The Simple Side's Saturday Sendout: Portfolio Updates & Upcoming Trades

Description

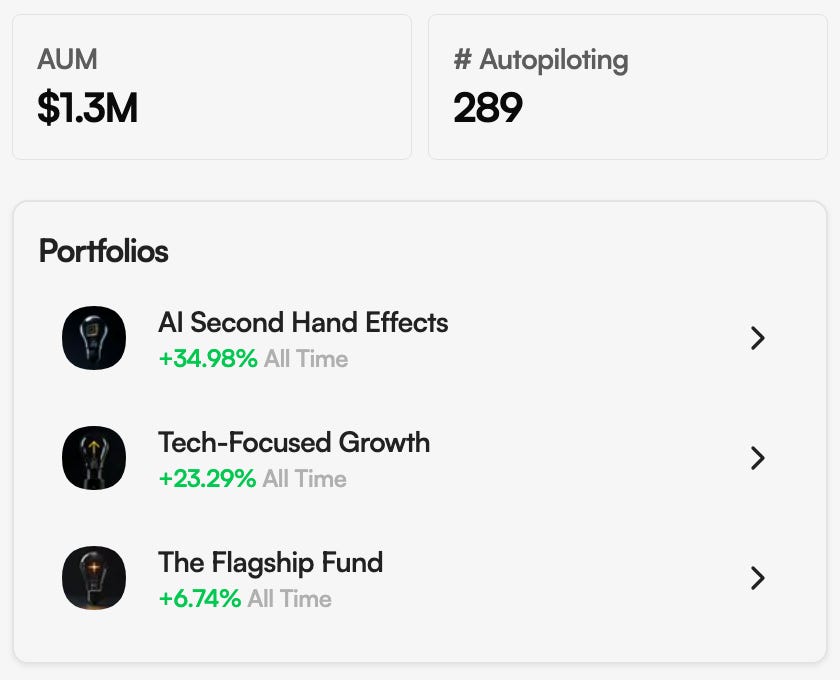

Quick Reminders:Our disclosure is in the email footerPortfolio copy trading is available here

To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout. As a reminder, you can find our podcast on YouTube, Spotify, Apple Music, and here on Substack!

Updates

The new format going forward will look similar to this in our weekly updates:

* FREE

* Market Commentary & News

* Quick Insider Trade Updates

* Interesting Trade Ideas

* Portfolio Performance

* PAID

* Portfolio Holdings & Updates

* Portfolio Strategies, Updates & New Bets

* Our Weekly Picks

* Mergers & Acquisitions Picks

* Top Stock Picks

As a reminder, all of this will be accessible to you via copy trading. Remember that these portfolios ARE NOT GET-RICH-QUICK portfolios. I am focused on long-term market outperformance.

There will be updates made to the paid subscriber spreadsheet as well, but I will likely update everyone on those when they are completed!

Market Commentary

The week in one glance

* After a choppy Tuesday, stocks firmed into week-end: S&P 500 up WTD (fresh intraday highs Friday morning), Nasdaq +1.1%, Dow -0.3%. Small/mid-caps finally joined the party (Russell 2000 +1.0%, S&P Mid Cap 400 +1.3%), a healthier look for breadth as the VIX spiked midweek and faded.

* Yields eased by Friday (≈4.08% 10-yr, ≈3.6% 2-yr) as labor data cooled and September cut odds pressed into the high-90s. Oil slipped toward $63 even as gold stayed firm; call it “soft landing with a safety net.”

Macro, rates & policy

* A softer ADP print, three straight months of contraction in ISM services employment (46.5), and 22k nonfarm payrolls with 4.3% unemployment kept the “one-and-done” cut narrative intact. Markets are effectively pricing a quarter-point trim in September because the Fed likes easing when the job market cools without breaking.

* A U.S. appeals-court challenge to tariff legality injected trade-policy noise; current tariffs remain into mid-October with likely appeals ahead. That’s not a forecast—just a reminder that supply chains dislike suspense.

Leadership & sectors

* Communication Services ran the table (+5.1% WTD) as Alphabet won breathing room on Chrome/search defaults, dragging mega-cap peers higher.

* Energy sagged (-3.5% WTD) even with crude’s early-week pop; defensives were mixed and Financials lagged (-1.7%) on the “lower yields, later NIM” math. Under the hood, equal-weight and small-caps improving is exactly what you want to see if you’re rooting for a durable tape.

AI, chips & cloud — the build-out keeps building

* Broadcom posted record results, a 63% YoY jump in AI semi sales, a $10B AI infra order from a new customer, and a fat backlog—evidence that networks and custom silicon are the picks-and-shovels of this cycle. OpenAI teaming with Broadcom on an in-house chip underlines the same theme: hyperscalers want control of their bill of materials, not just more GPUs.

