The Simple Side's Saturday Sendout: No Major Portfolio Changes | Impressive Portfolio Returns

Description

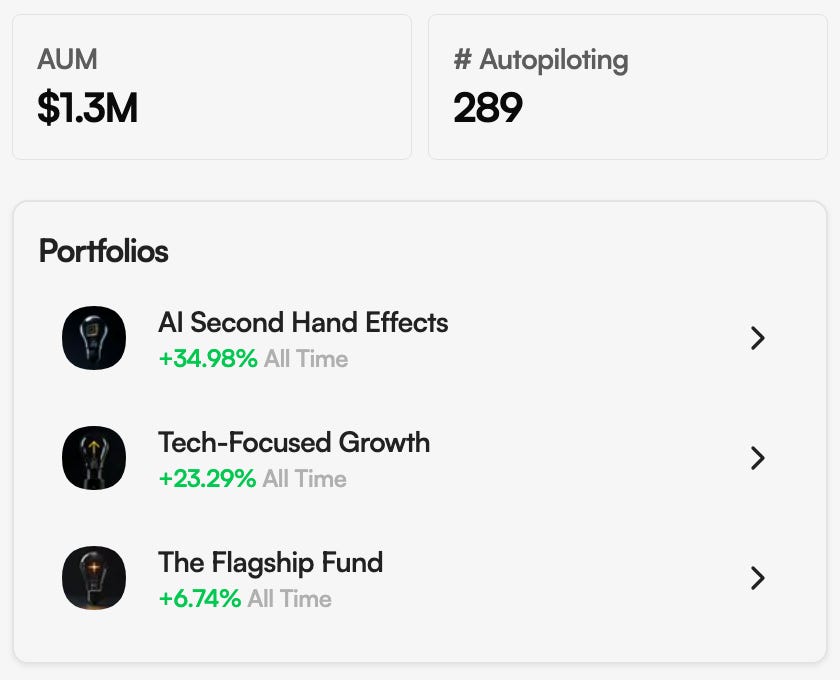

Quick Reminders:Our disclosure is in the email footerPortfolio copy trading is available here

To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout. As a reminder, you can find our podcast on YouTube, Spotify, Apple Music, and here on Substack!

Updates

The new format going forward will look similar to this in our weekly updates:

* FREE

* Market Commentary & News

* Quick Insider Trade Updates

* Interesting Trade Ideas

* Portfolio Performance

* PAID

* Portfolio Holdings & Updates

* Portfolio Strategies, Updates & New Bets

* Our Weekly Picks

* Mergers & Acquisitions Picks

* Top Stock Picks

As a reminder, all of this will be accessible to you via copy trading. Remember that these portfolios ARE NOT GET-RICH-QUICK portfolios. I am focused on long-term market outperformance.

There will be updates made to the paid subscriber spreadsheet as well, but I will likely update everyone on those when they are completed!

A few quick updates on all of the thoughts that you have been submitting.

* I have added a spot on my paid subscriber spreadsheet to track positions across all my portfolios that are “overextended” or are “oversold” and could be trimmed or added to in your personal portfolios.

* Someone was also asking for “Morning Tea” which I assume means that they want to see daily morning market news. Well… I have that already! You can go over to The Simple Side Daily and subscribe there!

Market Commentary

The big picture

* Indices: Nasdaq +2.0%, S&P 500 +1.6%, Dow +1.0% (equal-weight lagged again). Tech did the heavy lifting—semis popped and Oracle stole the show.

* Rates & odds: Headline PPI +0.4% m/m and initial claims up to 263k reinforced the “cooling, not collapsing” narrative. Markets kept a near-lock on a 25 bp Fed cut this month and left the door open for another by year-end.

* Tone: Mega-caps outran everything else; cyclicals and energy were choppy with oil hovering near $62–$64.

Tech & AI — the week’s horsepower

* Oracle (ORCL): With remaining performance obligations at $455B (up 359% y/y), Oracle said it’s scaling cloud infrastructure for AI customers (think training clusters, inference at the edge). Translation: multi-year visibility plus room to raise capacity pricing if demand stays hot.

* Synopsys (SNPS): With its purchase of Ansys now complete, Synopsys guided FY25 revenue to $7.03–$7.06B and said it’s steering chip-design IP toward AI, autos and high-speed connectivity, while trimming lines snarled by export controls and foundry bottlenecks. That’s code for “more dollars where demand is compounding, less where geopolitics slow POs.”

