Wealth Inequality and Inclusive Growth with Matthew Mendelsohn

Description

On this episode Matthew Mendelsohn joins Nate on the podcast to discuss the issue of wealth concentration and its threat to democratic stability. They discuss practical solutions to address wealth inequality, trust in democratic institutions, the role of the federal public service and the need for a competent and responsive government.

Matthew's extensive background includes serving as the Deputy Secretary to the Cabinet (Results and Delivery) in the Privy Council Office of Canada, where he played a key role in developing and implementing the federal government's policy agenda.

His work focused on achieving measurable results and improving government performance, particularly in areas related to inclusive economic growth, tax reform, and public service effectiveness.

Nate and Matthew explore the concept of inclusive growth, which focuses on equitable and sustainable economic growth benefiting both communities and individuals. They also highlight progress made on Indigenous issues and the need for transparency and risk-taking in the civil service.

Watch on YouTube:

Transcript:

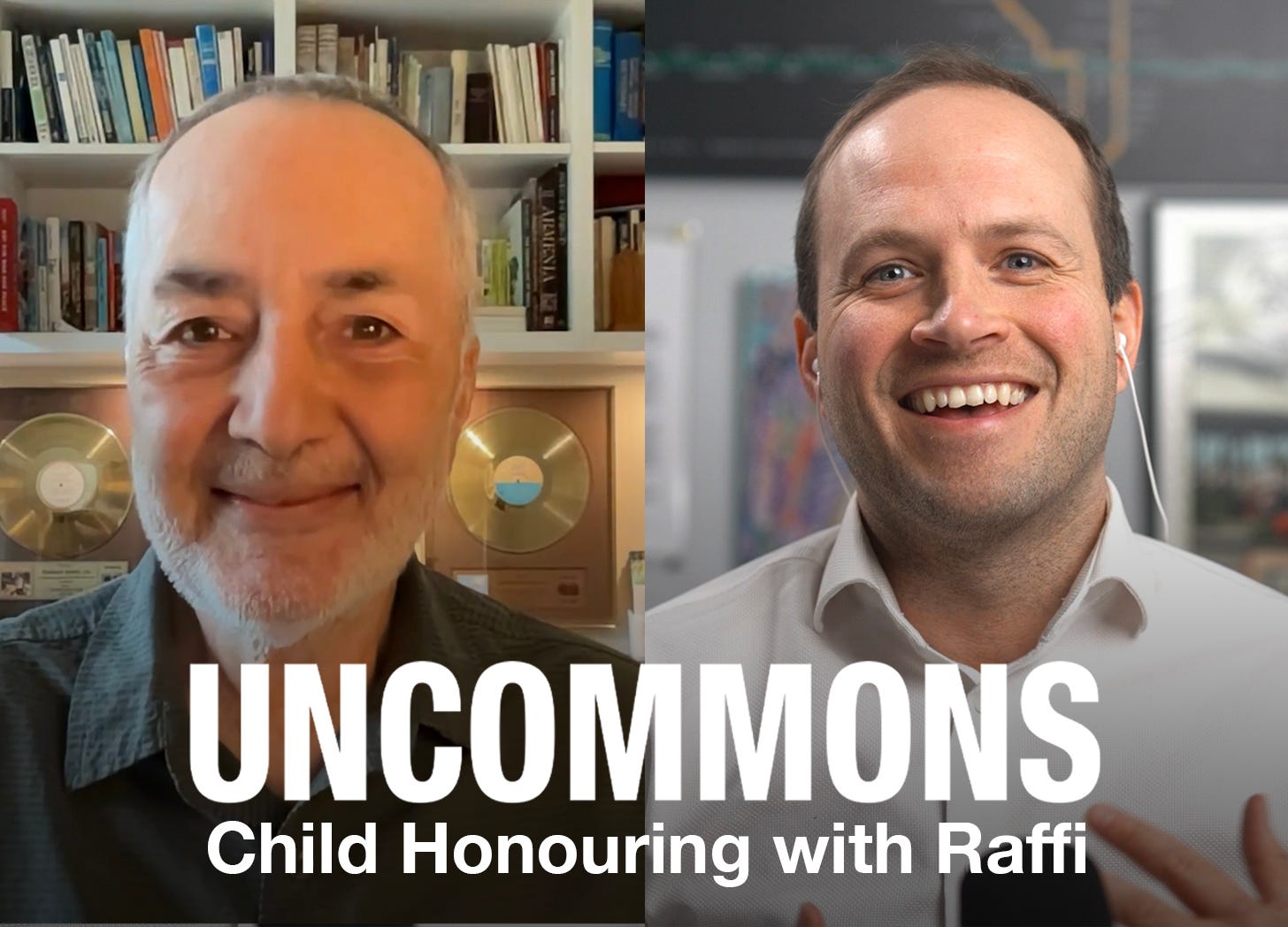

Nate: Welcome to Uncommons. I’m Nate Erskine-Smith, and on this episode I’m joined by Matthew Mendelsohn, a great thinker in Canadian public policy over the last number of years.

He has done many different things in this space. He has been a professor at TMU and Queen’s. He has founded the Mowat Centre, which was at U of T and the Monk School, and obviously canceled because we had a Doug Ford government here in Ontario after 2018. He, federally, he was the chief architect of the 2015 election platform for the Liberal party.

He led efforts to write and create openness around those ministerial mandate letters out of the 2015 election, and he led the Prime Minister’s results and delivery unit from 2016 to 2020. Now more recently and currently, he’s the CEO of Social Capital Partners. It’s a great organization focused on the social good in many different ways, from social enterprise to employee ownership to so much more, including a more recent focus on wealth concentration and wealth inequality.

