Discover The Variant Perception Podcast

The Variant Perception Podcast

The Variant Perception Podcast

Author: VP Research

Subscribed: 3Played: 32Subscribe

Share

© VP Research Inc.

Description

We build predictive investment models by combining timeless axioms with innovative techniques. Operating at the intersection of market history and data science, we believe that man + machine beats man or machine alone.

blog.variantperception.com

blog.variantperception.com

35 Episodes

Reverse

Inspired by Byron Wien, we listed VP's 10 surprises as part of our 2025 Themes. We followed his definition of a “surprise” as an event that the average investor would assign less than a 33% probability, but which we believed were “Probable,” having a 50%+ likelihood.The below AI summary provides the key takeaways that can be read in less than 5 minutes.AI Summary - Evaluating VP's 10 surprises for 2025#1 – Trump's tariff and migrant policies are not as inflationary as feared [00:01:05]Contrary to early concerns, tariffs and immigration restrictions have not forced the Fed into hiking. Inflation has risen, but not in a way that demands aggressive tightening. Instead, sticky inflation limits the Fed's ability to cut. Labor market impacts from immigration limits and deportations are still playing out, especially in construction and agriculture.#2 – US growth neither collapses nor surges, supported by consumption [00:04:10]Growth has been stable, but risks are rising. The fiscal impulse has plateaued, and manufacturing capex has weakened. Services have held up, but forward-looking indicators show rising downside risks to activity. Consumption remains resilient, though softening—so far, no cliff.#3 – Powell does nothing after Jan 2025; no cuts, no hikes [00:11:58]Initially seen as a hold scenario, Powell now has scope to cut if growth slows. The market is pricing in about three cuts, but this probably reflects a weighted probability of 1-2 cuts (without recession) or more than 4 cuts (with recession). Rate hikes are almost unthinkable due to political and fiscal constraints; even in a sharp rebound scenario, yield curve control would likely emerge instead.#4 – U.S. 10y yields never break 5% thanks to “Bessent put” and foreign buyers [00:16:46]Despite market volatility and bear steepening, 10-year Treasury yields have held below the key 5% level. The administration appears committed to ensuring yields don't breach this level. Policy intervention - either direct or via tools like SLR reform - is expected to keep long-end rates contained. This is a high-conviction view for us, given the importance of the bond market.#5 – US small caps continue to underperform [00:21:34]Despite optimism post-election, small caps have lagged due to poor index quality, interest rate sensitivity, and weak fundamentals. The index remains vulnerable to high funding costs and lacks appeal outside of single stocks related to reshoring or possibly regional banks. Tactical rallies may occur, but the broader underperformance trend remains intact.#6 – Trump and Xi make a deal [00:25:30]While rhetoric escalated sharply, both sides have signaled openness to talks. A shallow, symbolic deal is likely—low-quality but headline-friendly. Structural tensions remain, but neither side wants to escalate beyond manageable limits. Economic pain on both sides will push toward de-escalation later in the year. We believe peak escalation has passed, and the two parties will gradually move toward some form of a agreement.#7 – Euro breaks parity as Germany “brakes” its economy [00:34:32]This was a clear miss for us. German politics unexpectedly unified in response to Trump's early policies and managed to pass a massive fiscal expansion (~€1 trillion), loosening the debt brake. Liberation Day also unleashed a repatriation wave that weakened the dollar and boosted the euro. While economic fundamentals remain shaky, capital flows have overridden them. The euro might give back some of its gain on a tactical basis, but flows are a structural tailwind from here.#8 – OPEC Loses More Members as Oil Falls [00:43:49]The oil price has fallen since the start of the year, with Kazakhstan exceeding quotas and OPEC adjusting “voluntary” cuts. While no formal exits have occurred, cohesion in the cartel is weakening. The oil story is both supply- and demand-driven, with supply rising and growth headwinds reinforcing downside for demand. We still prefer energy equities over crude itself. So far, the surprise remains valid, with more to play out.#9 – Gold fails to make new highs, underperforms 60-40 [00:41:43]Liberation Day triggered a shift in global reserve preferences, with gold benefiting from reduced trust in Treasuries. Emerging market central banks, esp. those wary of sanctions, may now see gold as their primary neutral reserve asset. Gold is now seen as a structural allocation, and we think tactical sell-offs are opportunities to add exposure.