* TSMC (TSM) & the supply chain: August sales +34% y/y and sequentially higher—evidence that AI silicon demand is still outrunning capacity. ASE (ASX) echoed strength in assembly/test; Texas Instruments (TXN) talked up data-center revenue potentially jumping ~50% into 2025 as AI buildouts need a lot more power, sensing and analog.

* Adobe (ADBE): Record Q3 ($5.99B revenue) and a guidance lift as AI features (Acrobat AI Assistant et al.) pushed AI-influenced ARR >$5B. The story here isn’t just cool demos—it’s higher seat expansion and premium SKU mix.

* Microsoft & OpenAI: A new pact lets OpenAI restructure into a for-profit while keeping Microsoft’s access to the tech. Expect faster capital raises on OpenAI’s side and more consumption for Azure on Microsoft’s.

EVs & autos — growth meets growing pains

* Rivian & Tesla: Rivian recalled 24k vehicles (software fix for Hands-Free Highway Assist); Tesla lost another senior engineer as leadership churn continues. Software credibility and talent retention matter when you’re selling autonomy as a feature.

* Ford: 1.46M vehicles recalled for rear camera issues—costly, but more importantly it’s yet another reminder that legacy quality control remains under the microscope.

* XPeng: Unveiled the Next P7 in Europe (durability + AI focus) while separately recalling 47,490 P7+ sedans in China for a steering gear replacement. Global expansion only works if home-market reliability cooperates.

* NIO: Announced an equity raise (~$1B) to fund core EV tech and its swapping/charging network. Dilutive near-term, but it buys runway to keep the ecosystem moving.

* Hyundai/LG Energy JV: A U.S. immigration raid paused construction at the Georgia battery site—an unexpected supply-chain speed bump for an otherwise aggressive U.S. EV footprint.

Energy, resources & industrials — rewiring the world

* SpaceX ↔ EchoStar: SpaceX is buying EchoStar’s AWS-4 + H-block spectrum for ~$17B (half cash, half SpaceX stock, plus it covers $2B of EchoStar interest through Nov ’27). This gives Starlink cellular-grade spectrum for Direct-to-Cell service; for EchoStar it’s a de-leveraging event with growth optionality instead of bond math.

* Apollo ↔ RWE / Amprion: €3.2B equity commitment to back RWE’s 25.1% stake in grid operator Amprion. Why care? Regulated grid assets throw off stable dividends while Europe’s electrification needs colossal capex.

* Baker Hughes: Won liquefaction equipment for Rio Grande LNG Train 4—more evidence U.S. LNG buildout momentum is intact even with softer spot prices.

* Chevron: Plans to lean into South Korea petrochemicals via GS Caltex—not just fuels, but higher-margin materials as the refining cycle normalizes.

* Freeport-McMoRan: Temporarily halted operations at Grasberg to search for workers after a mudflow—human priority first, and near-term copper volumes likely trimmed.

* Energy Fuels: U.S.-processed rare earths showed up in EV magnets—a small technical win with big strategic implications for a China-light supply chain.

Deals, capital & corporate moves — the money map

* PNC x FirstBank (Colorado): PNC agreed to buy FirstBank for $4.1B (cash/stock), aiming to triple its branch footprint in Colorado. In plain English: PNC wants to be the go-to regional bank in one of the country’s fastest-growing economies, and deposits are the prize.

* Anglo American ↔ Teck (rumored ~$20B): Would super-charge Anglo’s copper exposure just as grids, EVs and AI data centers gobble it up.

* Phillips 66: Buying the remaining 50% of WRB Refining from Cenovus for $1.4B, taking full control of Wood River & Borger—simpler governance, cleaner allocation, better utilization.

* Exxon Mobil: Acquiring U.S. assets of Superior Graphite to make synthetic graphite domestically by 2029—critical battery material without Chinese dependence.

* Barrick: Selling Hemlo (Canada) for up to $1.09B to refocus on Tier-One gold/copper; Iberdrola lifting Neoenergia stake to 84% to deepen regulated networks in Brazil.

* Figure (FIGR) IPO: $787.5M raised; Klarna priced at $40/sh (valued $15.1B); Alibaba upsized with $3.17B zero-coupon converts; Nebius lined up $3.75B debt/equity to scale AI data centers (tied to its Microsoft deal).

* Veritone, Avidity, Astronics: More raises across AI and aero-sat niches—dilutive, yes, but they keep the growth engines funded into 2026.

Health care & life sciences — pipeline beats and portfolio pruning

* Eli Lilly: Late-stage Jaypirca data in leukemia extended <stro