That’s a big part of this conversation. We talk about wealth inequality, what we can do about it. We talk about democratic resilience and the connection to a lack of inclusive growth, a lack of equality, and too much concentration in wealth.

And we talk about the ability, or inability at times, of the federal public service to get big things done.

Statistics of Wealth Concentration

Nate: Matthew, thanks so much for joining me.

Matthew: Thank you for having me, Nate.

Nate: So you and I have come across one another when you were working in the federal government, but you were no longer working in the federal government. You left in 2020. You're still doing very interesting things. And before we get into some conversations about your work in the civil service and your history in politics and in public service, you're now at Social Capital Partners. And the current work of Social Capital Partners is very much focused on wealth concentration, which is an issue that I have a great interest in.

So let's start there and let's start with social capital partners, your role there, and the work that you're doing on wealth inequality.

Matthew: So Social Capital Partners is a not-for-profit that has been focused on impact investing, social enterprise, financial inclusion for over 20 years. Over the last five years, we have started to focus on the issue of wealth inequality, wealth concentration, the threat that it represents to democratic stability and democratic societies, the fact that it's not getting nearly enough attention, I think, in the public debate.

And we have been focused on very practical solutions. So at Social Capital Partners, we have always been interested in very practical, actionable ideas to push back against, earlier time, financial inclusion, but now wealth inequality.

So we've been leading the work that your government has supported around the creation of employee ownership trusts, making it easier for retiring business owners to sell their businesses to their employees rather than to private equity or to a competitor. And this creates options for business owners, but it allows workers to build state equity pathways to wealth in the businesses that they are working for and building.

It also creates more community resilience, that you have small and medium -sized businesses that are being run and owned, and with equity and deep roots in the community, with the people who work there and live there rather than being run by multinational global private equity funds out of New York or heaven forbid Toronto.

So that work is really important to us and we think that the wealth concentration question is not getting nearly enough attention in any of our discussions. The productivity discussion and the democracy discussion, the economic growth discussion. And our goal is to identify really practical policy and legislative changes that can push back against what I think everyone sees as a huge problem, which is the pooling up of wealth, like unbelievably mammoth pools of wealth in fewer and fewer hands, and more and more challenges for young people to buy a home, to save for retirement, to build economic security. So that's what we're focused on.

Nate: And let's dive into the specifics of that challenge in some ways, because StatsCan counts some of the numbers, but they count it very poorly in comparison to what we see in other jurisdictions, especially in the US. And I was following along with the work that Social Capital Partners has done through Billionaire Blind Spot, a report that better tracks wealth inequality in this country. And it's shocking. So it's...

Correct me if I'm wrong here, but it’s that the top 1% owns 26% of all wealth in this country, and the top 0.1% owns more than 12% of the wealth in this country. And it's not as bad as the US, but it's close to as bad as the US, and it's much worse than the picture that StatsCan provides to us.

Matthew: Yeah, that's right. And I don't want to overstate the accuracy of our work, but what we did, Dan Skilleter, our Policy Director, combined a bunch of different publicly available data sets. I'd also point out that the Parliamentary Budget Officer did good work on this and their work is out there publicly. And it's just very different than what StatsCan reports. And I think it's useful to remember that whether it's StatsCan or PBO or an academic study, a lot of these things are estimates, not just on wealth, but on lots of the data that we use publicly. We use it because we need to use something, and it helps us understand the world, but certainly around how one measures wealth, what gets counted, what gets reported.

I mean there's lots of uncertainty and ambiguity there, but the point that you make, and that Dan's report highlighted, was that StatsCan’s numbers are like an extreme outlier in terms of their estimates for wealth concentration. You know, talking about the top 1% from, you know, our estimates and PBO that hold, say, a quarter of all Canadian wealth and the top 0.1% owning, holding, you know, 11 or 12% of the wealth. It's an enormous concentration.

And, you know, while I recognize that StatsCan has some challenges, the US Statistical Agency does a much better job, European agencies do much better jobs, and I would like StatsCan to do a better job. But if they're not going to do a better job, they should at least be a lot more upfront in how bad their data are, and maybe stop recording it, because they put it out and then everyone talks about it and it gets picked up, and yeah, they'll have a footnote or they have a paragraph that highlights that the data probably aren't so accurate. But by the time that gets into public discussion, media discussion, from my perspective, the damage is done. And it allows us to tell ourselves this story about how equal we are and everyone has a fair chance. And sure, obviously, if you're born wealthy, you're more likely to end up wealthy.

And we recognize, you know, challenges for people growing up in more economically vulnerable situations. But we tell ourselves a story about how good we are, compared particularly to the United States. And for me, as someone who believes deeply in democracy, you want a story that citizens hear that aligns with reality. And it just doesn't align with reality.

Young people without access to family wealth in Canada today know how difficult it is to save for a home, pay for rent, pay off student debt, forget about saving for retirement. We understand all of these things are huge challenges. And not only the media narrative doesn't, you know, highlight these enough, but then there are these StatsCan reports that keep getting picked up that say, yeah, no, things aren't so bad after all.

The Role of Capital Gains Taxation Within the Fight Against Wealth Concentration

Nate: And then you have, unfortunately, and you track even over the last 10 years, over this Liberal government's tenure, you have a situation where when we first came into office, there was a conversation around inequality, but it was focused on income inequality. And you had measures focused on addressing that challenge. It wasn't until 2021 in the throne speech that we started to see a small commitment, but a commitment nonetheless, on tackling extreme wealth inequality, although I would argue we haven't really seen commensurate policy action until fairly recently, and other countries are having a more serious conversation in this regard. I know more about this in part because the OECD has done work on assessing wealth taxation, net wealth taxation around the world and what works, what doesn't, and