#10 – Capital Cycle: buy China tech, luxury goods as contrarian play [00:46:26]The call began well with a rally in Q1, but Liberation Day and the intensification of trade tensions prompted a reassessment. Chinese equities now face structural headwinds, especially for international investors. Luxury goods remain appealing long-term due to their IP and Lindy effect characteristics, but timing is poor amid global growth concerns and geopolitical risk. Both themes remain valid from a capital cycle view, but we are shifting our attention towards LatAm and US single stocks that may benefit from reshoring and other key themes that have emerged since Liberation Day. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This post is an excerpt from a video originally shared with VP clients on November 7, 2024. Link to original video here. To gain access to more of our research, contact us here.Speakers: Tian Yang (CEO & Head of Research) and Jonathan Petersen (Chief Markets Economist)Trump's decisive victory (foreseen by the “Keys to the White House”) reinforces structural trends: The Republican sweep should boost nearshoring, domestic CapEx, and FDI inflows into the U.S., accelerating ongoing megatrends such as reshoring, manufacturing, and supply chain restructuring.Don't expect dramatic change in Fed's policy or surge in UST yields: Powell's future remains uncertain, but the Fed is likely to proceed with rate cuts for the rest of 2024, before pausing and becoming data dependent as inflation stabilizes. Bond yields may rise further in the near term, but fears of a "Liz Truss moment" in the US bond market seem overblown.Strong dollar with regional divergences: The dollar is expected to stay strong, but Asian currencies may have limited downside due to already weak levels, while structural euro weakness could persist for years to restore competitiveness. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This post is an excerpt from a video originally shared with VP clients on October 11, 2024. Link to original video here. To gain access to more of our research, contact us here.* Speakers: Tian Yang (CEO & Head of Research) and Scott Freeman (Director of Asset Allocation)* The likely holding pattern until the US election makes it a good time to revisit our key structural (2-3y+) themes and their investment implications.* Fiscal deficits and greater government involvement will be a feature, not a bug, in the coming decades as moral obligations (e.g. social security, national security) have locked us into heavy future spending.* Industrial policies are mostly motivated by geopolitics and strategic competition. We are in a world that prioritizes security over efficiency. As geopolitical tensions rise, governments will continue to provide a relatively price-intensive source of demand for companies that offer the materials, tools, and infrastructure needed to support escalating geopolitical competition.* US housing has seen an extended period of underbuilding, creating a structural supply-demand mismatch specifically in entry-level single-family housing in the US.* Investment implications: long real assets, gold, energy, TIPS, US homebuilders. Avoid US nominal bonds. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This video was originally shared with VP clients on September 23, 2024. Link to original video here. To gain access to more of our research, contact us here.Speakers: Tian Yang (CEO & Head of Research) and Scott Freeman (Director of Asset Allocation)There are 2 key decisions to get right for asset allocation:* How much to allocate to risk assets (stock vs. bond vs. cash allocation).* How to gain exposure to outperforming sectors while avoiding underperforming ones.We address these two problems in a repeatable way, using the best frameworks we have developed over the 15 year history of Variant Perception.* Our leading indicators help us understand the business cycle.* Our capital cycle models help us understand long-term profitability trends across industries.* Our crowding indicators help us understand market positioning and herding behavior.These 3 key models can be synthesized into modular and customizable portfolios that:* Maximize upside capture & minimize downside capture vs. standard benchmarks.* Do NOT take undue risk with leverage or hero calls.* Have reasonable trading turnover. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This post is an excerpt from our August 28, 2024 market discussion video to VP clients. The full length, original video can be viewed here.* We discuss our recent thematic report: Asset Allocation Using LEIs, Capital Cycle and Crowding.* The VP Asset Allocation Engine uses a) LEIs to quantify the current macro outlook and make high level asset allocation decisions between equities and bonds, and b) capital cycle and crowding models to make more granular selection decisions across sectors within the equity allocation.* Our asset allocation process has been designed to be modular, so that the macro regime decision can be viewed separately from the equity sector allocation decision. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