* Credo (active electrical cables) and Ciena (optical) popped on strong prints tied to bandwidth-hungry AI clusters; Texas Instruments reminded everyone autos/industrial are still digesting inventory. Translation: AI spend is secular, but not every end-market is on the same calendar.

* Amazon kept stacking chips and real estate—ramping Trainium with Anthropic while opening a 100% renewables-powered AWS New Zealand region backed by NZ$7.5B in capex. The cloud isn’t done; it’s getting closer to customers.

Deals, capital moves & corporate resets

* Kraft Heinz will split into two tax-free public companies to simplify the story and capital allocation; Elliott took a ~$4B swing at PepsiCo, a nudge that “do more, faster” plays well when share gains stall.

* Air Lease agreed to a $65-per-share take-private backed by Sumitomo; lessors like steady, long-dated cash flows, and so do private buyers.

* SS&C bought South Africa’s Curo Fund Services; Coincheck moved for Paris-based Aplo; Aon is selling NFP’s wealth arm back to Madison Dearborn—everyone’s pruning to the core.

* On the balance-sheet front: Lyft raised $450M via converts (capped calls to tame dilution); BILL drew Starboard in at ~8%; T. Rowe Price rallied on Goldman’s planned $1B stake. The message: capital still chases fee streams and operating leverage.

Autos, EVs & autonomy

* Tesla’s India debut reportedly logged ~600 orders so far—limited cities, premium pricing, and early-days logistics make for a slow on-ramp; meanwhile BYD’s price-war squeeze clipped Q2 profits even as revenue rose, and NIO guided stronger Q3 deliveries while still burning cash. Competition is doing what competition does.

* Toyota put €680M into a Czech BEV line (first in Europe), Qualcomm + BMW launched Ride Pilot, and Waymo won the green light to operate at San Jose’s airport—less sci-fi, more route map.

Energy, resources & industrials

* Exxon’s Guyana machine keeps scaling after election clarity; TotalEnergies grabbed Nigerian offshore exploration licenses; Uranium Energy stood up a unit to explore U.S. refining/conversion—vertical integration meets energy security.

* In Canada, Strathcona took an 11.8% stake in MEG to contest the Cenovus deal; Tourmaline held its CAD 0.50 dividend; Teck launched an ops review around QB and tailings.

* Boeing landed 30 more 737-8s (Macquarie) while Alaska Air upsized to 787-10s—capacity and fuel burn still matter when international demand stays sticky.

* Niche but telling: Kraken Robotics booked $13M of sonar/battery orders, Dorchester Minerals added Colorado acreage, BW LPG sold an older tanker at a gain. Fleet discipline isn’t just for airlines.

Health care & life sciences

* United Therapeutics surged on a late-stage win for Tyvaso in IPF—label expansion talk is now justified revenue math. BioNTech posted positive Phase 3 breast-cancer data, Novartis inked a $5.2B cardio collaboration with Argo, and Medtronic’s Hugo robot delivered clean hernia-repair outcomes. When macro jitters rise, data wins the multiple.

* HealthEquity raised guidance as HSA yields help, Mineralys upsized an equity raise, Elevance flagged weaker Medicaid margins but kept FY guidance—payers threading the policy needle, as ever.

Software & data plumbing

* Salesforce said 4,000 support roles are now handled by AI agents, freeing quota-carrying capacity even as near-term guidance disappointed; UiPath, DocuSign, Samsara, Guidewire and Braze all leaned into AI-assisted pipelines and lifted FY views.

* Not all AI pixie dust sparkles every quarter: C3.ai guided light and shuffled leadership; GitLab faced second-half nerves. Investors are back to paying for bookings quality and dollar-based net retention, not just acronyms.

The bottom line

* The market absorbed a tariff curveball, softer labor data, and a semiconductor wobble—and still finished with better breadth and record highs in sight. Rate-cut hopes are doing some of the lifting, but the sturdier tell was where money flowed: into networks, storage, optical, and cloud regions that actually make AI usable, and into companies simplifying portfolios to unlock cash. If next week’s tape keeps rewarding execution over slogans, the rally has legs rather than headlines.

Insiders don’t always get it right… but they do get the best seats in the house. Here are this week’s trades that made us raise an eyebrow (and maybe place a limit order). As a side note, I try to stay away from insiders buying up their penny stock company. While these can still be great signals, the risk-to-reward ratio isn’t one I find favorable.

We keep track of all of these trades on our Google sheet, and then insider returns are quite astounding…

Buy the Dip Tracker

Insiders buying after meaningful drawdowns — percent and window included.

* STTK — Shattuck Labs<strong