The Simple Side's Saturday Sendout: Portfolios Ended +5.47% | +2.59% | +0.26%

Description

Quick Reminders:Our disclosure is in the email footerPortfolio copy trading is available hereYou can find our podcast on YouTube, Spotify, Apple Music, and here on Substack! You can get daily market news from: The Simple Side Daily newsletter.

Recent Updates:I added to the paid subscriber spreadsheet to track positions across all my portfolios that are “overextended” or are “oversold.” Here are some of those stocks:

Use this button below to leave me comments!

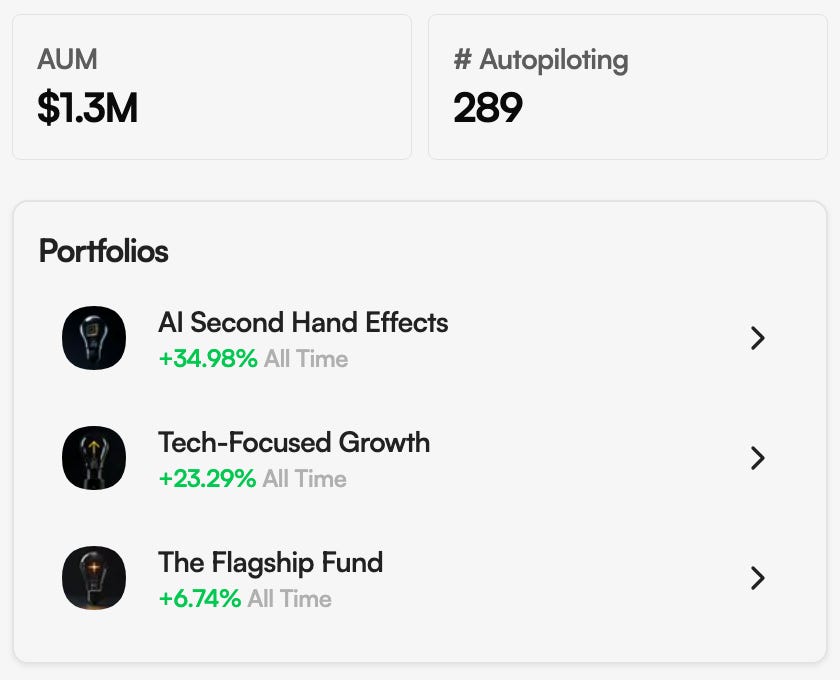

Quick Portfolio Highlights:

Copy My Trades By Clicking Here

Returns this week were brought to you by…

…AI money actually getting spent, weight-loss drug land-grabs, and a will-they/won’t-they Fed. Early in the week, big tech rode fresh AI headlines (Micron’s record outlook; Nvidia teaming closer with OpenAI; Apple iPhone 17 demand buzz).

Mid-week, rate-cut odds wobbled after firm economic prints; by Friday, the tape steadied but finished a touch lower: S&P 500 −0.3% WTD, Dow −0.2%, Nasdaq −0.7%. Under the hood, breadth was mixed—energy caught a bid on firmer crude while mega-caps took turns giving back gains.

Interestingly enough, if you take a look at the odds in Polymarket, it seems like the 25bps October rate cut is still in full force, with an 81% chance (down 5% from earlier in the week). The closest competitor is “no change” with odds under 20%…

Remember, the market right now is so inefficient with all of the new “dumb money,” and these downturn swings are currently nothing-burgers (thanks NYUGrad for my new favorite terminology when talking about the news).

The big moves (and why they matter)

* Pfizer is trying to champion the weight-loss arms raceWhat happened: Pfizer is reportedly close to buying Metsera for ~$7.3B (cash + milestones).Why it matters: GLP-1/obesity drugs are the fastest-growing profit pool in pharma. Pfizer exited its prior obesity pill; this would buy back a seat at the table and future revenue optionality.

* Micron blowing up: “tight chips, tight prices”What happened: Guided record Q1 FY26 revenue (~$12.5B) on AI-hungry DRAM/HBM demand.Why it matters: When memory gets tight, pricing power returns. That’s good for margins across the memory complex and a clean read-through to AI server build-outs.

* Samsung memory green-lit for NvidiaWhat happened: Nvidia approved Samsung’s advanced HBM parts.Why it matters: A second high-volume supplier alongside SK Hynix eases AI bottlenecks—and can cap runaway component prices. More HBM = more accelerators shipped.

* Nvidia is buying speed, not just chipsWhat happened: >$900M to hire Enfabrica’s team and license its networking tech that stitches 100k+ GPUs into one logical system.Why it matters: AI performance isn’t only about GPUs; it’s about feeding them fast. Better networking = more usable compute per dollar.

