What you need to know about finances and insurance when buying a car

Update: 2025-09-19

Description

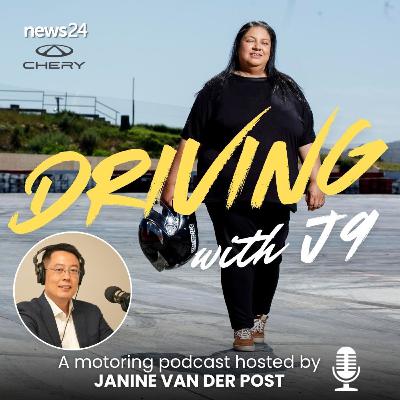

In this episode, Janine van der Post chats to NADA chairman Brandon Cohen about what consumers should know when they’re not happy with the car they’ve bought, how AI now plays a big role in the dealership, and what exactly you need to know about F&Is - finance and insurance when applying for a new or used car.

In Channel

Blimey, these car finance calculators have come a long way from the basic tools we had a few years back! What's brilliant about modern systems is how they factor in your credit situation to give proper realistic monthly payment estimates. I spend ages playing around with different scenarios on platforms like https://carplus.co.uk/calculator/ just to see how tweaking loan amounts and terms affects the final numbers. The stats they share are fascinating too, showing how people in their forties typically borrow around £11,008 compared to younger drivers at £6,101 average. Their working example of £7,000 over five years at 21.9% APR comes to £185.33 monthly with over four grand in total interest, which really drives home the importance of shopping around for better rates. Both HP and PCP options get calculated, which is ace because you can instantly see how different finance types affect your monthly budget. Basic requirements are straightforward enough, just need £1,000 monthly income and