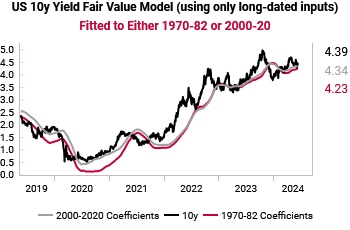

This post is an excerpt from our June 11, 2024 market discussion video to VP clients. The full length, original video can be viewed here.* We review our US Fixed Income Dashboard ahead of the June Fed Meeting and inflation data.* Structurally: Fiscal deficits, demographics, geopolitical tensions, and pension funding ratios all bias yields higher.* Cyclically: Our US term-premium, fair value, and neutral-rate models indicate fixed income markets are fairly priced on a 6-12m forward basis. * Tactically: Our Fed Hiking Regime model has triggered, but Powell has made clear his reluctance to hike, with the risk-reward appearing limited when looking at STIR markets. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

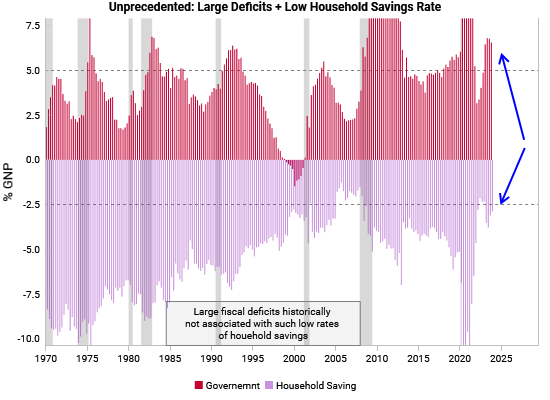

This post is an excerpt from our May 3, 2024 market discussion video to VP clients. The full length, original video can be viewed here.* We discuss our recent thematic report, The Structural Limits of Fiscal Policy, which dives into how politics led the US to its current state of "fiscal purgatory" and what history tells us is the most likely path forward to finance deficit spending.* The US fiscal situation appears to be a chronic rather than acute problem, making positioning for financial repression and low real yields our preferred allocation strategy in the long run. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This video was originally shared with VP clients on April 30, 2024 and can be viewed on the VP Portal here. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This post is an excerpt from our April 7, 2024 market discussion video to VP clients. The full length, original video can be viewed here.Highlights from April 2024 Big Picture discussion:* Investors now view inflation as the “biggest tail risk”, but leading data is telling a different story, aligning more with a “mini inflation scare” scenario. We view fading fiscal stimulus as the actual greatest risk over the next 6-12 months, with upcoming April tax receipts as a key sign post.* History tells us fiscal deficits persist overtime in democratic nations, which raises long-term inflation risks. To combat these risks, the political path of least resistance is likely financial repression pending a major rise in social unrest.* Commodities and real assets are the likely winners in this environment. This creates major structural tailwinds for resource-intensive Latin American economies that remain capital scarce. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This post is an excerpt from our March 22, 2024 market discussion video to VP clients. The full length, original video can be viewed here.Highlights from the March 2024 Global Macro Trading discussion:* What's worked and we still like: short THB, short CHF, short CNH* What hasn't moved or moved against us, but we still like: short SONIA vs SOFR, AUD flatteners* Cyclical trades that could be tactically choppy: long gold / energy / commodities, long Brazil equities, long USDLinks to the March and February EM/DM Leading Indicator Watch reports This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This video was originally shared with VP clients on February 4, 2024, and is also available on YouTube. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

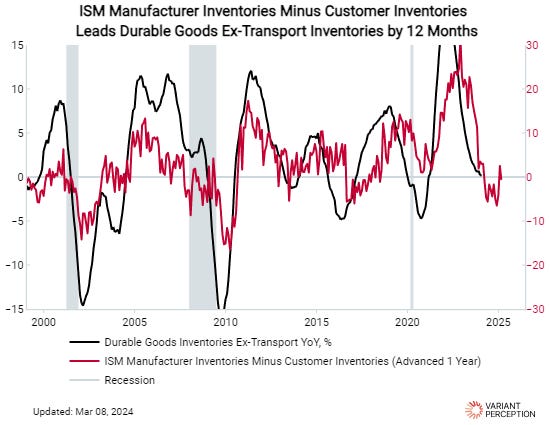

This post is an excerpt from our March 8, 2024 market discussion video to VP clients. The full length, original video can be viewed here.Highlights from the March 2024 Big Picture discussion:* The ongoing rebound in global leading growth inputs paired with the US fiscal outlook support our structural preference for commodities and real assets.* The covid-distorted inventory cycle is normalizing, shown by the closing of the ISM customer vs manufacturer inventory gap. This is a big positive development that we have been waiting for since 3Q23, and suggests we can have a classic manufacturing recovery again.* The mid-1990's disinflationary boom scenario was led by surging private investment, and while private investment has room to rise today, labor market and fiscal dynamics suggest greater inflation risk now vs the 90s. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

