The Simple Side's Saturday Sendout: Portfolios Ended +4.5% | +2.9% | -0.8%

Description

Quick Reminders:Our disclosure is in the email footerPortfolio copy trading is available hereYou can find our podcast on YouTube, Spotify, Apple Music, and here on Substack! You can get daily market news from: The Simple Side Daily newsletter.

Recent Updates:I added to the paid subscriber spreadsheet to track positions across all my portfolios that are “overextended” or are “oversold.” Here are some of those stocks:

Use this button below to leave me comments!

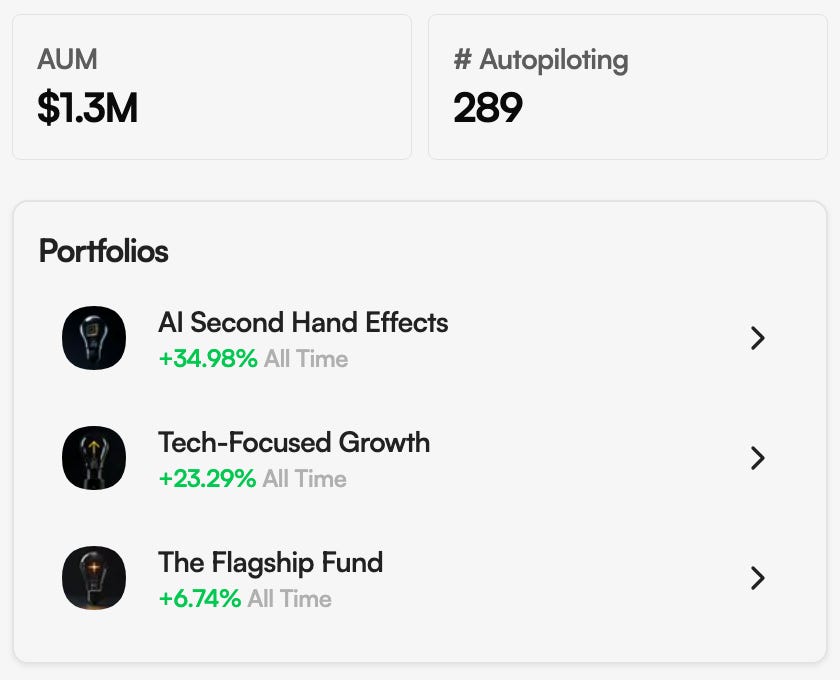

Quick Portfolio Highlights:

Copy My Trades By Clicking Here

Weekly Roundup

Returns this week were brought to you by…

…record-breaking AI, healthcare’s hot streak, and “shutdown? shrug.” The S&P 500 and Nasdaq notched fresh highs even with Washington closed for business. Big tech rode AI demand (hello, Nvidia’s $4.5T market cap), while healthcare ripped on drug-price headlines and fresh approvals. Small caps finally joined the party. Energy lagged as oil slipped into the low-$60s.

Now, I try to offer just the facts when I do my weekly roundups, but I am going to start inserting my opinions in these quick sections where I feel it is valuable. In this instance, I see two market events that could spell a market top. One, healthcare stocks seeing large amounts of capital flooding in shows investors are running to defensive sectors. Now, when I say investors, I mean big-time smart money investors. Go look at the retail sentiment around healthcare… in fact, here is a screenshot from the robinhood app on Centene (CNC), Molina Healthcare (MOH), and UnitedHealth (UNH) stocks:

Institutional money is getting defensive and retail is going risk on... who is right?

Stocks pushed to new peaks this week. Investors seem to be increasingly confident that Federal Reserve rate cuts are in our future. Yields on 10-year Treasuries hovered above 4.1% and slipped late in the week, which tends to help growth stocks.

We saw and felt this in both of our growth portfolios “AI-Second Hand Effects” and the “Tech-Focused Growth,” which had big runs on Thursday and Friday.

Oil drifted in the low-$60s, which is on the cheap side for this cycle—good news for shipping, travel, and input costs—while less great for energy company profits. Gold stayed near the very high end of its range, around $3,900, a sign that some money is still buying insurance against policy and geopolitical risks even as stocks climb.

In technology, Nvidia set a fresh milestone with a market value north of $4.5 trillion as demand for AI hardware and full-stack systems stayed strong. Just as important, companies are starting to place orders for AI projects — so the dollars are showing up in bookings and revenue for IT and chip suppliers.

