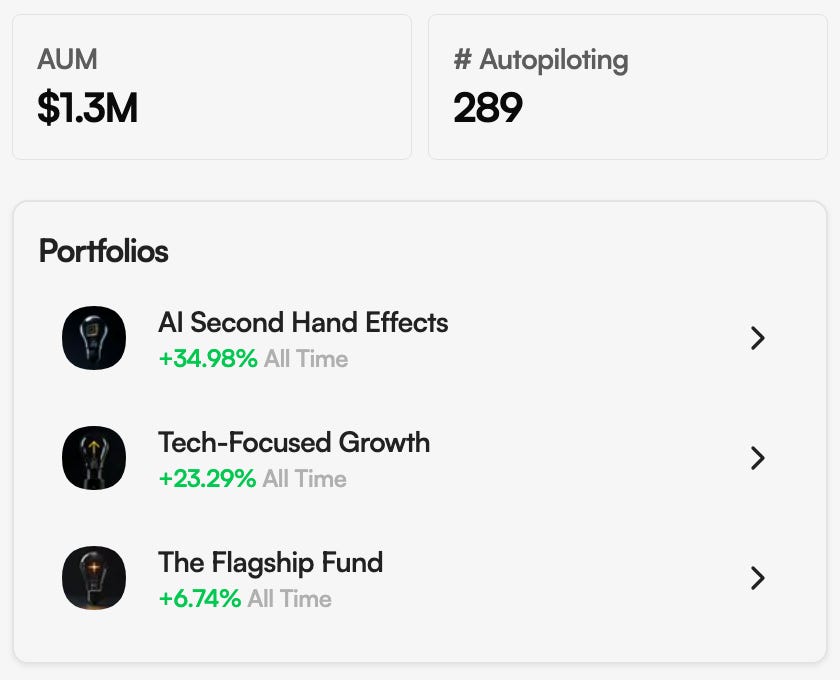

The Simple Side's Saturday Sendout: Portfolios Ended +6.12% | +3.88% | +0.85%

Description

Quick Reminders:Our disclosure is in the email footerPortfolio copy trading is available hereYou can find our podcast on YouTube, Spotify, Apple Music, and here on Substack! You can get daily market news from: The Simple Side Daily newsletter.

Recent Updates:I added to the paid subscriber spreadsheet to track positions across all my portfolios that are “overextended” or are “oversold.” Here are some of those stocks:

Use this button below to leave me comments!

Quick Portfolio Highlights:

Copy My Trades By Clicking Here

This week, the returns in our portfolios were brought to you by "The Federal Reserve” and their rate cuts! We are going to jump into the AI-Second hand effects portfolio here in just a minute to discuss some of the factors that drove this week’s performance.

If it just so happens that you were out on a beach this past week, don’t worry, I am going to catch you up with everything that happened in the markets this past week!

The Big Picture

The Fed finally trimmed 25 bps and the market did the happy shuffle: S&P 500 and Nasdaq printed fresh highs mid-week, small caps woke up, and the 2s/10s hovered near ~3.5%/4.1%—easy enough on cash-flow math without feeling bubbly. Oil camped in the low-$60s, gold stayed rich, VIX stayed sleepy. Translation: cheaper money + still-solid growth = “risk on,” with anything tied to AI buildouts, software, and financing (M&A, buybacks) getting an extra tailwind.

The Moves That Mattered

* Musk writes a billion-dollar love letter to Tesla. Elon bought ~2.57M TSLA shares ($371–$397), which isn’t a tweet—it’s a wire transfer. Insider buy that size resets sentiment and says management believes margins/volume or new products can outrun the current skepticism.

* Nvidia builds the AI plumbing while dodging geopolitics. A China pause on certain NVDA chips nicked the tape, but Nvidia countered by spending >$900M to hire Enfabrica’s CEO and license its networking tech (think: knitting 100,000+ GPUs into one logical machine). Add a planned $500M into UK self-driving startup Wayve and the story is clear: sell systems, not just chips.

* Alphabet plants a bigger flag in Britain. Google committed £5B to UK AI (new Waltham Cross data center + jobs). More local compute = lower latency, easier compliance, and another on-ramp for Cloud/DeepMind demand.

* Oracle keeps finding new on-ramps to cloud revenue. Reports it’s anchoring a consortium to keep TikTok running in the U.S. If that sticks, expect sticky, high-utilization workloads on Oracle iron—great for backlog visibility and margins.

