselves in a tough spot. They faced decreasing exports and required government bailouts to stay afloat. Is this the kind of economic stability we want? It’s clear: tariffs can create a ripple effect, leading to unintended consequences that harm American workers, families, and businesses.

Wrapping It Up

As we examine the impact of tariffs, we should keep in mind the lessons of the past. Tariffs increase costs for consumers, fail to deliver on promises, and can spark retaliatory actions from international partners. The question remains: how long can we ignore the hidden costs of tariffs on everyday American households?

A Dangerous Game: Weaken the Dollar, Risk Global Stability

The Implications of Weakening the Dollar

When we discuss the U.S. dollar's position as the world's reserve currency, we must understand its significance. It’s not just a piece of paper; it’s the backbone of global trade. Approximately 60% of the world's foreign exchange reserves are held in dollars. This means that weakening the dollar can have severe implications. What happens when the foundation of a building is compromised? The entire structure is at risk.

Currency manipulation can create a ripple effect, destabilizing not just the U.S. economy but also global markets. When you mess with the reserve currency, you're playing with fire. - An economic analyst’s words ring true here. If the dollar weakens, other nations may lose faith in it, prompting them to seek alternatives. Wouldn't it be wiser to maintain a strong dollar and global trust?

Potential Global Reactions and Economic Fallout

History has shown us the dangers of manipulating currency values. Take the Plaza Accord of 1985. It aimed to weaken the dollar, and what followed? Market chaos, leading