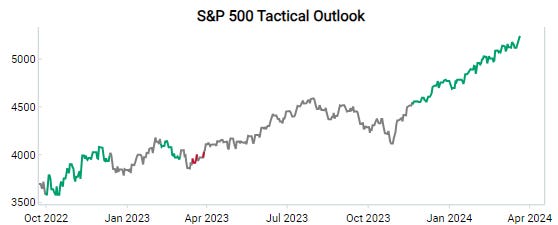

This post is an excerpt from our February 19, 2024 market discussion video to VP clients. The full length, original video can be viewed here.Each month, we plan to have separate, more targeted market discussion calls, centered around a) big picture, top of mind macro themes b) asset allocation c) global macro trade ideas and d) ad hoc single stock discussions.Highlights from the February 2024 Asset Allocation discussion:* Fixed Income: There remains a tension between the longer-term structural outlook for higher yields (the Age of Scarcity) vs the cyclical peak in term premiums. We continue to see attractive value in MBS and TIPS and like adding exposure in the current backdrop.* Equities: In the US, we likely cannot price any less cuts from the Fed this year, given the need to price in a probability of accidents/stress later in the year. We view capital scarce sectors with high duration as the best way to capture upside from a cutting cycle while staying aligned with core structural return drivers. Globally, energy, goldminers, and LatAm are our favorite equity expressions.* Commodities: Tactical, cyclical, and structural signals have aligned to support going long real assets. Oil & gas and gold are structural winners in the Age of Scarcity.Clients can access the Desert Island and Asset Allocation dashboards using the respective links. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This video clip is courtesy of The Grant Williams Podcast and is used with permission. Investors need to be aware of when market participants are acting for reasons other than economic. Our LPPL (log periodic power law) models are one of many powerful VP tools that allow investors to better "play the game." VP CEO Tian Yang recently sat down with Grant Williams on his podcast to discuss. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

US fiscal and labor hoarding have been key supports for US growth. Under-the-hood issues of tax receipts and job openings suggest an elevated dependence on deficit spending, creating inflation upside risk.The AI investment spree has echoes of the fiber optic build-out. The productivity gains need to be weighed against an increasingly geopolitical world focused on security vs efficiency and where fiscal and monetary policy co-ordination is much more likely.China structural risks appear to be a feature, not a bug, favoring proxy plays to benefit from upside risks. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

Tian Yang, Head of Research / CEO at Variant Perception Aaran Param, CFA, Head of Asset Allocation at Variant Perception Tian and Aaran engage in a discussion where they tie together insights from recent reports and discuss Variant Perception's thought process. We hope you find value in the conversation. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

Macro themes: • US Recession Signal active + LEIs point to deep downturn in 1H23. • Inflation LEIs showing a clear rollover across most of the world (ex Japan and eurozone). • Stick with risk-off asset allocation • When to buy back into risk assets: 1) policymakers panic and ease, 2) surge in selling exhaustion buy signals, 3) upturn in LEIs + Recession Signal falls to zero + market bottoms checklist confirmation. • Fed pivot unlikely in 1H23 and do NOT expect China reflation bonanza. Equity themes: • Short candidates: cyclical capex/industrial names + bad capital cycle (software + healthcare) • Long candidates: defensives (food, tobacco, telco) + beaten up cyclicals with positive capital cycle (homebuilders) • Regional themes: OW Brazil + UW Thailand, OW Switzerland + UW Canada Fixed income themes: • US 10y fair value in recession: 1.7-1.8% • Timing is key for steepeners • EM spreads not compelling. Stick with Brazil Alternatives themes: • Commodities: still in supercycle intermission, pare back energy euphoria • Credit: avoid HY, bet on spread blowout • FX: left-hand side of dollar smile but largely priced in. Play recession pairs: short CADJPY This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com