* Healthcare power plays. Roche is buying 89bio (up to $3.5B) to bulk up cardio-metabolic; Novo Nordisk rallied on data showing Ozempic beat Trulicity on heart outcomes and an oral sema readout with ~16.6% weight loss. That’s pipeline-by-checkbook from Roche and category expansion from Novo.

* Cash speaks elsewhere, too. Microsoft lifted its dividend +9.6% (AI spend and shareholder returns), Netskope raised ~$908M in a punchy cybersecurity IPO, and FedEx mapped FY26 EPS $17.20–$19 on $1B in savings—leaner networks, richer profits.

Portfolio Highlight

Okay, now let’s talk about the AI Second-Hands Effects Portfolio. I won’t go through the whole thing here (paying subscribers can access it below), but I want to highlight a few of the stocks.

The two stocks I want to talk about are SMR and LEU — both of which were parts of the initial contrarian trades I made on energy and “AI Second-Hand Effects” back in November of 2024. You can find the original article here: article link.

Since I wrote about LEU and SMR, the stocks have returned 320% and 103% respectively. The reason we are talking about them today is because they both hit the list of “top gainers” on Friday with SMR landing a number 5 with a healthy 22.69% return and LEU ending at spot 11 with 12.12% returns.

Now, the reason I want to highlight this is because I don’t make very many changes to my portfolios/investments. A lot of the time I am buying and DCAing into the same group of stocks for months or years. I make very few adjustments to the portfolios, and that makes my investment style the worst for writing a newsletter.

It means I don’t send out a lot of emails, and I don’t send out emails saying “this micro-cap is the next 100x for your portfolio.” Now, that would sure help me sell subscriptions, but it wouldn’t help you or I make any money in the stock market.

My personal money goes directly into the portfolios I share here. The gains you see are reflected in my brokerage account, and my goal is to make us money in the stock market.

The best way to do that is for me to find once-in-a-lifetime asymmetric upside bets, tell you about them, and then invest.

Sure, you won’t get 3 emails a week telling you about the next hot stock (boy that would sell better), but you will get outsized returns in the long run, and that is what I am here for.

Now, something that I will happily tell you more about are insider trades. I have been tracking insider trades in detail for months personally and I finally decided to keep track of them in our paid subscriber sheet as well.

Insiders don’t always get it right… but they do get the best seats in the house. Here are this week’s trades that made us raise an eyebrow. As a side note, I try to stay away from insiders buying up their penny stock company. While these can still be great signals, the risk-to-reward ratio isn’t one I find favorable.

We keep track of all of these trades on our Google sheet, and then insider returns are quite astounding… (I have been removing quite a few of the penny stocks/ super risky investments to make the returns more normalized.

Buy the Dip Tracker

Insiders buying after meaningful drawdowns — percent and window included.

* TTGT — TechTargetDirector bought 20,000 @ $5.97 after a 75.19% one-year slide. Deep cut in ad/MarTech; use the print as your line in the sand.

* NEXT — NextDecadeCEO bought 281,500 @ $7.14 after a 33.20% one-week drop;Director later bought 500,000 @ $7.31 after a 29.84% one-week drop;Other insider added 357,021 @ $6.98 after a 33.57% one-month pullback.Cluster + capitulation bounce setup; let price hold above the $7 area before leaning in.

* RAPP — Rapport TherapeuticsDirector bought 41,666 @ $24.65 and 20,400 @ $24.48 after a 21.42% one-week hit. When the doctor orders two doses, you read the label.

* ZVRA — Zevra TherapeuticsDirector bought 3,175 @ $7.79 after a 23.01% one-month drop. Small ticket, but it’s the third insider buy in 30 days — a nibble can still telegraph conviction.

Whales & Standout Size ($1M+)

Large prints that can set floors (or at least draw a line for the chartists).

* TSLA — Tesla: CEO bought 2,568,732 @ $389.28 ($999.96M). That’s not a toe-dip; that’s a cannonball.

* BRCB — Black Rock Coffee Bar: 10% Owner bought 3,118,938 @ $20.00 ($62.38M) in a public offering.

* LBRX — LB Pharmaceuticals: 10% Owner 2,666,666 @ $15.00 ($40.0M); Director 1,000,000 @ $15.00 ($15.0M); 10% Owner 333,333 @ $15.00 ($5.0M). Triple-shot accumulation.

* HYMC — Hycroft Mining: 10% Owner bought 14,017,056 @ $4.28 ($40.0M</strong