Healthcare was the week’s standout. Policy headlines on drug pricing, a handful of positive trial readouts, and new approvals lifted large drugmakers and biotech. This sector behaves defensively (steady cash flows) but still gets upside from successful medicines, which is a rare mix when the economy is slowing but not falling into recession.

Again, this is likey institutional money look for “undervalued safe havens” before the market starts to turn.

Autos delivered mixed signals. Tesla posted record quarterly deliveries as buyers rushed to capture a soon-to-expire $7,500 EV incentive, but it then raised U.S. lease prices after the credit lapsed. Ford and GM are using their finance units to keep lease math attractive by fronting incentives themselves. The near-term risk is that EV demand cools without subsidies; the longer-term support is that production costs are still trending down.

The auto industry seems like a very “sketchy” place to be investing right now. Eveyone seems to be in an EV fight, but no one seems to be making real money from it other than Tesla. Of course, autonomous vehicles are becoming everyones target for success. I think this is extremely bullish for companies like Uber, Lyft, etc. If everyone is trying to “rent” their autonomous cars out, I would want to be the company taking no risk and all the reward (aka the “marketplace”).

Industrial and energy news pointed to long-run investment, even with softer oil. Boeing lined up major aircraft orders and is exploring a new single-aisle jet that aims to be roughly 10% more fuel-efficient than today’s models—useful for airlines’ costs and emissions targets. BP approved a $5 billion deepwater Gulf project and outlined asset sales to cut debt, while TotalEnergies sold half of a North American solar portfolio to a financial partner but kept operating control. Pipeline and power deals (for example, Ares buying into key natural-gas infrastructure) underscored steady cash flows in the “picks and shovels” of energy.

It is hilarious to see everyone calling energy the “picks and shovels” now. Back in 2024 I was calling for this. In fact, I wrote an article that said “when everyone chases gold, sell them the shovels” in refrence to AI energy demand. Look where we are now.

China headlines were a mixed bag. Alibaba said it will spend even more on AI infrastructure and is adding office space in Hong Kong, signaling long-term commitment. BYD reported its first quarterly sales drop since 2020 amid intense price competition, while peers NIO, XPeng, and Li Auto each logged record deliveries. The takeaway: China’s EV market is still growing fast, but the fight for share is squeezing margins.

A few prices help frame the road ahead. If Treasury yields drift lower from here, rate-sensitive and long-duration stocks (tech, software, select biotech) should stay supported. Cheaper oil eases inflation pressure and helps most sectors’ costs, but it can weigh on energy earnings unless offset by buybacks or higher volumes. Elevated gold says not everyone believes the “soft landing” is a sure thing—so expect quick rotations if the next data point disappoints.

Now, something that I will happily tell you more about is insider trades. I have been tracking insider trades in detail for months personally, and I finally decided to keep track of them in our paid subscriber sheet as well.

Insiders don’t always get it right… But they do get the best seats in the house. Here are this week’s trades that made us raise an eyebrow. As a side note, I try to stay away from insiders buying up their penny stock company. While these can still be great signals, the risk-to-reward ratio isn’t one I find favorable.

We keep track of all of these trades on our Google sheet, and then insider returns are quite astounding… (I have been removing quite a few of the penny stocks/ super risky investments to make the returns more normalized.)

Buy-the-Dip Tracker

* $FBYD — Falcon’s Beyond Global, Inc.10% Owner bought 4,092,326 shares at $5.00 (≈$20.46M) after a −29.58% week. Note: classified as a dividend reinvestment—signal quality is lower than a pure open-market buy, but the check size is still eye-catching.

* $TONX — TON Strategy CompanyDirector bought 70,000 shares at $7.11 (≈$498K) after a −52.41% month.

* $NEXT — NextDecade Corporation10% Owner bought 1,001,329 shares at $7.00 (≈$7.01M) after a −31.98% month.

* $UUU — Universal Safety Products, Inc.Director bought 25,010 shares at $4.28 (≈$107K) after a −30.82% week.

Whales & Standout Size

* $MBX — MBX Biosciences, Inc.Director bought 666,666 shares at $18.00 (≈$12.0M). No “dip” tag, just size.

* $FBYD — Falcon’s Beyond Global, Inc.10% Owner DRIP buy $20.46M at $5.00 (also in Buy-the-Dip).

* $NEXT — NextDecade Corporation10% Owner $7.01M at $7.00 (adds to multiple recent buys).

* $PTRN — Pattern Group Inc.10% Owner bought 302,256 shares at $12.77 (≈$3.86M).

* $OPEN — Opendoor Technologies Inc.Director bought 300,752 shares a