* Oracle/TikTok chatter, Nvidia–OpenAI cozinessWhat happened: Headlines put Oracle back in the TikTok mix; Nvidia rallied on tighter OpenAI ties.Why it matters: Real, named workloads (social, cloud AI) mean actual invoices—less demo, more dollars.

* Alibaba picking up the speed: “if AI capex is a race, spend faster”What happened: CEO Eddie Wu flagged AI infrastructure spend above the prior $50B plan.Why it matters: Confirms a global AI build-out isn’t just a U.S. phenomenon. Also, a tailwind for chip, memory, and power/infrastructure names selling into China.

* Berkshire exits BYDWhat happened: After 17 years, Berkshire fully sold its BYD stake.Why it matters: Doesn’t doom EVs; it says “we made our money.” For BYD, it removes a perceived overhang but also a long-time vote of confidence.

* Accenture & TD SYNNEX → enterprise AI is moving from talk to invoicesWhat happened: Both printed strong bookings/revenue; Accenture cited $80B+ annual bookings with gen-AI in the mix; TD SYNNEX raised outlook.Why it matters: Corporations are signing Statements of Work (translation: paying) to deploy data platforms, GPUs, and AI apps. That’s real spending, not show-and-tell.

* Boeing wins with a huge Turkish Airlines orderWhat happened: 225 jets (mix of 787s, 737-8/10 with options).Why it matters: Long-cycle industrial demand is alive. Large wide-body orders help Boeing’s cash recovery story even as certification work continues.

* PayPal sells BNPL IOUsWhat happened: Offloading ~$7B of “buy now, pay later” receivables to Blue Owl.Why it matters: Lightens the balance sheet, keeps the customer front end. Think “more fee business, less loan book risk.”

* Eli Lilly coming at the world with a two-prong swingWhat happened: EU okayed Kisunla (Alzheimer’s); Lilly is also pouring billions into U.S. manufacturing for its obesity pipeline.Why it matters: One near-term revenue line plus scaled capacity for the category investors care about most (metabolic).

Rates, oil, gold, crypto — what these prices are telling you

* 10-Year Treasury ~4.12% → 4.18% (up slightly)That’s a highish real/nominal yield by post-2008 standards. Translation: the discount rate on future profits is still firm. Great stories still work, but cash-flow timing matters and “expensive” gets a closer look.

* Oil ~$62–65 (West Texas)That’s cheap vs. the 2022–23 cycle and below many OPEC “comfort” levels. Translation: markets see adequate supply + cooler demand. Lower oil helps margins for transports/chemicals and tempers headline inflation—but it’s a headwind to energy EPS unless volumes or buybacks offset.

* Gold ~$3,760–3,800 (elevated)That’s historically high. Translation: investors are paying up for insurance—against rate/path uncertainty, geopolitics, or just “AI-era” volatility. High gold often rhymes with sticky real-rate anxiety or big-picture hedging.

* Bitcoin ~$109k–115k (drifted lower on the week)Risk barometer took a breather. Translation: in weeks when rate-cut odds soften and megacap froth is questioned, crypto enthusiasm cools first.

Now, something that I will happily tell you more about is insider trades. I have been tracking insider trades in detail for months personally, and I finally decided to keep track of them in our paid subscriber sheet as well.

Insiders don’t always get it right… But they do get the best seats in the house. Here are this week’s trades that made us raise an eyebrow. As a side note, I try to stay away from insiders buying up their penny stock company. While these can still be great signals, the risk-to-reward ratio isn’t one I find favorable.

We keep track of all of these trades on our Google sheet, and then insider returns are quite astounding… (I have been removing quite a few of the penny stocks/ super risky investments to make the returns more normalized.

Buy-the-Dip Tracker

* ARVN — Arvinas, Inc.Director bought 30,000 @ $7.57 after a 68.74% one-year slide. Early stage drug programs + battered chart; look for a reclaim of $8.

* NEXT — NextDecade CorporationDirector bought 100,000 @ $6.86 after a 30.66% one-month drop. This makes 5 insider buys in 30 days — classic “find the floor” behavior. A daily close back above $7 keeps the squeeze thesis alive.

* BDSX — Biodesix, Inc.Director bought 142,045 @ $7.04 after a 74.59% one-year drawdown; 3rd insider buy in 30 days. Treat $7 as your pivot.

* NXXT — NextNRG Inc. (one-time exception)CEO & Executive Chairman bought 1,000,000 @ $1.67 after a 45.25% three-month selloff. High-beta/